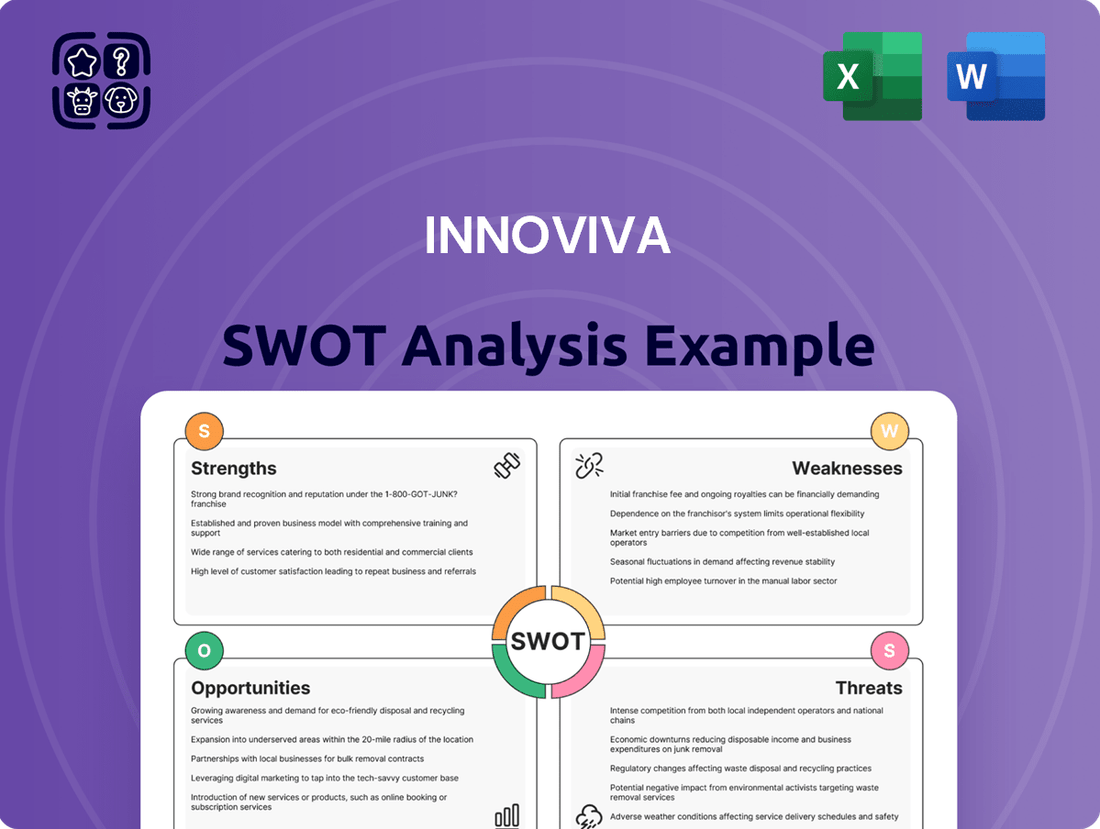

Innoviva SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

Innoviva's strengths lie in its diversified respiratory portfolio and strategic partnerships, but potential threats from generic competition and regulatory changes loom. Understanding these dynamics is crucial for navigating the competitive healthcare landscape.

Want the full story behind Innoviva’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Innoviva's dedicated focus on respiratory therapies is a significant strength. This specialization allows the company to cultivate deep expertise and concentrate its development efforts on a crucial and growing market, particularly for conditions like asthma and COPD. This targeted approach can lead to more efficient resource allocation and a nuanced understanding of patient and physician needs.

Innoviva's core strength lies in its effective partnership model, which centers on collaborating with larger pharmaceutical companies. This strategy allows Innoviva to tap into their extensive research and development capabilities and established commercialization infrastructure.

