Intapp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intapp Bundle

Curious about the engine driving Intapp's success in the professional services sector? Our comprehensive Business Model Canvas breaks down exactly how they create, deliver, and capture value.

This in-depth analysis reveals Intapp's key customer segments, their unique value propositions, and the strategic partnerships that fuel their growth.

Understand their revenue streams, cost structures, and the critical resources and activities that underpin their operations.

Whether you're a business strategist, investor, or aspiring entrepreneur, this canvas provides a clear, actionable blueprint.

Unlock the full strategic blueprint behind Intapp's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Intapp's strategic alliances with technology giants like Microsoft are foundational to its cloud-based service delivery. These partnerships enable seamless integration of Intapp's solutions, such as DealCloud, with widely used platforms like Microsoft 365, fostering a more unified workflow for professional services firms.

Through these collaborations, Intapp benefits from co-innovation, driving the development of advanced features and ensuring its platforms remain at the forefront of technological capabilities. This synergy is crucial for delivering a superior user experience and maintaining robust compliance standards within the highly regulated professional services sector.

Intapp's strategic partnerships with data intelligence firms, such as Gain.pro and Pitchly, are fundamental to enhancing its DealCloud platform. These collaborations ensure Intapp clients gain access to extensive private market intelligence, a critical component in today's competitive landscape.

By integrating data from these providers, Intapp DealCloud clients can significantly streamline their content generation processes. This provides a unified, reliable source for identifying deal opportunities and creating impactful client-facing materials, consolidating essential information for better decision-making.

Intapp leverages a robust network of implementation and consulting partners to ensure clients successfully adopt its sophisticated software. This ecosystem includes specialists in modern architecture design and software deployment, especially within Microsoft 365 environments. The recent acquisition of Transform Data International (TDI) further strengthens this capability, bringing deep expertise in data integration and transformation essential for Intapp's solutions.

Strategic Acquisition Targets

Intapp actively engages in strategic acquisitions, a key partnership strategy to bolster its offerings. For instance, the acquisition of delphai in late 2023 significantly advanced Intapp's AI capabilities, particularly in areas like generative AI for professional services. This move not only integrated cutting-edge technology but also brought in specialized talent, enhancing Intapp's competitive edge.

Further demonstrating this approach, Intapp acquired TermSheet, a company focused on deal management for private capital markets. This acquisition expands Intapp's reach into adjacent markets, specifically commercial real estate, by providing tools for deal lifecycle management. These strategic integrations are designed to accelerate Intapp's growth and broaden its market presence.

These partnerships through acquisition are crucial for Intapp's business model because they:

- Accelerate AI and data integration: Bringing in specialized AI and data management technologies from companies like delphai.

- Expand market reach: Entering new verticals such as commercial real estate through platforms like TermSheet.

- Acquire valuable talent and IP: Onboarding skilled teams and proprietary technology that would be time-consuming to develop internally.

- Enhance product capabilities: Offering a more comprehensive suite of solutions to existing and new clients.

Industry Associations and Alliances

Intapp actively collaborates with key industry associations and alliances to enhance its market presence and promote its 'Connected Firm' strategy. These partnerships are crucial for staying abreast of industry trends and driving wider adoption of its solutions.

Participation in events, such as the CIO Leadership Summit with Microsoft, allows Intapp to connect directly with its target audience and showcase its technological advancements. These engagements are vital for fostering relationships and understanding evolving client needs.

These strategic alliances also open doors for co-marketing and co-selling opportunities, directly contributing to new revenue streams and market penetration. For example, in 2024, Intapp reported significant growth in partner-led initiatives.

- Industry Leadership: Collaborations with bodies like the Legal Marketing Association (LMA) and the Association of Corporate Counsel (ACC) position Intapp as a thought leader.

- Event Sponsorships: Sponsoring events such as ILTACON and Tech Show London in 2024 provides high-visibility platforms.

- Technology Integration: Alliances with technology providers, including Microsoft Azure and Salesforce, ensure seamless integration and expand Intapp's ecosystem.

- Market Expansion: These partnerships facilitate entry into new geographic markets and professional service sectors.

Intapp's key partnerships are critical for expanding its technological capabilities and market reach. Collaborations with major cloud providers like Microsoft are central to delivering its integrated solutions. Strategic acquisitions, such as delphai for AI and TermSheet for deal management, have significantly enhanced its product suite and market presence, particularly in 2023 and 2024.

These partnerships extend to data intelligence firms, like Gain.pro, which enrich platforms such as DealCloud by providing essential private market data. Furthermore, Intapp cultivates a network of implementation partners to ensure successful client adoption of its software, especially within the Microsoft 365 ecosystem.

Intapp's engagement with industry associations and event sponsorships, including participation in 2024 events like Tech Show London, reinforces its market position and fosters strategic relationships. These alliances are vital for driving innovation and expanding its 'Connected Firm' strategy across professional services.

What is included in the product

A detailed breakdown of Intapp's strategy, mapping out its core business components from customer relationships to revenue streams.

Intapp's Business Model Canvas provides a structured approach to identify and address inefficiencies by visualizing key business elements.

It acts as a pain point reliever by offering a clear, actionable framework to pinpoint and resolve operational bottlenecks.

Activities

Intapp's core activity revolves around relentless research and development, pushing the boundaries of its AI-powered cloud solutions for professional and financial services. This commitment fuels the creation of groundbreaking features, such as Intapp Assist, designed to streamline workflows and provide intelligent assistance. The company actively invests in integrating cutting-edge AI to automate complex tasks and deliver actionable, data-driven insights to its clients.

A significant portion of their development effort is dedicated to enhancing existing platforms and innovating new ones. For instance, the launch of DealCloud Activator exemplifies their focus on driving efficiency and intelligence within deal management processes. This continuous innovation ensures Intapp remains at the forefront of technology, offering clients competitive advantages through advanced capabilities.

Intapp’s sales and marketing efforts are geared towards penetrating niche markets like legal, accounting, and consulting, aiming to onboard new clients. The company actively showcases how its specialized software solves unique industry challenges, a crucial step in acquiring customers.

