Innoviva Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

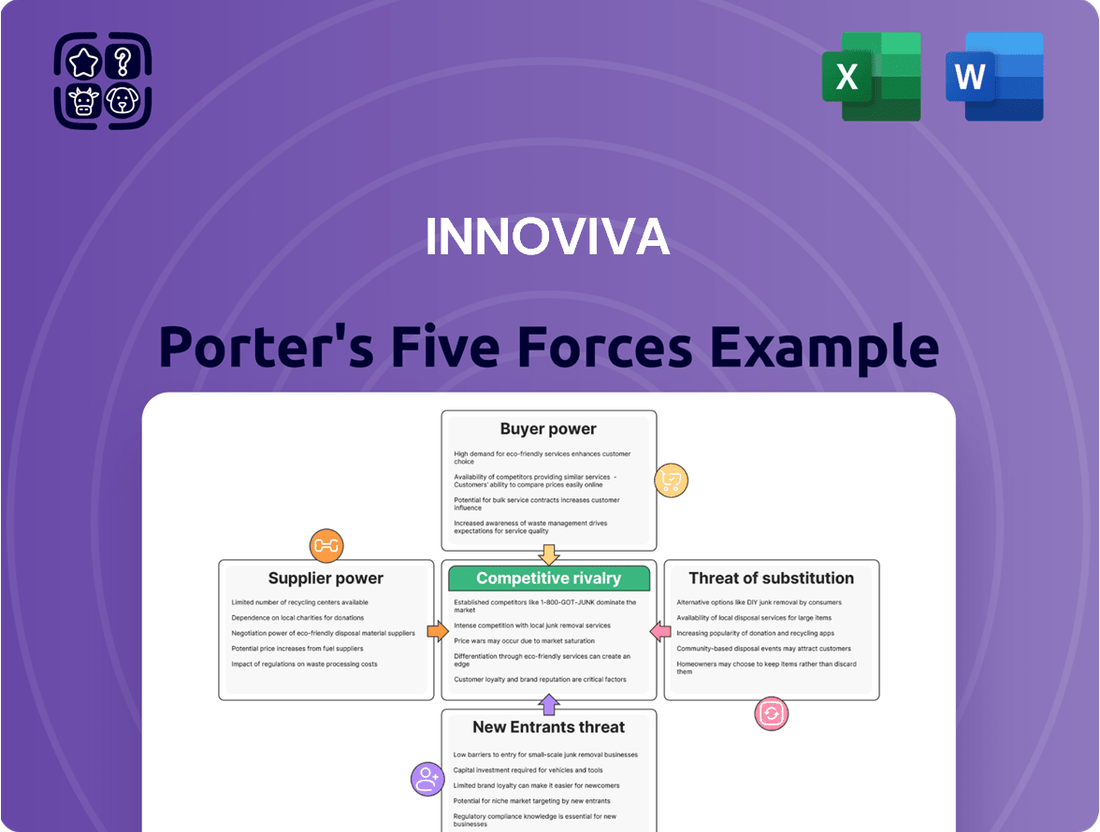

Innoviva's competitive landscape is shaped by intense rivalry, moderate buyer and supplier power, and a significant threat from substitutes, all within a market with a moderate barrier to entry. Understanding these dynamics is crucial for any strategic move.

The complete report reveals the real forces shaping Innoviva’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biopharmaceutical industry's reliance on a small number of specialized manufacturers for crucial Active Pharmaceutical Ingredients (APIs) significantly impacts supplier bargaining power. For instance, in 2024, reports indicated that the top five API manufacturers globally controlled a substantial portion of the market for certain essential compounds, giving them considerable leverage.

This concentration means that companies like Innoviva's partners, who depend on these APIs, face a situation where these few suppliers can dictate terms. This can translate into higher ingredient costs, impacting profitability, or create vulnerabilities in the supply chain if disruptions occur with these key players.

Suppliers who possess proprietary technology and patents on critical components or manufacturing techniques wield significant power. This allows them to set terms and pricing, as alternatives may be scarce or non-existent.

For Innoviva, whose revenue stream relies on royalties from its partnered products, the bargaining power of its partners' suppliers is a key consideration. For instance, if a key supplier to GSK, a major Innoviva partner, holds patents on essential drug components, that supplier can influence the cost and availability of the final product, indirectly impacting Innoviva's royalty income.

