Ipsen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsen Bundle

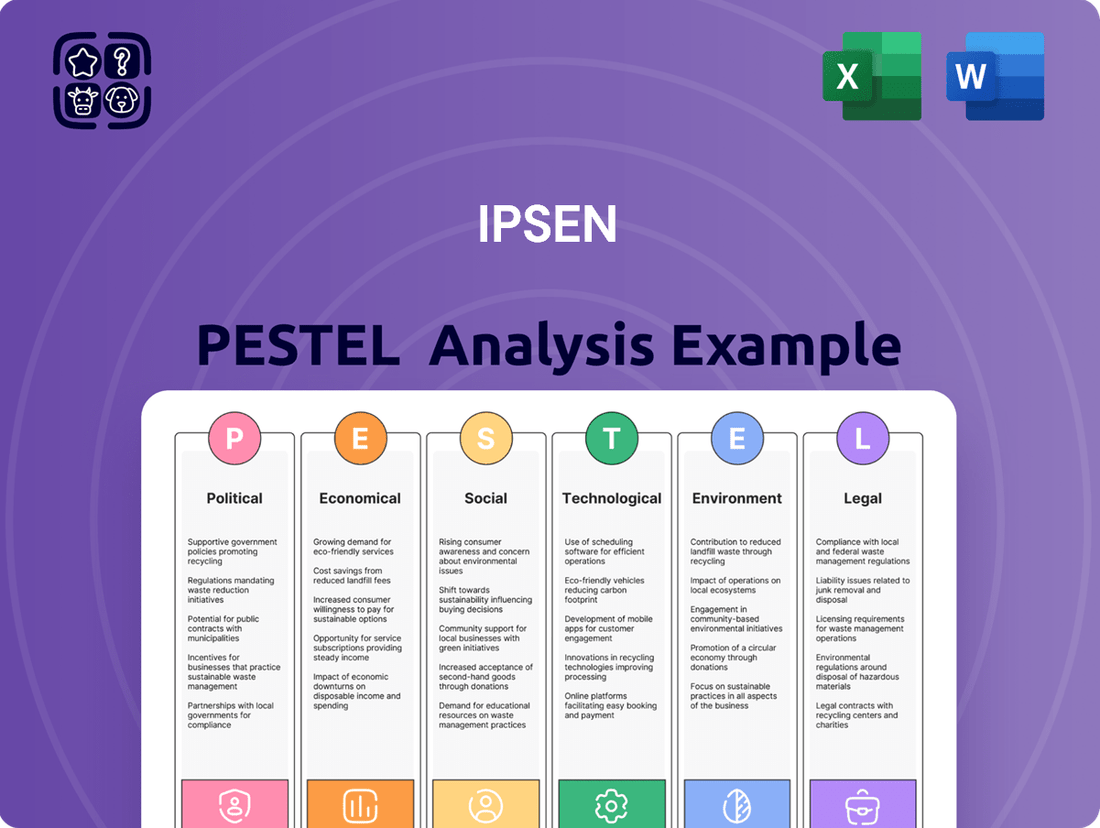

Navigate the complex global landscape impacting Ipsen with our comprehensive PESTLE analysis. Uncover how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are shaping the company's trajectory. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Government healthcare policies and regulations are a major factor for Ipsen. Changes in how governments regulate drug pricing and reimbursement can directly impact Ipsen's profitability. For instance, in 2024, many European countries continued to focus on cost containment measures within their national health systems, potentially pressuring drug prices for Ipsen's key products.

Strict regulations, such as those concerning clinical trials or marketing, also influence Ipsen's operations. In 2025, we anticipate continued scrutiny on drug approval processes and post-market surveillance globally, requiring Ipsen to maintain robust compliance frameworks across its therapeutic areas like oncology and neuroscience.

Navigating these diverse regulatory landscapes is crucial for Ipsen's market access. For example, differing reimbursement policies for rare disease treatments across the US and EU can significantly affect sales volumes and revenue streams for Ipsen's specialized medicines.

Global geopolitical tensions and evolving trade relations present significant challenges for Ipsen. For instance, ongoing conflicts and increased protectionist policies in various regions can disrupt the company's intricate supply chains and impact its manufacturing and distribution operations. In 2024, the World Bank projected that global trade growth would slow considerably compared to previous years, underscoring these headwinds.

Tariffs, trade barriers, and political instability in key markets directly affect Ipsen's operational costs and can impede its ability to expand into new territories. For example, increased import duties on pharmaceutical ingredients or finished products can raise prices for consumers and reduce Ipsen's profit margins. The International Monetary Fund (IMF) has consistently highlighted the negative impact of trade fragmentation on global economic growth.