By forming these strategic alliances, Innoviva significantly reduces its upfront development costs and mitigates the inherent risks associated with drug discovery and lengthy clinical trials. This approach enables the company to participate in the success of its partnered products without shouldering the entire financial and operational burden.

For instance, Innoviva's collaboration with Theravance Biopharma on respiratory assets like Trelegy Ellipta and Anoro Ellipta exemplifies this model. In 2023, Innoviva reported royalty revenues of $202.1 million from these partnerships, showcasing the financial benefits derived from its strategic alliances.

Innoviva's primary revenue source stems from stable royalty payments generated by its partnerships for commercialized respiratory products. This model provides a predictable and often high-margin income, shielding the company from the direct costs and risks of manufacturing and sales.

For instance, in the first quarter of 2024, Innoviva reported royalty revenue of $75.8 million, a significant portion of its total revenue, highlighting the strength and consistency of this revenue stream.

Established Marketed Products

Innoviva's established marketed products, particularly through its collaboration with GSK, represent a significant strength. These commercialized assets, like those in the respiratory space, have a proven track record of generating consistent revenue streams. For instance, in 2023, Innoviva reported total revenue of $371.1 million, largely driven by its royalty and sales-based agreements for key products. This demonstrates the success of its partnership model and the market acceptance of its developed therapies.

The company's portfolio prior to its acquisition by Verily Life Sciences (an Alphabet company) included several key products with established market presence. These commercialized assets have been instrumental in generating substantial royalty income and milestone payments. For example, the respiratory franchise, developed in partnership with GSK, has consistently contributed to Innoviva's financial performance. This established market penetration underscores the value and commercial viability of Innoviva's product development efforts.

- Proven Commercial Success: Products like those in the respiratory segment, partnered with GSK, have achieved significant market penetration and revenue generation.

- Consistent Revenue Generation: Royalties and sales milestones from these established products provide a stable and predictable income stream for Innoviva.

- Demonstrated Partnership Efficacy: The success of its collaborations highlights Innoviva's ability to effectively partner for product development and commercialization.

- Market Validation: The presence of these products in the market validates their therapeutic value and commercial demand.

Lean Operational Structure

Innoviva's strategic focus on partnerships and outsourcing for R&D and commercialization has likely resulted in a lean operational structure. This approach allows the company to maintain a more agile and cost-effective business model compared to vertically integrated biopharma firms. For instance, in 2023, Innoviva reported a gross profit margin of approximately 88%, reflecting the benefits of its asset-light strategy and efficient cost management.

This lean structure translates to potentially higher profitability margins and significantly reduced overhead expenses. By not bearing the full cost of extensive internal infrastructure for drug development and sales, Innoviva can allocate resources more strategically. The company's reported operating expenses as a percentage of revenue have historically been lower than many of its peers, underscoring this advantage.

- Reduced overhead costs: Outsourcing R&D and commercialization minimizes the need for large internal facilities and personnel.

- Enhanced profitability margins: A lean structure often leads to higher gross and operating profit margins relative to revenue.

- Increased flexibility: Partnerships allow for quicker adaptation to market changes and access to specialized expertise.

- Focus on core competencies: Innoviva can concentrate on its strategic management and partnership oversight rather than day-to-day operational burdens.

Innoviva's strength in its specialized focus on respiratory therapies is a significant advantage. This dedication allows for deep expertise and concentrated development efforts in a crucial, growing market for conditions like asthma and COPD. This targeted approach optimizes resource allocation and fosters a nuanced understanding of patient and physician needs.

The company's core strength is its effective partnership model, collaborating with larger pharmaceutical companies. This strategy grants Innoviva access to their extensive R&D capabilities and established commercialization infrastructure, significantly reducing its upfront development costs and mitigating risks associated with drug discovery and clinical trials. For example, Innoviva's collaboration with GSK on respiratory assets like Trelegy Ellipta and Anoro Ellipta exemplifies this model, with royalty revenues of $202.1 million reported in 2023 from these partnerships.