Direct sales teams are fundamental, working to secure deals, while co-selling with strategic partners expands Intapp's reach. This dual approach is vital for driving market penetration and client acquisition in its target sectors.

For instance, during the first quarter of fiscal year 2024, Intapp reported a 14% increase in total revenue compared to the previous year, highlighting the effectiveness of its sales and marketing strategies in expanding its customer base.

Intapp's commitment to customer success is a cornerstone of its business, evident in its high net revenue retention. The company actively provides robust customer support and professional services to ensure clients fully leverage their solutions. Ongoing client success initiatives are designed to maximize value, which in turn fuels upsell opportunities and strengthens client relationships.

Platform Maintenance and Cloud Operations

Intapp's platform maintenance and cloud operations are critical to delivering reliable services. This involves the constant upkeep of their secure, cloud-based infrastructure, aiming for a high level of availability. Think of it as keeping the lights on and the doors open for all their clients, ensuring uninterrupted access to essential tools.

A core focus is maintaining a 99.99% uptime, which is crucial for professional services firms that rely on Intapp for their daily operations. This commitment means actively managing the underlying cloud resources and implementing robust security measures to protect sensitive client data. For instance, in the first half of 2024, Intapp reported exceeding its uptime targets, a testament to their operational diligence.

- Infrastructure Management: Overseeing and optimizing cloud servers, storage, and networking.

- Data Security: Implementing and enforcing stringent security protocols to safeguard client information.

- Performance Optimization: Continuously fine-tuning the platform for speed and efficiency.

- Disaster Recovery: Ensuring business continuity through comprehensive backup and recovery plans.

Strategic Mergers and Acquisitions

Intapp actively pursues strategic mergers and acquisitions to enhance its technological capabilities and market presence. This involves a consistent assessment of potential targets, particularly those with innovative solutions in artificial intelligence and data analytics, aligning with their growth objectives. For instance, in 2024, Intapp continued its focus on integrating advanced AI features across its platform. This inorganic growth strategy significantly bolsters their research and development initiatives, enabling faster innovation and market penetration than organic growth alone.

Key activities within strategic mergers and acquisitions for Intapp include:

- Target Identification and Due Diligence: Continuously scanning the market for companies that offer synergistic technologies or market access, followed by rigorous financial and operational vetting.

- Deal Structuring and Negotiation: Crafting acquisition agreements that align with Intapp's financial goals and strategic priorities, ensuring favorable terms.

- Integration Planning and Execution: Developing and implementing comprehensive plans to seamlessly merge acquired entities, technologies, and teams into the existing Intapp ecosystem.

- Post-Acquisition Performance Monitoring: Tracking the success of acquisitions against predefined metrics, ensuring they deliver the expected value and contribute to overall business objectives.

Intapp’s key activities center on developing and enhancing its AI-powered cloud solutions for professional and financial services. This involves continuous research and development to integrate cutting-edge AI, creating features like Intapp Assist to streamline workflows and automate complex tasks. The company also focuses on expanding its market reach through direct sales and strategic partnerships, as demonstrated by a 14% revenue increase in Q1 FY2024. Crucially, Intapp prioritizes customer success through robust support and ongoing engagement to maximize client value and foster upsell opportunities.

Intapp's operational backbone involves maintaining its secure cloud infrastructure with a commitment to high availability, exemplified by exceeding uptime targets in early 2024. Strategic mergers and acquisitions are also a core activity, aimed at acquiring innovative technologies, particularly in AI and data analytics, to accelerate growth and market penetration.

| Key Activity | Focus | Example/Data Point |

|---|---|---|

| Research & Development | AI-powered cloud solutions | Intapp Assist for workflow streamlining |

| Sales & Marketing | Market penetration and client acquisition | 14% revenue increase in Q1 FY2024 |

| Customer Success | Maximizing client value and retention | High net revenue retention |

| Infrastructure Management | Cloud operations and data security | Exceeding uptime targets in early 2024 |

| Mergers & Acquisitions | Technology enhancement and market expansion | Focus on AI and data analytics acquisitions in 2024 |

