Ipsen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsen Bundle

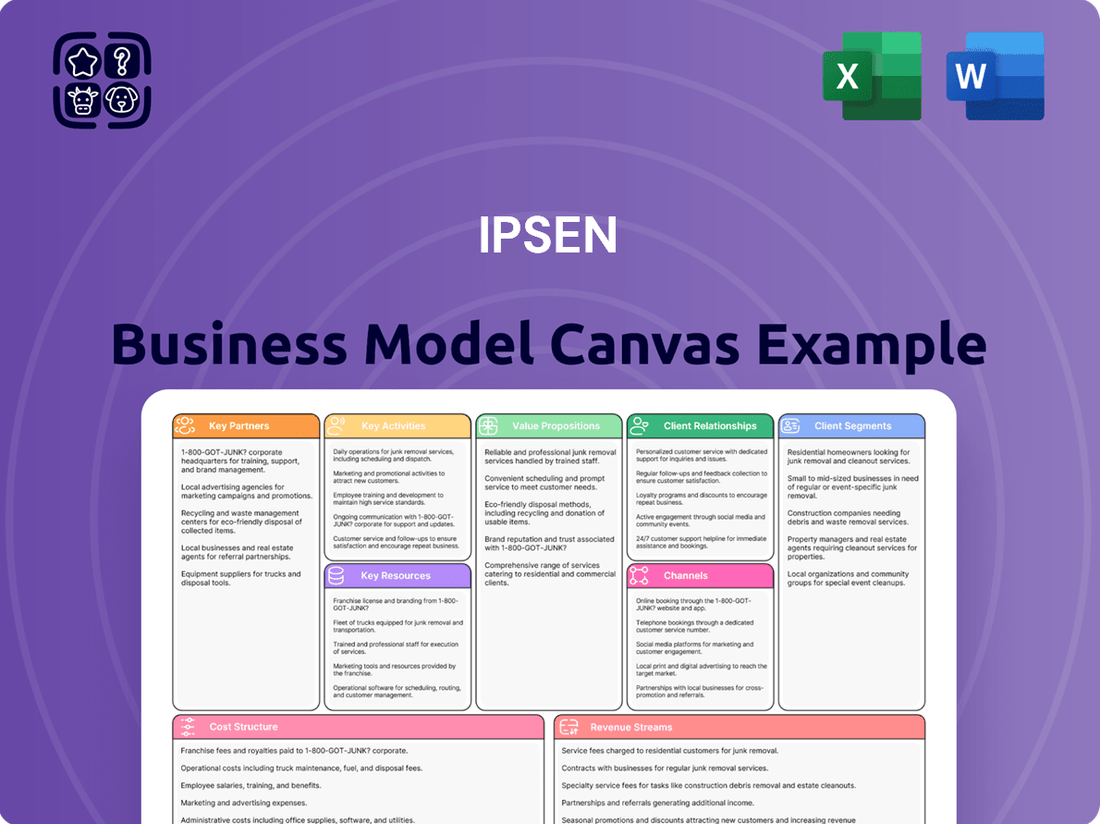

Curious about how Ipsen achieves its market dominance? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their strategic genius. For anyone aiming to replicate or adapt successful business frameworks, this is an essential tool.

Partnerships

Ipsen actively pursues global licensing agreements to bolster its drug pipeline, securing rights to promising new treatments. This approach is crucial for swiftly growing its portfolio, especially within its key therapeutic focus areas.

This strategic alliance model allows Ipsen to access cutting-edge science and technology, accelerating its development timelines. For instance, in 2024, Ipsen continued to explore opportunities in areas like Antibody Drug Conjugates (ADCs) and T-cell engagers, aiming to integrate novel modalities into its R&D framework.

Ipsen heavily relies on external innovation, actively partnering with academic institutions and biotech firms to access cutting-edge science. This strategy allows them to tap into specialized expertise, accelerating the discovery and development of novel therapies. For instance, in 2024, Ipsen continued to expand its pipeline through such collaborations, aiming to de-risk and diversify its research and development portfolio.

Ipsen's strategy heavily relies on mergers and acquisitions to fuel portfolio expansion, particularly in specialty care areas. This approach allows them to integrate innovative assets and solidify their market position.

Significant acquisitions like Albireo and Epizyme in recent years have been pivotal. These moves specifically targeted and strengthened Ipsen's rare disease and oncology segments, bringing in valuable products such as Bylvay and Tazverik.

In 2023, Ipsen completed the acquisition of Albireo Pharma for approximately $972 million, a move that significantly bolstered its rare liver disease portfolio. This acquisition, along with others, underscores their commitment to inorganic growth and strategic market penetration.

Contract Research and Manufacturing Organizations

Ipsen strategically collaborates with Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) to enhance its research and development processes and navigate the complexities of drug manufacturing.

These external partnerships provide Ipsen with access to specialized expertise and advanced technologies, allowing the company to accelerate drug discovery and development timelines. By outsourcing certain functions, Ipsen can concentrate its internal resources on core strategic initiatives, such as identifying novel therapeutic targets and advancing late-stage clinical trials.

For instance, in 2024, pharmaceutical companies globally continued to increase their reliance on CROs, with the market projected to reach over $70 billion by 2025, indicating a strong trend in outsourcing R&D activities. Ipsen's engagement with these partners is crucial for maintaining a competitive edge in a rapidly evolving biopharmaceutical landscape.

- Access to Specialized Expertise: CROs and CDMOs offer niche skills in areas like preclinical testing, clinical trial management, and complex biologics manufacturing.

