Intapp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intapp Bundle

Intapp's position within its market is shaped by five critical forces, from the bargaining power of its buyers to the threat of new entrants disrupting its space. Understanding these dynamics is crucial for any stakeholder looking to navigate Intapp's competitive landscape effectively. We've outlined the core pressures, but the real strategic advantage lies in a deeper dive.

The complete report reveals the real forces shaping Intapp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Intapp's dependence on major cloud infrastructure providers such as Microsoft Azure places it in a position of reliance on these powerful vendors. This reliance is a key factor in assessing supplier bargaining power.

The significant switching costs involved in migrating Intapp's substantial cloud infrastructure and associated data to a different provider grant these suppliers considerable leverage. These costs can include data egress fees, re-architecting applications, and retraining IT staff.

The market dominance of leading cloud providers, coupled with the essential nature of their services for Intapp's cloud-based platform, results in these suppliers wielding considerable bargaining power. For instance, in 2024, Microsoft Azure continued to be a top-tier cloud provider, holding a substantial market share, which reinforces its influential position.

Specialized software component vendors can wield significant bargaining power over Intapp. This is particularly true when Intapp relies on unique, critical APIs or libraries to deliver its core functionalities. If these components are highly specialized, with few readily available substitutes, the suppliers of these essential building blocks can command higher prices or dictate terms.

For instance, consider the potential reliance on advanced AI or machine learning libraries. If Intapp's competitive advantage is tied to proprietary algorithms or specialized data processing capabilities, the vendors providing these underlying technologies hold considerable sway. In 2024, the demand for such specialized components, especially in areas like data analytics and workflow automation which are Intapp’s focus, surged, potentially increasing supplier leverage.

The availability of highly skilled professionals, especially in cutting-edge fields like AI and cloud computing, directly impacts Intapp's operational efficiency and innovation capacity. A constrained supply of talent in these areas, particularly those with deep legal and financial services industry knowledge, significantly amplifies the bargaining power of potential employees. This means Intapp might face increased wage demands and more protracted recruitment processes.

Intapp's strategic emphasis on AI-driven solutions makes securing top-tier AI talent a critical factor. As of early 2024, demand for AI specialists continues to outstrip supply, with average salaries for experienced AI engineers often exceeding $150,000 annually in major tech hubs. This scarcity empowers these professionals, forcing companies like Intapp to offer competitive compensation and benefits to attract and retain them.

Data Providers

The bargaining power of data providers for a company like Intapp, which emphasizes applied AI and market intelligence, can be substantial. If Intapp relies on specialized or proprietary datasets crucial for its AI models, those providers gain leverage. For instance, access to unique financial transaction data or specialized legal case information could be highly valuable, making it difficult for Intapp to substitute these sources easily.

The integration of data is key, as seen in Intapp's partnerships. A 2024 report indicated that the market for data integration platforms, which facilitate such partnerships, was projected to grow significantly, highlighting the critical role of data sources in these ecosystems. Companies that can offer clean, well-structured, and exclusive data sets command stronger negotiation positions.

- Data Exclusivity: Providers of unique, proprietary data crucial for AI model training hold significant power.

- Data Quality and Structure: High-quality, easily integrated data reduces Intapp's internal processing costs, enhancing provider leverage.

- Market Dependence: If Intapp's competitive advantage hinges on specific data insights, providers of that data gain considerable bargaining strength.

- Partnership Value: Strategic alliances, like those with cloud data warehousing services, underscore the importance of reliable data infrastructure providers.

Cybersecurity and Compliance Tool Vendors

Cybersecurity and compliance tool vendors can exert significant bargaining power over Intapp, especially given the critical nature of these services for Intapp's clientele in highly regulated sectors. The increasing complexity and stringency of compliance mandates, such as those related to data privacy and financial regulations, necessitate specialized and often certified solutions. This specialization limits the pool of qualified suppliers, thereby concentrating power among them.

For instance, vendors providing advanced threat detection, data encryption, or regulatory reporting software tailored for financial institutions or law firms are likely to command premium pricing and favorable contract terms. The cost and time involved in switching these essential services also contribute to supplier stickiness. In 2024, the cybersecurity market saw continued investment, with spending on compliance solutions projected to grow as regulatory landscapes evolve globally, further solidifying the position of key vendors.