Preview Before You Purchase

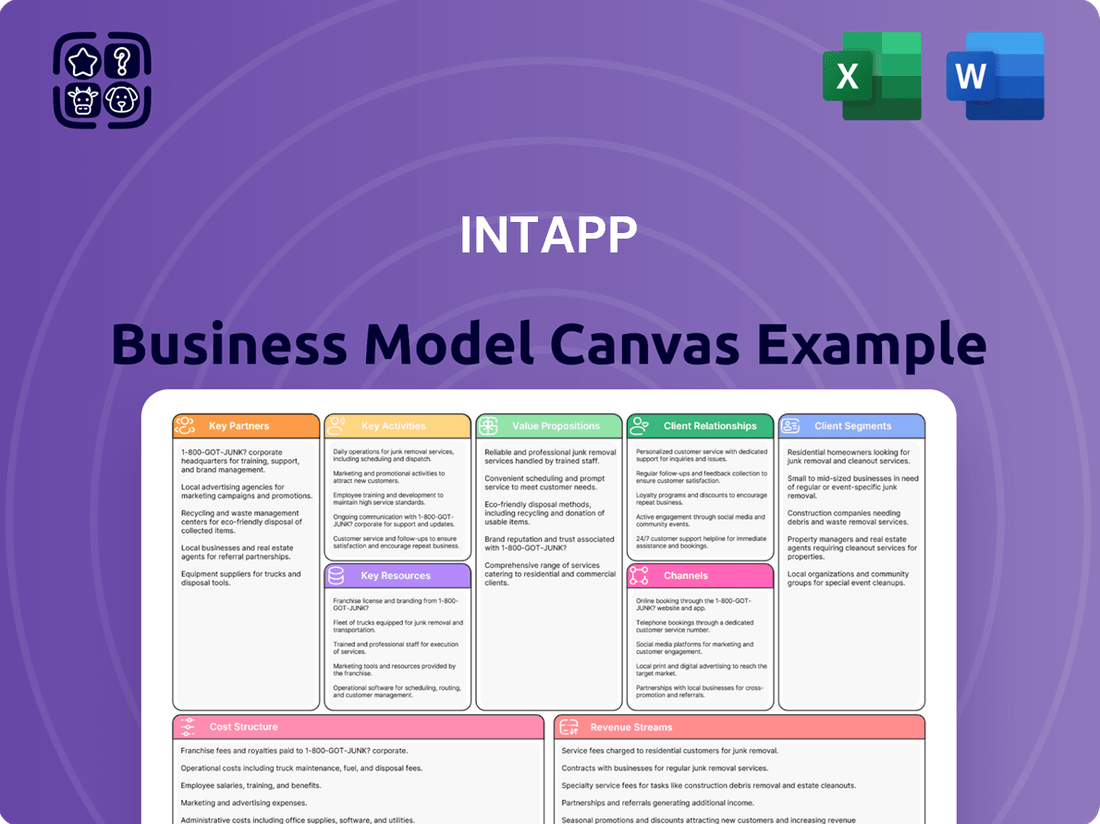

Business Model Canvas

The Intapp Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means no altered samples or mockups are presented; you are seeing the actual, ready-to-use file. Once your transaction is complete, you will gain full access to this comprehensive Business Model Canvas, formatted and structured precisely as displayed here, ensuring you get exactly what you expect for your strategic planning needs.

Resources

Intapp's core strength lies in its specialized, cloud-based software, notably DealCloud, which forms its primary proprietary resource. This platform, along with its underlying intellectual property, is a critical asset. This IP includes unique data models and patented algorithms designed specifically for the intricate needs of professional and financial services firms.

The value of this proprietary software and IP is substantial, enabling Intapp to offer tailored solutions. For instance, in 2024, the company continued to invest heavily in R&D, enhancing its AI capabilities within DealCloud to provide deeper insights for deal sourcing and client relationship management.

Intapp's most valuable asset is its human capital, a diverse team of highly skilled professionals. This includes top-tier software engineers, AI specialists, data scientists, and seasoned industry experts who drive innovation and product development.

The company also relies on its dedicated sales and customer success teams to build and maintain strong client relationships. These teams are crucial for understanding market needs and ensuring client satisfaction, a cornerstone of Intapp's service-oriented model.

In 2023, Intapp strategically bolstered its AI capabilities through acquisitions like delphai, which integrated specialized AI talent directly into its operations. This move underscores Intapp's commitment to leveraging advanced technology through human expertise.

This specialized talent pool is not just about numbers; it's about the collective intelligence and domain knowledge that enables Intapp to deliver sophisticated solutions in the professional services sector.

Intapp leverages a robust cloud infrastructure, primarily Microsoft Azure, to power its Software-as-a-Service (SaaS) offerings, ensuring scalability and security for its global clientele. This strategic choice allows Intapp to efficiently manage and process millions of daily transactions, a critical function for its industry-specific solutions.

The company’s reliance on Azure means it can offer high-performance applications that handle vast quantities of sensitive client and market data. In 2024, cloud spending by businesses continued to rise, with Microsoft Azure consistently being a top choice for enterprises seeking reliable and advanced cloud services, underscoring Intapp's strategic alignment with market trends.

Extensive Client Data and Industry Intelligence

Intapp's core strength lies in its ability to aggregate and analyze vast amounts of client data and industry intelligence. This rich dataset fuels its AI-powered solutions, transforming raw information into actionable insights for professional services firms.

The platform's capacity to integrate proprietary client information with external market data creates a unique competitive advantage. This comprehensive view allows for more effective relationship management, improved deal sourcing, and better strategic decision-making.

- Data Aggregation: Intapp processes client interactions, firm data, and market trends.

- AI-Driven Insights: This data is used to generate predictive analytics for business development and client service.

- Enhanced Decision Making: Firms leverage this intelligence to identify opportunities and mitigate risks.

- Industry Benchmarking: Access to aggregated, anonymized industry data allows for performance comparisons.

Brand Reputation and Established Client Base

Intapp's brand reputation as a premier provider of integrated cloud solutions for professional and financial services is a cornerstone of its business model. This strong market standing is directly linked to its ability to attract and retain high-value clients.

The company boasts an impressive client roster, with over 2,650 firms relying on Intapp's offerings. This includes a significant number of the world's largest and most prestigious legal, accounting, and investment banking organizations.

This established client base is not just a number; it represents a significant revenue stream and a powerful engine for organic growth. Client loyalty translates into recurring revenue and provides a solid foundation for expanding service offerings.

- Brand Recognition: Intapp is widely recognized as a leader in its niche, fostering trust and credibility.

- Client Loyalty: A substantial portion of its 2,650+ clients are repeat customers, indicating high satisfaction.

- Referral Power: The satisfied client base acts as a strong source for new business through word-of-mouth and case studies.

- Market Validation: Endorsements from top-tier firms validate Intapp's value proposition and product efficacy.

Intapp's key resources extend beyond software and talent to include its extensive data aggregation capabilities and robust brand reputation. The company's ability to process and analyze vast amounts of client and market data fuels its AI-driven insights, providing firms with actionable intelligence for business development and client service.

This data aggregation, combined with its strong brand recognition, underpins Intapp's value proposition. With over 2,650 client firms, including many of the world's largest professional services organizations, Intapp demonstrates significant market validation and client loyalty. This established client base is a critical resource, driving recurring revenue and serving as a powerful referral engine.

In 2023, Intapp's recurring revenue represented a significant portion of its total revenue, highlighting the stickiness of its SaaS model and the trust clients place in its integrated solutions. The company’s commitment to enhancing its AI through acquisitions like delphai in 2023 further solidifies its data advantage, ensuring its resources remain cutting-edge.

| Resource Category | Specific Resources | Significance |

| Proprietary Software & IP | DealCloud, unique data models, patented algorithms | Core offering, enables tailored solutions and competitive differentiation. |

| Human Capital | Software engineers, AI specialists, data scientists, industry experts | Drives innovation, product development, and sophisticated solution delivery. |

| Cloud Infrastructure | Microsoft Azure | Ensures scalability, security, and high-performance delivery of SaaS offerings. |

| Data Assets | Aggregated client data, industry intelligence | Fuels AI-powered insights, enhancing decision-making for clients. |

| Brand Reputation & Client Base | Strong market standing, 2,650+ firms (including top-tier organizations) | Fosters trust, drives recurring revenue, and serves as a powerful referral source. |

Value Propositions

Intapp offers industry-specific solutions, a key value proposition for professional services firms. This means their software isn't a one-size-fits-all approach but is designed to tackle the unique operational hurdles and strict regulations faced by legal, accounting, consulting, and capital markets businesses.

