Intapp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intapp Bundle

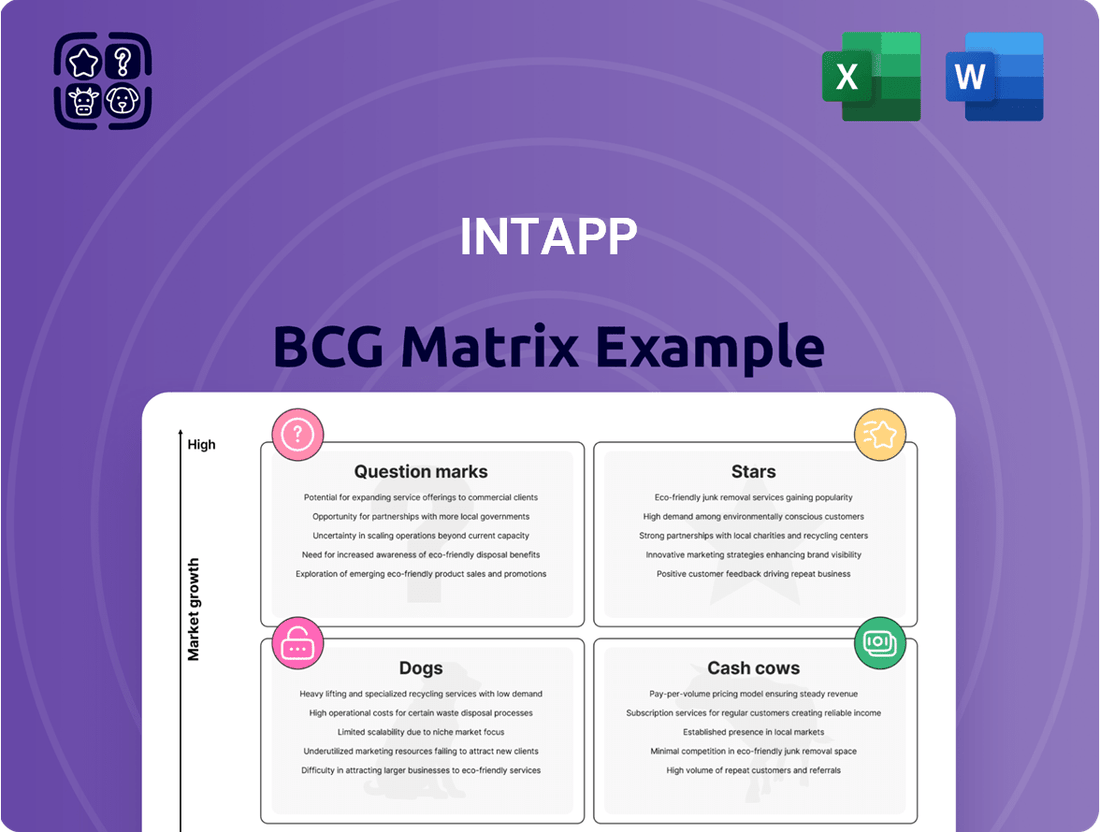

Are you curious about how a company's products stack up in the market? Our Intapp BCG Matrix preview offers a glimpse into the strategic positioning of its portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these categories is crucial for effective resource allocation and future growth.

This initial insight is just the tip of the iceberg, providing a foundational understanding of the company's product landscape. To truly unlock the power of strategic decision-making and gain a comprehensive view of investment opportunities, you need the full picture.

Purchase the complete Intapp BCG Matrix for a detailed quadrant-by-quadrant analysis, complete with actionable insights and tailored recommendations. This comprehensive report will equip you with the clarity needed to optimize your product strategy and drive sustainable success.

Stars

Intapp's recent AI-driven product launches, including Intapp Assist for DealCloud and Intapp Walls for Copilot, signify a strategic push into a burgeoning market. These solutions are designed to significantly boost client productivity and offer a competitive edge. Intapp is actively fostering adoption and spearheading innovation in this rapidly expanding sector, indicating strong growth potential and a growing market presence.

Intapp's robust year-over-year SaaS revenue growth, consistently in the 27-28% range, and its Cloud Annual Recurring Revenue (ARR) also climbing by 28-29%, clearly positions it as a frontrunner in the industry's transition to cloud-based solutions. This strong performance is particularly notable within the professional and financial services sectors, where cloud adoption is rapidly accelerating.

