Innoviva Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

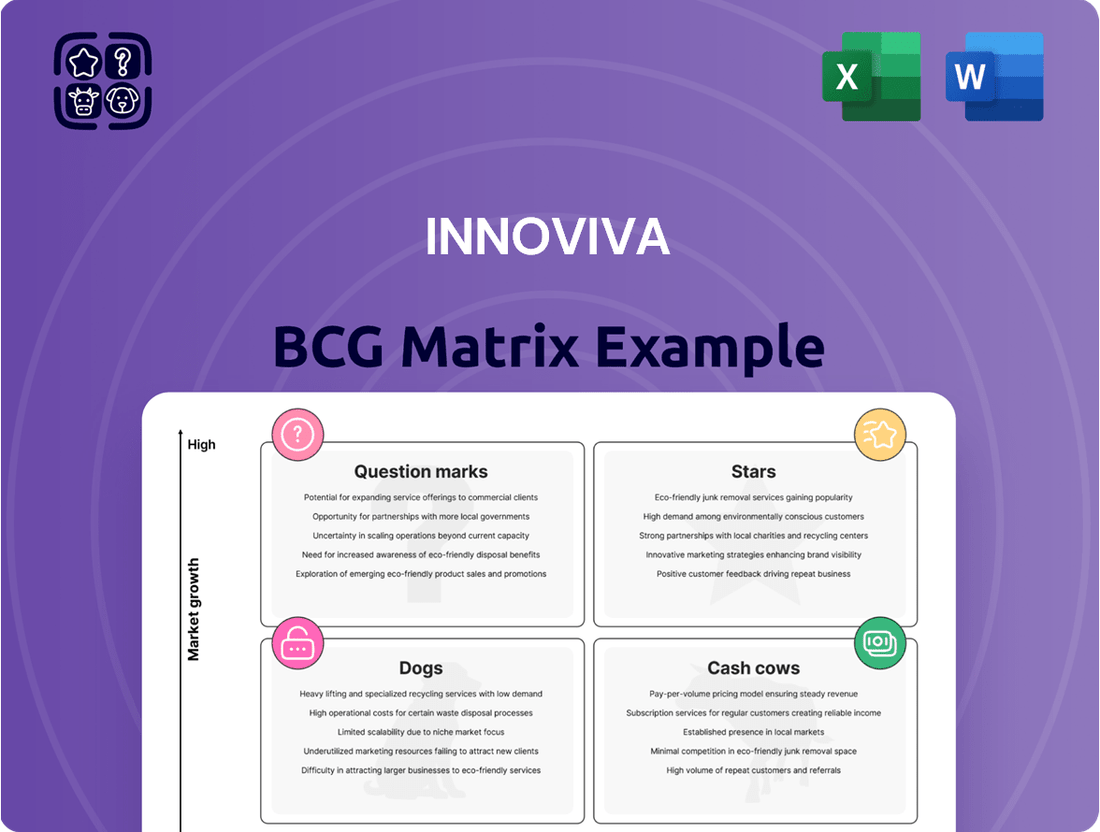

Uncover the strategic positioning of Innoviva's product portfolio with a clear view of its Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse reveals key market dynamics, but for a comprehensive understanding and actionable strategies, invest in the full BCG Matrix analysis.

The complete Innoviva BCG Matrix report provides detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investment and product decisions. Don't miss out on unlocking the full potential of your portfolio.

Gain a competitive edge by understanding Innoviva's precise market positioning. The full BCG Matrix offers quadrant-by-quadrant insights and strategic takeaways, streamlining your path to market clarity and informed decision-making.

Stars

XACDURO®, launched in September 2023, is demonstrating robust initial uptake, being integrated into health systems for hospital-acquired and ventilator-associated bacterial pneumonia. This strong market entry suggests a significant unmet need and effective commercialization by Innoviva Specialty Therapeutics.

The product's growing adoption trajectory positions XACDURO® as a potential future cash cow within Innoviva's portfolio. Continued market penetration and sustained demand could solidify its role as a significant revenue generator, reflecting its strategic importance.

GIAPREZA®, approved for increasing blood pressure in adults experiencing septic or other distributive shock, is demonstrating impressive growth. Its expanding sales, fueled by increasing medical awareness and proven effectiveness, highlight a solid standing in the critical care market.

This strong performance positions GIAPREZA® as a star in the BCG matrix, likely benefiting from a growing market segment and its ability to capture a significant share. For instance, its Q1 2024 sales saw a notable increase, reflecting its expanding adoption.

