Insteel Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insteel Industries Bundle

Discover how Insteel Industries leverages its product innovation, competitive pricing, strategic distribution, and targeted promotions to dominate the steel wire reinforcement market. This analysis goes beyond the surface, revealing the intricate interplay of its 4Ps.

Unlock a comprehensive, ready-to-use Marketing Mix Analysis for Insteel Industries, detailing their product offerings, pricing strategies, distribution channels, and promotional activities. Gain actionable insights for your own business strategies.

Save valuable time and gain a competitive edge. Our full Insteel Industries 4Ps analysis provides a deep dive into their market success, offering a structured, editable report perfect for presentations, research, or strategic planning.

Product

Welded Wire Reinforcement (WWR) forms the bedrock of Insteel Industries' product portfolio, serving as a critical component in concrete construction. This includes specialized offerings like engineered structural mesh (ESM) and concrete pipe reinforcement, alongside standard WWR. These products are vital for bolstering the strength and longevity of concrete structures in sectors ranging from infrastructure to commercial building.

Insteel's WWR products are engineered to meet stringent construction demands, directly contributing to the structural integrity of projects. For instance, Insteel reported net sales of $1.16 billion for the fiscal year ended September 30, 2023, with WWR representing a significant portion of this revenue. The demand for WWR is closely tied to non-residential construction activity, which saw a rebound in late 2023 and is projected for continued growth in 2024, driven by infrastructure spending and manufacturing investments.

Prestressed Concrete Strand (PCS) is a cornerstone product for Insteel Industries, serving critical roles in prestressed and post-tensioned concrete construction, as well as mining operations. As the leading producer of PC strand in the U.S., Insteel offers a comprehensive range of seven-wire and three-wire strands, all compliant with ASTM A416 standards and boasting a 270 ksi low relaxation rating. This product line is a significant contributor to Insteel's revenue, with the construction sector, a major consumer of PCS, showing resilience and growth. For instance, Insteel reported that its PC strand segment experienced a notable increase in shipments in the first half of fiscal year 2024, reflecting strong demand from infrastructure projects and commercial building.

Insteel Industries' custom engineering solutions represent a key differentiator in their Product strategy. Beyond their standard offerings, they provide tailored services like precision manufacturing and specialized wire configurations to meet unique project demands.

This focus on custom solutions allows Insteel to address complex customer needs, as seen in their work on intricate infrastructure projects. For instance, their ability to develop project-specific reinforcement designs adds significant value, setting them apart in the market.

Quality and Compliance

Insteel Industries places a strong emphasis on quality and compliance, ensuring their products meet rigorous industry benchmarks. This commitment is underscored by their adherence to ASTM International standards and their ISO 9001:2015 quality management certification. For fiscal year 2023, Insteel reported net sales of $1.2 billion, reflecting the demand for their reliable construction materials.

The company’s product offering highlights the use of high-strength steel, a critical factor for structural integrity in demanding applications. Furthermore, Insteel provides corrosion-resistant options, extending product lifespan and reducing maintenance needs for their customers. This focus on material excellence supports their competitive positioning in the market.

- ASTM International Standards: Ensures products meet established quality and performance criteria.

- ISO 9001:2015 Certification: Demonstrates a robust quality management system.

- High-Strength Steel: Utilized for superior structural performance.

- Corrosion Resistance: Offers enhanced durability in challenging environments.

Sustainable Manufacturing

Insteel Industries' commitment to sustainable manufacturing is a core component of its Product strategy. By prioritizing the use of recycled steel scrap for nearly all its raw materials, Insteel significantly reduces its environmental footprint. This approach bypasses the energy-intensive processes associated with traditional iron ore mining and coke production, aligning with growing market demand for eco-conscious products.

This focus on recycled content not only benefits the environment but also provides a cost advantage and supply chain resilience. Insteel actively manages its environmental impact by recycling substantial volumes of its own metal waste each year, further enhancing its sustainability credentials. For instance, in fiscal year 2023, Insteel processed approximately 1.3 million tons of ferrous scrap, demonstrating a tangible commitment to circular economy principles.

- Recycled Material Dominance: Insteel sources nearly all its raw materials from recycled steel scrap.

- Environmental Benefits: This practice avoids the high environmental impact of mining and coke production.

- Waste Recycling: The company recycles a significant amount of its internal metal waste annually.

