Ipsen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsen Bundle

Ipsen operates within a dynamic pharmaceutical landscape shaped by intense competition, evolving buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating the industry's complexities.

The complete report reveals the real forces shaping Ipsen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ipsen's reliance on specialized suppliers for critical raw materials and active pharmaceutical ingredients (APIs) presents a significant factor in supplier bargaining power. The intricate nature of biopharmaceutical production, especially for advanced therapies, often means only a select few manufacturers can meet the stringent quality and technical specifications required. This limited supplier pool grants them considerable leverage.

For instance, the development of novel oncology treatments or complex neuroscience drugs necessitates highly specific chemical compounds or biological inputs. Ipsen's strategic focus on these specialty areas, including Oncology, Neuroscience, and Rare Diseases, amplifies its dependence on a narrow range of expert providers. This dependency can translate into higher input costs or less favorable supply terms, impacting Ipsen's profitability and operational flexibility.

Suppliers who offer unique manufacturing technologies or highly specialized equipment crucial for pharmaceutical development and production wield significant influence. For instance, companies specializing in advanced bioprocessing equipment, which can cost millions and require extensive validation, often have strong leverage. Ipsen's reliance on such specialized machinery, which might have lead times of over a year for new installations, makes switching suppliers a complex and expensive undertaking, often involving costly re-validation processes and potential delays in bringing new therapies to market.

Ipsen relies on Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) for crucial functions like clinical trials and drug production. The specialized knowledge and existing facilities of these CROs/CMOs can give them significant leverage, as Ipsen may not possess the in-house capabilities. For instance, the global CRO market was valued at approximately $45.6 billion in 2023 and is projected to grow, indicating a robust and competitive supplier landscape.

Quality and Regulatory Compliance

Suppliers who consistently meet Ipsen's rigorous quality standards and comply with regulations like Good Manufacturing Practices (GMP) and those set by the FDA and EMA hold significant sway. Their ability to deliver without issue is critical for Ipsen’s operations.

A failure on a supplier's part, whether in quality or compliance, can trigger substantial disruptions for Ipsen, including production halts, product recalls, and costly regulatory fines. This dependency on dependable suppliers strengthens their negotiating position.

- Criticality of Compliance: Ipsen relies on suppliers adhering to strict pharmaceutical industry regulations, making non-compliance a major risk.

- Impact of Lapses: Quality or compliance failures from suppliers can lead to significant financial and reputational damage for Ipsen.

- Supplier Indispensability: Suppliers demonstrating consistent quality and regulatory adherence are difficult for Ipsen to substitute, enhancing their bargaining power.

Intellectual Property of Suppliers

Suppliers possessing patents or proprietary knowledge critical to Ipsen's drug development and manufacturing processes hold significant bargaining power. This intellectual property creates a dependency, making it difficult and risky for Ipsen to find alternative sources or replicate the technology. For instance, a supplier holding a patent on a key intermediate chemical for a blockbuster drug would have substantial leverage in price negotiations.

This reliance on unique supplier innovations can restrict Ipsen's ability to negotiate favorable terms. The cost of developing or acquiring equivalent technology internally could be prohibitive, or simply not feasible within the required timelines. This situation directly impacts Ipsen's cost structure and profitability.

- Patented Ingredients: Suppliers holding patents on essential raw materials or active pharmaceutical ingredients (APIs) can command premium pricing.

- Proprietary Manufacturing Processes: Knowledge of unique synthesis routes or formulation techniques can give suppliers an edge, limiting Ipsen's sourcing options.

- R&D Collaboration: Suppliers involved in early-stage research with Ipsen may leverage their contributions to secure favorable long-term supply agreements.

The bargaining power of suppliers for Ipsen is considerable, driven by the specialized nature of pharmaceutical inputs and the stringent regulatory environment. Suppliers of critical raw materials and active pharmaceutical ingredients (APIs) often face limited competition, allowing them to dictate terms. This is particularly true for unique chemical compounds or biological inputs essential for Ipsen's focus areas like Oncology and Neuroscience.