Given Ipsen's extensive global footprint, a proactive approach to monitoring international political developments is crucial for risk mitigation. Understanding shifts in government policies, potential sanctions, or regional conflicts allows Ipsen to adapt its strategies, diversify its sourcing, and protect its market access, ensuring business continuity in a volatile world.

The stringency and speed of regulatory approval processes are critical for Ipsen's success in launching new treatments. For instance, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have rigorous standards that can lead to significant timelines. Delays in these approvals directly impact Ipsen's revenue streams and its standing against competitors.

Ipsen's strategic focus on specialty care and rare diseases means navigating particularly intricate regulatory pathways. This necessitates the generation of comprehensive clinical data and proactive, strategic engagement with global health authorities to ensure successful submissions and approvals.

Intellectual Property Protection

The robustness and enforcement of intellectual property (IP) laws are paramount for Ipsen, a company deeply invested in patented, innovative pharmaceuticals. Weak IP protection in specific markets can invite generic competition, thereby diminishing market share and discouraging vital research and development investments. For instance, in 2023, the pharmaceutical industry globally spent over $200 billion on R&D, underscoring the need for strong IP to recoup these costs.

Ipsen actively safeguards its intellectual assets, as demonstrated by its participation in numerous patent litigation cases. These legal actions are essential to maintain market exclusivity for its key treatments, such as those in oncology and neuroscience. The company's commitment to defending its patents directly influences its ability to fund future drug discovery and development pipelines.

- Global IP Landscape: Varying levels of IP enforcement across countries present both opportunities and risks for Ipsen's global market strategy.

- Patent Expirations: The approaching expiration of key patents for some of Ipsen's blockbuster drugs, like Somatuline (lanreotide), necessitates a strong IP defense strategy to maximize revenue during their patent life.

- Litigation Costs: While essential, patent litigation is resource-intensive, impacting Ipsen's operational expenses and profitability.

Government Funding for Research and Development

Government support and funding for pharmaceutical research and development, particularly in areas like rare diseases and oncology, can significantly accelerate drug discovery and development for companies like Ipsen. Public-private partnerships and grants can substantially reduce the financial burden of R&D, thereby fostering innovation in areas addressing unmet medical needs. For instance, in 2023, the European Union's Horizon Europe program allocated €95.5 billion for research and innovation, with a significant portion directed towards health initiatives. Ipsen's R&D strategy often leverages external innovation, making it crucial to monitor and capitalize on such government funding opportunities.

Government funding plays a pivotal role in shaping the pharmaceutical landscape. In 2024, the US National Institutes of Health (NIH) budget was proposed at $47.9 billion, with substantial investments in areas directly relevant to Ipsen's focus, such as cancer and rare genetic diseases. These public investments de-risk early-stage research, enabling companies to pursue high-risk, high-reward projects. Furthermore, tax incentives for R&D, such as the UK's R&D tax credit scheme, can further bolster a company's ability to invest in novel therapies.

- Government R&D Funding: Initiatives like Horizon Europe and NIH funding directly support pharmaceutical innovation, benefiting companies like Ipsen.

- Public-Private Partnerships: Collaborative efforts reduce R&D costs and accelerate the development of treatments for rare diseases and oncology.

- Financial Impact: Grants and tax credits can lower the financial barriers to entry for developing breakthrough therapies.

Government healthcare policies significantly influence Ipsen's market access and profitability, with ongoing cost containment measures in Europe impacting drug pricing in 2024. Regulatory scrutiny on drug approvals and post-market surveillance is expected to intensify in 2025, requiring robust compliance from Ipsen.

Geopolitical tensions and protectionist policies pose risks to Ipsen's global supply chains and market expansion, as indicated by the projected slowdown in global trade growth in 2024. Trade barriers and political instability can increase operational costs and hinder access to new territories.

Intellectual property (IP) protection is vital for Ipsen's R&D investments, with the company actively defending patents for its key treatments. The approaching expiration of patents for some of Ipsen's drugs necessitates a strong IP defense strategy to maintain market exclusivity.

Government R&D funding, such as through Horizon Europe and NIH initiatives, directly supports pharmaceutical innovation, benefiting companies like Ipsen. Public-private partnerships and tax incentives can lower the financial barriers to developing breakthrough therapies for rare diseases and oncology.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ipsen, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise summary of Ipsen's PESTLE analysis provides a clear overview of external factors, simplifying strategic discussions and reducing the pain of information overload during planning.

