Ipsen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsen Bundle

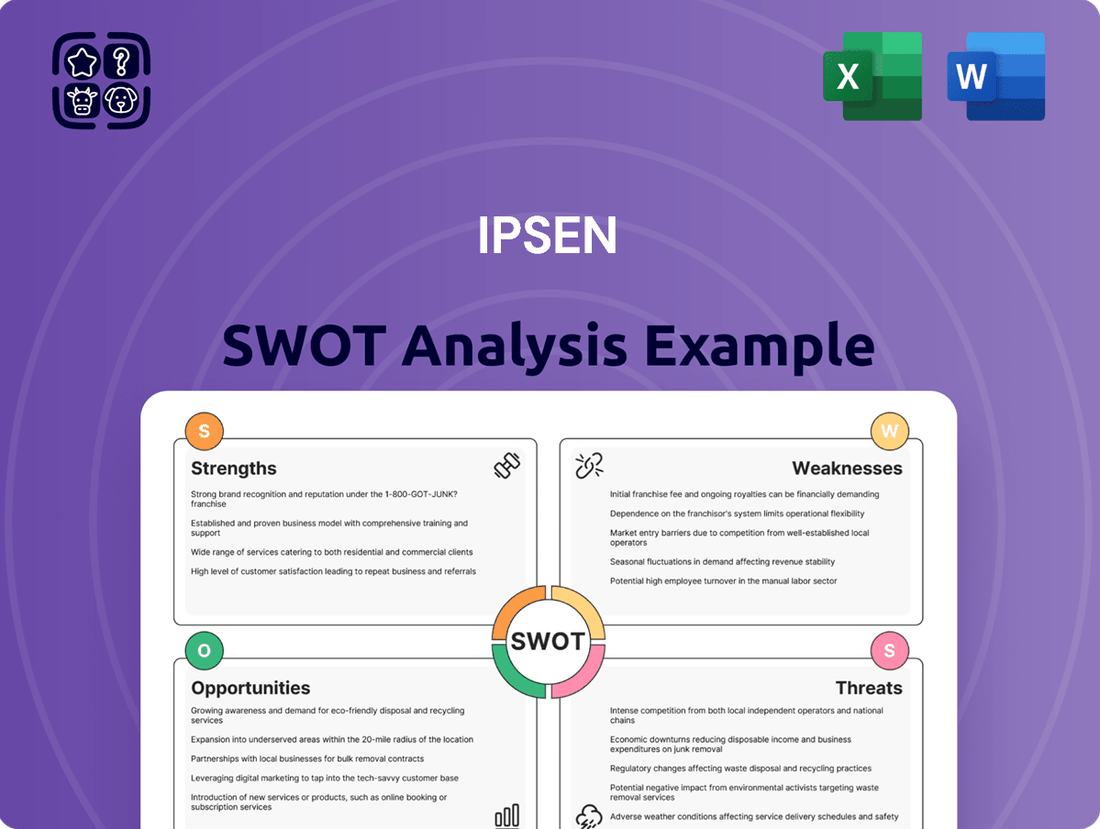

Ipsen's strategic positioning is clear, but what truly drives their success and where do potential vulnerabilities lie? Our comprehensive SWOT analysis dives deep into their market strengths, identifies key opportunities for expansion, and critically examines their weaknesses and the competitive threats they face.

Unlock the full picture of Ipsen's competitive edge and future trajectory. Purchase the complete SWOT analysis to gain access to actionable insights, expert commentary, and an editable format perfect for strategic planning and investor pitches.

Strengths

Ipsen has shown impressive financial strength, with total sales climbing 11.6% at constant exchange rates in the first quarter of 2025 and reaching 11.4% growth in the first half of the year. This solid performance has prompted the company to raise its full-year 2025 financial outlook, now anticipating total sales growth to surpass 7.0%.

Furthermore, Ipsen has boosted its forecast for the core operating margin, expecting it to be above 32.0% for the entirety of 2025. These upward revisions underscore the company's healthy financial standing and its effective strategy in managing its product offerings.

