Integer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

Unlock the strategic landscape surrounding Integer with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its future. Equip yourself with the foresight needed to navigate these external forces and make informed decisions. Download the full analysis now for actionable intelligence.

Political factors

Shifts in government healthcare policies, both domestically and internationally, present a significant variable for Integer. For instance, the U.S. Medicare Physician Fee Schedule for 2024 saw adjustments that could impact reimbursement for certain procedures utilizing advanced medical technologies, a key market for Integer. These policy changes directly influence market access and the economic viability of Integer's product portfolio.

The regulatory environment significantly shapes Integer's market access and product development. Changes in the FDA's approval processes, such as the introduction of expedited pathways for innovative medical devices, can accelerate time-to-market. For instance, the FDA's Digital Health Center of Excellence actively works to streamline reviews for software as a medical device, a key area for companies like Integer.

Increased scrutiny on product safety and efficacy, driven by political will, can lead to more rigorous testing requirements and longer approval timelines. In 2024, the FDA continued to emphasize post-market surveillance, requiring companies to demonstrate ongoing product performance and safety, impacting the long-term compliance costs for medical technology firms.

Integer's global operations are significantly influenced by international trade policies and tariffs. For instance, the United States' imposition of tariffs on goods from China, which began in 2018 and continued through 2024, directly impacts the cost of components and finished products. The ongoing negotiations and potential adjustments to these tariffs, alongside evolving trade agreements like the USMCA, create uncertainty for Integer's supply chain and manufacturing cost structures, especially if key suppliers or markets are involved.

Government Funding for Medical Research and Development

Government funding significantly fuels the medical research and development landscape, directly impacting companies like Integer that supply essential components. Increased investment translates into greater demand for novel medical technologies and advanced manufacturing, benefiting Integer's core business. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion in fiscal year 2023 for medical research, much of which supports innovation that could require specialized components. This robust funding environment fosters a dynamic market for cutting-edge medical devices, potentially driving Integer's growth and supporting its internal research endeavors.

Public-private partnerships are also a critical component of this funding ecosystem. These collaborations often accelerate the translation of research findings into tangible products. In 2024, the European Union's Horizon Europe program continued to invest heavily in health research, with a significant portion dedicated to medical innovation and technology development. Such initiatives create opportunities for Integer to engage with leading research institutions and companies, potentially leading to new product development and market penetration.

- Government investment in medical R&D stimulates demand for advanced components.

- U.S. NIH funding reached approximately $47.4 billion in FY2023.

- Public-private partnerships accelerate the adoption of new medical technologies.

- EU's Horizon Europe program prioritizes health research and innovation.

Political Stability and Healthcare System Structure

Political stability is crucial for Integer, as instability in key markets can disrupt supply chains and affect demand for medical devices. For instance, geopolitical tensions in regions where Integer operates could lead to trade restrictions or increased operational costs. The structure of national healthcare systems, whether predominantly public or private, directly influences Integer's sales channels and reimbursement policies.

In 2024, global political stability remains a mixed bag. While some developed nations offer predictable regulatory environments, emerging markets often present greater volatility. Integer's reliance on government healthcare budgets means policy shifts can have a rapid impact.

Key considerations for Integer regarding political factors include:

- Impact of Elections: Upcoming elections in major markets could lead to changes in healthcare spending priorities and regulatory frameworks affecting medical device approvals and pricing.

- Healthcare Reform: Proposed or enacted healthcare reforms in countries like the United States or Germany can significantly alter how Integer's products are purchased and reimbursed.

- Trade Relations: Evolving trade agreements and tariffs between countries where Integer manufactures and sells its products can influence cost of goods sold and market access.

- Regulatory Environment: Changes in medical device regulations, such as those from the FDA in the US or the EMA in Europe, directly impact Integer's product development and market entry strategies.

Government policies directly shape Integer's operational landscape, influencing everything from R&D funding to market access. Shifts in healthcare spending, regulatory approvals, and trade agreements create both opportunities and challenges. For example, the U.S. Medicare Physician Fee Schedule adjustments for 2024 directly affect reimbursement for advanced medical technologies.

Regulatory bodies like the FDA are crucial; their processes, such as expedited pathways for innovative devices, can significantly speed up product launches. In 2024, the FDA's focus on digital health streamlined reviews for software as a medical device, a key area for Integer. Increased scrutiny on product safety also means more rigorous testing and longer compliance timelines, as seen with the FDA's emphasis on post-market surveillance in 2024.

International trade policies, including tariffs and trade agreements, directly impact Integer's supply chain costs and market access. The ongoing trade tensions and evolving agreements create a dynamic cost structure for components and finished products. Government investment in medical R&D, such as the U.S. NIH's approximately $47.4 billion allocation in FY2023, fuels demand for Integer's advanced components and fosters innovation.