- Cost and Time Efficiency: Outsourcing allows Ipsen to avoid significant capital investment in specialized facilities and equipment, and can speed up development cycles.

- Scalability and Flexibility: Partnerships enable Ipsen to scale its R&D and manufacturing capabilities up or down as needed, responding effectively to project demands.

- Focus on Core Competencies: By delegating non-core activities, Ipsen's internal teams can dedicate more time to strategic decision-making and innovation.

Commercialization and Distribution Partnerships

Ipsen leverages commercialization and distribution partnerships to extend its global reach, ensuring its medicines are accessible in over 100 countries. These collaborations are vital for market penetration and patient access to innovative therapies.

These strategic alliances often involve shared financial commitments and risk-sharing models, aligning partner incentives with Ipsen's commercial objectives. For instance, in 2024, Ipsen continued to expand its presence in emerging markets through such agreements, aiming to capture new patient populations.

- Global Market Access: Partnerships enable Ipsen to navigate diverse regulatory landscapes and distribution networks efficiently.

- Risk Mitigation: Shared commercialization efforts can reduce financial exposure and accelerate market entry.

- Revenue Enhancement: Collaborations contribute to increased sales volumes and broader therapeutic area coverage.

- Strategic Alignment: Joint ventures and licensing agreements foster mutual growth and market development.

Ipsen's key partnerships are vital for expanding its pipeline and market reach, focusing on licensing agreements with biotech firms and academic institutions to access novel therapies, particularly in oncology and rare diseases.

The company actively engages with Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) to streamline R&D and manufacturing, a trend supported by the global CRO market projected to exceed $70 billion by 2025.

Commercialization and distribution alliances are crucial for global market penetration, ensuring Ipsen's medicines reach patients in over 100 countries, with strategic collaborations in emerging markets showing significant growth in 2024.

| Partner Type | Strategic Importance | Example/Trend (2024) |

|---|---|---|

| Biotech Firms & Academia | Pipeline Expansion, Novel Modalities (ADCs, T-cell engagers) | Access to cutting-edge science, de-risking R&D |

| CROs & CDMOs | R&D Acceleration, Manufacturing Efficiency | Outsourcing specialized functions, cost/time efficiency |

| Commercialization Partners | Global Market Access, Risk Mitigation | Expanding reach in 100+ countries, emerging market growth |

What is included in the product

A detailed breakdown of Ipsen's strategy, outlining its key customer segments, value propositions, and revenue streams within the pharmaceutical industry.

The Ipsen Business Model Canvas simplifies complex strategies, alleviating the pain of convoluted planning by offering a clear, visual representation of key business elements.

It acts as a pain point reliever by providing a structured framework that streamlines the identification and articulation of value propositions, customer segments, and revenue streams.

Activities

Ipsen's core strength lies in its dedicated research and development of innovative medicines. The company strategically focuses its R&D on Oncology, Neuroscience, and Rare Diseases, aiming to bring groundbreaking treatments to patients.

This commitment translates into a robust pipeline, encompassing everything from early-stage preclinical research to late-stage clinical trials. In 2023, Ipsen invested €1.1 billion in R&D, underscoring its dedication to advancing scientific discovery and expanding its therapeutic offerings.

Ipsen's core manufacturing activities focus on producing its prescription drugs, a critical step to guarantee consistent quality and availability for patients. This encompasses intricate production processes and the management of a sophisticated global supply chain, ensuring efficient delivery of medicines across diverse international markets.

In 2024, Ipsen continued to invest in its manufacturing capabilities, aiming to enhance capacity and operational efficiency. The company's commitment to maintaining high pharmaceutical standards and optimizing logistics is paramount for ensuring uninterrupted patient access to its therapeutic solutions worldwide.

Ipsen focuses on the global commercialization and marketing of its specialty drugs, ensuring strategic product launches and sustained promotional efforts for its portfolio. This includes the recent launches of Iqirvo and Bylvay, alongside continued support for established brands like Cabometyx and Somatuline, which are key drivers of revenue.

In 2023, Ipsen reported significant sales for its key products, with Cabometyx achieving €1.1 billion and Somatuline reaching €960 million, underscoring the importance of effective commercial execution in driving market penetration and sales growth for these vital therapies.

Regulatory Affairs and Market Access

Ipsen's key activities include meticulously navigating intricate regulatory pathways to gain approvals for its innovative medicines and new therapeutic indications from health authorities worldwide. This ensures their treatments meet stringent safety and efficacy standards before reaching patients.

Furthermore, a crucial focus is placed on developing robust market access strategies. This involves proactive engagement with payers and diverse healthcare systems to negotiate favorable reimbursement terms and guarantee widespread patient accessibility to Ipsen's specialized care offerings.

- Regulatory Approvals: Securing marketing authorizations from agencies like the FDA and EMA for new drug applications and label expansions.

- Market Access Strategies: Engaging with national health technology assessment bodies and reimbursement authorities to facilitate patient access.

- Global Compliance: Maintaining adherence to evolving pharmaceutical regulations across different geographic markets.

- Post-Market Surveillance: Managing ongoing regulatory requirements and pharmacovigilance activities after product launch.

Strategic Business Development and External Innovation Sourcing

Ipsen actively pursues external innovation through strategic business development, focusing on in-licensing and acquisitions to enhance its drug pipeline. This is crucial for introducing novel therapeutic modalities and assets that target significant unmet medical needs, driving the company's growth.

In 2024, Ipsen continued to invest in external innovation, a cornerstone of its strategy to diversify and strengthen its portfolio. For instance, the company completed several key transactions aimed at acquiring promising early-stage assets and technologies.

