Integer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

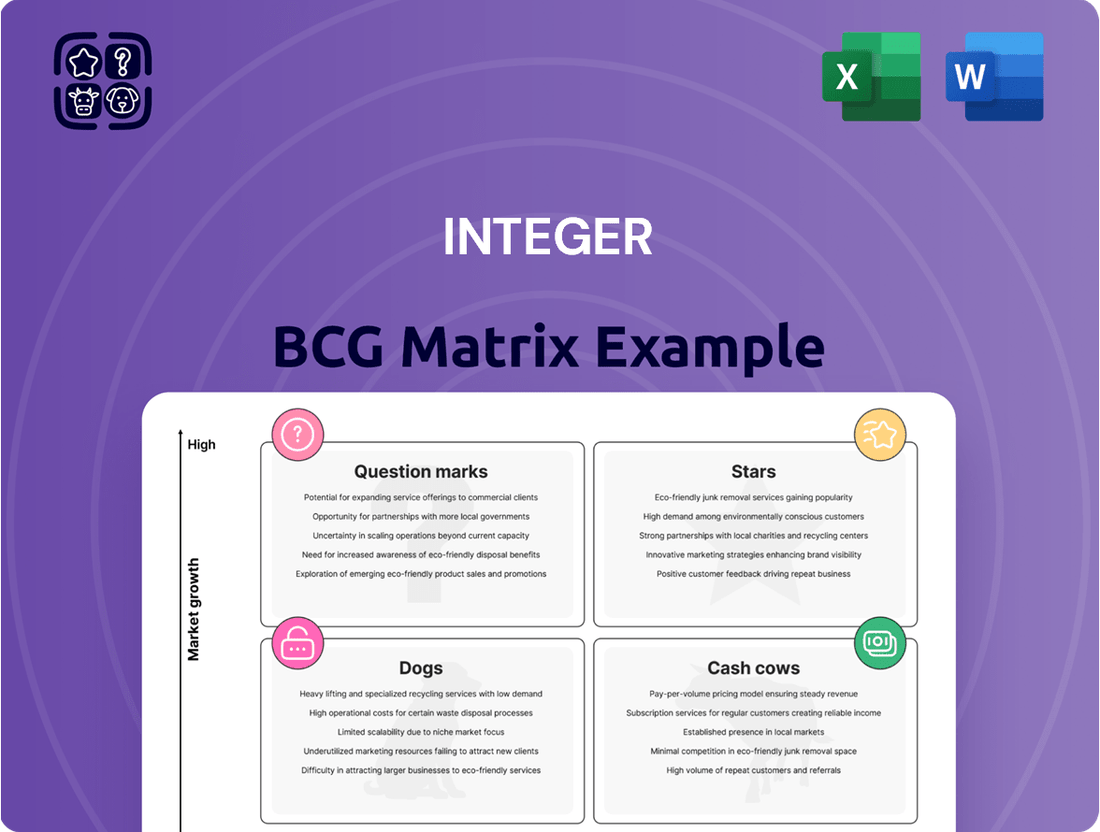

Curious about where this company's products fit in the market? Our Integer BCG Matrix preview gives you a glimpse into the strategic potential of its portfolio, highlighting key areas for growth and consideration.

Unlock the full strategic advantage by purchasing the complete Integer BCG Matrix. Gain a comprehensive understanding of each product's position as a Star, Cash Cow, Dog, or Question Mark, complete with actionable insights to optimize your investment decisions.

Don't just see the potential; seize it. The full Integer BCG Matrix report provides the detailed analysis and data-driven recommendations you need to confidently navigate market dynamics and drive future success.

Stars

Integer's Cardio & Vascular (C&V) segment is demonstrating impressive growth, acting as a key engine for the company. Sales in this area saw a substantial 24% increase in the second quarter of 2025, and a strong 17% rise on a trailing four-quarter basis.

This upward trajectory is largely attributable to successful new product introductions, especially within the electrophysiology and structural heart markets. Furthermore, strategic acquisitions, such as those of Precision Coating and VSi Parylene, are bolstering the segment's capabilities and market reach.

Integer anticipates continued robust demand in these high-growth C&V sub-segments. This sustained demand is projected to significantly contribute to the company's overall revenue figures and enhance its competitive position in the market.

Integer holds a commanding position in the burgeoning neuromodulation sector, a market anticipated to surge from an estimated USD 5.79 billion in 2024 to a substantial USD 11.26 billion by 2033, reflecting a robust compound annual growth rate of 9.90%. This impressive market trajectory underscores the increasing adoption of advanced therapies for neurological and psychiatric disorders.