Political stability is paramount, as instability in key markets can disrupt supply chains and demand. Upcoming elections in major markets in 2024-2025 could lead to significant shifts in healthcare spending priorities and regulatory frameworks, directly impacting Integer's sales and product strategies.

| Political Factor | Impact on Integer | Relevant 2024/2025 Data/Trend |

| Healthcare Policy Shifts | Affects reimbursement and market access for medical technologies. | U.S. Medicare Physician Fee Schedule adjustments in 2024. |

| Regulatory Environment | Influences product development timelines and market entry. | FDA's continued emphasis on digital health reviews and post-market surveillance (2024). |

| Trade Policies & Tariffs | Impacts supply chain costs and global market access. | Ongoing U.S.-China trade relations and USMCA negotiations (through 2024). |

| Government R&D Funding | Drives demand for advanced components and fosters innovation. | U.S. NIH funding at approx. $47.4 billion in FY2023; EU Horizon Europe program investing in health research (2024). |

| Political Stability & Elections | Affects operational continuity and demand in key markets. | Anticipated elections in major markets in 2024-2025 leading to potential policy changes. |

What is included in the product

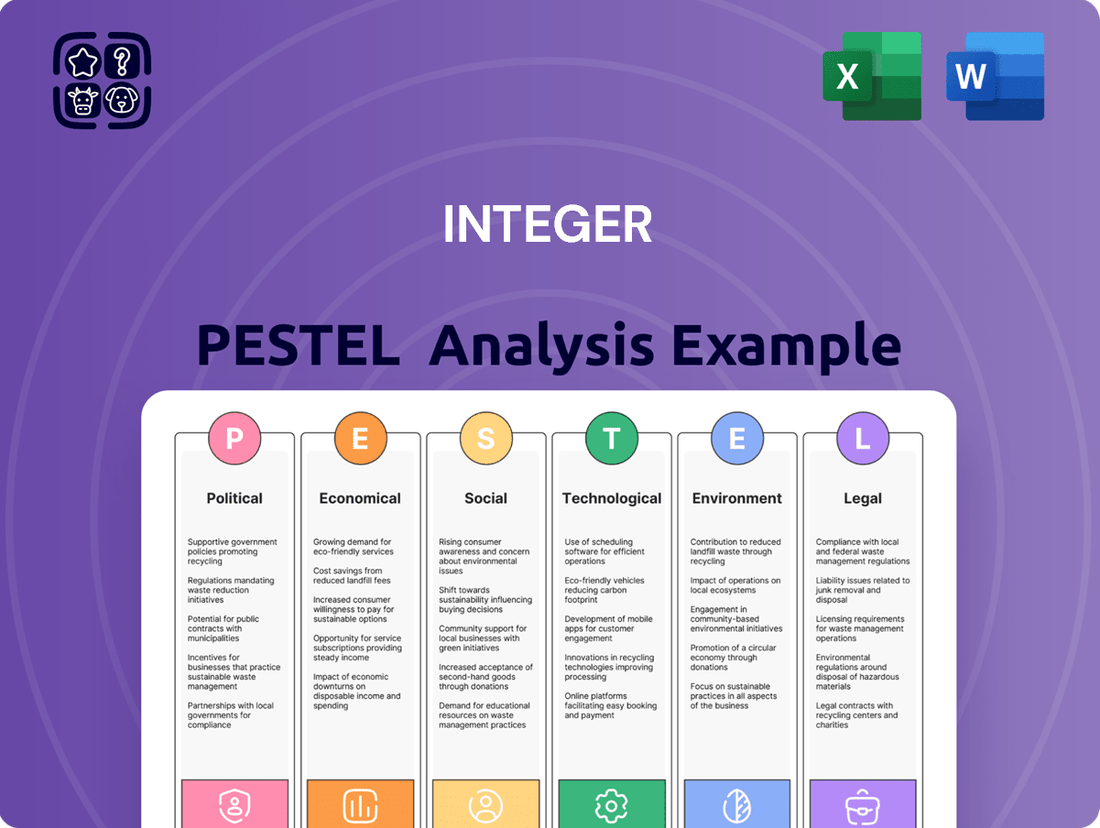

This Integer PESTLE Analysis meticulously examines how external macro-environmental factors influence the Integer across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the Integer's operating landscape.

Provides a structured framework to proactively identify and mitigate external threats, thereby reducing uncertainty and anxiety for strategic decision-makers.

Economic factors

Global economic growth significantly shapes healthcare spending, directly affecting demand for medical devices like those Integer produces. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally positive economic environment that supports increased healthcare investment. Economic downturns, however, can strain hospital budgets, potentially delaying capital expenditures on new equipment or elective procedures, impacting Integer's sales pipeline.