- Specialized Expertise: Vendors offering niche cybersecurity and compliance solutions, crucial for Intapp's target markets, possess unique capabilities that are difficult for Intapp to replicate internally or source elsewhere.

- High Switching Costs: The integration of these tools into Intapp’s platform and its customers’ operations involves significant technical and financial investment, making it costly and disruptive to change suppliers.

- Regulatory Demands: Evolving and stringent regulatory requirements in finance and professional services necessitate reliance on vendors that can guarantee up-to-date compliance and robust security, giving these vendors leverage.

- Market Concentration: In specific segments of the cybersecurity and compliance software market, a limited number of providers may dominate, reducing Intapp's negotiating options and increasing supplier bargaining power.

Intapp's reliance on critical third-party software components, particularly those enabling advanced AI and workflow automation, grants suppliers significant bargaining power. This leverage is amplified when these components are highly specialized and lack readily available substitutes, allowing vendors to dictate terms and pricing.

The scarcity of specialized AI talent, a crucial element for Intapp's strategic direction, also empowers these professionals. With demand consistently outpacing supply in 2024, Intapp faces increased wage pressures and protracted recruitment cycles, underscoring the bargaining strength of skilled individuals in this domain.

Vendors providing proprietary data essential for Intapp's AI models and market intelligence capabilities hold considerable sway. The unique value and integration challenges associated with these datasets contribute to their strong negotiating position.

Key cloud infrastructure providers, such as Microsoft Azure, continue to wield substantial bargaining power due to their market dominance and the high switching costs associated with migrating Intapp's extensive cloud operations.

| Factor | Impact on Intapp | 2024 Data/Context |

| Cloud Infrastructure Providers | High Bargaining Power due to Market Dominance and Switching Costs | Microsoft Azure, a leading provider, maintained a significant market share in 2024. |

| Specialized Software Components | Supplier Leverage due to Uniqueness and Lack of Substitutes | Demand for AI/ML libraries, critical for Intapp's focus, surged in 2024. |

| AI Talent Market | Empowerment of Professionals due to Scarcity | AI engineer salaries in tech hubs often exceeded $150,000 annually in early 2024. |

| Data Providers | Significant Leverage from Proprietary and Critical Datasets | The data integration platform market showed strong projected growth in 2024. |