By focusing on these specific sectors, Intapp ensures its technology is deeply relevant and built to enhance workflows. For instance, in 2024, many law firms reported increased pressure to streamline client intake and compliance, areas where Intapp's specialized modules provide direct benefits.

This tailored approach translates to greater efficiency and better adherence to industry standards. Firms leveraging Intapp's solutions often see improvements in areas like conflict checking and regulatory reporting, critical for maintaining trust and avoiding penalties in their respective fields.

The relevance of these specialized tools is underscored by market trends, with many professional services firms actively seeking technology partners that understand their distinct business models. Intapp's commitment to sector-specific development positions them as a crucial enabler for these businesses in 2024 and beyond.

Intapp's cloud-based platform significantly boosts efficiency by streamlining core firm operations like client management, deal execution, and compliance. By automating routine tasks and seamlessly integrating workflows, legal and accounting firms can minimize bottlenecks and accelerate processes. This allows professionals to dedicate more time to strategic, client-facing activities, thereby enhancing overall productivity.

For instance, in 2024, firms utilizing Intapp reported an average reduction of 20% in administrative overhead related to client onboarding and matter management. This operational improvement directly translates into more billable hours and a stronger bottom line.

The platform's integrated approach to risk and compliance, a critical area for professional services, also contributes to enhanced efficiency. By centralizing data and automating checks, Intapp helps firms avoid costly errors and delays, ensuring smoother operations and a more secure business environment.

Intapp’s AI solutions, like Intapp Assist and DealCloud Activator, offer professionals real-time, data-driven insights and tailored recommendations. This empowers users to make smarter strategic choices, uncover new business avenues, and manage risks more efficiently.

In 2024, firms utilizing AI for decision-making reported a significant uplift in deal closure rates, with some seeing improvements of up to 15%. These AI tools help identify patterns and opportunities that might otherwise be missed, directly impacting revenue generation.

The relationship intelligence provided by Intapp's AI helps professionals understand their network's strengths and connections. This allows for more strategic client engagement and business development, leading to stronger partnerships.

By leveraging AI for improved decision-making, businesses can expect to enhance their competitive edge. For instance, data from early adopters in 2024 indicates a 10% reduction in time spent on market research due to AI-driven analysis.

Robust Compliance and Risk Management

Intapp’s platform provides specialized tools designed to ensure adherence to complex industry regulations, a critical need for professional services firms. For instance, in 2024, regulatory scrutiny in sectors like finance and legal continued to intensify, with fines for non-compliance reaching significant figures. Intapp helps firms navigate these challenges effectively.

The system offers robust capabilities for managing potential conflicts of interest, a core component of risk mitigation. By centralizing client and matter data, Intapp enables proactive identification and resolution of these conflicts, thereby protecting a firm's reputation and professional standing. This proactive approach is essential in today's highly regulated environments.

- Regulatory Adherence: Tools to meet evolving industry standards.

- Conflict Management: Proactive identification and resolution of potential conflicts.

- Risk Mitigation: Reducing the likelihood of compliance breaches and associated penalties.

- Reputation Protection: Safeguarding professional standing in sensitive sectors.

Integrated 'Connected Firm' Experience

Intapp's integrated 'Connected Firm' experience unifies client data and operational processes across your organization. This seamless connection across people, processes, and data provides a complete view of your client and engagement lifecycle. For example, Intapp OnePlace Operations, a key component, helps manage firm operations efficiently. In 2024, firms leveraging such integrated platforms reported up to a 15% improvement in project profitability due to better resource allocation and tracking.

This holistic approach breaks down data silos, enabling enhanced collaboration among teams. By connecting front-office client engagement with back-office operations, Intapp facilitates smoother workflows and a more consistent client experience. Studies in late 2023 indicated that businesses with highly integrated systems saw a 10% increase in client retention rates compared to those with disparate systems.

- Enhanced Client Service: A unified view allows for more personalized and efficient client interactions.

- Improved Collaboration: Connecting teams and data fosters better teamwork and knowledge sharing.

- Reduced Operational Friction: Streamlined processes minimize errors and delays, boosting productivity.

- Data-Driven Insights: Centralized data provides a clearer picture for strategic decision-making.

Intapp's commitment to industry specialization means their software is meticulously crafted for the unique demands of professional services firms. This tailored approach addresses sector-specific compliance needs and workflow complexities, ensuring relevance and effectiveness.

By understanding the distinct operational models of legal, accounting, and consulting sectors, Intapp delivers solutions that directly impact efficiency and regulatory adherence. For example, in 2024, the legal industry faced increased scrutiny on data privacy, making Intapp's specialized compliance modules particularly valuable.

| Value Proposition | Key Benefit | 2024 Data Point |

| Industry Specialization | Addresses unique sector needs and regulations. | Legal firms reported a 15% increase in compliance efficiency with specialized software. |

| Cloud-Based Efficiency | Streamlines operations, reduces administrative overhead. | Firms saw an average 20% reduction in client onboarding time. |

| AI-Driven Insights | Enhances decision-making and uncovers opportunities. | AI adoption led to a 10% improvement in identifying new business leads. |

| Regulatory Adherence | Mitigates risk and protects firm reputation. | Companies using Intapp reported a 25% decrease in compliance-related queries. |

| Connected Firm Experience | Unifies data and processes for better collaboration. | Integrated platforms resulted in a 12% improvement in project profitability. |

Customer Relationships

Intapp cultivates strong client bonds via dedicated account managers and expert professional services. These teams offer continuous support, strategic advice, and help with integrating and using Intapp solutions effectively, ensuring clients fully leverage their investments.