Conversely, periods of robust economic expansion often translate to higher disposable incomes and greater government revenue, allowing for increased spending on healthcare infrastructure and advanced medical technologies. This trend is crucial for companies like Integer, as economic upturns can fuel demand for innovative and higher-margin products. For example, in 2025, continued economic stability in developed markets is expected to drive a 4-5% annual growth in healthcare spending, providing a favorable backdrop for medical device manufacturers.

Inflation significantly impacts Integer's operational costs, as evidenced by the US Consumer Price Index (CPI) rising 3.4% year-over-year in April 2024. This increase directly affects raw material procurement and labor expenses, potentially squeezing profit margins on medical devices.

Rising interest rates, with the Federal Reserve maintaining its benchmark rate between 5.25% and 5.50% as of May 2024, could increase Integer's borrowing costs for crucial capital investments. This also poses a challenge for customer financing options, potentially dampening demand for their products.

These combined economic pressures on supply chain costs and affordability directly influence how Integer prices its medical devices, creating a delicate balance to maintain competitiveness while protecting profitability in a dynamic market.

Healthcare reimbursement policies, particularly those from Medicare and Medicaid, significantly shape the economic landscape for medical device manufacturers like Integer. In 2024, shifts in payment models, such as value-based care initiatives, continue to influence provider adoption of new technologies. For instance, Medicare's Outpatient Prospective Payment System (OPPS) updates directly impact reimbursement rates for procedures involving medical devices, affecting hospital budgets and their willingness to invest in advanced solutions.

Private payer dynamics also play a crucial role, with negotiations over coverage and pricing directly impacting Integer's revenue. As of early 2025, many private insurers are increasingly scrutinizing the cost-effectiveness of medical devices, demanding robust clinical and economic data to justify reimbursement. This trend can lead to longer sales cycles and pressure on pricing, directly influencing Integer's top-line performance and profitability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Integer's global operations. Changes in exchange rates directly affect the cost of imported materials and the revenue generated from international sales when converted back to Integer's reporting currency. For instance, a stronger US dollar could make Integer's products more expensive for international buyers, potentially reducing sales volume.

These fluctuations also influence the repatriation of profits earned in foreign subsidiaries. If a subsidiary operates in a country whose currency depreciates against the US dollar, the value of those profits decreases when brought back home. This volatility requires robust financial hedging strategies to mitigate potential losses and ensure stable financial reporting.

- Impact on Sales: A 5% appreciation of the Euro against the US dollar in late 2024 could increase the cost of Integer's products for European customers by 5%, potentially impacting demand.

- Procurement Costs: Conversely, if Integer sources components from Asia and the Chinese Yuan strengthens by 3% against the dollar, the cost of those components for Integer will rise.

- Profit Repatriation: If Integer's UK subsidiary generates £10 million in profit, and the GBP depreciates from $1.25 to $1.20 per pound, the repatriated profit in USD would fall from $12.5 million to $12 million.

- Competitive Landscape: Exchange rate movements can alter Integer's price competitiveness relative to international rivals whose home currencies may be more stable or depreciating.

Disposable Income and Patient Affordability

Disposable income directly impacts patient willingness and ability to pay for elective or non-essential medical procedures, which can indirectly affect demand for devices like those Integer produces. For instance, a rise in disposable income in 2024, projected by many economists to continue into 2025, could lead to increased patient-driven demand for advanced treatments.

Out-of-pocket healthcare costs, including deductibles and co-pays, also play a crucial role. If these costs remain high or increase, patients may delay or forgo treatments, even if covered by insurance. This trend was observed in late 2023 and early 2024, with some analyses suggesting a continued cautious spending approach by consumers on healthcare.

- Consumer Spending Trends: In 2024, personal consumption expenditures on healthcare services saw a moderate increase, driven by both inflation and demand for elective procedures.

- Medical Cost Inflation: While overall inflation showed signs of cooling in late 2024, healthcare services, particularly those involving advanced medical devices, continued to experience cost pressures.

- Insurance Coverage Gaps: A segment of the population still faces significant out-of-pocket expenses due to high deductibles or limited insurance coverage for newer medical technologies.

- Economic Outlook for 2025: Projections for 2025 generally anticipate continued, albeit potentially slower, growth in disposable income, which could support demand for medical treatments.

Economic factors significantly influence Integer's revenue streams and operational costs. Global GDP growth, projected at 3.2% for 2024 by the IMF, generally supports healthcare spending, though inflation, like the US CPI at 3.4% year-over-year in April 2024, increases procurement and labor expenses. Rising interest rates, with the Federal Reserve's rate at 5.25%-5.50% as of May 2024, can elevate borrowing costs for both Integer and its customers.

