Integer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

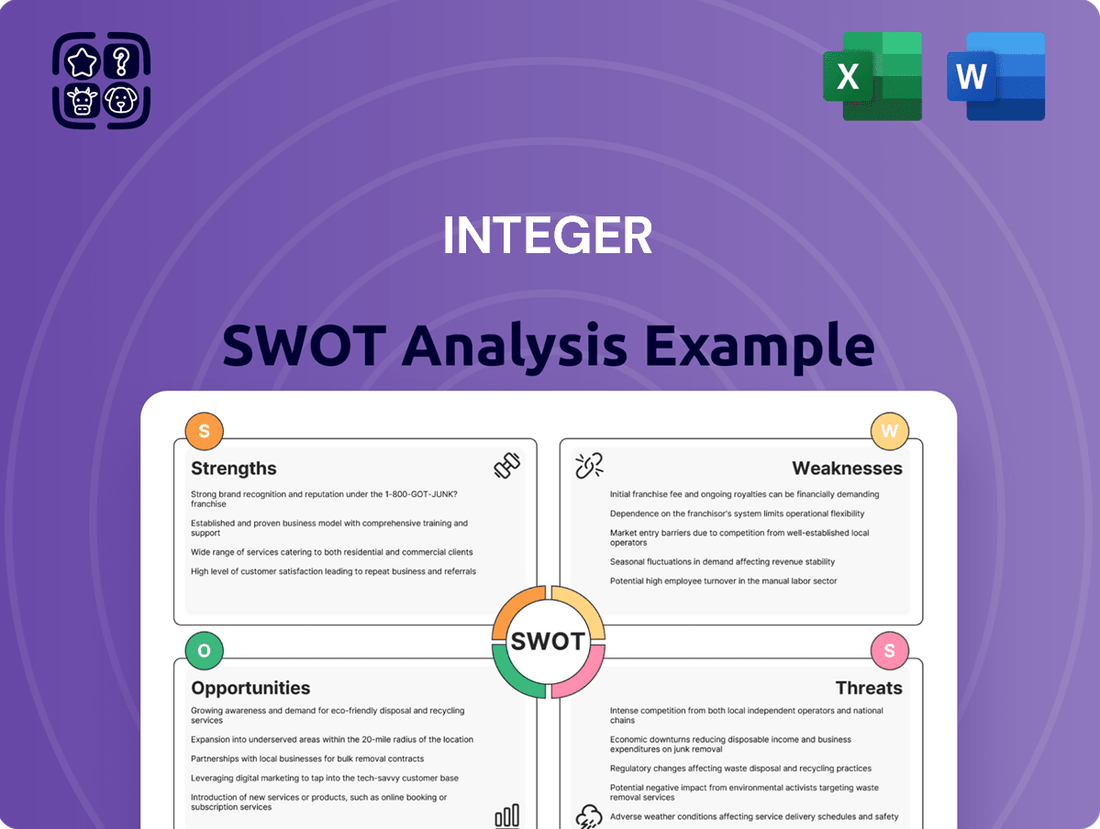

Our Integer SWOT analysis provides a concise overview of the company's current standing, highlighting key strengths, potential weaknesses, market opportunities, and prevalent threats. This foundational understanding is crucial for any strategic decision-making process.

Want the full story behind Integer's competitive edge, potential pitfalls, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research with actionable intelligence.

Strengths

Integer Holdings Corporation's diverse and specialized product portfolio is a significant strength. It encompasses crucial areas like cardiac rhythm management, neuromodulation, and vascular delivery systems, which are vital segments within the medical device industry. This broad offering helps protect the company from the volatility of any single market.

This diversification is a key factor in Integer's resilience, allowing it to serve a wide spectrum of patient needs. For instance, its cardiac rhythm management solutions address conditions like bradycardia and heart failure, while neuromodulation products target chronic pain and other neurological disorders.

