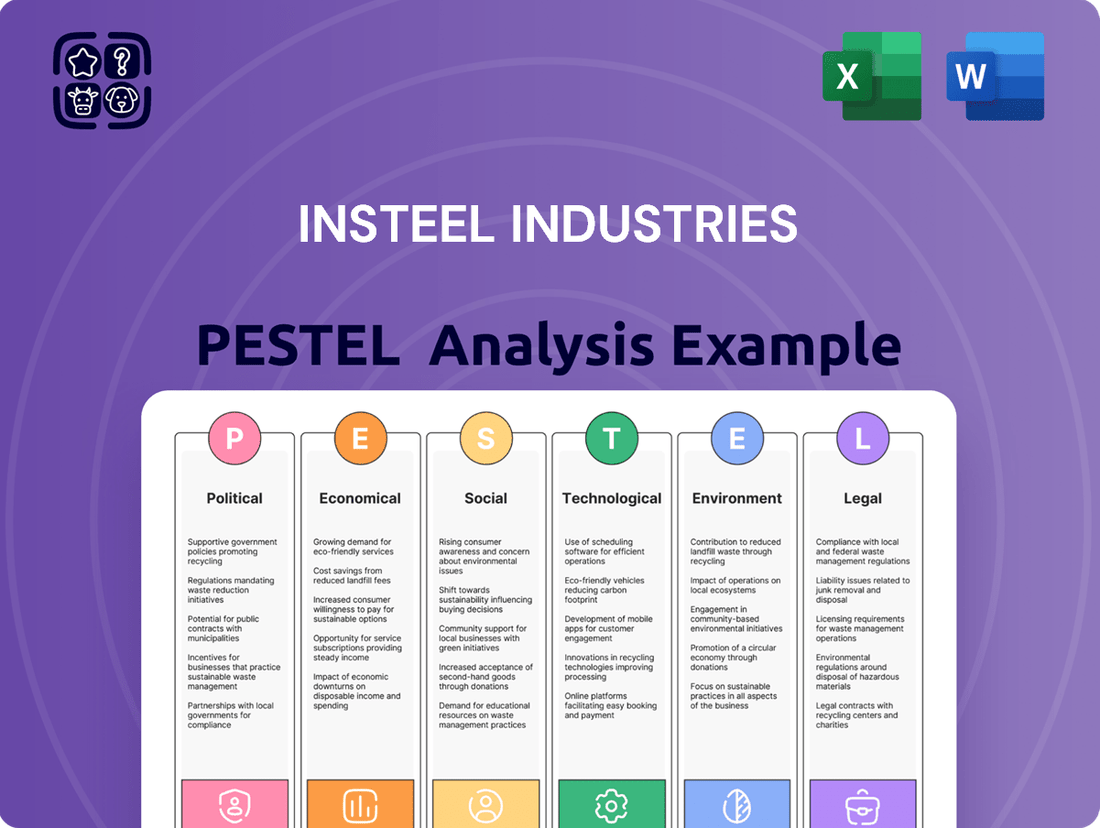

Insteel Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insteel Industries Bundle

Navigate the complex external forces shaping Insteel Industries's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic decisions. Gain a crucial competitive edge by leveraging these expert insights to anticipate challenges and capitalize on opportunities. Download the full analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

Government investment in infrastructure projects, like roads and bridges, directly drives demand for Insteel Industries' steel reinforcing products. For instance, the Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1 trillion towards upgrading America's infrastructure, with a significant portion dedicated to transportation projects expected to continue through 2025 and beyond. Fluctuations in this federal and state funding directly impact Insteel's sales volume and market opportunities.

Policy shifts favoring infrastructure modernization create a strong tailwind for the construction sector. As of early 2024, many states are accelerating their infrastructure spending plans, responding to federal grants and the need to address aging infrastructure. This focus on upgrading and expanding existing networks directly benefits companies like Insteel, which supply essential materials for these vital projects.

Government housing policies significantly influence the residential construction sector, directly impacting demand for Insteel's products. For instance, in 2024, the U.S. housing market saw continued efforts to address affordability, with various state and local governments exploring tax credits and zoning reforms to encourage new builds. These initiatives, if successful, could boost demand for welded wire reinforcing and prestressed concrete strand.

Supportive measures like interest rate subsidies or tax incentives for first-time homebuyers can stimulate the market. In 2025, projections suggest a potential uptick in housing starts if interest rates stabilize and government programs aimed at boosting homeownership gain traction. Such a scenario would translate into increased orders for Insteel's core materials.

