Ipsen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsen Bundle

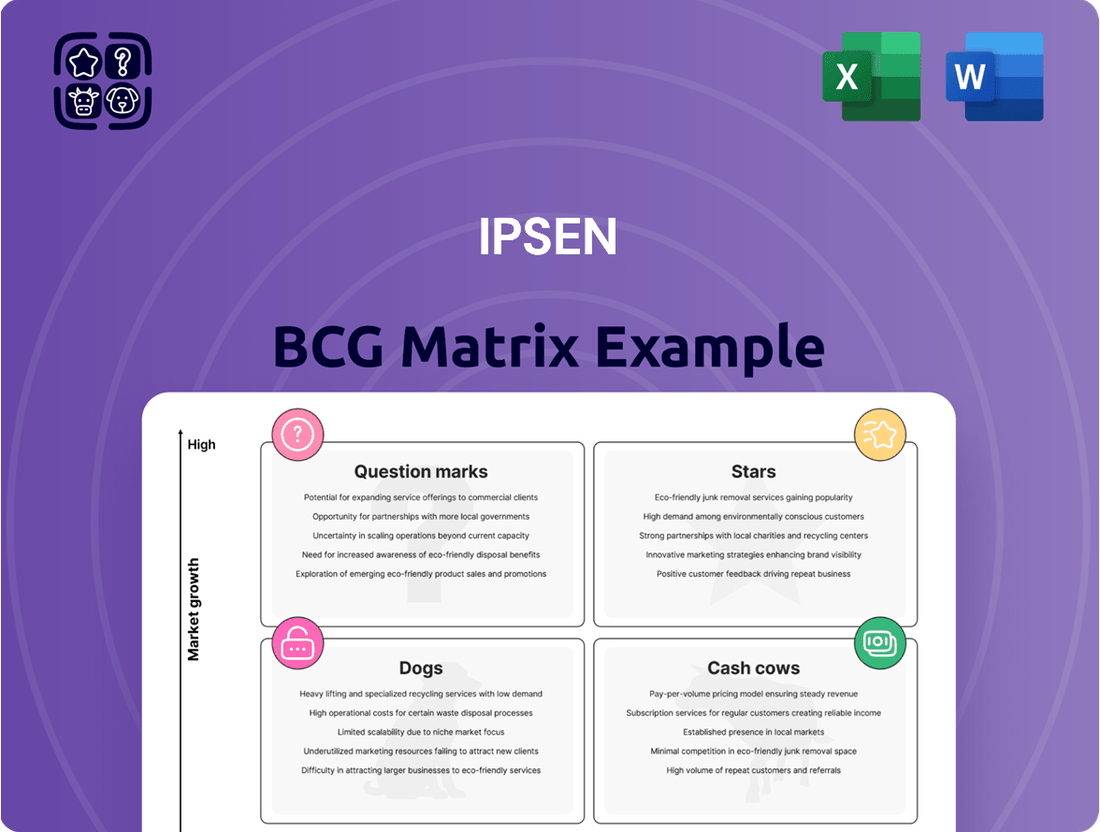

Unlock the strategic potential of Ipsen's product portfolio with a glimpse into its BCG Matrix. Understand how its offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

This preview offers a foundational understanding, but the full Ipsen BCG Matrix report provides the detailed quadrant analysis, market share data, and growth rate insights crucial for optimizing your investment strategy and product development.

Purchase the complete Ipsen BCG Matrix today to gain a comprehensive roadmap for resource allocation, divestment opportunities, and future growth initiatives, ensuring your business stays ahead in a competitive landscape.

Stars

Ipsen's Rare Diseases franchise, featuring Iqirvo and Bylvay, is a standout performer, experiencing a substantial 67.4% revenue surge in fiscal year 2024. This robust growth trajectory continued into the first half of 2025, with an impressive 95.7% increase.

The primary drivers behind this exceptional momentum are the successful global expansion and the broadening therapeutic applications of both Iqirvo and Bylvay. These drugs are particularly making a significant impact in the treatment of rare cholestatic liver diseases.

This rapidly developing franchise is clearly establishing itself as a key high-growth engine for Ipsen.

Cabometyx has demonstrated significant strength within Ipsen's oncology offerings, achieving notable success across several cancer types. Its market reach was further enhanced by a European Commission approval in July 2025 for advanced neuroendocrine tumors, bringing its total indications to six.

