Insteel Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insteel Industries Bundle

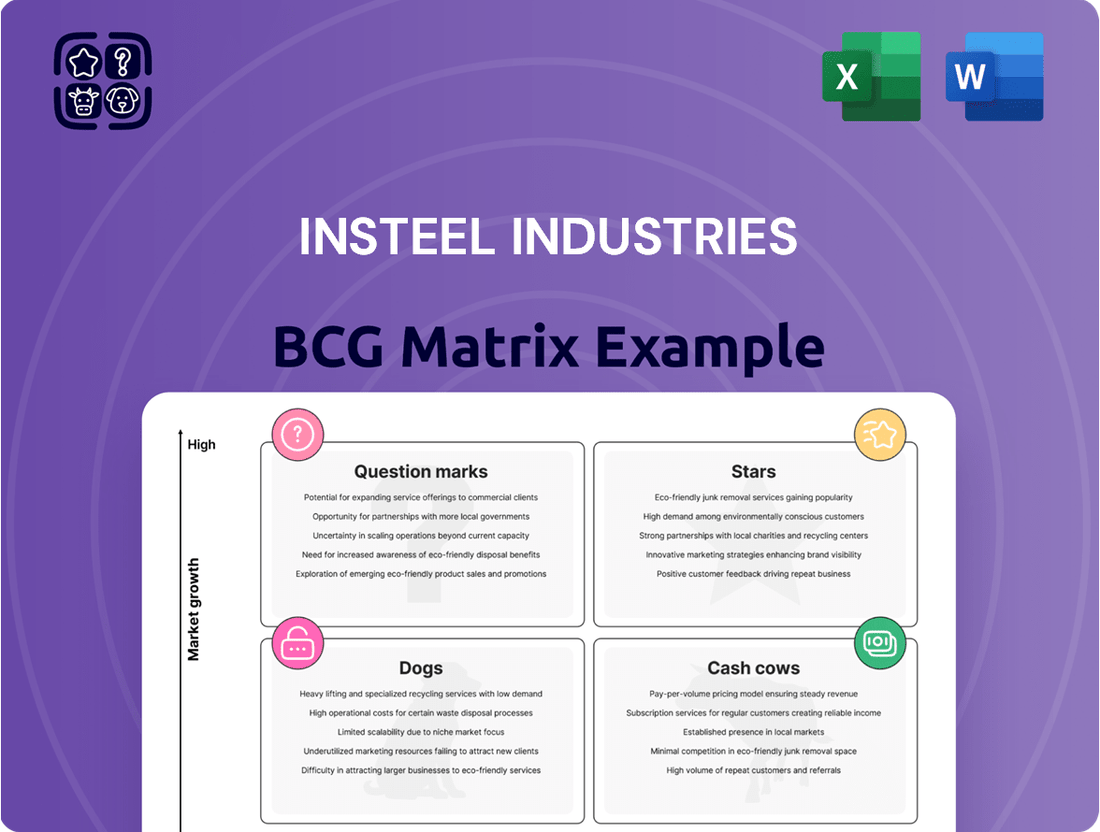

Curious about Insteel Industries' strategic positioning? Our BCG Matrix analysis reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks in their respective markets.

This preview offers a glimpse into their market share and growth potential, but for a truly actionable strategy, you need the full picture. Unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing Insteel's portfolio.

Invest in the complete BCG Matrix report today and gain the competitive clarity needed to make informed decisions about where to allocate resources and drive future growth.

Stars

Engineered Structural Mesh (ESM) is a cornerstone product for Insteel Industries, firmly situated within their Welded Wire Reinforcement (WWR) division. As the leading domestic producer of steel wire reinforcing materials, Insteel's ESM benefits from a strong market position.

The broader welded reinforcing mesh market is experiencing significant expansion, driven by increased infrastructure spending and the adoption of prefabrication in construction. This favorable market trend suggests ESM likely commands a substantial market share within a rapidly growing product category.