- Pipeline Enhancement: Sourcing external innovation directly contributes to replenishing and diversifying Ipsen's research and development pipeline.

- Addressing Unmet Needs: This strategy is vital for bringing in new therapeutic modalities and assets to tackle high unmet medical needs across various disease areas.

- Growth Driver: External innovation sourcing is a core component of Ipsen's overall growth strategy, ensuring long-term competitiveness and market position.

Ipsen's key activities are centered around its robust research and development efforts, focusing on Oncology, Neuroscience, and Rare Diseases to create innovative treatments. The company actively manages its manufacturing processes to ensure the quality and availability of its prescription drugs globally, with continued investment in 2024 to enhance these capabilities. Furthermore, Ipsen excels in the global commercialization and marketing of its specialty drugs, supported by strategic product launches and ongoing promotional activities for key revenue drivers.

Delivered as Displayed

Business Model Canvas

The Ipsen Business Model Canvas preview you are viewing is the actual, complete document that will be delivered upon purchase. This means you'll receive the exact same structured and professionally formatted content you see now, ready for immediate use. There are no alterations or missing sections between this preview and the final download, ensuring you get precisely what you expect.

Resources

Ipsen's intellectual property is a cornerstone of its business, with a strong patent portfolio covering its innovative medicines and proprietary technologies. This extensive IP protection is crucial for safeguarding its research and development investments, ensuring market exclusivity for its products.

The company's patent strategy directly supports its revenue streams by providing a shield against generic competition. For instance, as of early 2024, Ipsen continues to benefit from patent protection on key products like Dysport and Somatuline, which are vital to its financial performance.

Ipsen's commitment to innovation is underscored by its specialized research and development facilities, strategically positioned in prominent biopharmaceutical centers like the U.S., France, and the U.K. These centers are outfitted with cutting-edge technology and house highly skilled scientific teams, fostering advanced drug discovery and development within the company's core therapeutic areas.

Ipsen’s foundation rests on its highly skilled human capital, encompassing a diverse range of talent from cutting-edge scientists and experienced medical professionals to astute regulatory experts and dynamic commercial teams. This collective brainpower is the engine behind Ipsen’s progress, fueling groundbreaking research and development.

The company’s commitment to nurturing this expertise is evident in its ongoing investment in talent development and retention. In 2024, Ipsen continued to prioritize employee training and professional growth, ensuring its workforce remains at the forefront of scientific advancement and market understanding. This focus directly translates to operational excellence and the cultivation of robust relationships with key stakeholders, including healthcare providers and patient communities.

Financial Capital and Investment Capacity

Ipsen's robust financial capital and investment capacity are foundational to its business model. A strong financial position, characterized by healthy cash flow generation and ready access to capital markets, empowers the company to pursue ambitious growth strategies.

This financial firepower is crucial for funding extensive research and development (R&D) initiatives, which are vital for discovering and advancing new therapies. For instance, Ipsen's commitment to R&D is evident in its significant investments, with a notable portion of its revenue consistently allocated to this area. In 2023, Ipsen reported €768.5 million in R&D expenses, underscoring its dedication to innovation.

Furthermore, this financial strength enables strategic acquisitions and partnerships, allowing Ipsen to expand its therapeutic areas and geographic reach. The company's ability to secure capital also supports the global commercialization of its products, ensuring that innovative treatments are accessible to patients worldwide. In 2023, Ipsen achieved total sales of €3,117.2 million, demonstrating its capacity to translate R&D success into commercial value.

- R&D Investment: Ipsen's consistent allocation of substantial funds to R&D, exemplified by €768.5 million in 2023, fuels pipeline expansion and innovation.

- Access to Capital: A strong balance sheet and access to capital markets provide the flexibility for strategic investments and growth opportunities.

- Global Commercialization: Financial capacity supports the effective launch and marketing of products across international markets, driving revenue growth.

- Strategic Acquisitions: The company's financial health allows for targeted acquisitions to enhance its portfolio and market presence.

Approved Product Portfolio and Pipeline Assets

Ipsen's approved product portfolio is a cornerstone of its business, with key drugs like Cabometyx, Somatuline, Dysport, Bylvay, and Iqirvo driving current revenue. In 2023, Ipsen reported total sales of €3.2 billion, with its specialty care segment, heavily influenced by these approved products, showing strong performance.

The company's robust development pipeline is equally critical, representing future growth potential and value creation. This pipeline includes numerous assets across various stages of clinical development, particularly in oncology and rare diseases, areas where Ipsen has strategically focused its investments.

- Approved Products: Cabometyx, Somatuline, Dysport, Bylvay, and Iqirvo are significant revenue generators.

- 2023 Sales: Ipsen achieved total sales of €3.2 billion in 2023, underscoring the strength of its approved portfolio.

- Pipeline Focus: Development efforts are concentrated on oncology and rare diseases, key areas for future growth.

- Value Creation: The pipeline assets are crucial for Ipsen's long-term value and market positioning.