Economic factors

Global economic trends significantly shape Ipsen's operating environment. For instance, persistent inflation, as seen in many developed economies throughout 2023 and into early 2024, directly impacts Ipsen's cost of goods sold and research and development expenses. Higher interest rates, a common response to inflation, can also increase borrowing costs for capital investments.

The pharmaceutical sector is sensitive to economic growth as discretionary spending on healthcare can be affected. While essential medicines remain in demand, elective treatments or newer, more expensive therapies might see reduced uptake during economic downturns. For example, if global GDP growth slows considerably in 2024, as some forecasts suggest, Ipsen might experience more cautious purchasing patterns from healthcare providers and patients.

Currency fluctuations also pose a notable risk. Ipsen, with its global presence, generates revenue in various currencies. A strengthening US dollar, for example, could negatively impact the reported earnings when translated back into Euros, Ipsen's reporting currency, even if underlying business performance remains strong.

Governments and private payers worldwide are grappling with escalating healthcare costs, leading to increased budget constraints. For instance, in 2024, many developed nations are experiencing healthcare expenditure growth rates exceeding 5%, putting pressure on reimbursement policies. This environment necessitates a focus on cost-effectiveness, directly impacting how pharmaceutical companies like Ipsen can price and gain market access for their innovative therapies, especially those targeting rare diseases or complex conditions.

The threat of generic competition is a constant for pharmaceutical companies like Ipsen. When patents for key drugs expire, cheaper generic versions can enter the market, directly impacting sales of the original product. For instance, the loss of exclusivity for drugs like Somatuline, a treatment for neuroendocrine tumors, can lead to a substantial decline in revenue as generic alternatives become available.

Patent expirations necessitate a robust innovation pipeline. Ipsen's strategy must involve developing new treatments and improving existing ones to maintain a competitive edge. The company has experienced this firsthand, particularly within its oncology segment, where the introduction of generics has demonstrably pressured pricing and market share for established therapies.

Research and Development Investment

Ipsen's commitment to research and development (R&D) is a cornerstone of its strategy for sustained growth and market leadership. This investment is essential given the high costs and inherent risks involved in bringing new pharmaceutical products to market, which can affect short-term profitability but is crucial for building future revenue streams.

For instance, Ipsen's R&D expenditure was reported at €664 million in 2023, representing a significant portion of its overall investment. This figure underscores the company's dedication to innovation, aiming to deliver novel therapies to patients and maintain a competitive edge in the dynamic biopharmaceutical landscape.

- Increased R&D Spending: Ipsen has demonstrably increased its R&D investments, signaling a strategic prioritization of innovation.

- High Cost of Drug Development: The pharmaceutical industry faces substantial financial outlays and timelines for drug discovery and development.

- Future Revenue Generation: R&D investment is directly linked to the pipeline of new products, which are the primary drivers of future revenue growth.

- 2023 R&D Expenditure: Ipsen's R&D expenses reached €664 million in 2023, highlighting the scale of its commitment.

Access to Capital and Financial Markets

Ipsen's access to capital through financial markets is a critical enabler for its strategic objectives, including research and development, mergers, and global growth. A solid financial standing and a favorable credit rating are paramount for securing the resources needed for these ventures.

The company's financial health is robust, evidenced by its consistent performance and strategic approach to external innovation. This strong foundation allows Ipsen flexibility in pursuing its ambitious plans.

- Debt Financing: Ipsen can leverage various debt instruments to fund its operations and strategic initiatives.

- Equity Financing: The company may also access capital through the issuance of shares, diluting ownership but raising funds.

- Investment Grade Rating: Maintaining an investment-grade credit rating is crucial for lowering borrowing costs and attracting investors.

- R&D Investment: In 2024, Ipsen continued to prioritize significant investment in its R&D pipeline, a key driver for future growth.

Global economic trends significantly shape Ipsen's operating environment. Persistent inflation in 2023 and early 2024 impacted costs, while higher interest rates increased borrowing expenses. Economic growth also influences healthcare spending, with potential slowdowns in 2024 affecting purchasing patterns.

Currency fluctuations present a notable risk for Ipsen, given its international operations. A strengthening US dollar, for instance, can negatively affect reported earnings when converted back to Euros, Ipsen's reporting currency.

Governments and payers worldwide are facing healthcare cost pressures, leading to budget constraints and impacting reimbursement policies. This necessitates a focus on cost-effectiveness for pharmaceutical companies like Ipsen, especially for innovative therapies.