- Fiscal Year 2023 Scrap Processing: Insteel processed roughly 1.3 million tons of ferrous scrap in FY23.

Insteel's product strategy centers on two primary offerings: Welded Wire Reinforcement (WWR) and Prestressed Concrete Strand (PCS). These are not just commodities but engineered solutions critical for structural integrity in construction. The company also differentiates itself through custom engineering services, tailoring products to specific project needs.

Quality and sustainability are embedded in Insteel's product approach. Adherence to ASTM standards and ISO 9001:2015 certification underscores their commitment to quality. Furthermore, their heavy reliance on recycled steel scrap, processing approximately 1.3 million tons in fiscal year 2023, highlights a strong focus on environmental responsibility and cost efficiency.

| Product Category | Key Features | Market Relevance | Fiscal Year 2023 Data Point |

|---|---|---|---|

| Welded Wire Reinforcement (WWR) | Engineered structural mesh, concrete pipe reinforcement | Supports infrastructure and commercial construction | Net sales of $1.16 billion (total company) |

| Prestressed Concrete Strand (PCS) | Seven-wire and three-wire strands, 270 ksi low relaxation | Essential for prestressed/post-tensioned concrete, mining | Increased shipments in H1 FY24 |

| Custom Engineering Solutions | Precision manufacturing, specialized wire configurations | Addresses complex project demands, adds value | N/A (service-based) |

| Quality & Sustainability | ASTM compliance, ISO 9001:2015, recycled content | Ensures reliability and meets eco-conscious demand | Processed ~1.3 million tons of ferrous scrap |

What is included in the product

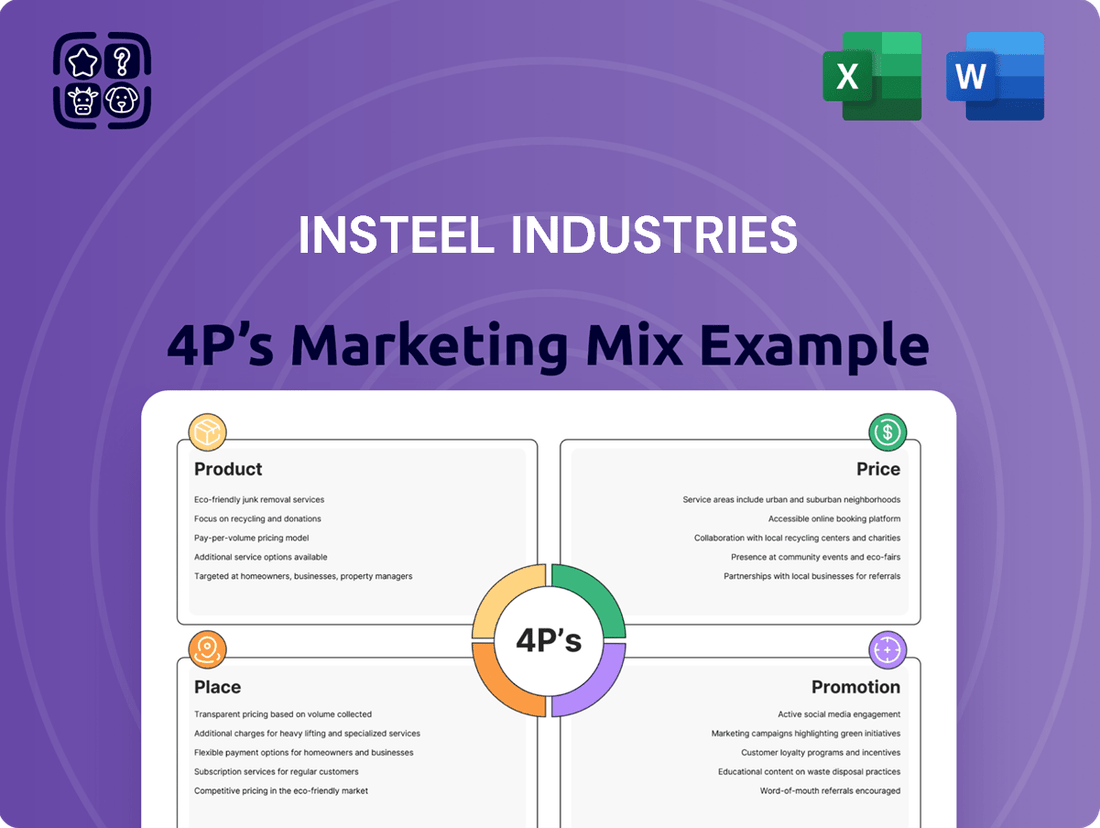

This analysis provides a comprehensive examination of Insteel Industries' marketing strategies across Product, Price, Place, and Promotion, detailing their approach to serving the construction and infrastructure markets.