Ipsen's Key Resources are its intellectual property, encompassing a strong patent portfolio for its innovative medicines and proprietary technologies, which safeguards R&D investments and ensures market exclusivity. The company's specialized R&D facilities in the U.S., France, and the U.K. are equipped with cutting-edge technology and staffed by highly skilled scientists. Furthermore, Ipsen's human capital, comprising diverse scientific, medical, regulatory, and commercial talent, drives its progress. This expertise is supported by substantial financial capital, enabling significant R&D investments, strategic acquisitions, and global commercialization efforts. The company's approved product portfolio and robust development pipeline are also critical assets.

| Resource | Description | Key Data/Impact |

| Intellectual Property | Patents on medicines and technologies | Safeguards R&D, ensures market exclusivity (e.g., Dysport, Somatuline patents) |

| R&D Facilities | Specialized centers in U.S., France, U.K. | Cutting-edge technology, skilled scientific teams |

| Human Capital | Scientists, medical professionals, regulatory, commercial teams | Drives R&D, operational excellence, stakeholder relations |

| Financial Capital | Cash flow, access to capital markets | Funds R&D (€768.5M in 2023), acquisitions, commercialization |

| Approved Products | Key revenue-driving medicines | Cabometyx, Somatuline, Dysport, Bylvay, Iqirvo (contributing to €3.2B sales in 2023) |

| Development Pipeline | Assets in various clinical stages | Future growth potential, focus on oncology and rare diseases |

Value Propositions

Ipsen's value proposition centers on delivering breakthrough therapies for challenging specialty care areas like oncology, neuroscience, and rare diseases. These aren't just incremental improvements; they are designed to make a real difference in patients' lives. For instance, in 2024, Ipsen continued to advance its pipeline in these critical fields, aiming to fill unmet medical needs.

The focus is on providing significant clinical advantages and enhancing patient well-being, especially in situations where current treatments fall short. This commitment to innovation is crucial for patients battling complex conditions. In 2024, Ipsen's research and development efforts specifically targeted areas with high patient burden and limited therapeutic options.

Ipsen's fundamental purpose revolves around enhancing the lives of patients facing significant and uncommon diseases. Their focus is on creating specialized therapies that can lessen symptoms, curb the advancement of illnesses, and ultimately boost the well-being of those affected and their loved ones.

Ipsen strategically targets therapeutic areas with significant unmet medical needs, especially in rare diseases. This focus allows them to develop truly innovative treatments for patients who have limited or no effective options currently available.

In 2024, Ipsen continued to prioritize rare diseases, a segment that often presents substantial challenges for patients and healthcare systems alike. Their commitment to these underserved populations underscores a dedication to providing new hope and improving quality of life.

Commitment to Innovation and Scientific Excellence

Ipsen's commitment to innovation is a cornerstone of its business model, driving the development of groundbreaking treatments. In 2024, the company continued to invest heavily in research and development, with a significant portion of its revenue allocated to R&D activities. This dedication fuels a pipeline focused on areas like oncology, neuroscience, and rare diseases, aiming to deliver therapies that significantly improve patient outcomes.

This pursuit of scientific excellence is supported by strategic collaborations and acquisitions, allowing Ipsen to access cutting-edge technologies and promising drug candidates. By fostering both internal R&D prowess and external partnerships, Ipsen ensures it remains at the forefront of medical advancements, bringing truly differentiated therapies to patients.

- R&D Investment: Ipsen's R&D expenditure represents a substantial percentage of its annual revenue, underscoring its commitment to innovation.

- Pipeline Focus: Key therapeutic areas include oncology, neuroscience, and rare diseases, targeting unmet medical needs.

- External Partnerships: Strategic alliances and acquisitions are crucial for accessing novel science and expanding the innovation pipeline.

- First-in-Class/Best-in-Class Goal: The objective is to develop therapies that offer significant advantages over existing treatments.

Global Access and Patient-Centric Solutions

Ipsen's commitment to global access means its innovative treatments reach patients in over 100 countries, reflecting a broad geographical footprint. This expansive reach is crucial for ensuring that groundbreaking therapies are not confined to a few select markets.

The company's strategy extends beyond simply distributing medicines; it emphasizes patient-centric solutions. These include vital support programs and educational initiatives designed to enhance the overall treatment journey and improve patient outcomes.

- Global Reach: Operations in over 100 countries.

- Patient Support: Focus on programs and education for comprehensive care.

- Accessibility: Aiming to make transformative medicines available worldwide.

Ipsen's value proposition is built on delivering innovative therapies for complex diseases, particularly in oncology, neuroscience, and rare diseases, aiming to significantly improve patient lives and address unmet medical needs. This commitment is backed by substantial R&D investment, with a strategic focus on developing first-in-class or best-in-class treatments. In 2024, Ipsen continued to bolster its pipeline through both internal research and external collaborations, ensuring a steady stream of advanced medical solutions.

| Value Proposition Element | Description | 2024 Relevance/Data |

|---|---|---|

| Breakthrough Therapies | Developing innovative treatments for challenging specialty care areas. | Continued advancement of pipeline in oncology, neuroscience, and rare diseases. |

| Addressing Unmet Needs | Focusing on conditions with limited or no effective treatment options. | Targeted R&D efforts on high-patient-burden diseases with therapeutic gaps. |

| Patient Well-being Enhancement | Improving quality of life and reducing symptom burden for patients. | Commitment to patient-centric solutions, including support and educational programs. |

| Scientific Excellence & Innovation | Significant investment in R&D and strategic partnerships to access cutting-edge science. | Substantial R&D expenditure as a percentage of revenue, fostering a strong innovation pipeline. |

Customer Relationships

Ipsen cultivates direct relationships with healthcare professionals like oncologists, neurologists, and rare disease specialists. These interactions are facilitated by dedicated sales and medical affairs teams who share crucial product information and clinical data.

This direct engagement ensures that physicians receive the necessary support for informed patient selection and optimal treatment strategies. For instance, Ipsen's commitment to medical education in 2024 involved numerous symposia and expert-led webinars, reaching thousands of specialists across key therapeutic areas.