The reliance on Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) further empowers suppliers. The global CRO market, valued at around $45.6 billion in 2023, demonstrates the scale of this outsourced expertise. Suppliers with patented technologies or proprietary manufacturing processes also hold significant leverage, as finding alternatives can be technically challenging and costly for Ipsen.

| Factor | Impact on Ipsen | Supplier Leverage |

|---|---|---|

| Specialized Inputs | High dependency on unique chemical compounds and biological materials for drug development. | Suppliers with niche expertise can command higher prices and stricter terms. |

| Regulatory Compliance | Strict adherence to GMP, FDA, and EMA standards is non-negotiable. | Suppliers consistently meeting these standards are indispensable, increasing their negotiating power. |

| Intellectual Property | Patents on key ingredients or manufacturing processes create significant dependency. | Suppliers holding IP can restrict sourcing options and influence pricing. |

| CRO/CMO Reliance | Outsourcing critical research and manufacturing functions. | Specialized CROs/CMOs with advanced capabilities gain leverage due to Ipsen's potential lack of in-house capacity. |

What is included in the product

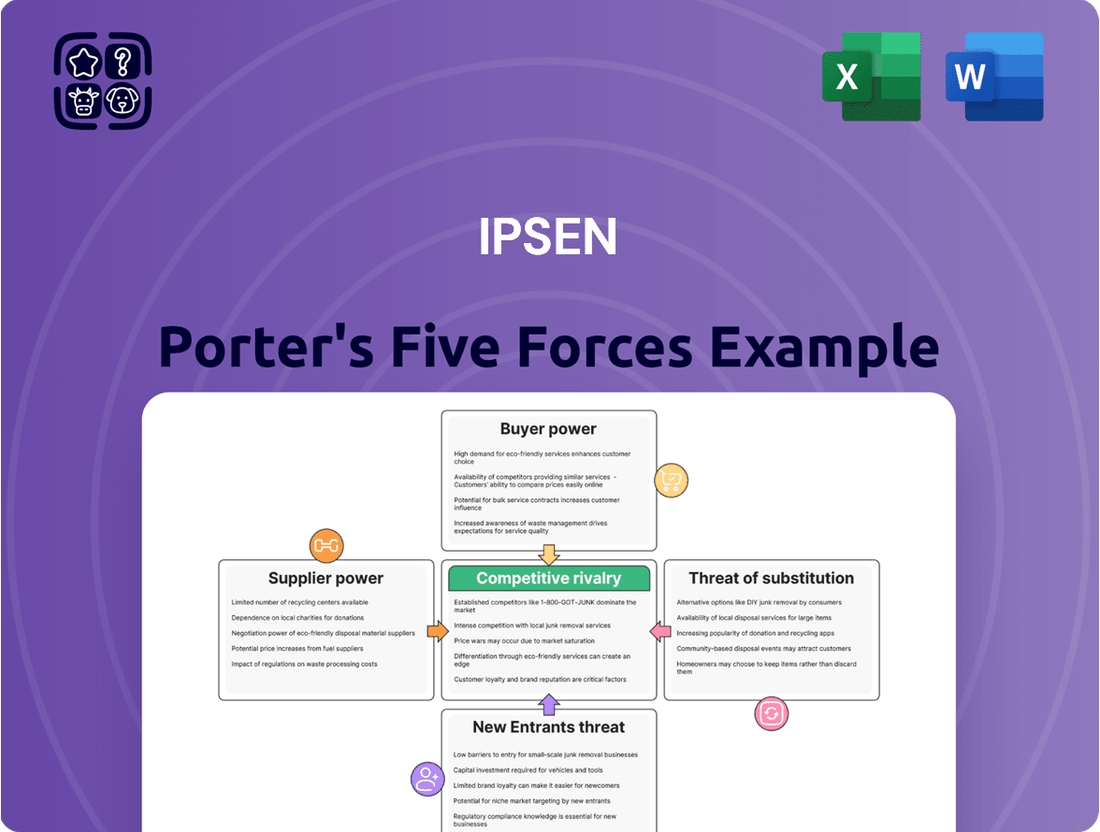

This analysis unpacks the competitive forces shaping Ipsen's pharmaceutical market, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Quickly identify and mitigate competitive threats by visualizing bargaining power of suppliers and buyers.

Customers Bargaining Power

Ipsen's primary customers are national healthcare systems, insurers, and hospitals, particularly in regions with established public or private health insurance frameworks. These substantial buyers wield considerable influence over drug pricing and reimbursement decisions, directly impacting Ipsen's revenue streams.

