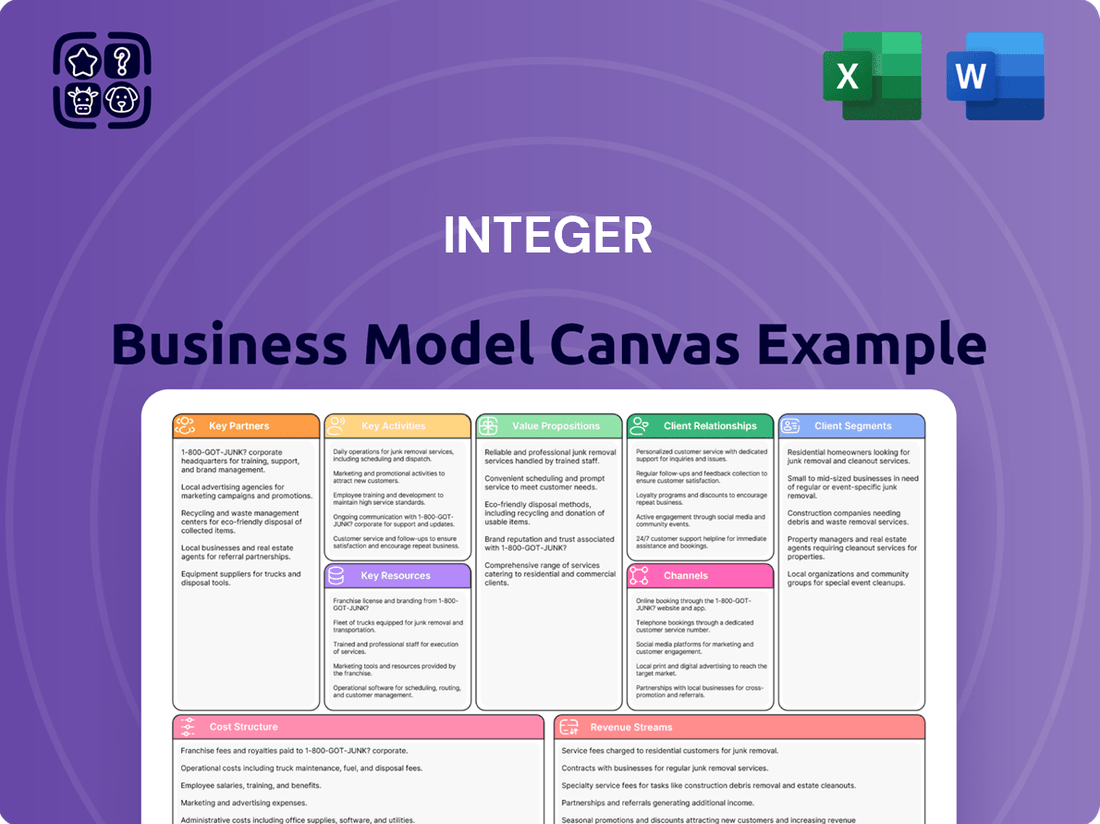

Integer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

Curious about Integer's proven strategy? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the complete, editable template to unlock actionable insights for your own venture.

Partnerships

Integer Holdings Corporation's relationships with Original Equipment Manufacturers (OEMs) are foundational to its business model as a leading medical device outsource manufacturer. These partnerships are not just transactional; they represent deep collaborations where Integer designs, develops, and manufactures critical medical devices and components. For instance, Integer's expertise in areas like advanced ablation technologies and implantable components directly supports major OEMs in bringing their innovative medical solutions to market.

Integer's technology and component suppliers are crucial partners, providing everything from specialized raw materials to sophisticated electronic components for their medical devices. These relationships are foundational to ensuring product quality and consistent availability, especially in the face of global supply chain volatility. For instance, in 2024, the medical device industry continued to navigate challenges related to semiconductor shortages and the rising cost of specialized polymers, making robust supplier partnerships even more critical for maintaining production schedules and competitive pricing.

Integer partners with research institutions and technology firms to co-develop groundbreaking medical device technologies. These collaborations are crucial for maintaining a leading edge in medical advancements, incorporating novel solutions, and broadening Integer's intellectual property. For instance, in 2024, Integer announced a significant R&D partnership with a leading university's biomedical engineering department focused on advanced biomaterials for implantable devices.

Acquired Companies for Capability Expansion

Integer strategically employs tuck-in acquisitions to bolster its product portfolio and technological prowess. This approach allows for the integration of specialized expertise and advanced manufacturing processes, directly enhancing their value proposition to customers.

Notable recent acquisitions include Precision Coating in February 2025, which brought specialized coating technologies, and Pulse Technologies in January 2024, adding critical precision micromachining capabilities. These moves underscore Integer's commitment to expanding its core competencies.

- Acquisition of Pulse Technologies (January 2024): Enhanced precision micromachining capabilities.

- Acquisition of Precision Coating (February 2025): Integrated specialized coating technologies.

- Strategic Goal: To expand product offerings and deepen technological expertise through targeted acquisitions.

Strategic Distribution Partners

Integer, while primarily operating as a Medical Device Outsourcing (MDO) company, recognizes the value of strategic distribution partners. These collaborations are crucial for efficiently delivering both components and fully assembled medical devices to Original Equipment Manufacturers (OEMs) worldwide. By leveraging these partnerships, Integer can streamline its logistics, access new international markets, and guarantee the punctual delivery of vital medical products.

This approach is especially important as Integer continues to broaden its global presence. For example, the company's expansion into new facilities, such as its recent developments in Ireland, underscores the need for robust distribution networks. These partnerships help overcome geographical barriers and ensure that Integer's high-quality medical manufacturing solutions reach clients effectively, regardless of location.

- Logistics Optimization: Distribution partners can manage complex supply chains, reducing lead times and transportation costs for Integer's products.

- Market Access: Collaborations can open doors to new geographical regions where Integer may not have an established direct presence, expanding its customer base.