Innoviva's primary revenue source, stable royalty payments from its respiratory product partnerships, provides a predictable and high-margin income. This shields the company from manufacturing and sales costs and risks. In the first quarter of 2024, royalty revenue reached $75.8 million, underscoring the consistency of this income stream.

The company's lean operational structure, achieved through outsourcing R&D and commercialization, results in potentially higher profitability margins and reduced overhead. This asset-light strategy is reflected in a gross profit margin of approximately 88% reported for 2023, allowing for strategic resource allocation and lower operating expenses compared to peers.

| Key Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Specialized Focus | Deep expertise in respiratory therapies. | Growing market for asthma and COPD treatments. |

| Partnership Model | Leverages larger pharma R&D and commercialization. | $202.1 million in royalty revenues (2023) from GSK partnerships. |

| Revenue Stability | Predictable royalty income from commercialized products. | $75.8 million in royalty revenue (Q1 2024). |

| Lean Operations | Outsourced R&D and commercialization. | ~88% gross profit margin (2023). |

What is included in the product

Delivers a strategic overview of Innoviva’s internal and external business factors, highlighting its strengths in respiratory care and opportunities for growth, while also addressing weaknesses in its product pipeline and threats from competition.

Offers a structured framework to identify and address Innoviva's strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Innoviva's reliance on its strategic partners for crucial aspects like product development and commercialization presents a significant weakness. This dependence means that shifts in partner priorities or financial stability can directly jeopardize Innoviva's revenue streams and future growth. For instance, a major partner facing regulatory hurdles or experiencing financial distress could severely curtail Innoviva's access to markets or product pipelines.

Innoviva's reliance on partnerships, while mitigating risk, also means it has less direct say in the research and development process. This can slow down how quickly new treatments emerge or how easily the company can shift focus to different medical needs. For instance, in its 2024 pipeline updates, the progress of key partnered assets like the respiratory combination therapy with Theravance Biopharma was still largely dependent on Theravance's development timelines.

Innoviva's singular focus on respiratory diseases, while fostering deep expertise, presents a considerable concentration risk. This specialization means that any adverse shifts within the respiratory market, such as heightened competition or the development of more effective therapies by rivals, could severely impact Innoviva's financial performance. For instance, if a new blockbuster drug emerges that directly challenges their existing portfolio, the lack of diversification across other therapeutic areas leaves Innoviva particularly vulnerable to revenue declines.

Vulnerability to Product Performance

Innoviva's financial performance is heavily reliant on the success of a select group of partnered products. For instance, in 2023, revenue from its respiratory franchise, primarily driven by products like Relvar Ellipta and Breo Ellipta, constituted a significant portion of its overall sales. A decline in sales for these key products, perhaps due to increased competition or patent cliffs, would directly threaten Innoviva's revenue streams and profitability.

This concentration creates a substantial vulnerability. Should any of these core products encounter issues such as:

- Patent Expiry: Leading to generic competition and price erosion.

- Market Saturation: Difficulty in gaining new market share or retaining existing patients.

- Adverse Regulatory Decisions: Such as stricter warnings or even market withdrawal.

- Competitor Product Launches: Superior alternatives entering the market.

Innoviva's financial stability would be significantly jeopardized. This dependence underscores the critical need for continuous product innovation and diversification to mitigate these inherent risks.

Loss of Independent Public Identity

Innoviva’s acquisition by Sarissa Capital Management in 2022 and subsequent delisting from NASDAQ represent a significant shift. This move means Innoviva no longer functions as an independent public company, impacting its strategic decision-making and access to public funding. Its future trajectory is now intrinsically tied to Sarissa’s overarching investment objectives.

This loss of independent public identity fundamentally alters Innoviva's strategic autonomy. Without the direct oversight of public shareholders and the ability to tap public capital markets, its ability to pursue independent growth initiatives may be constrained. The company's visibility and public narrative are now managed within Sarissa's broader portfolio, potentially diminishing its distinct brand recognition.