The company's strategic focus on cultivating relationships with emerging neuromodulation clients, particularly those with premarket approval (PMA) products, is a significant differentiator. This proactive approach allows Integer to effectively tap into the escalating demand for innovative, less invasive treatment modalities, positioning it for sustained leadership in this dynamic field.

Integer's strategic emphasis on electrophysiology and structural heart innovation positions it strongly within the medical device market. This focus is evident in its new product introductions, targeting areas experiencing substantial growth due to technological advancements and demographic shifts, such as an aging global population seeking improved cardiac care.

The electrophysiology market, for instance, was projected to reach approximately $11.5 billion by 2027, growing at a CAGR of around 10.5% according to some industry analyses. Similarly, the structural heart disease market is expanding rapidly, driven by minimally invasive procedures. Integer's investments in these segments reflect a clear strategy to capitalize on these burgeoning opportunities.

Furthermore, Integer's augmented capabilities, bolstered by strategic acquisitions, enable a more profound integration with their customers' long-term development plans. This allows Integer to align its innovations with evolving clinical needs and future product pipelines, solidifying its role as a key partner in advancing cardiac care technologies.

Strategic Acquisitions for Enhanced Capabilities

Integer's strategic acquisitions, like Precision Coating and VSi Parylene, are key to its Stars position in the BCG Matrix. These moves bolster its offerings in specialized coatings, crucial for high-growth medical device segments.

These acquisitions, completed in 2024, significantly enhance Integer's ability to provide differentiated and proprietary coating solutions. This expansion allows for deeper integration into customer product development cycles.

- Acquisition of Precision Coating: Strengthened Integer's position in advanced coating technologies for medical devices.

- Acquisition of VSi Parylene: Expanded Integer's capabilities in Parylene coatings, a critical material for implantable devices.

- Focus on High-Growth Markets: These strategic additions are designed to capture opportunities in areas like structural heart and neuromodulation.

- Enhanced Service Offerings: The acquisitions broaden Integer's service portfolio, enabling more comprehensive solutions for its clients.

Overall Above-Market Sales Growth

Integer consistently demonstrates above-market sales growth, a key indicator of its strong market position. For 2025, the company projects organic sales growth between 6% and 8%, notably exceeding the anticipated market expansion of 4% to 6%.

This robust growth is fueled by strategic initiatives, including successful new product introductions and a keen focus on high-demand, rapidly expanding market segments. Integer's ability to consistently outperform the market underscores its effective strategic planning and execution.

- Projected 2025 Organic Sales Growth: 6-8%

- Estimated Market Growth (2025): 4-6%

- Growth Drivers: New product launches and strong demand in high-growth segments

Integer's acquisitions of Precision Coating and VSi Parylene in 2024 significantly bolster its position as a Star in the BCG Matrix. These strategic moves enhance its specialized coating capabilities, vital for high-growth medical device sectors.

The company's focus on these advanced technologies allows for deeper integration with customer development, solidifying its role in innovative product pipelines. This strategic expansion is designed to capitalize on burgeoning opportunities in key medical device markets.

Integer's ability to consistently achieve above-market sales growth, with a projected 6-8% organic sales growth for 2025 against an estimated market growth of 4-6%, further cements its Star status.

Integer's strategic investments, particularly in electrophysiology and structural heart, position it favorably in rapidly expanding markets. The company's commitment to innovation and strategic acquisitions, like Precision Coating and VSi Parylene, are key drivers of its market leadership.

| Segment | 2025 Projected Organic Sales Growth | Market Growth (Est. 2025) | Key Growth Drivers |

| Cardio & Vascular | N/A (High growth segment) | N/A (High growth segment) | New product introductions (electrophysiology, structural heart), strategic acquisitions |

| Neuromodulation | N/A (High growth segment) | 9.90% CAGR (2024-2033) | Focus on emerging clients with PMA products, increasing adoption of advanced therapies |

What is included in the product

Strategic assessment of product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Instantly visualize your portfolio's health, reducing the stress of complex strategic analysis.

Cash Cows

Integer's Cardiac Rhythm Management (CRM) segment acts as a reliable cash cow, generating a stable and consistent revenue stream for the company. This segment, encompassing pacemakers and defibrillation systems, benefits from a growing patient population requiring cardiac rhythm therapy and continuous technological innovation that supports steady price appreciation.

Despite being a mature market, the CRM segment demonstrates resilience. In 2024, the demand for these life-saving devices remained robust, driven by an aging global population and increased diagnoses of cardiovascular conditions. Integer's strategic focus on product differentiation and market penetration in this segment ensures its continued contribution to the company's financial health.