What is included in the product

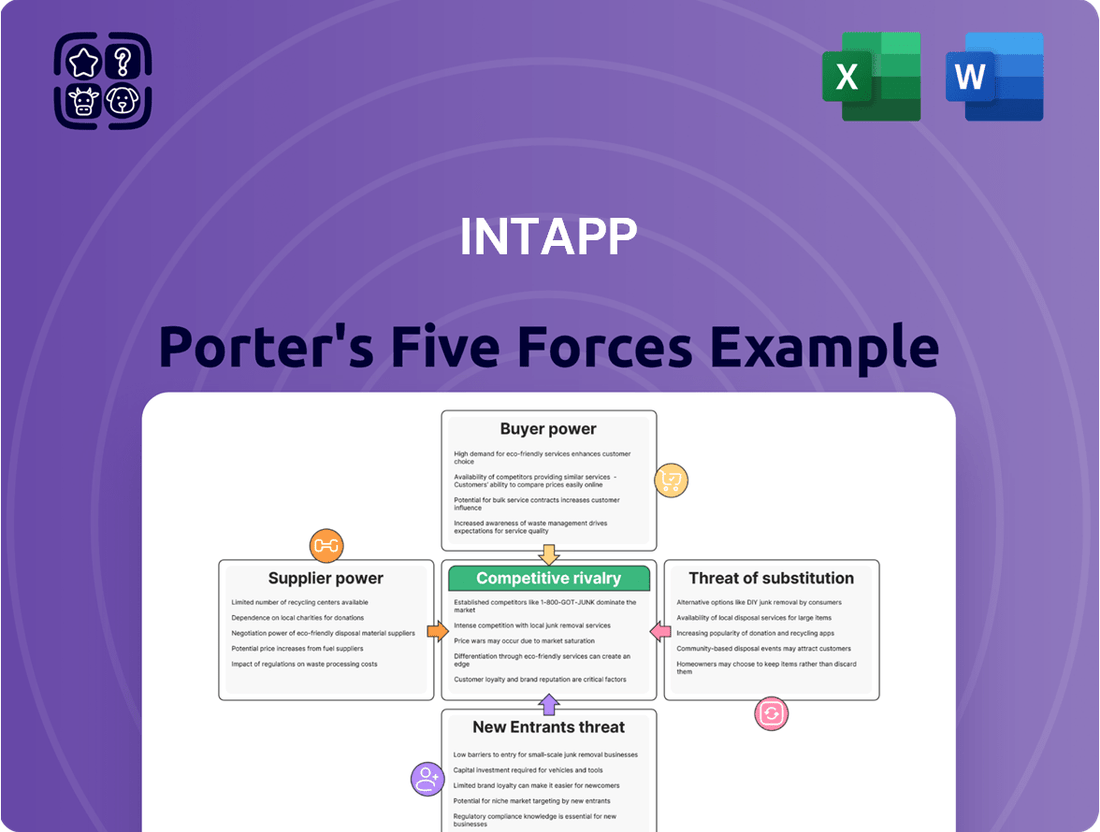

Intapp's Porter's Five Forces analysis details the competitive intensity within its market, examining threats from new entrants, the power of buyers and suppliers, and the availability of substitutes.

Visually map competitive pressures with a dynamic, interactive dashboard—making complex market dynamics easily digestible for strategic planning.

Customers Bargaining Power

Intapp's core offerings are intricately woven into the daily operations of professional services firms, touching everything from client interactions to deal execution and regulatory adherence. This deep integration means that switching to a competitor isn't a simple matter of changing software; it involves substantial operational upheaval, complex data migration, and extensive employee re-training, effectively locking in existing customers.

Consequently, the bargaining power of Intapp's customers is significantly diminished. The sheer effort and cost associated with migrating away from Intapp's deeply embedded solutions make it an unattractive proposition for most firms. This high barrier to switching is a critical factor in maintaining Intapp's competitive position.

Intapp's software is not just a helpful tool; it's essential for the day-to-day operations of many professional services firms. Its ability to streamline client lifecycle management and ensure compliance with evolving regulations makes it a core component for efficiency and profitability, not an optional add-on. This deep integration means clients are highly reliant on Intapp's platforms to manage their business effectively.

Intapp's client base, exceeding 2,650 firms, includes many large enterprises. While this breadth is positive, if a significant portion of Intapp's revenue comes from a small number of these major clients, those clients could wield considerable bargaining power. This concentration means these key customers can potentially negotiate for more favorable pricing or terms.

Professional services firms, Intapp's core market, are typically highly sophisticated buyers. They possess a deep understanding of their operational needs and often have robust procurement processes. This sophistication translates into strong negotiation skills, allowing them to effectively press for tailored solutions or advantageous contract conditions.

Cloud Net Revenue Retention Rate

Intapp's impressive cloud net revenue retention rate of 119% as of March 31, 2025, directly counters the bargaining power of its customers. This metric signifies that not only are customers staying with Intapp, but they are also increasing their spending with the company. This high retention rate suggests deep customer loyalty and satisfaction with Intapp's solutions.

When customers are deriving increasing value and are expanding their usage, their motivation to switch to competitors diminishes significantly. This reduces their leverage to negotiate lower prices or demand more favorable terms. Intapp's ability to consistently grow revenue from its existing customer base is a strong indicator of its product stickiness.

- Customer Value: Intapp's 119% net revenue retention rate demonstrates that customers find substantial and growing value in its cloud offerings.

- Upselling and Cross-selling Success: This rate reflects Intapp's effectiveness in selling additional products or services to its current client base.

- Reduced Incentive to Switch: High retention limits customers' desire to explore or switch to alternative solutions, thereby weakening their bargaining power.

- Increased Customer Loyalty: The strong retention numbers point to a high degree of customer satisfaction and commitment to the Intapp platform.

Industry-Specific Customization Needs

Intapp's strength lies in its industry-specific solutions for sectors like legal, accounting, and consulting. However, these very specializations can empower customers. If a firm has unique requirements that Intapp must meet to secure or keep their business, it can amplify that customer's bargaining power.

This dynamic is particularly relevant as businesses increasingly seek deeply integrated technology. For instance, in 2024, many professional services firms are prioritizing workflow automation that aligns precisely with their established processes. When a significant client demands extensive customization for their Intapp platform, it can create leverage for that client.

- Specialized Software: Intapp’s tailored offerings for legal, accounting, and consulting create dependencies.