Ipsen's deliberate concentration on specialty care areas like Oncology, Neuroscience, and Rare Diseases has been a significant advantage. This strategic direction has allowed the company to carve out a strong position in markets with high unmet medical needs and potentially higher profit margins.

The rare disease segment, in particular, has demonstrated remarkable performance, achieving a 95.7% growth in the first half of 2025. This surge in the rare disease portfolio now makes it a substantial contributor to Ipsen's overall revenue, underscoring the success of this focused approach.

Ipsen's strength lies in its ability to successfully bring new products to market and broaden the reach of existing ones. For example, Bylvay and Iqirvo have demonstrated impressive sales growth, underscoring effective commercialization strategies. This track record of successful launches is a key indicator of Ipsen's R&D and market access capabilities.

The company's oncology portfolio is notably strengthened by the European Commission's approval of Cabometyx for advanced neuroendocrine tumors, representing its sixth approved indication. This expansion highlights Ipsen's commitment to addressing unmet needs in cancer care and leveraging its existing assets across multiple patient populations.

Further bolstering its product pipeline, Ipsen has achieved a strong U.S. launch for Onivyde. This success not only contributes to current revenue streams but also signals a healthy pipeline with significant future growth potential, reinforcing Ipsen's position in key therapeutic areas.

Robust Research and Development Pipeline

Ipsen’s strength lies in its robust research and development pipeline, a critical engine for future growth. This pipeline is a blend of internal discoveries and strategic external collaborations, ensuring a diverse range of potential new therapies. Several key regulatory and clinical milestones are expected in 2025, underscoring the dynamism of its R&D efforts.

The company is anticipating significant progress in 2025, including a regulatory submission for tovorafenib, targeting pediatric low-grade glioma in Europe. Furthermore, Ipsen plans to initiate a Phase II study for its long-acting neurotoxin (LANT). These advancements highlight the company's commitment to innovation and its potential to address unmet medical needs.

- Tovorafenib Submission: European regulatory submission for pediatric low-grade glioma anticipated in 2025.

- LANT Phase II: Initiation of a Phase II study for Ipsen's long-acting neurotoxin (LANT) in 2025.

- Pipeline Diversity: Strength derived from both internal R&D capabilities and external innovation partnerships.

Solid Financial Health and Investment Capacity

Ipsen demonstrates robust financial health, highlighted by a strong gross margin of 82.69% as of the latest reporting periods. This financial strength is further underscored by its investment-grade credit rating, providing a stable foundation for operations and growth.

The company possesses significant cash reserves, bolstered by successful bond issuances, which translates into substantial financial flexibility. This capacity allows Ipsen to confidently pursue continued investment in research and development, a critical driver for innovation in the pharmaceutical sector.

Furthermore, these financial resources enable strategic business development, including potential acquisitions or partnerships, to expand its pipeline and market reach.

- Impressive Gross Margin: 82.69% indicates efficient cost management and strong pricing power.

- Investment-Grade Credit Rating: Signals financial stability and lower borrowing costs.

- Substantial Cash Reserves: Provides liquidity for operational needs and strategic initiatives.

- Successful Bond Issuance: Demonstrates market confidence and access to capital for R&D and business development.

Ipsen's financial performance is robust, with total sales growing 11.6% at constant exchange rates in Q1 2025 and 11.4% in H1 2025, leading to an upward revision of its full-year sales growth forecast to over 7.0%. The company also increased its core operating margin forecast to above 32.0% for 2025, reflecting strong financial management and strategic execution.

A key strength is Ipsen's focused strategy on specialty care areas like Oncology, Neuroscience, and Rare Diseases, which have high unmet medical needs. The rare disease segment, in particular, saw a remarkable 95.7% growth in H1 2025, becoming a significant revenue contributor and validating this focused approach.

Ipsen excels at bringing new products to market and expanding the reach of existing ones, evidenced by strong sales growth for Bylvay and Iqirvo. The oncology portfolio is strengthened by Cabometyx's approval for advanced neuroendocrine tumors in Europe, its sixth indication, and a strong U.S. launch for Onivyde, indicating effective commercialization and a promising pipeline.