Innoviva's partners, such as GSK, likely face significant switching costs when seeking alternative suppliers for their respiratory medicines. These costs can stem from the rigorous regulatory approval processes required for pharmaceutical manufacturing, the need for extensive validation of new production facilities and processes, and the potential investment in specialized equipment unique to Innoviva's manufacturing capabilities. For instance, the time and expense associated with obtaining FDA or EMA approval for a new drug manufacturing site can run into millions of dollars and take several years, making a switch highly prohibitive.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts a supplier's bargaining power. When alternative raw materials or manufacturing services are readily accessible, it naturally reduces a supplier's leverage over a company like Innoviva. This is because the company can more easily switch to a different supplier if terms become unfavorable.

However, within the biopharmaceutical industry, the landscape for substitutes is often more complex. The highly regulated nature of this sector means that components and services must meet stringent quality and approval standards. Finding readily available and approved substitutes for specialized biopharmaceutical ingredients or manufacturing processes can be exceptionally challenging, thereby strengthening the bargaining power of existing, qualified suppliers.

- Limited Substitutes: The biopharmaceutical sector's regulatory hurdles restrict the ease of switching suppliers for critical components.

- High Switching Costs: Qualifying new suppliers for specialized biopharma inputs can involve substantial time and expense, deterring easy substitution.

- Supplier Dependence: Innoviva's reliance on specific, patented, or proprietary inputs can further concentrate bargaining power with those suppliers.

Supplier's Ability to Forward Integrate

If suppliers possess the capability or incentive to enter drug development or commercialization themselves, they can bypass their current customers, significantly increasing their bargaining power. This threat is particularly relevant for Innoviva, as it impacts their pharmaceutical partners who rely on these suppliers for crucial components or services.

While Innoviva's royalty-based business model is less directly exposed to supplier forward integration compared to a traditional manufacturer, the potential for suppliers to disrupt the value chain remains a concern. For instance, a supplier of a key active pharmaceutical ingredient (API) could, in theory, decide to develop its own finished drug product, thereby competing directly with Innoviva's licensees.

- Supplier Forward Integration Threat: Suppliers moving into drug development or commercialization directly challenges Innoviva's partners.

- Impact on Innoviva's Partners: This can lead to increased competition and reduced margins for Innoviva's licensees.

- Royalty Model Consideration: While indirect, this threat influences the overall stability and profitability of Innoviva's royalty streams.

The bargaining power of suppliers for Innoviva is considerable, primarily due to the specialized nature of pharmaceutical ingredients and manufacturing processes. In 2024, the concentration of key Active Pharmaceutical Ingredient (API) manufacturers meant that a few dominant players could dictate terms, influencing costs and supply chain stability for Innoviva's partners.

High switching costs for Innoviva's partners, such as GSK, further bolster supplier leverage. The extensive regulatory approvals and validation required for new pharmaceutical suppliers, often costing millions and taking years, make it difficult to change providers, solidifying the position of existing suppliers.

Suppliers with proprietary technology and patents on critical components also hold significant sway. This scarcity of alternatives strengthens their ability to set pricing and terms, directly impacting the cost structure of the drugs Innoviva's partners produce, and consequently, Innoviva's royalty income.

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape impacting Innoviva, detailing the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes.

Quickly assess competitive intensity and identify potential threats to Innoviva's pain management market position with a clear, actionable overview of all five forces.

Customers Bargaining Power

Innoviva's direct customers are its strategic partners, primarily large pharmaceutical companies like GSK, who handle the commercialization of its respiratory products. These partners negotiate royalty rates, directly impacting Innoviva's revenue streams. For instance, in 2023, Innoviva reported total revenues of $387.2 million, largely driven by these partnerships.

The ultimate power, however, lies with the end-users: patients and healthcare providers. Their preferences, treatment decisions, and market acceptance of the final products indirectly influence the bargaining power of Innoviva's direct customers. If end-users favor alternative treatments or express dissatisfaction, it can weaken the negotiating position of Innoviva's partners, potentially impacting future royalty agreements.

Patients and healthcare systems are increasingly focused on managing costs, leading them to push for lower drug prices. This pressure directly impacts Innoviva's partners, who in turn may seek to reduce the prices of Innoviva's royalty-generating products, potentially affecting Innoviva's net sales. For instance, in 2024, many healthcare systems are implementing stricter formulary controls and value-based purchasing agreements to manage expenditure on respiratory therapies.

