Intapp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intapp Bundle

Unlock Intapp's strategic landscape with our comprehensive PESTLE analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are actively shaping Intapp's trajectory. These expert-driven insights are crucial for anyone seeking to understand the external forces impacting the company's performance and future growth. Don't miss out on the critical intelligence that can inform your own strategic decisions. Purchase the full PESTLE analysis now for actionable insights.

Political factors

Governments worldwide are stepping up their oversight of artificial intelligence, with a particular focus on fairness and potential biases, especially within critical industries like finance and law. As Intapp integrates AI into its offerings, it faces the challenge of adapting to a complex and shifting regulatory landscape. For instance, the European Union's AI Act, expected to be fully implemented in 2025, categorizes AI systems by risk, with high-risk applications requiring strict compliance measures regarding data quality, transparency, and human oversight. This means Intapp must ensure its AI solutions meet these varied jurisdictional standards for accountability and ethical deployment.

Intapp's global operations are significantly shaped by evolving data sovereignty and cross-border data flow policies. For instance, the European Union's General Data Protection Regulation (GDPR) imposes stringent requirements on personal data processing and transfers, impacting how Intapp handles client information across its services. Many US states, including California with its CCPA/CPRA, have also enacted comprehensive privacy laws, adding complexity to data management for international tech firms.

These regulations directly influence Intapp's cloud infrastructure choices and service delivery models. Companies must now navigate a patchwork of national and sub-national laws dictating data residency and transfer mechanisms, potentially increasing operational costs and requiring localized data storage solutions. As of late 2024, the global regulatory landscape for data privacy continues to tighten, with ongoing discussions and potential new legislation in various jurisdictions, underscoring the need for Intapp to maintain flexible and compliant data handling practices.

Governments worldwide are actively backing digital transformation. For instance, the UK government's Digital Strategy, updated in 2024, emphasizes investment in technology and skills to boost productivity across various sectors, including professional services. This creates a fertile ground for Intapp's offerings, as firms are encouraged and often incentivized to adopt advanced solutions.

In the United States, initiatives like the National Science Foundation's funding for AI research and development, with significant allocations in 2024 and projected increases for 2025, indirectly benefit companies like Intapp by fostering innovation in the very technologies they leverage. Such federal support for cutting-edge tech adoption translates into a stronger market for sophisticated software solutions.

European nations are also prioritizing digital advancements. Germany's "Digital Strategy 2025," for example, outlines plans to invest heavily in digitalization, with particular focus on enhancing the competitiveness of its service industries. This commitment to digital integration means increased opportunities for Intapp to provide its clients with tools for efficiency and growth.

These government-led pushes for digital adoption, often coupled with financial incentives for cloud migration and data analytics, directly translate into increased demand for Intapp's specialized software. Firms are more likely to invest in platforms that streamline operations and enhance client engagement when public policy actively supports such modernization efforts.

Geopolitical Stability and Trade Relations

Global geopolitical stability directly impacts Intapp’s ability to expand internationally and manage its existing operations. For instance, the ongoing geopolitical landscape in 2024, marked by regional conflicts and shifting alliances, necessitates careful consideration of market entry strategies and the potential for supply chain disruptions, even for a software-centric business. Intapp’s reliance on a global client base means that instability in major economic regions can directly affect client spending and project timelines.

Trade relations are another crucial element. In 2024 and looking into 2025, trade tensions between major economic blocs could manifest as tariffs, sanctions, or increased regulatory hurdles. These could directly impact Intapp’s software solutions by increasing the cost of doing business in certain regions or creating new barriers to market entry. For example, the digital services tax discussions in various countries could affect how Intapp prices and delivers its cloud-based solutions internationally.

- Geopolitical Risk: Increased political instability in regions where Intapp has a significant client base or potential for expansion could lead to reduced IT spending by clients.

- Trade Barriers: Escalating trade disputes could result in higher costs for cross-border data transfer or impose new compliance requirements on Intapp's software solutions.

- Regulatory Uncertainty: Shifting trade agreements and political alignments can create uncertainty around data privacy laws and intellectual property protection, impacting Intapp's global operational framework.

- Market Access: Political tensions might lead to restrictions on technology exports or imports, potentially limiting Intapp's access to certain markets or its ability to serve existing international clients.

Industry-Specific Political Lobbying and Advocacy

Professional and financial services associations actively lobby governments, impacting policies that govern technology adoption and compliance. These organizations often advocate for standards that can either accelerate or hinder the implementation of new solutions. For instance, in 2024, lobbying efforts by financial industry groups in the US focused on data privacy regulations, which could influence how cloud-based solutions like Intapp's are deployed and managed.

Intapp can leverage its participation in these industry groups to advocate for regulations that support its cloud-based, AI-powered offerings. By contributing to discussions on data security and interoperability, Intapp can help shape policies that favor its technology. For example, the Financial Services Forum, a prominent advocacy group, has been actively engaged in shaping discussions around AI governance in finance throughout 2024 and into 2025.

