Intapp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intapp Bundle

Intapp's market position is fortified by strong client relationships and a reputation for specialized solutions within professional services. However, navigating evolving technology and competitive pressures presents key challenges.

Uncover the full strategic landscape of Intapp, including critical growth opportunities and potential threats that could impact its trajectory.

Want to understand the complete picture of Intapp's competitive advantages and areas for improvement? Purchase the full SWOT analysis for actionable insights.

This in-depth report reveals Intapp's unique strengths and the strategic vulnerabilities that demand attention, offering a clear roadmap for informed decision-making.

Gain access to a professionally written, fully editable report designed to support your strategic planning and investment research on Intapp.

Strengths

Intapp has carved out a leadership position in specialized software for professional and financial services, a testament to their deep industry expertise. Their solutions are specifically designed for sectors like legal, accounting, consulting, and capital markets, which are heavily regulated and have unique operational demands. This specialization makes their offerings highly valuable and difficult for broader software companies to match, fostering significant client loyalty.

Intapp's robust cloud-based platform is a cornerstone of its strength, offering clients unparalleled scalability and accessibility. This infrastructure is fortified by stringent security measures, evidenced by its ISO 27001 and SOC 2 compliance, assuring clients of data integrity and protection.

The strategic integration of Applied AI is a key differentiator. Solutions like DealCloud Activator and Intapp Time leverage AI to boost operational efficiency, deliver predictive insights, and automate intricate client workflows, showcasing Intapp's commitment to cutting-edge technology.

This AI-driven approach places Intapp at the vanguard of innovation within its specialized markets, providing clients with a distinct technological advantage. For instance, Intapp Time's AI-powered time capture saw a reported 15% increase in billable hours for some users in early 2024, demonstrating tangible efficiency gains.

Intapp benefits significantly from a robust recurring revenue model, primarily driven by its Software-as-a-Service (SaaS) subscriptions. This structure ensures predictable and stable income, which is a cornerstone of financial health for any technology company.

The company's impressive cloud net revenue retention rate stood at 119% as of March 31, 2025. This metric is crucial, as it signifies that Intapp not only keeps its existing clients but also successfully encourages them to spend more, either by upgrading their services or adopting additional solutions.

With a client base exceeding 2,650 firms, and a notable number of these clients having substantial, high-value contracts, Intapp demonstrates a deep ability to foster long-term relationships. This extensive client base, coupled with their willingness to invest further, underscores exceptional client retention and loyalty.

Strategic Partnerships and Ecosystem

Intapp's strategic partnerships are a significant strength, particularly its collaboration with Microsoft. This alliance allows Intapp to leverage Microsoft Azure and its industry cloud solutions, significantly enhancing its go-to-market capabilities and the depth of its product integrations with Microsoft 365.

These collaborations aren't just about distribution; they drive co-innovation, leading to more robust and user-friendly solutions for their clients. For instance, the integration with Microsoft's ecosystem allows Intapp to offer more comprehensive digital transformation tools to professional services firms.

The benefits extend to expanded market reach and the ability to deliver integrated solutions that streamline client operations. This ecosystem approach is crucial for fostering growth and solidifying Intapp's position in the market, enabling them to tap into a broader customer base and offer more sophisticated, cloud-native functionalities.

Key aspects of these partnerships include:

- Enhanced Go-to-Market: Access to Microsoft's extensive sales channels and customer relationships.

- Product Integration: Deeper integration with Microsoft Azure and Microsoft 365, improving functionality and user experience.

- Co-innovation: Collaborative development leading to advanced, industry-specific solutions.

- Market Expansion: Increased reach into new customer segments within the professional services industry.

Consistent Product Innovation and Development

Intapp’s strength lies in its relentless pursuit of product innovation and development, consistently enhancing its platform. This is evident in their regular release of new features and strategic acquisitions, such as TermSheet, which bolstered their presence in the real assets sector. For instance, in 2024, Intapp continued to integrate AI into its solutions, notably within Intapp Time, to streamline workflows and improve operational efficiency for legal and accounting professionals.

The company’s focus extends to refining existing products, like DealCloud, by incorporating advanced relationship management capabilities. This commitment ensures Intapp’s offerings remain at the forefront of industry needs, driving deeper client engagement and reinforcing its market position. By prioritizing continuous improvement, Intapp maintains its competitive edge and maximizes the value proposition for its diverse client base.

