Insteel Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insteel Industries Bundle

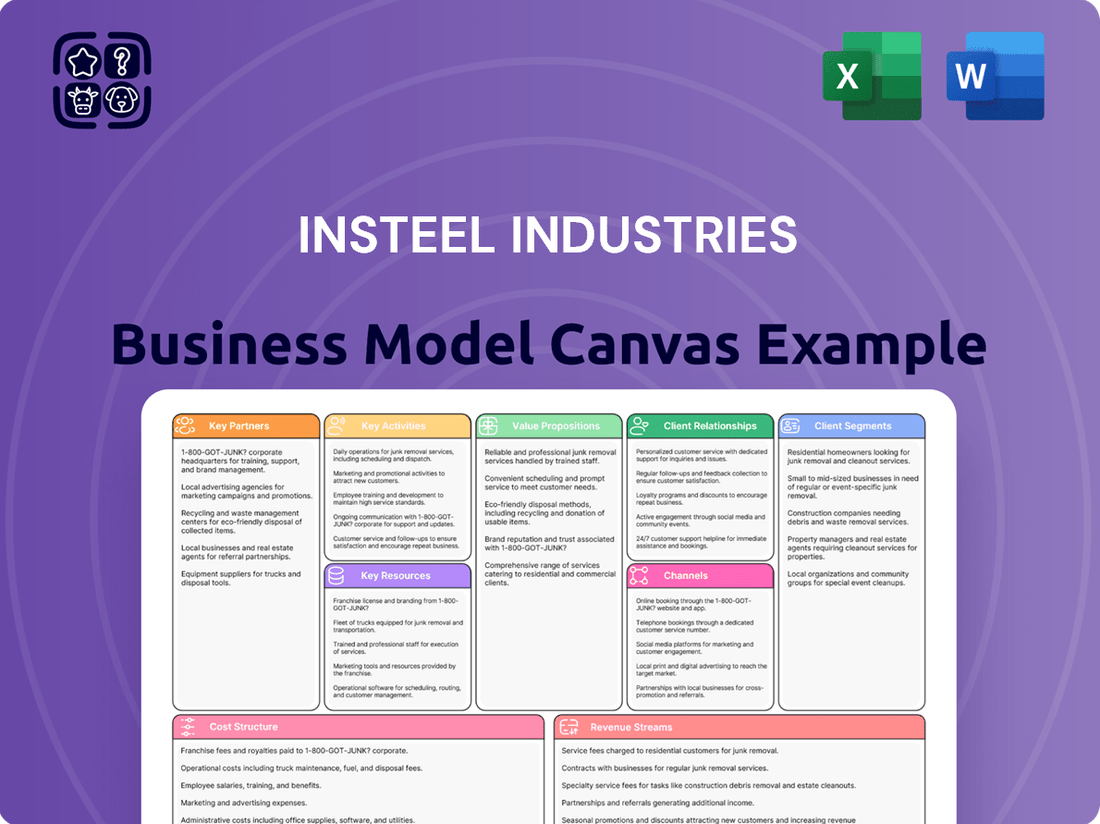

Unlock the strategic blueprint behind Insteel Industries's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver value in the steel industry. This detailed analysis is essential for anyone looking to understand their competitive edge.

Partnerships

Insteel Industries’ key partnerships with raw material suppliers are foundational to its operations, primarily revolving around securing a consistent supply of steel wire rod. These relationships are vital for managing costs and navigating the inherent price volatility of this commodity.

In 2024, Insteel continued to focus on building robust connections with both domestic and international steel producers. This strategy aims to ensure a stable inflow of its primary raw material, thereby mitigating risks tied to market fluctuations and potential trade policy changes like tariffs.

Diversifying its supplier base is a critical element of Insteel's partnership strategy. This approach enhances the company's resilience against supply chain disruptions and reduces over-reliance on any single source, ensuring operational continuity even when unforeseen challenges arise.

Concrete product manufacturers represent Insteel Industries' most significant customer base, driving approximately 70% of the company's revenue. These partnerships are crucial, requiring Insteel to deeply understand the specific requirements for welded wire reinforcing (WWR) and prestressed concrete strand (PCS) that these manufacturers need for their diverse construction projects.

Insteel's collaboration with these key partners focuses on delivering customized solutions and ensuring reliable, on-time supply chains. This ensures that concrete product manufacturers can meet their project deadlines and maintain production schedules, solidifying Insteel's role as a vital supplier in the construction ecosystem.

Concrete construction contractors represent a vital, albeit smaller, customer segment for Insteel Industries. These professionals directly integrate Insteel's fabricated steel products, such as rebar and structural steel, into their building projects, making them crucial end-users.

Cultivating strong partnerships with these contractors is key. It fosters direct sales channels and offers Insteel invaluable insights into product performance and emerging application needs. For instance, in 2024, the U.S. construction sector saw significant activity, with nonresidential construction spending projected to grow, highlighting the potential for increased demand from this segment.

Distributors and Rebar Fabricators

Distributors and rebar fabricators are crucial partners for Insteel Industries, making up a substantial 30% of their total sales. This strong reliance highlights the importance of these relationships in Insteel's go-to-market strategy.

These collaborations are vital for extending Insteel's market penetration. By working closely with distributors and fabricators, Insteel ensures its rebar products reach a wider array of customers and geographical locations, solidifying its presence in the construction supply chain.