This latest approval is a key driver for the continued expansion and robust growth Ipsen is experiencing in its oncology division. Cabometyx's expanding therapeutic applications underscore its importance as a revenue generator and a strategic asset for the company.

Ipsen's strategic direction centers on specialty care, specifically targeting Oncology, Neuroscience, and Rare Diseases. This focus is designed to drive consistent, robust growth for the company.

The company is committed to developing treatments that are either the best in their class or entirely new to the market within these therapeutic areas. Ipsen's established expertise and extensive global reach are key assets in this pursuit.

By concentrating its resources on these high-potential segments, Ipsen can effectively address significant market opportunities and critical unmet patient needs. For instance, in 2024, Ipsen continued to invest heavily in its oncology pipeline, with several key assets progressing through late-stage clinical trials.

Strategic Pipeline Expansion

Ipsen is strategically growing its product pipeline by investing heavily in research and development, alongside pursuing external innovation opportunities. This focused effort has resulted in the addition of more than 20 new programs since 2020, underscoring a commitment to future growth.

The company's strategy centers on developing a robust portfolio of next-generation medicines. This ensures a consistent flow of potentially high-impact products that can drive sustained revenue and market presence.

Ipsen's proactive approach to forming strategic partnerships and executing acquisitions is crucial for its pipeline expansion. These collaborations enhance its capacity to bring cutting-edge therapies to patients more efficiently.

- R&D Investment: Ipsen's commitment to innovation is demonstrated by its significant investment in research and development.

- Pipeline Growth: Over 20 new programs have been added to the pipeline since 2020, indicating substantial expansion.

- External Innovation: The company actively seeks external innovation through partnerships and acquisitions to bolster its R&D efforts.

- Future Sustainability: This strategy aims to create a sustainable portfolio of next-generation medicines for long-term growth.

Strong Financial Performance Momentum

Ipsen has demonstrated strong financial performance momentum. In fiscal year 2024, the company achieved a notable total sales growth of 9.9%.

- Ipsen's fiscal year 2024 sales grew by 9.9%.

- The company upgraded its full-year 2025 guidance to over 7.0% growth at constant exchange rates.

- This growth is particularly strong in key therapeutic areas.

- Ipsen consistently exceeds revenue forecasts, signaling market leadership.

Stars in the BCG matrix represent products with high market share in a high-growth market. Ipsen's Rare Diseases franchise, driven by Iqirvo and Bylvay, exemplifies this category. The franchise saw a remarkable 67.4% revenue increase in fiscal year 2024, continuing its strong performance with a 95.7% surge in the first half of 2025.

This exceptional growth is fueled by the successful global rollout and expanding indications for these treatments, particularly in rare cholestatic liver diseases. This segment is clearly Ipsen's high-growth engine.

| Product/Franchise | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Rare Diseases (Iqirvo & Bylvay) | High | High | Star |

| Oncology (Cabometyx) | High | High | Star |

What is included in the product

The Ipsen BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It guides strategic decisions on resource allocation, investment, and divestment for each unit.

A clear visual of business unit performance, simplifying strategic decisions.

Cash Cows

Somatuline, a key player in Ipsen's oncology and neuroendocrine tumor portfolio, demonstrated robust performance in FY 2024, achieving a 5.6% sales increase. This growth highlights its continued importance as a substantial revenue contributor, even with rising generic competition in major markets like the U.S. and Europe.

The drug's established market position and consistent sales underscore its status as a vital cash cow for Ipsen. Its ability to maintain strong sales despite competitive pressures speaks to its enduring value and market penetration.

Dysport, a key player in Ipsen's neuroscience and aesthetics segments, functions as a Cash Cow. This established botulinum toxin type A product consistently generates significant revenue, underpinning Ipsen's financial stability.

While not experiencing the explosive growth of emerging therapies, Dysport's mature market presence and dual therapeutic and aesthetic applications ensure a reliable and substantial cash flow for Ipsen. In 2023, Ipsen reported that their neuroscience division, heavily influenced by Dysport, achieved a notable performance, contributing significantly to the company's overall revenue.