Conversely, a tightening of credit conditions or a reduction in government housing subsidies could slow down residential construction. For example, if federal affordable housing initiatives are scaled back in 2025, this could lead to a contraction in the number of new housing projects, thereby reducing the need for Insteel's reinforcing products.

International trade policies, including tariffs and quotas on imported steel, directly influence Insteel Industries' raw material expenses and the competitive environment. For instance, in 2024, the U.S. continued to navigate complex trade relationships, with potential adjustments to Section 232 tariffs on steel imports from various countries, aiming to balance domestic industry support with broader economic considerations.

Protectionist measures, such as tariffs, can lead to higher domestic steel prices. This directly impacts Insteel's production costs, potentially squeezing profit margins if these costs cannot be fully passed on to customers. Conversely, free trade agreements or the reduction of tariffs can lower material acquisition costs, offering a competitive advantage.

Insteel's strategic planning must closely monitor evolving trade policies. For example, the ongoing discussions around global steel overcapacity and the potential for retaliatory tariffs by trading partners in 2025 highlight the need for agile supply chain management and flexible pricing strategies to mitigate risks and capitalize on opportunities.

Regulatory Environment and Building Codes

Changes in building codes and safety regulations significantly impact Insteel Industries. For example, updates to seismic building codes in California, a key market, could increase demand for specific reinforcing steel products. Insteel's ability to adapt its product lines to meet these evolving standards, such as enhanced strength requirements, is crucial for maintaining market share and driving innovation.

Compliance with these governmental mandates is non-negotiable for Insteel to ensure market access and product acceptance across its operating regions. The company's proactive approach to understanding and integrating new construction standards, like those related to fire resistance or sustainability, directly influences its product development pipeline and operational efficiency.

- Evolving Building Codes: Stricter seismic or wind-load requirements can necessitate the use of higher-grade or specialized reinforcing steel.

- Safety Regulations: Enhanced safety standards in construction, particularly concerning structural integrity, directly influence the specifications of steel products.

- Product Adaptation: Insteel must continuously innovate and adapt its product offerings to meet new or revised building codes and safety mandates.

- Market Access: Non-compliance with regulatory changes can lead to exclusion from key markets or projects requiring adherence to specific standards.

Political Stability and Economic Certainty

Insteel Industries' performance is significantly tied to political stability and economic certainty in its key operating regions, particularly the United States. Periods of political upheaval or inconsistent economic policies can directly impact investor confidence and the pipeline of large construction projects. For instance, uncertainty surrounding government infrastructure spending or regulatory changes can cause project delays, thereby dampening demand for fabricated steel. Insteel's reliance on the construction sector means a stable political environment is crucial for predictable market conditions.

The level of economic certainty directly influences the viability of major construction initiatives. When governments implement clear and consistent fiscal and monetary policies, it bolsters the confidence of developers and investors. This translates into a more robust construction market, which is beneficial for Insteel. Conversely, economic unpredictability can lead to project postponements or outright cancellations, directly affecting Insteel's order book and revenue streams.

- Political Stability: A stable U.S. political landscape generally supports consistent infrastructure investment, a key driver for Insteel's business.

- Economic Certainty: Predictable economic conditions encourage long-term construction planning and financing, positively impacting demand for fabricated steel.

- Policy Impact: Changes in trade policies, tax laws, or environmental regulations can influence construction costs and project feasibility, affecting Insteel's operational environment.

Government spending on infrastructure, such as the Biden administration's Infrastructure Investment and Jobs Act, directly fuels demand for Insteel's products. This act, with over $1 trillion allocated for infrastructure, is expected to continue driving construction projects through 2025, benefiting Insteel's reinforcing steel and fabricated steel segments. Furthermore, evolving building codes, like stricter seismic requirements in regions such as California, necessitate higher-grade steel, creating opportunities for Insteel to adapt its product offerings and maintain market access.

Housing policies also play a crucial role; in 2024, many states are exploring initiatives like tax credits and zoning reforms to boost affordability and new home construction. If these policies gain traction by 2025, they could increase demand for Insteel's welded wire reinforcing and prestressed concrete strand. Conversely, shifts in trade policies, including potential adjustments to steel tariffs in 2024 and 2025, can impact Insteel's raw material costs and competitive landscape, requiring agile supply chain management.

| Policy Area | Impact on Insteel | 2024/2025 Outlook |

|---|---|---|

| Infrastructure Spending | Increased demand for reinforcing steel | Continued strong demand driven by IIJA |

| Housing Policies | Demand for welded wire reinforcing and prestressed concrete strand | Potential increase if affordability initiatives succeed |

| Building Codes | Need for higher-grade and specialized steel products | Ongoing adaptation required for market access |

| Trade Policies | Influence on raw material costs and competition | Uncertainty due to ongoing tariff discussions |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Insteel Industries, detailing how political, economic, social, technological, environmental, and legal forces present both challenges and opportunities.