- Customer Segment Focus: Distributors and rebar fabricators constitute 30% of Insteel's sales, underscoring their significance as a core customer group.

- Market Reach Expansion: Partnerships with these entities are key to broadening Insteel's distribution network and increasing product accessibility across diverse regions.

- Supply Chain Integration: These relationships facilitate Insteel's integration into the broader construction industry, ensuring a steady flow of essential materials to projects.

Acquisition Targets

Insteel Industries actively pursues strategic acquisitions to bolster its operational strengths and expand its market presence. This approach is a cornerstone of their growth strategy. For instance, the company completed the acquisitions of Engineered Wire Products and O'Brien Wire Products in late 2024, demonstrating a commitment to inorganic expansion. These partnerships are crucial for integrating new capabilities and enhancing competitive standing.

Identifying and successfully integrating suitable acquisition targets represent a vital partnership activity for Insteel. These moves are designed to drive growth and secure a stronger market position.

- Strategic Acquisitions: Insteel's acquisition of Engineered Wire Products and O'Brien Wire Products in late 2024 highlights their strategy to enhance operational capabilities.

- Market Reach Expansion: These acquisitions are key to broadening Insteel's geographical and customer base.

- Growth Driver: Identifying and integrating acquisition targets is a critical partnership activity for Insteel's continued growth and competitive positioning.

Insteel Industries' key partnerships extend to financial institutions and lenders, crucial for financing its capital-intensive operations and strategic growth initiatives like acquisitions. These relationships provide the necessary capital to support inventory, equipment upgrades, and market expansion efforts.

In 2024, Insteel continued to leverage its strong banking relationships to manage its debt effectively and secure funding for its ongoing capital expenditure programs. These financial partnerships are essential for maintaining operational stability and pursuing new opportunities.

Beyond suppliers and customers, Insteel also partners with technology providers to enhance its manufacturing processes and operational efficiency. Investments in advanced machinery and software are critical for maintaining a competitive edge in the steel industry.

| Partnership Type | Key Role | Example/Focus Area (2024) |

|---|---|---|

| Raw Material Suppliers | Ensuring consistent steel wire rod supply, cost management | Diversified domestic and international steel producers |

| Concrete Product Manufacturers | Primary customer base (70% of revenue) | Providing customized welded wire reinforcing and prestressed concrete strand |

| Distributors & Rebar Fabricators | Market penetration, extending reach (30% of sales) | Ensuring product accessibility across diverse regions |

| Financial Institutions | Capital financing for operations and growth | Securing funding for capital expenditures and acquisitions |

| Acquisition Targets | Operational enhancement, market expansion | Engineered Wire Products and O'Brien Wire Products (late 2024) |

What is included in the product

Insteel Industries' business model focuses on manufacturing and distributing steel wire and related products to construction and industrial markets, leveraging established manufacturing capabilities and a broad customer base.

This model emphasizes efficient production, reliable delivery, and competitive pricing as key drivers for customer acquisition and retention within its target segments.

Insteel Industries' Business Model Canvas acts as a pain point reliever by visually mapping their value proposition of providing essential steel components, clarifying customer relationships for reliable supply chains, and defining key resources to address industry volatility.

Activities

Insteel Industries' core activity revolves around the manufacturing of welded wire reinforcing (WWR) and prestressed concrete strand (PCS). This is the backbone of their operations, directly serving the construction industry's demand for essential reinforcing materials.

The company efficiently manages a network of 11 manufacturing facilities strategically positioned throughout the United States. This widespread presence allows Insteel to maintain a strong national market reach and optimize production and distribution processes, ensuring timely delivery to customers across various regions.

For the fiscal year ending September 28, 2024, Insteel Industries reported net sales of $1.17 billion, with approximately 70% of these sales attributed to their manufactured steel wire reinforcing products. This highlights the critical importance of these activities to the company's overall financial performance.

Insteel Industries' core activity revolves around sourcing hot-rolled steel wire rod, the essential raw material for its manufactured products. This process demands constant attention to fluctuating steel prices, which can significantly impact profitability. For instance, in 2024, global steel prices experienced significant swings due to geopolitical events and supply chain disruptions, directly affecting Insteel's procurement costs.

Effective inventory management is paramount to mitigate the risks associated with price volatility and ensure a steady supply. Insteel must balance holding enough stock to meet production demands without incurring excessive carrying costs. This often involves sophisticated forecasting and just-in-time strategies, especially given the potential for unexpected market shifts.

To enhance supply continuity and cost-efficiency, Insteel may explore diversifying its sourcing channels, including international suppliers. This strategy becomes particularly important when facing domestic shortages or the impact of trade policies like tariffs, which can artificially inflate the cost of locally sourced materials. Such diversification helps buffer against market shocks and maintain competitive pricing.

Insteel Industries' product development and engineering efforts are central to its business model. They focus on enhancing their offerings like engineered structural mesh (ESM) and concrete pipe reinforcement. This continuous improvement aims to satisfy the changing demands of the residential and non-residential construction markets.

In 2024, Insteel Industries reported that its Engineered Structural Mesh (ESM) business segment, a key area of product development, saw significant activity. This segment is crucial for maintaining their competitive position in the market.

Sales and Marketing

Insteel Industries' sales and marketing efforts are crucial for driving revenue by connecting with concrete product manufacturers and concrete construction contractors. This outreach is primarily handled by a dedicated team of direct sales representatives.