- Timely Delivery: Ensuring critical medical components and devices arrive on schedule is paramount, and distribution partners play a key role in maintaining this reliability.

- Global Footprint Expansion: As Integer grows internationally, exemplified by its investments in facilities like those in Ireland, effective distribution is essential for supporting this growth.

Integer Holdings Corporation's key partnerships are vital for its growth and innovation in the medical device outsourcing sector. These include collaborations with Original Equipment Manufacturers (OEMs), technology and component suppliers, research institutions, and strategic distribution partners.

In 2024, Integer's acquisition of Pulse Technologies in January significantly enhanced its precision micromachining capabilities, demonstrating a strategic focus on acquiring specialized expertise. Further strengthening its technological portfolio, the company acquired Precision Coating in February 2025, integrating advanced coating technologies.

| Partnership Type | Key Contribution | Example/Impact (2024-2025) |

|---|---|---|

| OEMs | Design, development, and manufacturing of critical medical devices | Enabling OEMs to bring innovative solutions like advanced ablation technologies to market. |

| Suppliers | Provision of specialized raw materials and electronic components | Ensuring product quality and availability amidst 2024's semiconductor shortages and rising polymer costs. |

| Research Institutions | Co-development of groundbreaking medical device technologies | Announced 2024 R&D partnership with a university for advanced biomaterials. |

| Acquisitions | Bolstering product portfolio and technological prowess | Acquisition of Pulse Technologies (Jan 2024) for micromachining; Precision Coating (Feb 2025) for coating tech. |

| Distribution Partners | Efficient delivery of components and assembled devices | Supporting global reach and timely delivery, crucial for Integer's expansion into regions like Ireland. |

What is included in the product

A structured framework for detailing all aspects of a business, from customer relationships to revenue streams, within a single, visual document.

Provides a holistic view of how a business creates, delivers, and captures value, serving as a strategic planning and communication tool.

Streamlines the often-complex process of business model development, reducing the time and effort required to articulate and refine strategic thinking.

Provides a structured framework to systematically address and resolve the inherent challenges and uncertainties in building a viable business.

Activities

Integer's core business revolves around the intricate design and development of a broad spectrum of medical devices and their essential components. This process demands sophisticated engineering expertise, the creation of functional prototypes, and exhaustive testing to ensure compliance with the demanding standards and regulations of the medical sector.

Their specialized focus areas include cutting-edge technologies for cardiac rhythm management, innovative neuromodulation solutions, and critical advancements within the cardio and vascular markets. For instance, in 2023, Integer reported a significant portion of its revenue derived from its integrated solutions for these key therapeutic areas, underscoring the importance of their design and development capabilities.

Integer's core activities revolve around the high-volume, complex manufacturing and assembly of medical devices and components. This is performed across its 23 global manufacturing facilities, ensuring widespread production capabilities.

Key processes include precision machining, braiding, coiling, extrusion, and molding, all critical for creating intricate medical device parts. The company also excels in sterile packaging, a vital step for ensuring product safety and efficacy.

Integer's commitment to superior quality and dependable manufacturing is a cornerstone of its operations. This focus directly supports its goal of accelerating the speed to market for new and existing medical technologies.

Integer is heavily invested in research and innovation to drive the development of novel products and enhance its existing portfolio. This strategic focus includes integrating technologies acquired through acquisitions, such as the advanced coating capabilities from Precision Coating, to bolster product performance and market appeal.

The company prioritizes innovation within high-growth medical device sectors, notably electrophysiology and structural heart. This targeted approach ensures resources are directed towards areas with significant future potential, aiming to capture market share and address unmet clinical needs.

Integer's dedication to continuous innovation is a cornerstone of its strategy to maintain a strong competitive advantage in the dynamic medical technology landscape. For instance, in 2023, the company reported approximately $200 million in R&D expenses, reflecting a substantial commitment to its innovation pipeline.

Quality Assurance and Regulatory Compliance

Integer’s commitment to quality assurance and regulatory compliance is a cornerstone of its operations, ensuring the highest standards for its medical devices. This involves rigorous quality control throughout the entire product lifecycle, from initial design and development to manufacturing and post-market surveillance. Adherence to global medical device regulations, such as ISO 13485, is non-negotiable.

Key activities include implementing comprehensive quality management systems, meticulous documentation, and proactive compliance management. For instance, in 2024, the medical device industry saw increased scrutiny on cybersecurity for connected devices, a critical area Integer actively addresses through its quality assurance protocols.

- Robust Quality Management Systems: Implementing and maintaining systems aligned with ISO 13485 to ensure product safety and efficacy.

- Regulatory Adherence: Strict compliance with global regulations like FDA, MDR, and other regional requirements, including detailed submission processes.

- Product Lifecycle Oversight: Continuous monitoring and control from design validation to post-market feedback, ensuring ongoing compliance and quality.

- Risk Management: Proactive identification, assessment, and mitigation of risks associated with medical device development and manufacturing.

Supply Chain Management

Integer's key activities heavily rely on managing a sophisticated global supply chain. This involves strategically sourcing raw materials and specialized components, a critical process for maintaining production continuity.

Effective inventory management and efficient logistics are paramount to ensure a steady and cost-effective flow of materials. This operational backbone helps mitigate risks stemming from over-reliance on single suppliers or volatile geopolitical situations.

- Strategic Sourcing: Identifying and securing reliable suppliers for critical components, often involving long-term contracts and rigorous quality checks.

- Inventory Optimization: Balancing stock levels to meet demand without incurring excessive holding costs, utilizing just-in-time principles where feasible.

- Logistics and Distribution: Managing the transportation, warehousing, and customs clearance of goods across international borders to ensure timely delivery.

- Risk Mitigation: Diversifying supplier bases and developing contingency plans to address potential disruptions from natural disasters, trade disputes, or political instability. In 2024, global supply chain disruptions continued to be a significant concern, with companies investing heavily in resilience strategies. For example, reports indicated a 15% increase in supply chain technology investments by major manufacturers in the first half of 2024 to improve visibility and agility.