- Influence on Technology Adoption: Lobbying by associations directly impacts the pace and direction of technology adoption within the financial sector, potentially creating opportunities or challenges for Intapp.

- Compliance Landscape Shaping: Industry advocacy groups play a crucial role in defining compliance requirements, which can be tailored to favor or disfavor specific technological approaches.

- Standards Development: Associations contribute to setting industry standards for areas like data management and cybersecurity, influencing the compatibility and competitiveness of Intapp's solutions.

- Regulatory Alignment: Intapp's engagement with these bodies allows it to align its product development with anticipated regulatory changes, fostering a more favorable market environment.

Governmental focus on AI regulation is intensifying, particularly concerning fairness and bias in sectors like finance. The EU's AI Act, with full implementation anticipated in 2025, mandates strict compliance for high-risk AI, impacting Intapp's need for transparent and accountable AI solutions across jurisdictions.

Data sovereignty laws, like GDPR and US state-level privacy regulations, are tightening, compelling Intapp to manage client data with localized storage and flexible compliance strategies. These evolving privacy landscapes, active in late 2024, necessitate robust data handling practices.

Government initiatives promoting digital transformation, such as the UK's 2024 Digital Strategy and US NSF AI funding in 2024-2025, create a supportive market for Intapp's advanced software solutions, driving demand for efficiency and modernization tools.

Geopolitical instability and trade relations in 2024-2025 present risks of market access limitations and increased operational costs due to potential tariffs or sanctions, requiring Intapp to navigate complex global trade dynamics.

What is included in the product

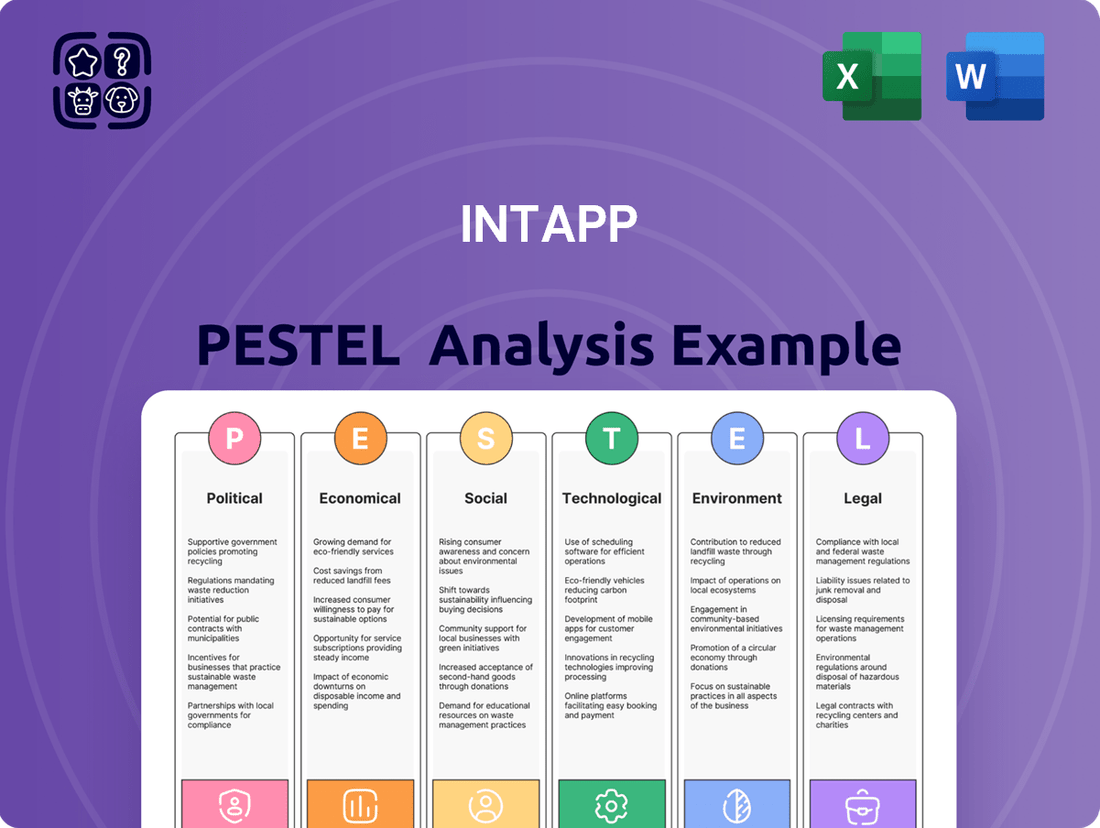

This Intapp PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives, equipping stakeholders with the knowledge to navigate market dynamics and formulate effective strategies.

Intapp's PESTLE Analysis offers a clear, summarized version of the full analysis, relieving the pain point of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

Global economic growth significantly influences the spending power of professional and financial services firms. As economies expand, these businesses typically increase their technology budgets, making them more receptive to investing in solutions like Intapp's platform to enhance efficiency and client engagement. For example, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight deceleration from 3.5% in 2023, indicating a generally positive, albeit moderating, economic environment.

