Insteel Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insteel Industries Bundle

Insteel Industries faces moderate buyer power due to the commoditized nature of its products, but also contends with significant supplier power from raw material providers. The threat of substitutes is relatively low, but the threat of new entrants is a persistent concern in the steel industry.

The complete report reveals the real forces shaping Insteel Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Raw material cost volatility is a significant factor impacting Insteel Industries. The primary input, steel wire rod, experiences considerable price swings. For instance, in 2024, steel prices have shown notable fluctuations influenced by global supply and demand dynamics, as well as energy costs.

These price movements directly affect Insteel's cost of goods sold. The price of scrap steel, a crucial component in steel manufacturing, also contributes to this volatility. In 2024, scrap steel prices have been influenced by factors such as automotive production levels and international trade policies.

The bargaining power of suppliers for Insteel Industries is influenced by the concentration within the steel wire rod market. While precise numbers of key suppliers are not publicly detailed, such markets often exhibit a degree of concentration, meaning Insteel may rely on a relatively small group of major producers for its essential raw material. This limited supplier pool can grant those suppliers greater leverage in negotiating prices and contract terms, potentially impacting Insteel's cost of goods sold.

Government tariffs on steel imports, like the Section 232 tariffs, can significantly hike the cost of imported steel wire rod. This situation compels Insteel Industries to lean more heavily on domestic suppliers. Consequently, these domestic suppliers may find themselves with greater leverage, able to dictate terms more forcefully.

Recent developments in 2025 underscore this dynamic. The restoration of Section 232 steel tariffs for shipments originating from Canada and Mexico, coupled with a broad 10% tariff applied to all countries, directly impacts raw material costs. For Insteel, this means a potential increase in their input expenses, further solidifying the bargaining power of their steel rod suppliers.

Supplier Switching Costs

Supplier switching costs can significantly impact Insteel Industries' bargaining power. If it's costly and time-consuming for Insteel to switch from one steel wire rod supplier to another, suppliers gain leverage. These costs can include the expense and effort of qualifying new suppliers, modifying existing manufacturing processes to accommodate different material specifications, or establishing new logistics and supply chain arrangements.

These switching costs can reduce Insteel's flexibility and increase its reliance on current suppliers. For instance, in 2023, Insteel Industries reported that its cost of goods sold was approximately $1.1 billion. A substantial portion of this would be attributable to raw materials like steel wire rod. If switching suppliers requires significant investment in new tooling or process re-validation, these upfront expenses make frequent supplier changes less appealing.

- Supplier Qualification: The process of vetting and approving new suppliers can be lengthy and resource-intensive.

- Process Adaptation: Adjusting machinery and production lines for different steel wire rod tolerances or compositions incurs costs and potential downtime.

- Logistical Integration: Setting up new shipping, receiving, and inventory management systems for a new supplier adds complexity and expense.

Supplier Vertical Integration

Supplier vertical integration poses a significant threat if Insteel's steel wire rod suppliers were to also produce concrete reinforcing products. This would transform them from mere suppliers into potential competitors, granting them greater leverage in pricing negotiations and potentially limiting Insteel's options. While there's no explicit indication of this happening with Insteel's current primary suppliers, such a move by any major supplier would substantially diminish Insteel's bargaining power.

The potential for supplier vertical integration highlights a critical aspect of supply chain dynamics. If a key supplier, for instance, were to integrate forward into Insteel's product market, they could dictate terms more forcefully. This scenario would directly impact Insteel's cost structure and competitive positioning.

- Supplier Integration Risk: The threat of suppliers integrating forward into Insteel's business, becoming direct competitors in the concrete reinforcing products market.

- Leverage Shift: Such integration would shift bargaining power significantly towards suppliers, allowing them to exert more control over pricing and supply terms.

- Market Dynamics: While not currently evident for Insteel's immediate suppliers, the general industry trend towards vertical integration could create future challenges.

- Impact on Insteel: Increased costs and reduced flexibility for Insteel if key raw material providers become market rivals.