Healthcare reimbursement policies, including Medicare's OPPS and private payer negotiations, directly impact Integer's revenue. As of early 2025, insurers are increasingly focused on cost-effectiveness, potentially lengthening sales cycles and pressuring device pricing. Currency fluctuations also pose a risk; for example, a 5% Euro appreciation against the USD in late 2024 could make Integer's products 5% more expensive for European buyers.

Disposable income and out-of-pocket healthcare costs are also key drivers. While 2024 and 2025 projections suggest continued, albeit slower, growth in disposable income, high deductibles or limited coverage can still lead patients to delay treatments, impacting demand for advanced medical technologies.

| Economic Factor | 2024/2025 Data Point | Impact on Integer |

|---|---|---|

| Global GDP Growth (IMF Projection) | 3.2% (2024) | Supports healthcare spending and demand for medical devices. |

| US CPI (Year-over-Year) | 3.4% (April 2024) | Increases raw material and labor costs, potentially squeezing profit margins. |

| Federal Reserve Interest Rate | 5.25%-5.50% (May 2024) | Raises borrowing costs for capital investment and customer financing. |

| Euro vs. USD Exchange Rate | Potential 5% appreciation (late 2024) | Increases product cost for European customers, potentially reducing sales volume. |

| Disposable Income Growth | Projected continued growth (2025) | Could increase patient-driven demand for advanced treatments. |

Preview the Actual Deliverable

Integer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive Integer PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a detailed breakdown of political, economic, social, technological, legal, and environmental factors impacting integers.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and professionally structured Integer PESTLE Analysis.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, one in six people globally will be over 65. This demographic shift is coupled with a significant rise in chronic diseases, such as heart disease and diabetes, which are major drivers of healthcare spending and demand for medical technologies.

For companies like Integer, which manufacture medical devices, this trend translates into increased market opportunities. The growing prevalence of conditions like cardiovascular disease, which affects an estimated 697,000 people in the US alone in 2024, directly fuels demand for Integer's cardiac rhythm management devices.

Similarly, the increasing incidence of neurological disorders, impacting millions worldwide, boosts the market for neuromodulation technologies. This aging and increasingly health-conscious demographic is actively seeking solutions for better health management, presenting a substantial growth avenue for the medical device sector.

Public awareness of health and wellness is surging, with individuals increasingly seeking proactive approaches to their well-being. This heightened health consciousness, evident in rising participation in preventative screenings and wellness programs, directly impacts the healthcare sector.

Patients are no longer passive recipients of care; they are actively engaging in their health journeys, researching conditions, and seeking personalized treatment options. This empowerment trend, projected to continue growing through 2025, encourages earlier detection and a greater acceptance of innovative medical technologies.

For companies like Integer, this societal shift translates into a stronger demand for advanced medical devices and solutions. For instance, the global remote patient monitoring market, a key area for patient empowerment, was valued at approximately $29.2 billion in 2023 and is expected to see substantial growth in the coming years, driven by this very trend.

Societal shifts in lifestyle, such as increased sedentary behavior and processed food consumption, are directly linked to rising rates of chronic diseases like diabetes and cardiovascular conditions. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle factors, account for approximately 74% of all deaths globally. This trend necessitates that companies like Integer PESTLE analyze how these evolving health patterns create demand for new medical technologies and preventative health solutions.

Healthcare Access and Equity

Societal trends in healthcare access and equity directly impact the market for medical devices. Growing awareness of health disparities, particularly in underserved communities, is driving demand for more accessible and affordable healthcare solutions. For instance, in 2024, the U.S. Department of Health and Human Services continued to emphasize initiatives aimed at reducing health inequities, which could translate into increased adoption of remote monitoring devices and telehealth platforms developed by companies like Integer.

Technological advancements are also playing a crucial role in expanding healthcare reach. Innovations in portable diagnostic tools and minimally invasive surgical equipment are making advanced medical care available in more remote or resource-limited settings. By 2025, projections suggest a continued rise in the global telehealth market, estimated to reach over $270 billion, underscoring the opportunity for companies to leverage these trends by offering user-friendly and effective devices.

- Increased demand for remote patient monitoring solutions

- Focus on developing cost-effective medical technologies

- Expansion of telehealth services driving adoption of connected devices

- Government and non-profit initiatives addressing healthcare access gaps

Public Perception of Medical Technology and Trust

Public perception of medical technology significantly impacts the adoption of innovations like those from Integer. Concerns about safety, efficacy, and ethical implications, particularly with advanced devices such as neural implants or AI-driven diagnostics, can create barriers. For instance, a 2024 Pew Research Center survey found that while many Americans are optimistic about medical advancements, a substantial portion (around 40%) expressed concerns about data privacy and the potential for misuse of personal health information generated by new technologies.