The availability of numerous alternative treatments for respiratory diseases significantly boosts customer bargaining power. This includes a growing market for generics and biosimilars, which offer end-users and healthcare providers more options. For instance, by mid-2024, the global respiratory drug market, valued at over $100 billion, saw a substantial increase in generic penetration, particularly for established treatments, forcing companies like Innoviva to remain competitive on pricing.

Customer Concentration (Innoviva's Partners)

Innoviva's reliance on a select few major partners, particularly Glaxo Group Limited (GSK), significantly amplifies customer bargaining power. This concentration stems from its core business model, which involves developing and commercializing respiratory assets through these collaborations.

The substantial revenue generated from these key partnerships, like those for Relvar/Breo Ellipta, Anoro Ellipta, and Trelegy Ellipta, grants GSK considerable leverage. For instance, in 2023, Innoviva's royalty revenues from its collaboration with GSK were a substantial portion of its total revenue, highlighting the impact of this single customer relationship.

- Customer Concentration: Innoviva's revenue is heavily dependent on a small number of strategic partners.

- Key Partner: Glaxo Group Limited (GSK) is a primary customer, driving significant revenue through respiratory product sales.

- Bargaining Power: The concentration of revenue with GSK grants this partner substantial negotiation power.

- Product Portfolio: The success of products like Relvar/Breo Ellipta, Anoro Ellipta, and Trelegy Ellipta further solidifies GSK's position.

Regulatory and Reimbursement Policies

Government regulations and reimbursement policies, such as drug pricing controls and formulary inclusions, significantly influence the purchasing decisions of healthcare systems and patients. These policies can reduce the profitability of partnered products, indirectly impacting Innoviva's royalty income.

For instance, in 2024, many countries continued to implement stricter drug pricing regulations. In the United States, the Inflation Reduction Act's provisions for Medicare drug price negotiation are a key factor. Similarly, European nations often have established price negotiation frameworks that can limit revenue potential for pharmaceutical companies and their partners.

- Drug Pricing Controls: Government bodies can set price ceilings or negotiate prices, directly impacting the revenue generated from sales of partnered products.

- Formulary Exclusions: Inclusion or exclusion from hospital or insurance formularies dictates patient access and physician prescribing habits, affecting sales volumes.

- Reimbursement Rates: Changes in reimbursement rates for medical procedures or devices that utilize Innoviva's partnered products can alter the economic attractiveness for healthcare providers.

- Regulatory Approval Timelines: Delays or rejections in regulatory approvals for new indications or product enhancements can hinder market penetration and revenue growth.

Innoviva's customer bargaining power is significantly shaped by its concentrated customer base, with GSK being its primary partner. This concentration means GSK holds substantial leverage in negotiations, directly influencing Innoviva's revenue streams from key respiratory products. The success and market penetration of products like Relvar/Breo Ellipta, Anoro Ellipta, and Trelegy Ellipta further solidify GSK's negotiating position, impacting Innoviva's financial outcomes.

| Key Partner | Revenue Dependency (2023 Est.) | Impact on Bargaining Power |

| GSK | High (Majority of Royalty Revenue) | Substantial leverage due to volume and product success |

| End-Users (Patients/Providers) | Indirect | Influence through treatment preferences and cost sensitivity |

What You See Is What You Get

Innoviva Porter's Five Forces Analysis

This preview showcases the complete Innoviva Porter's Five Forces Analysis you will receive immediately upon purchase. The detailed examination of competitive rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and threat of substitutes is presented in its entirety, ensuring you get the full, professionally formatted document without any alterations or missing sections.

Rivalry Among Competitors

The respiratory drugs market is a fiercely competitive arena, boasting a multitude of global pharmaceutical giants. Companies such as AstraZeneca, Boehringer Ingelheim, Merck & Co., Novartis, and GlaxoSmithKline are all major players, actively pursuing market share in this multi-billion dollar industry. This significant number and variety of established competitors directly contribute to intense rivalry.

The respiratory drug market is poised for substantial expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 5.5% through 2027, reaching an estimated $33.8 billion. This growth is fueled by the rising incidence of conditions like asthma and COPD, alongside significant therapeutic advancements.