- Delisting Impact: Innoviva's delisting from NASDAQ in 2022 removed it from public scrutiny and capital raising opportunities.

- Strategic Integration: As a private entity under Sarissa Capital Management, its strategic direction is now subordinate to Sarissa's broader investment thesis.

- Reduced Visibility: The absence of public reporting and investor relations activities inherently lowers its public profile and market awareness.

Innoviva's reliance on key partnered products for revenue, such as Relvar Ellipta and Breo Ellipta, creates a significant vulnerability. In 2023, these respiratory franchise products formed a substantial portion of its sales, meaning any decline in their performance due to competition or patent expiry directly impacts Innoviva's profitability.

The company's specialization in respiratory diseases, while beneficial for expertise, exposes it to considerable concentration risk. Adverse shifts in this specific market, like increased competition or the emergence of superior therapies, could severely damage Innoviva's financial standing due to its lack of diversification across other therapeutic areas.

Innoviva's acquisition by Sarissa Capital Management in 2022 and subsequent delisting from NASDAQ have fundamentally altered its strategic autonomy and access to public funding. Its future is now closely tied to Sarissa's investment objectives, potentially limiting independent growth initiatives and reducing public visibility.

Full Version Awaits

Innoviva SWOT Analysis

This is the actual Innoviva SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full Innoviva SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage this strategic insight for your own business planning.

Opportunities

Sarissa Capital's acquisition of Innoviva, now a private entity, opens doors for new strategic alliances. Innoviva's proven model of fostering partnerships for drug development can be amplified, potentially leading to collaborations in respiratory or other promising therapeutic fields.

This expansion of Innoviva's partnership strategy could leverage its existing expertise in managing complex relationships, a valuable asset for Sarissa. For instance, in 2023, Innoviva's collaborations contributed significantly to its pipeline, with key milestones achieved in its partnered programs.

Sarissa Capital's acquisition of Innoviva in late 2023, valued at approximately $1.8 billion, opens a significant window for strategic re-evaluation. This shift in ownership provides an opportunity to rethink the company's direction and operational framework.

The infusion of new capital and potentially different management perspectives from Sarissa could streamline Innoviva's operations. This might involve optimizing resource allocation or exploring new investment avenues that align with Sarissa's broader portfolio strategy.

Furthermore, this transition could facilitate diversification beyond Innoviva's existing business scope. Integration into Sarissa's existing network might unlock synergistic opportunities or lead to the development of entirely new product lines or market segments.

Innoviva's deep expertise in respiratory medicine development and commercialization presents a prime opportunity for expansion into adjacent therapeutic areas like immunology or other chronic inflammatory conditions. Leveraging this established knowledge base can facilitate strategic partnerships, allowing the company to diversify its revenue streams and mitigate risks associated with over-reliance on a single disease category.

Leveraging Existing IP and Data

Innoviva's extensive history, marked by successful product development and commercialization via strategic partnerships, suggests a robust portfolio of intellectual property (IP), clinical trial data, and accumulated regulatory expertise. This treasure trove of information can be a significant asset for Sarissa, potentially accelerating the development of new therapeutic assets or refining current ones. For instance, Innoviva's prior success with products like Relvar Ellipta and Trelegy Ellipta, which generated significant revenue streams, highlights the value embedded in their IP and data.

This existing IP and data can be strategically employed by Sarissa to explore various avenues for growth and value creation. These opportunities include:

- Developing novel drug candidates: Utilizing existing preclinical and clinical data to identify new targets or optimize drug formulations for unmet medical needs.

- Enhancing existing product lines: Leveraging clinical data to support label expansions or combination therapies for Innoviva's current approved products, thereby extending their lifecycle and market reach.