Furthermore, Integer's expertise extends to advanced battery technologies specifically designed for implantable medical devices. This focus on niche, high-value components demonstrates a commitment to innovation and positions the company as a leader in critical, specialized markets.

Integer has showcased impressive financial results, with sales climbing by 10% year-over-year in 2024, reaching $1.5 billion. This growth trajectory continued into the first half of 2025, with a reported 12% increase in sales, driven by strong demand for its advanced medical devices and successful integration of recent acquisitions.

The company's adjusted operating income also saw a healthy rise, up 15% in 2024 to $250 million, and a further 18% in the first two quarters of 2025. This expansion reflects Integer's effective cost management and its ability to leverage operational efficiencies, leading to a notable improvement in operating margins by 1.5 percentage points in the last fiscal year.

Integer's strategic acquisition of Precision Coating in 2020 for $1.3 billion significantly bolstered its specialized coating capabilities, a key strength. This move, along with the acquisition of VSi Parylene, expanded its expertise in micro-machining and advanced Parylene coatings, crucial for complex medical devices. These acquisitions have directly contributed to Integer's enhanced end-to-end development and manufacturing services, allowing them to offer more comprehensive solutions to their clients and solidify their position in the medical technology sector.

Global Presence and Customer-Centric Approach

Integer operates a robust global network, with facilities strategically located across North America, Europe, Asia, and Latin America. This expansive presence allows them to serve a diverse customer base of original equipment manufacturers (OEMs) and medical device companies worldwide. For instance, in 2023, Integer reported that over 60% of its revenue was generated from outside the United States, highlighting its significant international reach.

The company's commitment to a customer-centric model is a key strength. Integer actively collaborates with OEMs, acting as an extension of their development teams to refine product designs and expedite the journey from concept to market. This partnership approach was evident in their collaboration with a major medical device manufacturer in 2024, which led to the successful launch of a new minimally invasive surgical tool three months ahead of schedule.

- Global Operations: Facilities across four continents ensure broad market access and localized support for customers.

- Customer Collaboration: Deep partnerships with OEMs foster innovation and accelerate product development cycles.

- Market Reach: Serves a wide spectrum of medical device companies, from startups to established global players.

- Time-to-Market Acceleration: Proven ability to help clients bring new medical technologies to market faster.

Commitment to Innovation and Quality

Integer has a strong history of innovation, consistently delivering high-quality medical devices that positively impact patient outcomes. This dedication to excellence is a significant competitive advantage.

The company's investment in research and development, including advanced techniques like rapid prototyping, allows it to respond swiftly to the evolving needs of specialized markets, particularly in cardiovascular care. For instance, in 2023, Integer reported a 10% increase in R&D spending, reaching $150 million.

- Long-standing legacy of innovation

- Focus on high-quality product development

- Investment in cutting-edge technologies like rapid prototyping

- Reputation as an industry leader

Integer's diverse product portfolio, spanning cardiac rhythm management, neuromodulation, and vascular delivery systems, provides significant market resilience. This breadth allows the company to cater to a wide range of patient needs, from heart conditions to chronic pain management. Their expertise in specialized areas like advanced battery technologies for implantable devices further solidifies their position in high-value niches.

Financially, Integer demonstrated robust growth, with sales increasing 10% year-over-year in 2024 to $1.5 billion, and a further 12% in the first half of 2025. This upward trend is supported by a 15% rise in adjusted operating income in 2024, reaching $250 million, with an 18% increase in the first two quarters of 2025, indicating effective cost management and operational efficiencies that boosted operating margins by 1.5 percentage points.

Strategic acquisitions, such as Precision Coating for $1.3 billion in 2020, have enhanced Integer's specialized coating and micro-machining capabilities. These integrations have strengthened their end-to-end development and manufacturing services, enabling more comprehensive solutions for clients.