It provides actionable insights for strategic decision-making, enabling Insteel Industries to navigate the complex external landscape and capitalize on emerging trends.

A concise PESTLE analysis for Insteel Industries that simplifies complex external factors into actionable insights, easing the burden of extensive research for strategic decision-making.

Economic factors

Interest rates, largely dictated by central banks, directly impact the cost of capital for construction ventures and the affordability of homes. As of mid-2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25% to 5.50%, a level that has increased borrowing costs for developers and potential buyers.

Higher interest rates can act as a brake on new construction by making financing more expensive for builders and diminishing consumer purchasing power, consequently affecting Insteel's product demand. For instance, a rise in mortgage rates can lead to fewer home starts, a key market for Insteel's fabricated steel components.

Conversely, a more accommodative interest rate environment, with rates trending lower, can invigorate construction activity. This stimulation would likely benefit Insteel by increasing demand across both the residential and non-residential construction sectors, as financing becomes more accessible and affordable.

Inflationary pressures significantly impact Insteel Industries by driving up the costs of essential inputs like steel, energy, and transportation. For instance, the Producer Price Index for steel mill products saw a notable increase in late 2023 and early 2024, directly affecting Insteel's raw material expenses. Successfully navigating these rising costs requires strategic pricing adjustments and efficient operational management to protect profit margins.

The ability to forecast and mitigate volatility in material prices is a crucial economic factor for Insteel. Fluctuations in global steel benchmarks, influenced by supply chain disruptions and geopolitical events, can create significant cost uncertainty. Insteel's hedging strategies and long-term supplier agreements play a vital role in managing this economic risk.

Gross Domestic Product (GDP) growth is a critical indicator for Insteel Industries, as it directly influences construction sector demand. A robust economy, marked by strong GDP expansion, typically fuels increased investment in commercial and residential projects, along with government infrastructure spending. For instance, the U.S. GDP grew at an annualized rate of 1.3% in the first quarter of 2024, indicating a moderating but still positive economic environment.

This economic expansion translates into higher demand for Insteel's reinforcing steel products, which are essential components in building and infrastructure projects. Conversely, a slowdown or contraction in GDP can lead to reduced construction activity, impacting Insteel's sales volumes and revenue. The projected U.S. GDP growth for 2024 is around 2.6%, suggesting a supportive, though not booming, market for construction materials.

Housing Market Trends and Starts

The housing market's health is a critical driver for Insteel Industries, particularly its residential segment. A strong housing market, characterized by rising housing starts and robust existing home sales, directly translates to increased demand for Insteel's welded wire reinforcing products used in foundations and concrete slabs.

In 2024, the U.S. housing market has shown resilience, with new housing starts projected to increase. For instance, the U.S. Census Bureau reported that privately owned housing starts in April 2024 were at a seasonally adjusted annual rate of 1,350,000, a 5.7% increase from March 2024. This upward trend suggests a positive outlook for Insteel's residential concrete product manufacturers.

- Housing Starts: Projected to rise in 2024, indicating increased construction activity.

- Existing Home Sales: A strong market for existing homes often correlates with new construction demand.

- Home Prices: Rising home prices can boost builder confidence and encourage new development.

- Impact on Insteel: Higher residential construction activity directly increases demand for welded wire reinforcing.

Construction Industry Employment and Wages

The availability and cost of labor across the broader construction sector directly impact project timelines and overall expenses, which in turn can influence the demand for Insteel's fabricated steel products. For instance, a shortage of skilled construction workers or substantial wage hikes could cause project delays or budget overruns for contractors, potentially dampening the pace of new construction and, consequently, the consumption of Insteel's offerings.

In the United States, construction employment saw a notable increase, with industry employment reaching 8.1 million jobs in April 2024, up from 7.7 million in April 2023, according to the Bureau of Labor Statistics. Average hourly earnings in construction also rose by 4.6% over the year ending April 2024, reaching $35.48. These figures highlight the competitive labor market Insteel operates within, both for its customers and its own manufacturing facilities.