- Customization Demands: Unique client needs can drive requests for bespoke features.

- Client Leverage: A willingness by Intapp to customize extensively for a key client increases that client's bargaining power.

- Industry Trends: The 2024 push for hyper-personalized business software exacerbates this.

Intapp's high cloud net revenue retention rate of 119% as of March 31, 2025, significantly dampens customer bargaining power. This metric indicates not only customer retention but also increased spending by existing clients, highlighting their satisfaction and reliance on Intapp's solutions.

This strong retention reduces customers' inclination to explore competitors, thereby limiting their leverage to negotiate for lower prices or more favorable terms.

While Intapp serves many large enterprise clients, the potential for a few major clients to hold significant bargaining power exists, especially if they represent a substantial portion of revenue. These key clients can leverage their importance to negotiate better pricing or contract conditions.

The sophisticated nature of Intapp's clients in the professional services sector means they understand their needs well and possess strong negotiation skills, which can be used to secure tailored solutions or advantageous contract terms.

| Metric | Value (as of March 31, 2025) | Impact on Customer Bargaining Power |

|---|---|---|

| Cloud Net Revenue Retention Rate | 119% | Significantly Lowers; indicates increasing client value and reduced incentive to switch. |

| Number of Firms Served | Over 2,650 | Diversified base, but concentration among large clients could increase their leverage. |

Same Document Delivered

Intapp Porter's Five Forces Analysis

This preview showcases the comprehensive Intapp Porter's Five Forces Analysis you will receive. The document displayed here is the exact file, fully formatted and ready for immediate download after your purchase. You're not seeing a sample; what you preview is precisely the professional analysis you'll gain access to. This detailed examination of Intapp's competitive landscape is delivered in its entirety, ensuring no surprises or missing sections. Upon completing your purchase, you'll get instant access to this complete, ready-to-use document.

Rivalry Among Competitors

The market Intapp operates in is quite fragmented, meaning there are many companies vying for business. Think of it like a pie with lots of slices, and each slice represents a different software provider. While Intapp has carved out a substantial piece for itself, especially in its key areas, the sheer number of competitors, reportedly around 135 active ones, highlights this broad distribution of market share.

Intapp's aggressive push into AI and cloud solutions directly fuels competitive rivalry. By positioning itself as an AI leader, Intapp compels other players in its served industries to accelerate their own AI investments. This creates a dynamic where companies are in a constant race to develop and deploy cutting-edge AI capabilities to avoid falling behind.

This intensified focus means that innovation in AI is no longer a niche differentiator but a table-stakes requirement. Competitors are pouring resources into R&D, aiming to offer superior AI-powered functionalities, which in turn drives up the pace of technological advancement across the sector. For instance, the overall spend on AI in enterprise software is projected to grow substantially, with many industry reports anticipating double-digit annual growth rates through 2024 and beyond, reflecting this competitive pressure.

Intapp's competitive rivalry is significantly shaped by its product differentiation and specialization. The company focuses on industry-specific, cloud-based solutions and 'Applied AI' for professional and financial services. This targeted approach allows Intapp to cater to unique client needs and complex regulatory environments, thereby mitigating direct price competition from broader software providers.

This specialization is crucial. For instance, in 2024, many professional services firms faced increasing pressure to comply with evolving data privacy regulations. Intapp's tailored solutions, designed with these specific compliance requirements in mind, offer a distinct advantage over generic software that may not adequately address these critical operational aspects, thus lessening the intensity of direct head-to-head price wars.

Customer Switching Costs as a Barrier

High customer switching costs significantly deter new entrants and existing rivals from aggressively targeting Intapp's client base. Intapp's impressive cloud net revenue retention rate of 119% for the fiscal year ending June 30, 2023, underscores the sticky nature of its platform and the embedded value clients derive from its services. This metric indicates that existing customers are not only staying but also expanding their usage, making it costly and disruptive for them to transition to a competitor.

This stickiness directly reduces competitive rivalry by making it harder for rivals to acquire Intapp's installed base. When clients are deeply integrated into Intapp's solutions, the effort and expense involved in migrating data, retraining staff, and re-establishing workflows create a substantial barrier. Consequently, competitors must offer a demonstrably superior value proposition or significantly lower costs to overcome these entrenched switching costs.