The company's R&D pipeline is a significant asset, blending internal discoveries with external partnerships, with key regulatory and clinical milestones expected in 2025. Anticipated progress includes a European regulatory submission for tovorafenib in pediatric low-grade glioma and the initiation of a Phase II study for its long-acting neurotoxin (LANT).

| Key Financial & Performance Indicators (H1 2025) | Value | Growth (Constant Exchange Rate) |

| Total Sales | N/A | 11.4% |

| Rare Disease Segment Sales | N/A | 95.7% |

| Gross Margin | 82.69% | N/A |

What is included in the product

Delivers a strategic overview of Ipsen’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing pain points in Ipsen's strategic landscape.

Weaknesses

Ipsen faces a significant challenge with generic competition impacting Somatuline, a key oncology product. This is particularly concerning in major markets like the U.S. and Europe.

The anticipated decline in Somatuline sales due to generic entrants is a notable weakness, as it underscores a reliance on products nearing patent expiry. This situation has already drawn investor scrutiny, signaling a potential vulnerability in Ipsen's revenue streams.

Ipsen has encountered significant pricing pressures within emerging markets, a trend that notably impacted its performance in early 2025. Specifically, sales of its key drug, Cabometyx, saw a 3% decrease in these regions during the first quarter of 2025.

While robust sales volumes in Europe helped to mitigate these declines, the situation in emerging markets highlights ongoing difficulties in preserving pricing strength across diverse geographical landscapes. This suggests a need for strategic adjustments to navigate these challenging market dynamics.

While Ipsen's overall performance shows strength, a closer look reveals some portfolio products are not meeting expectations. For instance, Bylvay experienced quarter-over-quarter stagnation in Q2 2025, a concerning trend for a key product.

Furthermore, other significant products like Dysport, Decapeptyl, Cabometyx, and Onivyde also underperformed relative to consensus forecasts during the same period. This uneven performance across its portfolio suggests challenges in certain therapeutic areas or market segments.

Inherent Risks of Clinical Development

Ipsen, like all biopharmaceutical firms, navigates the significant inherent risks within clinical development. This process is notoriously lengthy and expensive, with a high failure rate for drug candidates even after extensive trials. For instance, the average cost to bring a new drug to market can exceed $2 billion, and a substantial percentage of compounds fail during Phase III trials.

These challenges directly impact Ipsen's pipeline and financial projections. Delays in regulatory approvals, such as those from the FDA or EMA, can push back revenue generation. Furthermore, unexpected adverse events or lack of efficacy observed in late-stage trials can lead to the discontinuation of promising therapies, resulting in sunk costs and a need to pivot research efforts.

- High Failure Rates: Historically, only about 10% of drugs entering clinical trials ultimately receive regulatory approval.

- Costly Development: The financial investment in each drug candidate can run into hundreds of millions of dollars, with Phase III trials alone often costing tens of millions.

- Regulatory Hurdles: Obtaining approval from bodies like the FDA and EMA involves rigorous review processes that can take years and are subject to evolving scientific and safety standards.

- Unforeseen Outcomes: Clinical trials can reveal unexpected side effects or a lack of therapeutic benefit, leading to the termination of development programs, as seen with numerous candidates across the industry in recent years.

Potential for Impairment Losses

Ipsen's financials can be significantly impacted by impairment losses, which occur when the carrying value of an asset exceeds its recoverable amount. This is a notable weakness that can erode profitability and shareholder value. For instance, in 2024, Ipsen recognized a substantial impairment loss of €279 million. This was specifically linked to Sohonos, a drug that experienced lower-than-expected patient uptake, highlighting challenges in achieving commercialization targets.

These types of write-downs directly affect Ipsen's bottom line, reducing net income and potentially impacting earnings per share. Such events can also signal underlying issues with the company's ability to accurately forecast market demand or effectively execute its commercial strategies for new or existing products. Investors often view significant impairment charges as a negative indicator of management's foresight and operational execution.

- Impairment Loss in 2024: Ipsen recorded a €279 million impairment loss related to Sohonos.

- Reason for Impairment: The loss was primarily driven by lower-than-anticipated patient uptake for Sohonos.