Conversely, recessionary risks can dampen demand for new software. During economic downturns, firms often face reduced revenue and tighter margins, leading to a prioritization of essential operational costs over new technology acquisitions. This can result in delayed or canceled software projects. The persistent threat of inflation and higher interest rates in major economies continues to pose a risk to sustained global growth, potentially impacting Intapp's sales pipeline.

Rising inflation, a persistent concern through 2024 and into 2025, directly impacts Intapp's operational expenses. Costs for essential services like cloud computing, crucial for their SaaS model, are experiencing upward pressure. For instance, major cloud providers have seen incremental price hikes, potentially increasing Intapp's infrastructure spend significantly.

Talent acquisition and retention also become more costly in an inflationary environment, as competitive salaries are needed to attract and keep skilled professionals in software development and client support. This necessitates careful budgeting for human resources to maintain service quality and innovation pipelines.

Intapp may face the difficult decision of passing these increased operating costs onto its clients through price adjustments for its professional services and software subscriptions. The success of such adjustments hinges on the perceived value of Intapp's offerings and the price sensitivity of its target market, particularly law firms and accounting firms navigating their own economic challenges.

Failure to effectively manage these escalating costs or implement strategic pricing could lead to compressed profit margins. For example, if Intapp's revenue growth doesn't outpace its cost increases, its profitability will be directly impacted, potentially affecting reinvestment in product development and market expansion.

Interest rate fluctuations significantly shape the investment climate for companies like Intapp. When rates rise, borrowing becomes more expensive, potentially dampening a firm's appetite for investing in new technologies or large-scale software projects, which are core to Intapp's client base. For instance, if the Federal Reserve raises its benchmark rate, it directly impacts the cost of capital for businesses considering substantial IT upgrades.

Furthermore, Intapp itself faces financing costs that are sensitive to interest rate movements. If the company pursues expansion or acquisitions, its ability to secure favorable debt financing in a higher rate environment is reduced. This can affect its strategic growth initiatives and overall profitability. As of late 2024, benchmark interest rates remain elevated compared to the previous decade, presenting a persistent consideration for corporate spending on technology solutions.

Client Firm Profitability and Budget Allocation

Intapp's financial performance is directly influenced by the profitability and spending habits of its core clientele, which includes law firms, accounting practices, consulting groups, and capital markets institutions. When these client firms are doing well financially, they have more resources to invest in technology that streamlines operations, ensures regulatory adherence, and strengthens client interactions.

For instance, in 2023, average profit per equity partner (PEP) for major US law firms saw a slight dip but remained robust, with many firms reporting strong revenue growth. This indicates a continued capacity for technology investment, especially in areas like Intapp's solutions for client development and risk management. Similarly, the consulting sector, projected to grow by 7-9% in 2024 according to industry reports, signals increased IT budget allocations for firms aiming to improve project delivery and client satisfaction.

Budget allocation within these professional services firms is a key driver for Intapp's revenue. Increased profitability allows for larger technology budgets, enabling firms to adopt more comprehensive solutions. This can lead to higher adoption rates and expansion of Intapp's services within a client organization. The focus for 2024 and 2025 is on solutions that demonstrably improve efficiency and client retention, making Intapp’s integrated platform particularly attractive.

- Client Profitability Drives IT Spending: Strong financial health in legal, accounting, and consulting sectors enables greater investment in technology solutions.

- 2024 Sector Growth Projections: The consulting industry, for example, is expected to see continued growth, potentially boosting IT budgets.

- Efficiency and Compliance Investments: Firms with healthy profits are more likely to allocate funds towards software that enhances operational efficiency and regulatory compliance.

- Intapp's Value Proposition: Solutions that directly contribute to client relationship management and risk mitigation are prioritized during budget cycles.

Digital Transformation Spending Trends

The global digital transformation market is experiencing robust growth, with continued strong spending anticipated through 2025. This trend is particularly pronounced in the professional services sector, where firms are actively seeking solutions to streamline operations and gain a competitive edge.

Companies are increasingly allocating budgets towards cloud migration and the integration of artificial intelligence (AI) capabilities. These investments are driven by the need to improve productivity, enhance customer experiences, and unlock new revenue streams. For Intapp, this represents a substantial market opportunity.

- Global spending on digital transformation was projected to reach $2.9 trillion in 2024, a 17.5% increase from 2023.

- By 2025, cloud services spending is expected to exceed $1 trillion globally.

- AI adoption in enterprises is forecasted to grow significantly, with many businesses planning to increase their AI investments in the next 1-2 years.

- The professional services sector is a key adopter, with many firms prioritizing technology investments to manage complex client demands and data.

Economic factors significantly shape the market for Intapp's solutions. Global economic growth influences client spending power, with expansions generally leading to increased technology budgets. Conversely, economic downturns and recessionary risks can curb investment in new software, as firms prioritize cost-cutting measures.