The bargaining power of these large-scale customers is a significant factor for Ipsen. For instance, in 2024, many European countries continued to implement cost-containment measures within their healthcare budgets, putting pressure on pharmaceutical companies to negotiate lower prices for their products. This can lead to situations where Ipsen faces potential price reforms or even the risk of its medicines being removed from reimbursable lists, which would directly affect sales volumes and overall profitability.

Patient advocacy groups wield significant influence, even without direct purchasing power, by shaping perceptions and advocating for access to therapies. These organizations, representing patients with conditions like those Ipsen targets in oncology and rare diseases, can heavily impact reimbursement decisions and market adoption rates.

In 2024, the pharmaceutical industry continued to see patient advocacy play a crucial role in market access, with groups actively engaging with payers and policymakers to highlight unmet needs and the value of innovative treatments. For Ipsen, whose portfolio often addresses severe and rare conditions, this collective patient voice is a vital factor in navigating the complex healthcare landscape and ensuring their treatments reach those who need them.

Prescribing physicians hold significant sway as the initial gatekeepers for Ipsen's pharmaceuticals. Their decisions are guided by a complex interplay of a drug's proven efficacy, its safety profile, and its overall cost-effectiveness. For instance, in 2024, the average physician prescription decision for a new specialty drug often considers clinical trial data showing a statistically significant improvement in patient outcomes compared to existing treatments.

Furthermore, the influence of hospital formularies and managed care organizations cannot be overstated. These entities actively manage drug expenditures by prioritizing medications that offer the best value, frequently favoring generics or biosimilars when available. In 2024, many health insurers implemented stricter prior authorization requirements for high-cost specialty drugs, further amplifying the pressure on physicians to justify their prescribing choices.

To navigate this landscape, Ipsen must compellingly showcase its products' superior clinical value. Securing favorable formulary placement and physician preference requires demonstrating clear advantages over established, often less expensive, alternatives. This often involves presenting robust real-world evidence and pharmacoeconomic data that resonate with the cost-conscious decision-making processes prevalent in healthcare systems today.

Availability of Generics and Biosimilars

The availability of generic medicines significantly amplifies customer bargaining power for pharmaceutical companies like Ipsen. For instance, Somatuline, a key product for Ipsen, faces potential competition from generics. This availability allows customers, including healthcare providers and patients, to seek out more affordable alternatives, directly impacting Ipsen's pricing power and market share.

Generic competition can erode sales growth and profitability. When cheaper versions of a drug enter the market, customers are incentivized to switch, forcing companies like Ipsen to either lower prices or invest in strategies to maintain customer loyalty. This dynamic is particularly relevant as patents expire on established treatments.

- Increased Price Sensitivity: The presence of generics makes customers highly sensitive to price differences, pressuring Ipsen to justify its pricing.

- Market Share Erosion: Generic entry can lead to a substantial loss of market share for originator drugs, impacting revenue streams.

- Need for Differentiation: Companies like Ipsen must differentiate their products through superior efficacy, safety data, or enhanced patient support programs to counter generic competition.

Market Concentration of Buyers

The bargaining power of customers for Ipsen is significantly influenced by market concentration among buyers, particularly in specific therapeutic areas or geographic markets. When a few large hospital networks or purchasing consortia dominate the customer landscape, they gain considerable leverage.

This concentrated buying power allows these entities to negotiate more favorable terms from pharmaceutical companies like Ipsen. Such terms can include substantial discounts on drug prices, extended payment periods, or preferential supply agreements. For instance, in 2024, major European hospital groups have been consolidating their purchasing power, leading to increased pressure on drug manufacturers to offer competitive pricing.

The ability of Ipsen to effectively manage its receivables is directly tied to the financial health and negotiating strength of these large, concentrated customer groups. A downturn in the financial stability of a key hospital network could delay payments, impacting Ipsen's cash flow and profitability.

- Concentrated Buyer Power: In specialized markets, a few large entities may control a significant portion of drug purchases.

- Negotiation Leverage: This concentration enables buyers to demand lower prices and more favorable payment terms.

- Impact on Receivables: Ipsen's cash flow can be affected by the financial stability and negotiating tactics of these key customers.

- Regional Variations: The degree of buyer concentration can differ significantly across various geographic markets where Ipsen operates.