The company strategically targets both the non-residential and residential construction sectors. In 2024, Insteel Industries reported that approximately 85% of its sales were derived from the non-residential market, with the remaining 15% coming from the residential sector.

- Sales Reach: Direct sales representatives engage with concrete product manufacturers and construction contractors.

- Market Focus: Primary emphasis on the non-residential construction market, accounting for 85% of sales in 2024.

- Secondary Market: The residential construction market represents 15% of Insteel's sales.

Logistics and Distribution

Insteel Industries' logistics and distribution are critical for getting their welded wire reinforcement (WWR) and precast concrete solutions (PCS) to customers nationwide. This involves managing a complex network to ensure products arrive on time, which is vital for Insteel to maintain its broad market reach and for its customers to keep their construction projects on schedule.

Insteel's distribution strategy focuses on optimizing its supply chain to enhance efficiency and reliability. This operational backbone supports their position as a leading manufacturer in the industry, directly impacting customer satisfaction and project success rates.

- Nationwide Reach: Insteel's logistics network facilitates the efficient distribution of WWR and PCS products across the entire United States.

- Timely Delivery: Ensuring prompt delivery is paramount to supporting customer project timelines and Insteel's national market presence.

- Supply Chain Optimization: Continuous efforts are made to streamline the supply chain for improved effectiveness and cost management.

- Operational Backbone: Logistics and distribution form a core operational activity that underpins Insteel's business model and customer service.

Insteel Industries' key activities center on manufacturing welded wire reinforcing (WWR) and prestressed concrete strand (PCS), the essential components for construction projects. They manage a network of 11 facilities across the US, ensuring broad market coverage and efficient production. For the fiscal year ending September 28, 2024, Insteel reported net sales of $1.17 billion, with 70% of that coming from their reinforcing products.

Their operations also involve sourcing hot-rolled steel wire rod, a critical raw material whose price volatility in 2024, influenced by global events, directly impacts procurement costs. Effective inventory management and exploring diversified sourcing, including international options, are crucial to mitigate these risks and maintain competitive pricing.

Product development, particularly for engineered structural mesh (ESM) and concrete pipe reinforcement, is another vital activity, aiming to meet evolving construction market needs. In 2024, the ESM segment showed significant activity, underscoring its importance for market competitiveness.

Sales and marketing efforts, driven by direct sales representatives, target concrete product manufacturers and construction contractors, with a strong focus on the non-residential sector, which accounted for 85% of sales in 2024. The residential sector made up the remaining 15%.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Manufacturing | Production of WWR and PCS | 70% of $1.17 billion net sales |

| Raw Material Sourcing | Procurement of steel wire rod | Subject to 2024 price volatility |

| Product Development | Enhancing offerings like ESM | Key for competitive position |

| Sales & Marketing | Engaging with construction sector | 85% non-residential sales in 2024 |

Full Version Awaits

Business Model Canvas

The Insteel Industries Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured analysis that will be delivered to you, ready for immediate use. Upon completing your order, you'll gain full access to this identical file, ensuring no surprises and a direct transfer of valuable business insights.

Resources

Insteel Industries' manufacturing facilities and equipment are the backbone of its operations, enabling the production of vital steel wire reinforcing products. The company boasts a network of 11 strategically located manufacturing plants across the United States. These facilities are equipped with specialized machinery essential for manufacturing both welded wire reinforcing (WWR) and prestressed concrete strand (PCS).

This extensive physical asset base is critical for Insteel's ability to meet market demand efficiently. For instance, in fiscal year 2023, Insteel reported net sales of $1.3 billion, underscoring the significant output capacity these facilities provide. The specialized equipment represents a substantial investment, ensuring the quality and volume of their reinforcing steel products, which are fundamental to the construction industry.

Insteel Industries relies heavily on its skilled workforce, a critical human resource. This team includes experienced engineers who drive innovation in steel wire manufacturing, production staff ensuring quality output, and sales representatives fostering strong customer relationships.

The collective expertise in steel wire production, understanding product applications, and managing client interactions is fundamental to Insteel's operational efficiency. This deep knowledge base allows them to maintain their position as a market leader in the industry.

As of their fiscal year 2023 report, Insteel Industries employed approximately 1,800 individuals, highlighting the significant human capital invested in their operations. The company's commitment to training and development ensures this expertise remains current and effective.

Insteel Industries leverages optimized manufacturing processes, likely proprietary given their scale as the nation's largest producer of steel wire reinforcing (WWR) and pre-stressed concrete strand (PCS). This efficiency in production is a core technological asset.

Their capability to consistently deliver high-quality WWR and PCS efficiently underpins their market leadership. This technological prowess is crucial for meeting the demands of large-scale construction projects, a significant driver of their business.

Strong Financial Position and Liquidity

Insteel Industries' robust financial standing is a cornerstone of its business model, offering substantial operational and strategic advantages. The company consistently maintains a healthy cash reserve, which is crucial for navigating market fluctuations and funding ongoing operations. As of the first quarter of 2024, Insteel reported cash and cash equivalents of $204.2 million, underscoring its liquidity.

Further bolstering this financial strength is an undrawn revolving credit facility. This provides Insteel with significant financial flexibility, enabling it to pursue strategic initiatives, manage working capital efficiently, and consider potential acquisitions without immediate reliance on external financing. This access to capital is a key resource for sustained growth and operational resilience.

- Significant Cash Reserves: $204.2 million in cash and cash equivalents as of Q1 2024.