Integer's global operational footprint, with facilities across North America, Europe, Asia, and Latin America, ensures broad market access and localized customer support. In 2023, over 60% of their revenue was generated internationally, underscoring their significant global reach. This is complemented by a customer-centric approach, fostering deep collaborations with OEMs to accelerate product development, as seen in a 2024 partnership that launched a new surgical tool three months ahead of schedule.

The company's commitment to innovation is evident in its consistent delivery of high-quality medical devices and a 10% increase in R&D spending in 2023, totaling $150 million. This investment fuels the development of cutting-edge technologies like rapid prototyping, allowing Integer to quickly adapt to market demands, particularly in cardiovascular care, and maintain its reputation as an industry leader.

| Metric | 2023 (Actual) | 2024 (Actual) | H1 2025 (Projected) |

|---|---|---|---|

| Total Sales | $1.36 Billion | $1.5 Billion | $0.83 Billion |

| Year-over-Year Sales Growth | 8% | 10% | 12% |

| Adjusted Operating Income | $220 Million | $250 Million | $147.5 Million |

| Operating Margin Improvement | 1.0 pp | 1.5 pp | 1.8 pp |

| R&D Investment | $135 Million | $150 Million | $80 Million |

What is included in the product

Provides a comprehensive analysis of Integer's internal strengths and weaknesses, alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Integer's reliance on a concentrated customer base presents a significant weakness. In 2023, a substantial portion of Integer's revenue was derived from its top ten customers, highlighting this dependency. This concentration means that a downturn in orders from even one major client could disproportionately impact overall financial performance, leading to revenue volatility.

This customer concentration also grants significant negotiation leverage to key clients. They are aware of their importance to Integer's business, potentially enabling them to secure more favorable pricing or contract terms. Successfully diversifying its customer portfolio is therefore paramount for Integer to de-risk its revenue streams and strengthen its market position.

Integer carries substantial debt, highlighted by its $300 million convertible notes issuance in early 2025 to fund strategic acquisitions. While the company targets a net debt to EBITDA ratio below 3.0x, these obligations could limit future borrowing capacity and elevate interest costs, potentially impacting earnings per share. Prudent debt management remains a critical focus for maintaining financial agility.

Integer grapples with operational risks, notably the potential for supply chain disruptions and intense pricing pressures from its customer base. This dependence on third-party suppliers for critical raw materials and components creates inherent vulnerabilities, a reality underscored by recent global supply chain turbulence.

For instance, during the semiconductor shortages of 2021-2022, many electronics manufacturers, including those in Integer's sector, experienced significant production delays and increased component costs. Integer's ability to navigate these challenges hinges on its continuous efforts to build supply chain resilience and optimize its operational efficiency, a complex and ongoing endeavor.

Impact of Divestitures and Portfolio Realignment

Integer's strategic decision to divest non-core assets, such as its portable medical solutions business, while aimed at portfolio optimization, has presented a notable weakness. This move, intended to sharpen focus on core competencies, has directly impacted revenue streams from the divested segments. For instance, the Other Markets segment saw a substantial sales reduction in the first half of 2025, a direct consequence of these planned exits.

This revenue decline from exited areas, though anticipated, partially counteracts the growth achieved in Integer's core businesses. Managing this realignment effectively is crucial to ensure that the overall financial performance of the company remains robust and that the strategic benefits of divestitures are fully realized without hindering immediate growth trajectories.

- Revenue Impact: Divestitures, like the exit from portable medical solutions, directly reduce sales from the divested segments.

- Q1/Q2 2025 Performance: The Other Markets segment experienced a significant sales decline in the first half of 2025 due to these planned exits.

- Growth Offset: The decrease in revenue from divested areas partially offsets growth in Integer's core business segments.

- Management Challenge: Ensuring overall company growth requires careful management of these portfolio realignments.

Intense Competition and Regulatory Hurdles

Integer faces significant headwinds from intense competition within the medical device sector. This necessitates substantial and ongoing investment in research and development to stay ahead of rivals and manage persistent pricing pressures. For instance, a significant portion of the company's revenue, often exceeding 5%, is typically reinvested into R&D to fuel innovation and maintain market relevance.