- Consistent Feature Enhancement: Intapp regularly updates its core products, such as DealCloud, with new functionalities to meet evolving client demands.

- Strategic Acquisitions: The acquisition of TermSheet in 2023 exemplifies Intapp’s strategy to expand its market reach and technological capabilities, particularly in specialized financial sectors.

- AI Integration: By embedding AI into solutions like Intapp Time, the company aims to automate tasks and provide intelligent insights, enhancing user productivity.

- Market Relevance: This ongoing innovation cycle ensures Intapp’s technology remains relevant and valuable, fostering strong client adoption and retention.

Intapp's deep specialization in software for professional and financial services is a significant strength, providing highly tailored solutions for regulated industries like legal and accounting. Their robust, secure cloud platform ensures scalability and accessibility, backed by ISO 27001 and SOC 2 compliance. The integration of Applied AI, as seen in Intapp Time's reported 15% increase in billable hours for some users in early 2024, drives operational efficiency and provides a distinct technological advantage.

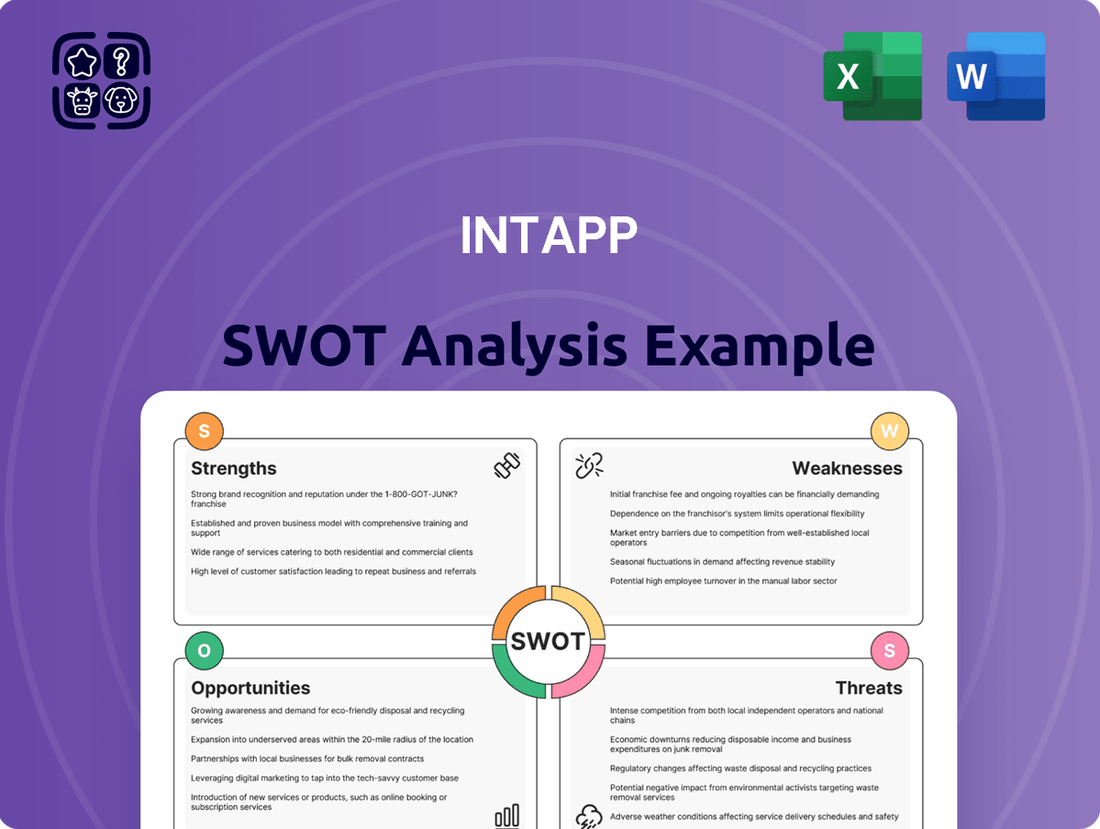

What is included in the product

Delivers a strategic overview of Intapp’s internal strengths, weaknesses, external opportunities, and threats.