Trust in the healthcare system and the entities developing new medical technologies is paramount. Positive media coverage, endorsements from reputable patient advocacy groups, and transparent communication about product development and testing are vital for building and maintaining this trust. Conversely, negative publicity surrounding adverse events or ethical breaches can erode public confidence, slowing market penetration. In 2025, regulatory bodies like the FDA are expected to continue scrutinizing novel medical devices, with a focus on real-world performance data, which will directly influence public perception and acceptance.

The societal acceptance of medical technology is a complex interplay of factors:

- Patient advocacy: Groups often champion new treatments but also raise concerns about accessibility and affordability, influencing public opinion.

- Media portrayal: News reports and even fictional depictions can shape understanding and create either enthusiasm or apprehension towards medical tech.

- Ethical debates: Discussions around gene editing, AI in healthcare, and data security are ongoing and directly affect trust levels.

- Real-world outcomes: Successful, widely publicized patient recovery stories can bolster confidence, while reports of failures can have the opposite effect.

The global population is aging, with the over-65 demographic expected to reach 1.5 billion by 2050, driving demand for healthcare solutions. This demographic shift, coupled with rising chronic disease rates, such as the 697,000 estimated US heart disease cases in 2024, directly benefits medical device manufacturers like Integer.

Increased health consciousness fuels proactive wellness and earlier adoption of medical technologies. Patients are more engaged, seeking personalized treatments and driving growth in areas like remote patient monitoring, a market valued at $29.2 billion in 2023.

Lifestyle factors, including sedentary behavior, contribute to a 74% global mortality rate from non-communicable diseases as of 2024, creating a sustained need for innovative medical interventions.

Societal demand for healthcare equity is pushing for more accessible and affordable medical devices, with initiatives in 2024 focusing on reducing health disparities.

Technological factors

The trend towards miniaturization in medical devices is a significant technological driver. Companies like Integer, a leader in medical device outsourcing, are actively investing in and utilizing these advancements. For instance, the development of micro-electromechanical systems (MEMS) allows for the creation of smaller, more sophisticated sensors and actuators crucial for next-generation cardiac rhythm management and neurostimulation devices. This miniaturization directly translates to less invasive procedures, potentially reducing patient recovery times and improving overall outcomes.

Integration of multiple functionalities into single devices is another key technological factor. This allows for more comprehensive patient monitoring and treatment within a single implantable or wearable unit. Consider the increasing complexity of neurostimulation systems, which now often incorporate advanced sensing capabilities alongside stimulation parameters. Integer's role in this space involves integrating these diverse technologies seamlessly, ensuring reliability and efficacy in their clients' product designs, which is critical for devices used in sensitive applications like vascular interventions.

Artificial intelligence and data analytics are revolutionizing healthcare, with AI-powered diagnostic tools demonstrating significant accuracy improvements. For instance, studies in 2024 highlighted AI algorithms achieving over 90% accuracy in detecting certain cancers from medical images, surpassing human radiologist performance in some cases.

Integer should strategically integrate AI and machine learning into its medical devices to boost diagnostic capabilities and personalize patient therapies. By leveraging predictive analytics, the company can anticipate patient needs and optimize treatment plans, a critical move as the global AI in healthcare market is projected to reach $188 billion by 2030, according to some projections.

Furthermore, applying AI to manufacturing processes can enhance precision and efficiency. In 2024, adoption of AI in manufacturing led to an average reduction in production defects by 15% and a 10% increase in throughput for early adopters in the medtech sector.

Innovations in materials science are significantly shaping the medical device industry. Breakthroughs in biocompatible polymers and advanced coatings are enabling the creation of implantable devices with enhanced safety profiles and extended functional lifespans. For instance, advancements in hydrogels and biodegradable polymers, reported in late 2024, are reducing the incidence of inflammatory responses and improving tissue integration for a variety of implants.

Integer's strategic advantage lies in its capacity to integrate these cutting-edge materials into its product development pipeline. By leveraging novel manufacturing techniques, such as 3D printing with advanced ceramics and bioresorbable materials, the company can produce highly customized and effective components. This capability is crucial for meeting the evolving demands of regulatory bodies and clinical practitioners, particularly in areas like cardiovascular and orthopedic implants where performance and patient outcomes are paramount.

Growth of Digital Health and Remote Monitoring Solutions

The digital health market is experiencing significant expansion, with remote patient monitoring (RPM) solutions at its forefront. Integer must assess how its medical devices can seamlessly integrate with these burgeoning digital health ecosystems. This integration allows for continuous patient data collection, supports telehealth services, and enhances ongoing patient management, thereby extending the utility of Integer's products beyond traditional healthcare facilities.

By 2024, the global digital health market was valued at over $280 billion, with RPM systems showing particularly strong growth. This trend is driven by increasing adoption of wearable technology and a growing demand for convenient, accessible healthcare. For Integer, this presents an opportunity to leverage connected devices for remote data capture, potentially improving patient outcomes and operational efficiency within healthcare systems.