Ipsen's customers, including national healthcare systems and large hospital networks, possess significant bargaining power due to their substantial purchasing volumes and the increasing pressure for cost containment in healthcare. In 2024, many European countries continued to implement stringent cost-saving measures, directly influencing drug pricing negotiations. This power is further amplified by the availability of generic alternatives, which compels Ipsen to demonstrate clear clinical and economic value to maintain market position and pricing. The concentration of buyers in certain markets also grants them increased leverage, enabling them to negotiate more favorable terms, impacting Ipsen's revenue and profitability.

| Customer Segment | Bargaining Power Factors | Impact on Ipsen (2024 Trends) |

|---|---|---|

| National Healthcare Systems/Insurers | Volume purchasing, cost-containment policies, reimbursement decisions | Pressure on drug pricing, potential for price reforms, risk of delisting |

| Hospitals/Formularies | Formulary inclusion, managed care protocols, preference for cost-effective options | Need for strong pharmacoeconomic data, competition from generics/biosimilars |

| Patient Advocacy Groups | Shaping perceptions, influencing market access and reimbursement | Crucial for market adoption of specialized therapies, especially in rare diseases |

| Prescribing Physicians | Clinical efficacy, safety profile, cost-effectiveness considerations | Requirement for robust clinical trial data and real-world evidence |

Full Version Awaits

Ipsen Porter's Five Forces Analysis

This preview showcases the complete Ipsen Porter's Five Forces Analysis you will receive immediately upon purchase. You are viewing the exact, professionally formatted document that will be available for download, ensuring no surprises or placeholder content. This comprehensive analysis is ready for your immediate use, providing valuable insights into Ipsen's competitive landscape.

Rivalry Among Competitors

Ipsen operates within intensely competitive therapeutic areas, notably Oncology, Neuroscience, and Rare Diseases. This landscape is populated by a multitude of global and regional biopharmaceutical firms, all striving for market dominance.

Major industry players such as Merck, Regeneron, Teva, Biogen, and Astellas are direct rivals, offering comparable treatments and innovations. For instance, in the oncology sector, where Ipsen has a significant presence, the market is characterized by rapid drug development and extensive clinical trials, making it a battleground for market share.

This dense competitive environment means that companies like Ipsen must constantly innovate and differentiate their offerings to capture physician preference and patient adoption. The sheer volume of competitors vying for attention and resources in these key areas significantly amplifies the intensity of rivalry, impacting pricing power and market penetration strategies.

The biopharmaceutical sector thrives on a relentless pursuit of innovation, with companies like Ipsen dedicating substantial resources to research and development. This commitment is crucial for discovering and bringing to market novel, differentiated therapies. In 2024, global R&D spending in the biopharma sector is projected to exceed $250 billion, underscoring the intensity of this innovation race.

Ipsen actively fuels its pipeline through external innovation, aiming to deliver groundbreaking medicines to patients. This constant influx of new research means competitors are perpetually developing next-generation products. For instance, in 2024, numerous clinical trial advancements were announced across various therapeutic areas, signaling a dynamic competitive landscape where market positions can shift rapidly due to R&D breakthroughs.

Competitive rivalry at Ipsen is significantly shaped by product differentiation and the strength of its overall portfolio. Ipsen's diversified offerings, featuring prominent treatments such as Cabometyx in oncology, Somatuline for neuroendocrine tumors, Dysport for aesthetic and therapeutic uses, and Onivyde for pancreatic cancer, grant it considerable strategic maneuverability.

This broad product base allows Ipsen to compete effectively across multiple fronts. For instance, in the highly competitive aesthetics market, Dysport directly challenges established players like Allergan's Botox, underscoring the need for continuous innovation and robust commercial strategies to maintain market share and attract new customers.

Impact of Generic and Biosimilar Competition

The threat from generic and biosimilar products significantly intensifies competitive rivalry, especially for established medications. Ipsen has explicitly noted the adverse sales impact stemming from heightened generic competition for its Somatuline product in both the United States and European markets. This competitive pressure necessitates that Ipsen prioritizes and accelerates the sales growth of its newer, non-Somatuline product lines.

Consequently, the company must strategically shift its focus towards developing and commercializing innovative assets to counteract the erosion of revenue from older, off-patent drugs. For instance, in 2024, Ipsen continued to invest heavily in its pipeline, aiming to bolster its portfolio with novel therapies that offer greater differentiation and pricing power.

The impact of generics on a company like Ipsen is substantial, as it directly affects revenue streams and market share for key products. This dynamic forces a proactive approach to portfolio management and innovation.

- Increased Generic Penetration: In 2024, several of Ipsen’s mature products faced increased generic penetration, leading to price erosion.