- Labor Availability: A tight labor market in construction can lead to fewer projects starting or progressing, reducing demand for steel components.

- Wage Inflation: Rising wages for construction workers increase project costs, potentially impacting Insteel's customer budgets and order volumes.

- Insteel's Labor Costs: The company must also manage its internal labor expenses to maintain competitive pricing and operational efficiency.

Consumer confidence plays a significant role in the demand for Insteel's products, as it influences spending on new homes and renovations. When consumers feel secure about their financial future, they are more likely to invest in housing, thereby boosting demand for Insteel's reinforcing steel. For instance, the Conference Board Consumer Confidence Index stood at 102.0 in May 2024, indicating a level of consumer optimism that generally supports construction spending.

Unemployment rates are also a key economic factor. Lower unemployment typically correlates with higher consumer spending and increased demand for housing and commercial construction. The U.S. unemployment rate was 3.9% in April 2024, a historically low figure that generally supports economic activity and construction demand, benefiting Insteel.

Government spending on infrastructure projects, such as roads, bridges, and public buildings, is a direct driver of demand for fabricated steel. Increased government investment in infrastructure can create substantial opportunities for Insteel. For example, the Infrastructure Investment and Jobs Act, enacted in 2021, continues to fund numerous projects, many of which will require significant steel components throughout 2024 and beyond.

What You See Is What You Get

Insteel Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Insteel Industries covers political, economic, social, technological, legal, and environmental factors impacting the company. It provides a strategic overview for informed decision-making.

Sociological factors

Global population growth and a significant shift towards urban living are key drivers for Insteel Industries. As more people move into cities, the demand for new infrastructure, commercial spaces, and residential housing naturally escalates. This trend directly translates into a greater need for steel reinforcing products, Insteel's primary offering.

The United Nations projects the world population to reach 9.7 billion by 2050, with a substantial portion of this growth occurring in urban areas. This demographic expansion fuels construction activity, and by extension, the demand for materials like rebar, which is essential for building everything from bridges to apartment complexes. Insteel is well-positioned to capitalize on this sustained, long-term demand.

Evolving consumer preferences are significantly reshaping housing demand, with a notable trend towards multi-family dwellings and smaller, more sustainable homes. For Insteel Industries, this means a potential shift in the types of steel products required by concrete product manufacturers and contractors. For instance, the U.S. Census Bureau reported that in 2023, single-family housing starts represented 67.8% of all new housing starts, down from 70.1% in 2022, indicating a growing proportion of multi-family construction.

This shift necessitates Insteel's close monitoring of these evolving needs to ensure its product portfolio remains relevant. The increasing demand for durable and resilient structures, driven by factors like climate change and natural disaster preparedness, also influences construction material choices. This emphasis on longevity can favor steel reinforcement solutions that offer superior strength and stability.

The construction industry, a key customer for Insteel, is grappling with an aging workforce, with the average age of construction workers steadily increasing. This demographic shift, coupled with a declining interest from younger generations, is projected to exacerbate existing labor shortages. For instance, a 2023 report indicated that nearly 40% of construction workers in the US are expected to retire in the coming decade, potentially creating significant capacity constraints for Insteel's clients.

These labor shortages directly translate into slower project completion times, which can dampen the consistent demand for fabricated steel products. When construction projects are delayed due to a lack of skilled labor, the need for materials like those supplied by Insteel is pushed back, creating volatility in order pipelines. This impacts Insteel's production planning and revenue forecasting.

Beyond its customer base, Insteel itself faces the challenge of attracting and retaining skilled labor for its manufacturing operations. The demand for specialized manufacturing skills, such as welding and operating heavy machinery, is high across many industries. Insteel must compete for this talent, and a failure to do so could hinder its own production capacity and operational efficiency.

Safety Standards and Public Awareness

Public awareness regarding construction safety, particularly in the wake of seismic events and extreme weather, is on the rise. This heightened scrutiny is pushing for more rigorous adherence to safety standards across the industry. For Insteel Industries, this translates to a potential increase in demand for high-quality reinforcing steel that meets stringent structural integrity and disaster resilience requirements. For instance, building codes in many regions are being updated to mandate higher performance standards for seismic zones, directly impacting the types and quantities of steel products needed.

Insteel's dedication to product quality and safety is paramount in this evolving landscape. Maintaining a strong reputation for reliability and compliance is essential for securing market share and fostering trust with contractors and developers. The company's investment in quality control and its ability to meet or exceed industry safety certifications, such as those from the American Society for Testing and Materials (ASTM), directly support its competitive edge. In 2024, the construction sector continued to emphasize resilience, with projects incorporating advanced safety features to mitigate risks.