The bargaining power of Insteel Industries' suppliers is a key concern, particularly given the concentration in the steel wire rod market. A limited number of major producers can exert significant influence over pricing and terms, directly impacting Insteel's cost of goods sold. For instance, in 2024, steel prices have been volatile due to global demand and energy costs, amplifying supplier leverage.

Government policies, such as the Section 232 tariffs, further bolster supplier power by increasing the cost of imported steel and pushing Insteel towards domestic sources, which then gain leverage. In 2025, the reintroduction of these tariffs on specific countries has exacerbated this situation, potentially raising Insteel's input expenses and strengthening supplier negotiating positions.

High supplier switching costs also empower suppliers. If Insteel faces substantial expenses or operational disruptions when changing suppliers, their current providers gain leverage. These costs can include supplier qualification, process adaptation for new material specifications, and logistical integration, all of which reduce Insteel's flexibility and increase dependence.

The threat of vertical integration by suppliers, where they might produce concrete reinforcing products themselves, would significantly shift bargaining power. This would turn suppliers into potential competitors, allowing them to dictate terms more forcefully and limit Insteel's options, impacting both costs and market positioning.

| Factor | Impact on Insteel | 2024/2025 Relevance |

|---|---|---|

| Supplier Concentration | Increased leverage for suppliers | Market often has few major steel wire rod producers |

| Tariffs (e.g., Section 232) | Higher raw material costs, reduced supplier options | Restored tariffs in 2025 increase reliance on domestic suppliers |

| Switching Costs | Reduced flexibility, increased supplier dependence | Costs include qualification, process adaptation, and logistics |

| Vertical Integration Risk | Suppliers become competitors, dictate terms | General industry trend could impact Insteel's supply chain |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Insteel Industries' position in the manufactured steel wire products market.