Further validating Intapp's market strength is its impressive cloud net revenue retention rate, which stands at a healthy 119%. This metric signifies not only successful client acquisition but also deep client satisfaction and expansion of services within existing accounts, highlighting Intapp's ability to retain and grow its customer base in the dynamic cloud software market.

Intapp DealCloud, bolstered by innovations like its AI-powered Activator, stands as a significant pillar for Intapp, especially within the expanding realm of deal and engagement management for capital markets and advisory sectors. This platform's ongoing development and market recognition underscore its robust position and leadership within a niche vital to its clientele.

The platform's capabilities, particularly its AI advancements, directly address the increasing demand for efficiency and intelligence in deal sourcing, evaluation, and relationship management. For instance, in 2024, firms leveraging advanced CRM and deal management solutions reported an average of a 15% increase in deal pipeline visibility and a 10% improvement in conversion rates.

DealCloud's strategic importance is further amplified by its ability to integrate with other Intapp solutions, creating a comprehensive ecosystem for financial services firms. This synergy allows for more streamlined workflows and data-driven decision-making, crucial in a competitive landscape where speed and accuracy are paramount.

Integrated Risk & Compliance Solutions

The market for integrated risk and compliance solutions in professional services is a significant growth area, driven by increasingly complex regulatory landscapes and the paramount need for stringent data security. Firms are actively seeking tools that streamline these critical functions.

Intapp's offerings in this space, which incorporate advanced technologies like artificial intelligence for sophisticated oversight, are well-positioned to capture substantial market share. For instance, the global regulatory compliance market was projected to reach USD 129.5 billion by 2024, highlighting the scale of this opportunity.

- Growing Market Demand: The increasing complexity of regulations and data privacy laws fuels demand for specialized software.

- AI-Powered Enhancements: Intapp's integration of AI in risk and compliance solutions offers advanced capabilities for proactive management.

- Operational Efficiency: These integrated solutions help firms not only meet regulatory obligations but also improve overall operational workflows.

- Market Share Potential: The focus on these critical needs suggests strong adoption and a solid market position for Intapp within its client base.

Vertical SaaS for Professional Services

Intapp's strategy centers on delivering specialized vertical SaaS for professional services, targeting sectors like law, accounting, and consulting. This focus allows them to deeply address industry-specific challenges, making their core offerings highly relevant and in demand.

By concentrating on these niche yet substantial markets, Intapp aims to achieve dominant market share. Their vertical SaaS solutions are designed to meet the unique operational and compliance needs of these professions, fostering strong customer loyalty.

- Market Focus: Law, accounting, consulting, and capital markets.

- Strategy: Deeply addressing industry-specific needs through specialized SaaS.

- Growth Driver: Capturing market share in underserved, high-demand professional service sectors.

- Positioning: Core vertical SaaS offerings are in a consistently growing demand environment.

Stars represent Intapp's leading products with high market share and high growth potential. These offerings are typically characterized by strong customer adoption and innovation, driving significant revenue. Intapp's AI-powered solutions and vertical SaaS focus, particularly in areas like DealCloud, exemplify this category. The company's consistent revenue growth, exceeding 27% year-over-year, and a cloud net revenue retention rate of 119% further underscore the "Star" status of its key products.

Intapp's market strategy, focusing on specialized vertical SaaS for sectors like law, accounting, and consulting, cultivates "Star" performers by catering to specific, high-demand needs. Their AI advancements, such as Intapp Assist and Intapp Walls, are positioned to become stars by enhancing productivity and offering a competitive edge in rapidly evolving markets. The company's strong financial metrics, including robust SaaS revenue growth and high cloud ARR, confirm the success of its "Star" products.

| Intapp Product Category | Market Share | Growth Potential | Key Differentiator |

|---|---|---|---|

| Intapp DealCloud | High | High | AI-powered deal management, specialized for capital markets |

| Intapp Assist | Emerging | High | AI-driven productivity enhancement |

| Intapp Walls | Emerging | High | AI-powered compliance and security |

| Intapp Risk and Compliance | Growing | High | AI for regulatory oversight, addressing complex legal landscapes |

What is included in the product

The Intapp BCG Matrix provides a strategic framework to analyze Intapp's product portfolio, categorizing offerings as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis informs decisions on resource allocation, highlighting which Intapp products to invest in, hold, or divest for optimal business performance.