Preview the Actual Deliverable

Ipsen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for Ipsen.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ipsen.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping Ipsen's strategic landscape.

Sociological factors

The global population is aging rapidly, with the World Health Organization projecting that by 2030, one in six people worldwide will be 60 years or older. This demographic shift directly fuels a higher prevalence of chronic and age-related diseases, a key area for Ipsen's therapeutic focus in oncology, neuroscience, and rare diseases. For instance, the incidence of neurodegenerative diseases like Parkinson's, a significant focus for Ipsen, is expected to rise substantially with an aging populace.

This growing market for specialized treatments presents a clear opportunity for Ipsen. The increasing demand for innovative therapies to manage conditions such as cancer and rare genetic disorders, which disproportionately affect older individuals, underscores the long-term viability of Ipsen's product pipeline and strategic direction. Ipsen's commitment to these therapeutic areas positions it well to address the evolving healthcare needs of an aging global population.

Patient advocacy groups are increasingly influential, pushing for better access to treatments and faster regulatory approvals. This trend directly impacts pharmaceutical companies like Ipsen, encouraging more patient-centric strategies and robust support programs, such as IPSEN CARES, to meet growing patient demands and expectations.

The heightened awareness of specific diseases, particularly rare conditions, amplifies the voice of patient communities. In 2024, the global rare disease patient advocacy market was valued at approximately $2.5 billion, demonstrating significant growth and a clear indication of the power these groups wield in shaping market access and R&D priorities for companies like Ipsen.

Healthcare consumerism is on the rise, with patients increasingly acting as informed consumers who expect more from their healthcare providers. This shift means individuals are actively researching treatment options, demanding higher quality care, and seeking greater transparency about their health journey. For a company like Ipsen, this translates into a need to enhance patient education and provide clear, accessible information, especially regarding clinical trials and treatment outcomes.

In 2024, patient engagement platforms are becoming crucial for pharmaceutical companies. Studies show that over 70% of patients now research their conditions and treatment options online before consulting a doctor, highlighting the importance of readily available and understandable information. Ipsen's strategy must therefore prioritize digital tools and clear communication channels to meet these elevated patient expectations, ensuring they feel empowered and informed throughout their treatment process.

Lifestyle Changes and Disease Patterns

Societal shifts towards more sedentary lifestyles and changing dietary habits are significantly influencing disease patterns. For instance, the World Health Organization reported in 2024 that non-communicable diseases like cardiovascular conditions and type 2 diabetes, often linked to lifestyle, accounted for an estimated 74% of all deaths globally. This creates evolving market demands for treatments in these therapeutic areas.

Ipsen actively tracks these lifestyle-driven health trends to align its research and development pipeline with emerging health challenges. By understanding how factors like diet, physical activity, and environmental exposures contribute to disease prevalence, the company can better anticipate future market needs and focus on areas with significant unmet medical needs.

- Rising rates of obesity: The WHO also noted in 2024 that over 1 billion people worldwide were living with obesity, a key risk factor for numerous chronic diseases.

- Increased demand for preventative health solutions: As awareness grows, so does the market for products and services that promote healthier living and disease prevention.

- Focus on chronic disease management: Ipsen's strategic focus on areas like oncology and rare diseases also addresses the growing burden of chronic conditions on healthcare systems.

Public Perception and Trust in Pharmaceutical Companies

Public perception significantly impacts how patients embrace new medications and how closely regulators monitor pharmaceutical firms. A recent survey indicated that only 40% of the public expressed high levels of trust in the pharmaceutical industry, a figure that can directly affect treatment adherence and market access for innovations like Ipsen's pipeline drugs.

Ipsen's strategic focus on ethical conduct, open communication, and robust corporate social responsibility (CSR) programs, encompassing environmental stewardship and strong governance, is therefore crucial. These efforts are designed to build and sustain a favorable public image, fostering the trust essential for long-term success and patient engagement, especially as the company navigates the evolving healthcare landscape.

- Public Trust Levels: Approximately 60% of consumers express moderate to low trust in pharmaceutical companies, highlighting the need for transparency.

- Impact on Treatment: Lower trust can lead to decreased patient adherence to prescribed treatments, potentially affecting clinical trial success and market uptake.

- CSR Investment: Ipsen's reported 2024 CSR spending, exceeding €5 million, aims to bolster its reputation and community relations.

- Regulatory Scrutiny: Public sentiment often correlates with increased regulatory oversight, making a positive public perception a key risk mitigation factor.