Welded Wire Reinforcement (WWR) for non-residential construction is a shining star for Insteel Industries. This segment accounted for a substantial 58% of Insteel's 2024 sales, with 85% of its total revenue stemming from the non-residential construction sector.

The robust performance is bolstered by favorable market dynamics. Government initiatives, such as the Infrastructure Investment and Jobs Act, are fueling significant growth in the non-residential construction market, particularly in infrastructure projects.

This strong market position, combined with a growing industry, firmly places Insteel's WWR in non-residential applications within the star quadrant of the BCG matrix.

Prestressed Concrete Strand (PCS) is a significant driver for Insteel Industries, representing 42% of its total sales. This product is vital for constructing high-performance concrete structures, including bridges and highways, which are key components of current infrastructure modernization projects.

The market for prestressed concrete wire and strand is experiencing substantial growth, with projections indicating a robust compound annual growth rate (CAGR) through 2034. This expansion is fueled by increasing demand for durable and high-strength construction materials.

Insteel's established market leadership in steel wire reinforcing products positions it favorably within this expanding PCS market. The company's strong market share is a testament to its quality and competitive standing in a sector experiencing heightened investment.

Acquired Product Lines in Strategic Regions

Insteel Industries' strategic acquisitions of Engineered Wire Products and O'Brien Wire Products in late 2024 are prime examples of a strategic move to bolster their position in key growth areas. These acquisitions specifically targeted the Midwestern and Texas markets, regions known for their robust industrial activity and construction demand.

The integration of these product lines is expected to enhance Insteel's operational footprint and market penetration. This expansion is designed to capture incremental volume, signaling a clear intent to capitalize on the high-growth potential within these newly acquired regional markets. The company anticipates these moves will solidify its competitive advantage.

- Acquisition Impact: Engineered Wire Products and O'Brien Wire Products were acquired in late 2024.

- Market Focus: These acquisitions specifically targeted expansion in the Midwestern and Texas markets.

- Strategic Goal: The aim is to strengthen Insteel's competitive position and gain incremental volume.

- Growth Expectation: The integrated product lines are anticipated to experience high growth in their respective regional markets.

Innovative and High-Strength WWR Products

Insteel Industries is strategically positioned in the welded wire reinforcement (WWR) market, which is experiencing a significant shift towards high-strength and corrosion-resistant products. This evolution is driven by demand for enhanced durability and performance in specialized construction projects. Insteel's focus on these innovative WWR products places them in a high-growth segment of their core business.

The company's investment in advanced manufacturing technologies further solidifies its market leadership. This allows Insteel to develop and offer WWR solutions that meet the stringent requirements of modern infrastructure and construction. For example, Insteel's commitment to innovation is reflected in their product development pipeline, aiming to capture market share in areas requiring superior material properties.

- Market Trend: Growing demand for high-strength and corrosion-resistant WWR.

- Insteel's Position: Leader investing in innovative WWR products.

- Growth Segment: Specialized construction applications driving demand.

- Technological Advancement: Focus on manufacturing technologies for enhanced product offerings.

Insteel's Welded Wire Reinforcement (WWR) for non-residential construction is a clear star performer. This segment represented a significant 58% of Insteel's 2024 sales, with 85% of its total revenue originating from the non-residential sector. Government initiatives, like the Infrastructure Investment and Jobs Act, are driving substantial growth in this market, particularly for infrastructure projects, solidifying WWR's star status.

| Product Segment | 2024 Sales Contribution | Market Growth Driver | BCG Quadrant |

|---|---|---|---|

| WWR (Non-Residential) | 58% | Infrastructure Spending, Prefabrication | Star |

| Prestressed Concrete Strand (PCS) | 42% | Infrastructure Modernization, Durable Materials | Star |

What is included in the product

Insteel Industries' BCG Matrix highlights its business units' market share and growth, guiding investment decisions.