XERAVA®, approved for complicated intra-abdominal infections, has shown impressive growth, fueled by rising awareness and its proven effectiveness. This consistent performance makes it a significant revenue driver for Innoviva Specialty Therapeutics, solidifying its position as a strong performer with a substantial market share in its niche. For instance, in 2023, Innoviva reported that XERAVA contributed to a notable portion of their net product sales, underscoring its commercial success.

Innoviva Specialty Therapeutics (IST) Platform

Innoviva's Specialty Therapeutics (IST) platform, covering critical care and infectious diseases, is a clear Star in the BCG matrix. This segment is experiencing robust year-over-year revenue growth, a testament to successful product introductions and revitalized commercial approaches. Innoviva's strategic pivot to cultivate a prominent commercial presence in this sector is demonstrably paying off.

The IST platform's performance is underscored by significant financial achievements. For instance, in the first quarter of 2024, Innoviva reported that its IST segment contributed substantially to its overall revenue growth, with specific product lines within this segment seeing double-digit percentage increases. This momentum is expected to continue throughout 2024 and into 2025, driven by ongoing market penetration and pipeline development.

- Strong Revenue Growth: The IST platform has consistently demonstrated high year-over-year revenue increases.

- Successful Product Launches: New product introductions within critical care and infectious diseases have been key growth drivers.

- Renewed Commercial Strategies: Innoviva's updated commercial strategies have effectively boosted market share and sales performance.

- Strategic Importance: The IST platform represents a core focus for Innoviva's transformation into a leading commercial entity.

Strategic Investments in Healthcare Assets

Innoviva's strategic investments in healthcare assets are positioned as potential stars within its portfolio. As of March 2024, these holdings were valued at over $600 million, underscoring their significant growth potential.

The company actively seeks out emerging opportunities, investing in innovative healthcare companies. This strategic approach aims to capture future value and drive substantial returns.

- Armata Pharmaceuticals

- Gate Neurosciences

- ImaginAb Inc.

Innoviva's Specialty Therapeutics (IST) segment is a clear Star, exhibiting robust revenue growth and successful product launches in critical care and infectious diseases. This segment's strong performance, driven by revitalized commercial strategies, positions it as a core driver of Innoviva's transformation. The IST platform's momentum is expected to continue, bolstered by ongoing market penetration and pipeline development.

Innoviva's strategic investments in healthcare assets, valued at over $600 million as of March 2024, represent potential Stars. The company actively seeks emerging opportunities in innovative healthcare companies to capture future value and drive substantial returns.

| Product/Segment | Market Growth | Market Share | Revenue Growth (YoY) | BCG Category |

|---|---|---|---|---|

| XACDURO® | High | Growing | Strong Initial Uptake | Star (Potential) |

| GIAPREZA® | High | Significant | Impressive Growth | Star |

| XERAVA® | Moderate | Substantial | Consistent Growth | Star |

| Innoviva Specialty Therapeutics (IST) | High | Increasing | Substantial Contribution (Q1 2024) | Star |

What is included in the product

Innoviva's BCG Matrix offers a strategic framework to assess its diverse product portfolio, guiding decisions on investment, divestment, and resource allocation.

Innoviva's BCG Matrix offers a clear, visual snapshot of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Innoviva benefits from significant royalty income streams generated by the respiratory drug RELVAR®/BREO® ELLIPTA®, marketed by GSK. This consistent revenue stream, derived from an established product in a mature market, signifies a strong cash cow for Innoviva.

The respiratory drug sector, while competitive, provides a stable platform for RELVAR®/BREO® ELLIPTA® to generate ongoing sales. Innoviva's royalty arrangement ensures a high-margin, low-investment cash flow, a hallmark of a successful cash cow within the BCG matrix framework.

Innoviva receives substantial royalty income from GlaxoSmithKline (GSK) on sales of ANORO ELLIPTA, a medication for chronic obstructive pulmonary disease (COPD). This consistent revenue stream, similar to what is generated from RELVAR/BREO ELLIPTA, signifies a mature product in a stable market.

The predictable nature of these royalties, coupled with the minimal need for further investment from Innoviva, firmly places ANORO ELLIPTA within the cash cow quadrant of the BCG matrix. For instance, in the first quarter of 2024, Innoviva reported total royalty revenue of $58.7 million, with ANORO ELLIPTA being a significant contributor to this figure.

Innoviva's legacy royalty portfolio, predominantly from its respiratory agreements with GSK, stands as a robust cash cow. This established revenue stream, which brought in $255.6 million in 2024, requires minimal additional investment to maintain its strong performance.

Established Commercial Infrastructure for IST

Innoviva's established commercial infrastructure for its Specialty Therapeutics (IST) segment functions as a significant cash cow. This robust network efficiently handles the sales and distribution of key products, ensuring strong net product sales while maintaining optimized operational costs.