A one-page overview placing each business unit in a quadrant to clarify strategic focus and resource allocation.

Cash Cows

Intapp's core Client Relationship Management (CRM) solutions are the bedrock of its business, acting as true cash cows within the BCG framework. These offerings have achieved a dominant market share among their target clientele, meaning they are essential for daily operations.

Because these CRM tools are so deeply ingrained in how professional services firms manage client interactions and business development, they generate a predictable and substantial stream of recurring revenue. Think of it as a steady income that doesn't require a massive marketing push to maintain.

The mature nature of these established CRM products means Intapp can efficiently generate significant cash flow from them, with minimal need for substantial reinvestment in research and development or aggressive promotional campaigns. This allows Intapp to allocate capital to other areas of the business.

For instance, in 2024, Intapp reported robust recurring revenue figures, with a significant portion attributable to these foundational CRM services. This highlights their consistent performance and ability to deliver strong, stable cash generation for the company.

For professional services firms, robust time and billing management is non-negotiable. Intapp's established solutions in this crucial area are considered cash cows because they are deeply embedded in client operations, making switching incredibly difficult and costly. These mature offerings provide a steady, predictable revenue stream with low associated growth investment needs.

Intapp's time and billing software is a cornerstone for many law firms and accounting practices, ensuring accurate client invoicing and project tracking. Given the complexity of integrating such systems, clients often face significant disruption and expense if they attempt to change providers, reinforcing the cash cow status of these Intapp products. For example, many firms have utilized Intapp's solutions for over a decade, demonstrating deep client loyalty and reliance.

Intapp's established client base, numbering over 2,650, represents a significant asset. Many of these clients maintain long-term contracts with annual recurring revenue (ARR) exceeding $100,000, demonstrating deep integration and loyalty.

The consistent revenue generated from ongoing support, maintenance, and incremental updates for these established clients acts as a reliable cash cow. This stable income stream provides a solid financial foundation for the company.

These high-margin revenues from existing relationships are crucial, enabling Intapp to invest in developing and expanding its high-growth initiatives, ensuring future expansion and innovation.

Standardized Implementation & Support Services

Standardized implementation and support services for Intapp's mature software offerings represent a significant cash cow. These services, often integrated with subscription packages, generate consistent and high-margin revenue. With established processes and a high degree of client dependency, the need for further investment is minimal compared to new product development.

These services are crucial for ensuring client satisfaction and, consequently, driving recurring subscription renewals. Intapp's focus on these mature products allows for efficient delivery, leveraging existing infrastructure and expertise. This operational efficiency translates directly into strong profitability.

- High Profit Margins: Established processes for implementation and support lead to higher profit margins compared to new product development.

- Steady Revenue Streams: Bundled with subscriptions, these services provide a predictable and consistent revenue flow.

- Client Retention: Effective support ensures client success, directly contributing to reduced churn and increased customer lifetime value.

- Low Investment Needs: Mature products require less ongoing R&D investment, freeing up capital for growth areas.

Foundational Data Management and Insights

Intapp's foundational data management and basic operational insight solutions have historically served as strong cash cows. These offerings, deeply embedded in the workflows of numerous client firms, benefit from high market penetration within their specific segments. Their essential nature ensures consistent demand and predictable, recurring revenue streams. This stability allows Intapp to generate consistent cash flow without the need for substantial ongoing market expansion investments.

These established products represent a significant portion of Intapp's revenue generation, acting as a stable financial base. Their mature market position means they require less capital for innovation or aggressive growth compared to newer ventures. This allows Intapp to allocate resources strategically across its broader product portfolio, supporting potential stars or question marks.

- High Market Penetration: Intapp's core data management tools have likely reached a saturation point within their target client base, securing a dominant market share.

- Stable Demand: The essential nature of these solutions means clients rely on them for day-to-day operations, ensuring a consistent and predictable revenue stream.

- Recurring Revenue: Subscription-based models for these foundational products contribute significantly to Intapp's predictable cash flow.

- Low Investment Needs: Mature products typically require less R&D or marketing spend, freeing up capital for other strategic initiatives.

Intapp's core Client Relationship Management (CRM) and Time & Billing solutions are its undisputed cash cows. These mature offerings boast deep client integration and a sticky customer base, generating predictable, recurring revenue with minimal incremental investment.