- Portfolio Diversification: Ipsen’s strategy to mitigate this involves accelerating the growth of its newer products, such as those in oncology and neuroscience.

- R&D Investment: The company’s commitment to innovation is evident in its ongoing R&D expenditures, aimed at bringing novel treatments to market.

- Market Share Defense: Ipsen actively works to defend market share for its key brands through lifecycle management and strategic marketing initiatives.

Global Market Presence and Strategic Partnerships

Companies that have established a significant global presence and cultivated robust strategic partnerships often find themselves with a distinct competitive advantage. Ipsen, for instance, demonstrates this by operating in over 100 countries, with a direct commercial footprint in more than 30, bolstered by its global hubs and alliances.

These collaborations are crucial for navigating the complexities of the pharmaceutical landscape. For example, Ipsen's strategic alliances, particularly in areas like oncology and rare neurological diseases, allow for the sharing of development costs and risks. This not only broadens access to cutting-edge technologies but also strengthens Ipsen's standing against competitors.

- Global Reach: Ipsen's operations span over 100 countries, with a direct commercial presence in more than 30.

- Strategic Collaborations: Partnerships in oncology and rare neurological diseases are key to cost and risk sharing.

- Technology Access: Alliances provide access to new and innovative technologies, enhancing competitive positioning.

Competitive rivalry for Ipsen is fierce, driven by numerous global and regional biopharmaceutical firms vying for market share in key therapeutic areas like Oncology and Neuroscience. Major players such as Merck, Regeneron, and Biogen directly compete with comparable treatments, making innovation and differentiation critical for physician and patient adoption.

The biopharmaceutical sector's intense R&D focus, with global spending projected to exceed $250 billion in 2024, fuels a constant stream of new products. This dynamic landscape means Ipsen must continually innovate to maintain its market position against competitors who are also advancing their pipelines through clinical trial breakthroughs announced throughout 2024.

Ipsen's competitive standing is bolstered by its diversified portfolio, including Cabometyx and Somatuline, which allows it to compete across multiple fronts. However, the threat of generic and biosimilar competition, as seen with Somatuline, intensifies rivalry and necessitates a strategic shift towards newer, more differentiated therapies to offset revenue erosion.

SSubstitutes Threaten

The most significant threat of substitution for Ipsen's products arises from generic and biosimilar alternatives. As Ipsen's key treatments, particularly Somatuline, face patent expirations in major markets, the availability of lower-cost generics and biosimilars directly challenges its market position and pricing power.

In 2024, the global market for biosimilars is projected to reach over $100 billion, indicating a substantial and growing competitive landscape. This trend directly impacts Ipsen by offering patients and healthcare systems comparable therapeutic options at a reduced price point, thereby eroding Ipsen's revenue streams from its established products.

Beyond just other drugs, alternative treatments like surgery or radiation therapy can also be a threat to Ipsen's products. For instance, in oncology, advancements in minimally invasive surgical techniques or more targeted radiation therapies might lessen the need for certain chemotherapy or immunotherapy drugs. Ipsen needs to highlight the unique benefits and effectiveness of its pharmaceutical solutions compared to these non-drug options.

For certain conditions, especially in their initial phases or when symptoms are mild, individuals might opt for lifestyle adjustments, dietary changes, or preventative health practices instead of immediately turning to pharmaceutical treatments. While Ipsen primarily targets severe and rare diseases where such substitutions are less likely to be a direct threat, a general societal trend towards proactive health management could indirectly influence the market for some chronic disease medications.

Emerging Technologies and Therapies

The threat of substitutes for Ipsen's products is elevated by rapid advancements in medical science. New treatments like gene therapies, cell therapies, and personalized medicine approaches are emerging, potentially offering alternatives to current pharmaceutical solutions. For instance, the global gene therapy market was valued at approximately USD 11.3 billion in 2023 and is projected to grow significantly, indicating a strong trend toward innovative therapeutic modalities that could substitute existing treatments.

Ipsen's strategy includes investing in its own research and development and pursuing external innovation to stay ahead of these evolving therapeutic landscapes. However, if competitors achieve breakthroughs with significantly superior efficacy or safety profiles, these new therapies could rapidly gain market share and displace Ipsen's existing product portfolio.

- Emerging Technologies: Gene and cell therapies represent a growing segment of the pharmaceutical market, with significant investment flowing into their development.