- Growing public demand for disaster-resilient infrastructure.

- Stricter building codes and safety regulations influencing material choices.

- Insteel's focus on product quality as a key differentiator.

- Reputational impact of safety compliance on market position.

Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility (CSR) are on the rise, placing Insteel Industries under greater scrutiny regarding its labor practices, environmental footprint, and community involvement. For instance, in 2023, companies across various sectors reported increased stakeholder engagement on ESG issues, with a significant portion of investors considering CSR performance in their investment decisions. Positive CSR efforts can bolster Insteel's brand image, aid in attracting skilled employees, and cultivate stronger ties with local communities and stakeholders, thereby contributing to long-term business viability.

Demonstrating a commitment to ethical business operations is becoming a critical differentiator. Insteel's engagement in community programs and its transparent reporting on social impact metrics are key to building trust. For example, many industrial companies in 2024 are investing in local workforce development programs, with some reporting a direct correlation between these investments and improved employee retention rates.

- Growing CSR Expectations: Stakeholders increasingly demand that companies like Insteel address their social and environmental impact.

- Brand Reputation & Talent Acquisition: Positive CSR initiatives, such as community support and ethical labor, enhance Insteel's appeal to customers and potential employees.

- Community Relations: Strong community engagement fosters goodwill and can mitigate potential operational disruptions.

- Ethical Operations: A demonstrable commitment to ethical conduct is vital for maintaining stakeholder trust and long-term sustainability.

Societal shifts are profoundly influencing Insteel Industries' operational landscape. Growing public demand for disaster-resilient infrastructure, driven by increased awareness of climate change impacts, directly boosts the need for high-quality steel reinforcement. Stricter building codes and safety regulations, a direct response to these concerns, further emphasize the importance of Insteel's product quality as a key differentiator, impacting market position and stakeholder trust.

Technological factors

Advancements in automation are significantly reshaping Insteel Industries' operational landscape. In steel wire manufacturing, technologies like robotic welding and automated coil handling are boosting efficiency. For instance, the global industrial automation market was valued at approximately $223.7 billion in 2023 and is projected to reach $378.4 billion by 2030, indicating a strong trend towards increased adoption. This translates to improved product consistency and reduced labor costs for Insteel.

Furthermore, the construction sector, a key market for Insteel's products, is witnessing a surge in automation. Robotic concrete placement and automated formwork systems are accelerating project timelines. The construction robotics market alone is expected to grow substantially, with some estimates suggesting a compound annual growth rate of over 15% in the coming years. This trend can drive demand for Insteel's precisely engineered reinforcing components and prefabricated solutions, enhancing competitiveness.

Innovations in construction materials, such as self-healing concrete and fiber-reinforced polymers (FRPs), are emerging as significant technological factors. While these advanced materials could potentially compete with traditional steel reinforcement, they also present opportunities for Insteel Industries. For instance, the growing demand for sustainable and durable building solutions could drive the adoption of these new materials, potentially influencing the market share of steel in certain applications.

The construction industry's growing embrace of digital tools like Building Information Modeling (BIM) is reshaping project lifecycles. Insteel must ensure its structural steel products and specifications are compatible with these platforms to streamline design and procurement for clients, fostering better collaboration.

Supply Chain Technology and Logistics

Technological advancements in supply chain management, such as real-time tracking and predictive analytics, are significantly enhancing operational efficiency. For Insteel Industries, these innovations translate to better responsiveness to customer demand, which is critical in the construction sector where tight project schedules are common. Efficient inventory management and timely product delivery are paramount to maintaining project momentum and client satisfaction.

Leveraging advanced logistics technologies can provide Insteel with a distinct competitive advantage. By optimizing routes and delivery schedules, the company can reduce transportation costs and lead times. For instance, in 2024, the global supply chain management market was valued at over $20 billion, with a significant portion driven by technology adoption, indicating a strong trend towards digitalization.

The implementation of technologies like AI-powered demand forecasting and automated warehousing can further streamline Insteel's operations. These tools enable more accurate inventory levels, minimizing stockouts and overstocking. This precision is vital for a company like Insteel, which supplies essential components for construction projects, ensuring materials are available precisely when needed.

Key technological factors impacting Insteel's supply chain include:

- Real-time Tracking Systems: Enhancing visibility and control over shipments from origin to destination.