Streamlines complex SWOT analysis into an intuitive, visual framework, relieving the pain of data overwhelm and facilitating clearer strategic direction.

Weaknesses

Intapp has consistently shown strong revenue growth, but it has also reported ongoing GAAP operating and net losses. This is a significant weakness, as investors are keen to see a clear path to profitability under standard accounting rules. For instance, in fiscal year 2024, Intapp reported a GAAP operating loss of $28.3 million, even as revenue grew to $341.4 million.

The company's transition to a fully cloud-based (SaaS) model is a key factor in these losses, as it involves substantial upfront investments in technology and infrastructure. While this shift is expected to drive long-term efficiency, the continued GAAP losses highlight the challenges in managing expenses and scaling operations effectively to achieve sustained profitability.

Investors are closely watching how Intapp navigates this transition, particularly its ability to control costs associated with its SaaS migration and sales and marketing efforts. The gap between its non-GAAP operating income and GAAP operating loss remains a point of scrutiny, signaling the importance of operational efficiency and expense management in the near term.

Intapp has faced execution challenges during its shift from on-premise software to cloud-based services. The decline in on-premise Annual Recurring Revenue (ARR) has been steeper than initially expected, impacting the company's financial trajectory. This transition, moving from upfront license sales to subscription revenue, naturally alters cash flow patterns.

Furthermore, recent quarters have seen account reallocation issues hinder net new ARR growth. These operational complexities underscore the difficulties inherent in managing such a significant business model transformation, impacting the pace of cloud adoption and revenue realization.

While Intapp's specialization in professional and financial services is a core strength, it also creates a significant weakness due to market concentration. The company's revenue streams are heavily tied to the economic health and discretionary spending of these specific sectors. For instance, reports from late 2024 indicated that over 70% of Intapp's revenue originated from North America, highlighting a pronounced geographical dependency alongside industry specialization.

This concentrated reliance means that any downturn or significant shift within these particular industries, such as reduced IT budgets in law firms or investment banks, could disproportionately affect Intapp's financial performance and growth trajectory. An economic slowdown specifically impacting these high-value service providers poses a direct and substantial risk to the company's revenue stability.

Potential for High Implementation Costs and Complexity

While Intapp's integrated platform offers robust capabilities, its comprehensive nature can translate into complex and potentially high implementation costs for clients. Many firms find that the setup process requires a substantial investment of both time and financial resources. This can be a significant hurdle, particularly for smaller organizations or those with limited IT budgets. The need for dedicated resources and potential customization adds to this complexity.

For instance, average implementation timelines for Intapp solutions often span 4 to 6 months, with associated costs frequently falling between $150,000 and $250,000. These figures underscore the significant commitment required from client firms to successfully deploy the platform. This investment level may understandably deter smaller firms or those prioritizing quicker, more streamlined deployment options.

- Complexity of Integrated Platform: Intapp's strength lies in its interconnectedness, which can make initial setup more intricate than standalone solutions.

- Significant Time Investment: Typical implementation durations of 4-6 months demand considerable internal resource allocation.

- Substantial Financial Outlay: Costs ranging from $150,000 to $250,000 represent a major expenditure for many businesses.

- Potential Deterrent for Smaller Firms: The scale of investment and complexity may limit adoption among smaller professional service businesses.

Competitive Pressure and Market Share Risks

Intapp operates in a fiercely competitive landscape, challenged by giants like Microsoft, Oracle, and Salesforce, alongside specialized software firms. This intense rivalry puts pressure on Intapp to continually innovate and maintain its edge.

The company's recent slowdown in Annual Recurring Revenue (ARR) growth, falling below 20%, is a significant concern. This deceleration suggests potential vulnerabilities in retaining and expanding its customer base.

- Market Share Erosion: Competitors offering more attractive cloud solutions or smoother customer onboarding could chip away at Intapp's market share.

- Pricing Pressure: Intense competition may force Intapp to lower prices, impacting profitability.

- Innovation Lag: Failure to keep pace with competitor advancements in areas like AI integration could lead to Intapp falling behind.

- Customer Churn: If competitors provide superior value or a better user experience, Intapp could see increased customer attrition.