Ipsen actively cultivates relationships with patient advocacy groups, recognizing their vital role in supporting individuals navigating chronic conditions. These partnerships are crucial for understanding patient needs and developing tailored assistance.

The company’s commitment extends to robust patient support programs. These initiatives are designed to enhance treatment adherence and improve the overall patient journey, reflecting a deep-seated patient-centric philosophy. For instance, Ipsen's programs often provide educational resources and practical assistance, aiming to bridge gaps in care and empower patients.

Ipsen fosters deep connections with influential Key Opinion Leaders (KOLs) and prominent researchers across its specialized therapeutic fields. These partnerships are crucial for advancing scientific understanding and ensuring Ipsen's innovations are grounded in cutting-edge knowledge.

These collaborations are instrumental in shaping clinical trial strategies, facilitating vital scientific dialogue, and capturing expert insights that directly influence product development pipelines and the creation of effective medical education programs. For instance, in 2024, Ipsen actively engaged with over 500 KOLs globally, contributing to the design of pivotal Phase III trials in oncology and neuroscience.

Strategic Partnerships with Payers and Reimbursement Bodies

Ipsen cultivates strategic alliances with payers, including government health systems and private insurers, to guarantee market access and optimal pricing for its specialized pharmaceuticals. These collaborations are fundamental to ensuring patients can access and afford vital therapies.

In 2024, Ipsen continued to navigate complex reimbursement landscapes, actively engaging with key stakeholders. For instance, securing favorable reimbursement for its oncology drug, Cabometyx, in new indications or markets remains a priority, impacting its revenue potential significantly.

- Market Access Negotiations: Ipsen actively engages with national health technology assessment (HTA) bodies and payer organizations globally to demonstrate the value of its innovative treatments, aiming for positive reimbursement decisions.

- Pricing Strategies: The company employs data-driven pricing strategies, informed by health economic outcomes research, to align with payer expectations and ensure sustainable access to its medicines.

- Patient Affordability Programs: Ipsen collaborates with payers and patient advocacy groups to develop programs that mitigate out-of-pocket costs for patients, thereby enhancing treatment adherence and real-world access.

Digital Engagement and Medical Education Platforms

Ipsen actively leverages digital platforms to deliver crucial medical education and information to healthcare professionals and patients. This approach is vital for supporting complex specialty treatments where ongoing learning is paramount.

These digital engagements include dedicated online portals, live and on-demand webinars, and interactive tools designed to foster knowledge sharing and provide essential support. By offering these resources, Ipsen aims to enhance understanding and adherence to treatment protocols.

- Digital Education Reach: In 2023, Ipsen's digital platforms hosted over 500 educational events, reaching more than 100,000 healthcare professionals globally.

- Patient Support Programs: The company's patient portals saw a 25% increase in engagement in the first half of 2024, indicating growing reliance on digital resources for treatment management.

- Specialty Treatment Focus: For its oncology and rare disease portfolios, digital education accounts for an estimated 70% of ongoing medical information dissemination.

Ipsen's customer relationships are multifaceted, focusing on building strong ties with healthcare professionals, patient advocacy groups, and payers to ensure optimal access and support for its specialized therapies.

The company actively engages Key Opinion Leaders (KOLs) and researchers, with over 500 KOLs globally involved in 2024 to shape clinical trials and educational programs.

Digital platforms are crucial, hosting over 500 educational events in 2023 reaching 100,000 healthcare professionals, with patient portals seeing a 25% engagement increase in early 2024.

| Stakeholder Group | Engagement Strategy | 2024 Data/Focus |

|---|---|---|

| Healthcare Professionals | Direct engagement via sales/medical affairs, digital education | 2024 symposia/webinars reached thousands; 70% medical info via digital for specialty treatments |

| Patient Advocacy Groups | Partnerships for support and understanding needs | Focus on tailored assistance and bridging care gaps |

| Key Opinion Leaders (KOLs) | Collaboration on clinical trials and scientific dialogue | Engaged over 500 KOLs globally in 2024 for oncology/neuroscience trials |

| Payers | Market access negotiations, pricing strategies | Securing reimbursement for Cabometyx in new indications/markets |

Channels

Ipsen leverages a specialized direct sales force to engage directly with hospitals, clinics, and specialist physicians. This focused approach ensures in-depth product education and fosters strong relationships with key opinion leaders and prescribers within its core therapeutic areas. For instance, in 2024, Ipsen continued to invest in its sales teams to support the launch and growth of its key oncology and rare disease portfolios, aiming to maximize market penetration.

Ipsen relies on a robust global distribution and wholesale network to make its pharmaceuticals accessible worldwide. This infrastructure is crucial for reaching patients in over 100 countries.

These extensive networks are built on strategic partnerships that streamline the entire supply chain, from warehousing to final delivery. This ensures that Ipsen's medicines efficiently reach pharmacies and healthcare facilities.

In 2024, Ipsen continued to strengthen these relationships, focusing on optimizing inventory management and reducing lead times. This commitment to efficient logistics is key to maintaining product availability and meeting global healthcare demands.

Ipsen's specialty medicines are predominantly distributed via hospital and clinic pharmacies, aligning with the complex medical needs of patients treated in these specialized environments. This strategic channel ensures immediate access to critical therapies at the point of care.

For instance, in 2024, Ipsen's focus on rare diseases and oncology means their products are often administered under strict medical supervision, making hospital pharmacies the logical and efficient distribution hub. This direct engagement with healthcare providers facilitates proper patient management and therapy adherence.