Ipsen's established oncology portfolio acts as a significant cash cow, consistently delivering robust financial returns. These mature products leverage established market positions and loyal patient bases, necessitating reduced marketing expenditures. For instance, in 2024, Ipsen reported that its oncology segment continued to be a bedrock of its financial performance, providing stable earnings that bolster the company's overall financial health and fund innovation.

Consistent Core Operating Margin

Ipsen's Cash Cows, characterized by their consistent core operating margin, demonstrate robust financial health. In fiscal year 2024, Ipsen achieved an impressive operating margin of 32.6%.

This strong profitability is further underscored by the company's upgraded guidance for 2025, projecting a core operating margin exceeding 32.0%. Such a high margin reflects exceptional operational efficiency and diligent cost control within its established product portfolio.

- Consistent Profitability: Ipsen's core operating margin stood at 32.6% in FY 2024, highlighting the strength of its established products.

- Upgraded Guidance: The company anticipates its 2025 core operating margin to surpass 32.0%, indicating sustained performance.

- Operational Efficiency: The high margins suggest effective cost management and streamlined operations across its mature business segments.

- Strategic Reinvestment: Significant profit generation from these Cash Cows provides Ipsen with the financial capacity for future investments and strategic initiatives.

Strong Free Cash Flow Generation

Ipsen's strong free cash flow generation is a key indicator of its Cash Cow status. In fiscal year 2024, the company reported a robust €774.4 million in free cash flow, marking a significant 8.9% increase compared to the prior year.

This substantial cash flow provides Ipsen with considerable financial flexibility. It allows the company to effectively fund its ongoing research and development initiatives, pursue strategic acquisition opportunities, and comfortably cover its operational and administrative expenses.

- Robust Free Cash Flow: €774.4 million in FY 2024.

- Year-over-Year Growth: An increase of 8.9% from the previous year.

- Financial Flexibility: Enables funding for R&D, acquisitions, and operational costs.

- Indicator of Health: Demonstrates the financial strength of mature, profitable product lines.

Ipsen's established oncology and neuroscience products, like Somatuline and Dysport, function as its primary Cash Cows. These products consistently generate substantial revenue with limited need for aggressive marketing investment due to their mature market positions. This reliable income stream is crucial for funding Ipsen's growth initiatives.

The company's strong financial performance in FY 2024, including a core operating margin of 32.6% and free cash flow of €774.4 million, directly reflects the contribution of these mature assets. Ipsen's upgraded 2025 guidance, projecting a core operating margin exceeding 32.0%, further solidifies the enduring strength of its Cash Cow portfolio.

| Product Category | FY 2024 Sales Performance | Cash Cow Status Justification |

|---|---|---|

| Oncology (e.g., Somatuline) | 5.6% sales increase in FY 2024 | Established market, consistent revenue despite competition |

| Neuroscience (e.g., Dysport) | Significant contributor to overall revenue | Mature market presence, reliable cash flow |

| Overall Financials | 32.6% core operating margin (FY 2024) | High profitability indicates efficient operations of mature products |

| Free Cash Flow | €774.4 million (FY 2024), up 8.9% | Demonstrates financial strength and flexibility from established assets |

Full Transparency, Always

Ipsen BCG Matrix

The Ipsen BCG Matrix document you are previewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete strategic analysis ready for your professional use. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version will be precisely the same. It's designed for immediate application in your business planning, allowing you to leverage its strategic framework without any further preparation.

Dogs

Sohonos, a treatment for Fibrodysplasia Ossificans Progressiva, faced a significant hurdle in 2024 with an impairment loss of €279 million. This substantial write-down was directly linked to revised sales projections, which were negatively impacted by slower-than-expected patient adoption.

The limited market traction despite its approval positions Sohonos as a product with a low market share within its specialized therapeutic area. This underperformance is a critical factor in evaluating its future strategic direction within the company's portfolio.

Given its current performance and the financial impact, Sohonos exhibits characteristics of a cash trap. This suggests that the company may consider divesting the product or significantly reducing further investment to reallocate resources to more promising ventures.

Ipsen's strategic divestment of assets, such as Increlex in 2024, signifies a move away from products that no longer fit its core business or exhibit substantial growth prospects. This action is characteristic of a company pruning its portfolio, often shedding 'dog' assets to redirect capital and focus towards more promising ventures.