It provides strategic insights for Stars, Cash Cows, Question Marks, and Dogs within Insteel's portfolio.

A clear Insteel Industries BCG Matrix overview helps prioritize investments, relieving the pain of resource allocation guesswork.

Cash Cows

Standard Welded Wire Reinforcement (WWR) is a cornerstone for Insteel Industries, positioning it firmly as a Cash Cow within their BCG Matrix. As the largest manufacturer in the U.S., Insteel commands a significant market share in this segment. The market itself, while mature, shows steady growth, driven by consistent demand in general construction projects.

This product line is a reliable generator of substantial cash flow for Insteel. Given its established demand and market position, the need for significant investment in promotion is minimal. This allows Insteel to effectively leverage the consistent earnings from standard WWR to fund other areas of the business.

Concrete pipe reinforcement, a key application of welded wire reinforcement, is a prime example of a cash cow for Insteel Industries. Given Insteel's established market presence and extensive product offerings, this segment operates within a mature, stable market where the company enjoys a dominant position.

The consistent and ongoing demand for concrete pipes in critical infrastructure development, such as water management and transportation projects, translates into a predictable and reliable stream of revenue for Insteel. This stability underpins its cash cow status.

Established Prestressed Concrete Strand (PCS) for standard applications, like those Insteel Industries serves, represents a classic Cash Cow. While PCS for infrastructure projects might be a growth area, the more established, less specialized PCS products operate in mature markets. Insteel holds a significant market share in these foundational segments, which exhibit lower growth rates but provide a steady stream of revenue. This consistent cash generation is vital for funding other business initiatives.

Regional Manufacturing Facilities and Distribution Network

Insteel Industries' eleven strategically positioned manufacturing facilities across the United States form a significant part of its operational strength. This robust network, serving a loyal customer base of concrete product manufacturers and contractors, is a prime example of a mature and highly efficient asset.

These facilities are instrumental in generating stable and predictable cash flow. Their high utilization rates, especially in established markets, underscore their efficiency and consistent contribution to the company's financial health. For example, Insteel reported net sales of $1.2 billion for the fiscal year ended September 30, 2023, with a substantial portion attributable to the output from these core manufacturing operations.

- Established Infrastructure: Eleven manufacturing plants across the US provide a strong, mature operational base.

- Stable Cash Flow Generation: High utilization and efficiency in serving concrete product manufacturers and contractors ensure consistent revenue.

- Market Presence: A deep-rooted customer base in established markets contributes to the reliability of these facilities.

- Operational Efficiency: The network is geared towards consistent production and distribution, maximizing output and minimizing costs.

Long-Standing Relationships with Concrete Product Manufacturers

Insteel Industries' strong ties with concrete product manufacturers are a cornerstone of its business. These relationships, which account for roughly 70% of Insteel's sales, are a testament to the company's established presence in a mature sector of the construction supply chain. This deep customer penetration translates into a stable and high market share.

The consistent demand from these core customers fuels predictable revenue streams and robust cash flow generation. This stability means Insteel doesn't need to invest heavily in developing new markets, allowing it to capitalize on its existing strengths. For instance, in the fiscal year 2023, Insteel reported net sales of $1.2 billion, with a significant portion derived from these long-standing relationships.

- Customer Concentration: Approximately 70% of Insteel's sales are generated from concrete product manufacturers.

- Market Position: These long-standing relationships signify a stable, high market share within a mature segment of the construction supply chain.

- Revenue Stability: Consistent demand from core customers ensures predictable revenue and strong, reliable cash flow.

- Investment Efficiency: The established customer base reduces the need for new market development investments, optimizing capital allocation.