- High Cloud Net Revenue Retention: Intapp's cloud net revenue retention rate reached 119% for the fiscal year ending June 30, 2023, illustrating strong customer loyalty and expansion.

- Barrier to Entry: The significant costs and effort associated with switching platforms make it difficult for competitors to attract Intapp's existing clients.

- Reduced Rivalry Intensity: This high retention rate acts as a moat, lessening the pressure from rivals seeking to gain market share by poaching Intapp's customer base.

Acquisitions and Partnerships as Competitive Strategy

Intapp's competitive strategy heavily features acquisitions and partnerships. The acquisition of TermSheet in April 2025 is a prime example, aimed at broadening Intapp's market reach and enhancing its solution suite, especially within emerging sectors like real assets.

These strategic moves are crucial for staying ahead. By integrating new capabilities and accessing new markets, Intapp directly addresses competitive pressures and strengthens its overall market position.

Furthermore, Intapp cultivates strategic partnerships to bolster its ecosystem. Collaborations with firms like Pitchly and Bite Investments are designed to create a more robust and interconnected offering, thereby improving its competitive standing.

- Intapp acquired TermSheet in April 2025 to expand into real assets.

- Partnerships with Pitchly and Bite Investments strengthen Intapp's ecosystem.

- These actions highlight Intapp's proactive approach to competitive rivalry.

The competitive landscape for Intapp is characterized by a large number of players, estimated at around 135 active competitors. This fragmentation means market share is widely distributed, intensifying the race for dominance.

Intapp's strategic focus on AI and cloud solutions directly escalates rivalry, pushing competitors to invest heavily in similar technologies to remain competitive. This creates a rapid innovation cycle where staying ahead technologically is paramount.

Intapp differentiates itself through specialized, industry-specific cloud solutions, particularly for professional and financial services. This targeted approach, exemplified by its handling of evolving data privacy regulations in 2024, reduces direct price-based competition from broader software providers.

Customer stickiness, evidenced by a 119% cloud net revenue retention rate for FY23, significantly dampens rivalry by creating high switching costs for clients, making it difficult for competitors to poach Intapp's established customer base.

| Metric | Value | Significance |

|---|---|---|

| Number of Active Competitors | ~135 | High market fragmentation, intense rivalry. |

| Cloud Net Revenue Retention (FY23) | 119% | Strong customer loyalty, high switching costs, reduced rivalry intensity. |

| AI Investment Trend | Double-digit annual growth projected | Intensified competition in innovation and technology deployment. |

SSubstitutes Threaten

Large professional and financial services firms, particularly those with substantial IT budgets like many major law firms or investment banks, can choose to build their own software. This in-house development offers unparalleled control over customization and data security, directly competing with Intapp's integrated solutions. For instance, a top-tier global law firm might allocate tens of millions of dollars annually to IT, making custom development a viable, albeit resource-intensive, alternative.

Even with advancements, some businesses, especially smaller ones or those hesitant to adopt new technology, continue to use manual processes for client management and deal tracking. These methods, while familiar, are generally less efficient than integrated software solutions.

For instance, many smaller legal or accounting firms might still rely on spreadsheets and paper-based filing systems. A 2024 survey indicated that approximately 30% of small businesses with under 20 employees still use primarily manual methods for client onboarding, highlighting the persistent presence of these substitutes.

These traditional approaches act as a substitute to more sophisticated, integrated platforms like Intapp, offering a lower-cost, albeit less capable, alternative. The reliance on these methods is often driven by perceived cost savings or a lack of perceived need for advanced digital tools.

Firms might try to use general-purpose software like CRM or project management tools from large providers such as SAP or Salesforce as an alternative to Intapp's specialized offerings. These widespread platforms can seem more cost-effective or familiar to users, potentially reducing the perceived need for niche solutions.

While these general tools may require significant customization to meet specific business needs, their broad availability and established ecosystems can be attractive. For instance, many businesses already have existing investments and training in platforms like Microsoft Dynamics or Oracle, which could be adapted, albeit with limitations.

The threat here is that if these general solutions become robust enough or if companies are willing to accept a less perfect fit, they could bypass Intapp's more specialized, and potentially more expensive, products. This is particularly relevant in 2024 as businesses continue to scrutinize IT spending for cost efficiencies.