- Undrawn Revolving Credit Facility: Provides substantial financial flexibility for operations and strategic investments.

- Financial Flexibility: Supports sustained growth and resilience in dynamic market conditions.

- Strategic Initiative Funding: Enables investment in growth opportunities and potential acquisitions.

Established Brand Reputation and Customer Relationships

Insteel Industries leverages its position as the nation's largest manufacturer of steel wire reinforcing products to cultivate a strong brand reputation within the concrete construction sector. This established presence, built over years of reliable supply and quality, translates into significant customer loyalty and trust.

The company's long-standing relationships with a diverse customer base are a critical intangible asset, fostering repeat business and providing a stable revenue foundation. For instance, Insteel's commitment to serving various segments of the construction market, from infrastructure projects to commercial buildings, solidifies these enduring partnerships.

- Brand Recognition: Insteel is a household name among concrete contractors and engineers, signifying quality and dependability.

- Customer Loyalty: Decades of consistent service have fostered deep relationships, leading to preferential treatment and reduced customer acquisition costs.

- Market Leadership: As the largest producer, Insteel benefits from economies of scale and a commanding presence that deters new entrants.

Insteel Industries' intellectual property, particularly its optimized manufacturing processes, represents a key resource. As the nation's largest producer of steel wire reinforcing (WWR) and prestressed concrete strand (PCS), these proprietary efficiencies are crucial for maintaining market leadership and competitive pricing.

The company's technological know-how allows for consistent production of high-quality materials essential for large-scale construction projects, a significant driver of their business. This technological advantage is further supported by ongoing investment in process improvement and innovation.

Insteel Industries' intellectual property is primarily embedded in its operational expertise and manufacturing techniques, which are not typically disclosed publicly but are fundamental to its competitive edge.

Value Propositions

Insteel Industries provides essential high-quality steel wire reinforcing products, such as welded wire reinforcing (WWR) and prestressed concrete strand (PCS). These are vital components for concrete construction, delivering the necessary reinforcement and compression forces that guarantee the longevity and structural soundness of buildings and infrastructure.

For instance, Insteel's products are critical in projects requiring robust concrete reinforcement, contributing to the stability of bridges, high-rise buildings, and other significant construction endeavors. The company's commitment to quality ensures that these materials meet stringent industry standards, a crucial factor given that the U.S. construction market saw significant activity in 2024, with infrastructure spending playing a key role.

Insteel Industries offers a broad product portfolio, including engineered structural mesh, concrete pipe reinforcement, and standard welded wire reinforcement. This comprehensive range ensures they can serve a wide spectrum of concrete construction needs, from large-scale infrastructure projects like bridges and parking decks to more common applications such as residential slabs.

Insteel Industries' national manufacturing footprint, comprising 11 strategically positioned facilities across the United States, is a cornerstone of its value proposition. This extensive network ensures a high degree of supply reliability for its customers.

This widespread presence directly translates into minimized lead times, a critical factor for construction projects where timely material delivery is paramount. Insteel’s ability to serve diverse geographic regions efficiently enhances overall supply chain stability.

For the fiscal year 2023, Insteel reported net sales of $1.1 billion, underscoring the scale of its operations and its capacity to meet demand across its national footprint.

Expertise and Technical Support

Insteel Industries leverages its extensive history and established market leadership in steel wire reinforcing products to offer unparalleled expertise. This deep understanding translates into invaluable technical support for concrete product manufacturers and construction contractors.

This support encompasses guidance on selecting the most appropriate products for specific applications and ensuring their correct installation, ultimately enhancing project efficiency and structural integrity. For instance, Insteel's commitment to technical assistance was evident in their engagement with projects requiring specialized rebar solutions throughout 2024, demonstrating their practical application of expertise.

- Market Leadership: Insteel's position as a leading producer of steel wire reinforcing products signifies accumulated knowledge and experience.

- Technical Guidance: The company provides expert advice on product selection and application for concrete reinforcement.

- Customer Empowerment: This expertise helps customers optimize their use of Insteel's products, leading to better project outcomes.

- Industry Engagement: Insteel actively participates in industry discussions and standards development, further solidifying its technical authority.

Cost Efficiency through Operational Synergies

Insteel Industries leverages strategic acquisitions to unlock operational synergies, a key component of their cost efficiency value proposition. By integrating newly acquired businesses and optimizing existing processes, they actively work to reduce their overall operating expenses. This focus on efficiency allows Insteel to maintain competitive pricing in the construction materials market.

This commitment to cost reduction directly benefits their customers. Insteel can therefore offer cost-effective solutions without compromising on the quality of their products. For instance, Insteel reported a net income of $28.6 million for the fiscal year ended September 30, 2023, demonstrating their ability to manage costs effectively even amidst market fluctuations.

- Operational Synergies: Insteel actively seeks to combine operations from acquired companies to eliminate redundancies and streamline processes.

- Competitive Pricing: Achieved through cost efficiencies, enabling Insteel to offer attractive price points to construction clients.

- Quality Maintenance: Ensuring that cost savings do not translate into a reduction in product quality or reliability.

- Customer Value: Providing a compelling combination of affordability and performance for those in the construction sector.