- Impact on Profitability: Such impairment charges directly reduce the company's reported profits.

- Commercialization Challenges: The event underscores difficulties in successfully commercializing certain assets as planned.

Ipsen's reliance on key products facing generic competition, particularly Somatuline in major markets, presents a significant revenue vulnerability. This dependence on products nearing patent expiry has already attracted investor attention, indicating a potential weakness in its financial stability.

The company is also grappling with pricing pressures in emerging markets, which impacted Cabometyx sales by 3% in Q1 2025. This ongoing challenge across diverse regions highlights difficulties in maintaining pricing power and suggests a need for strategic adjustments.

Furthermore, a portion of Ipsen's portfolio is underperforming, with Bylvay showing stagnation in Q2 2025. Other key products like Dysport, Decapeptyl, Cabometyx, and Onivyde also missed consensus forecasts in the same period, pointing to uneven performance across therapeutic areas.

The company incurred a €279 million impairment loss in 2024 related to Sohonos due to lower-than-expected patient uptake. Such write-downs directly reduce profitability and can signal issues with commercialization strategy execution.

Same Document Delivered

Ipsen SWOT Analysis

This is the same Ipsen SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Ipsen SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Ipsen is strategically positioned to leverage the significant growth within the rare disease sector. This market is anticipated to grow at a compound annual growth rate of 9.5% up to 2030, indicating substantial future potential.

The company's rare disease division has shown remarkable expansion, largely due to the success of key products such as Bylvay and Iqirvo. This strong performance provides a solid foundation for further market share gains and solidifying Ipsen's leadership in this specialized therapeutic area.

Ipsen's pipeline advancement, particularly with fidrisertib targeting fibrodysplasia ossificans progressiva (FOP) and the LANT program, presents substantial future growth opportunities. These developments are key to expanding its therapeutic reach and revenue potential.

The company's strategic focus on further regulatory approvals and the exploration of new indications within its core therapeutic areas, such as oncology and rare diseases, is crucial. This diversification aims to build more resilient revenue streams, lessening dependence on current blockbuster products.

Ipsen's commitment to strategic partnerships and external innovation is a cornerstone of its growth strategy, enabling it to broaden its drug pipeline and share the significant costs and risks associated with research and development. This approach also provides crucial access to cutting-edge technologies and specialized knowledge that might otherwise be out of reach.

Recent collaborations, particularly in high-impact areas like oncology and rare neurological diseases, are designed to significantly boost Ipsen's capabilities in creating truly transformative medicines. For instance, in 2024, Ipsen announced a collaboration with a biotech firm focused on developing novel gene therapies for specific neurological disorders, aiming to leverage external expertise to accelerate progress in this complex field.

Global Market Expansion for Neuroscience Products

Ipsen's neuroscience division is experiencing robust growth, driven by its successful global expansion strategies and a rising demand for its neurotoxin-based therapies. This momentum offers a clear pathway for further market penetration worldwide.

Leveraging its established expertise in neurotoxins presents a significant opportunity, particularly in expanding both therapeutic applications and the lucrative aesthetic market. The company's collaboration with Galderma exemplifies this strategy, showcasing the potential for synergistic growth.

- Global Neuroscience Market Growth: The global market for neurotoxins, a key segment for Ipsen's neuroscience division, was projected to reach approximately $7.5 billion by 2024, with continued strong growth expected in the following years.

- Therapeutic Applications: Ipsen's focus on treatments for conditions like cervical dystonia and spasticity continues to drive demand in established and emerging markets.

- Aesthetic Market Potential: The aesthetic neurotoxin market, a significant growth driver, saw global revenues exceeding $5 billion in 2023, with Ipsen's strategic partnerships poised to capture a larger share.

- Geographic Expansion: Continued investment in expanding commercial infrastructure in key regions, including Asia-Pacific and Latin America, is crucial for capitalizing on unmet medical needs and increasing market access.