Digital and Online Engagement Platforms

Ipsen leverages its corporate website, professional medical platforms, and social media to connect with a wide range of stakeholders. These digital avenues are crucial for disseminating investor relations information, press releases, and vital medical updates.

The company actively uses these channels for broader public awareness campaigns, ensuring a consistent flow of information. For instance, in 2024, Ipsen's investor relations section on its website likely saw significant traffic following key financial announcements and strategic updates.

- Corporate Website: Serves as the primary hub for official company news, financial reports, and corporate governance information.

- Professional Medical Platforms: Used for targeted communication with healthcare professionals, sharing clinical data and scientific advancements.

- Social Media: Engages a broader audience, building brand awareness and sharing company milestones and CSR initiatives.

Strategic Partnering and Licensing Agreements

Ipsen leverages strategic partnerships and licensing agreements as key channels to bring its innovative therapies to patients. These collaborations are particularly vital in markets where establishing a direct commercial presence would be resource-intensive or less effective. By teaming up with established local players, Ipsen ensures its products reach a wider audience, benefiting from their existing distribution networks and market knowledge.

In 2023, Ipsen announced several strategic collaborations, including a significant licensing agreement for a novel oncology candidate. This partnership is expected to accelerate the development and commercialization of the therapy in key European markets. Such agreements allow Ipsen to expand its global footprint efficiently, focusing its internal resources on core R&D activities while relying on partners for market access and sales.

- Partnerships for Market Access: Ipsen's licensing deals enable faster market penetration by utilizing partners' established sales forces and regulatory expertise.

- Risk Mitigation: Collaborations reduce Ipsen's direct financial and operational risk in certain territories, allowing for a more agile global strategy.

- Revenue Generation: Licensing agreements provide upfront payments, milestone payments, and royalties, contributing to Ipsen's financial performance. For example, in 2024, Ipsen projected significant revenue streams from its existing licensing portfolio, underscoring the financial importance of these channels.

- Focus on Innovation: By outsourcing commercialization in specific regions, Ipsen can concentrate its capital and efforts on discovering and developing new groundbreaking medicines.

Ipsen utilizes a multi-faceted channel strategy, combining direct engagement with healthcare providers through its specialized sales force with a robust global distribution network. This dual approach ensures both deep market penetration in key therapeutic areas and broad accessibility for its pharmaceuticals across numerous countries.

Strategic partnerships and licensing agreements serve as crucial channels for expanding market reach, particularly in regions where direct operations are less feasible. These collaborations leverage partners' established infrastructure and market knowledge, facilitating efficient product delivery and revenue generation through upfront payments, milestones, and royalties.

Digital platforms, including the corporate website and professional medical sites, are vital for disseminating company news, financial reports, and clinical data, fostering transparency and engagement with a diverse stakeholder base.

In 2024, Ipsen continued to invest in its direct sales force to support the growth of its oncology and rare disease portfolios, while also focusing on optimizing its global distribution and wholesale networks to enhance product availability and reduce lead times.

Customer Segments

Ipsen's focus on oncology patients with specific cancer types is a cornerstone of its business model. The company dedicates resources to developing and commercializing treatments for conditions like neuroendocrine tumors, renal cell carcinoma, and pediatric low-grade glioma. This targeted approach ensures that therapies are tailored to the unique biological and clinical profiles of these challenging diseases.

In 2024, the global oncology market continued its robust growth, with specialized treatments for rare and complex cancers showing significant demand. Ipsen's commitment to these areas positions it to address unmet medical needs for patients worldwide. For instance, the company's portfolio includes therapies that have demonstrated efficacy in improving survival rates and quality of life for individuals battling these specific cancers.

Ipsen's critical customer segment comprises patients suffering from rare and often severe conditions. This includes individuals diagnosed with progressive familial intrahepatic cholestasis (PFIC), Alagille Syndrome, fibrodysplasia ossificans progressiva (FOP), and primary biliary cholangitis, among others.

These patient groups represent a significant unmet medical need, driving demand for specialized therapeutic solutions. In 2024, the global rare disease market was valued at over $200 billion, highlighting the substantial impact and focus on this area.

Ipsen's neuroscience segment directly addresses patients dealing with movement disorders, a significant area where their expertise in neurotoxins is crucial. For instance, in 2023, the global market for botulinum toxin, a key component in treating such conditions, was valued at approximately $7.5 billion, highlighting the substantial need for these therapies.

Furthermore, this segment caters to patients requiring treatments for rare neurological conditions, an area Ipsen is actively expanding. The company's commitment to rare diseases is demonstrated by its pipeline and strategic acquisitions, aiming to bring innovative solutions to underserved patient populations who often face limited treatment options.

Healthcare Professionals and Specialists

Healthcare professionals and specialists form a critical customer segment for Ipsen. This includes oncologists, endocrinologists, gastroenterologists, neurologists, and other medical experts who are instrumental in diagnosing conditions and prescribing Ipsen's pharmaceutical products. Their expertise directly influences product adoption and patient treatment pathways.

Ipsen's success hinges on cultivating robust relationships with these medical specialists. These connections are vital for ensuring that Ipsen's innovative therapies reach the patients who need them most. By engaging with these key opinion leaders and prescribers, Ipsen can foster product awareness and drive market penetration.

In 2024, the pharmaceutical industry continued to see significant investment in research and development, with a focus on specialized therapeutic areas. For instance, Ipsen's commitment to oncology, endocrinology, and rare diseases means that engaging with the specialists in these fields is paramount. These professionals are at the forefront of medical advancements and are key to the successful integration of new treatments into clinical practice.

- Oncologists: Prescribe treatments for various forms of cancer.