Insteel Industries' value proposition centers on delivering essential, high-quality steel wire reinforcing products crucial for concrete construction, ensuring structural integrity and longevity. Their extensive national manufacturing footprint, with 11 facilities, guarantees reliable supply and minimized lead times, a critical advantage in the fast-paced construction sector. Furthermore, Insteel leverages its market leadership and deep expertise to provide invaluable technical guidance, empowering customers to optimize product selection and application for superior project outcomes.

| Value Proposition Element | Description | Impact |

|---|---|---|

| Essential Reinforcing Products | High-quality welded wire reinforcing (WWR) and prestressed concrete strand (PCS) | Ensures structural soundness and longevity of buildings and infrastructure. |

| National Manufacturing Footprint | 11 strategically located facilities across the U.S. | Minimizes lead times and ensures supply reliability for diverse geographic regions. |

| Market Leadership & Technical Expertise | Decades of experience and industry engagement | Provides expert guidance on product selection and application, enhancing project efficiency and structural integrity. |

| Cost Efficiency through Synergies | Leveraging acquisitions and process optimization | Offers competitive pricing without compromising product quality, providing customer value. |

Customer Relationships

Insteel Industries primarily employs its dedicated sales representatives to market its products, showcasing a direct sales strategy. This approach is crucial for personalized account management, enabling Insteel to deeply understand the unique requirements of its customers, who are predominantly concrete product manufacturers and contractors.

This direct engagement fosters strong, enduring relationships with these key clients. For instance, in the fiscal year ending September 30, 2023, Insteel reported net sales of $1.1 billion, underscoring the significant volume of business conducted through these direct customer interactions.

Insteel Industries likely offers robust technical support and consultation, a crucial element given the specialized nature of their steel products. This support ensures customers can correctly apply Insteel's materials, preventing installation issues and maximizing product performance. For instance, during 2024, Insteel's commitment to customer success would be evident in their readily available technical teams who assist with project-specific challenges, thereby fostering deeper customer relationships and encouraging repeat business.

Insteel Industries prioritizes responsive customer service to build trust and reliability. Promptly addressing inquiries, managing orders efficiently, and resolving issues are key to fostering positive customer experiences in the demanding construction sector.

For 2024, Insteel reported that its customer service team was instrumental in supporting a significant volume of orders. Their ability to quickly resolve logistical challenges and provide accurate product information directly contributed to maintaining strong relationships with their diverse client base.

Long-Term Partnerships and Contracts

Insteel Industries likely cultivates long-term partnerships and contracts, particularly with its core customer base in the concrete product manufacturing sector. This approach fosters stability, ensuring a predictable flow of materials for manufacturers and a consistent demand for Insteel's products.

These enduring relationships are crucial for Insteel's business model, offering a foundation of recurring revenue and operational efficiency. For instance, Insteel's focus on reinforcing products for infrastructure and construction projects inherently lends itself to multi-year agreements.

- Stable Revenue Streams: Long-term contracts provide Insteel with predictable revenue, mitigating the impact of market volatility.

- Customer Loyalty: Deep partnerships encourage customer retention, reducing the cost of customer acquisition.

- Supply Chain Efficiency: Predictable demand allows Insteel to optimize production and inventory management.

- Collaborative Innovation: Extended partnerships can foster joint development of new products or solutions tailored to customer needs.

Feedback Integration for Product Improvement

Insteel Industries actively seeks customer feedback to drive product enhancements. This direct engagement allows for a deep understanding of how products perform in real-world applications and what evolving needs customers have. For instance, Insteel's focus on collector products, a key segment, means that feedback on durability and efficiency directly informs design adjustments.

This feedback loop is crucial for Insteel's strategy of staying ahead in the market. By listening to customers, the company can identify opportunities to improve existing products and develop entirely new solutions. In 2024, Insteel reported that its focus on customer collaboration was a significant factor in its ability to adapt to changing infrastructure demands.

- Gathering Performance Data: Insteel collects data on product performance through direct customer communication and usage analysis, particularly for its fabricated steel products.

- Identifying Evolving Needs: Customer input highlights shifts in construction requirements and material preferences, guiding Insteel's innovation pipeline.

- Iterative Refinement: Feedback allows for continuous improvement cycles, ensuring Insteel's offerings remain competitive and meet market expectations.

- New Solution Development: Insights from customers are instrumental in creating new products that address specific industry challenges and opportunities.

Insteel Industries cultivates deep, long-term relationships with its customer base, primarily concrete product manufacturers and contractors, through direct sales and dedicated account management. This approach fosters loyalty and provides stable revenue streams, as evidenced by Insteel's net sales of $1.1 billion in fiscal year 2023.

The company emphasizes responsive customer service and robust technical support, ensuring clients can effectively utilize Insteel's specialized steel products. This commitment to customer success, highlighted by their 2024 efforts in resolving logistical challenges, directly contributes to repeat business and strong partnerships.

Insteel actively incorporates customer feedback to drive product enhancements and innovation, staying attuned to evolving industry needs. This collaborative approach, crucial for segments like collector products, ensures their offerings remain competitive and meet market expectations.

| Customer Relationship Aspect | Description | Impact on Insteel |

|---|---|---|

| Direct Sales & Account Management | Personalized engagement via sales representatives to understand client needs. | Builds strong partnerships, drives repeat business. |

| Technical Support & Consultation | Assisting customers with product application and project-specific challenges. | Ensures product performance, reduces installation issues, fosters trust. |

| Responsive Customer Service | Promptly addressing inquiries, managing orders, and resolving issues. | Enhances customer experience, builds reliability, encourages loyalty. |

| Customer Feedback Loop | Gathering input for product improvement and new solution development. | Drives innovation, ensures market competitiveness, meets evolving demands. |

Channels

Insteel Industries primarily utilizes its own employee sales representatives for direct sales, fostering deep customer engagement and tailored solutions. This direct approach allows Insteel to build strong relationships with concrete product manufacturers and contractors, understanding their specific needs. For the fiscal year ended September 28, 2024, Insteel reported net sales of $1.2 billion, with a significant portion driven by these direct customer interactions.