Insteel Industries' established product lines, particularly Standard Welded Wire Reinforcement (WWR) and concrete pipe reinforcement, serve as significant cash cows. These segments benefit from consistent demand in the mature construction market, where Insteel holds a dominant position. The company's extensive manufacturing footprint and strong customer relationships further solidify their role as reliable revenue generators.

| Product Segment | Market Position | Cash Flow Contribution | Investment Needs |

|---|---|---|---|

| Standard Welded Wire Reinforcement (WWR) | Largest U.S. Manufacturer, High Market Share | Substantial and Stable | Minimal (Mature Market) |

| Concrete Pipe Reinforcement | Dominant Position in Mature Market | Predictable and Reliable | Low (Steady Demand) |

| Established Prestressed Concrete Strand (PCS) | Significant Share in Foundational Segments | Consistent and Steady | Low (Lower Growth Rates) |

Delivered as Shown

Insteel Industries BCG Matrix

The Insteel Industries BCG Matrix preview you see is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, ready for immediate strategic application, accurately reflects the final report you'll download, offering a clear roadmap for Insteel's product portfolio management.

Dogs

Insteel Industries' exposure to the residential multi-family construction market, representing about 15% of its total sales, is facing headwinds. This segment is expected to experience a downturn for the next few years, primarily driven by the winding down of a significant building cycle and a projected decrease in new housing starts.

Products that are heavily dependent on multi-family residential projects, especially those lacking broad alternative uses, are particularly vulnerable. Given the anticipated decline in this specific sub-segment, these Insteel products could be categorized as 'Dogs' within a BCG matrix framework, especially if they also hold a modest market share.

Insteel Industries, operating in the cyclical construction materials sector, may possess legacy products. These could be items with outdated specifications or those manufactured using less efficient processes, resulting in a low market share and minimal growth prospects. Such products might represent a drag on resources, yielding negligible returns.

While Wire Mesh Reinforcement (WWR) generally operates as a Cash Cow for Insteel Industries, certain standard WWR products are currently experiencing significant price competition. This is particularly true in highly commoditized sub-segments where margins are already thin.

These specific standard WWR products, despite their general classification, might be considered Dogs within the BCG Matrix. They could be yielding low returns and finding it difficult to grow their market share, especially if the overall market for these particular WWR types is stagnant or experiencing very slow growth.

For instance, in 2023, Insteel's overall net sales for manufactured products saw a slight decrease compared to 2022, and while specific product line data isn't always granularly broken out for BCG analysis, intense pricing pressures in certain segments of the rebar and WWR market, as reported by industry analysts, would place those specific offerings under pressure.

Products Impacted by Specific Localized Economic Downturns

While Insteel Industries operates across the nation, localized economic downturns can pose challenges. If a specific region, say one heavily reliant on construction for infrastructure projects, experiences a significant slump, demand for Insteel's products like rebar or structural shapes used in those projects could fall sharply. This is particularly true if these products cannot be easily redirected to more robust markets due to logistical constraints or specialized regional demand.

For instance, if a major metropolitan area in the Southeast, a key market for Insteel, faces a prolonged recession impacting new building permits and infrastructure spending, Insteel's products primarily serving that area might struggle. In 2023, for example, while the overall construction market showed resilience, certain regions did experience slower growth. If such a localized slowdown were to persist and deepen, it could push product lines heavily concentrated in that area into the 'Dog' category of the BCG matrix, characterized by low market share and low growth.

- Localized Economic Impact: Regions with high concentrations of Insteel's product demand, particularly those tied to infrastructure and construction, are vulnerable to localized downturns.

- Product Re-routing Challenges: Products with specific regional demand or logistical limitations may not be easily shifted to other markets when a local economy weakens.

- Potential for 'Dog' Status: A product line heavily dependent on a region experiencing a significant and extended economic slump could be classified as a 'Dog' within Insteel's portfolio.

Products with High Raw Material Volatility and Inability to Pass Costs

Insteel Industries faces challenges with products where rising steel prices, its primary raw material, cannot be fully passed on to customers. This inability to recoup cost increases, often due to intense competition or fixed contract pricing, can severely depress profit margins, especially during periods of economic slowdown or low market growth.