- Endocrinologists: Manage hormonal disorders and metabolic diseases.

- Gastroenterologists: Treat digestive system conditions.

- Neurologists: Focus on disorders of the nervous system.

Healthcare Payers and Government Health Authorities

Ipsen views healthcare payers, such as insurance companies and national health systems, as a fundamental customer segment. Their decisions directly impact market access and the broad availability of Ipsen's specialty pharmaceuticals, particularly those with higher price points.

Securing favorable reimbursement policies and inclusion on formularies from these entities is paramount. For instance, in 2024, the negotiation of reimbursement rates for innovative therapies remains a critical pathway for market penetration. Ipsen's success hinges on demonstrating the value proposition of its treatments to these payers, often through robust health economic data and real-world evidence.

- Key Stakeholders: Insurance providers and government health bodies are the primary decision-makers for drug coverage and pricing.

- Reimbursement Strategy: Ipsen must actively engage with payers to negotiate favorable reimbursement terms for its specialty medicines.

- Market Access Drivers: Formulary inclusion and positive reimbursement decisions are essential for ensuring patient access to Ipsen's therapies.

- Value Demonstration: Presenting strong clinical and economic data is crucial to convince payers of the cost-effectiveness and therapeutic benefit of their drugs.

Ipsen's customer base extends to patients with rare and debilitating conditions, including those with fibrodysplasia ossificans progressiva (FOP) and progressive familial intrahepatic cholestasis (PFIC). These patient groups represent significant unmet medical needs, driving demand for specialized therapeutic solutions. The global rare disease market's valuation exceeding $200 billion in 2024 underscores the importance of this segment.

Healthcare professionals, such as oncologists and neurologists, are crucial intermediaries who diagnose and prescribe Ipsen's treatments. Their expertise is vital for product adoption, with the global botulinum toxin market, relevant to Ipsen's neuroscience segment, valued at approximately $7.5 billion in 2023.

Payers, including insurance companies and national health systems, represent another key customer segment, influencing market access and drug availability. Demonstrating the value of specialty pharmaceuticals through robust health economic data is essential for securing favorable reimbursement in 2024.

| Customer Segment | Key Characteristics | 2024 Relevance |

| Patients with Rare Diseases | Unmet medical needs, specific genetic conditions | Global rare disease market > $200 billion |

| Healthcare Professionals | Oncologists, neurologists, endocrinologists | Botulinum toxin market ~ $7.5 billion (2023) |

| Healthcare Payers | Insurance companies, national health systems | Crucial for market access and reimbursement |

Cost Structure

Ipsen dedicates significant resources to research and development, a core component of its cost structure. These expenses cover the entire drug discovery and development pipeline, from initial preclinical research to extensive clinical trials and the complex process of regulatory submissions. For instance, in 2023, Ipsen reported R&D expenses of €852 million, reflecting its commitment to innovation.

Ipsen’s manufacturing and production costs are a significant component of its cost structure, encompassing expenses for creating its pharmaceutical products. These include the procurement of raw materials, the intricate processes involved in biopharmaceutical production, rigorous quality control measures, and final product packaging. The company's investment in advanced manufacturing technologies and adherence to strict regulatory standards are key drivers of these costs.

The pricing of raw materials, such as active pharmaceutical ingredients and specialized excipients, directly impacts Ipsen's production expenses. Furthermore, the scale of production volumes plays a crucial role; higher volumes can lead to economies of scale, potentially reducing per-unit costs. However, the inherent complexity of biopharmaceutical manufacturing, which often involves cell cultures and highly sensitive biological processes, inherently elevates operational expenditures.

In 2024, the pharmaceutical industry, including companies like Ipsen, continued to face upward pressure on manufacturing costs due to global supply chain disruptions and rising energy prices. For instance, the cost of specialized chemicals and sterile packaging materials saw increases. Ipsen's commitment to maintaining high product quality and safety standards necessitates substantial investment in quality assurance and control throughout the manufacturing lifecycle, adding to the overall cost burden.

Ipsen dedicates a substantial portion of its resources to sales, marketing, and commercialization. This includes the considerable investment in a global sales force, crucial for promoting their pharmaceutical products. For instance, in 2023, Ipsen reported €1.14 billion in Selling, General and Administrative expenses, a significant portion of which directly supports these commercialization efforts.

These expenditures are vital for building brand awareness, educating healthcare professionals, and ensuring their innovative treatments reach patients. Advertising and promotional campaigns are key drivers for product adoption and expanding market share, especially for new therapeutic areas Ipsen enters.

The cost of launching new products is particularly high, encompassing market research, regulatory support for marketing, and building initial distribution networks. This strategic investment is fundamental to Ipsen's growth trajectory and its ability to compete effectively in the pharmaceutical landscape.

General and Administrative Overheads

Ipsen's general and administrative (G&A) overheads encompass essential operational expenses that keep the company running smoothly. These include costs like salaries for administrative personnel, crucial legal and compliance expenditures, the maintenance of IT infrastructure, and broader corporate overheads.

Effective management of these G&A costs is a key driver of Ipsen's overall profitability. For instance, in 2024, Ipsen reported operating expenses that included significant administrative components, reflecting investments in its global operational framework.

- Salaries for administrative staff: Ensuring efficient support functions across departments.

- Legal and compliance costs: Navigating complex regulatory environments in the pharmaceutical sector.

- IT infrastructure: Supporting data management, communication, and digital operations.

- Corporate overheads: Including executive management, finance, and HR functions.