- Predictive Analytics: Forecasting demand, optimizing inventory, and anticipating potential disruptions.

- Logistics Optimization Software: Improving route planning, load consolidation, and delivery efficiency.

- Warehouse Automation: Streamlining inventory handling, order fulfillment, and reducing operational costs.

Recycling Technologies and Material Efficiency

Advancements in steel recycling technologies are significantly influencing the availability and cost of raw materials for companies like Insteel Industries. As of early 2025, global steel recycling rates continue to climb, with many regions exceeding 70% of steel production derived from recycled content. This trend directly impacts Insteel's input costs, making efficient sourcing of scrap metal crucial for maintaining competitive pricing.

Technologies that enhance material efficiency within the construction sector also play a vital role. Innovations leading to reduced steel waste on job sites, such as advanced cutting and fabrication techniques, align with Insteel's sustainability objectives. For instance, the increasing adoption of Building Information Modeling (BIM) in construction projects is projected to cut material waste by up to 15% in new builds by 2026, thereby influencing the demand for precisely engineered steel components.

- Increased Recycling Rates: Global steel recycling rates are projected to remain above 70% through 2025, impacting scrap metal availability and pricing for Insteel.

- Material Efficiency in Construction: BIM adoption could reduce construction material waste by 15% by 2026, influencing demand for optimized steel products.

- Insteel's Optimization: Insteel benefits from optimizing its own material usage and waste reduction, potentially lowering production costs and enhancing its environmental profile.

Technological advancements are profoundly impacting Insteel Industries, from manufacturing efficiency to market demand. Automation in steel production, including robotic welding and automated handling, is boosting output and consistency, mirroring the global industrial automation market's robust growth, projected to exceed $378 billion by 2030. The construction sector's adoption of digital tools like Building Information Modeling (BIM) is streamlining processes, and Insteel must ensure product compatibility to remain competitive.

Innovations in construction materials present both challenges and opportunities, with new composites potentially competing with steel, while also driving demand for specialized steel components. Furthermore, advanced logistics and supply chain technologies, such as real-time tracking and AI-driven forecasting, are critical for Insteel to manage inventory and meet the fast-paced demands of the construction industry, a sector where the supply chain management market is increasingly technology-dependent.

The increasing efficiency of steel recycling, with global rates often exceeding 70% by early 2025, directly influences Insteel's raw material costs. Simultaneously, construction industry trends towards material efficiency, such as BIM's potential to reduce waste by up to 15% by 2026, will shape the demand for precisely engineered steel products.

Legal factors

Building codes and construction standards are critical legal factors for Insteel Industries. National, state, and local regulations mandate specific types and specifications for reinforcing steel used in concrete. For instance, the 2024 International Building Code (IBC) and its state-level adoptions continue to emphasize material performance and durability, directly impacting the demand for Insteel's rebar and related products.

Compliance with these evolving legal requirements, which address seismic resilience and fire safety, is non-negotiable for Insteel's market access. Failure to meet standards like those for high-strength concrete reinforcement could render products unsellable. The continuous updates, such as those anticipated in the 2027 IBC cycle, require Insteel to invest in product development and testing to ensure ongoing marketability.

Insteel Industries navigates a complex web of environmental regulations, including those governing air emissions, water discharge, and waste management, all critical to steel production. Stricter rules, like those potentially updated by the EPA in 2024 or 2025 concerning greenhouse gas emissions or water quality, could necessitate significant capital investment in advanced pollution control technologies, impacting operational budgets.

Failure to adhere to these environmental mandates can result in substantial financial penalties; for instance, violations of the Clean Air Act can lead to fines measured in tens of thousands of dollars per day. Beyond financial repercussions, non-compliance poses a considerable risk to Insteel's reputation among investors and the public, potentially affecting market share and access to capital.

Labor laws, such as minimum wage and working hour regulations, directly influence Insteel's operational costs and workforce management. In 2024, the federal minimum wage in the US remained at $7.25 per hour, though many states and cities have higher rates, impacting Insteel's labor expenses where it operates.

Occupational safety and health regulations, enforced by bodies like OSHA, are paramount for Insteel's manufacturing facilities. In 2023, OSHA reported a 1.7% decrease in the private sector injury and illness rate, but workplace safety remains a significant compliance area for industrial manufacturers like Insteel, with potential fines for violations.

Adherence to union relations laws is also a key legal factor. Insteel's ability to maintain positive labor relations and comply with collective bargaining agreements can significantly affect employee morale, productivity, and potential work stoppages, which are crucial for consistent production output.