Inflation and rising interest rates present dual challenges, increasing Intapp's operational costs for cloud services and talent, while potentially making clients more hesitant to invest in new technologies due to higher borrowing costs.

Client profitability is a direct driver for Intapp's revenue; financially healthy law firms, accounting practices, and consulting groups are more likely to allocate funds towards efficiency-enhancing software, especially solutions focused on client development and risk management.

The robust global digital transformation market, with significant projected growth in cloud services and AI adoption through 2025, presents a substantial opportunity for Intapp within the professional services sector.

| Economic Factor | Impact on Intapp | Data Point (2024/2025 Projection) |

|---|---|---|

| Global Economic Growth | Influences client IT spending; positive growth generally boosts budgets. | Global growth projected at 3.2% in 2024 (IMF). |

| Inflation | Increases Intapp's operational costs (cloud, talent); may impact client investment capacity. | Persistent inflation concerns through 2024/2025. |

| Interest Rates | Affects Intapp's financing costs and clients' cost of capital for technology investments. | Elevated benchmark rates persist into late 2024. |

| Client Profitability | Directly correlates with client technology investment capacity. | Consulting sector growth projected at 7-9% in 2024. |

| Digital Transformation Spending | Represents a key market opportunity for Intapp's solutions. | Global digital transformation market projected to reach $2.9 trillion in 2024. |

What You See Is What You Get

Intapp PESTLE Analysis

The preview shown here is the exact Intapp PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Intapp provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's strategic landscape.

You'll gain valuable insights into market opportunities and potential threats, enabling informed decision-making for Intapp's future growth and competitive positioning.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable strategic assessment.

Sociological factors

The shift towards hybrid and remote work is fundamentally reshaping professional and financial services. By the end of 2024, surveys indicated that over 60% of financial services firms were operating with some form of hybrid model, a significant increase from pre-pandemic levels. This necessitates robust cloud-based platforms for consistent collaboration and client engagement, regardless of employee location.

This evolution directly fuels the demand for integrated solutions like those offered by Intapp. As professionals increasingly work from distributed locations, the need for seamless access to client data, communication tools, and project management capabilities becomes paramount. Firms are prioritizing technologies that can bridge the gap between in-office and remote experiences, ensuring productivity and client satisfaction remain high. In 2025, the market for such integrated cloud solutions is projected to see continued strong growth, driven by these persistent workplace trends.

Clients of professional and financial services firms now demand a digital-first experience, expecting seamless online interactions and personalized services. This societal shift is evident as 81% of consumers expect businesses to understand their unique needs and expectations, according to a 2024 report by Salesforce. This means firms must invest in advanced software solutions, like those offered by Intapp, to deliver efficient communication and tailored engagements, crucial for retaining and attracting clients in a competitive landscape.

Professional services firms are increasingly wrestling with talent acquisition and retention, particularly as younger professionals enter the workforce with distinct expectations. These individuals, often digital natives, demand intuitive technology that streamlines their daily tasks. For instance, a 2024 survey by Deloitte found that 70% of Gen Z employees prioritize modern technology in their workplace.

Intapp's suite of solutions directly addresses this by offering user-friendly and efficient platforms designed to simplify complex processes. By automating administrative work, Intapp frees up valuable time for professionals. This shift allows them to dedicate more energy to client-facing activities and strategic initiatives, directly boosting job satisfaction and engagement.

The impact on employee experience is significant; a more seamless technological environment reduces frustration and enhances productivity. This focus on employee experience is critical, as a 2025 LinkedIn report indicated that companies with a strong employee value proposition see a 20% higher retention rate for critical talent. Intapp's technology plays a crucial role in building that proposition.

Emphasis on Diversity, Equity, and Inclusion (DEI)

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DEI) within organizations, including professional services firms. This shift directly impacts technology adoption, as companies seek solutions that align with these values.

Software that actively supports equitable hiring processes, mitigates unconscious bias in talent management, and fosters inclusive team dynamics is gaining traction. For instance, AI-powered recruitment tools are being scrutinized for their potential to reduce bias, with studies in 2024 indicating that companies with strong DEI initiatives report higher innovation and profitability.

- DEI drives demand for bias-reducing technologies

- Inclusive collaboration tools are becoming essential

- Data supporting DEI’s link to performance is growing

- Firms are seeking technology partners with strong DEI commitments

Generational Shifts in Technology Adoption

Younger professionals, often called digital natives, are entering the workforce with a strong expectation for sophisticated and user-friendly technology. This is directly influencing the speed at which cloud-based and AI-powered solutions are being adopted across industries. Their comfort with digital tools means they demand similar efficiency and intuitiveness from their professional software.

Intapp's success hinges on its capacity to meet these evolving user preferences. By offering advanced, cloud-native, and AI-driven solutions, Intapp can better align with the expectations of this incoming talent pool. This alignment is key for not just attracting new users but also ensuring sustained engagement and satisfaction, which translates to better market penetration and retention.