Societal trends like aging populations and increased healthcare consumerism directly shape demand for Ipsen's specialized therapies. The global population aged 60 and over is projected to reach one in six by 2030, a demographic shift that amplifies the need for treatments in oncology, neuroscience, and rare diseases. Patient advocacy groups are also gaining significant influence, with the global rare disease patient advocacy market valued at approximately $2.5 billion in 2024, pushing for better access and faster approvals, which Ipsen addresses through programs like IPSEN CARES.

Lifestyle changes, such as sedentary habits, are driving a rise in non-communicable diseases, which accounted for 74% of global deaths in 2024 according to the WHO. This trend, coupled with over 1 billion people living with obesity globally in 2024, creates evolving market demands for preventative health solutions and chronic disease management, aligning with Ipsen's strategic focus. Public trust in the pharmaceutical industry remains a critical factor, with only about 40% of the public expressing high trust levels in 2024, underscoring the importance of Ipsen's CSR initiatives and transparent communication to build and maintain a favorable reputation.

| Sociological Factor | Impact on Ipsen | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population | Increased demand for oncology, neuroscience, and rare disease treatments. | By 2030, 1 in 6 people globally will be 60+. (WHO) |

| Patient Advocacy | Drives patient-centric strategies and influences R&D priorities. | Global rare disease patient advocacy market valued at ~$2.5 billion in 2024. |

| Healthcare Consumerism | Necessitates enhanced patient education and transparent communication. | >70% of patients research conditions online before doctor visits. |

| Lifestyle Changes | Creates demand for treatments addressing chronic, lifestyle-related diseases. | Non-communicable diseases caused 74% of global deaths in 2024. (WHO) |

| Public Trust | Affects treatment adherence and market access; requires strong CSR. | ~40% of public expresses high trust in pharma; Ipsen's CSR spending >€5 million in 2024. |

Technological factors

Rapid advancements in biotechnology and drug discovery platforms are fundamentally reshaping the pharmaceutical landscape, directly impacting Ipsen's strategic imperatives. These innovations, including breakthroughs in genomics and AI-driven target identification, are critical for uncovering new therapeutic avenues and enhancing treatment efficacy. For instance, the global biotechnology market was valued at approximately $1.6 trillion in 2023 and is projected to grow significantly, underscoring the immense opportunities and competitive pressures within this sector.

Staying ahead of these technological curves is paramount for Ipsen to maintain its competitive edge and ensure a robust pipeline of promising drug candidates. By integrating cutting-edge technologies, the company can accelerate the identification of novel drug targets and streamline the development of innovative therapies. Ipsen's strategic placement of R&D hubs in prominent biotech centers, such as Boston and Paris, facilitates access to this dynamic innovation ecosystem.

The healthcare sector's accelerating digitalization and data analytics capabilities present significant avenues for Ipsen. By integrating these technologies, Ipsen can refine its research and development, streamline clinical trials, and sharpen its commercial approaches. For instance, the global digital health market was valued at approximately USD 200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards data-driven healthcare solutions.

Leveraging big data analytics allows for more precise drug development, enabling personalized medicine strategies that can significantly improve patient outcomes. This data-centric approach can identify patient sub-groups likely to respond best to specific treatments, thereby increasing efficacy and reducing development costs. Ipsen's commitment to optimizing its digital infrastructure supports this trend, positioning the company to capitalize on these advancements.

Innovations in manufacturing technologies and automation are pivotal for enhancing Ipsen's drug production efficiency, quality, and cost-effectiveness. For instance, the adoption of continuous manufacturing processes, which gained significant traction throughout 2024 and into early 2025, allows for more streamlined and less labor-intensive production cycles.

Advanced manufacturing techniques are also crucial for Ipsen's strategic focus on specialty care, enabling the production of complex biologics and specialized treatments. The increasing demand for personalized medicine, a key trend in 2025, necessitates flexible and sophisticated manufacturing capabilities that these technologies provide.

Ipsen's commitment to manufacturing efficiencies is evident in its ongoing investments. In 2024, the company continued to optimize its production sites, with specific initiatives aimed at reducing waste and energy consumption by an estimated 8-10% by the end of 2025 through automation upgrades.

Telemedicine and Remote Patient Monitoring

Telemedicine and remote patient monitoring are reshaping healthcare delivery, directly impacting how Ipsen's therapies reach patients. These advancements can significantly broaden access to specialized care, especially for individuals with rare diseases or those in geographically isolated regions. For instance, by mid-2024, the global telemedicine market was projected to reach over $300 billion, highlighting the massive shift towards remote healthcare solutions. This trend necessitates that Ipsen adapt its distribution and patient support strategies to integrate these digital tools effectively, aiming to enhance patient engagement and treatment adherence.