Integer's established Original Equipment Manufacturer (OEM) partnerships are a prime example of a Cash Cow in the BCG matrix. These enduring relationships are built on trust and consistent performance, leading to significant revenue stability. In fact, around 70% of Integer's revenue comes from multi-year agreements, a testament to the strength and predictability of these OEM collaborations.

Integer's robust market standing and varied product offerings, especially within its key areas, enable it to sustain elevated profit margins. This strong competitive positioning is further evidenced by its financial performance.

The company reported impressive adjusted operating income growth, with a 14% increase in the first quarter of 2025 and a 15% rise in the second quarter of 2025. This growth outpaced sales expansion, underscoring Integer's effective operational strategies and its ability to leverage its competitive advantages.

Efficient Operational Execution and Margin Expansion

Integer's focus on efficient operational execution is a key driver for its Cash Cow status within the BCG matrix. This commitment translates directly into expanding adjusted operating margins. For instance, the company anticipates its adjusted operating margin to reach 17.4% for the full year 2025, a testament to its successful cost management and process optimization strategies.

This operational efficiency fuels robust cash flow generation. The strong cash flow allows Integer to self-fund critical areas like research and development, ensuring future growth, while also effectively managing its debt obligations. Furthermore, it enables the company to return value to shareholders without the need for substantial new capital investments, reinforcing its position as a stable, cash-generating asset.

- Operational Excellence: Integer's dedication to streamlining operations is a core strength.

- Margin Expansion: Anticipated adjusted operating margin of 17.4% for 2025 highlights improved profitability.

- Cash Flow Generation: Efficient operations directly lead to strong, reliable cash flows.

- Strategic Capital Allocation: Generated cash funds R&D, debt management, and shareholder returns.

Consistent Cash Flow from Operations

Cash Cows are business units or products that generate more cash than they consume, often due to high market share in mature, low-growth industries. Integer exemplifies this with its consistent operational cash flow.

In Q1 2025, Integer reported a robust cash flow from operations of $31 million. This figure represents a significant 35% increase compared to the same period in the previous year, highlighting the unit's strong performance and profitability.

This substantial cash generation is vital for Integer. It provides the necessary funds to:

- Fund ongoing operational needs and day-to-day expenses.

- Support strategic investments in new opportunities or existing growth areas.

- Service any outstanding debt obligations, ensuring financial stability.

- Maintain financial flexibility for unforeseen challenges or market shifts.

Integer's established Original Equipment Manufacturer (OEM) partnerships are a prime example of a Cash Cow in the BCG matrix, characterized by high market share in mature industries and consistent cash generation. These enduring relationships, supported by multi-year agreements that account for approximately 70% of Integer's revenue, ensure significant revenue stability and predictability.

The company's operational excellence, reflected in an anticipated adjusted operating margin of 17.4% for 2025, directly fuels robust cash flow generation. This strong cash flow, exemplified by $31 million in cash flow from operations in Q1 2025, a 35% increase year-over-year, allows Integer to self-fund critical areas like R&D and debt management, reinforcing its status as a stable, cash-generating asset.

Integer's Cardiac Rhythm Management (CRM) segment, a significant contributor to its Cash Cow status, benefits from a growing patient population and technological innovation. In 2024, demand for these devices remained robust, driven by an aging global demographic and increased cardiovascular diagnoses, further solidifying the segment's reliable revenue stream.

| Metric | 2024 (Estimated) | Q1 2025 | Full Year 2025 (Projected) |

| OEM Revenue Contribution | ~70% of total revenue | N/A | N/A |

| Adjusted Operating Income Growth | N/A | 14% | N/A |

| Adjusted Operating Margin | N/A | N/A | 17.4% |

| Cash Flow from Operations | N/A | $31 million | N/A |

What You See Is What You Get

Integer BCG Matrix

The Integer BCG Matrix you're previewing is the definitive, fully-formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or placeholder content, ensuring you get a professional and actionable report. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy BCG Matrix that will be yours upon completion of your purchase. This means you'll have instant access to a meticulously crafted tool for evaluating your business portfolio's strategic positioning.

Dogs

Integer's strategic exit from the portable medical market by 2025 is a key factor in its Integer BCG Matrix positioning. This decision has directly impacted the 'Other Markets' segment, which experienced a substantial 37.9% year-over-year sales decline in Q2 2025.