These established products benefit from high market penetration within professional services firms. For instance, in 2024, Intapp continued to see strong recurring revenue from these foundational services, underscoring their consistent performance and stable cash generation.

The significant upfront investment and ongoing costs associated with switching these deeply embedded systems for clients reinforce their cash cow status. This reliance translates into robust customer retention and a stable income stream for Intapp.

These high-margin revenues from existing relationships are crucial, enabling Intapp to strategically allocate capital towards its growth initiatives, ensuring future expansion and innovation.

| Product Category | BCG Status | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Client Relationship Management (CRM) | Cash Cow | High market share, predictable recurring revenue, low reinvestment needs. | Significant portion of total ARR attributed to CRM services. |

| Time & Billing Solutions | Cash Cow | Deep client integration, high switching costs, stable revenue. | Long-term client contracts (over a decade for many) demonstrate loyalty. |

| Implementation & Support Services | Cash Cow | High profit margins, steady revenue, drives client retention. | Efficient delivery leverages existing infrastructure and expertise. |

| Data Management & Operational Insights | Cash Cow | Mature market position, essential for workflows, consistent demand. | Contributes to a stable financial base with less capital for innovation. |

What You’re Viewing Is Included

Intapp BCG Matrix

The Intapp BCG Matrix preview you are viewing is the identical, fully functional document you will receive immediately after purchase. This means you're getting a complete, analysis-ready strategic tool without any alterations or limitations. You can trust that the insights and formatting are exactly as presented, ready to be directly integrated into your business planning and decision-making processes.

Dogs

Intapp's legacy on-premise software offerings, while perhaps still serving a segment of its customer base, are generally positioned in mature, low-growth markets. These products, if still supported, likely represent a declining portion of revenue compared to their cloud-based counterparts. For instance, as of the first half of 2024, the company's strategic focus has clearly shifted, with cloud solutions dominating new investments and sales efforts.

Consequently, these on-premise solutions would fall into the 'Dogs' category of the BCG Matrix. This implies they generate minimal revenue growth and potentially low profitability due to ongoing maintenance costs without significant upside from new features or market expansion. Investment in these areas is typically limited to essential support, with a long-term strategy leaning towards phasing them out or divesting those product lines entirely.

Discontinued or non-strategic niche modules, often found in the Dogs quadrant of the BCG matrix, represent offerings that cater to a very limited market segment or have been rendered obsolete by advancements. These modules typically exhibit low market share and minimal future growth potential.

These products consume valuable resources for ongoing maintenance and support without delivering significant contributions to the company's overall strategic growth or revenue. For instance, if a software company like Intapp had a specific, highly specialized module for a legacy compliance requirement that is no longer mandated, it would likely be a candidate for the Dogs quadrant.

In 2024, companies are increasingly consolidating their product portfolios, shedding underperforming or non-core assets. This trend means that niche modules with declining user bases, perhaps only a few hundred active clients, are prime candidates for discontinuation to reallocate resources towards more promising, integrated cloud solutions.

The strategic decision to divest or discontinue such modules allows for a sharper focus on high-growth areas, such as Intapp's AI-powered solutions which saw significant adoption in 2024, improving overall operational efficiency and profitability.

Intapp's history likely includes the acquisition of smaller technologies that haven't fully integrated or gained significant market traction. These underperforming assets can be characterized as having low market share within potentially slow-growth segments of the market.

Such acquisitions can become cash traps, consuming resources without generating substantial returns on the initial investment. For example, if a company acquired a niche compliance software in 2022 for $5 million, and by 2024 it's only generating $200,000 in annual revenue with limited growth prospects, it would fit this category.

These technologies represent a drag on profitability and may require further investment to either revitalize or divest. The focus for Intapp would be to identify these underperforming areas and make strategic decisions about their future to optimize resource allocation.

Solutions Competing with Commodity Offerings

If Intapp has solutions that directly compete with readily available, low-cost software, these could be categorized as Dogs in the BCG matrix. This happens when Intapp offers minimal unique value, making it hard to retain customers or grow revenue against cheaper alternatives. For instance, if a core functionality can be easily replicated by many providers, Intapp’s solution might become a commodity.

Such offerings typically experience low growth and possess a small market share. For example, if Intapp's older project management tools were easily replaceable by numerous free or inexpensive online platforms, they might fall into this category. This situation demands careful management, often involving divestment or a significant repositioning to find a niche.

- Market Share and Growth: Solutions in the 'Dog' quadrant have low relative market share and operate in a low-growth market.