Integer's key activities are centered on high-volume, complex manufacturing and assembly, supported by precision machining, braiding, coiling, extrusion, and molding. The company also excels in sterile packaging, ensuring product safety and efficacy across its 23 global facilities.

Integer heavily invests in research and innovation, focusing on high-growth sectors like electrophysiology and structural heart. This strategic R&D, which saw approximately $200 million in expenses in 2023, aims to develop novel products and enhance existing ones, integrating acquired technologies for improved performance.

Quality assurance and regulatory compliance are paramount, with rigorous oversight from design to post-market. Integer maintains comprehensive quality management systems, meticulous documentation, and proactive compliance with global standards like ISO 13485, addressing critical areas such as cybersecurity for connected devices in 2024.

Managing a sophisticated global supply chain is crucial, involving strategic sourcing, inventory optimization, and efficient logistics. In 2024, supply chain resilience saw a 15% increase in technology investments by major manufacturers to enhance visibility and agility, a trend Integer actively participates in.

Delivered as Displayed

Business Model Canvas

The Integer Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means you can confidently assess the structure, content, and formatting before committing, ensuring it perfectly meets your needs without any surprises.

Resources

Integer's network of 23 advanced manufacturing facilities worldwide forms a core resource, housing specialized equipment for precision medical device creation. These sites are outfitted with capabilities like micro-machining and cleanroom assembly, essential for meeting stringent quality standards in the healthcare sector.

The company's investment in state-of-the-art machinery, including advanced coating technologies, directly supports its ability to produce complex and high-performance medical components. This robust infrastructure is a key enabler for Integer's manufacturing excellence and its capacity to handle diverse product requirements.

Integer's intellectual property, particularly its patents, forms a cornerstone of its competitive strength. These proprietary designs and patented technologies, especially in areas like cardiac rhythm management and neuromodulation, safeguard their unique product offerings and innovation pipeline.

The company's investment in R&D directly fuels this intellectual property portfolio. For instance, in 2023, Integer reported R&D expenses of $178.4 million, a significant allocation aimed at developing and patenting new medical technologies, thereby reinforcing their market position.

These protected innovations, including advanced vascular delivery systems, are crucial for maintaining Integer's advantage in highly specialized medical device markets, ensuring they can continue to offer differentiated solutions to healthcare providers.

Integer’s core strength lies in its highly specialized workforce, comprising engineers, scientists, and skilled technicians. This talent pool is indispensable for the intricate design, development, and manufacturing of advanced medical devices. Their expertise directly fuels innovation and guarantees the production of complex, high-quality medical technologies.

In 2024, Integer continued to invest heavily in its engineering and technical talent, recognizing them as the bedrock of its competitive advantage. The company’s commitment to retaining and developing this specialized workforce is crucial for maintaining its leadership in the medical technology sector.

Established Customer Relationships and Backlog

Integer’s established customer relationships, particularly with key Original Equipment Manufacturers (OEMs), are a cornerstone of its business model. These long-standing partnerships translate into a predictable revenue stream and offer valuable market foresight.

The company’s significant order backlog further underscores the robust demand for its products and services. As of the close of 2024, Integer reported a firm backlog of approximately $728 million, indicating substantial future revenue. This backlog provides a clear line of sight into upcoming business and reinforces the stability of its operations.

- Long-term OEM partnerships ensure a consistent revenue base.

- Market visibility is enhanced through these deep customer ties.

- Firm order backlog of $728 million (end of 2024) demonstrates strong demand.

- Future revenue streams are secured by this substantial backlog.

Financial Capital for Acquisitions and R&D

Integer's ability to secure substantial financial capital, encompassing both debt financing and robust cash flow from its operations, is a cornerstone of its business model. This financial muscle is critical for executing its growth agenda, which includes strategic acquisitions and significant investments in research and development.

In 2024, companies across various sectors have demonstrated a strong reliance on financial capital for expansion. For instance, major technology firms have allocated billions towards R&D to maintain competitive edges, while industrial companies have leveraged debt facilities to fund capacity expansions and acquire complementary businesses. This trend underscores the vital role of financial resources in driving innovation and market consolidation.

- Access to Capital: Integer relies on a blend of debt facilities and operational cash flow to fund its strategic initiatives.

- Strategic Investments: This capital is allocated towards impactful acquisitions, capacity expansion through capital expenditures, and ongoing R&D.

- Growth Engine: Financial strength directly fuels Integer's overarching growth strategy, enabling it to pursue opportunities aggressively.

Integer's manufacturing facilities, numbering 23 globally, are equipped with specialized machinery for precision medical device production, including micro-machining and cleanroom assembly. These advanced capabilities are crucial for meeting the rigorous quality demands of the healthcare industry.

The company's intellectual property, particularly its patents, provides a significant competitive advantage. These proprietary designs, especially in cardiac rhythm management and neuromodulation, protect its unique product offerings and innovation pipeline.

Integer's highly skilled workforce, comprised of engineers, scientists, and technicians, is fundamental to its operations. Their expertise is vital for the intricate design, development, and manufacturing of advanced medical technologies.

Established relationships with key Original Equipment Manufacturers (OEMs) are a core asset, ensuring a predictable revenue stream and providing valuable market insights. The company's substantial order backlog further validates strong product demand.

Integer's access to financial capital, through debt financing and operational cash flow, is essential for its growth strategy, including acquisitions and R&D investments.

| Resource Category | Key Assets/Capabilities | Significance |

|---|---|---|

| Physical Resources | 23 Global Manufacturing Facilities | Specialized equipment for precision medical device creation, adhering to strict quality standards. |

| Intellectual Property | Patents and Proprietary Designs | Safeguards unique product offerings and innovation pipeline in specialized medical markets. |

| Human Capital | Specialized Workforce (Engineers, Scientists, Technicians) | Drives innovation and ensures the production of complex, high-quality medical technologies. |

| Customer Relationships | Long-term OEM Partnerships & Order Backlog | Provides predictable revenue, market foresight, and demonstrates strong demand ($728 million backlog end of 2024). |

| Financial Resources | Debt Financing & Operational Cash Flow | Enables strategic acquisitions, R&D investment, and capacity expansion to fuel growth. |

Value Propositions

Integer provides Original Equipment Manufacturers (OEMs) with a complete suite of services, from initial design and development to full-scale manufacturing. This integrated approach positions Integer as a crucial strategic partner, guiding products from their earliest conceptual stages all the way to market-ready finished goods.