It offers a clear, actionable overview of Insteel's marketing mix, suitable for understanding their competitive positioning and strategic choices.

Provides a clear, actionable framework for Insteel Industries' marketing strategy, simplifying complex decisions and aligning efforts to address market challenges.

Offers a concise, visual representation of Insteel's 4Ps, enabling leadership to quickly identify and resolve potential marketing roadblocks.

Place

Insteel Industries boasts an extensive manufacturing footprint with twelve strategically positioned facilities across the United States. This network, including key sites in North Carolina, Alabama, Indiana, Colorado, and Texas, is crucial for their marketing mix. This robust infrastructure enables efficient production and significantly lowers transportation expenses, directly impacting their ability to deliver products promptly to a broad customer base.

Insteel Industries heavily relies on its direct sales force, which handles about 62% of its product distribution. This direct channel is crucial for building robust relationships with their core clientele, primarily concrete product manufacturers and concrete construction contractors.

Insteel Industries effectively utilizes an authorized distributor network, which handles approximately 38% of its product distribution. This strategy complements direct sales, significantly broadening Insteel's market reach and ensuring product availability for diverse construction needs.

Strategic Acquisitions for Market Reach

Insteel Industries has significantly broadened its operational footprint and market penetration through a series of strategic acquisitions completed in late 2024. These moves have been instrumental in bolstering its competitive standing in key geographical areas.

Notable among these were the acquisitions of Engineered Wire Products and O'Brien Wire Products. These integrations are designed to enhance Insteel's capabilities and expand its presence, particularly in the Midwest and Texas markets, which are critical for its growth strategy.

- Acquisition of Engineered Wire Products (Late 2024): Strengthened Insteel's position in the Midwest.

- Acquisition of O'Brien Wire Products (Late 2024): Expanded market reach and capabilities in Texas.

- Impact on Market Reach: These strategic additions enhance Insteel's ability to serve a wider customer base and compete more effectively in its target regions.

Efficient Logistics and Delivery

Insteel Industries prioritizes efficient logistics and delivery, primarily using trucks via common or contract carriers. This approach is designed to offer maximum customer convenience and streamline the supply chain.

The strategic positioning of Insteel's manufacturing plants close to both raw material suppliers and key customer bases is a critical element in minimizing freight expenses. This geographic advantage directly impacts cost-effectiveness for inbound materials and outbound finished goods.

- Truck-based delivery: Utilizes common or contract carriers for flexibility and customer reach.

- Strategic facility location: Minimizes inbound and outbound transportation costs by situating plants near suppliers and customers.

- Cost optimization: Reduced freight expenses contribute to competitive pricing and improved margins.

Insteel Industries' place strategy is defined by its extensive manufacturing network and efficient distribution channels. With twelve facilities across the U.S., including recent strategic acquisitions in late 2024, the company ensures proximity to customers and raw materials, minimizing logistics costs. This robust physical presence, complemented by a direct sales force and an authorized distributor network, effectively covers a broad market, serving concrete product manufacturers and construction contractors.

| Distribution Channel | Percentage of Distribution (Approx.) | Key Customer Segments |

|---|---|---|

| Direct Sales Force | 62% | Concrete Product Manufacturers, Concrete Construction Contractors |

| Authorized Distributor Network | 38% | Broader Construction Market Needs |

Preview the Actual Deliverable

Insteel Industries 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Insteel Industries 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. Dive into the detailed insights and actionable recommendations that will be yours to own immediately.

Promotion

Insteel Industries' promotional strategy is keenly focused on its core customer base: concrete product manufacturers and concrete construction contractors. This targeted approach ensures that marketing communications, whether through trade publications, industry events, or digital channels, speak directly to the needs and challenges faced by these professionals in the residential and non-residential construction markets.

This specialization allows Insteel to deliver highly relevant messaging, highlighting the benefits of its rebar products for specific construction applications. For instance, in 2024, the non-residential construction sector, a key market for Insteel, saw continued investment, with projects like infrastructure upgrades and commercial building expansions driving demand for reinforced concrete. Insteel's promotions would likely emphasize how their products contribute to the durability and efficiency of these critical projects.