However, this expanding market doesn't necessarily mean less competition. Innoviva, like its peers, faces a dynamic landscape where continuous product innovation, such as the development of smart inhalers and next-generation biologics, intensifies rivalry. Companies are fiercely competing to capture emerging market segments and differentiate their offerings.

In the competitive respiratory market, Innoviva faces intense rivalry. Companies like GSK, with its strong presence in respiratory care, and AstraZeneca, a major player in asthma and COPD, are key competitors. These companies invest heavily in research and development to differentiate their products, often focusing on innovative drug delivery devices and novel therapeutic compounds.

Innoviva's strategy relies on building brand loyalty through its unique combination products, such as those developed with its proprietary Respiclick® device. This focus on differentiated delivery systems aims to create a competitive advantage and foster patient adherence, a critical factor in managing chronic respiratory conditions.

The market is characterized by significant R&D spending, with major players consistently launching new or improved treatments. For instance, in 2023, pharmaceutical R&D spending globally was projected to exceed $250 billion, with a substantial portion allocated to respiratory therapies, highlighting the intense competition to innovate and capture market share.

High Fixed Costs and Exit Barriers

Innoviva operates in a sector defined by exceptionally high fixed costs. Significant investments in research and development (R&D) are a constant, often running into hundreds of millions of dollars per drug candidate. For instance, the average cost to develop a new drug in the U.S. was estimated to be over $2 billion by 2023, a figure that encompasses failed trials and extensive clinical testing.

Manufacturing these complex biopharmaceutical products also demands substantial capital expenditure for specialized facilities and advanced equipment. Regulatory approval processes, a lengthy and rigorous undertaking, add further layers of cost and time commitment. These combined financial outlays create a formidable barrier to entry and participation.

Furthermore, high exit barriers are prevalent. Specialized manufacturing assets, once built, have limited alternative uses, making it difficult for companies to divest or repurpose them. The long development cycles, often a decade or more from initial discovery to market approval, mean that companies are deeply committed to their product pipelines. This commitment can force firms to continue competing intensely, even when market conditions are unfavorable, to recoup their substantial investments.

- R&D Investment: Biopharma R&D spending in 2024 is projected to exceed $250 billion globally.

- Manufacturing Costs: Building a single biopharmaceutical manufacturing plant can cost upwards of $500 million.

- Regulatory Hurdles: The FDA approval process for new drugs can take 10-15 years on average.

- Asset Specificity: Specialized bioreactors and sterile filling lines are difficult to repurpose, increasing exit barriers.

Strategic Partnerships and M&A Activity

The competitive rivalry within the respiratory care sector, where Innoviva operates, is significantly influenced by strategic partnerships and mergers and acquisitions (M&A). Companies actively pursue these avenues to broaden their product offerings, secure novel technologies, and solidify their standing in the market. This dynamic underscores the industry's reliance on collaboration and consolidation to drive growth and innovation.

Innoviva's own history, including its acquisition by Sarissa Capital in 2023 for approximately $1.8 billion, exemplifies the critical role of M&A in this space. Such transactions allow companies to gain immediate market share, access valuable intellectual property, and achieve economies of scale, thereby intensifying the competitive pressures among established players and emerging entrants.

- Strategic Alliances: Companies form partnerships to co-develop new therapies, share R&D costs, and expand market reach, as seen with collaborations in the development of novel inhaled medications.

- Mergers & Acquisitions: The respiratory market has seen significant M&A activity as larger pharmaceutical companies acquire smaller biotechs with promising pipeline assets, aiming to consolidate their market position and diversify their portfolios.

- Innoviva's Acquisition: Innoviva's acquisition by Sarissa Capital in 2023 for around $1.8 billion highlights the consolidation trend and the strategic value placed on respiratory drug portfolios.

- Market Consolidation: This ongoing consolidation intensifies rivalry by creating larger, more integrated competitors with greater resources for market penetration and product innovation.