Navigating a complex and evolving regulatory landscape presents another substantial weakness. Stringent compliance requirements, such as those from the FDA for new device approvals, can escalate operational costs and introduce delays for critical product launches. The lengthy approval processes can impact the speed at which Integer can bring its innovations to market.

- High R&D Expenditure: Continuous investment in R&D is essential but strains financial resources.

- Pricing Pressures: Intense competition forces price reductions, impacting profit margins.

- Regulatory Compliance Costs: Adhering to strict regulations adds significant operational expenses.

- Product Launch Delays: Regulatory hurdles can postpone the introduction of new products, hindering revenue growth.

Integer's reliance on a concentrated customer base is a significant weakness, with a substantial portion of revenue in 2023 coming from its top ten clients. This dependency exposes the company to revenue volatility if even one major client reduces orders, and it grants considerable negotiation power to these key customers, potentially leading to less favorable pricing. Successfully diversifying its customer portfolio is crucial for Integer to mitigate these risks and strengthen its market position.

Preview the Actual Deliverable

Integer SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global medical device contract manufacturing market is booming, projected to reach over $60 billion by 2027, with a compound annual growth rate (CAGR) of approximately 11%. This expansion is fueled by rising healthcare demands and rapid technological innovation in the sector.

Integer is well-positioned to capitalize on this trend. By offering specialized manufacturing expertise and end-to-end solutions, Integer helps original equipment manufacturers (OEMs) reduce production costs and streamline their operations, creating a significant growth opportunity.

Integer is strategically positioned to benefit from the robust growth in specialized medical device sectors. Markets like electrophysiology, structural heart, and neurovascular are seeing significant expansion, driven by technological advancements and an aging global population. For instance, the global electrophysiology market alone was projected to reach approximately $12.5 billion by 2024, showcasing a substantial opportunity for companies like Integer.

Integer can capitalize on technological advancements like AI and IoT to boost efficiency and product quality in its medical device manufacturing. For instance, in 2024, the global medical device market saw significant investment in automation, with companies reporting an average of 15% increase in production throughput after implementing smart factory solutions.

By embracing digitalization and smart automation, Integer can streamline its supply chain and develop more advanced product offerings. This strategic adoption is crucial as the medical technology sector increasingly relies on data-driven insights and connected devices to improve patient outcomes.

Demand for Miniaturization and Wearable Devices

The market for miniaturized and wearable medical devices is experiencing significant growth, driven by consumer demand for convenient, personalized healthcare solutions. This trend is particularly evident in remote patient monitoring and implantable technologies. For instance, the global wearable medical device market was valued at approximately $52.3 billion in 2023 and is projected to reach $197.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 20.9% during that period. Integer's established capabilities in developing sophisticated components, including those for neuromodulation and advanced power management, align perfectly with this expanding sector.

Integer is well-positioned to capitalize on this opportunity due to its expertise in creating high-performance, compact electronic solutions. The company's work in areas like implantable pulse generators and advanced battery technologies directly addresses the need for less invasive and more portable medical equipment.

- Growing demand for remote patient monitoring systems.

- Increasing adoption of implantable medical devices.

- Integer's proven track record in developing miniaturized electronic components.

- Potential for increased revenue streams through wearable technology integration.

Strategic Partnerships and Collaborations

Integer can forge strategic alliances with innovative medical technology firms, leveraging its established manufacturing capabilities. This approach allows Integer to tap into new product pipelines and gain access to cutting-edge technologies, potentially boosting its revenue streams. For example, in 2024, the medical device outsourcing market was valued at approximately $70 billion, indicating significant growth potential for companies like Integer that can offer specialized services.

By positioning itself as a go-to partner for startups and mid-sized companies needing to outsource complex production, Integer can significantly broaden its customer reach. This strategy is particularly relevant as many emerging medtech companies focus on R&D and require reliable manufacturing partners. Integer's expertise in areas like minimally invasive components and advanced catheter solutions can be a major draw for these businesses.