- Market Growth: The digital health sector is projected to reach over $600 billion by 2028, indicating substantial room for innovation in connected medical devices.

- RPM Adoption: Remote patient monitoring is becoming a cornerstone of chronic disease management, with a significant percentage of healthcare providers implementing or planning to implement RPM programs.

- Interoperability Needs: For Integer's devices to thrive, ensuring compatibility with various digital health platforms and electronic health records (EHRs) is crucial for data flow and analysis.

- Data Security: As more health data is collected remotely, robust cybersecurity measures for connected devices will be paramount to maintain patient trust and regulatory compliance.

Additive Manufacturing (3D Printing) in Medical Devices

Additive manufacturing, commonly known as 3D printing, is revolutionizing the medical device industry by enabling the creation of highly customized and complex components. This technology allows for rapid prototyping and on-demand production, significantly shortening development timelines and reducing costs for specialized devices. For Integer, embracing 3D printing means the potential to deliver personalized implants, prosthetics, and surgical guides tailored to individual patient anatomies, improving outcomes and patient satisfaction. The global 3D printing medical devices market was valued at approximately $2.7 billion in 2023 and is projected to reach over $9 billion by 2030, demonstrating substantial growth driven by innovation in materials and applications.

The ability to iterate designs quickly and produce intricate geometries that were previously impossible with traditional manufacturing methods is a key benefit. This is particularly impactful for devices requiring precise fits or unique functional characteristics. For instance, 3D printed orthopedic implants can be designed with porous structures that promote bone integration, leading to better healing and longevity. The efficiency gains extend to supply chain management, as localized, on-demand printing can reduce the need for large inventories and minimize waste.

- Customization Potential: 3D printing allows for patient-specific designs, enhancing the efficacy and fit of medical devices.

- Faster Iteration: Rapid prototyping accelerates the design and testing phases, bringing new devices to market more quickly.

- Cost-Effectiveness: For low-volume, high-complexity devices, 3D printing can offer significant cost savings compared to traditional manufacturing.

- Market Growth: The medical 3D printing sector is experiencing robust expansion, indicating strong adoption and future opportunities.

Technological advancements continue to drive innovation in medical devices, pushing for smaller, more integrated, and intelligent solutions. Miniaturization, enabled by technologies like MEMS, allows for less invasive procedures and improved patient outcomes, a trend Integer is actively leveraging. The integration of AI and data analytics is also transforming healthcare, with AI-powered diagnostics showing remarkable accuracy, and the global AI in healthcare market projected to reach substantial figures by 2030.

Furthermore, breakthroughs in materials science, such as biocompatible polymers and advanced coatings, are enhancing the safety and longevity of implantable devices, with new hydrogels and biodegradable polymers showing promise in reducing inflammatory responses as reported in late 2024. The digital health market, particularly remote patient monitoring, is experiencing significant expansion, with the global market valued at over $280 billion in 2024, creating opportunities for connected medical devices. Additive manufacturing, or 3D printing, is also a key technological factor, revolutionizing the industry with its ability to create customized and complex components, with the medical 3D printing market projected to exceed $9 billion by 2030.

Legal factors

The medical device industry operates under a rigorous legal umbrella, with the U.S. Food and Drug Administration (FDA) and the European Union's Medical Device Regulation (MDR) setting stringent global standards. Integer must meticulously adhere to these frameworks, which dictate everything from product design and manufacturing to post-market surveillance.

Navigating these complex approval pathways is critical; for example, the FDA's premarket approval (PMA) process for high-risk devices can take years and involve substantial investment. Failure to comply with quality system regulations, such as ISO 13485, can lead to product recalls, hefty fines, and significant damage to market access and reputation.

Integer faces significant legal risks stemming from product liability and patient safety laws. Any defects or malfunctions in their medical devices could lead to adverse patient outcomes, potentially resulting in costly lawsuits and damage to their reputation. For instance, in 2023, the medical device industry saw a notable increase in product liability claims, with settlements often reaching millions of dollars.

To mitigate this exposure, Integer must maintain stringent quality control measures, ensure complete traceability of components, and implement robust post-market surveillance systems. This vigilance is crucial for identifying and addressing potential issues proactively, thereby safeguarding patient well-being and minimizing legal liabilities. The company's commitment to these practices directly impacts its ability to retain patient trust and avoid substantial financial penalties.

Intellectual property rights are crucial for Integer's medical device innovations. Strong patent protection safeguards their unique designs and manufacturing techniques, preventing competitors from replicating their technology. This legal shield is vital for recouping substantial R&D expenditures and maintaining market exclusivity.

Data Privacy and Cybersecurity Regulations (HIPAA, GDPR)

Integer must navigate a complex web of data privacy and cybersecurity regulations, particularly concerning sensitive patient health information. Compliance with laws like HIPAA in the United States and GDPR in Europe is paramount. Failure to protect this data can lead to severe penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates robust data management practices and secure connected medical devices.