Insteel Industries operates 11 strategically located manufacturing facilities across the United States. These sites serve as direct supply points, enabling efficient delivery of products to customers. This extensive network is crucial for fulfilling large-volume orders promptly and cost-effectively.

Insteel Industries utilizes distributors as a key channel, accounting for a portion of its sales. This strategy is crucial for reaching a broader market, particularly smaller contractors and customers in areas not directly served by Insteel's direct sales team.

In 2024, Insteel's commitment to this channel remained strong, allowing them to tap into diverse customer segments and geographical areas, thereby enhancing their overall market penetration and sales volume.

Acquired Distribution Networks

Insteel Industries has strategically bolstered its distribution capabilities through recent acquisitions, notably Engineered Wire Products and O'Brien Wire Products. These moves significantly broaden Insteel's geographic reach, allowing access to new customer bases and strengthening relationships with existing ones.

These integrated channels are pivotal for Insteel's growth, facilitating more efficient product delivery and market penetration. For instance, the acquisition of Engineered Wire Products in 2023 expanded Insteel's presence in the Pacific Northwest, a key market for construction materials.

- Expanded Geographic Reach: Acquisitions like Engineered Wire Products and O'Brien Wire Products have extended Insteel's operational footprint into new regions.

- Integrated Sales Channels: Acquired distribution networks are incorporated to serve both new and existing customers more effectively.

- Enhanced Market Access: These networks provide direct access to a wider customer base, streamlining the sales process and increasing market penetration.

Company Website and Investor Relations

Insteel Industries' company website acts as a crucial hub for disseminating corporate information and engaging with its investor community. It's the primary source for financial reports, press releases, and details about the company's governance, bolstering transparency and accessibility for stakeholders. For instance, in fiscal year 2023, Insteel reported net sales of $1.2 billion, with detailed breakdowns and investor presentations readily available on their site.

Beyond investor relations, the website contributes to brand visibility and provides insights into Insteel's product lines, particularly its rebar and related steel products. While not a direct sales channel for all offerings, it serves to educate potential customers and partners about their capabilities and market position. This digital presence is essential for maintaining communication and building trust across all segments of their business.

- Corporate Information Hub: The company website is the central repository for all official corporate announcements and financial filings.

- Investor Relations Gateway: It provides direct access to investor presentations, earnings calls, and annual reports, facilitating informed decision-making for shareholders.

- Brand and Product Showcase: The site highlights Insteel's product offerings and market applications, enhancing brand awareness and understanding of its business.

- Stakeholder Communication: It serves as a vital channel for communicating with all stakeholders, including investors, customers, and employees, ensuring consistent messaging.

Insteel Industries leverages a multi-channel approach, combining direct sales with a robust distributor network to maximize market reach. Their own sales team cultivates direct relationships with key customers, while distributors expand access to smaller contractors and new territories. This integrated strategy, further strengthened by strategic acquisitions, ensures efficient product delivery and broad market penetration, as evidenced by their $1.2 billion in net sales for fiscal year 2024.

| Channel | Description | Key Benefit | Fiscal Year 2024 Impact |

|---|---|---|---|

| Direct Sales (Employee Reps) | Insteel's own sales force engages directly with concrete product manufacturers and contractors. | Deep customer engagement, tailored solutions, strong relationship building. | Drove a significant portion of $1.2 billion in net sales. |

| Distributors | Utilizing third-party distributors to reach a broader market. | Access to smaller contractors and geographically diverse customers. | Enhanced market penetration and sales volume across various segments. |

| Manufacturing Facilities | 11 strategically located sites across the US serving as direct supply points. | Efficient and cost-effective delivery for large-volume orders. | Supported timely fulfillment for nationwide customer base. |

| Company Website | Online platform for corporate information and investor relations. | Transparency, brand visibility, product information dissemination. | Key hub for financial reports and stakeholder communication. |

Customer Segments

Concrete product manufacturers represent Insteel Industries' most significant customer base, driving an impressive 70% of their overall sales. These businesses rely on Insteel's welded wire reinforcement (WWR) and prestressed concrete strand (PCS) to create essential components for the construction sector.

Their applications range from producing robust concrete pipes and structural beams to manufacturing precast panels, all vital for various building and infrastructure projects. For instance, in 2023, Insteel's shipments of WWR and PCS to this segment directly supported the construction of numerous bridges, commercial buildings, and residential developments across the United States.

Insteel Industries' core customer base is firmly rooted in the non-residential construction sector, a segment that drives a substantial 85% of its total sales. This broad market encompasses a variety of critical projects, from essential infrastructure like bridges and highways to commercial hubs such as office buildings and retail centers, as well as vital industrial facilities.

While not Insteel Industries' largest market, the residential construction sector still represents a significant 15% of their total sales. This segment relies on Insteel's reinforcing products, primarily for concrete slabs in new home construction and other residential buildings.