Leveraging Sustainability Initiatives for Brand Enhancement

Ipsen's robust sustainability efforts, such as their commitment to reducing greenhouse gas emissions and improving sustainable transportation, present a significant opportunity to bolster brand image. This focus resonates strongly with a growing segment of investors and business partners who prioritize environmental, social, and governance (ESG) factors. For instance, Ipsen reported a 20% reduction in Scope 1 and 2 GHG emissions by the end of 2023 compared to their 2019 baseline, a tangible achievement that underscores their dedication.

By effectively communicating these initiatives, Ipsen can attract environmentally conscious stakeholders and enhance its appeal in the market. This proactive approach not only strengthens brand loyalty but also fosters long-term operational resilience by anticipating and mitigating environmental risks. The company's investment in sustainable logistics, including a 15% increase in the use of electric vehicles within its European fleet in 2024, further demonstrates this commitment.

- Enhanced Corporate Reputation: Ipsen's sustainability achievements, like their 20% GHG emission reduction by end-2023, bolster brand image.

- Attracting ESG Investors: A strong ESG profile appeals to a growing base of environmentally and socially conscious investors.

- Improved Operational Resilience: Proactive sustainability measures help mitigate environmental risks and ensure long-term business continuity.

- Sustainable Transportation Advancements: The 15% increase in electric vehicle usage in their European fleet in 2024 highlights practical sustainability implementation.

Ipsen's strategic focus on rare diseases and neuroscience presents significant avenues for growth, bolstered by strong product performance and pipeline advancements. The company is well-positioned to capitalize on the expanding global market for neurotoxins, estimated to reach approximately $7.5 billion by 2024, and the burgeoning aesthetic market, which exceeded $5 billion in global revenues in 2023.

Further opportunities lie in expanding therapeutic applications for existing neurotoxins and increasing market access in regions like Asia-Pacific and Latin America. Ipsen's commitment to sustainability, evidenced by a 20% reduction in Scope 1 and 2 GHG emissions by the end of 2023 and a 15% increase in electric vehicle usage in its European fleet in 2024, enhances its corporate reputation and attracts ESG-focused investors.

| Opportunity Area | Key Drivers | Market Data (2023-2024) |

|---|---|---|

| Rare Diseases | Bylvay, Iqirvo success; Pipeline (fidrisertib, LANT) | Rare disease market CAGR: 9.5% (to 2030) |

| Neuroscience | Global neurotoxin market growth; Aesthetic market expansion | Neurotoxin market: ~$7.5 billion (2024 projection); Aesthetic market: >$5 billion (2023) |

| Strategic Partnerships | Access to novel technologies (e.g., gene therapy) | Collaborations in oncology & neurological disorders (2024) |

| Sustainability (ESG) | Enhanced brand image; Attracting ESG investors | 20% GHG emission reduction (vs. 2019 baseline by end-2023); 15% EV fleet increase (Europe, 2024) |

Threats

A major threat for Ipsen is the increasing competition from generic drug manufacturers, particularly as patents for key products expire. This is especially concerning for revenue drivers like Somatuline.

The loss of patent protection allows cheaper generic versions to enter the market, which can significantly reduce Ipsen's sales and profit margins. For instance, the patent for Somatuline Autogel expired in the US in 2023, opening the door for generic competition.

Ipsen faces significant risks from broader economic downturns and unpredictable currency movements. These macroeconomic factors can negatively impact the company's reported financial performance, making it harder to predict revenue and profitability.

The company anticipates an adverse impact on its total sales due to currency fluctuations in 2025. This projection underscores the ongoing challenge of managing currency exchange rate volatility in its global operations.

The biopharmaceutical sector is fiercely competitive, characterized by swift technological progress and a constant stream of new competitor products, often backed by aggressive patent maneuvering. This dynamic environment can constrain Ipsen's ability to capture and maintain market share, while simultaneously exerting downward pressure on pricing. For instance, in 2024, the global biopharmaceutical market was valued at approximately $500 billion, with significant R&D spending by major players to secure market advantages.

Evolving Regulatory and Healthcare Policy Environment

The pharmaceutical industry constantly navigates a shifting landscape of regulations and healthcare policies. For Ipsen, this means keeping a close eye on changes in areas like drug pricing controls, market access requirements, and intellectual property laws. For instance, in 2024, many European countries continued to implement stricter price negotiations and reimbursement policies, potentially impacting the profitability of new and existing treatments.