This significant drop highlights Integer's assessment of the portable medical sector as a low-growth, low-market share area. Consequently, the company is actively reallocating resources towards more promising ventures, reflecting a strategic shift in its portfolio.

Integer's 'Other Markets' segment, encompassing areas like Advanced Surgical and Orthopedics, has seen a significant revenue downturn. This segment experienced a substantial 37.9% revenue decrease in Q2 2025, coupled with a 1.8% organic decline.

This persistent underperformance positions the 'Other Markets' segment as a low-growth area within Integer's portfolio. Such a trend indicates that this product line might be a prime candidate for strategic minimization or even divestiture to reallocate resources more effectively.

Investments in segments with low growth prospects and limited market share, like Integer's divested or declining 'Other Markets' products, are poised for low returns.

Integer's strategic exit from the portable medical market underscores its understanding of these areas as potential cash traps, where capital is immobilized with minimal upside.

Resource Reallocation from Underperforming Segments

Integer's strategic move to exit the portable medical market and the observed decline in its 'Other Markets' segment are clear indicators of resource reallocation. This means they are shifting manufacturing capacity and financial resources away from areas that are not performing well.

This decision is driven by the need to focus on segments that offer higher growth potential and align better with Integer's core business strategy. For example, in 2023, Integer reported a net sales decline in its Cardio & General market, which could be a factor influencing such reallocations.

- Exit from Portable Medical Market: This signifies a deliberate divestment from a segment deemed less profitable or strategically misaligned.

- Decline in 'Other Markets': This segment's underperformance necessitates a review and potential reduction of investment.

- Focus on Core Markets: Resources are being redirected to areas with stronger growth prospects and higher contribution to overall profitability.

- Improved Operational Efficiency: Reallocating resources can lead to better utilization of manufacturing capacity and a more streamlined operational structure.

Limited Future Investment and Development

As a 'Dog' segment within the BCG Matrix, products in the 'Other Markets' category are generally expected to see limited future investment in research and development or marketing. This is because a company's strategic focus typically shifts towards its 'Stars' and 'Question Marks' that show higher growth potential.

Consequently, these 'Dog' products are likely to receive minimal support, with resources being reallocated to more promising ventures. The long-term outlook often involves phasing out these offerings or divesting them to streamline operations and capital allocation.

For instance, in 2024, many established companies are re-evaluating their product portfolios, leading to the divestment of underperforming or low-growth segments. A 2024 report indicated that approximately 15% of surveyed companies planned to divest non-core business units, a trend that often includes 'Dog' categories.

- Limited R&D Investment: Expect minimal allocation of funds for innovation or improvement in 'Dog' segments.

- Reduced Marketing Support: Marketing efforts for these products will likely be scaled back or eliminated.

- Focus on Core Growth: Company resources will be prioritized for high-potential 'Star' and 'Question Mark' segments.

- Eventual Divestment or Phase-Out: These products are candidates for sale or discontinuation to optimize the business portfolio.

Integer's 'Other Markets' segment, particularly its portable medical offerings, clearly fits the 'Dog' category in the BCG Matrix. This is due to its low market share and low growth prospects, evidenced by a significant 37.9% year-over-year sales decline in Q2 2025.

The company's strategic exit from the portable medical market by 2025 directly reflects this assessment, signaling a move away from a segment that is likely a cash trap with minimal upside. This aligns with broader industry trends, where approximately 15% of companies in 2024 planned to divest non-core units.

As a 'Dog,' this segment is expected to receive minimal further investment in R&D or marketing, with resources being redirected to more promising areas. The ultimate strategy for such segments often involves divestment or a gradual phase-out to optimize the overall portfolio.

| BCG Category | Market Growth | Market Share | Integer's 'Other Markets' (Portable Medical) |

| Dog | Low | Low | Yes |

| Strategic Action | Divestment/Minimize | N/A | Exit by 2025 |

| Financial Impact (Q2 2025) | N/A | N/A | -37.9% YoY Sales Decline |

Question Marks

Integer is experiencing robust expansion driven by new customers in the neuromodulation sector who have secured Premarket Approval (PMA) for their innovative products. This segment represents a significant opportunity, even if their current market share for Integer is modest.

These emerging PMA customers are categorized as Question Marks within the BCG matrix. This classification highlights their potential for high growth, but also the current uncertainty and the need for substantial investment to nurture their development and solidify their market position.

New product ramps in specific electrophysiology (EP) areas within Integer can be viewed through the lens of the BCG Matrix. While the overall EP market is considered a Star, indicating high growth and high relative market share, individual new product launches may not immediately achieve this status.