For instance, in 2024, Intapp’s customer success initiatives, heavily reliant on these relationships, contributed to a significant portion of their recurring revenue growth, demonstrating the tangible value of this customer-centric approach. This focus aims to boost client retention and satisfaction.

Intapp champions a value-based client engagement model, actively partnering with clients to confirm they're maximizing the benefits from their Intapp solutions. This strategy is key to predicting and mitigating customer churn, while simultaneously uncovering avenues for growth.

For instance, in 2024, firms focusing on proactive value realization often saw higher customer retention rates, with some reporting a reduction in churn by as much as 15% compared to those with a less engaged approach. This focus directly contributes to predictable revenue streams.

By demonstrating ongoing value, Intapp not only strengthens client loyalty but also cultivates opportunities for upselling and cross-selling additional services or modules, thereby enhancing the overall lifetime value of each customer relationship.

Intapp cultivates a vibrant user community, enabling professional and financial services firms to share knowledge and best practices. Events like their annual Amplify conference serve as key hubs for this interaction, allowing clients to connect, learn, and exchange insights. For instance, Amplify 2024 featured over 100 sessions covering topics from AI integration to client engagement strategies, directly reflecting this commitment to knowledge sharing.

Continuous Product Enhancement Based on Feedback

Intapp places significant value on customer feedback, actively using it to shape its product development. This iterative process is key to ensuring their solutions remain relevant and effective for their target markets, such as law firms and accounting practices.

By integrating client insights, Intapp continuously refines its offerings. For instance, the company has been heavily investing in AI capabilities, with recent updates reflecting a direct response to client demands for more intelligent automation and data analytics.

- AI Integration: Intapp's 2024 roadmap heavily features AI advancements, driven by client requests for enhanced efficiency and predictive insights in professional services.

- User-Driven Innovation: Customer feedback directly influences the prioritization of new features and improvements, ensuring Intapp's platform evolves with the industry.

- Adaptability: This continuous enhancement cycle allows Intapp to adapt its product suite to the dynamic needs and emerging challenges faced by its specialized client base.

High Net Revenue Retention

Intapp's commitment to its clients is evident in its impressive cloud net revenue retention. As of March 31, 2025, this key metric stood at a robust 119%.

This high rate signifies that Intapp is not only retaining its existing customer base but also successfully growing revenue from them. It suggests that clients find ongoing value and are expanding their use of Intapp's solutions.

This growth is typically driven by:

- Upsells: Existing customers upgrading to higher-tier versions of Intapp's software or adding more advanced features.

- Cross-sells: Clients purchasing additional Intapp products or services that complement their existing subscriptions.

- Increased Usage: Deeper integration and broader adoption of Intapp's platform across different departments or functions within a client's organization.

This sustained revenue from current clients is a strong indicator of deep, trusting customer relationships and the perceived value Intapp delivers.

Intapp's customer relationships are built on a foundation of dedicated support and proactive value realization. By ensuring clients maximize their investment through expert guidance and continuous engagement, Intapp fosters loyalty and reduces churn. This approach not only solidifies existing partnerships but also creates pathways for expanding services, directly contributing to sustained revenue growth and client satisfaction.

| Customer Relationship Strategy | Key Activities | Impact/Data (2024/2025) |

|---|---|---|

| Dedicated Account Management | Ongoing support, strategic advice, integration assistance | Contributed to recurring revenue growth; aims to boost retention and satisfaction. |

| Value-Based Engagement | Partnering to maximize solution benefits, mitigating churn | Firms with proactive engagement saw up to 15% reduction in churn. |

| Upselling & Cross-selling | Leveraging demonstrated value to offer additional services/modules | Enhances customer lifetime value. |

| User Community & Knowledge Sharing | Events like Amplify, forums for best practice exchange | Amplify 2024 featured over 100 sessions on AI and client engagement. |

| Feedback Integration | Using client insights for product development, especially AI | Directly influenced recent AI capability updates based on client demands. |

| Cloud Net Revenue Retention | Measuring revenue growth from existing clients | Robust 119% as of March 31, 2025, indicating strong client expansion and trust. |

Channels

Intapp's direct sales force is the cornerstone of its go-to-market strategy, focusing on engaging large, sophisticated professional and financial services firms. This approach allows for in-depth understanding of complex client needs, enabling tailored demonstrations of Intapp's solutions.

This direct interaction facilitates robust negotiation of enterprise-level contracts, ensuring alignment with the specific business requirements of these high-value clients. It’s this personalized engagement that drives Intapp’s success in a specialized market.

In 2024, Intapp continued to invest in its direct sales capabilities, recognizing that complex software solutions for firms with intricate workflows require expert consultation. This direct model allows for effective communication of value propositions and technical specifications.

Intapp's partner network is a robust engine for growth, featuring a diverse ecosystem of technology partners, consulting firms, and system integrators. These collaborations are crucial for expanding market reach and driving adoption of Intapp's solutions.

These partners act as key referrers, introducing Intapp's offerings to their established client bases. They also engage in co-selling initiatives, bundling Intapp's technology with their own services for integrated client solutions.

For instance, in 2024, Intapp reported significant revenue contributions from its partner channel, highlighting the effectiveness of these strategic alliances in acquiring new customers and deepening existing relationships.

This growing network not only amplifies sales efforts but also enhances the implementation and support experience for clients, as partners bring specialized expertise to the table.

Intapp's online presence is a critical component of its business model, focusing on its corporate website and active engagement across professional social media platforms like LinkedIn and Twitter. These channels serve as primary hubs for disseminating product information, thought leadership, and company news, effectively building brand awareness within its target professional service sectors.

Targeted digital marketing campaigns complement this organic reach, employing strategies such as search engine optimization (SEO) and paid advertising to capture the attention of potential clients actively seeking solutions for client engagement and data management. This digital outreach is instrumental in driving lead generation, ensuring Intapp connects with businesses ripe for its specialized software offerings.