- Out-licensing opportunities: Identifying valuable IP or data sets that can be licensed to other pharmaceutical companies for development in different therapeutic areas or geographies, generating non-dilutive revenue.

- Streamlining regulatory pathways: Employing the company's deep understanding of regulatory processes, gained through past approvals, to expedite the review and approval of new or modified products.

Growth in Global Respiratory Market

The global respiratory therapeutics market is experiencing robust expansion, projected to reach approximately $100 billion by 2025, driven by escalating air pollution levels and a growing aging demographic susceptible to chronic respiratory conditions. This upward trend in demand creates a significant opportunity for Innoviva to leverage its existing partnerships and pipeline for sustained revenue growth.

Innoviva is well-positioned to capitalize on this expanding market. The company's focus on developing and commercializing treatments for respiratory diseases aligns perfectly with the increasing global need for effective solutions.

Key factors contributing to this market growth include:

- Increasing prevalence of chronic respiratory diseases: Conditions like COPD and asthma affect millions worldwide.

- Rising air pollution: Environmental factors are directly linked to respiratory health issues.

- Aging global population: Older individuals are more prone to developing respiratory ailments.

Innoviva's acquisition by Sarissa Capital in late 2023 for roughly $1.8 billion presents a prime chance to expand its therapeutic reach beyond respiratory ailments into areas like immunology. This strategic pivot can leverage Innoviva's established expertise in managing complex drug development partnerships, which have historically yielded significant pipeline advancements, as seen in 2023 milestones. The company's robust intellectual property and extensive clinical data, exemplified by past successes like Relvar Ellipta and Trelegy Ellipta, offer substantial value for developing new candidates, enhancing existing products, out-licensing, and streamlining regulatory processes.

Threats

The respiratory market is intensely competitive, with many established and emerging biopharmaceutical firms actively developing treatments. This crowded landscape means Innoviva faces constant pressure from rivals who may launch superior therapies or employ aggressive pricing, potentially impacting the success of its partnered products.

Innoviva faces significant threats from evolving regulatory environments, as seen with the ongoing scrutiny of pharmaceutical product approvals. Stricter requirements can lead to costly delays or even outright prevention of new product market entry, impacting future revenue streams.

Furthermore, increasing pressure on drug pricing and reimbursement from healthcare payers, including government bodies and private insurers, presents a substantial risk. For instance, in 2024, many healthcare systems continued to implement value-based pricing models and demand greater evidence of cost-effectiveness, which could directly affect Innoviva's profitability for its existing and pipeline therapies.

Innoviva's reliance on partnered products makes it susceptible to patent expirations. When patents lapse, generic or biosimilar competitors can enter the market, drastically reducing sales and royalty income for Innoviva. This is a persistent threat to their revenue stability, especially as key patents for partnered products approach expiration.

Dependence on Key Partner Performance

Innoviva's reliance on partners like GSK presents a significant threat. For instance, the commercial performance of Trelegy Ellipta, a key product developed with GSK, directly influences Innoviva's royalty streams. Any underperformance or strategic shifts by GSK could materially affect Innoviva's financial projections.

Innoviva's revenue is heavily dependent on the success of its partnered products. In 2023, a substantial portion of Innoviva's revenue was derived from royalties on sales of partnered respiratory products. A slowdown in sales growth for these key drugs, or a change in partner strategy, could lead to reduced income for Innoviva, as it lacks direct control over the marketing and sales efforts.

- Revenue Vulnerability: Innoviva's royalty revenue is directly tied to the sales performance of partnered products.

- Partner Strategy Risk: Changes in a partner's commercial strategy or product focus can negatively impact Innoviva's income.

- Limited Control: Innoviva has limited direct influence over the sales and marketing activities of its partners.

Integration Risks Post-Acquisition

Integrating Innoviva into Sarissa Capital's portfolio presents significant challenges. For instance, a failure to effectively merge IT systems, a common hurdle in mergers, could lead to operational disruptions. In 2024, the average cost of post-merger IT integration failures was estimated to be in the millions, impacting productivity and data security.