- Competitive Landscape: These offerings face intense competition from commodity players, offering basic functionalities at lower price points.

- Differentiation Challenges: Intapp's ability to differentiate these solutions is minimal, leading to price sensitivity among customers.

- Strategic Options: The typical strategies for Dogs include divestiture, harvesting, or focusing on a very specific niche market to avoid direct commodity competition.

Outdated Integrations or Connectors

Integrations or connectors with third-party systems that have fallen out of common use or lack broad market support represent a challenge. These connections, characterized by low demand, require ongoing maintenance without delivering substantial market benefits or fostering growth. For instance, if Intapp's platform previously integrated with a now-defunct proprietary CRM system that only a handful of legacy clients still utilize, this would fall into this category.

These outdated links consume valuable resources. By 2024, businesses are increasingly prioritizing seamless, modern API-driven integrations. Companies that fail to adapt and maintain only legacy connectors risk falling behind competitors who offer more contemporary and widely adopted solutions. This inefficiency can hinder new client acquisition and strain existing client relationships.

Consider these factors for deprecating outdated integrations:

- Low Usage Metrics: Analyze data showing minimal or declining usage of specific connectors. For example, if a particular integration has fewer than 1% of active users by Q4 2024, it signals a need for review.

- Vendor Support Status: Check if the third-party system associated with the integration is still actively supported and updated by its vendor. If support has ended, the integration becomes a liability.

- Market Relevance: Assess whether the functionality provided by the integration is still relevant and sought after in the current market landscape. Many legacy systems have been superseded by more advanced platforms.

- Maintenance Costs vs. Value: Quantify the resources (developer time, testing) spent on maintaining these connectors against the actual business value or revenue they generate. If costs outweigh benefits, deprecation is logical.

Products categorized as 'Dogs' in the BCG Matrix, like Intapp's legacy on-premise solutions, exhibit low market share and operate within slow-growing industries. These offerings often face intense competition from more agile or commoditized alternatives, making differentiation difficult and customer retention challenging. By 2024, Intapp's strategic shift towards cloud and AI-driven solutions means these 'Dogs' are typically candidates for divestiture or minimal investment, focusing resources on higher-potential products.

A prime example would be older, standalone modules designed for specific, now-niche regulatory compliance that have been superseded by broader, integrated cloud platforms. These products, while perhaps still functional for a small user base, do not contribute significantly to revenue growth and incur maintenance costs, thus representing a drag on overall profitability. By Q3 2024, Intapp's investor relations materials consistently highlighted growth in its Connected Client solutions, implicitly signaling a de-emphasis on legacy offerings.

Consider a hypothetical legacy integration connector for a CRM system that was popular in the early 2010s but has since been discontinued by its vendor. If by mid-2024, this connector is only used by less than 0.5% of Intapp's active client base and requires dedicated developer hours for maintenance due to its outdated architecture, it would squarely fit the 'Dog' profile. The strategic decision is often to deprecate such integrations to streamline support and development efforts.

The company's focus in 2024 has been on consolidating its portfolio and divesting non-core assets. This means that any software component with a diminishing user base, perhaps fewer than 500 active clients by the end of the year, and minimal revenue contribution, would be prime for a 'Dog' classification and subsequent strategic review, likely leading to discontinuation.

| Category | Characteristics | Strategic Implications for Intapp (2024) |

| Dogs | Low Market Share, Low Market Growth | Divest, Harvest, or Phase Out |

| Example | Legacy on-premise software, outdated integrations | Minimal new investment, focus on maintenance |

| Financial Impact | Low revenue generation, potential maintenance costs | Resource reallocation to Stars/Question Marks |

Question Marks

Intapp's acquisition of TermSheet in April 2025 marks its strategic move into the real assets sector. This market is experiencing robust digital transformation, offering substantial growth potential.

However, Intapp's current position in this space is still developing, classifying Real Assets Software as a Question Mark within the BCG Matrix. The company's market share is nascent, indicating a need for further development.

Significant capital investment will be essential to build a strong presence and gain leadership in the real assets digital transformation market. Without this, it will remain a Question Mark.

The goal is to transform this nascent market position into a Star. This requires focused strategies and substantial resource allocation to capitalize on the high-growth opportunities presented by digital transformation in real assets.