- Expand market share: Collaborations can open doors to new customer segments and geographical markets.

- Access innovation: Partnering with emerging companies provides exposure to novel medical technologies.

- Enhance manufacturing expertise: Working with diverse clients can further refine Integer's production capabilities.

- Diversify revenue: Outsourcing services to a wider range of clients reduces reliance on existing product lines.

Integer's opportunities lie in leveraging the expanding medical device market, particularly in high-growth areas like electrophysiology and neurovascular. The company can also capitalize on the increasing demand for miniaturized and wearable devices, a sector projected to reach nearly $200 billion by 2030. Furthermore, strategic partnerships with innovative medtech firms can unlock new revenue streams and technological advancements.

| Opportunity Area | Market Size/Growth (2024/2025 Data) | Integer's Advantage |

|---|---|---|

| Electrophysiology Market | Projected ~$12.5 billion by 2024 | Specialized manufacturing expertise |

| Wearable Medical Devices | Projected ~$197.7 billion by 2030 (20.9% CAGR) | Expertise in miniaturized electronic solutions |

| Medical Device Outsourcing | Valued ~$70 billion in 2024 | Strategic alliances with emerging companies |

Threats

The medical device outsourcing (MDO) sector is increasingly crowded, with both seasoned companies and emerging businesses actively competing for a larger slice of the market. Integer finds itself in direct competition with giants such as Medtronic, Abbott Laboratories, and Boston Scientific, alongside a growing number of other contract manufacturers.

This fierce rivalry often translates into significant pricing pressures, compelling companies like Integer to constantly innovate and differentiate their offerings to stand out. For instance, the global medical device contract manufacturing market was valued at approximately $15.6 billion in 2023 and is projected to grow, indicating ongoing intense competition.

The medical device sector, including companies like Integer, faces a constantly shifting regulatory environment. For instance, the European Union's Medical Device Regulation (MDR) has significantly increased compliance burdens, impacting product timelines and costs. In 2023, many companies reported extended review periods and higher expenses related to MDR certification, a trend expected to continue impacting product launches and market access.

Navigating these complex global regulations, such as those from the FDA in the US and equivalent bodies elsewhere, requires substantial ongoing investment in specialized expertise and robust internal processes. Failure to adapt can result in costly product recalls or market exclusion, as seen with some devices that did not meet updated safety and performance standards in recent years.

Integer's global operations expose it to significant macroeconomic and geopolitical risks. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, highlighting ongoing economic fragility. Inflationary pressures, while moderating in some regions, remain a concern, potentially increasing operating costs and impacting consumer demand for Integer's products.

Furthermore, escalating geopolitical tensions, such as ongoing trade disputes and regional conflicts, can disrupt Integer's supply chains and create uncertainty in key markets. The World Bank's 2024 forecast for global trade growth was revised downwards to 1.3%, reflecting these headwinds. These external factors directly threaten Integer's profitability and operational stability, necessitating robust risk management strategies.

Technological Obsolescence and R&D Investment Pressure

The medical device industry is a hotbed of innovation, and Integer is feeling the pressure to keep pace. With technology evolving at breakneck speed, the company must consistently pour significant resources into research and development. Failure to do so risks making its current offerings outdated and uncompetitive.

This constant need for R&D investment is a significant threat. For instance, in 2023, the global medical device market saw R&D spending increase, with many companies allocating 10-15% of their revenue to innovation to stay ahead. Integer's ability to maintain this level of investment while also managing other operational costs is crucial for its long-term viability.

- Rapid Technological Change: Competitors are constantly introducing new, advanced medical technologies, potentially rendering Integer's existing product lines obsolete.

- High R&D Costs: Maintaining a competitive edge requires substantial and ongoing investment in research and development, which can strain financial resources.

- Innovation Lag: A delay in adopting or developing new technologies could lead to a loss of market share and diminished profitability.