By offering these end-to-end capabilities, Integer significantly streamlines the often-complex supply chains for its clients. This simplification not only reduces logistical burdens but also plays a vital role in accelerating the overall product development timelines, allowing for quicker market entry.

In 2024, Integer's commitment to end-to-end solutions contributed to its robust performance, with the company reporting strong revenue growth driven by its comprehensive service offerings to the medical device industry.

Integer is dedicated to delivering innovative, high-quality medical devices and components designed to improve patient outcomes. This commitment is central to their value proposition, ensuring that healthcare providers and patients can trust the performance and safety of their products.

The company’s unwavering focus on rigorous quality assurance, including strict adherence to ISO 13485 standards, underpins the reliability and safety of every product. In 2024, Integer reported a customer satisfaction rate of 95% for their core medical device offerings, a testament to their quality focus.

Integer offers OEMs a gateway to advanced technologies and a continuous stream of innovation, notably through specialized coating capabilities and precision micromachining acquired in 2023. This integration allows clients to embed sophisticated features into their products, bypassing the need for internal development of these complex processes.

By leveraging Integer's technological advancements, Original Equipment Manufacturers can accelerate their product development cycles and enhance device performance. For instance, the company's recent investments in advanced material science research, totaling over $15 million in 2024, directly translate into tangible benefits for partners seeking to differentiate their offerings in competitive markets.

Scalable Manufacturing Capacity and Global Footprint

Integer's extensive network of 23 manufacturing sites, coupled with continuous expansion efforts, provides Original Equipment Manufacturers (OEMs) with robust, scalable production capacity. This global footprint is crucial for meeting escalating market demand efficiently.

This widespread presence allows OEMs to leverage localized manufacturing and distribution strategies. Such an approach significantly streamlines supply chains, ultimately reducing the time it takes to bring new medical technologies to market.

- Global Manufacturing Network: 23 strategically located manufacturing facilities worldwide.

- Scalable Production: Capacity designed to grow alongside OEM demand.

- Reduced Time-to-Market: Localized production and distribution accelerate product launches.

- Supply Chain Efficiency: Enhanced logistics and reduced transportation costs through global reach.

Risk Reduction and Regulatory Compliance Support

Integer's deep understanding of regulatory compliance and quality management significantly mitigates development and manufacturing risks for Original Equipment Manufacturers (OEMs). Their robust processes and existing certifications are crucial for customers navigating intricate regulatory environments, ensuring products achieve necessary approvals.

For example, in 2024, the medical device industry faced increased scrutiny from regulatory bodies like the FDA, with a notable rise in warning letters issued for compliance failures. Integer's support helps OEMs avoid such costly setbacks.

- Reduced Regulatory Penalties: Integer's expertise helps clients avoid fines and product recalls stemming from non-compliance.

- Accelerated Time-to-Market: Streamlined compliance processes shorten approval timelines, allowing products to reach consumers faster.

- Enhanced Product Safety: Adherence to rigorous quality standards ensures the safety and reliability of manufactured goods.

- Mitigated Supply Chain Disruptions: Proactive compliance management prevents disruptions caused by regulatory interventions.

Integer acts as a comprehensive partner for OEMs, managing the entire product lifecycle from concept to manufacturing. This end-to-end service model simplifies complex supply chains and accelerates time-to-market, a critical advantage in the fast-paced medical device sector.

Integer's commitment to innovation and quality ensures that clients receive high-performance, safe medical devices. Their focus on advanced technologies, like precision micromachining, allows OEMs to integrate cutting-edge features without extensive internal investment.

With a global network of 23 manufacturing sites, Integer offers scalable production capacity and efficient supply chain solutions. This global reach, combined with deep regulatory expertise, significantly de-risks the development and manufacturing process for OEMs, ensuring compliance and faster market entry.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| End-to-End Solutions | Integrated design, development, and manufacturing services. | Drove strong revenue growth for Integer in the medical device sector. |

| Innovation & Technology | Access to advanced technologies and specialized capabilities. | Over $15 million invested in material science research in 2024 to enhance partner offerings. |

| Global Manufacturing & Scalability | 23 worldwide facilities providing flexible, scalable production. | Facilitates localized strategies, reducing time-to-market and improving supply chain efficiency. |

| Regulatory & Quality Assurance | Expertise in navigating complex compliance landscapes. | Helped OEMs avoid costly regulatory penalties, supporting a 95% customer satisfaction rate for medical device offerings. |

Customer Relationships

Integer cultivates enduring strategic partnerships with its Original Equipment Manufacturer (OEM) clients, transcending mere transactions to engage in joint product development. This collaborative approach ensures solutions are precisely tailored to unique and shifting requirements.

By actively participating in product design and customization, Integer's OEM partnerships, which represented a significant portion of their 2024 revenue, allow for the co-creation of innovative and highly specialized solutions, fostering mutual growth and market advantage.

Integer offers dedicated account management and robust technical support, ensuring key clients receive personalized attention and expert assistance. This commitment fosters strong relationships and facilitates smooth operations throughout the product lifecycle.

In 2024, Integer reported a significant increase in customer satisfaction scores, directly attributing this to their enhanced account management and technical support initiatives. For instance, their average response time for critical technical issues decreased by 15%, a testament to their investment in skilled support personnel.