Cultural integration is another critical threat. If Innoviva's established corporate culture clashes with Sarissa's, it can lead to employee dissatisfaction and attrition. Studies from 2024 indicated that a poor cultural fit was a primary reason for integration failure in over 30% of acquisitions, directly impacting synergy realization.

The risk of losing key Innoviva personnel post-acquisition is substantial. These individuals often possess crucial institutional knowledge and client relationships. A 2025 survey of M&A activity highlighted that retention of top talent is a major concern, with companies losing up to 15% of their key employees within the first year of an acquisition if integration is not managed carefully.

Furthermore, a misalignment of strategic objectives between Sarissa and Innoviva could derail the acquisition's intended benefits. This could manifest as differing views on research and development priorities or market expansion strategies, potentially undermining Innoviva's growth trajectory.

Innoviva faces intense competition in the respiratory market, with rivals potentially launching superior therapies or employing aggressive pricing strategies. Evolving regulatory landscapes and increasing pressure on drug pricing from payers, who are increasingly adopting value-based models, also pose significant threats. For instance, in 2024, many healthcare systems continued to implement value-based pricing, directly impacting potential profitability.

Innoviva's reliance on partnered products makes it vulnerable to patent expirations, which can lead to a drastic reduction in royalty income from generic or biosimilar competition. Furthermore, the commercial success of key partnered products, such as Trelegy Ellipta, is heavily dependent on the performance and strategic decisions of partners like GSK. Any underperformance or strategic shifts by these partners could materially affect Innoviva's financial projections.

The integration into Sarissa Capital's portfolio presents challenges such as potential IT system disruptions and cultural clashes, which in 2024 were cited as primary reasons for integration failure in over 30% of acquisitions. There's also a substantial risk of losing key personnel, as companies can lose up to 15% of key employees within the first year of an acquisition if integration is not managed carefully, according to 2025 surveys. Misalignment of strategic objectives between Sarissa and Innoviva could also derail the acquisition's intended benefits.

| Threat Category | Specific Threat | Impact | Data Point/Example |

| Market Competition | Intense competition in the respiratory market | Pressure on partnered product success, potential for superior therapies | Established and emerging biopharma firms actively developing treatments. |

| Regulatory Environment | Evolving regulatory requirements | Costly delays or prevention of new product market entry | Ongoing scrutiny of pharmaceutical product approvals. |

| Pricing & Reimbursement | Pressure on drug pricing and reimbursement | Reduced profitability for existing and pipeline therapies | 2024 saw continued implementation of value-based pricing models by healthcare systems. |

| Partner Reliance | Reliance on partnered products | Vulnerability to patent expirations and generic competition | Key patents for partnered products approaching expiration. |

| Partner Performance | Dependence on partner's commercial success | Reduced royalty income if partnered product sales slow or partner strategy changes | 2023 revenue heavily derived from royalties on partnered respiratory products. |

| Acquisition Integration | IT system integration failure | Operational disruptions, impacting productivity and data security | Average cost of post-merger IT integration failures estimated in the millions in 2024. |

| Acquisition Integration | Cultural integration clashes | Employee dissatisfaction and attrition, hindering synergy realization | Poor cultural fit cited as a primary reason for integration failure in over 30% of acquisitions (2024 data). |

| Acquisition Integration | Loss of key personnel | Loss of institutional knowledge and client relationships | Companies can lose up to 15% of key employees within the first year of acquisition if integration is poorly managed (2025 survey). |

| Acquisition Integration | Misalignment of strategic objectives | Derailing intended acquisition benefits and growth trajectory | Differing views on R&D priorities or market expansion strategies. |

SWOT Analysis Data Sources

This Innoviva SWOT analysis is built upon a robust foundation of data, drawing from Innoviva's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and actionable assessment.