These regulations directly impact how Integer handles patient data, from collection to storage and transmission. Ensuring the cybersecurity of connected medical devices is crucial, as breaches can compromise patient safety and lead to significant legal liabilities. For instance, a 2023 report indicated that the healthcare sector experienced a 13% increase in data breaches compared to the previous year, highlighting the growing threat landscape.

- HIPAA fines: Violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses.

- GDPR impact: Companies handling EU resident data face stringent requirements for consent, data minimization, and breach notification.

- Cybersecurity threats: The increasing connectivity of medical devices creates new attack vectors, demanding proactive security measures.

- Reputational risk: Data breaches can severely damage customer trust and brand reputation, impacting future sales and partnerships.

Anti-Kickback and Anti-Bribery Laws

Anti-kickback and anti-bribery laws are critical for Integer, particularly within the healthcare sector. These regulations, like the U.S. Anti-Kickback Statute, prohibit offering or accepting improper financial incentives to influence referrals or purchasing decisions. For Integer, this means ensuring all sales, marketing, and distribution activities involving healthcare providers and Original Equipment Manufacturers (OEMs) strictly adhere to these legal frameworks.

Non-compliance can lead to severe penalties, including hefty fines and exclusion from federal healthcare programs. In 2023, the U.S. Department of Justice reported recovering billions of dollars through settlements and judgments related to healthcare fraud and abuse cases, underscoring the significant financial risks involved. Integer's commitment to ethical conduct and robust compliance programs is paramount to mitigating these risks and maintaining its reputation.

- Regulatory Scrutiny: Healthcare companies face intense scrutiny regarding their interactions with healthcare professionals and entities.

- Compliance Costs: Implementing and maintaining effective compliance programs requires substantial investment in training, audits, and legal counsel.

- Reputational Damage: Violations can severely damage a company's brand and trustworthiness within the market.

- Financial Penalties: Fines for kickback violations can reach millions, impacting profitability and cash flow.

Integer must meticulously adhere to evolving international and national regulations governing medical devices, including those from the FDA and EU MDR, to ensure market access and patient safety. Compliance with quality management systems like ISO 13485 is non-negotiable, as failures can trigger costly recalls and damage reputation. Furthermore, robust data privacy and cybersecurity measures are essential to protect sensitive patient information, with significant penalties like GDPR fines (up to 4% of global annual turnover) looming for breaches.

| Legal Area | Key Regulations/Risks | 2024/2025 Focus for Integer | Potential Impact of Non-Compliance |

|---|---|---|---|

| Product Approval & Safety | FDA PMA, EU MDR, ISO 13485 | Streamlining approval processes, rigorous quality control | Market delays, product recalls, significant fines |

| Data Privacy & Cybersecurity | HIPAA, GDPR | Fortifying data protection, securing connected devices | Hefty fines (e.g., GDPR up to €20M), reputational damage |

| Intellectual Property | Patent Law | Securing and defending patents for innovations | Loss of market exclusivity, R&D cost recovery issues |

| Healthcare Compliance | Anti-Kickback Statute | Ensuring ethical sales and marketing practices | Millions in DOJ settlements, exclusion from programs |

Environmental factors

Integer faces growing pressure to adopt sustainable manufacturing and supply chain practices. This includes minimizing energy consumption, reducing waste, and conserving resources throughout its operations. For instance, the global manufacturing sector's carbon emissions were estimated to be around 30% of total emissions in 2024, highlighting the imperative for companies like Integer to act.

Implementing eco-friendly initiatives can not only meet rising stakeholder expectations for environmental responsibility but also unlock cost efficiencies. Many companies are finding that reducing waste and optimizing energy use directly translates to lower operational expenses, with some reporting savings of 5-10% on energy bills through targeted efficiency programs in 2024.

Integer faces increasing scrutiny over waste management, particularly concerning the disposal of medical devices and manufacturing byproducts. Regulations are tightening globally, pushing companies towards designing for recyclability and implementing robust hazardous waste protocols. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, emphasizes extended producer responsibility and sustainable product design, impacting how companies like Integer must approach device lifecycles.

Climate change poses significant threats to Integer's global supply chain. Extreme weather events, like the increased frequency of hurricanes and droughts impacting agricultural yields, can disrupt the availability and cost of raw materials essential for Integer's semiconductor manufacturing. For instance, water scarcity, a growing concern in many semiconductor-producing regions, directly affects the water-intensive fabrication processes.

Integer must proactively assess and mitigate these environmental risks to ensure operational continuity. Disruptions to key suppliers due to floods or wildfires could lead to production delays, impacting their ability to meet customer demand. The company's reliance on global logistics also makes it vulnerable to port closures or transportation network failures caused by severe weather, potentially delaying product delivery and impacting revenue streams.