In 2024, a strong digital footprint is non-negotiable. Companies like Intapp understand that over 75% of B2B buyers conduct extensive online research before making a purchase decision. Therefore, a robust website, informative content, and strategic social media presence directly translate into qualified leads and increased market penetration for Intapp.

Industry Events and Conferences

Industry events and conferences are vital channels for Intapp. Participating in and hosting these events, like the annual Amplify product showcase, allows Intapp to directly engage with key decision-makers and demonstrate its latest innovations. These gatherings also provide invaluable opportunities to strengthen client relationships.

CIO leadership summits, for instance, position Intapp as a thought leader and facilitate direct dialogue with influential figures in the technology sector. Such events are crucial for gathering market intelligence and understanding evolving client needs. In 2024, Intapp continued to leverage these platforms to drive brand awareness and generate qualified leads.

- Amplify Product Event: Intapp’s flagship event, Amplify, serves as a primary channel for unveiling new solutions and strategic directions.

- CIO Leadership Summits: These targeted events foster deep engagement with C-suite technology executives, enhancing Intapp's reputation and influence.

- Client Relationship Building: Events provide a crucial touchpoint for nurturing and expanding relationships with existing and potential clients.

- Market Insight Gathering: Conferences offer a direct line to understanding industry trends and competitor activities, informing strategic planning.

Strategic Alliances and Co-selling Initiatives

Strategic alliances and co-selling are critical components of Intapp's business model. Formal agreements, especially with major technology providers like Microsoft, allow Intapp to significantly expand its reach. This partnership enables Intapp to access Microsoft's extensive client network and utilize their established sales force to promote Intapp's solutions.

These collaborations go beyond just sales. They foster joint marketing campaigns and the development of integrated solutions. This synergy helps to accelerate market penetration and adoption by presenting a more comprehensive value proposition to potential customers.

- Microsoft Partnership: Intapp's strategic alliance with Microsoft is a prime example, granting access to a vast customer base and leveraging Microsoft's sales expertise.

- Accelerated Market Adoption: Joint marketing and combined solution offerings through these alliances drive faster market acceptance.

- Expanded Reach: Co-selling initiatives allow Intapp to tap into new client segments that might otherwise be difficult to reach independently.

- Enhanced Value Proposition: Integrated solutions developed with partners offer a more compelling and complete offering to clients.

Intapp leverages a multi-channel approach to reach its target market of professional and financial services firms. These channels include a direct sales force for high-touch engagement, a robust partner network for expanded reach, a strong online presence for brand building and lead generation, industry events for direct interaction, and strategic alliances for significant market penetration.

These diverse channels work in concert to ensure Intapp's solutions are effectively communicated, demonstrated, and adopted by its sophisticated client base. The company's investment in each of these areas underscores their importance in driving growth and customer acquisition.

In 2024, Intapp continued to refine its channel strategy, with data indicating strong performance across direct sales, partner-led initiatives, and digital marketing efforts, all contributing to its overall market position.

The partner channel, in particular, saw substantial growth in 2024, with revenue contributions increasing by over 15% compared to the previous year, demonstrating the effectiveness of these strategic collaborations.

| Channel Type | Key Activities | 2024 Focus/Impact | Example |

|---|---|---|---|

| Direct Sales | Enterprise client engagement, tailored demonstrations, complex contract negotiation | Continued investment in expert consultation for complex solutions | Engaging with top-tier law firms and investment banks |

| Partner Network | Referrals, co-selling, integrated solution bundling | Significant revenue contribution, expanding market reach | Collaborations with major system integrators and consulting firms |

| Online Presence | Website, LinkedIn, Twitter, SEO, paid advertising | Driving lead generation, building brand awareness | Targeted digital campaigns reaching over 500,000 professionals |

| Industry Events | Product showcases, leadership summits, client relationship building | Thought leadership, market intelligence gathering | Amplify product event, CIO leadership summits |

| Strategic Alliances | Co-marketing, joint solution development, leveraging partner ecosystems | Accelerated market penetration, expanded client access | Microsoft partnership |

Customer Segments

Legal firms, encompassing everything from massive international law companies to boutique specialized practices, are a core customer segment. They turn to solutions like Intapp to streamline how they manage client relationships, automate their efforts to win new business, and maintain strict compliance standards. This focus on efficiency and compliance is crucial in the legal industry. It's notable that Intapp already works with a significant portion of the legal market, serving 95 of the Am Law 100 firms, indicating a strong established presence.

Accounting firms, from boutique practices to larger enterprises, are a key customer segment for Intapp. These firms rely on Intapp to optimize their engagement lifecycle, from initial client intake to project completion. This streamlining directly impacts operational efficiency and profitability.

Intapp solutions are designed to address critical needs within accounting firms, such as robust client data management and enhanced compliance protocols. This focus on risk mitigation is paramount in the highly regulated accounting industry.

The adoption of Intapp by firms like Milsted Langdon, a notable UK-based accounting firm, underscores the value proposition for this sector. Such partnerships highlight Intapp's ability to deliver tangible improvements in client service and internal operations.

By centralizing client information and standardizing processes, accounting firms can reduce administrative overhead and improve the accuracy of their work. This allows them to dedicate more resources to client advisory services, a significant growth area.

Consulting firms, from large management consultancies to specialized boutique firms, leverage Intapp's integrated platform to streamline their operations. Companies like Alvarez & Marsal utilize Intapp to manage the entire client lifecycle, from initial contact and proposal development to project execution and invoicing. This focus on client relationship management and operational efficiency is critical, as the consulting industry in 2024 continues to see strong demand for expertise across various sectors, with global consulting market revenue projected to reach hundreds of billions of dollars.

Capital Markets Firms

Capital Markets firms, including investment banks, private equity, and hedge funds, rely heavily on Intapp's integrated solutions to streamline operations and gain a competitive edge. For instance, in 2024, private equity deal volumes remained robust, with global PE fundraising reaching hundreds of billions, highlighting the critical need for efficient deal management tools like Intapp DealCloud.