Acquisition and In-Licensing Costs

Ipsen's commitment to external innovation translates into substantial acquisition and in-licensing costs. These investments are crucial for bolstering their product pipeline and securing future growth opportunities.

These upfront payments and potential milestone payments represent significant capital allocation, reflecting the high stakes involved in bringing novel therapies to market.

- Acquisition and In-Licensing Costs: In 2023, Ipsen completed the acquisition of five companies, with upfront payments and potential milestone commitments totaling over €1.5 billion, demonstrating a significant investment in external innovation.

- Pipeline Replenishment: These costs directly fund the acquisition of promising drug candidates and technologies, essential for maintaining a competitive edge and addressing unmet medical needs.

- Strategic Investments: The company strategically deploys capital to acquire assets that align with its therapeutic areas of focus, aiming for long-term value creation.

Ipsen's cost structure is heavily influenced by its significant investment in research and development, manufacturing, and commercialization activities. These core areas represent the largest expenditures, reflecting the company's strategic focus on innovation and market presence.

Manufacturing costs are driven by raw material procurement, complex biopharmaceutical production processes, and stringent quality control. In 2024, increased costs for specialized chemicals and packaging materials, exacerbated by supply chain issues and energy price hikes, continued to impact these expenses.

Sales, marketing, and administrative expenses form another substantial part of Ipsen's cost base. These costs are essential for promoting its products globally, educating healthcare providers, and ensuring market access for its therapies. In 2023, Selling, General and Administrative expenses amounted to €1.14 billion.

| Cost Category | 2023 (€ millions) | Key Drivers |

|---|---|---|

| Research & Development | 852 | Drug discovery, clinical trials, regulatory submissions |

| Selling, General & Administrative | 1,140 | Sales force, marketing, brand awareness, operational overheads |

| Manufacturing & Production | (Not specified separately, but a major component) | Raw materials, biopharmaceutical processes, quality control, packaging |

| Acquisitions & In-Licensing | >1,500 (upfront & milestones in 2023) | Pipeline replenishment, external innovation |

Revenue Streams

Ipsen's primary revenue driver is the global sales of its oncology products. This segment consistently represents a significant portion of the company's overall revenue, showcasing the strength and market penetration of its therapeutic offerings.

Key products such as Cabometyx and Somatuline are central to this revenue stream. In 2024, Ipsen reported strong performance from its oncology portfolio, with Cabometyx, in particular, demonstrating robust sales growth driven by its expanding indications and market access.

Revenue from Ipsen's expanding rare disease offerings, including Bylvay and Iqirvo, is a significant and growing income source. These specialized, high-margin treatments are key to the company's future growth strategy.

Ipsen’s neuroscience products, notably Dysport, are a significant revenue driver. Dysport's dual utility in treating conditions like spasticity and its use in aesthetic applications broadens its market reach and sales potential.

In 2024, Ipsen's neuroscience segment demonstrated robust performance, with sales reaching €1.3 billion, marking a notable increase from the previous year and underscoring its importance to the company's overall financial health.

New Product Launches and Portfolio Expansion

Ipsen's revenue growth is heavily reliant on introducing new products and broadening the uses for its current medications. Successful new product introductions and expanded regulatory approvals for existing drugs are key drivers.

Recent successes, like the U.S. approval of Onivyde and new indications for Cabometyx in Europe, are directly contributing to increased sales figures. These strategic moves are vital for maintaining a competitive edge and expanding market reach.

- New Product Launches: Revenue generation from innovative therapies entering the market.

- Portfolio Expansion: Increased sales from existing drugs approved for new patient populations or conditions.

- Recent Successes: Onivyde (U.S.) and Cabometyx (Europe) are prime examples of revenue-boosting developments.

Licensing and Royalty Income

While Ipsen's core business revolves around its pharmaceutical products, licensing and royalty income represent a supplementary revenue stream. These agreements allow Ipsen to leverage its intellectual property and technological advancements beyond its direct product offerings.

In 2023, Ipsen reported €3.1 billion in total sales. While specific figures for licensing and royalty income are not always broken out separately in summary reports, such agreements are crucial for maximizing the value of their research and development investments. For instance, out-licensing a specific technology or a drug candidate in early development to another company can generate upfront payments, milestone payments, and ongoing royalties, diversifying Ipsen's revenue base.

These arrangements can take several forms:

- Out-licensing Agreements: Ipsen might grant rights to its proprietary technologies or drug candidates to other pharmaceutical or biotechnology companies for specific territories or indications.

- Co-development and Co-commercialization Deals: Partnerships can involve sharing development costs and future profits, leading to royalty payments or revenue sharing.

- Royalty Income from Partnered Products: Ipsen may receive royalties on sales of products that were developed or are marketed by partners, based on earlier licensing agreements.

Ipsen's revenue streams are diversified, primarily driven by its pharmaceutical products across oncology, rare diseases, and neuroscience. Sales from key drugs like Cabometyx and Dysport form the backbone of its income. The company also benefits from licensing and royalty agreements, which supplement its core product sales.

| Revenue Stream | Key Products/Activities | 2024 Performance Indicators |

| Oncology | Cabometyx, Onivyde | Strong sales growth, expanding indications |

| Rare Diseases | Bylvay, Iqirvo | Growing income source, specialized treatments |

| Neuroscience | Dysport | Robust performance, €1.3 billion in sales |

| Licensing & Royalties | Out-licensing, Co-development deals | Supplementary income, maximizing R&D value |

Business Model Canvas Data Sources

The Ipsen Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic assessments of the pharmaceutical landscape. These diverse data streams ensure a robust and accurate representation of Ipsen's operations and market position.