Intapp's ongoing GAAP operating and net losses, exemplified by a $28.3 million operating loss in fiscal year 2024 against $341.4 million in revenue, present a clear weakness. This financial performance, driven by substantial investments in its cloud transition, raises concerns about the company's ability to achieve profitability under standard accounting metrics.

The company has also experienced execution challenges during its business model shift, with on-premise ARR declining faster than anticipated and account reallocation issues hindering net new ARR growth in recent quarters. These operational hurdles impact the pace of cloud adoption and revenue realization.

Intapp's reliance on the professional and financial services sectors, with over 70% of revenue originating from North America as of late 2024, creates a significant market concentration weakness. Downturns or reduced IT spending within these specific industries could disproportionately impact the company's financial performance.

The complexity and cost of implementing Intapp's integrated platform, often requiring 4-6 months and $150,000-$250,000, can deter smaller firms or those seeking more streamlined deployment options.

Intapp faces intense competition from major players like Microsoft, Oracle, and Salesforce, as well as specialized firms. This rivalry, coupled with a recent slowdown in ARR growth to below 20%, indicates potential vulnerabilities in customer retention and expansion.

| Weakness | Description | Supporting Data (FY24 unless noted) |

| Ongoing GAAP Losses | Persistent operating and net losses under standard accounting rules. | $28.3 million GAAP operating loss; $341.4 million revenue. |

| Execution Challenges in SaaS Transition | Slower-than-expected decline in on-premise ARR and recent ARR growth deceleration. | ARR growth below 20% in recent quarters. |

| Market Concentration | Heavy reliance on specific industries and geographic regions. | Over 70% of revenue from North America (late 2024 data). |

| High Implementation Costs and Complexity | Significant time and financial investment required for platform setup. | Implementation: 4-6 months; Costs: $150,000 - $250,000. |

| Intense Competitive Landscape | Pressure from large tech companies and specialized software providers. | Competitors include Microsoft, Oracle, Salesforce. |

What You See Is What You Get

Intapp SWOT Analysis

The content below is pulled directly from the final Intapp SWOT analysis. Unlock the full report when you purchase, gaining access to our comprehensive evaluation of Intapp's strategic position. This includes detailed insights into its market standing, competitive advantages, and potential areas for growth and improvement. You'll receive the complete, professionally structured document ready for your strategic planning needs.

Opportunities

The professional and financial services sectors are actively pursuing digital transformation, creating a substantial demand for cloud-based solutions. This shift directly benefits Intapp, as it's well-positioned to help firms modernize their operations. For instance, a 2024 report indicated that 85% of financial services firms were planning to increase their cloud spending in the next two years, highlighting a fertile ground for Intapp's offerings.

The increasing reliance on cloud services, driven by the pursuit of greater efficiency and stringent compliance requirements, presents a significant growth avenue for Intapp. This trend allows Intapp to not only attract new clients but also strengthen its relationships with existing ones by offering advanced cloud capabilities. By 2025, it's projected that cloud adoption within professional services will reach over 90%, underscoring the vast market opportunity.

The widespread adoption of artificial intelligence (AI) in professional settings, with 72% of professionals utilizing AI in 2025, offers Intapp a considerable growth avenue. By enhancing its AI-driven tools such as Intapp Assist and DealCloud Activator, the company can deliver more sophisticated analytics and automation. This strategic focus on AI integration will bolster client productivity and strengthen Intapp's competitive standing.

Intapp's impressive 119% cloud net revenue retention rate, coupled with a robust client base exceeding 2,650 firms, presents a prime opportunity for cross-selling and upselling. As businesses continue their digital transformation journeys, the demand for integrated solutions is escalating, creating a fertile ground for Intapp to expand its offerings within existing accounts.

By leveraging its strong client relationships and proven track record, Intapp can effectively introduce additional cloud services and modules, deepening its penetration and increasing customer lifetime value. This strategy capitalizes on the trust already established, making it easier to present new solutions that address evolving client needs.

Geographic and Vertical Expansion

Intapp's current stronghold is North America, but significant opportunities lie in expanding its geographic footprint. Targeting emerging financial hubs in Asia-Pacific and Europe could unlock new revenue streams. For instance, the APAC region's financial services market is projected to grow substantially, with opportunities in countries like Singapore and Hong Kong.