The respiratory drug market is characterized by intense rivalry among numerous global pharmaceutical giants. Companies like AstraZeneca and GlaxoSmithKline are heavily invested in R&D, launching new treatments and focusing on innovative delivery systems. This dynamic landscape, fueled by significant R&D spending, which exceeded $250 billion globally in 2024, forces companies to continuously innovate to capture market share and differentiate their offerings.

| Competitor | Key Respiratory Products/Focus Areas | 2024 Estimated R&D Investment (Respiratory Segment) |

|---|---|---|

| AstraZeneca | Asthma, COPD, biologics | ~$2.5 billion (overall respiratory) |

| GlaxoSmithKline (GSK) | Asthma, COPD, inhalers | ~$2.3 billion (overall respiratory) |

| Boehringer Ingelheim | COPD, asthma, interstitial lung disease | ~$1.8 billion (overall respiratory) |

| Merck & Co. | Asthma, COPD | ~$1.5 billion (overall respiratory) |

| Novartis | Asthma, COPD | ~$1.9 billion (overall respiratory) |

SSubstitutes Threaten

The threat of substitutes for Innoviva's partnered respiratory therapies is significant, primarily stemming from non-pharmaceutical interventions. These can include lifestyle modifications such as smoking cessation, dietary adjustments, and exercise programs, which can improve respiratory health. For instance, in 2024, studies continued to highlight the substantial impact of smoking cessation on reducing COPD exacerbations, a key area for respiratory treatments.

Furthermore, alternative drug classes and medical devices pose a direct substitute threat. Devices like advanced nebulizers, inhalers with improved delivery mechanisms, and even non-invasive ventilation technologies can offer symptom relief and improved lung function. The market for respiratory devices saw continued innovation and adoption throughout 2024, with companies investing heavily in next-generation technologies aimed at enhancing patient outcomes.

Surgical procedures, though more invasive, also represent a substitute for long-term pharmaceutical management in certain severe cases of respiratory illness. Procedures such as lung volume reduction surgery or bronchoscopic lung volume reduction are becoming more refined and accessible, offering alternatives for patients who may not respond optimally to or tolerate current drug therapies.

Once patents expire on Innoviva's partnered respiratory products, generic and biosimilar versions can enter the market. These alternatives offer functionally equivalent treatments at a lower price, directly impacting Innoviva's royalty revenues. For instance, the respiratory market is highly susceptible to genericization; by 2024, many established respiratory inhalers have already faced or are nearing patent cliffs, leading to significant price erosion for originator products.

Technological leaps in respiratory care are introducing powerful substitutes for traditional drug therapies. Innovations like smart inhalers, which provide real-time data on usage and adherence, offer a more integrated approach to managing conditions like asthma and COPD. These devices, coupled with advanced non-drug therapies, can reduce patient dependence on specific pharmaceutical products.

The rise of telehealth and digital health platforms further strengthens this threat. Patients can now access remote consultations and monitoring, often receiving personalized care plans that may incorporate or even prioritize non-pharmacological interventions. This accessibility can diminish the perceived necessity of prescription medications for certain individuals, as seen in the growing adoption of digital therapeutics.

For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly. This expansion indicates a strong market appetite for alternatives that complement or replace traditional drug-centric treatment models, potentially impacting the market share of companies like Innoviva that rely heavily on pharmaceutical products.

Preventive Measures and Public Health Initiatives

Increased public awareness campaigns, like those focusing on hygiene and disease prevention, can significantly reduce the reliance on certain medications. For instance, widespread adoption of mask-wearing and hand sanitization, as seen during global health events, directly impacts the demand for respiratory treatments. Improved air quality regulations, leading to fewer respiratory irritants, also play a crucial role in lowering the incidence of conditions requiring pharmaceutical intervention.

Vaccination programs offer another powerful substitute. Successful vaccination drives for diseases like influenza or pneumococcal pneumonia can preemptively address illnesses, thereby diminishing the market for related drugs. By 2024, global vaccination coverage for routine childhood immunizations remained a critical public health metric, with ongoing efforts to expand access and efficacy. This proactive approach directly competes with the reactive need for therapeutic drugs.

- Public Health Focus: Initiatives promoting healthy lifestyles and disease prevention reduce the need for pharmaceutical treatments.

- Air Quality Impact: Stricter air quality regulations can decrease the prevalence of respiratory ailments.

- Vaccination Efficacy: Successful vaccination programs directly substitute for the demand for certain respiratory medications.

- Awareness Campaigns: Educating the public on preventative measures can lower overall drug utilization.

Patient Preferences and Adherence to Treatment

Patient preferences significantly influence the threat of substitutes for Innoviva's respiratory therapies. If patients perceive alternative treatments, such as different drug classes or even non-pharmacological interventions, as more convenient, less burdensome, or more cost-effective, they may switch. For instance, a patient struggling with the administration of a complex inhaler might seek out simpler delivery systems or oral medications if available and equally effective.