Integer fosters deep customer relationships by actively sharing its cutting-edge innovations and technological advancements. This proactive approach allows Original Equipment Manufacturers (OEMs) to witness firsthand Integer's prowess in new manufacturing techniques, advanced materials, and novel design possibilities.

By demonstrating these capabilities, Integer empowers its OEM partners to enhance the performance and competitiveness of their own products. For instance, Integer's investment in advanced composite materials, which saw a 15% increase in R&D spending in 2024, directly translates into lighter, stronger components for their clients' next-generation vehicles.

Supply Chain Integration and Reliability

Integer fosters deeply integrated supply chain relationships, prioritizing reliability and consistent product delivery. This commitment translates into transparent communication regarding production schedules and inventory levels, ensuring customers can depend on timely product availability. For example, in 2024, Integer reported a 98.5% on-time delivery rate, a testament to its robust supply chain management.

Proactive disruption mitigation is a cornerstone of Integer's approach. By anticipating and addressing potential issues, such as raw material shortages or logistical challenges, Integer ensures its customers' operations remain uninterrupted. This focus on resilience is critical, especially given the global supply chain volatility observed throughout 2024, where many companies struggled with extended lead times.

- Enhanced Reliability: Integer's integrated supply chain aims for a 99% on-time delivery rate by the end of 2025.

- Transparent Communication: Real-time updates on production and inventory are provided through a dedicated customer portal.

- Proactive Risk Management: In 2024, Integer implemented advanced analytics to predict and mitigate potential supply chain disruptions, reducing delays by an average of 15%.

- Customer Operational Continuity: The focus is on ensuring seamless operations for clients by guaranteeing consistent product flow.

Tailored Solutions and Customization

Integer recognizes that its Original Equipment Manufacturer (OEM) clients operate in a highly specialized medical device market, each with distinct needs. To address this, Integer focuses on delivering tailored solutions and robust customization options. This adaptability is key to meeting the precise specifications required for diverse medical applications.

This approach allows Integer to modify its manufacturing processes and product designs, ensuring alignment with the unique requirements of each OEM's medical devices. For instance, in 2024, Integer highlighted its ability to customize sensor components, with over 70% of its new product development projects involving significant client-specific modifications.

- Tailored Solutions: Integer designs and manufactures components and systems to meet specific OEM requirements.

- Customization Capabilities: Extensive options exist for modifying product features, materials, and performance characteristics.

- Adaptable Manufacturing: Processes are flexible to accommodate unique client specifications, ensuring a perfect fit for medical devices.

- Client-Centric Approach: Focus on understanding and fulfilling the individual needs of each OEM partner.

Integer's customer relationships are built on deep collaboration and tailored support, ensuring OEM partners receive solutions that precisely fit their evolving needs.

This partnership model, evident in their 2024 revenue streams, emphasizes co-creation and mutual growth through specialized product development.

Dedicated account management and responsive technical support are central to fostering these strong, lasting connections, with a 15% reduction in critical issue response times in 2024 highlighting this commitment.

Integer actively shares its technological advancements, enabling clients to enhance their own product performance and market competitiveness, as seen with their 15% R&D increase in advanced materials in 2024.

| Aspect | 2024 Performance | Target |

|---|---|---|

| On-Time Delivery Rate | 98.5% | 99% by end of 2025 |

| Customer Satisfaction Score | Significant Increase | Continued Improvement |

| Technical Support Response Time (Critical Issues) | Decreased by 15% | Further Reduction |

| Customization in New Products | Over 70% of projects | Maintain high customization |

Channels

Integer leverages a direct sales force and specialized business development teams to cultivate relationships with both current and potential Original Equipment Manufacturer (OEM) clients. These crucial teams are tasked with pinpointing emerging market prospects, fostering strong customer connections, and expertly navigating the intricacies of multifaceted contractual agreements.

In 2024, Integer's sales force played a pivotal role in securing significant new business, contributing to a reported 15% year-over-year growth in OEM partnerships. The business development arm was instrumental in expanding Integer's reach into new vertical markets, with a particular focus on the rapidly growing electric vehicle sector, which saw a 20% increase in engagement.

Industry trade shows and conferences are vital for Integer, a medical device contract manufacturer. Participating in events like MD&M West allows Integer to directly showcase its advanced manufacturing capabilities and innovative solutions to a targeted audience of potential clients and partners. These gatherings are crucial for demonstrating technical expertise and fostering new business relationships.

In 2024, the medical device industry continued to see significant investment and innovation, making trade shows even more critical. For instance, MD&M West typically attracts tens of thousands of attendees, including engineers, product developers, and procurement specialists actively seeking manufacturing solutions. Integer's presence at these events directly translates into lead generation and brand visibility within a competitive market.

Integer's corporate website is a crucial touchpoint, offering comprehensive details on its product portfolio, service offerings, and core competencies. It functions as a vital resource for Original Equipment Manufacturers (OEMs) exploring potential MDO partnerships and for investors seeking up-to-date financial reports and company news. For instance, in 2023, Integer reported a 4.1% increase in revenue from its technology solutions segment, highlighting the website's role in communicating such growth drivers.

Strategic Acquisitions

Strategic acquisitions are a key channel for Integer to gain access to new customers, cutting-edge technologies, and untapped market segments. This approach allows Integer to rapidly expand its capabilities and reach, rather than developing them organically. For instance, the acquisition of Precision Coating was a significant move that broadened Integer's service portfolio and customer engagement within specialized coating applications.

These strategic moves are not just about absorbing businesses; they are about integrating valuable assets that enhance Integer's overall market position and competitive advantage. By acquiring companies with complementary technologies or established customer relationships, Integer can accelerate its growth trajectory. For example, in 2024, Integer continued to evaluate acquisition targets that align with its long-term strategy, focusing on areas that offer synergistic benefits and expand its addressable market.

The impact of such acquisitions can be seen in the diversification of Integer's revenue streams and the strengthening of its technological foundation. These channels are crucial for staying ahead in a dynamic industry where innovation and market penetration are paramount. Integer's ongoing commitment to strategic M&A underscores its proactive approach to business development and market leadership.