Beyond geography, Intapp can pursue vertical expansion. The company's platform, designed for professional services, could be adapted for sectors like legal tech, accounting services, or even specialized consulting firms. This diversification leverages existing technology and expertise. In 2024, the global legal tech market alone was valued at over $20 billion, presenting a substantial adjacent market.

The expansion strategy could look like this:

- Geographic Expansion: Target key financial centers in APAC and EMEA.

- Vertical Expansion: Adapt core platform for legal, accounting, and consulting sectors.

- Market Penetration: Leverage existing technology for unmet needs in adjacent professional services.

Strategic Acquisitions and Partnerships

Intapp's proven track record of strategic acquisitions, exemplified by its April 2025 acquisition of TermSheet, continues to bolster its product suite and market penetration. This ongoing strategy, focused on acquiring complementary technologies and smaller niche competitors, presents a significant opportunity to accelerate growth, diversify its service portfolio, and solidify its market leadership. Such moves not only expand capabilities but also integrate valuable intellectual property and customer bases.

Further cultivating and deepening existing strategic alliances, particularly with major technology providers like Microsoft, offers another avenue for substantial opportunity. These reinforced partnerships can unlock access to new and expansive go-to-market channels, facilitating broader customer reach and co-development of innovative solutions. This collaborative approach can significantly enhance Intapp's competitive edge and expand its ecosystem influence.

The potential benefits of this approach are quantifiable:

- Accelerated Market Expansion: Acquisitions can quickly embed Intapp into new geographic regions or industry verticals, reducing the time and cost associated with organic market entry.

- Enhanced Product Offering: Integrating acquired technologies allows Intapp to offer a more comprehensive and sophisticated suite of solutions, meeting a wider range of client needs.

- Synergistic Revenue Growth: Partnerships, such as those with Microsoft, can lead to bundled offerings and joint sales initiatives, driving incremental revenue streams.

- Consolidated Market Position: By acquiring competitors or complementary service providers, Intapp can reduce market fragmentation and strengthen its overall market share.

Intapp has a significant opportunity to expand its market reach by targeting emerging financial hubs in Asia-Pacific and Europe. The company can also leverage its platform for adjacent professional services sectors like legal tech and accounting, a market valued at over $20 billion in 2024.

Strategic acquisitions, like the April 2025 purchase of TermSheet, allow Intapp to quickly integrate new technologies and customer bases, accelerating growth. Deepening partnerships with major tech providers, such as Microsoft, can open up new go-to-market channels and foster co-development of innovative solutions.

| Opportunity Area | Key Action | Market Potential/Data Point |

| Geographic Expansion | Target APAC and EMEA financial centers | APAC financial services market projected for substantial growth |

| Vertical Expansion | Adapt platform for legal, accounting, consulting | Global legal tech market valued at over $20 billion (2024) |

| Strategic Acquisitions | Acquire complementary technologies | Accelerates product suite enhancement and market penetration |

| Partnership Deepening | Strengthen alliances with tech providers (e.g., Microsoft) | Unlocks new go-to-market channels and co-development opportunities |

Threats

Intapp operates in a fiercely competitive landscape, contending with both established tech giants and nimble specialized firms. This intense rivalry, prevalent in the enterprise software market for professional and financial services, puts pressure on pricing and necessitates higher marketing investments. For instance, major players like Microsoft and Salesforce offer broad suites that can sometimes overlap with Intapp's functionalities, while niche competitors may focus on specific pain points with tailored solutions.

The threat is significant: if competitors introduce more innovative products, offer better value, or can deploy their solutions more quickly, Intapp risks losing market share. A significant portion of the enterprise software market sees rapid innovation cycles, meaning staying ahead requires continuous investment in R&D. For example, the adoption of AI-driven analytics and cloud-native architectures by competitors could quickly outpace Intapp's offerings if not matched.

Intapp's position as a cloud-based platform for sensitive client data exposes it to substantial cybersecurity risks. A data breach, like the significant increase in ransomware attacks targeting professional services firms in 2024, could lead to severe reputational damage and financial penalties, potentially costing millions in remediation and regulatory fines.