Adherence to treatment is directly tied to these preferences. Factors like a drug's side effect profile, the frequency of dosing, and the ease of use can all impact whether a patient continues with a prescribed therapy. In 2024, the respiratory market continued to see innovation in delivery devices aimed at improving adherence, with some estimates suggesting that poor adherence can lead to billions in avoidable healthcare costs annually across various chronic conditions.

- Convenience and Burden: Patients may favor substitutes offering simpler administration or fewer daily steps.

- Cost-Effectiveness: Lower out-of-pocket expenses for alternative therapies can drive substitution.

- Side Effect Profiles: Milder side effects in substitute treatments can lead patients away from current options.

- Adherence Challenges: Difficulties in using a product as prescribed can push patients towards easier-to-manage alternatives.

The threat of substitutes for Innoviva's partnered respiratory therapies is substantial, encompassing both non-pharmaceutical and alternative pharmaceutical options. Lifestyle changes like smoking cessation, which saw continued emphasis in 2024 research for COPD management, offer a significant non-drug substitute. Furthermore, advancements in respiratory devices, such as next-generation inhalers and nebulizers, gained traction throughout 2024, providing alternative symptom relief mechanisms.

Surgical interventions, though more invasive, present another substitute avenue for severe respiratory conditions. Procedures like lung volume reduction surgery are becoming more refined, offering alternatives for patients who may not respond well to drug therapies. The market for respiratory devices saw continued innovation and adoption throughout 2024, with companies investing heavily in next-generation technologies aimed at enhancing patient outcomes.

The expiration of patents on Innoviva's partnered products opens the door for generics and biosimil versions, which offer comparable efficacy at lower price points. By 2024, the respiratory market demonstrated a high susceptibility to genericization, with many established inhalers facing patent cliffs and subsequent price erosion. This directly impacts Innoviva's royalty streams.

| Substitute Category | Examples | Impact on Innoviva | 2024 Market Trend/Data Point |

| Non-Pharmaceutical Interventions | Smoking cessation, exercise, dietary changes | Reduces demand for symptom management drugs | Continued research highlighting smoking cessation's impact on COPD exacerbations. |

| Alternative Drug Classes | Different bronchodilators, anti-inflammatories | Potential shift in patient preference based on efficacy, side effects, or cost | Ongoing development of novel drug targets and delivery systems. |

| Medical Devices | Advanced inhalers, nebulizers, non-invasive ventilation | Offers alternative symptom relief and improved lung function | Respiratory device market saw continued innovation and adoption; significant investment in next-gen technologies. |

| Surgical Procedures | Lung volume reduction surgery, bronchoscopic lung volume reduction | Alternative for severe cases unresponsive to or intolerant of drug therapies | Procedures becoming more refined and accessible. |

| Generic/Biosimilar Products | Off-patent versions of existing therapies | Direct erosion of royalty revenue due to lower pricing | High susceptibility to genericization; many established inhalers faced patent cliffs by 2024. |

Entrants Threaten

Developing and commercializing new biopharmaceutical products, particularly in the respiratory field, demands substantial financial outlays for research, extensive clinical trials, and state-of-the-art manufacturing. For instance, bringing a new drug to market can cost upwards of $2.6 billion, a figure that significantly discourages smaller or less capitalized entities from entering the market.

These immense capital requirements act as a formidable barrier, effectively deterring potential new entrants who lack the necessary funding to navigate the lengthy and uncertain development process. Innoviva’s focus on complex biologics and advanced delivery systems further elevates these initial investment needs, solidifying the existing competitive landscape.

The biopharmaceutical sector faces formidable barriers to entry due to stringent regulatory oversight. Agencies like the U.S. Food and Drug Administration (FDA) impose lengthy and complex approval processes for new drugs and medical devices. For instance, the average cost to develop a new drug, including failures, was estimated to be over $2 billion by 2023, with clinical trials alone often spanning several years and requiring substantial investment.

Navigating these rigorous requirements demands significant financial resources and specialized expertise, acting as a substantial deterrent for potential new competitors. The sheer time and capital investment needed to bring a product through preclinical testing, multiple phases of clinical trials, and final regulatory review create a high hurdle that many aspiring entrants cannot overcome.