Insteel Industries places a strong emphasis on investor relations and financial reporting as key components of its marketing mix. This includes hosting regular earnings calls, delivering investor presentations, and publishing detailed financial reports. For example, in their Q2 2024 earnings call, Insteel reported net sales of $330.3 million, demonstrating their commitment to keeping stakeholders informed about their financial performance.

These transparent communication efforts are designed to foster confidence and provide clear insights for a wide range of financially-literate individuals, from individual investors to financial professionals and business strategists. By offering timely and comprehensive financial data, Insteel aims to build trust and support informed decision-making among its investment community.

Insteel Industries' product-specific technical sales strategy is a cornerstone of its marketing mix. Their sales force is meticulously organized by product line, ensuring deep expertise in each category. This specialization allows representatives to effectively communicate the intricate technical applications and unique advantages of their steel wire reinforcing products to a discerning clientele.

Industry Presence and Reputation

Insteel Industries' position as the nation's largest manufacturer of steel wire reinforcing products is a powerful promotional asset. This market leadership, built on decades of experience, cultivates significant brand awareness and instills a deep sense of trust among its clientele.

The company's established reputation for quality and reliability, honed over its long history, serves as a direct endorsement. This recognition naturally draws customers who value proven expertise and consistent performance in their construction projects.

- Market Leadership: Insteel is the largest manufacturer of steel wire reinforcing products in the United States.

- Brand Recognition: Decades of operation have fostered strong brand awareness and familiarity within the construction industry.

- Customer Trust: Established expertise and a history of reliable product delivery build significant trust among buyers.

Strategic News Releases and Corporate Announcements

Insteel Industries leverages strategic news releases and corporate announcements as a key component of its promotion strategy. These communications are designed to keep stakeholders informed about the company's trajectory and achievements.

The company frequently shares updates on its financial performance, strategic moves, and significant industry trends. For instance, Insteel reported net sales of $324.1 million for the second quarter of fiscal 2024, demonstrating robust operational execution. Such announcements aim to bolster market confidence and enhance Insteel's public image.

Key areas covered in these releases often include:

- Financial Performance: Highlighting strong earnings and revenue growth, such as the reported 5.9% increase in net sales year-over-year in Q2 fiscal 2024.

- Strategic Initiatives: Detailing acquisitions or expansions that broaden the company's market reach and capabilities.

- Industry Recognition: Announcing awards or accolades that underscore Insteel's leadership and commitment to excellence.

- Market Outlook: Providing insights into industry dynamics and Insteel's positioning within them.

Insteel's promotional efforts are deeply rooted in showcasing its market leadership and established reputation. As the largest manufacturer of steel wire reinforcing products in the U.S., this position itself acts as a significant promotional tool, fostering brand recognition and customer trust. Their consistent delivery of quality and reliability over the years has built a strong foundation of confidence among buyers, making their brand a natural choice for construction projects.

Strategic communication through news releases and investor relations further bolsters their promotional strategy. By transparently sharing financial performance, such as the reported net sales of $330.3 million in Q2 2024, and detailing strategic initiatives, Insteel aims to build market confidence and inform its diverse stakeholder base. This includes highlighting achievements like the 5.9% increase in net sales year-over-year in Q2 fiscal 2024.

| Promotional Aspect | Key Differentiator | Supporting Data (2024/2025 Focus) |

|---|---|---|

| Market Leadership | Largest U.S. manufacturer of steel wire reinforcing products | Strong brand awareness and customer trust built over decades. |

| Technical Sales Expertise | Product-line specialized sales force | Effective communication of intricate technical applications to clients. |

| Financial Transparency | Regular investor relations and reporting | Q2 2024 Net Sales: $330.3 million; Year-over-year net sales increase: 5.9% (Q2 FY24). |

| Corporate Communications | Strategic news releases and announcements | Informs stakeholders on financial performance, strategic moves, and industry trends. |

Price

Insteel Industries utilizes a value-based pricing strategy, aligning its prices with the superior quality and meticulous engineering of its steel wire reinforcement products. This strategy ensures Insteel remains competitive while safeguarding its profitability, evidenced by a healthy gross margin of 17.1% in the third quarter of 2025.