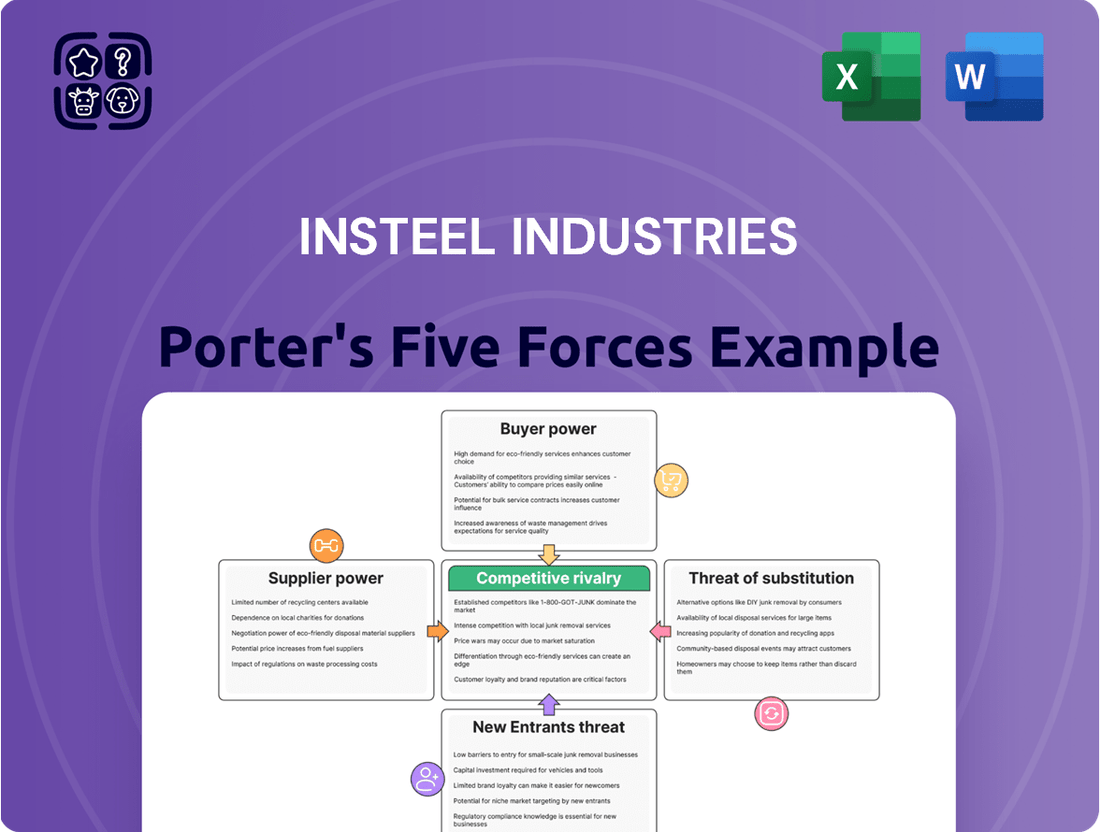

Effortlessly identify and mitigate competitive threats with a visual representation of Insteel's Porter's Five Forces, highlighting key areas of pressure.

Customers Bargaining Power

Insteel Industries primarily serves concrete product manufacturers and concrete construction contractors. This broad customer base, spread across various projects and regions, typically means that no single customer accounts for a dominant portion of Insteel's sales. For instance, in fiscal year 2023, Insteel's largest single customer represented only a small percentage of total net sales, underscoring this fragmentation.

The construction sector, particularly for residential and non-residential projects, demonstrates significant price sensitivity. This means customers are keenly aware of and influenced by the cost of materials when making purchasing decisions.

Customers often shop around for the best prices on essential construction components like welded wire reinforcement (WWR) and pre-stressed concrete strand (PCS). This is especially true during times when construction activity slows down, increasing competition among suppliers.

For instance, in 2024, the U.S. construction industry faced challenges with rising material costs and interest rates, leading to increased price scrutiny from buyers. This environment amplifies the bargaining power of customers as they can more easily switch to alternative suppliers offering lower prices for key inputs like those Insteel Industries provides.

The availability of alternative products can influence Insteel Industries' customer bargaining power. While Insteel specializes in welded wire reinforcement (WWR) and prestressed concrete strand (PCS), customers might find other manufacturers for these specific products. For instance, the WWR market includes several significant players alongside smaller, regional suppliers, offering some degree of choice.

Customer Order Volume and Consistency

Large customers, especially those placing significant and ongoing orders, hold considerable sway in negotiating better prices and contract terms with Insteel Industries. This is particularly true if these customers represent a substantial portion of Insteel's revenue base, as their business is crucial for maintaining production volumes.

Insteel's financial performance can be directly influenced by shifts in customer inventory levels. When customers reduce their stock, it can lead to decreased orders for Insteel, impacting sales and potentially requiring adjustments in production schedules. For example, during periods of economic uncertainty, customers might trim inventories, leading to a slowdown in demand for construction materials like those produced by Insteel.

- Customer Concentration: Insteel's reliance on a few major clients could amplify customer bargaining power.

- Order Size: The sheer volume of orders placed by key customers allows them to demand more competitive pricing.

- Inventory Management: Fluctuations in customer inventory, such as a build-up or drawdown, directly affect Insteel's order book and sales forecasts.

Importance of Product Specifications and Quality

For critical concrete construction applications, customers place a high premium on product quality and strict adherence to specifications. This focus on reliability and performance in demanding environments means that buyers are less likely to switch suppliers based solely on price if quality is compromised. Insteel's established reputation as a leading manufacturer, coupled with its demonstrated commitment to quality control, helps to differentiate its offerings and consequently can mitigate the bargaining power of its customers.

Insteel's emphasis on meeting precise product specifications, particularly for construction projects where structural integrity is paramount, directly influences customer purchasing decisions. For instance, in 2023, Insteel reported that its fabricated rebar shipments, a key product for concrete reinforcement, met stringent industry standards, which is crucial for customer retention. This adherence to quality reduces the perceived substitutability of Insteel's products, thereby strengthening its position against buyer pressure.

- Customer Priority: High demand for quality and adherence to specifications in concrete construction.

- Insteel's Advantage: Reputation as a leading manufacturer and focus on quality differentiation.

- Impact on Bargaining Power: Reduced customer ability to switch based on price alone due to quality assurance.

- 2023 Data Point: Insteel's fabricated rebar shipments met all stringent industry standards, reinforcing product reliability.