The evolving threat landscape necessitates constant vigilance; for instance, the average cost of a data breach reached $4.45 million globally in 2023, a figure that continues to climb. Intapp must maintain continuous investment in advanced security measures to mitigate these evolving threats and protect its clients' confidential information.

Economic downturns pose a significant threat to Intapp, as its revenue is directly linked to the spending power of professional and financial services firms. Should these sectors experience a recession or considerable instability, clients may scale back on new software investments, potentially leading to contract renegotiations or increased churn. For instance, a projected slowdown in global economic growth for 2024, with some analysts forecasting a sub-2% expansion, could directly impact Intapp's recurring revenue model.

Rapid Technological Change and AI Disruption

The accelerated evolution of technology, especially in artificial intelligence and generative AI, presents a significant threat to Intapp. Competitors could leverage these advancements more rapidly, integrating sophisticated AI features into their offerings and potentially eroding Intapp's competitive edge. This rapid change necessitates substantial and ongoing investment in research and development to keep pace, which could place considerable pressure on the company's profit margins.

For instance, the global AI market was valued at approximately $196.6 billion in 2023 and is projected to grow significantly, with some estimates reaching over $1.8 trillion by 2030. This rapid expansion highlights the speed at which AI capabilities are developing and being adopted across industries, including legal and professional services where Intapp operates. Failure to match or exceed this pace of innovation could lead to Intapp falling behind in terms of product functionality and market relevance.

- AI Integration Pace: Competitors might integrate advanced AI, like predictive analytics or automated workflow solutions, faster than Intapp, creating a gap in product capabilities.

- R&D Expenditure: Keeping up with AI advancements requires significant capital for research and development, potentially impacting profitability if not managed efficiently.

- Market Disruption: New AI-driven solutions could emerge that fundamentally alter how professional services firms operate, disrupting Intapp's existing business model if it cannot adapt.

- Talent Acquisition: The demand for AI expertise is high, and attracting and retaining top AI talent is crucial but costly, adding to operational expenses.

Challenges in International Expansion and Regulatory Compliance

Expanding Intapp's reach into new international markets introduces significant hurdles. These include diverse regulatory landscapes, strict data sovereignty laws like the GDPR in Europe, and differing cultural norms that impact business operations and client engagement. Successfully navigating these varied legal and cultural frameworks requires substantial investment and a nuanced approach, potentially slowing down global growth initiatives.

The complexity of compliance across multiple jurisdictions can be a major impediment. For instance, Intapp's software, used in highly regulated sectors like financial services and legal, must adhere to sector-specific rules that vary widely from country to country. This can translate into significant costs for legal counsel, compliance officers, and technology adaptations, impacting the profitability of international ventures.

- Regulatory Divergence: Intapp must contend with a patchwork of international laws governing data privacy, cybersecurity, and professional services, creating compliance complexities.

- Data Sovereignty: Adhering to local data storage and processing requirements, such as those mandated by emerging national data laws in 2024 and 2025, adds operational and infrastructure costs.

- Cultural Adaptation: Tailoring business practices and software interfaces to local customs and communication styles is crucial but resource-intensive.

- Compliance Costs: Meeting stringent international compliance standards can divert significant financial and human resources away from core product development and market penetration.

Intapp faces significant threats from competitors rapidly integrating advanced AI, which could outpace their own development and erode market share. This requires substantial R&D investment, potentially straining profit margins. New AI-driven solutions could also fundamentally disrupt Intapp's business model if they cannot adapt quickly enough to changing market demands.

The company's reliance on professional and financial services firms makes it vulnerable to economic downturns. A recession could lead to reduced spending on software, impacting Intapp's recurring revenue. For instance, a projected global economic growth of under 2% for 2024 could directly affect client investment capacity.

Cybersecurity risks are a major concern, especially with the rise in ransomware attacks. A data breach could result in severe reputational damage and substantial financial penalties, with the average cost of a data breach reaching $4.45 million globally in 2023.

Expanding into new international markets presents challenges due to diverse regulations, data sovereignty laws, and cultural differences. Compliance with varying legal frameworks, such as GDPR, can incur significant costs and slow down global expansion efforts.

SWOT Analysis Data Sources

This Intapp SWOT analysis is built on a robust foundation of data, drawing from financial disclosures, comprehensive market intelligence, and expert industry insights to provide a precise and actionable strategic overview.