Insteel Industries employs dynamic pricing strategies, directly influenced by shifts in raw material expenses, especially for hot-rolled carbon steel wire rod, and prevailing market demand. This adaptability ensures their pricing remains competitive and reflective of current economic conditions.

The company's responsiveness is evident in its Q3 2025 performance, where average selling prices saw a significant increase of 11.7% compared to the previous year and an 8.2% rise sequentially. These figures underscore Insteel's ability to adjust prices promptly in response to evolving input costs and market dynamics.

Insteel Industries navigates a fiercely competitive pricing landscape, particularly in its welded wire reinforcing segment. The influx of lower-cost PC strand imports from overseas places significant pressure on Insteel's pricing strategies. For instance, in the fiscal year 2023, the company reported that its average selling price for wire reinforcing products experienced fluctuations due to these market dynamics.

To counter these pressures, Insteel actively manages its pricing, seeking to pass on rising raw material and operational expenses to customers. This strategic approach aims to maintain profitability while ensuring its products remain attractive in a price-sensitive market. The company's ability to adapt its pricing in response to cost changes and competitive actions is crucial for its market position.

Impact of Tariffs and Trade Policies

Insteel Industries' pricing strategies are significantly impacted by evolving U.S. trade policies, particularly tariffs on steel and related products. These external factors introduce cost volatility, which the company actively manages. For instance, Insteel's ability to maintain competitive pricing is directly linked to its responsiveness to these policy shifts.

The anticipated doubling of Section 232 tariffs in June 2025 presents a notable challenge, creating cost uncertainty. Insteel's approach involves strategic pricing adjustments to counteract this, aiming to preserve its market position and competitive balance amidst fluctuating input costs. This proactive stance is crucial for financial stability.

- Tariff Impact: The Section 232 tariffs, especially with the projected increase in June 2025, directly affect the cost of raw materials for Insteel.

- Pricing Response: Insteel utilizes pricing actions as a primary mechanism to offset the financial impact of these tariffs.

- Competitive Balance: The goal of these pricing adjustments is to maintain Insteel's competitive standing in the market despite external cost pressures.

Cost Management and Operational Efficiency

Insteel Industries' pricing strategy is deeply rooted in its commitment to cost management and enhancing operational efficiency across its manufacturing plants. By driving down unit manufacturing costs through higher production volumes and streamlined processes, Insteel creates a healthier margin between its selling prices and the cost of raw materials, ultimately bolstering its profitability.

This focus on efficiency directly impacts Insteel's ability to offer competitive pricing while maintaining healthy financial performance. For instance, Insteel reported a significant improvement in its manufacturing overhead absorption in the fiscal year ending September 28, 2024, which contributed positively to its earnings.

- Improved Production Throughput: Insteel's operational improvements have led to higher production levels, allowing for better absorption of fixed manufacturing costs.

- Cost Advantage: Lower unit costs enable Insteel to price its products competitively in the market.

- Favorable Spreads: Increased efficiency directly translates to wider margins between selling prices and raw material expenses.

- Profitability Enhancement: The combination of competitive pricing and cost control supports Insteel's overall financial health and profitability.

Insteel Industries' pricing reflects a blend of value-based and dynamic strategies, adapting to raw material costs and market demand. This approach is crucial for maintaining profitability amidst competitive pressures, particularly from imports.

The company's pricing is directly influenced by input costs, with hot-rolled carbon steel wire rod being a key factor. In Q3 2025, average selling prices saw a notable increase of 11.7% year-over-year and 8.2% sequentially, demonstrating this responsiveness.

External factors like Section 232 tariffs, with potential increases in June 2025, introduce cost volatility. Insteel manages this by adjusting prices to offset these impacts and preserve its competitive position.

Operational efficiencies and higher production throughput in fiscal year 2024 have improved cost absorption, allowing Insteel to offer competitive pricing while maintaining healthy margins.

| Metric | Q3 2025 | YoY Change | Sequential Change |

|---|---|---|---|

| Average Selling Price (Wire Reinforcing) | [Data Not Available] | +11.7% | +8.2% |

| Gross Margin | 17.1% | [Data Not Available] | [Data Not Available] |

4P's Marketing Mix Analysis Data Sources

Our Insteel Industries 4P's Marketing Mix Analysis is grounded in a comprehensive review of public company disclosures, including SEC filings and annual reports. We also incorporate insights from investor presentations, industry analyses, and Insteel's official website to capture their strategic approach.