The bargaining power of customers for Insteel Industries is moderate, influenced by price sensitivity and the availability of alternatives. While Insteel's customers, primarily concrete product manufacturers and contractors, value quality and adherence to specifications, they are also cost-conscious, especially in a competitive construction market. The fragmentation of Insteel's customer base, with no single customer dominating sales, generally limits individual customer leverage. However, larger customers who place substantial orders can negotiate more favorable terms. For example, in 2024, the construction sector's focus on material costs means buyers are actively seeking competitive pricing, which can increase pressure on Insteel.

| Factor | Impact on Insteel | Customer Leverage |

|---|---|---|

| Customer Base Fragmentation | Lowers individual customer power | Generally Moderate |

| Price Sensitivity in Construction | Increases pressure for competitive pricing | Moderate to High |

| Availability of Alternatives (WWR, PCS) | Provides customers with choices | Moderate |

| Emphasis on Quality & Specifications | Mitigates price-based switching | Low to Moderate |

| Large Customer Order Volume | Grants negotiation advantage to key buyers | Moderate to High for large accounts |

Same Document Delivered

Insteel Industries Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Insteel Industries, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, fully formatted analysis you'll receive instantly after purchase, providing immediate insight into Insteel's market position and potential challenges.

Rivalry Among Competitors

Insteel Industries operates in a market characterized by a significant number of competitors, with several major players vying for market share. As the nation's largest manufacturer of steel wire reinforcing products for concrete construction, Insteel faces competition from other substantial companies.

Key competitors in the standard welded wire reinforcement products sector include Tree Island Steel and MID-CONTINENT STEEL AND WIRE. These companies, along with numerous smaller regional manufacturers, contribute to a fragmented competitive landscape. For instance, in 2023, the US construction market saw continued demand for reinforcing materials, highlighting the ongoing competition among these entities.

The steel wire and prestressed concrete wire and strand markets are poised for steady growth, fueled by robust construction and infrastructure projects. For instance, the global construction market is expected to reach $14.8 trillion by 2030, showcasing significant demand for these materials.

While this expansion generally tempers intense rivalry by increasing overall market pie, competition for market share remains a significant factor. Companies like Insteel Industries must still differentiate themselves through product quality, pricing, and customer service to capture a larger portion of this expanding market.

Insteel Industries primarily produces standardized products such as welded wire reinforcement (WWR) and prestressed concrete strands (PCS). While the company strives to differentiate through superior quality and customer service, the inherently commoditized nature of these offerings often places price as a dominant factor in competitive decision-making.

For instance, in 2024, the construction industry's reliance on these materials means that even minor price fluctuations can significantly impact Insteel's market share. The company's ability to manage production costs effectively directly influences its competitiveness in a market where buyers frequently compare suppliers based on price points.

High Fixed Costs and Capacity Utilization

The steel wire manufacturing sector, where Insteel Industries operates, is characterized by substantial fixed costs. These are primarily associated with significant investments in heavy machinery, advanced manufacturing facilities, and ongoing maintenance. These high upfront and ongoing expenditures create a strong pressure for companies to operate at or near full capacity to spread the costs over a larger output volume.

This drive for high capacity utilization can intensify competitive rivalry. When demand softens, manufacturers may resort to aggressive pricing strategies to keep their production lines running and cover their fixed overheads. This can lead to price wars, eroding profit margins for all players in the industry, including Insteel.

- High Fixed Costs: Steel wire production requires substantial capital for machinery and plant infrastructure, creating a barrier to entry and a constant pressure to utilize assets efficiently.

- Capacity Utilization Incentive: Companies are motivated to maintain high production levels to amortize fixed costs, which can lead to increased output even when market demand is weak.

- Pricing Pressure: The need to cover fixed costs can result in aggressive pricing tactics, especially during economic downturns or periods of oversupply, impacting profitability across the industry.

Acquisition Strategy to Enhance Position

Insteel Industries faces intense competition, often responding through strategic acquisitions to bolster its market standing. For instance, the company's acquisition of Engineered Wire Products and O'Brien Wire Products in late 2024 demonstrates a proactive approach to expanding its geographic reach and solidifying its competitive advantages in the steel industry. This move highlights a market where rivals are also likely pursuing consolidation to gain scale and market share.