Consider these points regarding generational shifts and technology:

- Digital Natives' Expectations: A significant portion of the 2024 workforce comprises Gen Z and younger millennials, who grew up with advanced digital interfaces. Studies in late 2023 indicated that over 70% of Gen Z professionals prioritize technology that simplifies workflows.

- Cloud and AI Demand: This demographic is highly receptive to cloud-based platforms and AI-driven automation, seeing them as standard tools rather than novelties. Research from early 2024 suggests that adoption rates for AI-powered productivity tools within professional services firms are climbing rapidly, with younger employees often leading the charge.

- Impact on Software Adoption: For firms like those Intapp serves, this generational shift means that legacy systems are increasingly viewed as cumbersome. The preference for intuitive, integrated, and mobile-accessible software is a direct consequence of these digital upbringing experiences.

- Market Relevance: Intapp's ability to continuously innovate and offer cutting-edge, AI-enhanced solutions is crucial for maintaining its relevance and competitive edge as this digitally fluent workforce becomes the dominant user base.

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DEI) within organizations. This shift influences technology adoption, with companies seeking solutions that support equitable hiring and mitigate bias. For instance, a 2024 report by McKinsey highlighted that companies in the top quartile for ethnic diversity are 36% more likely to outperform on profitability.

Inclusive collaboration tools are also becoming essential as firms aim to foster environments where all employees feel valued and can contribute fully. Data from a 2025 Deloitte survey indicated that 65% of employees feel more engaged when they perceive their workplace as inclusive.

Furthermore, the growing emphasis on work-life balance and mental well-being is shaping demand for technologies that can automate mundane tasks, thereby reducing employee burnout. A 2024 study by the American Psychological Association found that 77% of employees experienced work-related stress, with improved technology being a cited solution.

These evolving societal values directly impact how professional services firms select and implement technology, favoring platforms that enhance efficiency, promote fairness, and support a positive employee experience.

Technological factors

The rapid advancement of artificial intelligence and machine learning creates significant opportunities for Intapp. AI integration into platforms like Intapp DealCloud Activator is enhancing client relationship management and deal sourcing by automating data analysis and identifying patterns. This technological shift allows Intapp to offer more intelligent solutions, improving efficiency for its clientele.

Intapp's reliance on cloud computing means its success is directly tied to the ongoing expansion and refinement of this technology. By mid-2024, global public cloud spending was projected to reach over $678 billion, a significant increase from previous years, underscoring the widespread adoption that benefits Intapp's platform.

The increasing trend of enterprises adopting multi-cloud strategies, where businesses utilize services from multiple cloud providers, presents both opportunities and challenges for Intapp. This widespread adoption, with a significant majority of companies employing at least one cloud service by 2024, means Intapp must be adaptable to diverse cloud environments.

Furthermore, the escalating demand for robust cloud security solutions directly impacts Intapp's ability to deliver its services reliably and scale effectively. As data breaches become more sophisticated, businesses are prioritizing cloud providers and SaaS solutions that demonstrate strong security postures, a crucial factor for Intapp’s client trust and growth.

Cybersecurity is a paramount concern for professional and financial services firms, which manage vast amounts of sensitive client data. The sophistication of threats, from ransomware to advanced persistent threats, is escalating, making robust data protection a non-negotiable for companies like Intapp. In 2024, cybercrime costs are projected to reach $10.5 trillion annually worldwide, highlighting the immense financial and reputational risks at stake.

Intapp's commitment to client trust hinges on its ability to continuously innovate its security offerings. This includes integrating AI-powered threat detection systems, which can identify anomalous activity in real-time, and ensuring strict adherence to evolving data protection regulations like GDPR and CCPA. For instance, the global spending on AI in cybersecurity is expected to exceed $40 billion by 2025, demonstrating the industry's focus on this technological advancement.

Integration Capabilities and Ecosystem Development

Intapp's technological strength lies in its integration capabilities, allowing its platform to connect smoothly with other critical business systems like Microsoft 365. This interoperability is crucial for firms looking for unified management solutions. For instance, in 2024, many professional services firms are prioritizing cloud-based ecosystems that offer seamless data flow across various applications to boost efficiency.

Strategic partnerships further bolster Intapp's ecosystem development, extending the reach and functionality of its offerings. These collaborations are vital for creating a comprehensive value proposition that meets the evolving needs of clients in the digital age. By fostering these relationships, Intapp enhances its ability to deliver end-to-end solutions for client engagement and firm operations.

- Seamless Integration: Intapp's platform connects with over 500 common business applications and services, including major CRM, ERP, and HR systems.

- Ecosystem Growth: The company actively pursues partnerships, aiming to expand its network of integrated solutions and data sources.

- Client Value: Enhanced interoperability allows clients to leverage Intapp for more connected and efficient firm-wide operations, driving better client service.

- Future-Proofing: Continuous development in integration technology ensures Intapp remains adaptable to new platforms and evolving client technology stacks.

Automation and Workflow Optimization

Technological trends in automation and workflow optimization are paramount for Intapp, given its core mission of streamlining deal and engagement processes for professional services firms. The relentless drive for efficiency means Intapp must continuously innovate its software to automate tasks like client intake, document management, time tracking, and risk assessment. This directly impacts their product development roadmap, pushing for more sophisticated AI-powered features.