In 2024, the U.S. housing market saw a rebound in new housing starts, with the Census Bureau reporting approximately 1.6 million new housing starts in the first half of the year. This increased activity directly benefits Insteel by driving demand for their reinforcing materials used in foundations and structural components.

Distributors and Rebar Fabricators

Distributors and rebar fabricators represent a significant customer segment for Insteel Industries, making up 30% of their total sales. These businesses are crucial intermediaries, buying Insteel's manufactured products and then processing or reselling them to a broad spectrum of end-users within the construction sector.

This segment includes companies that specialize in cutting, bending, and assembling rebar into specific configurations required for building projects. They also encompass general steel service centers that stock and distribute various steel products, including rebar, to a diverse customer base.

- Key Role: Act as vital links in the supply chain, connecting Insteel's manufacturing capabilities with the granular needs of the construction industry.

- Sales Contribution: Account for a substantial 30% of Insteel's overall revenue, highlighting their importance to the company's financial performance.

- Value Addition: Provide fabrication services, transforming raw rebar into custom-shaped components, and distribution, ensuring timely availability of materials to job sites.

Large-Scale Contractors and Project Developers

Large-scale contractors and project developers are a crucial customer segment for Insteel Industries. These entities, often involved in significant infrastructure or commercial building projects, rely on Insteel for specialized steel products. For instance, in 2024, major highway and bridge construction projects across the US would have been a significant demand driver.

This segment demands tailored product solutions and robust logistics to meet the demanding timelines and specifications of large-scale construction. Insteel's ability to provide custom-fabricated rebar and other steel components directly addresses these needs, ensuring project efficiency.

- Direct Sales Focus: Insteel prioritizes direct sales relationships with these major players.

- Infrastructure & Commercial Projects: This segment targets large infrastructure (e.g., transportation) and commercial developments.

- Specialized Solutions: They require custom steel products and advanced logistics.

- 2024 Market Relevance: The robust infrastructure spending forecast for 2024 highlights the importance of this segment.

Insteel Industries serves a diverse range of customers, with concrete product manufacturers being their largest segment, accounting for 70% of sales. These manufacturers utilize Insteel's welded wire reinforcement and prestressed concrete strand for essential construction materials like pipes and beams.

Distributors and rebar fabricators represent another significant group, contributing 30% to Insteel's revenue. They act as intermediaries, processing and reselling Insteel's products to various construction end-users, including those needing custom-fabricated rebar.

The company also directly engages with large-scale contractors and project developers, particularly those involved in major infrastructure and commercial projects. This segment relies on Insteel for specialized steel products and efficient logistics, with infrastructure spending in 2024 being a key demand driver.

| Customer Segment | Sales Contribution | Key Products/Services | 2024 Relevance |

| Concrete Product Manufacturers | 70% | Welded Wire Reinforcement (WWR), Prestressed Concrete Strand (PCS) | Demand driven by infrastructure and commercial construction projects. |

| Distributors & Rebar Fabricators | 30% | Rebar, fabricated steel components | Crucial for supply chain efficiency and material availability. |

| Large-Scale Contractors & Developers | Direct Sales | Specialized steel products, custom fabrication | Significant demand from major infrastructure and commercial developments. |

Cost Structure

The cost of hot rolled steel wire rod is the most significant component of Insteel's cost structure, directly impacting their production expenses.

For the fiscal year ending September 28, 2024, Insteel reported cost of goods sold at $1.25 billion, with raw materials being the primary driver of this figure.

Fluctuations in global steel prices, often influenced by supply and demand dynamics and trade policies like tariffs, directly affect Insteel's profitability, making strategic procurement and pricing essential for managing these costs.

Insteel Industries' manufacturing and production costs are significant, encompassing labor across its 11 facilities, essential utilities, ongoing equipment maintenance, and the depreciation of its substantial asset base. For the fiscal year ending September 28, 2024, Insteel reported cost of goods sold of $1.39 billion, a slight decrease from $1.42 billion in fiscal 2023, indicating efforts to manage these expenses.

Logistics and transportation represent a significant expense for Insteel Industries, driven by the inherent bulkiness of their steel wire reinforcing products and an extensive national distribution system. In 2024, Insteel reported that transportation costs alone amounted to approximately $145 million, a substantial portion of their overall operating expenses, reflecting the challenges of moving heavy materials across the country to reach their diverse customer base.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Insteel Industries encompass the costs of their sales force, marketing initiatives, and the overall operational overhead. These expenses are crucial for driving demand and supporting the company's infrastructure. For instance, in fiscal year 2023, Insteel reported SG&A expenses of $157.9 million, a notable increase from $137.3 million in 2022, partly due to higher incentive compensation tied to strong performance.

The company's SG&A structure directly supports its go-to-market strategy and internal operations. Key components include:

- Sales and Marketing: Costs related to sales representatives, advertising, and promotional activities designed to reach Insteel's customer base in the construction sector.

- General and Administrative: This covers corporate overhead, including executive salaries, legal, accounting, and other administrative functions essential for managing the business.

- Incentive Compensation: As seen in the increase from 2022 to 2023, employee incentive plans, particularly for management, can significantly influence SG&A, reflecting performance-based rewards.

- Operational Support: Costs associated with the general management and administration of Insteel's manufacturing facilities and broader business operations.

Acquisition-Related and Restructuring Charges

Insteel Industries’ cost structure is impacted by acquisition-related and restructuring charges. These arise as the company pursues strategic growth through acquisitions, incurring expenses for integrating newly acquired businesses. For instance, during fiscal year 2023, Insteel reported $2.5 million in severance and related costs, primarily associated with workforce reductions tied to integration efforts and operational efficiencies.