This acquisition strategy directly addresses the competitive rivalry by:

- Expanding Market Presence: Acquiring companies in new regions allows Insteel to tap into previously underserved markets and diversify its customer base, reducing reliance on any single geographic area.

- Increasing Scale and Efficiency: Larger operational footprints often lead to economies of scale in production and distribution, potentially lowering costs and improving price competitiveness against rivals.

- Broadening Product Offerings: The acquired businesses may bring complementary product lines or specialized capabilities, enabling Insteel to offer a more comprehensive suite of solutions to customers and differentiate itself from competitors.

- Gaining Talent and Expertise: Acquisitions can also bring valuable human capital, including experienced management teams and skilled labor, which can enhance Insteel's operational capabilities and innovation potential.

Insteel Industries operates in a highly competitive market for steel wire reinforcing products, facing pressure from numerous rivals, including larger players like Tree Island Steel and MID-CONTINENT STEEL AND WIRE, as well as smaller regional manufacturers. The commoditized nature of its core products, welded wire reinforcement and prestressed concrete strands, often makes price a primary deciding factor for customers. This intense rivalry is further exacerbated by high fixed costs in steel wire production, incentivizing companies to maintain high capacity utilization, which can lead to aggressive pricing strategies, particularly during periods of softer demand. Insteel's strategic acquisitions, such as the late 2024 purchases of Engineered Wire Products and O'Brien Wire Products, highlight a market trend of consolidation aimed at enhancing scale, geographic reach, and competitive positioning.

| Competitor | Primary Products | 2024 Market Focus |

|---|---|---|

| Tree Island Steel | Welded wire reinforcement, rebar, fasteners | North American construction and industrial markets |

| MID-CONTINENT STEEL AND WIRE | Welded wire reinforcement, rebar, merchant wire products | US construction, agricultural, and industrial sectors |

| Numerous Regional Manufacturers | Varied steel reinforcing products | Specific geographic construction projects |

SSubstitutes Threaten

While steel wire reinforcing products are a staple in concrete construction, the market isn't without its alternatives. Materials like fiber-reinforced polymers (FRP) and other composite materials are emerging as viable substitutes.

These alternatives can offer distinct advantages, such as enhanced corrosion resistance or lighter weight, which could make them more attractive in certain specialized applications. For instance, FRP rebar sales have been growing, with the global market projected to reach over $1.5 billion by 2027, indicating a tangible shift in material preference for some projects.

This growing adoption of alternative reinforcement materials presents a potential threat to Insteel Industries by offering customers choices that may outperform traditional steel in specific performance criteria or lifecycle cost analyses.

While Insteel Industries primarily focuses on engineered reinforcing products like welded wire reinforcement (WWR) and prestressed concrete strand (PCS), traditional concrete methods without significant steel reinforcement can be considered a substitute in certain less demanding applications. For example, basic concrete foundations or non-structural elements might not require the same level of reinforcement, presenting a lower-cost alternative.

However, for most structural applications where Insteel's products are critical, these basic concrete methods are not viable substitutes. The demand for robust and durable construction, especially in infrastructure and commercial buildings, necessitates the strength and integrity provided by steel reinforcement. In 2023, the U.S. construction industry, a key market for Insteel, saw significant investment in infrastructure projects, underscoring the need for reinforced concrete solutions.

Innovations like self-healing concrete and ultra-high-performance concrete (UHPC) are emerging, potentially decreasing reliance on traditional steel reinforcement in construction over time. For instance, UHPC offers significantly higher strength and durability, which could lead to thinner concrete sections and reduced steel rebar requirements in certain structural designs.

The development of sustainable concrete alternatives, such as those using supplementary cementitious materials or novel binders, also presents a threat. These materials aim to lower the carbon footprint of concrete production, a key driver in the construction industry's ongoing sustainability push.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitute products significantly impacts Insteel Industries. If alternative materials, such as engineered wood or advanced composites, become more affordable or offer a better performance-to-cost ratio compared to Insteel's fabricated steel, customers may switch. For instance, fluctuations in steel prices versus the cost of alternative construction materials directly influence this threat.