The demand for automated solutions is not just a trend but a necessity for firms looking to reduce manual effort and minimize errors. For instance, the legal sector, a key Intapp market, is increasingly adopting AI for tasks such as contract review and due diligence. A 2024 survey indicated that 78% of law firms are exploring or implementing AI for workflow automation, highlighting the critical need for Intapp to stay ahead in this domain.

Intapp's focus on AI development is evident in its investments in machine learning for predictive analytics and intelligent workflow routing. This allows firms to not only automate existing processes but also to gain deeper insights from their data, leading to better decision-making. The market for legal tech and professional services automation is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% through 2028, underscoring the opportunities for Intapp.

Key technological factors influencing Intapp include:

- AI and Machine Learning Integration: Enhancing deal intelligence, risk analysis, and client onboarding through predictive capabilities.

- Cloud-Native Architecture: Enabling scalability, accessibility, and continuous updates for their software solutions.

- Data Analytics and Business Intelligence: Providing actionable insights to professional services firms from their operational data.

- Cybersecurity Advancements: Ensuring the protection of sensitive client and firm data within their automated workflows.

Technological advancements are reshaping how professional services firms operate, and Intapp is at the forefront of this evolution by integrating AI and machine learning into its core offerings. This allows for more intelligent deal sourcing and client relationship management, directly enhancing firm efficiency. The increasing adoption of cloud computing, with global spending projected to exceed $678 billion by mid-2024, also underpins Intapp's scalable platform delivery.

Intapp's commitment to robust cybersecurity is crucial, especially as cybercrime costs are estimated to reach $10.5 trillion annually by 2024. The firm's investment in AI-powered threat detection and adherence to data protection regulations are vital for maintaining client trust. Furthermore, Intapp's strength in seamless integration with over 500 business applications, including Microsoft 365, facilitates efficient, connected firm-wide operations.

The drive for automation and workflow optimization is a key technological factor for Intapp, as evidenced by the legal sector's increasing adoption of AI, with 78% of law firms exploring or implementing it for workflow automation in 2024. Intapp's focus on AI for predictive analytics and intelligent workflow routing positions it to capitalize on the projected 15% annual growth in the professional services automation market through 2028.

| Key Technological Factors | Description | Impact on Intapp | Relevant Data Point |

| AI & Machine Learning | Enhancing deal intelligence, risk analysis, client onboarding | Improved product offerings, competitive advantage | Global AI in cybersecurity spending projected over $40B by 2025 |

| Cloud-Native Architecture | Enabling scalability, accessibility, continuous updates | Platform reliability and agility | Global public cloud spending projected over $678B by mid-2024 |

| Data Analytics & BI | Providing actionable insights from operational data | Empowering client decision-making | N/A (Qualitative benefit) |

| Cybersecurity Advancements | Protecting sensitive client and firm data | Building client trust, mitigating risk | Projected global cybercrime costs of $10.5T annually by 2024 |

| Integration Capabilities | Connecting with over 500 business applications | Creating a connected ecosystem, boosting client efficiency | Intapp integrates with over 500 common business applications |

Legal factors

Intapp navigates a constantly shifting terrain of data privacy rules, such as the GDPR in Europe. New US state laws, including those implemented in 2024 and 2025, add further layers of complexity. Staying compliant is non-negotiable for safeguarding sensitive client and financial information.

The financial services sector, a key market for Intapp, faces particularly stringent data protection mandates. For instance, the California Privacy Rights Act (CPRA), fully effective in 2023, significantly impacts how businesses handle personal information, setting a precedent for other states. Non-compliance can lead to substantial fines, with GDPR penalties reaching up to 4% of global annual revenue.

Professional and financial services firms are heavily regulated, requiring Intapp’s solutions to support compliance. For instance, upcoming regulations like DORA (Digital Operational Resilience Act) in the EU, which came into full effect in January 2024, mandate robust operational resilience for financial entities, impacting how firms manage technology and data.

Intapp’s software must facilitate adherence to these complex rules, ensuring clients can manage financial transactions and legal risk effectively. PSD3, anticipated to be proposed in 2024 or 2025, will further shape payment services, demanding ongoing adaptation from financial technology providers like Intapp.

Adherence to legal ethics and risk management standards is paramount, with stringent data privacy laws like GDPR continuing to influence data handling practices. The global regulatory landscape is dynamic; for example, the UK's Financial Services and Markets Act 2023 introduced significant reforms, requiring continuous updates to compliance features.

The evolving landscape of artificial intelligence regulation, exemplified by the EU AI Act and emerging US state-level rules, directly shapes Intapp's development and deployment of AI solutions. Compliance with these regulations is paramount for market access and continued innovation.

Ethical AI use, including the critical areas of bias mitigation and transparency in AI-driven decisions, is transitioning from best practice to a legal imperative. Failure to address these ethical considerations can lead to significant legal and reputational risks for companies like Intapp.