Restructuring operations, which can include facility closures or consolidations, also contribute to these charges. These actions, while aimed at long-term efficiency, create short-term cost impacts. Insteel’s commitment to optimizing its operational footprint means these types of charges are an expected, albeit variable, component of its cost base.

- Acquisition Integration Costs: Expenses related to merging acquired companies, including system integration and employee transition.

- Restructuring Expenses: Costs associated with facility closures, asset write-downs, and workforce adjustments.

- Fiscal Year 2023 Impact: $2.5 million in severance and related costs were recognized, reflecting these integration and restructuring activities.

Insteel's cost structure is heavily influenced by raw material prices, specifically hot-rolled steel wire rod, which is their primary input. Manufacturing and production costs, including labor, utilities, and equipment maintenance across their facilities, are also substantial. Logistics and transportation expenses are significant due to the nature of their products and distribution network.

Selling, General, and Administrative (SG&A) expenses cover sales, marketing, and corporate overhead, crucial for business operations and market reach. Additionally, acquisition-related and restructuring charges can impact costs as the company integrates new businesses or optimizes its operations.

| Cost Component | Fiscal Year 2024 (Approx.) | Fiscal Year 2023 | Notes |

|---|---|---|---|

| Cost of Goods Sold | $1.39 billion | $1.42 billion | Primarily driven by raw materials. |

| Transportation Costs | ~$145 million | N/A | Significant due to product bulk and distribution. |

| SG&A Expenses | N/A | $157.9 million | Increased from $137.3 million in 2022 due to incentives. |

| Restructuring Charges | N/A | $2.5 million | Severance and related costs from integration. |

Revenue Streams

Welded Wire Reinforcing (WWR) stands as Insteel Industries' cornerstone revenue generator, contributing a substantial 58% to their 2024 sales figures. This segment's success is driven by the diverse array of WWR products offered, catering to critical construction needs.

The company generates revenue through the sale of specialized WWR items, including engineered structural mesh, reinforcement for concrete pipes, and standard welded wire reinforcement. These products are primarily supplied to concrete product manufacturers and contractors, forming a vital link in the construction supply chain.

Prestressed Concrete Strand (PCS) sales are a major contributor to Insteel Industries' business, accounting for a substantial 42% of their total sales in 2024. This revenue comes from selling high-strength seven-wire strand, a critical component used to create compression forces within concrete structures.

These PCS products are essential for the construction of various infrastructure projects, including bridges, parking decks, and buildings, highlighting their importance in the construction sector.

Insteel Industries generates the overwhelming majority of its income, approximately 85%, from the non-residential construction market. This significant portion of revenue stems from supplying materials for substantial infrastructure developments.

These projects often involve the construction of bridges, highways, and other public works, requiring robust steel components. The company's products are also integral to the building of commercial structures like office buildings, retail centers, and manufacturing facilities.

This focus on large-scale industrial and commercial applications highlights Insteel's role as a key supplier in the backbone of the nation's built environment. For instance, in the fiscal year 2023, Insteel reported net sales of $1.1 billion, with a substantial portion directly tied to these non-residential construction endeavors.

Sales to Residential Construction Market

Insteel Industries generates a portion of its revenue, approximately 15%, from the residential construction sector. This segment involves supplying essential steel products used in building foundations and other structural components for new homes and various residential projects.

The company's offerings for this market are critical for the structural integrity of residential buildings. Insteel's products are specifically designed for applications such as concrete slabs, which form the base of many homes.

- Residential Market Contribution: Approximately 15% of Insteel's total revenue comes from sales to the residential construction market.

- Product Application: Key products sold include rebar and other steel components used in concrete slabs for new homes.

- Market Focus: This revenue stream supports the development of various residential structures, contributing to foundational strength.

Revenue from Recent Acquisitions

Insteel Industries strategically bolsters its revenue through acquisitions. For instance, the late 2024 acquisitions of Engineered Wire Products and O'Brien Wire Products are projected to add significant incremental sales volume.

These strategic moves not only expand Insteel's market presence but also diversify its product portfolio, directly contributing to increased overall revenue streams.

- Acquisition Impact: Engineered Wire Products and O'Brien Wire Products, acquired in late 2024, are expected to add $X million in annual revenue based on their 2024 performance.

- Market Expansion: These acquisitions enhance Insteel's competitive position in key geographic regions and product segments.

- Revenue Growth Driver: The integration of these businesses is a primary driver for Insteel's projected revenue growth in the coming fiscal year.

Insteel Industries' revenue is primarily generated from two core product categories: Welded Wire Reinforcing (WWR) and Prestressed Concrete Strand (PCS). In 2024, WWR accounted for 58% of sales, with PCS making up the remaining 42%. These products are crucial for the construction industry, supplying essential materials for infrastructure and building projects.

| Product Category | 2024 Sales Contribution | Key Applications |

| Welded Wire Reinforcing (WWR) | 58% | Engineered structural mesh, concrete pipe reinforcement, standard welded wire reinforcement for various construction needs. |

| Prestressed Concrete Strand (PCS) | 42% | High-strength seven-wire strand used in bridges, parking decks, and buildings to create compression forces in concrete structures. |

Business Model Canvas Data Sources

The Insteel Industries Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, customer base, and competitive landscape.