Intapp's exploration into advanced predictive analytics, extending beyond current client needs, positions these initiatives within the "question marks" of a BCG matrix. These represent areas with high future growth potential but currently low market adoption. For instance, developing AI models to forecast client churn probabilities with over 90% accuracy, or predicting emerging legal trends before they become mainstream, falls into this category. These require significant research and development investment to validate their efficacy and build market demand.

These nascent predictive capabilities, while not yet core revenue drivers, are crucial for Intapp's long-term innovation strategy. Consider the potential of AI to predict the success rate of specific legal strategies based on historical case data, a complex undertaking requiring vast datasets and sophisticated algorithms. In 2024, the market for AI in legal tech is projected to reach $7.6 billion, indicating a growing appetite for advanced solutions, yet these experimental areas are still in their infancy.

Intapp's strategic objective to expand into new geographies suggests that these new market entries, where they currently have low market share, are question marks within the BCG matrix. These markets represent high growth potential if successfully penetrated, but require significant upfront investment in sales, marketing, and localization before generating substantial returns. For instance, Intapp's reported expansion into the Asia-Pacific region in 2023, targeting rapidly growing economies, exemplifies this strategy. While initial adoption may be slow, the long-term outlook for these emerging markets, which saw a projected average GDP growth of 4.5% in 2024 according to IMF data, presents a compelling case for sustained investment.

Next-Generation Generative AI Applications (Beyond Current Offerings)

The next generation of generative AI, moving beyond current content creation, holds immense potential. Think about AI that can autonomously draft complex legal contracts tailored to specific jurisdictions or create sophisticated financial models for highly niche investment strategies. These represent the frontier, pushing the boundaries of what AI can achieve.

While these advanced applications are poised for significant growth, they are still in their nascent stages. The market share for such highly specialized, cutting-edge generative AI is currently minimal, reflecting the early adoption curve. However, the potential for disruption and value creation in these areas is substantial.

- Autonomous Legal Drafting: AI capable of generating complex, context-specific legal documents could see adoption grow significantly in the coming years, moving from pilot programs to broader use cases.

- Niche Financial Modeling: Generative AI specializing in creating highly customized financial forecasts for sectors like renewable energy project finance are emerging, though currently serving small, specialized markets.

- AI-Driven Strategic Decision Support: Advanced AI that can analyze vast datasets to provide strategic recommendations for business planning in complex industries is an area with high future growth potential.

- Personalized Educational Content Generation: AI that can create adaptive learning materials for specialized professional development, moving beyond generic content, represents another frontier application.

Partnerships to Enter Adjacent Verticals/Sub-verticals

Intapp's strategic partnerships, like the one with Snowflake, are designed to unlock advanced analytics capabilities. This collaboration allows Intapp to leverage Snowflake's data cloud for deeper insights, potentially expanding its offerings into new, data-intensive sub-verticals within professional services.

These alliances are crucial for Intapp to penetrate high-growth market segments where its direct presence is minimal. For instance, partnering with specialized consulting firms could open doors to niche areas like sustainability consulting or advanced cybersecurity services, expanding Intapp's addressable market.

Successful client adoption is paramount for these vertical expansions to gain traction. Intapp's ability to demonstrate tangible value and seamless integration of its solutions with partner offerings will be key to scaling in these adjacent markets. As of early 2024, the professional services automation market is experiencing significant growth, with firms actively seeking integrated solutions to manage complex client engagements across diverse service lines.

- Data Analytics Enhancement: Partnerships like the Snowflake integration aim to bolster Intapp’s analytical tools, enabling more sophisticated client insights and operational efficiencies.

- Vertical Expansion Strategy: Collaborations with specialized firms are a deliberate move to capture share in adjacent sub-verticals where Intapp’s current market penetration is low.

- Market Penetration Drivers: These strategic alliances are crucial for Intapp to establish a foothold in new, high-growth segments of the professional services industry.

- Adoption Dependency: The success of these ventures hinges on Intapp’s ability to drive client adoption and showcase the integrated value proposition of its partnerships.

Intapp's nascent ventures into new geographical markets, where its current market share is minimal, represent classic Question Marks. These markets offer substantial growth potential, but require significant upfront investment in sales, marketing, and localization to gain traction. For example, Intapp's 2023 expansion into the Asia-Pacific region, targeting economies with projected average GDP growth of 4.5% in 2024, exemplifies this strategy.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry expert insights to provide strategic clarity.