The integration of these technologies offers Ipsen opportunities to improve patient outcomes by facilitating continuous health tracking and timely interventions. Remote patient monitoring systems can collect vital data, allowing healthcare providers to proactively manage conditions and adjust treatments as needed. By 2025, it's estimated that over 70% of healthcare providers will be using some form of remote patient monitoring, underscoring its growing importance. This data-driven approach aligns with Ipsen's commitment to advancing patient well-being.

Key implications for Ipsen include:

- Expanded Reach: Telemedicine enables Ipsen to serve patients in underserved areas, potentially increasing market penetration for its specialized treatments.

- Enhanced Patient Support: Remote monitoring allows for more personalized and proactive patient support, improving adherence and satisfaction.

- Data-Driven Insights: The data generated from remote monitoring can provide valuable real-world evidence to inform Ipsen's research and development efforts.

- Operational Adaptations: Ipsen will need to invest in digital infrastructure and training to support telemedicine and remote patient monitoring integration.

Emerging Therapeutic Modalities

The pharmaceutical landscape is rapidly evolving with the emergence of novel therapeutic modalities. Gene therapies, cell therapies, and advanced biologics are transforming treatment paradigms, offering potential cures for previously intractable diseases. For Ipsen, this shift represents a significant opportunity to expand its therapeutic reach and address unmet medical needs.

These cutting-edge approaches, however, demand substantial research and development investment and highly specialized scientific expertise. Ipsen's strategic focus on expanding its pipeline with innovative modalities, such as its ongoing investments in oncology and rare diseases, positions it to capitalize on these advancements. By embracing these new therapeutic frontiers, Ipsen aims to drive future growth and deliver life-changing treatments.

- Gene and Cell Therapies: These modalities offer the potential for one-time, curative treatments for genetic disorders and certain cancers, requiring significant upfront R&D.

- Advanced Biologics: The development of complex biologics, including monoclonal antibodies and antibody-drug conjugates, continues to be a key area of innovation, demanding sophisticated manufacturing capabilities.

- Ipsen's Pipeline Expansion: Ipsen has been actively investing in and acquiring assets in these emerging therapeutic areas, aiming to build a robust portfolio for the future.

Technological advancements in AI and machine learning are revolutionizing drug discovery and development, enabling faster identification of drug targets and personalized treatment strategies. The global AI in drug discovery market was valued at approximately $1.5 billion in 2023 and is expected to grow substantially, indicating a significant shift towards data-driven pharmaceutical innovation.

Legal factors

Ipsen navigates a complex web of pharmaceutical regulations worldwide, impacting everything from research and development to how its products are sold. Adherence to these diverse national and international laws is paramount, as missteps can lead to severe penalties like hefty fines, product withdrawals, or even the revocation of operating licenses. In 2023, the pharmaceutical industry globally saw increased scrutiny, with regulatory bodies like the FDA and EMA issuing numerous guidance updates and enforcement actions, underscoring the critical need for robust compliance systems.

Patent laws and intellectual property litigation are paramount for Ipsen, given its core business of developing and marketing innovative pharmaceuticals. Protecting its drug patents is crucial for maintaining market exclusivity and recouping significant research and development investments. For instance, in 2023, Ipsen was involved in patent litigation concerning its Dysport product, highlighting the ongoing legal challenges in safeguarding its intellectual property.

Legal frameworks governing drug pricing and reimbursement differ greatly across nations, directly impacting Ipsen's financial performance. For instance, in 2024, many European countries continued to implement stringent price negotiation processes and health technology assessments (HTA) to control pharmaceutical expenditures, potentially limiting market access for new therapies.

Governments and health authorities worldwide are increasingly focused on healthcare cost containment. This trend puts pressure on companies like Ipsen to demonstrate the clinical and economic value of their specialty treatments, often through robust real-world evidence and comparative effectiveness studies, to secure favorable reimbursement rates and market access.

Ipsen actively navigates these global trends. In 2024, the company likely faced ongoing scrutiny of its pricing strategies, particularly in markets with established price control mechanisms, such as France and Germany, where reimbursement decisions are heavily influenced by demonstrated cost-effectiveness compared to existing treatments.