Ipsen's portfolio includes products like Somatuline, which are experiencing significant generic erosion. This competition is a natural progression for older, established drugs, and it directly impacts market share and profitability.

While Somatuline has seen some benefit from supply chain issues impacting competitors, the long-term trend points towards increasing generic penetration. This competitive pressure is a key factor in classifying such products as potential 'dogs' within the BCG matrix framework.

Ipsen's financial outlook, as indicated in their 2024 guidance, already accounts for the anticipated negative financial effects stemming from this ongoing generic competition. This proactive approach acknowledges the reality of market dynamics for mature pharmaceuticals.

Underperforming Legacy Products

Certain legacy products within Ipsen's portfolio might be experiencing a slowdown, showing low growth or even declining sales. These products, while perhaps once successful, are no longer meeting market expectations. For instance, if a product's sales in 2024 were down 5% compared to 2023, it would fall into this category.

These underperforming assets can tie up valuable resources, such as research and development funds or marketing budgets, without generating substantial returns. They don't contribute much to the company's overall revenue growth or market share. Imagine a product that only accounts for 1% of Ipsen's total revenue in 2024 but still requires significant operational support.

The continued presence of these products can distract from more promising opportunities. It's like trying to keep too many old cars running when you could be investing in a new, high-performance vehicle. Strategic review is often necessary to decide whether to divest, reposition, or phase out these underperformers.

- Low Market Growth: Products in mature or declining markets with limited expansion potential.

- Declining Sales Trend: Consistent year-over-year decreases in revenue for a specific product.

- High Resource Consumption: Products requiring significant investment in manufacturing, marketing, or regulatory compliance relative to their sales.

- Low Profitability: Products that contribute minimally to profit margins or are even loss-making.

Products with Limited Future Investment

Products classified as 'dogs' within Ipsen's BCG Matrix represent those with a low market share in a low-growth market. Ipsen's strategic focus on investing in high-potential opportunities and external innovation means that such products are unlikely to receive substantial future investment. This approach naturally leads to a reduction in resources allocated to assets that do not align with the company's growth objectives.

Without dedicated research and development or significant marketing support, these 'dog' products are destined to remain in their current position. Ipsen's pipeline prioritization is firmly on opportunities with the highest potential for future returns, which inherently sidelines products with limited prospects.

- Low Market Share: These products typically hold a negligible position in their respective markets.

- Low Market Growth: The industries or therapeutic areas these products serve are not expanding significantly.

- Minimal R&D Allocation: Future investment in product development or enhancement is highly improbable.

- Reduced Marketing Spend: Promotional efforts are likely to be scaled back or eliminated entirely.

Products classified as 'dogs' in Ipsen's portfolio exhibit low market share within slow-growing or declining markets. These are often mature products facing significant competition, such as from generics, leading to reduced profitability and minimal strategic investment. Ipsen's strategy involves managing these assets efficiently, potentially through divestment, to free up resources for more promising growth areas.

| Product Example | Market Share | Market Growth | R&D Allocation | Marketing Spend |

| Legacy Products (e.g., impacted by generic erosion) | Low | Low/Declining | Minimal | Reduced |

Question Marks

Ipsen's Long-Acting Neurotoxin (LANT) program, featuring IPN10200, represents a significant potential growth area. With proof-of-concept data anticipated in 2025 for aesthetic applications and a Phase II study already underway for cervical dystonia, the program is poised for advancement.

Despite its high growth prospects across both therapeutic and aesthetic markets, the LANT program currently holds a minimal market share due to its ongoing clinical development. This early stage necessitates substantial investment to nurture its potential and guide its progression towards becoming a market leader, or a Star in the BCG matrix.

Tovorafenib, an oral RAF inhibitor targeting pediatric low-grade glioma, represents a potential "Question Mark" in Ipsen's portfolio. Its recent acceptance for review by the EMA highlights its promise in a niche, high-need oncology area, but it currently lacks any market share.

The drug's future trajectory, moving from Question Mark to potentially a Star or even a Dog, is entirely dependent on securing regulatory approval and achieving successful market penetration. This will necessitate significant investment in commercialization strategies to capture its potential.

Fidrisertib, a treatment for fibrodysplasia ossificans progressiva (FOP), is currently positioned as a Question Mark within Ipsen's business portfolio. The drug is awaiting the critical readout of its pivotal Phase IIb trial in 2025, which will significantly influence its future trajectory.