In 2024, the global construction market continued to see price volatility in raw materials. While steel prices experienced some stabilization compared to previous years, the cost of alternative materials also evolved. For example, the price of lumber, a key substitute in certain construction segments, saw moderate increases in early 2024, potentially mitigating some of the threat for Insteel in those specific applications. However, ongoing advancements in composite materials could present a growing challenge.

- Cost Sensitivity: Insteel's pricing strategy must remain competitive against substitutes, especially in price-sensitive construction segments.

- Performance-Value Proposition: The perceived value of steel's durability and strength must outweigh the cost advantage of alternatives.

- Material Innovation: Continuous monitoring of innovations in substitute materials that could offer superior cost-effectiveness or performance is crucial.

- Market Share Impact: A significant cost advantage for substitutes could lead to a gradual erosion of Insteel's market share in specific product categories.

Building Code and Regulatory Acceptance

The threat of substitute materials for Insteel Industries' products, particularly reinforcing steel, is significantly shaped by building codes and regulatory acceptance. If alternative materials, such as engineered composites or advanced polymers, achieve broad approval and become integrated into mainstream construction practices, this could erode demand for traditional rebar. For instance, the International Code Council (ICC) plays a crucial role in approving new materials for construction, and their acceptance directly impacts market penetration. As of early 2024, ongoing research and pilot programs are evaluating the long-term performance and safety of various innovative building materials, which could influence future code revisions.

The widespread adoption of substitute materials is directly tied to their endorsement by governing bodies and their inclusion in standard building specifications. A shift towards readily approved alternatives would present a greater competitive challenge to Insteel. For example, the Federal Highway Administration (FHWA) often pilots and evaluates new materials for infrastructure projects, and their positive findings can accelerate broader regulatory acceptance and adoption across the United States. The performance data and successful implementation of these substitutes in large-scale projects directly influence their standing in code development.

- Building Code Impact: Regulatory bodies like the ICC and state-level building departments dictate which materials are permissible in construction, directly influencing the viability of substitutes.

- Acceptance of Composites: The growing acceptance of fiber-reinforced polymer (FRP) composites in corrosive environments, due to their durability, presents a potential substitute threat in specific applications.

- Infrastructure Projects: Federal and state transportation departments' willingness to specify and utilize alternative materials in infrastructure projects can accelerate their market acceptance and code integration.

The threat of substitutes for Insteel Industries' steel reinforcing products is moderate but growing, driven by advancements in alternative materials like fiber-reinforced polymers (FRP) and innovative concrete technologies. While steel remains dominant in many structural applications, these substitutes offer advantages such as corrosion resistance and lighter weight, potentially chipping away at market share in specialized segments. For instance, the global FRP rebar market is expected to exceed $1.5 billion by 2027, signaling increasing customer interest.

The cost-effectiveness and performance-to-cost ratio of substitutes are critical factors. While steel prices saw some stabilization in 2024, the evolving costs of alternatives, coupled with their performance benefits, directly influence Insteel's competitive landscape. Regulatory acceptance, particularly through bodies like the International Code Council (ICC), is also key; as alternative materials gain approval and are integrated into building codes, their threat level increases.

| Substitute Material | Key Advantages | Potential Threat to Insteel | Market Growth Indicator |

|---|---|---|---|

| Fiber-Reinforced Polymers (FRP) | Corrosion resistance, lighter weight | Niche applications, specialized structures | Global market projected over $1.5 billion by 2027 |

| Advanced Concrete Technologies (UHPC) | Higher strength, durability | Reduced steel rebar requirements in some designs | Ongoing research and pilot programs |

| Engineered Wood | Sustainability, cost variability | Certain residential and lighter commercial projects | Price fluctuations relative to steel |

Entrants Threaten

The manufacturing of steel wire reinforcing products demands substantial upfront capital. Insteel Industries, for instance, operates with significant fixed assets. In 2023, the company reported property, plant, and equipment valued at approximately $630 million. This high level of investment in specialized machinery and large-scale production facilities acts as a considerable deterrent for new players looking to enter the market.