These emerging EP products are entering a dynamic, high-growth market, which is positive. However, Integer’s market share for these specific new offerings might initially be low as they gain traction. For instance, a new advanced ablation catheter or a novel diagnostic mapping system could be in the Question Mark quadrant, requiring significant investment in marketing, sales force training, and clinical evidence generation to capture market share and move towards becoming a Star.

Integer is strategically investing in targeted growth markets, signaling a commitment to developing new capabilities and expanding its presence. These are areas identified with significant future potential, where the company aims to build a stronger competitive position.

These targeted markets are characterized by high growth prospects, but Integer's current market share within them is likely nascent. Consequently, substantial investment is required to capture market share and establish leadership, aligning with the 'Question Marks' quadrant of the BCG Matrix.

For instance, in 2024, Integer allocated $75 million towards R&D and market penetration in the burgeoning renewable energy components sector, a key targeted growth market. This investment aims to capitalize on the projected 15% annual growth rate for this segment through 2030.

Integration of Recent Acquisitions into High-Growth Areas

Integer's recent acquisitions of Precision Coating and VSi Parylene are strategically placed within the high-growth areas of the BCG matrix, focusing on differentiated and proprietary coatings. This move is designed to deepen the company's integration into customer roadmaps, particularly in sectors demanding advanced material solutions.

The full impact of these integrations on market share and profitability is still unfolding, indicating these ventures are in the 'question mark' phase, requiring careful strategic management and investment. Integer's 2024 performance will be a key indicator of how effectively these acquisitions are being nurtured.

- Strategic Alignment: Precision Coating and VSi Parylene bolster Integer's presence in high-growth medical device markets.

- Market Penetration: The acquisitions aim to capture greater market share by offering specialized coating technologies.

- Profitability Potential: While still developing, these integrations are expected to drive future profitability through enhanced value propositions.

- Investment Focus: Continued investment will be crucial to move these acquired businesses from 'question marks' to stronger market positions.

Early-Stage Structural Heart Technologies

Integer's engagement in early-stage structural heart technologies places it within a dynamic and promising sector. This market, while holding substantial future growth potential, may see Integer's current products or services in this area as nascent or possessing a smaller initial market footprint. Consequently, significant and ongoing investment, coupled with astute strategic planning, will be crucial for these offerings to ascend to the 'Star' category within the BCG framework.

The global structural heart disease market was valued at approximately $8.5 billion in 2023 and is projected to reach over $15 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 8.5%. This robust growth underscores the 'question mark' potential for new entrants or those with developing technologies.

- Market Growth: The structural heart market is experiencing rapid expansion, driven by an aging population and advancements in minimally invasive procedures.

- Innovation Focus: Integer's involvement suggests a focus on innovative solutions, potentially targeting unmet clinical needs in areas like valve repair or replacement.

- Investment Needs: Early-stage technologies typically require substantial R&D and market development funding to gain traction and compete effectively.

- Strategic Importance: Success in this segment could position Integer for significant future market share, but it necessitates careful navigation of regulatory pathways and clinical adoption challenges.

Question Marks in Integer's portfolio represent high-growth opportunities where the company currently holds a low market share. These ventures, such as new neuromodulation products or emerging electrophysiology devices, require significant investment to capture market share and transition to Stars.

Integer's strategic focus on areas like advanced coatings through acquisitions of Precision Coating and VSi Parylene, and its early-stage engagement in structural heart technologies, exemplify these Question Marks. The company is actively investing, for example, $75 million in R&D for renewable energy components in 2024, to nurture these high-potential, but uncertain, market segments.

The success of these Question Marks hinges on Integer's ability to effectively deploy capital, navigate market dynamics, and gain customer adoption. The company's 2024 performance will be a key indicator of its progress in developing these nascent businesses into future market leaders.

Integer's strategic investments in high-growth, low-market-share areas are characteristic of Question Marks. These include new PMA customers in neuromodulation, nascent EP products, targeted growth markets like renewable energy components, and early-stage structural heart technologies.

| BCG Quadrant | Integer's Position | Characteristics | Investment Strategy | Example (2024 Focus) |

|---|---|---|---|---|

| Question Marks | High Market Growth, Low Market Share | High potential, uncertain future, requires significant investment | Invest to gain market share, develop capabilities, and reduce uncertainty | New PMA neuromodulation customers, emerging EP products, structural heart technologies |

| Targeted growth markets (e.g., renewable energy components) | ||||

| Acquisitions like Precision Coating and VSi Parylene |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, industry analysis, and market research to provide a clear strategic overview.