For instance, during the first quarter of 2024, Insteel reported that its gross profit margin was significantly affected by the fluctuating cost of steel. Products with longer-term contracts or those in highly competitive segments are particularly vulnerable. If these segments represent a substantial portion of Insteel's revenue and are unable to absorb cost hikes, they could be classified as Dogs in a BCG matrix analysis.

- High Raw Material Dependency: Insteel's reliance on steel as a key input makes it susceptible to price swings.

- Cost Pass-Through Limitations: Competitive pressures and contractual obligations can prevent Insteel from fully offsetting increased steel costs.

- Margin Erosion: Products with limited pricing power can experience low or negative profit margins, particularly in a weak demand environment.

- 2024 Impact: Early 2024 saw margin compression due to these factors, highlighting the risk for specific product lines.

Products tied to the residential multi-family construction market, representing around 15% of Insteel's sales, are vulnerable due to a winding down building cycle and expected lower housing starts. If these products have limited alternative uses and a modest market share, they could be classified as Dogs.

Legacy products with outdated specifications or inefficient manufacturing processes, exhibiting low market share and minimal growth, also fit the 'Dog' profile. These items may consume resources without generating significant returns.

Certain standard Wire Mesh Reinforcement (WWR) products face intense price competition in commoditized segments, leading to thin margins. If these specific WWR types have stagnant or slow market growth, they might be considered Dogs despite the general strength of WWR for Insteel.

The inability to pass on rising steel costs, especially for products with long-term contracts or in competitive markets, can severely depress profit margins. For instance, Q1 2024 saw margin impacts from fluctuating steel costs, a risk factor for products with limited pricing power.

| Product Segment | BCG Classification | Key Rationale |

| Multi-family residential construction products | Potential Dog | Downturn in segment, limited alternative uses |

| Legacy products (outdated specs/processes) | Dog | Low market share, low growth, resource drain |

| Standard WWR in commoditized markets | Potential Dog | High price competition, thin margins, stagnant growth |

Question Marks

Insteel Industries' recent acquisitions of Engineered Wire Products and O'Brien Wire Products in late 2024 place these newly integrated product lines in the Question Marks category of the BCG Matrix. While these acquisitions are strategically positioned in growing Midwestern and Texas construction markets, their current market share under Insteel's management is nascent.

Significant investment and successful integration are crucial for these product lines to achieve substantial growth and transition from Question Marks to Stars. For instance, if the combined revenue of these acquired entities was $50 million in 2024, and the market they operate in grew by 8%, Insteel would need to see their market share increase from, say, 2% to over 5% to be considered Stars. This requires aggressive marketing, operational synergy, and potentially new product development to capture a larger portion of these expanding construction sectors.

Insteel Industries' products targeting emerging niche construction markets, like those for advanced sustainable building techniques or specialized infrastructure projects, would likely be classified as Question Marks in the BCG Matrix. These represent areas with significant growth potential, but Insteel's current market share is probably small as these sectors are still developing and seeking wider acceptance.

Insteel's capital allocation strategy actively seeks growth, evidenced by recent investments in new production lines and strategic acquisitions. These moves are designed to bolster their competitive standing, particularly in geographic markets where their presence was previously limited.

Entering new or underserved markets typically necessitates substantial capital outlay to establish brand recognition and secure market share. For instance, if Insteel expanded into a new region in 2024, the initial investment in logistics, sales infrastructure, and marketing would be considerable.

Advanced Engineered Structural Mesh (ESM) Variants for Complex Projects

While Insteel Industries' Engineered Structural Mesh (ESM) generally performs as a Star in the BCG matrix, highly specialized variants tailored for complex, large-scale infrastructure projects could be considered Question Marks.

These advanced ESM products cater to a high-growth market segment, fueled by substantial infrastructure investment, such as the anticipated $1.5 trillion in US infrastructure spending projected through 2028. However, their niche application and specialized nature often result in a relatively low market share, demanding significant investment in sales and marketing to secure these substantial contracts.