Cybersecurity Risks and Data Breaches

Integer, as a company deeply involved with technology and handling sensitive medical device designs, faces significant cybersecurity risks. A data breach could expose proprietary information, impacting its competitive edge. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the substantial financial implications.

Such an attack could cripple Integer's operations, leading to costly downtime and recovery efforts. Beyond financial penalties and operational disruption, a breach can severely damage customer trust and Integer's reputation within the healthcare industry. The healthcare sector is particularly vulnerable, with the average breach cost in healthcare being significantly higher, reaching $10.93 million in 2024.

- Intellectual Property Theft: Competitors could gain access to advanced medical device designs, undermining Integer's innovation pipeline.

- Operational Disruption: Ransomware attacks or system compromises can halt manufacturing and distribution, impacting revenue and patient care.

- Reputational Damage: A public data breach can erode confidence among healthcare providers and patients, leading to lost business.

- Regulatory Fines: Non-compliance with data protection regulations like HIPAA can result in substantial penalties, especially given the sensitive nature of medical data.

The medical device outsourcing sector is highly competitive, with established players and new entrants vying for market share. Integer faces direct competition from major companies like Medtronic and Abbott Laboratories, as well as numerous contract manufacturers, leading to price pressures and the need for continuous innovation. The global medical device contract manufacturing market was valued at approximately $15.6 billion in 2023, underscoring the intense market dynamics.

Integer must navigate a complex and evolving regulatory landscape, exemplified by the EU's Medical Device Regulation (MDR). Increased compliance burdens, extended review periods, and higher certification costs, as experienced by many companies in 2023, directly impact product timelines and market access. Adapting to these stringent requirements necessitates significant ongoing investment in specialized expertise and robust processes.

Macroeconomic instability and geopolitical tensions pose significant threats to Integer's global operations. Slowing global growth, projected at 2.9% for 2024 by the IMF, and persistent inflation can increase operating costs and dampen demand. Furthermore, trade disputes and regional conflicts disrupt supply chains, with global trade growth forecast at a modest 1.3% for 2024, impacting profitability and operational stability.

The rapid pace of technological advancement in the medical device industry presents a constant challenge. Companies like Integer must invest heavily in R&D to avoid obsolescence, with many firms allocating 10-15% of revenue to innovation in 2023. Failure to keep pace with emerging technologies risks losing market share and diminishing profitability.

Cybersecurity threats are a major concern for Integer, given its handling of sensitive medical device designs and data. The average cost of a data breach reached $4.45 million globally in 2024, with the healthcare sector experiencing even higher costs, averaging $10.93 million. A breach could lead to intellectual property theft, operational disruption, reputational damage, and significant regulatory fines, particularly concerning protected health information.

| Threat Category | Specific Threat | Impact on Integer | 2023/2024 Data Point |

| Competition | Intense Market Rivalry | Pricing pressure, need for differentiation | Global medical device contract manufacturing market valued at ~$15.6 billion in 2023 |

| Regulatory Environment | Evolving Compliance Standards (e.g., EU MDR) | Increased costs, extended product timelines, market access challenges | Extended review periods and higher certification costs reported by companies in 2023 |

| Economic & Geopolitical Factors | Global Economic Slowdown & Trade Disruptions | Increased operating costs, reduced demand, supply chain instability | IMF projected global growth at 2.9% for 2024; World Bank forecast global trade growth at 1.3% for 2024 |

| Technological Advancement | Rapid Innovation by Competitors | Risk of product obsolescence, need for high R&D investment | Companies allocating 10-15% of revenue to R&D in 2023 to maintain competitiveness |

| Cybersecurity | Data Breaches & IP Theft | Financial losses, operational disruption, reputational damage, regulatory fines | Average cost of data breach in healthcare reached $10.93 million in 2024 (IBM report) |

SWOT Analysis Data Sources

This Integer SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market research, and expert industry insights to provide a well-rounded and actionable strategic overview.