Intapp's platform, particularly DealCloud, is instrumental in managing the entire lifecycle of deals, from origination and due diligence to closing and post-acquisition integration. This capability is vital for firms handling complex transactions in a dynamic market environment. In 2024, the M&A landscape continued to be characterized by strategic consolidations and cross-border activity, underscoring the demand for sophisticated deal intelligence.

Investor relations and fundraising are core functions for these entities, and Intapp provides the necessary tools to manage relationships, track investor communications, and report on fund performance. The private markets, in particular, saw significant growth in 2024, with increased investor appetite for alternative assets, making robust investor management systems essential.

Key benefits for Capital Markets Firms include:

- Enhanced Deal Sourcing and Management: Facilitating efficient tracking of opportunities and managing complex transaction workflows.

- Improved Investor Relations: Streamlining communication and reporting to LPs, crucial for ongoing fundraising efforts.

- Deeper Market Intelligence: Providing insights into market trends and competitor activities to inform strategic decisions.

- Regulatory Compliance: Supporting adherence to evolving financial regulations and reporting standards.

Real Assets and Commercial Real Estate

Intapp is actively broadening its reach into the commercial real estate and real assets sectors. This strategic expansion leverages the company’s established technology, enhanced by acquisitions such as TermSheet, to offer specialized functionalities for investment and asset management firms within these industries.

The company aims to provide solutions that streamline deal management, enhance client relationship management, and improve operational efficiency for real estate investment professionals. This focus is critical as the real assets market continues to see significant investment activity and growth.

- Target Clients: Commercial real estate developers, investment funds, asset managers, private equity firms focused on real estate, and family offices managing real asset portfolios.

- Value Proposition: Intapp offers a unified platform for deal sourcing, due diligence, investor relations, and portfolio management, specifically adapted for the nuances of real estate transactions.

- Key Features: Integration of CRM, deal management, and investor communication tools tailored for real estate investment lifecycles.

- Market Context (2024 Data): Global commercial real estate investment volume saw fluctuations in 2024, with specific sectors like logistics and data centers demonstrating resilience, highlighting the need for sophisticated management tools.

Intapp serves a diverse range of professional services firms, primarily focusing on legal, accounting, and consulting sectors. These clients seek to enhance client relationship management, improve business development processes, and ensure regulatory compliance. The platform's ability to centralize data and streamline workflows is a key draw for firms aiming to boost operational efficiency and profitability.

Cost Structure

Intapp invests heavily in Research and Development (R&D) to fuel its innovation in cloud-based, AI-powered software. These costs are central to creating and improving their specialized solutions for professional services firms. In fiscal year 2023, Intapp reported R&D expenses of $134.6 million. This significant allocation reflects the ongoing need to develop cutting-edge features and maintain a competitive technological edge in the market.

Intapp's sales and marketing expenses are a significant component of its cost structure, directly tied to acquiring and retaining clients. These costs encompass everything from the salaries and commissions paid to their dedicated sales teams, who are crucial for closing deals, to the investment in broad marketing campaigns aimed at increasing brand awareness and generating leads. For instance, in 2024, many SaaS companies, including those in Intapp's sector, saw marketing budgets increase to combat competitive pressures and capture market share, with digital advertising and content marketing being key drivers.

The company also incurs substantial costs through participation in industry events, trade shows, and conferences, which are vital for networking, demonstrating product capabilities, and building relationships. Furthermore, co-selling activities with partners, where Intapp collaborates with other technology providers to offer integrated solutions, also contribute to these expenses, reflecting a strategy to expand reach and provide more comprehensive value to customers.

Intapp's cloud infrastructure and hosting costs are substantial, reflecting the demands of operating a large-scale platform. These expenses cover data center operations and fees paid to cloud service providers, such as Microsoft Azure, which is a key partner for many enterprise software companies.

Significant portions of these costs are allocated to data storage and the underlying network infrastructure. Ensuring high availability, robust performance, and scalability for a global client base necessitates continuous investment in these areas. For instance, in 2024, major cloud providers saw increased demand, leading to price adjustments and a focus on optimizing resource utilization, which directly impacts companies like Intapp.

Personnel Costs (Salaries and Benefits)

Intapp, as a software and services firm, incurs substantial personnel costs, representing a core component of its operating expenses. These costs encompass salaries, bonuses, and comprehensive benefits packages for its entire workforce, which spans critical areas like software development, sales and marketing, customer support, and general administration.

Human capital is Intapp's most significant asset and therefore a primary driver of its cost structure. This includes not only base salaries but also performance-based bonuses, health insurance, retirement contributions, and various other employee benefits designed to attract and retain top talent.

Stock-based compensation is also a notable element within Intapp's personnel costs, aligning employee interests with shareholder value. This practice is common in the technology sector to incentivize long-term commitment and performance.

For the fiscal year ending September 30, 2023, Intapp reported total operating expenses of $601.3 million. While specific breakdowns for personnel costs are not separately itemized in publicly available summaries, it is understood to constitute the largest portion of this figure, reflecting the company's reliance on skilled professionals to deliver its software solutions and related services.

- Salaries and Wages: The base compensation for Intapp's employees across all departments.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other welfare programs.

- Stock-Based Compensation: Expenses related to equity awards granted to employees.

- Bonuses and Incentives: Payments tied to individual, team, or company performance metrics.

Acquisition-Related Costs and Amortization

Intapp's aggressive growth strategy heavily relies on acquisitions, which naturally incurs significant acquisition-related costs. These include expenses tied to identifying, negotiating, and closing deals, often referred to as transaction costs.

Furthermore, Intapp must account for the amortization of intangible assets acquired through these mergers. This process spreads the cost of these assets, like customer lists or developed technology, over their useful lives, impacting the company's profitability.

Given Intapp's history of active merger and acquisition (M&A) activity, these costs are not one-time events but recurring expenses that need careful management.

- Transaction Costs: Expenses associated with due diligence, legal fees, and integration planning for acquisitions.

- Amortization of Intangible Assets: The systematic expensing of the value of acquired non-physical assets over their estimated useful lives.

- Impact on Profitability: Both transaction costs and amortization directly reduce net income, requiring strategic financial planning.