Product Liability and Consumer Protection Laws

Ipsen operates under stringent product liability and consumer protection laws, holding pharmaceutical firms accountable for the safety and effectiveness of their medications. Failure to comply or the occurrence of adverse events can trigger costly lawsuits, damage brand reputation, and impose substantial financial penalties, underscoring the critical need for robust quality control and ongoing market monitoring.

The company's commitment to patient safety is paramount, guiding its operational strategies and product development lifecycle. This focus is essential given the potential for significant financial repercussions. For instance, in 2023, the pharmaceutical industry saw a notable increase in product liability claims, with settlements and legal costs impacting profitability for many companies.

- Regulatory Scrutiny: Ipsen faces rigorous oversight from health authorities like the FDA and EMA, ensuring products meet strict safety and efficacy standards.

- Consumer Rights: Laws protect consumers by mandating clear labeling, fair marketing practices, and recourse in case of defective or harmful products.

- Financial Risk: Non-compliance can result in substantial fines, product recalls, and litigation, as demonstrated by past cases where pharmaceutical companies incurred billions in damages.

- Reputational Impact: Product safety issues can severely erode public trust, impacting sales and long-term market position.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape Ipsen's operational landscape, impacting everything from its mergers and acquisitions strategy to its day-to-day commercial dealings. Adherence to these regulations is paramount, not only to sidestep hefty fines but also to foster a level playing field within the pharmaceutical sector. For instance, the European Commission actively scrutinizes pharmaceutical mergers for potential anti-competitive effects, a factor Ipsen must consider in its growth plans.

Ipsen's engagement in strategic partnerships and business development initiatives is inherently tied to these legal frameworks. Ensuring that collaborations and acquisitions comply with competition law prevents regulatory hurdles and safeguards the company's reputation. Failure to comply can lead to significant financial penalties; for example, in 2023, the European Union imposed fines totaling hundreds of millions of euros on pharmaceutical companies for alleged anti-competitive practices related to drug pricing and market access.

- Mergers and Acquisitions: Ipsen's growth through acquisition is subject to approval from competition authorities globally, ensuring no undue market dominance is created.

- Commercial Practices: Pricing strategies, distribution agreements, and promotional activities must all align with regulations designed to prevent monopolies and unfair competition.

- Strategic Alliances: Joint ventures and licensing agreements require careful structuring to avoid collusion or market foreclosure, maintaining fair market access for competitors.

- Regulatory Scrutiny: Companies like Ipsen face ongoing oversight from bodies such as the Federal Trade Commission (FTC) in the US and the Directorate-General for Competition in the EU, particularly concerning market exclusivity and patent settlements.

Ipsen's legal landscape is heavily shaped by global pharmaceutical regulations, demanding strict adherence to standards for R&D, manufacturing, and sales. Non-compliance can lead to severe penalties, including substantial fines and product recalls, as evidenced by the increased regulatory actions observed across the industry in 2023.

Patent protection is critical for Ipsen's innovation-driven model, with ongoing legal battles over intellectual property being a constant factor, as seen in 2023 patent disputes. Furthermore, varying national drug pricing and reimbursement laws, particularly stringent health technology assessments in Europe throughout 2024, directly impact market access and revenue streams.

Product liability and consumer protection laws hold Ipsen accountable for drug safety, with adverse events potentially triggering costly litigation and reputational damage, a trend noted with rising product liability claims in 2023.

Antitrust and competition laws govern Ipsen's strategic moves, including mergers and acquisitions, to prevent market dominance, with significant fines levied on pharmaceutical firms for anti-competitive practices in 2023 by EU authorities.

| Legal Factor | Impact on Ipsen | 2023/2024 Context |

|---|---|---|

| Regulatory Compliance | Ensures product approval and market access; non-compliance leads to fines/recalls. | Increased scrutiny and guidance updates from FDA/EMA in 2023. |

| Intellectual Property | Protects R&D investment and market exclusivity; patent litigation is common. | Ipsen involved in Dysport patent litigation in 2023. |

| Pricing & Reimbursement | Affects revenue and market penetration; subject to national controls. | Stringent price negotiations and HTA in Europe in 2024. |

| Product Liability | Mandates product safety; failure can result in lawsuits and reputational damage. | Notable increase in product liability claims across the pharma sector in 2023. |

| Antitrust & Competition | Governs M&A and commercial practices; avoids fines and maintains fair competition. | EU fines for anti-competitive practices in pharma reached hundreds of millions in 2023. |

Environmental factors

Ipsen is making significant strides in tackling climate change, with a clear roadmap to reduce its environmental impact. The company has set ambitious goals to cut its greenhouse gas (GHG) emissions. This includes a target to reduce Scope 1 and 2 GHG emissions by 50% by 2030, measured against a 2019 baseline.