- Personalized Medicine: Advances in diagnostics and tailored treatment plans offer alternatives that could reduce reliance on one-size-fits-all pharmaceutical solutions.

- Competitive Landscape: The speed at which competitors can bring disruptive therapies to market poses a direct threat to established products.

- Market Disruption: Breakthroughs in efficacy or safety for substitute therapies can lead to rapid market share erosion for incumbent products.

Off-Label Use of Existing Drugs

The threat of substitutes for Ipsen's products arises from the potential off-label use of existing drugs. If a drug approved for a different condition demonstrates effectiveness in Ipsen's target therapeutic areas, it can emerge as a lower-cost alternative. This is particularly relevant in markets where physician discretion plays a significant role in treatment selection.

While regulatory bodies like the FDA or EMA oversee drug approvals and indications, physicians may still prescribe off-label if they perceive a readily available and more economical option. This underscores the critical need for Ipsen to maintain strong clinical trial data and secure broad regulatory approvals to solidify its products as the preferred standard of care.

For instance, in 2024, the market for certain rare disease treatments, where Ipsen has a presence, has seen increased scrutiny regarding the cost-effectiveness of therapies. This environment makes the threat of off-label use of older, less expensive drugs a tangible concern.

- Off-label use presents a cost-driven substitute threat.

- Physician prescribing habits can facilitate this substitution.

- Robust clinical data and regulatory approvals are key defenses for Ipsen.

The threat of substitutes for Ipsen's pharmaceutical products is significant, driven by both direct and indirect alternatives. The increasing prevalence of generic and biosimilar drugs, particularly as patents expire on key Ipsen medications like Somatuline, presents a substantial challenge. For example, the global biosimilar market is expected to exceed $100 billion in 2024, offering lower-cost options that can erode Ipsen's market share and pricing power.

Beyond pharmaceutical alternatives, non-drug treatments such as surgery or radiation therapy can also substitute for Ipsen's offerings, especially in areas like oncology. Furthermore, emerging technologies like gene and cell therapies, with the gene therapy market valued at approximately USD 11.3 billion in 2023, represent a growing wave of innovation that could displace existing treatments. Even lifestyle changes or preventative measures can act as substitutes in milder cases of chronic conditions, though this is less of a direct threat for Ipsen's focus on rare and severe diseases.

The potential for off-label use of existing, less expensive drugs also poses a threat, particularly in markets where physician discretion is high and cost-effectiveness is a major consideration, as seen in some rare disease treatments in 2024. Ipsen must continually demonstrate the superior efficacy, safety, and value proposition of its patented therapies through robust clinical data and regulatory approvals to counter these diverse substitution threats.

| Substitute Type | Key Drivers | Impact on Ipsen | 2024 Market Data/Projections |

|---|---|---|---|

| Generics & Biosimilars | Patent expirations, lower cost | Erosion of market share and pricing power | Global biosimilar market > $100 billion |

| Non-Drug Therapies | Advancements in surgery, radiation | Reduced demand for certain pharmaceuticals | N/A (specific to therapeutic areas) |

| Emerging Technologies | Gene therapy, cell therapy, personalized medicine | Potential displacement of existing treatments | Gene therapy market ~USD 11.3 billion (2023) |

| Off-Label Use | Cost-effectiveness, physician discretion | Competition from existing drugs for new indications | Heightened concern in cost-sensitive markets |

Entrants Threaten

Developing new biopharmaceutical drugs demands substantial and ongoing investment in research and development, with no certainty of a successful outcome. Ipsen's approach involves considerable R&D expenditures, often augmented by external innovation, highlighting the financial commitment required.

These exceptionally high costs serve as a significant deterrent, effectively discouraging many potential new competitors from entering the market in the first place.

The biopharmaceutical sector presents a formidable barrier to new entrants due to exceptionally stringent regulatory approval processes. Companies must successfully navigate lengthy and complex clinical trials, a journey often spanning many years and costing hundreds of millions, if not billions, of dollars. For instance, bringing a new drug to market typically requires an investment of over $2.6 billion, according to some industry estimates.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards for safety and efficacy. Failure to meet these exacting requirements at any stage of development can result in significant financial losses and delays, effectively deterring less capitalized or less experienced new players from entering the market.