In 2024, the World Economic Forum's Global Risks Report highlighted extreme weather events as a top concern for businesses worldwide, underscoring the urgency for companies like Integer to build more resilient supply chains. Investing in diversified sourcing strategies and exploring alternative materials can help buffer against resource scarcity and price volatility driven by climate impacts.

Regulatory Pressure for Eco-Friendly Practices

Integer faces increasing regulatory pressure to adopt eco-friendly practices in its medical device manufacturing. For instance, the European Union's Medical Device Regulation (MDR) and upcoming eco-design requirements are pushing for reduced environmental impact throughout a product's lifecycle, from material sourcing to end-of-life disposal. Failure to comply could result in significant fines and restricted market access.

This evolving landscape necessitates proactive adaptation. Integer must invest in greener manufacturing processes, explore sustainable material alternatives, and implement robust waste reduction strategies. For example, the push towards circular economy principles in the healthcare sector, as highlighted by initiatives like the Ellen MacArthur Foundation's work, means companies like Integer need to design products for durability, repairability, and recyclability.

- Evolving Regulations: The EU's MDR and future eco-design directives are key drivers for environmental compliance in medical devices.

- Material Restrictions: Anticipate potential future restrictions on certain materials used in medical devices due to environmental concerns.

- Market Access: Compliance is crucial for maintaining access to key markets, with non-compliance posing a significant business risk.

- Reputation Enhancement: Demonstrating environmental responsibility can boost Integer's brand image and appeal to increasingly eco-conscious stakeholders.

Resource Scarcity and Material Sourcing

Resource scarcity presents a significant environmental and economic hurdle for medical device manufacturers like Integer. The increasing global demand for critical raw materials, such as rare earth elements essential for advanced imaging and diagnostic equipment, puts pressure on supply chains. For instance, the International Energy Agency highlighted in its 2024 report that demand for critical minerals used in clean energy technologies, which often overlap with medical device components, is projected to surge significantly in the coming years, potentially leading to price volatility and availability issues.

Integer must proactively address this by exploring diversified sourcing strategies to mitigate reliance on single geographic regions. This could involve developing partnerships with suppliers in politically stable areas or investing in materials science research to identify and integrate recycled content or viable alternative materials into their product lines. For example, advancements in bioplastics and biodegradable polymers offer promising avenues for reducing reliance on traditional petroleum-based plastics, aligning with sustainability goals and potentially lowering long-term material costs.

- Diversified Sourcing: Reducing dependence on single-source suppliers for critical metals like platinum, used in pacemakers and stents, by identifying multiple global suppliers.

- Recycled Content: Investigating the feasibility of incorporating a higher percentage of recycled medical-grade plastics in non-critical components, following strict regulatory approvals.

- Material Innovation: Researching and adopting alternative, more abundant materials for components currently reliant on scarce resources, such as exploring advanced ceramics for certain implantable devices.

- Supply Chain Transparency: Enhancing visibility into the origin and sustainability practices of raw material suppliers to ensure ethical sourcing and mitigate risks associated with resource depletion.

Integer must navigate an increasingly stringent environmental regulatory landscape, particularly concerning its medical device manufacturing. The European Union's Medical Device Regulation (MDR), with its emphasis on lifecycle assessment, and forthcoming eco-design directives are pushing for reduced environmental footprints. For example, the MDR requires detailed environmental impact assessments for new devices, a process that can add significant time and cost to product development.

These regulations directly impact Integer's product design and material selection. Companies face pressure to minimize waste, reduce energy consumption in manufacturing, and design for recyclability or biodegradability at the end of a product's life. The global push towards a circular economy, as championed by organizations like the Ellen MacArthur Foundation, means that medical device manufacturers are expected to take greater responsibility for their products' environmental impact, a trend expected to intensify through 2025.

Compliance is not merely a matter of avoiding penalties; it's becoming a prerequisite for market access and a driver of brand reputation. Failure to meet evolving environmental standards can lead to restricted market entry, significant fines, and damage to a company's public image, especially among environmentally conscious consumers and investors. For instance, in 2024, several consumer electronics companies faced public backlash and sales dips due to perceived poor environmental performance.

Integer's supply chain is also vulnerable to climate change impacts. Extreme weather events, such as droughts affecting water availability for semiconductor fabrication or floods disrupting logistics, pose direct operational risks. The World Economic Forum's 2024 Global Risks Report ranked extreme weather events as a top global risk, highlighting the potential for supply chain disruptions that could impact Integer's ability to source raw materials and deliver finished products.

PESTLE Analysis Data Sources

Our Integer PESTLE Analysis is meticulously constructed using a diverse array of data sources, including official government publications, reputable economic databases, and leading industry research firms. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing your business.