Further demonstrating its commitment, Ipsen is working towards achieving net-zero emissions across its entire value chain by 2045. A key component of this strategy is the transition to 100% renewable electricity sourcing, a goal Ipsen aims to accomplish by 2025.

Ipsen demonstrates a commitment to sustainable resource management, focusing on responsible water and waste handling to minimize environmental impact. This dedication is reflected in efforts to reduce discharge effects and boost waste recycling. By 2023, Ipsen achieved a significant milestone, increasing its waste recycling or recovery rate to 51%, a substantial jump from the 22% recorded in 2019.

Ipsen acknowledges the critical role of biodiversity in maintaining planetary health and is actively integrating its protection into its business operations. The company's environmental strategy prioritizes the preservation of natural resources and ecosystems, with specific programs aimed at safeguarding and improving biodiversity. This commitment was underscored in May 2024, reflecting a growing emphasis on ecological stewardship within its corporate responsibility framework.

Energy Consumption and Renewable Energy Adoption

Ipsen is actively working to lower its energy use across its operations and boost its use of renewable energy. The company has made significant strides, achieving 95% renewable electricity for its global facilities by the close of 2023. This commitment is set to reach 100% renewable electricity by 2025, demonstrating a clear environmental strategy.

Further reinforcing its environmental goals, Ipsen is also in the process of converting its vehicle fleet to electric models. This transition aligns with broader industry trends and regulatory pressures pushing for decarbonization in transportation sectors.

- 95% of Ipsen's global electricity was from renewable sources by the end of 2023.

- 100% renewable electricity is the target for Ipsen's facilities by 2025.

- Ipsen is transitioning its company fleet to **electric vehicles**.

Product Life Cycle and Circularity

Ipsen is actively integrating circular economy principles into its product development, aiming to boost sustainability. This strategy focuses on designing products for enhanced recyclability and identifying opportunities for sustainable value chain improvements.

The company's commitment is evident in its 'Generation Ipsen' sustainability plan, which prioritizes minimizing environmental impact by reducing waste across the entire product life cycle, from initial design to end-of-life management. For instance, in 2023, Ipsen reported a reduction in waste generated per unit of production, a key metric for their circularity efforts.

- Circular Design: Ipsen is investing in research and development to ensure new products are designed with recyclability and reduced material usage in mind.

- Waste Reduction: The company has set targets to decrease operational waste, with a specific goal of a 15% reduction in non-hazardous waste by 2025 compared to a 2022 baseline.

- Sustainable Sourcing: Efforts are underway to increase the proportion of sustainably sourced materials in their packaging and product components.

- End-of-Life Solutions: Ipsen is exploring partnerships and initiatives to improve the collection and recycling of its products and associated packaging.

Ipsen is actively pursuing a comprehensive environmental strategy, aiming for significant reductions in greenhouse gas emissions and a transition to renewable energy sources. The company has committed to cutting Scope 1 and 2 GHG emissions by 50% by 2030 from a 2019 baseline and plans to achieve net-zero emissions across its value chain by 2045.

By the end of 2023, 95% of Ipsen's global electricity usage was sourced from renewables, with a target of 100% by 2025. Furthermore, Ipsen is integrating circular economy principles, focusing on product design for recyclability and reducing waste, with a goal to decrease non-hazardous waste by 15% by 2025 compared to a 2022 baseline.

Ipsen is also prioritizing biodiversity protection and is converting its vehicle fleet to electric models to further its environmental stewardship. These initiatives demonstrate a strong commitment to minimizing ecological impact and fostering sustainable operations.

| Environmental Goal | Target | Status/Year |

|---|---|---|

| Scope 1 & 2 GHG Emission Reduction | 50% by 2030 | Measured against 2019 baseline |

| Net-Zero Emissions | Across value chain by 2045 | Ongoing |

| Renewable Electricity Sourcing | 100% by 2025 | 95% achieved by end of 2023 |

| Waste Recycling/Recovery Rate | Increase | 51% achieved by 2023 |

| Non-Hazardous Waste Reduction | 15% by 2025 | Measured against 2022 baseline |

| Fleet Electrification | Transition underway | Ongoing |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ipsen is built on a robust foundation of data from leading financial news outlets, regulatory bodies, and market research firms. We analyze economic indicators, healthcare policy changes, and technological advancements to provide a comprehensive overview.