Consulting Services for Process Optimization

Firms may opt for management consultants to refine existing workflows rather than adopting new software solutions for process optimization. This strategy leverages current technology and expertise to achieve efficiency and compliance goals. For instance, in 2024, many organizations focused on internal process improvements, with the global management consulting market expected to grow, reflecting this trend.

These consulting services act as a viable substitute by offering process re-engineering and best practice implementation, thereby mitigating the need for substantial software capital outlay. Such engagements can deliver comparable benefits in terms of operational streamlining and regulatory adherence.

- Alternative Solution Consultants offer expertise to improve existing processes, bypassing new software purchases.

- Cost-Effectiveness This approach can be more budget-friendly than significant software investments.

- Focus on Efficiency The goal remains enhanced operational efficiency and compliance.

- Market Trend (2024) Increased demand for consulting services focused on process optimization highlights this substitute's relevance.

Bundled Solutions from Large Tech Companies

Major tech giants, like Microsoft with its Dynamics 365 or Salesforce with its broader ecosystem, offer integrated suites that can serve as substitutes. These platforms often combine CRM, project management, and communication tools, providing a cost-effective option for professional services firms. For instance, Microsoft reported over 300 million commercial seats for Microsoft Teams in 2023, highlighting the widespread adoption of bundled productivity solutions.

While these general-purpose bundles may lack the deep industry-specific functionality of Intapp's specialized solutions, they can appeal to firms prioritizing a unified, cost-efficient platform. This can lead to a trade-off for some firms, accepting less specialized features in exchange for a lower overall technology spend. The threat is particularly potent for smaller firms or those with less complex operational needs.

Consider the following aspects of bundled solutions as substitutes:

- Cost Advantage: Bundled solutions often present a lower entry price compared to integrating multiple specialized software products.

- Integration Simplicity: Major tech companies invest heavily in seamless integration within their own product suites, reducing implementation headaches.

- Broad Functionality: While not always deep, these bundles offer a wide range of common business functionalities that can meet basic needs.

- Market Dominance: The established user bases and extensive marketing power of large tech firms make their bundled offerings highly visible and accessible.

The threat of substitutes for Intapp's offerings is significant, encompassing everything from in-house development to manual processes and broader software suites. Major tech players like Microsoft and Salesforce provide integrated solutions that, while less specialized, offer a cost-effective alternative for many firms. Even management consultants can act as substitutes by optimizing existing workflows, reducing the perceived need for new software. By 2024, businesses are increasingly scrutinizing IT spend, making these more budget-friendly or process-focused alternatives particularly appealing.

| Substitute Category | Description | Key Appeal | 2024 Relevance/Data Point |

|---|---|---|---|

| In-house Development | Firms build custom software solutions. | Full control, tailored security. | Top-tier law firms with IT budgets in the tens of millions may consider this. |

| Manual Processes | Reliance on spreadsheets, paper, and traditional methods. | Low initial cost, familiarity. | ~30% of small businesses (<20 employees) still use primarily manual client onboarding (2024 survey). |

| General-Purpose Software Suites | Integrated platforms from major tech providers (e.g., Microsoft Dynamics, Salesforce). | Cost-effectiveness, broad functionality, simpler integration. | Microsoft Teams had over 300 million commercial seats in 2023. |

| Management Consulting | Process optimization and workflow refinement by external experts. | Leverages existing technology, cost-effective compared to new software. | Global management consulting market growth reflects increased focus on internal process improvements in 2024. |

Entrants Threaten

The threat of new entrants into the enterprise software market, particularly for solutions like those offered by Intapp, is significantly mitigated by the immense capital requirements. Developing and maintaining sophisticated, cloud-based software, especially with advanced AI capabilities, demands substantial upfront investment in research and development, robust infrastructure, and specialized talent. For instance, major players in the SaaS space, like Salesforce, consistently invest billions annually in R&D, with their 2024 fiscal year R&D spend reaching approximately $4.2 billion. This high barrier to entry deters many potential competitors.

Intapp's focus on highly regulated industries like legal and accounting presents a formidable barrier to new entrants. These sectors demand intricate knowledge of specific workflows, compliance mandates, and ethical considerations, which are difficult and time-consuming to acquire. For instance, the legal industry alone is projected to reach $711 billion in 2024, underscoring the complexity and value of specialized knowledge.

Intapp's deep integration with a substantial portion of the leading professional services firms, many of whom boast retention rates exceeding 90%, presents a formidable hurdle for newcomers. This loyalty is fueled by the embedded nature of Intapp's solutions within daily operations.