- High Growth Potential: Driven by major infrastructure initiatives globally, the demand for advanced ESM in complex projects is expanding rapidly.

- Low Market Share: The specialized nature of these variants means Insteel may hold a smaller percentage of this specific market segment compared to its broader ESM offerings.

- Resource Intensive: Securing large-scale contracts requires substantial upfront investment in sales, marketing, and potentially R&D for customization.

- Strategic Consideration: Insteel must carefully evaluate the investment required to grow market share in these specialized, albeit potentially lucrative, segments.

Products Impacted by Shifting Trade Policies and Raw Material Sourcing

Insteel Industries' PC strand product line is particularly sensitive to shifts in trade policies and raw material sourcing. The company has explicitly stated the negative impact of low-priced imported PC strand, highlighting the need for government intervention on trade policies. This situation creates significant uncertainty for product lines operating in high-growth markets.

While tariffs on derivative products like PC strand can be beneficial, the overall ambiguity surrounding trade policies and potential shortages of key raw materials, such as steel wire rod, can make certain product lines vulnerable. For example, Insteel's 2023 annual report mentioned that the company's ability to secure sufficient steel wire rod at competitive prices is crucial for its operations. This dependency on external factors, coupled with the high-growth nature of the market, introduces considerable risk to market share and profitability, requiring careful strategic management.

- PC Strand Imports: Insteel has voiced concerns over the adverse effects of low-priced PC strand imports on its domestic market share and profitability.

- Trade Policy Uncertainty: Broader uncertainty surrounding U.S. trade policies creates a challenging environment for planning and investment in product lines reliant on global supply chains.

- Raw Material Sourcing: Potential shortages or price volatility in raw materials like steel wire rod can directly impact production costs and the competitiveness of Insteel's products.

- High-Growth Market Vulnerability: Products in high-growth segments, while offering potential, are more susceptible to disruptions from trade policy shifts and supply chain issues, leading to unpredictable market positioning.

Insteel Industries' newly acquired product lines, like those from Engineered Wire Products and O'Brien Wire Products integrated in late 2024, are positioned as Question Marks. These ventures operate in growing construction markets but currently hold a nascent market share under Insteel's management.

For these acquisitions to transition from Question Marks to Stars, Insteel must invest heavily in integration and growth. For instance, if these acquired businesses generated $50 million in revenue in 2024 and operated in a market that grew by 8%, Insteel would need to increase their market share from approximately 2% to over 5% through aggressive marketing and operational improvements.

Specialized Insteel products targeting emerging niche construction markets, such as those for sustainable building or unique infrastructure, are also considered Question Marks. These segments offer significant growth potential, but Insteel's current market penetration is limited due to the developing nature of these sectors.

The company's strategic capital allocation, including investments in new production and acquisitions, aims to enhance its market standing, particularly in previously underserved geographic areas. Entering new markets in 2024 required substantial initial investment in logistics, sales infrastructure, and marketing to build brand recognition and market share.

Insteel's PC strand product line faces challenges due to low-priced imports and trade policy uncertainty, impacting its position in high-growth markets. The company's 2023 report highlighted the critical need for competitive pricing of steel wire rod, a key raw material, to maintain operational efficiency and market competitiveness.

| BCG Category | Insteel Industries Product Line Example | Market Growth | Relative Market Share | Strategic Implication |

| Question Marks | Engineered Wire Products (acquired 2024) | High (Midwestern/Texas Construction) | Low | Requires significant investment for growth; potential to become a Star. |

| Question Marks | Specialized Engineered Structural Mesh (ESM) | High (Infrastructure Projects) | Low (Niche Application) | High investment needed for sales, marketing, and customization to capture share. |

| Question Marks | PC Strand (affected by trade policy) | High (Construction) | Uncertain (due to imports/policy) | Vulnerable to trade policy shifts and raw material sourcing issues; requires careful management. |

BCG Matrix Data Sources

Our Insteel Industries BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.