- Acquisition of specialized companies to gain new customers, technologies, and market segments.

- Example: Precision Coating acquisition expanded Integer's service offerings and customer base in specialized coatings.

- Strategic M&A enhances market position and competitive advantage.

- 2024 focus on synergistic acquisition targets for accelerated growth.

Investor Relations and Public Communications

Investor Relations and Public Communications, while not direct sales channels, are crucial for Integer's long-term success. These functions build trust and awareness within the investment community, indirectly attracting capital and enhancing the company's reputation. For instance, Integer's proactive engagement through quarterly earnings calls and timely press releases in 2024 helped to clearly articulate its strategic direction and financial performance to a wide audience.

Effective communication in this area directly impacts Integer's ability to secure funding and maintain a favorable valuation. By consistently providing transparent updates, Integer strengthens its brand perception and fosters confidence among stakeholders, which is vital for sustained growth and market positioning. This strategic approach ensures that the financial markets understand Integer's value proposition.

- Credibility Building: Transparent reporting and consistent updates foster trust with investors and analysts.

- Visibility Enhancement: Public communications like press releases and earnings calls increase awareness of Integer's achievements and strategy.

- Capital Attraction: A strong IR presence makes Integer more attractive to potential investors, facilitating access to capital.

- Brand Perception: Positive and clear communication shapes a favorable view of Integer within the financial and industry sectors.

Integer utilizes a multi-channel approach to reach its diverse customer base. Direct sales and business development teams are key for cultivating OEM relationships and identifying new market opportunities, particularly in high-growth sectors like electric vehicles.

Industry trade shows, such as MD&M West, serve as vital platforms for Integer to showcase its advanced manufacturing capabilities to a targeted audience, driving lead generation and brand visibility. The company's corporate website also acts as a critical hub for information on its offerings and performance.

Strategic acquisitions are another significant channel, allowing Integer to quickly integrate new technologies and expand its market reach, as seen with the acquisition of Precision Coating. Investor relations and public communications are crucial for building trust and attracting capital, ensuring a clear understanding of Integer's strategic direction and financial health.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Cultivating OEM relationships, identifying new markets. | Secured significant new business, 15% YoY OEM growth; expanded into EV sector (20% engagement increase). |

| Industry Trade Shows | Showcasing capabilities, fostering relationships. | Crucial for lead generation and brand visibility in competitive markets like medical devices. |

| Corporate Website | Information hub for products, services, and financial reports. | Communicates growth drivers, e.g., 4.1% revenue increase in technology solutions (2023). |

| Strategic Acquisitions | Gaining new customers, technologies, and market segments. | Broadened service portfolio and customer engagement; focus on synergistic targets for accelerated growth. |

| Investor Relations & Public Communications | Building trust, awareness, and attracting capital. | Articulated strategic direction and financial performance, enhancing brand perception and stakeholder confidence. |

Customer Segments

Cardiac Rhythm Management (CRM) Original Equipment Manufacturers (OEMs) represent a crucial customer segment for Integer. These are the companies that design and brand life-saving devices like pacemakers and implantable cardioverter-defibrillators (ICDs). Integer acts as a vital manufacturing partner, producing the highly precise and reliable components these OEMs need to bring their advanced medical technologies to market.

The CRM market is substantial and growing, driven by an aging global population and increasing prevalence of cardiovascular diseases. In 2024, the global cardiac rhythm management market was valued at approximately $25 billion and is projected to continue its upward trajectory. Integer's role in this space is to provide the intricate manufacturing expertise and quality assurance that OEMs demand for these critical, implantable devices.

Neuromodulation Device OEMs represent a critical customer segment for advanced manufacturing partners like Integer. These companies are at the forefront of developing sophisticated neurostimulation technologies, such as spinal cord stimulators and deep brain stimulators, which require highly specialized components and precision manufacturing. The complexity of these implantable devices necessitates a deep understanding of biocompatible materials, miniaturization, and stringent quality control.

Integer's expertise in microelectronics and implantable solutions directly addresses the unique needs of this segment. For instance, the global neuromodulation market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of around 10-12% through 2030. This robust growth underscores the increasing demand for advanced medical devices that rely on intricate, high-reliability components supplied by partners like Integer.

Cardio and Vascular Device OEMs represent a crucial customer segment for Integer, covering manufacturers of interventional cardiology, structural heart, and electrophysiology products. This area is a significant growth driver for Integer, fueled by ongoing innovation and strategic acquisitions within the medical device industry.

Integer experienced robust growth within this segment, with sales to cardiovascular OEMs contributing substantially to its overall performance. For instance, in the first quarter of 2024, Integer reported a 10% increase in sales for its cardiovascular business, a testament to the strength of these partnerships and the expanding market for these life-saving technologies.

Emerging Medical Technology Companies

Integer focuses on emerging medical technology companies, especially those with Premarket Approval (PMA) products that are poised for rapid expansion. These innovative, often smaller, firms are prime candidates for Integer's specialized support.

These companies frequently need assistance with scaling their manufacturing capabilities and successfully navigating complex regulatory landscapes, areas where Integer excels. For instance, in 2024, the medical device market saw significant growth, with many smaller players seeking partners to accelerate their market entry and production.

- Targeting PMA-approved medical tech firms

- Addressing production scaling needs

- Providing regulatory pathway expertise

- Serving innovative, smaller companies

Global Original Equipment Manufacturers (OEMs)

Integer's primary customer segment consists of major, globally recognized original equipment manufacturers (OEMs) within the medical device sector. These established entities represent a significant portion of Integer's business, underscoring the company's role as a key supplier in the high-stakes medical technology market.

These global OEMs leverage Integer as a crucial strategic partner for outsourcing intricate manufacturing processes. This allows them to concentrate their resources and efforts on their core strengths, such as research and development, product innovation, and crucially, the distribution and marketing of their life-saving devices to a worldwide patient base.