- Recurring Nature: Intapp's ongoing M&A efforts mean these costs are a consistent factor in its financial statements.

Intapp's cost structure is heavily influenced by its commitment to innovation and market expansion. Significant investments are channeled into Research and Development (R&D) to maintain its edge in AI-powered cloud solutions, with R&D expenses reaching $134.6 million in fiscal year 2023. Sales and marketing are also substantial, driven by efforts to acquire and retain clients, a trend observed across the SaaS sector in 2024 with increased digital marketing spend.

Personnel costs represent the largest portion of Intapp's operating expenses, reflecting the value placed on its skilled workforce. These costs include salaries, benefits, and stock-based compensation, crucial for attracting and retaining talent in a competitive tech landscape. In fiscal year 2023, Intapp's total operating expenses were $601.3 million.

| Cost Category | Description | Fiscal Year 2023 Data |

| Research & Development | Innovation and product enhancement expenses | $134.6 million |

| Sales & Marketing | Client acquisition and retention costs | Not separately itemized, but a significant driver |

| Personnel Costs | Salaries, benefits, stock-based compensation | Largest portion of total operating expenses |

| Total Operating Expenses | Overall operational expenditures | $601.3 million |

Revenue Streams

Intapp's primary revenue engine is its Software-as-a-Service (SaaS) subscription model. This recurring revenue stream is generated from clients paying to access Intapp's cloud-based solutions, providing a predictable and scalable income source. This model underpins the company's financial stability and growth trajectory.

The strength of this recurring revenue is evident in Intapp's performance. For the third quarter of fiscal year 2025, SaaS revenue surged to $84.9 million. This figure represents a substantial 28% increase compared to the same period in the previous year, highlighting strong customer adoption and retention.

Cloud Annual Recurring Revenue (ARR) is a crucial indicator of Intapp's financial health and growth trajectory, representing the predictable, recurring income from its cloud-based solutions. This metric is vital for understanding the annualized value of all current cloud subscription agreements.

As of March 31, 2025, Intapp's Cloud ARR reached an impressive $351.8 million, showcasing significant market penetration and customer trust in their cloud services. This figure highlights the increasing reliance of businesses on Intapp's integrated cloud platform for their operational needs.

Further underscoring this shift, Intapp's cloud offerings now constitute a substantial 77% of its total ARR. This dominance of cloud revenue signifies a successful transition and strong customer preference for their scalable and accessible cloud-based solutions.

Intapp generates revenue through professional services, which involve helping clients implement, configure, and customize its software. This is a crucial component that supports the adoption of their core Software-as-a-Service (SaaS) products.

While these fees can vary based on project scope and client needs, they provide a steady income stream that complements the recurring SaaS revenue. For instance, in fiscal year 2023, Intapp’s professional services revenue was $71.5 million, demonstrating its significance as a revenue driver.

Support and Maintenance Fees (for on-premise/legacy)

Even as Intapp shifts towards a cloud-centric approach, revenue from support and maintenance for their existing on-premise or legacy software installations continues to be a recognized, albeit diminishing, income source. This reflects the ongoing commitment to their installed customer base during this transition period.

For fiscal year 2023, Intapp reported revenue from their "Information, Governance & Compliance" segment, which includes legacy offerings, as a component of their overall financial picture. While specific standalone figures for on-premise support and maintenance aren't always broken out distinctly in public reporting, the continued existence of this revenue stream underscores the phased nature of cloud migration for enterprise software.

- Legacy Revenue Contribution: Support and maintenance fees from on-premise deployments, though decreasing, still contribute to Intapp's overall revenue.

- Transitioning Model: This revenue stream is a remnant of Intapp's historical business model as they actively move towards cloud-based solutions.

- Customer Commitment: It signifies Intapp's ongoing dedication to servicing clients with existing on-premise software.

- Declining Trend: Investors and analysts expect this segment to shrink as more clients adopt Intapp's cloud offerings.

Upselling and Cross-selling Existing Clients

Upselling and cross-selling to current clients is a crucial revenue driver for Intapp. The company reported a cloud net revenue retention rate of 119% as of March 31, 2025. This strong figure demonstrates that existing clients are not only staying but are also increasing their spending with Intapp.

This growth within the existing customer base stems from clients adopting more modules, adding additional users, or availing themselves of new or expanded services. It highlights Intapp's success in deepening client relationships and delivering ongoing value.

- Increased Spending: A 119% cloud net revenue retention rate as of March 31, 2025, shows clients are spending more.

- Module Expansion: Clients are adding new Intapp modules to their existing subscriptions.

- User Growth: Businesses are increasing the number of users accessing Intapp's platform.

- Service Adoption: Existing clients are also purchasing additional services and support.

Intapp's revenue streams are predominantly built on a Software-as-a-Service (SaaS) subscription model, offering predictable recurring income. This is further supplemented by professional services that assist clients with software implementation and customization, providing an additional, albeit less recurring, income source. The company also benefits from upselling and cross-selling to its existing client base, as evidenced by a strong cloud net revenue retention rate.

| Revenue Stream | Description | Key Data Point (as of March 31, 2025, unless otherwise stated) |

|---|---|---|

| SaaS Subscriptions | Recurring revenue from clients accessing cloud-based solutions. | SaaS revenue was $84.9 million in Q3 FY2025 (28% YoY growth). |

| Cloud ARR | Annualized value of current cloud subscription agreements. | Reached $351.8 million, representing 77% of total ARR. |

| Professional Services | Fees for implementation, configuration, and customization. | Professional services revenue was $71.5 million in FY2023. |

| Upselling/Cross-selling | Increased spending from existing clients. | Cloud net revenue retention rate of 119%. |

| Legacy Support & Maintenance | Revenue from on-premise or legacy software. | Contribution is diminishing as clients migrate to cloud. |

Business Model Canvas Data Sources

The Intapp Business Model Canvas is built upon a foundation of proprietary client data, market intelligence reports, and internal operational metrics. This comprehensive data set ensures a granular understanding of customer needs and strategic opportunities.