Established players like Insteel Industries benefit significantly from economies of scale in production, raw material procurement, and distribution networks. For instance, Insteel's large-scale manufacturing operations in 2024 likely allowed them to spread fixed costs over a greater output, leading to lower per-unit production expenses. New entrants would find it challenging to match these cost efficiencies without substantial initial investment and achieving comparable sales volumes.

Insteel Industries benefits from established relationships with concrete product manufacturers and construction contractors, complemented by a national manufacturing footprint. This existing infrastructure presents a significant barrier for potential new entrants.

New companies would need to invest heavily in building their own distribution networks and cultivating crucial customer relationships. This process is inherently challenging and time-consuming, potentially taking years to replicate Insteel's current market access.

Regulatory and Environmental Hurdles

The steel and construction materials sectors are heavily regulated, with stringent environmental standards and safety protocols. Newcomers must invest significantly to meet these compliance requirements, which can be a substantial barrier to entry. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce emissions standards for industrial facilities, including steel manufacturers, requiring advanced pollution control technologies.

Navigating this complex web of regulations adds considerable cost and time to establishing operations. Companies like Insteel Industries have long-established systems and expertise in managing these challenges, giving them an advantage over potential new entrants who would need to build this capacity from scratch. The capital expenditure for compliance alone can be prohibitive for smaller or less-resourced companies looking to enter the market.

- Regulatory Compliance Costs: Significant investment required for environmental permits and safety certifications.

- Environmental Standards: Adherence to evolving emissions and waste management regulations.

- Capital Investment: High upfront costs for necessary pollution control and safety equipment.

- Operational Complexity: Managing compliance adds layers of operational difficulty for new firms.

Brand Recognition and Customer Loyalty

Even though Insteel Industries' products are somewhat standardized, their status as the largest manufacturer in the nation means they've built significant brand recognition and strong customer loyalty. New competitors would face a considerable challenge in quickly matching this established market presence and the trust customers place in Insteel.

This brand equity acts as a significant barrier, as it translates into preferential treatment from buyers who may be less inclined to switch to an unknown entity, even if pricing is competitive. For instance, in 2024, Insteel reported net sales of $1.3 billion, reflecting its substantial market share and the strength of its customer relationships.

- Brand Recognition: Insteel's long-standing position as the nation's largest manufacturer fosters a level of awareness and familiarity that new entrants must overcome.

- Customer Loyalty: Established relationships with a broad customer base are difficult and time-consuming for new companies to cultivate.

- Market Share: A significant market share, like Insteel's, often correlates with higher customer retention and brand preference.

- Switching Costs: While not always financial, the effort and perceived risk involved in switching suppliers can deter customers from opting for new entrants.

The threat of new entrants in the steel wire reinforcing products market, where Insteel Industries operates, is generally considered moderate to low. This is primarily due to the significant capital requirements for establishing manufacturing facilities and the need to build extensive distribution networks. For example, in 2023, Insteel's investment in property, plant, and equipment reached approximately $630 million, highlighting the substantial financial commitment necessary to compete.

New companies also face challenges in matching the economies of scale enjoyed by established players like Insteel. Insteel's large-scale operations in 2024 likely enabled lower per-unit costs, a hurdle for newcomers to overcome without considerable investment. Furthermore, stringent environmental regulations, such as EPA emissions standards enforced in 2024, necessitate significant upfront spending on compliance technology, adding another layer of difficulty for potential entrants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of machinery, plants, and infrastructure. | Significant financial hurdle, requiring substantial upfront investment. |

| Economies of Scale | Lower per-unit costs due to large-scale production. | New entrants struggle to match cost efficiencies without comparable output. |

| Regulatory Compliance | Meeting environmental and safety standards. | Requires investment in pollution control and safety equipment, increasing entry costs. |

| Brand Recognition & Loyalty | Established customer relationships and market presence. | Difficult and time-consuming for new firms to build trust and market share. |

Porter's Five Forces Analysis Data Sources

Our Insteel Industries Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Insteel's annual reports, SEC filings, and industry-specific market research from sources like IBISWorld and Statista.