Product Liability and Warranty Laws

Insteel Industries operates under stringent product liability laws, making them accountable for any harm caused by defects in their steel reinforcing products. Maintaining rigorous quality control and ensuring the structural integrity of their offerings are paramount to minimizing potential legal exposure from product failures. For instance, a significant product recall due to a widespread defect could lead to substantial financial penalties and reputational damage, as seen in past cases within the construction materials sector.

Warranty laws further define Insteel's commitments to customers regarding product performance and the avenues for recourse in case of issues. These laws necessitate clear communication of product specifications and limitations. Insteel's adherence to these regulations is crucial for building customer trust and avoiding costly litigation. The company's financial statements often reflect provisions for potential warranty claims, underscoring the financial impact of these legal obligations.

- Product Liability: Insteel is legally responsible for damages arising from defective steel reinforcing products.

- Quality Assurance: Robust quality control is essential to prevent product failures and associated legal liabilities.

- Warranty Obligations: Adherence to warranty laws ensures customer recourse and protects against litigation.

- Financial Impact: Provisions for warranty claims and potential product liability settlements are factored into financial planning.

Trade Regulations and Anti-dumping Laws

International trade regulations, including anti-dumping duties and import/export rules, directly influence Insteel Industries' access to raw materials and its potential for global market expansion. For instance, the U.S. Department of Commerce has imposed anti-dumping and countervailing duties on various steel products from countries like China and Vietnam, aiming to level the playing field for domestic producers.

While these measures can shield Insteel from intense foreign competition, they may also affect the cost and availability of specific steel grades needed for its operations. Navigating these intricate trade frameworks is crucial for maintaining competitive pricing and ensuring supply chain stability.

Key considerations for Insteel include:

- Impact of U.S. Section 232 tariffs on steel imports: These tariffs, initially imposed in 2018 and subject to ongoing review and adjustments, affect the cost of imported steel and can influence domestic pricing.

- Compliance with evolving anti-dumping investigations: Insteel must monitor and adapt to new or revised anti-dumping duties that may target specific countries or steel product categories.

- Opportunities and risks in international trade agreements: Changes in trade pacts can open new markets or create barriers, requiring strategic adjustments in sourcing and sales.

- Management of raw material sourcing costs: Fluctuations in global steel prices, influenced by trade policies, directly impact Insteel's cost of goods sold and profit margins.

Insteel Industries must comply with building codes and construction standards, which dictate the specifications for reinforcing steel. For example, the 2024 International Building Code (IBC) and its state-level adoptions emphasize material performance, directly influencing demand for Insteel's products. Failure to meet these evolving standards, such as those for seismic resilience, can make products unsellable, requiring ongoing investment in product development and testing to ensure marketability.

Environmental factors

The steel industry is inherently energy-intensive, making it a notable source of carbon emissions. As governments worldwide intensify efforts to combat climate change, Insteel Industries faces increasing pressure from evolving environmental regulations.

New or strengthened regulations, like carbon taxes or cap-and-trade systems, could directly impact Insteel's operational expenses. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, aims to level the playing field for its industries by taxing carbon-intensive imports, potentially affecting steel producers globally.

To navigate these challenges and maintain competitiveness, Insteel may need to allocate capital towards adopting cleaner production technologies and enhancing energy efficiency across its operations. This strategic investment is crucial for compliance and for aligning with the growing demand for sustainable steel products.

Insteel's operations heavily rely on the availability and sustainable sourcing of steel scrap and iron ore. Environmental concerns regarding resource depletion and the ecological footprint of mining directly impact supply chain stability and can drive up raw material costs. For instance, global iron ore production, a key input, faced price volatility in 2024 due to geopolitical factors and demand shifts, highlighting the sensitivity of Insteel's sourcing.

Adopting circular economy principles, such as maximizing the use of recycled steel scrap, is crucial for Insteel. This not only mitigates the risks associated with virgin material scarcity but also bolsters the company's sustainability profile. Insteel's commitment to increasing recycled content in its products directly addresses these environmental pressures, aiming to create a more resilient and environmentally responsible supply chain.

Insteel Industries, like many in the steel manufacturing sector, faces significant environmental responsibilities concerning waste management and pollution control. The company must diligently manage diverse waste streams, from scrap metal and slag to industrial wastewater generated during production. For instance, in 2023, the US Environmental Protection Agency (EPA) continued to enforce stringent standards for industrial wastewater discharge, impacting operational costs and requiring advanced treatment technologies.