Global trends toward healthcare cost containment present a significant challenge. Governments worldwide are increasingly focused on managing healthcare expenditures, which can directly affect how pharmaceutical companies like Ipsen price their products and gain market approval. This pressure can lead to reduced profit margins and a more competitive environment for drug commercialization.

- Increased Scrutiny on Drug Pricing: In 2024, several major markets saw intensified government negotiations and proposed legislation aimed at capping or reducing pharmaceutical prices, directly impacting revenue potential.

- Evolving Reimbursement Frameworks: Changes in how healthcare systems evaluate and pay for new therapies, often prioritizing cost-effectiveness, can create hurdles for market access and adoption of Ipsen's innovative products.

- Global Policy Divergence: Differing regulatory approaches across key markets in 2024 and 2025 create complexity in market access strategies and can slow down the commercialization of new drugs.

Risks Associated with Third-Party Dependencies

Ipsen's reliance on third parties for the development and marketing of certain medicines, which are crucial for generating substantial royalty income, presents a significant threat. For instance, if a key partner fails to meet contractual obligations or experiences operational issues, Ipsen's projected revenues from these collaborations could be severely impacted. This dependency creates vulnerability to external factors beyond Ipsen's direct control.

Potential disputes with these third-party partners also pose a risk. Such disagreements could lead to costly legal battles, delays in product launches or marketing efforts, and ultimately, a reduction in anticipated royalty payments. The progression of Ipsen's pipeline can be hindered if these collaborations falter.

- Partnership Performance: Any underperformance by a key partner in development or commercialization could directly affect Ipsen's royalty income and market access for critical drugs.

- Contractual Disputes: Disagreements over intellectual property, revenue sharing, or performance metrics can lead to protracted legal battles, disrupting business and impacting financial forecasts.

- Supply Chain Disruptions: If a third-party manufacturer or distributor faces issues, it could lead to shortages or delays in product availability, affecting sales and patient access, thereby impacting Ipsen's revenue streams.

- Strategic Misalignment: A divergence in strategic priorities between Ipsen and its partners could result in suboptimal marketing efforts or a reduced focus on shared assets, diminishing their commercial potential.

Ipsen faces intense competition from generic manufacturers as patents expire, notably for Somatuline, which lost US patent protection in 2023. This erosion of exclusivity directly impacts sales and profitability. Furthermore, the dynamic biopharmaceutical landscape, valued at around $500 billion in 2024, is marked by rapid innovation and aggressive patent strategies from rivals, potentially limiting Ipsen's market share and pricing power.

Navigating evolving global healthcare policies and cost-containment measures presents a significant hurdle. Stricter pricing negotiations and reimbursement frameworks, particularly in Europe during 2024, can reduce profit margins and complicate market access for Ipsen's treatments. Additionally, Ipsen's reliance on third-party partnerships for key drug development and marketing introduces risks related to partner performance, potential contractual disputes, and supply chain disruptions, all of which could negatively affect royalty income and product availability.

| Threat Area | Specific Risk | Impact on Ipsen | 2024/2025 Context |

|---|---|---|---|

| Competition | Generic Erosion | Reduced sales & margins | Somatuline US patent expired 2023 |

| Competition | Rival Innovation | Market share & pricing pressure | Biopharma market ~$500B in 2024 |

| Regulatory & Policy | Pricing Controls | Lower profitability | Increased price negotiations in Europe (2024) |

| Regulatory & Policy | Reimbursement Hurdles | Market access challenges | Focus on cost-effectiveness |

| Partnerships | Partner Underperformance | Lower royalty income | Crucial for pipeline progression |

| Partnerships | Contractual Disputes | Legal costs, launch delays | Disagreements over IP, revenue sharing |

SWOT Analysis Data Sources

This Ipsen SWOT analysis is built upon a robust foundation of credible data, including Ipsen's official financial filings, comprehensive market intelligence reports, and expert industry analysis to ensure a thorough and informed strategic assessment.