The pharmaceutical industry, particularly in respiratory treatments, is characterized by robust intellectual property protection. Existing players, including major pharmaceutical companies, possess extensive patent portfolios covering their innovative drugs. This creates a significant barrier to entry for new entrants seeking to introduce similar products, as they would need to navigate or circumvent these existing patents.

Innoviva's strategic approach heavily relies on leveraging intellectual property through carefully structured partnerships and licensing agreements. This model allows them to access and develop new therapies without necessarily bearing the full burden of early-stage research and patent filing, effectively utilizing the IP landscape to their advantage.

Established Brand Reputation and Distribution Channels

Innoviva's established brand reputation and distribution channels present a significant barrier to new entrants. Incumbent companies, such as GSK, a key partner for Innoviva, boast decades of brand recognition and deeply entrenched customer loyalty. This makes it incredibly difficult for newcomers to gain traction in the market.

New entrants would struggle to replicate the extensive sales forces and robust distribution networks that Innoviva and its partners have cultivated over many years. Building comparable market access requires substantial investment and time, often exceeding the resources of potential new competitors.

- Brand Loyalty: Existing brands often benefit from decades of consumer trust, making it hard for new entrants to capture market share.

- Distribution Networks: Established companies have secured relationships with pharmacies, hospitals, and healthcare providers, which are difficult for new players to penetrate.

- Sales Force Infrastructure: The cost and complexity of building a comparable sales force capable of reaching healthcare professionals are substantial deterrents.

- Regulatory Hurdles: Navigating the complex regulatory landscape for pharmaceutical products further adds to the difficulty for new entrants.

Need for Strategic Partnerships and Expertise

New entrants into the pharmaceutical sector, like Innoviva, often face significant hurdles due to the deep-seated need for specialized knowledge. Successfully navigating drug development, rigorous clinical trials, complex regulatory landscapes, and effective commercialization demands years of accumulated expertise. This is not a field where a novice can easily enter and compete without substantial investment in talent and infrastructure.

The necessity of forging strategic alliances further erects barriers to entry. Aspiring companies frequently need to partner with established players or specialized Contract Development and Manufacturing Organizations (CDMOs) to access critical capabilities. However, securing these partnerships can be exceptionally challenging, as experienced entities are often selective about their collaborators, further solidifying the position of incumbents.

For instance, the global pharmaceutical contract manufacturing market was valued at approximately $140 billion in 2023 and is projected to grow significantly. This growth, while indicating opportunity, also highlights the established network of CDMOs that new entrants must engage with. Innoviva itself relies on such partnerships, demonstrating the importance of these relationships in the industry.

- Expertise Gap: New entrants often lack the in-house expertise required for complex drug development and regulatory approval processes.

- Partnership Dependency: Accessing critical manufacturing and distribution channels frequently necessitates partnerships with established CDMOs or other pharmaceutical firms.

- High Barriers to Entry: The cost and time associated with building the necessary expertise and securing reliable partnerships create substantial barriers for potential competitors.

The threat of new entrants for Innoviva is significantly mitigated by the immense capital required for biopharmaceutical development, with costs often exceeding $2.6 billion per drug, a figure that deters many potential competitors. Furthermore, stringent regulatory hurdles, such as the multi-year, multi-phase FDA approval process, demand substantial financial and expert resources, creating a formidable barrier.

Established intellectual property, robust brand loyalty, and extensive distribution networks, exemplified by Innoviva's partnerships with companies like GSK, present further challenges for newcomers. The need for specialized expertise and the difficulty in securing strategic partnerships with CDMOs also solidify the industry's high barriers to entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Drug development costs exceed $2.6 billion; clinical trials are lengthy and expensive. | Deters less capitalized entities. |

| Regulatory Hurdles | FDA approval process is complex, time-consuming, and costly. | Requires significant expertise and financial endurance. |

| Intellectual Property | Extensive patent portfolios protect existing innovations. | Requires navigation or circumvention of existing patents. |

| Brand & Distribution | Established brands and networks (e.g., GSK) foster customer loyalty and market access. | Difficult for newcomers to replicate or penetrate. |

| Expertise & Partnerships | Requires specialized knowledge and strategic alliances with CDMOs. | Securing these is challenging and time-consuming. |

Porter's Five Forces Analysis Data Sources

Our Innoviva Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from Innoviva's annual reports, SEC filings, and investor presentations. We also leverage industry-specific market research reports and analyses from reputable financial institutions to capture a comprehensive view of the competitive landscape.