As of late 2024, discussions around AI governance are intensifying globally, with several jurisdictions proposing or enacting specific legislation. For instance, the EU AI Act, expected to be fully implemented in phases, categorizes AI systems based on risk, imposing stricter requirements on high-risk applications, which could impact Intapp's professional services automation tools.

Intellectual Property Rights and Software Licensing

Protecting Intapp's intellectual property (IP) and effectively managing its software licensing agreements are core legal imperatives. As a software-centric business, Intapp’s competitive edge hinges on its proprietary technology, making robust IP protection paramount. The company must navigate complex patent, copyright, and trade secret laws to safeguard its innovations.

Ensuring compliance with various software licensing models is also critical. This includes understanding and adhering to end-user license agreements (EULAs), as well as managing any third-party software components integrated into Intapp's offerings. In 2024, the global software market continued to see significant growth, with cybersecurity and data privacy regulations becoming even more stringent, directly impacting how software IP is managed and licensed.

- Intellectual Property Protection: Intapp must actively pursue patent filings for novel technologies and enforce copyrights on its software code to prevent unauthorized use or replication.

- Software Licensing Compliance: Adherence to all licensing terms, whether for proprietary software sold to clients or third-party components used internally, is essential to avoid legal disputes and maintain operational integrity.

- Trade Secret Management: Implementing strong internal controls and confidentiality agreements for employees and partners is vital to protect proprietary algorithms and business processes that are not publicly patented.

- Evolving Regulatory Landscape: Staying abreast of changes in IP law and data protection regulations globally, such as the GDPR and CCPA, is necessary to ensure licensing agreements and IP strategies remain compliant and effective in 2024 and beyond.

Contractual Obligations and Service Level Agreements (SLAs)

Intapp's cloud-based services are underpinned by comprehensive contractual obligations and Service Level Agreements (SLAs) with its clientele. These legally binding documents are crucial for establishing clear expectations and ensuring client confidence. They meticulously outline key performance indicators, such as guaranteed service uptime, data privacy protocols, and the framework for addressing any potential disputes, all vital for maintaining operational integrity and fostering long-term client relationships.

These agreements are particularly important in the context of cloud services where reliability and security are paramount. For instance, many SLAs in the SaaS industry, including those likely utilized by Intapp, aim for 99.9% uptime, a standard that directly impacts a client's business continuity. Intapp's adherence to these contractual terms and SLAs directly influences client retention and its reputation within the professional services sector.

- Service Uptime Guarantees: Contracts often specify minimum uptime percentages, with penalties for deviations, ensuring consistent service availability for clients.

- Data Security and Privacy: Legal clauses detail Intapp's responsibilities regarding data protection, compliance with regulations like GDPR or CCPA, and breach notification procedures.

- Dispute Resolution Mechanisms: Agreements outline processes for resolving conflicts, which could include arbitration or mediation, to prevent prolonged legal battles.

- Liability Limitations: Contracts typically define the extent of Intapp's liability in case of service failures or data breaches, providing a legal ceiling on potential damages.

Intapp must navigate a complex web of regulations impacting data handling and financial transactions. New data privacy laws in the US, building on frameworks like GDPR, continue to evolve, with significant implications for 2024 and 2025. Compliance is critical for protecting sensitive client data and avoiding hefty penalties.

The financial services industry, a core market for Intapp, is under particularly strict scrutiny. Regulations like the EU's DORA, effective January 2024, demand enhanced operational resilience, directly affecting how technology and data are managed. Future payment service regulations, such as anticipated PSD3 updates, will require ongoing adaptation.

Intapp’s commitment to legal and ethical standards is essential. This includes robust intellectual property protection for its software and adherence to licensing agreements. The company must also manage contractual obligations and SLAs for its cloud services, ensuring reliability and security for its clients.

Environmental factors

The drive for sustainability is reshaping the IT landscape, with professional and financial services firms actively seeking technology partners who champion environmental responsibility. This trend translates into a significant demand for IT solutions aligned with green computing principles and energy-efficient operations.

Intapp's focus on these areas, such as optimizing data center energy consumption, can serve as a powerful competitive advantage. For instance, the global IT sector's energy use is projected to reach 8% of global greenhouse gas emissions by 2030, highlighting the urgency and market opportunity for greener solutions.

By integrating sustainable IT practices, Intapp can attract clients who prioritize environmental, social, and governance (ESG) factors in their vendor selection. This not only meets regulatory pressures but also appeals to a growing segment of the market willing to invest in eco-conscious technology.

Environmental factors are increasingly shaping how businesses operate, especially concerning sustainability. For firms like Intapp, this means adapting to a landscape where Environmental, Social, and Governance (ESG) reporting is becoming standard practice, particularly for their larger clients in the professional and financial services sectors. These clients are scrutinizing their supply chains, and Intapp's ability to meet their evolving ESG expectations could be a key differentiator. For example, many large corporations are setting ambitious emissions reduction targets, and they expect their partners to demonstrate a similar commitment.