The network effects generated by Intapp's platform are a critical barrier. As more firms adopt Intapp, the value proposition for existing and potential users grows, making it increasingly difficult for new entrants to offer a comparable level of interconnectedness and data utilization.

These established client relationships are not easily replicated. New entrants would need to invest heavily in building trust and demonstrating superior value to displace Intapp from firms that have relied on its services for years, often across multiple departments.

Technological Complexity and Data Advantages

The threat of new entrants into Intapp's market is significantly mitigated by the technological complexity and data advantages inherent in its offerings. Intapp's proprietary 'Intelligent Cloud' platform, powered by its 'Applied AI' capabilities, represents a sophisticated and deeply integrated technological stack. This complexity makes it exceedingly difficult and time-consuming for new players to replicate the same level of functionality and performance quickly.

Furthermore, Intapp has cultivated a substantial data advantage. Having served thousands of professional services firms, the company has amassed a vast repository of industry-specific data and insights. This accumulated intelligence, refined through years of application and learning, provides a significant barrier to entry. New entrants would face an uphill battle to gather and process comparable data sets, which are crucial for developing effective AI-driven solutions in this niche.

- Technological Depth: Intapp's 'Intelligent Cloud' platform showcases a high degree of technological sophistication, requiring substantial investment and expertise to replicate.

- AI Integration: The 'Applied AI' component within the platform is not easily reverse-engineered or quickly developed by competitors.

- Data Network Effects: Intapp benefits from network effects where more data leads to better AI, creating a virtuous cycle that new entrants cannot easily disrupt.

- Industry Data Advantage: The sheer volume and specificity of data collected from thousands of client firms give Intapp a unique insight into professional services workflows that new entrants lack.

Challenges in Sales and Distribution

Establishing effective sales and distribution channels to reach and acquire large professional and financial services firms presents a significant hurdle for new entrants. These markets require specialized knowledge and established relationships, making it difficult for newcomers to gain traction. For instance, in 2024, the average sales cycle for enterprise software targeting financial institutions often exceeded nine months, underscoring the time and resources needed to build trust and secure deals.

Building credibility and a dedicated direct sales force capable of navigating complex procurement processes in these sectors is a substantial barrier. Many established firms have long-standing relationships with vendors, making it challenging for new players to displace them. The development of a robust partner ecosystem, essential for broader market reach, also demands considerable investment and time, further deterring potential entrants.

- High Customer Acquisition Costs: Acquiring new clients in the professional and financial services sectors is expensive, with reported customer acquisition costs for enterprise software solutions sometimes reaching hundreds of thousands of dollars.

- Long Sales Cycles: The typical sales cycle for software targeting these industries often spans 9-18 months, requiring sustained sales efforts and significant upfront investment.

- Need for Specialized Sales Teams: Companies need highly trained sales professionals who understand the nuances of financial services and professional firm operations.

- Partner Ecosystem Development: Building a network of implementation partners and resellers takes time and strategic effort, often requiring financial incentives and co-marketing initiatives.

The threat of new entrants for Intapp is considerably low due to substantial barriers. These include the high capital investment needed for developing sophisticated AI-driven enterprise software and the intricate, specialized knowledge required for regulated industries like legal and accounting. Intapp's established client relationships and the network effects of its platform further solidify its market position, making it difficult for newcomers to gain a foothold.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Developing advanced SaaS with AI demands billions in R&D and infrastructure. Salesforce, for example, spent approximately $4.2 billion on R&D in fiscal year 2024. | High barrier due to immense upfront costs. |

| Industry Specialization | Deep understanding of legal and accounting workflows and compliance is essential. The legal industry alone is valued at $711 billion in 2024. | New entrants struggle to acquire the necessary domain expertise. |

| Customer Loyalty & Integration | Intapp's solutions are deeply embedded, with over 90% retention rates in many firms. | Displacing established vendors requires significant effort and value proposition. |

| Network Effects | Increased user adoption enhances the platform's value, creating a data advantage. | New entrants face a disadvantage in data depth and connectivity. |

Porter's Five Forces Analysis Data Sources

Our Intapp Porter's Five Forces analysis leverages a comprehensive mix of public company filings, industry-specific market research reports, and expert interviews with sector analysts to ensure a robust and accurate assessment of competitive dynamics.