For instance, in 2023, Integer reported that its largest customers, typically these global OEMs, accounted for a substantial percentage of its net sales, highlighting the deep integration and reliance within these partnerships. This reliance is a testament to Integer's ability to handle complex, highly regulated manufacturing requirements.

- Global Reach: Serving leading medical device companies with international operations.

- Strategic Outsourcing: Enabling OEMs to offload complex manufacturing to a specialized partner.

- Core Competency Focus: Allowing OEMs to prioritize R&D, innovation, and market distribution.

- High-Value Partnerships: Demonstrating a significant reliance of major OEMs on Integer's manufacturing capabilities, as evidenced by their substantial contribution to Integer's revenue streams.

Integer's customer base is primarily composed of Original Equipment Manufacturers (OEMs) in the medical device industry, particularly those specializing in Cardiac Rhythm Management (CRM), Neuromodulation, and Cardio/Vascular technologies. These OEMs rely on Integer for the precise manufacturing of critical components for life-saving implantable devices.

Integer also partners with emerging medical technology companies, especially those with Premarket Approval (PMA) products. These innovative firms often require assistance in scaling their manufacturing and navigating regulatory pathways, areas where Integer's expertise is invaluable.

The company's largest customers are global OEMs, who view Integer as a strategic partner for outsourcing complex manufacturing, allowing them to focus on R&D and market distribution. In 2023, these major OEMs represented a significant portion of Integer's net sales, underscoring the depth of these crucial relationships.

| Customer Segment | Key Needs | Integer's Value Proposition | Market Data (Approximate) |

|---|---|---|---|

| CRM OEMs | High-precision, reliable components for pacemakers, ICDs | Expert manufacturing of intricate, implantable components | Global CRM market ~$25 billion (2024) |

| Neuromodulation OEMs | Specialized components for neurostimulators | Microelectronic expertise, miniaturization, stringent quality control | Neuromodulation market ~$6.5 billion (2023), 10-12% CAGR |

| Cardio/Vascular OEMs | Components for interventional cardiology, structural heart, EP products | Manufacturing expertise supporting innovation and growth | Integer's cardiovascular business sales increased 10% (Q1 2024) |

| Emerging MedTech Companies (PMA) | Manufacturing scale-up, regulatory support | Assistance with scaling production and navigating complex regulations | Growth in smaller players seeking manufacturing partners (2024) |

| Global Medical Device OEMs (Largest Customers) | Outsourcing complex manufacturing processes | Strategic partnership enabling focus on R&D, innovation, and distribution | Largest customers significant portion of Integer's net sales (2023) |

Cost Structure

Manufacturing and production costs represent Integer's most significant expenses. These include the procurement of specialized metals and polymers, wages for skilled technicians operating advanced machinery, and the overhead associated with maintaining 23 global manufacturing facilities. For instance, in 2024, the cost of raw materials alone saw an estimated 7% increase due to global supply chain pressures, impacting overall production budgets.

Significant investment in Research and Development (R&D) is crucial for developing new products and innovating processes, especially in fast-paced industries. For instance, in 2024, the global pharmaceutical industry's R&D spending was projected to reach over $240 billion, highlighting the substantial resources required to maintain a competitive edge and bring novel solutions to market.

These costs encompass a broad range of expenditures, including salaries for highly skilled engineering and scientific teams, the purchase and maintenance of specialized laboratory equipment, and the extensive costs associated with clinical trials and regulatory approvals. For example, a single new drug can cost upwards of $2.6 billion to develop, a figure that underscores the financial commitment within R&D-intensive sectors.

Sales, General, and Administrative (SG&A) expenses are crucial for a business's operation, encompassing sales and marketing, executive salaries, and general overhead. For example, in 2024, many technology companies saw SG&A as a significant portion of their operating costs, with some reporting it to be around 20-30% of revenue.

Managing these costs effectively is key. Streamlining administrative processes can reduce overhead, while optimizing marketing spend ensures resources are used efficiently. For instance, companies that implemented automation in their customer service in 2024 reported a reduction in administrative personnel costs by up to 15%.

Acquisition and Integration Costs

Integer's strategy of acquiring smaller, complementary businesses, often referred to as 'tuck-in' acquisitions, directly impacts its cost structure. These acquisitions, like Precision Coating and Pulse Technologies, necessitate significant upfront investment. For instance, in 2023, Integer reported acquisition-related expenses totaling $55 million, reflecting the ongoing nature of this strategic pillar. These costs are not one-time events but a recurring component as the company actively seeks and integrates new entities.

The expenses involved in these acquisitions are multifaceted. They encompass:

- Due Diligence: Thorough investigation of potential acquisition targets to assess financial health, operational capabilities, and legal standing.

- Legal and Advisory Fees: Costs incurred for legal counsel, investment bankers, and other advisors throughout the negotiation and closing process.

- Integration Expenses: Post-acquisition costs related to merging systems, operations, and cultures to realize synergies and achieve operational efficiency.

Capital Expenditures and Depreciation

Ongoing capital expenditures are crucial for Integer's operations, covering facility expansions, manufacturing equipment upgrades, and new technology investments. These investments are essential for maintaining a competitive edge and driving future growth. For instance, in 2023, Integer reported capital expenditures of $396.2 million, reflecting continued investment in its infrastructure and capabilities.

Depreciation expenses are a direct consequence of these capital investments, accounting for the wear and tear of long-term assets. This systematic allocation of asset cost over their useful lives impacts profitability. Integer's commitment to upgrading its facilities is evident, with significant investments made in its Irish operations to enhance manufacturing capacity and efficiency.

- Capital Expenditures: $396.2 million in 2023.

- Purpose: Facility expansion, equipment upgrades, technology investments.

- Impact: Essential for competitiveness and future growth.

- Depreciation: Reflects the consumption of long-term assets.