The demand for robust ESG data is growing, with many jurisdictions implementing new disclosure regulations. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) requires many companies to report on their sustainability impacts, which will cascade down to their vendors. Intapp may need to provide detailed information about its own environmental footprint or its efforts to promote social responsibility and good governance to remain competitive. This could involve showcasing energy efficiency measures in its operations or its approach to data privacy and ethical AI development.

The energy demands of cloud infrastructure, while often more efficient than on-premises solutions, still contribute to a significant carbon footprint. Major cloud providers are increasingly investing in renewable energy sources to mitigate this impact. For instance, in 2023, Microsoft announced its goal to be carbon negative by 2030, a commitment that extends to its Azure cloud services.

Intapp's reliance on cloud infrastructure means its environmental performance is intrinsically linked to the sustainability practices of its providers. Companies like Amazon Web Services (AWS) and Google Cloud Platform (GCP) have made substantial commitments to powering their data centers with renewable energy. AWS, for example, achieved 99% renewable energy for its operations in 2023, and aims for 100% by 2025.

Intapp's strategic choices in selecting cloud partners and negotiating service level agreements that include environmental considerations are crucial for its environmental, social, and governance (ESG) profile. As regulatory scrutiny and investor expectations around corporate environmental responsibility intensify, Intapp's approach to managing the carbon footprint of its cloud infrastructure will become an increasingly important factor in its overall sustainability narrative and market perception.

Client Pressure for Environmentally Responsible Vendors

Clients are increasingly scrutinizing their supply chains for environmental impact. For instance, a 2024 survey by Accenture found that 60% of consumers consider sustainability a key factor in their purchasing decisions. This trend extends to business-to-business relationships, meaning Intapp could see clients prioritizing vendors with demonstrable eco-friendly practices.

This client pressure translates directly into a competitive advantage for companies like Intapp that actively manage and communicate their environmental initiatives. Demonstrating a commitment to sustainability can strengthen existing client partnerships and open doors to new opportunities. According to a report by Deloitte in early 2025, companies with strong ESG (Environmental, Social, and Governance) performance are projected to see a 5-10% higher growth rate compared to their peers.

Intapp's approach to environmental responsibility can therefore become a significant differentiator in the market. This includes how the company manages its own operations, such as energy consumption in data centers, and the environmental footprint of its software solutions. Companies that can clearly articulate their sustainability efforts are better positioned to meet client demands.

The impact of this client-driven environmental focus is tangible:

- Increased Client Retention: Meeting sustainability requirements can prevent client churn.

- New Business Acquisition: A strong environmental profile can attract clients seeking responsible partners.

- Enhanced Brand Reputation: Positive environmental stewardship bolsters Intapp's image.

- Risk Mitigation: Proactively addressing environmental concerns can avoid future regulatory or reputational issues.

Climate Change Impact on Business Continuity

Climate change, while seemingly distant, can subtly disrupt the physical backbone of cloud computing, directly affecting business continuity for companies like Intapp. Extreme weather events, such as floods or severe storms, can damage the data centers that host vital cloud infrastructure. This highlights the critical need for robust disaster recovery and business continuity plans.

Intapp's commitment to resilience is demonstrated through its strategically located, geographically diverse data centers. This dispersion mitigates the risk of a single event crippling its operations. For instance, in 2024, major cloud providers faced localized disruptions due to extreme weather, underscoring the importance of this diversification strategy. Ensuring uninterrupted service delivery relies heavily on this proactive approach to infrastructure protection.

The financial implications of climate-related disruptions are significant. A study by the University of Cambridge in 2025 estimated that the average cost of a significant cloud service outage for a mid-sized enterprise could reach $1.5 million. This underscores the business imperative for cloud providers to invest in climate-resilient infrastructure and advanced continuity planning.

- Infrastructure Vulnerability: Climate change poses risks to data center facilities through increased frequency and intensity of extreme weather events.

- Geographic Diversification: Intapp's use of multiple, geographically dispersed data centers is a key strategy to ensure service availability during localized climate-related incidents.

- Cost of Disruption: Financial losses from cloud service outages, exacerbated by climate events, can be substantial, impacting revenue and reputation.

- Resilience Investment: Proactive investment in climate-resilient infrastructure and advanced disaster recovery planning is crucial for maintaining business continuity in the face of environmental challenges.

Growing demand for sustainable IT solutions is a key environmental factor influencing Intapp's market position. Clients, particularly in finance and professional services, are increasingly prioritizing vendors with strong Environmental, Social, and Governance (ESG) credentials. This trend is amplified by new regulations like the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed sustainability disclosures, impacting supply chains. By 2025, reports indicate a significant portion of consumers and businesses are factoring sustainability into purchasing decisions, making eco-conscious practices a competitive imperative for Intapp.

PESTLE Analysis Data Sources

Our Intapp PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations, and reputable financial news outlets. We synthesize information on regulatory changes, economic indicators, and societal shifts to provide comprehensive insights.