Intellectual property, particularly patents, acts as a significant barrier for new entrants in the biopharmaceutical sector. Ipsen, like its peers, invests heavily in research and development, protecting its discoveries with patents that grant market exclusivity, typically for 20 years from filing. For instance, the patent protection for Ipsen's key oncology drug, Cabometyx, is crucial for its revenue stream. New players must either innovate entirely new compounds, a costly and time-consuming process, or wait for existing patents to expire, which can be years away, significantly delaying their ability to compete and generate profits.

Need for Specialized Manufacturing and Distribution

The biopharmaceutical industry, particularly for complex products like those Ipsen specializes in, presents a significant hurdle for new entrants due to the immense need for specialized manufacturing and distribution capabilities. Building state-of-the-art facilities that meet stringent regulatory requirements and possess the necessary technical expertise is a capital-intensive endeavor. For instance, the development and validation of a single biopharmaceutical manufacturing line can cost tens of millions of dollars.

Furthermore, establishing a robust global distribution network for specialty care medicines is a complex and costly undertaking, requiring compliance with diverse international regulations and cold chain logistics. Ipsen's established presence in over 100 countries, with its existing infrastructure and market access, acts as a substantial barrier. New players would need to replicate this extensive network, demanding considerable financial investment and time, potentially years, to achieve comparable reach and efficiency.

- High Capital Investment: Specialized biopharmaceutical manufacturing facilities can cost upwards of $100 million to build and equip.

- Regulatory Compliance: Meeting Good Manufacturing Practices (GMP) across multiple jurisdictions is a significant barrier.

- Distribution Network Complexity: Establishing a global cold chain logistics network requires substantial investment and expertise.

- Ipsen's Global Footprint: Operating in over 100 countries provides Ipsen with significant competitive advantages in market access and distribution.

Brand Recognition and Physician Relationships

The threat of new entrants for Ipsen, particularly in specialized fields like oncology, neuroscience, and rare diseases, is tempered by the significant capital and time required to cultivate brand recognition and physician loyalty. Building trust with key opinion leaders and prescribers is paramount, a process that new companies would find challenging to replicate quickly. Ipsen's nearly a century of experience has fostered deep-seated relationships and a strong market presence.

New players face substantial hurdles in establishing credibility. They would need to allocate considerable resources to marketing, sales force development, and comprehensive medical education initiatives to compete effectively with established entities like Ipsen. For instance, the global pharmaceutical market saw R&D spending reach an estimated $240 billion in 2024, highlighting the immense investment needed to gain traction.

- Brand equity: Ipsen's long-standing presence has cultivated significant brand recognition, making it difficult for newcomers to gain immediate market acceptance.

- Physician relationships: Deeply entrenched relationships with prescribing physicians and key opinion leaders are a substantial barrier to entry, requiring years to build.

- Marketing and sales investment: New entrants must commit substantial financial resources to marketing, sales forces, and medical education to challenge established players.

The threat of new entrants in the biopharmaceutical sector, where Ipsen operates, is significantly mitigated by the immense capital investment required for research, development, and manufacturing. For example, bringing a new drug to market can cost upwards of $2.6 billion, a figure that deters many potential competitors. Furthermore, stringent regulatory hurdles, such as those imposed by the FDA and EMA, demand extensive clinical trials and compliance, adding years and substantial costs to market entry.

Intellectual property protection, particularly patents that can last for 20 years, grants established companies like Ipsen a crucial period of market exclusivity. Building specialized manufacturing facilities, which can cost tens of millions of dollars per line, and establishing global distribution networks with cold chain capabilities are also major barriers.

Moreover, cultivating brand recognition and deep physician relationships takes years and significant marketing investment, estimated at billions globally in R&D for 2024. These combined factors create a formidable entry barrier, limiting the threat of new players for companies with established infrastructure and market presence.

| Barrier Type | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| R&D and Clinical Trials | $2.6 billion+ per drug | Prohibitive for many |

| Regulatory Approval | Years, extensive documentation | High risk of failure, delays |

| Patent Exclusivity | Up to 20 years | Delays market entry for generics |

| Manufacturing Facilities | $100 million+ per facility | Requires massive capital outlay |

| Distribution Network | Significant investment, complex logistics | Challenging to replicate global reach |

| Brand & Physician Loyalty | Years of marketing and relationship building | Difficult to gain immediate market share |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ipsen is built upon a robust foundation of data, incorporating Ipsen's annual reports, investor presentations, and SEC filings. We also leverage industry-specific market research reports and analyses from reputable pharmaceutical and biotechnology consultancies.