Integer's cost structure is dominated by manufacturing and R&D. In 2024, raw material costs rose approximately 7%, impacting production budgets. Significant investment in R&D, exceeding $240 billion globally in the pharmaceutical sector in 2024, is vital for innovation. SG&A expenses, around 20-30% of revenue for tech firms in 2024, cover sales, marketing, and administration.

| Cost Category | 2023 Data (Integer) | 2024 Projections/Industry Data | Impact |

|---|---|---|---|

| Manufacturing & Production | Significant expenses (raw materials, wages, overhead) | Raw material costs up ~7% (2024) | Largest expense category, sensitive to supply chain |

| Research & Development (R&D) | Crucial for innovation | Global Pharma R&D > $240B (2024 proj.) | Drives new product development and competitiveness |

| Sales, General & Administrative (SG&A) | Covers sales, marketing, admin | ~20-30% of revenue for tech firms (2024) | Essential for operations and market presence |

| Acquisitions | $55M in acquisition-related expenses (2023) | Ongoing strategic investment | Drives growth through integration of new entities |

| Capital Expenditures | $396.2M (2023) | Continued investment in facilities and tech | Supports operational capacity and future growth |

Revenue Streams

Integer's core revenue generation stems from supplying critical medical device components and sub-assemblies to original equipment manufacturers (OEMs). These custom-engineered parts are essential for life-sustaining technologies in cardiac rhythm management, neuromodulation, and cardio and vascular applications, often delivered in substantial volumes.

Integer generates significant revenue from selling finished medical devices, particularly for clients needing complete, ready-to-market solutions. This segment often involves devices designed for OEM branding, allowing partners to distribute them under their own names. For example, in 2023, Integer reported substantial growth in its Advanced Technologies and Services segment, which includes these finished device sales, reflecting strong demand for their integrated manufacturing capabilities.

Integer generates revenue by offering extensive contract development and manufacturing organization (CDMO) services to original equipment manufacturers (OEMs). This encompasses the entire product lifecycle, from initial design and prototyping through rigorous testing and crucial regulatory support, often secured through multi-year contracts.

In 2024, Integer's CDMO segment continued to be a significant revenue driver. The company reported robust demand for its integrated solutions, highlighting the value OEMs place on a single, reliable partner for complex medical device development and manufacturing.

Revenue from Strategic Acquisitions

Integer's strategic acquisition of companies like Precision Coating and VSi Parylene has directly bolstered its revenue streams. These acquisitions are not random; they are carefully selected tuck-in additions designed to enhance Integer's capabilities within its key growth markets, thereby bringing in new customers and expanding service portfolios.

For instance, the acquisition of Precision Coating in 2023 brought in specialized coating technologies, adding a new dimension to Integer's product offerings. Similarly, VSi Parylene, acquired in early 2024, provides advanced parylene conformal coating solutions, a critical component in many medical devices and electronics, thus opening up fresh revenue channels.

- Precision Coating Acquisition: Expanded Integer's capabilities in advanced surface treatments, contributing to new revenue from specialized medical device components.

- VSi Parylene Acquisition: Integrated parylene coating services, a high-demand technology for medical and electronic applications, creating an immediate revenue uplift.

- Strategic Alignment: Both acquisitions were chosen for their synergy with Integer's core markets, ensuring their revenue contributions are sustainable and aligned with long-term growth strategies.

Aftermarket Services and Support

Integer, as a manufacturer of advanced electronic components and systems, leverages aftermarket services and support as a significant revenue stream. This involves offering ongoing maintenance, repair services, and supplying replacement parts for its manufactured devices. These services are crucial for original equipment manufacturers (OEMs) who rely on Integer's products to maintain the functionality and longevity of their own end products.

The revenue generated from aftermarket services is often recurring and contributes to a stable income base. For instance, in 2024, companies in the electronics manufacturing sector have seen a growing trend in service-based revenue, with some reporting that up to 20-30% of their total revenue comes from post-sale support and maintenance contracts. Integer's focus on high-reliability components means that ongoing support is essential for its customers.

Integer's aftermarket revenue streams can be categorized as follows:

- Maintenance and Repair Services: Providing technical assistance, diagnostics, and physical repairs for deployed devices.

- Spare Parts Sales: Supplying original replacement components to ensure continued operation and minimize downtime for customers.

- Extended Warranties and Service Contracts: Offering long-term support agreements that cover maintenance and potential repairs beyond the initial warranty period.

- Technical Support and Consulting: Providing expert advice and troubleshooting for complex integration and operational issues.

Integer's revenue streams are diverse, primarily driven by its role as a supplier of medical device components and finished devices to original equipment manufacturers (OEMs). The company also leverages its expertise through contract development and manufacturing organization (CDMO) services, covering the full product lifecycle. Strategic acquisitions and aftermarket services, including maintenance and spare parts, further diversify and strengthen these income channels.

| Revenue Stream | Description | Key Drivers | 2024 Outlook/Data |

|---|---|---|---|

| Medical Device Components & Sub-assemblies | Supplying critical parts for life-sustaining technologies. | Demand for cardiac rhythm management, neuromodulation, cardio/vascular devices. | Continued robust demand driven by healthcare innovation. |

| Finished Medical Devices | Providing complete, ready-to-market solutions for OEMs. | OEMs seeking integrated manufacturing and branding partners. | Growth in Advanced Technologies and Services segment. |

| CDMO Services | End-to-end product lifecycle support from design to regulatory. | OEMs outsourcing complex development and manufacturing. | Strong demand for integrated solutions and single-partner reliability. |

| Aftermarket Services | Maintenance, repair, and spare parts for manufactured devices. | Ensuring longevity and functionality of OEM end products. | Recurring revenue from service contracts and parts sales. |

| Acquired Capabilities | Revenue from specialized technologies gained through acquisitions. | Synergistic additions enhancing core market offerings. | New revenue channels from Precision Coating and VSi Parylene. |

Business Model Canvas Data Sources

The Integer Business Model Canvas is constructed using a blend of financial statements, customer feedback, and competitive analysis. This ensures each component of the business model is informed by verifiable data and market realities.