The unmet medical need in FOP is substantial, indicating a potentially high-growth market for Fidrisertib if clinical trials prove successful. However, its current low market share, coupled with the inherent uncertainties of drug development and regulatory approval, firmly places it in the Question Mark category, requiring careful strategic consideration and investment.

New Preclinical Innovative Therapies

Ipsen's strategic expansion into five new preclinical innovative therapies, including novel modalities and global licensing agreements for oncology Antibody Drug Conjugates (ADCs), positions these assets as potential high-growth drivers. While these early-stage developments offer significant future potential, they currently represent zero market share and are several years from commercialization, demanding considerable research and development investment to navigate clinical trials and demonstrate market viability. For instance, in 2024, Ipsen continued to invest heavily in its R&D pipeline, with a significant portion allocated to early-stage research and development activities, reflecting the commitment to bringing these innovative therapies to market.

- Pipeline Expansion: Ipsen has added five preclinical innovative therapies with global rights and new modalities, alongside global licensing agreements for ADCs in oncology.

- Growth Prospects: These early-stage assets represent high-growth potential for the future.

- Market Position: They currently have no market share and are years away from market entry.

- Investment Needs: Substantial R&D investment is required to advance these therapies through clinical development and prove their commercial viability.

IPN01194 (ERK inhibitor) and IPN01195 (RAF inhibitor)

IPN01194, an ERK inhibitor, and IPN01195, a RAF inhibitor, represent Ipsen's early-stage investments in the oncology market, specifically targeting the MAPK pathway. These compounds are currently in Phase I/IIa clinical trials for advanced solid tumors, indicating a high-risk, high-reward profile due to their nascent commercial stage.

The success of these assets hinges on demonstrating efficacy and safety in ongoing trials, with the potential to address significant unmet needs in cancer treatment. For instance, the MAPK pathway is implicated in a substantial percentage of cancers, with estimates suggesting mutations in RAS or BRAF, key components of this pathway, occur in up to 50% of all human cancers.

- Market Potential: The global oncology market is projected to reach over $270 billion by 2027, with targeted therapies like MAPK inhibitors expected to capture a significant share.

- Clinical Stage: As Phase I/IIa assets, IPN01194 and IPN01195 are in the early stages of development, meaning substantial investment is required before potential commercialization.

- Competitive Landscape: The MAPK pathway is a heavily researched area, with several established and emerging therapies, necessitating strong differentiation for IPN01194 and IPN01195 to succeed.

- Risk Factors: Early-stage clinical trial failures, regulatory hurdles, and competitive pressures are key risks that could impact the future commercial viability of these pipeline candidates.

Question Marks represent products with low market share in high-growth markets. These are typically new products or those in early development stages that require significant investment to grow. Ipsen's pipeline includes several such candidates, each with the potential to become future Stars.

For example, Tovorafenib for pediatric low-grade glioma and Fidrisertib for fibrodysplasia ossificans progressiva are both in development, facing clinical trial uncertainties and regulatory hurdles, but targeting areas with substantial unmet needs.

Ipsen's preclinical innovative therapies and early-stage oncology compounds like IPN01194 and IPN01195 also fall into this category, demanding considerable R&D investment to navigate the path from concept to commercialization.

The success of these Question Marks is crucial for Ipsen's future growth, as they represent the next generation of potential market leaders.

| Product Candidate | Therapeutic Area | Development Stage | Market Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|---|

| LANT Program (IPN10200) | Neurotoxin (Aesthetic & Therapeutic) | Phase II (Cervical Dystonia), Proof-of-Concept (Aesthetic) | High | Minimal | Substantial |

| Tovorafenib | Pediatric Low-Grade Glioma (Oncology) | Regulatory Review (EMA) | High | Zero | Significant |

| Fidrisertib | Fibrodysplasia Ossificans Progressiva (FOP) | Phase IIb Trial Readout (2025) | High | Low | Careful Strategic Consideration |

| Preclinical Innovative Therapies & ADCs | Various (Oncology focus) | Preclinical | High | Zero | Considerable R&D |

| IPN01194 & IPN01195 | MAPK Pathway (Oncology) | Phase I/IIa | High | Nascent | Substantial |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth rates, to accurately position each business unit.