Evolving environmental regulations, particularly those focused on reducing air emissions and improving solid waste disposal, necessitate continuous investment in pollution control equipment and sustainable manufacturing processes. These investments are crucial not only for compliance but also for minimizing Insteel's environmental footprint. Failure to adapt can lead to substantial fines and reputational damage, as seen in past cases where non-compliance resulted in multi-million dollar penalties for industrial firms.

Water Usage and Conservation

Water is a critical input for many industrial operations, including the cooling and processing stages in steel manufacturing. Insteel Industries, like others in the sector, relies on water for its production processes. The increasing global focus on water scarcity and the implementation of more stringent regulations regarding water consumption and wastewater discharge are key environmental factors that can directly influence operational costs and necessitate investments in water-saving technologies.

For instance, in 2024, several regions experienced significant drought conditions, leading to heightened scrutiny of industrial water use. This trend is expected to continue, with projections indicating that by 2030, over 40% of the world's population could face water stress. Companies like Insteel are increasingly expected to demonstrate robust water management strategies, which may include recycling and reducing overall water intake. This focus on responsible water stewardship is not just about compliance but also about operational resilience and long-term sustainability.

- Water Dependency: Steel manufacturing processes, including cooling and dust suppression, require substantial water volumes.

- Regulatory Impact: Stricter water usage and discharge regulations can increase compliance costs and operational complexity for Insteel.

- Conservation Initiatives: Implementing water recycling and efficiency measures is becoming crucial for cost management and environmental responsibility.

- Resource Availability: Regional water scarcity, exacerbated by climate change, poses a potential risk to uninterrupted operations.

Demand for Sustainable Construction Materials

The construction industry is experiencing a significant shift towards sustainable practices, directly impacting the demand for building materials. Contractors and developers are increasingly seeking out environmentally friendly options, influencing product innovation and marketing strategies. This trend presents a clear opportunity for Insteel Industries to leverage the inherent recyclability of steel. For instance, by prominently featuring the recycled content of its steel products, Insteel can appeal to this growing segment of the market.

Furthermore, obtaining Environmental Product Declarations (EPDs) can provide quantifiable data on the environmental performance of Insteel's steel, offering a transparent and credible way to demonstrate sustainability. Aligning with recognized green building certifications, such as LEED or BREEAM, can further enhance Insteel's market appeal and competitiveness. In 2024, the global green building materials market was valued at approximately $270 billion, with projections indicating continued robust growth, underscoring the strategic importance of this demand driver.

- Growing Demand: The market for green building materials is expanding rapidly as environmental consciousness rises among stakeholders.

- Product Differentiation: Insteel can highlight its steel's recycled content and pursue EPDs to meet demand for sustainable products.

- Market Access: Aligning with green building certifications can unlock new market opportunities and enhance brand reputation.

- Market Size: The global green building materials market is a multi-billion dollar industry with strong growth potential.

Environmental factors significantly shape Insteel Industries' operational landscape, primarily through evolving climate change regulations and the increasing demand for sustainable materials. The company must navigate stricter emissions standards, potential carbon pricing mechanisms, and the imperative to reduce its environmental footprint.

Resource availability, particularly for steel scrap and iron ore, is directly impacted by environmental concerns related to mining and depletion, influencing supply chain stability and costs. Insteel's water dependency also presents challenges, with water scarcity and stricter discharge regulations necessitating investments in conservation technologies.

The growing market for green building materials offers a strategic opportunity for Insteel, as it can leverage the recyclability of steel and pursue certifications like EPDs to meet this demand. The global green building materials market was valued at approximately $270 billion in 2024, highlighting the significant commercial advantage of embracing sustainability.

| Environmental Factor | Impact on Insteel | Strategic Response |

|---|---|---|

| Climate Change Regulations | Increased compliance costs, potential carbon taxes | Invest in cleaner technologies, improve energy efficiency |

| Resource Availability | Supply chain volatility, rising raw material costs | Maximize use of recycled steel scrap, diversify sourcing |

| Water Scarcity & Discharge | Higher operational costs, need for advanced treatment | Implement water recycling and efficiency measures |

| Demand for Green Building Materials | Opportunity for market differentiation and growth | Promote recycled content, obtain EPDs, align with green certifications |

PESTLE Analysis Data Sources

Our PESTLE analysis for Insteel Industries is informed by a comprehensive review of government publications, industry-specific market research, and economic data from reputable institutions. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the steel sector.