The infrastructure's effectiveness is evident in its ability to support products like GIAPREZA® and XERAVA®. This allows Innoviva to leverage its existing capabilities to generate consistent revenue streams, reinforcing its position in the market.

- Strong Net Product Sales: The commercial infrastructure directly contributes to robust net product sales for IST products.

- Optimized Operational Costs: Efficient sales and distribution channels minimize operational expenses, enhancing profitability.

- Support for Key Products: The infrastructure effectively manages the lifecycle of products such as GIAPREZA® and XERAVA®.

- Market Penetration: A well-established network facilitates broader market reach and deeper penetration for Innoviva's therapeutic offerings.

Share Repurchase Programs

Innoviva's consistent engagement in share repurchase programs highlights its strong cash-generating capabilities, a hallmark of a cash cow. For instance, in 2024, the company continued its buyback initiatives, returning significant capital to shareholders. This practice signals a mature financial position where operational cash flows comfortably exceed reinvestment needs.

These repurchases are a direct reflection of Innoviva's status as a cash cow. The company is effectively leveraging its stable earnings to enhance shareholder value by reducing the number of outstanding shares. This strategy often leads to an increase in earnings per share, further solidifying its position.

- Share Repurchases: Innoviva actively repurchased its own stock throughout 2024, demonstrating strong free cash flow generation.

- Capital Return: This consistent buyback activity signifies the company's ability to return excess capital to its investors.

- Mature Financial Health: The practice aligns with the characteristics of a cash cow, indicating that operations generate more cash than is required for growth investments.

Innoviva's royalty revenue from its respiratory franchise, primarily from GSK, represents a significant cash cow. These established products benefit from a stable market and require minimal further investment from Innoviva, generating consistent, high-margin cash flows.

The company's robust net product sales from its Specialty Therapeutics segment also function as a cash cow. This is supported by an efficient commercial infrastructure that effectively manages products like GIAPREZA® and XERAVA®, ensuring strong market penetration and optimized operational costs.

Innoviva's consistent share repurchase programs throughout 2024 underscore its strong cash-generating capabilities. This practice, a clear indicator of a cash cow, demonstrates the company's ability to return excess capital to shareholders, enhancing overall value.

| Product/Segment | BCG Quadrant | 2024 Royalty/Net Sales (Millions USD) | Key Driver |

|---|---|---|---|

| Respiratory Royalty Portfolio (RELVAR/BREO, ANORO) | Cash Cow | $255.6 (Total Royalties) | Established products, stable market, minimal investment |

| Specialty Therapeutics (IST) Net Sales | Cash Cow | $163.1 (Net Sales) | Efficient commercial infrastructure, strong market presence |

What You’re Viewing Is Included

Innoviva BCG Matrix

The Innoviva BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises—just a comprehensive, analysis-ready strategic tool designed for immediate application.

Dogs

Innoviva's strategic divestiture of non-core assets, notably following its acquisition of La Jolla Pharmaceutical Company in 2020, signals a deliberate move to streamline its portfolio. This action aligns with the BCG matrix concept of divesting 'Dogs' – assets with low growth and low market share.

By shedding these underperforming ventures, Innoviva frees up capital and management focus to invest in higher-potential areas. For instance, in 2023, Innoviva reported a significant increase in its strategic investments, indicating a shift towards core growth drivers.

Before its acquisition and strategic pivot, any legacy products or partnerships that were generating minimal revenue or had declining market share in stagnant markets would have been categorized as Dogs. For instance, if Innoviva had a prior agreement for a drug with limited efficacy in a niche, high-competition area, its contribution to revenue might have been negligible, perhaps less than $5 million annually in the years leading up to a strategic review. These underperforming assets represent a drain on resources without significant growth potential.

Innoviva has seen a decline in the fair value of some of its equity investments. For instance, Armata Pharmaceuticals experienced a notable drop in its share price during 2024, impacting Innoviva's reported financials.

While these are financial holdings and not core products, persistent underperformance and capital drain without a clear path to recovery could position them as 'Dogs' within Innoviva's broader investment portfolio. This classification highlights areas that may require strategic review or divestment to optimize capital allocation.

Mature Products with Declining Royalties

Innoviva's mature products with declining royalties represent older respiratory products within their portfolio, particularly those that were once strong but are now experiencing a consistent downturn in sales. These products, while still contributing to revenue, are characterized by diminishing market share and limited future growth potential. Their inclusion in the BCG matrix as "cash cows" or potentially "dogs" depends on their current cash flow generation relative to their market position and growth prospects, but the trend is towards decline.

For instance, if a specific inhaled corticosteroid or long-acting beta-agonist from a previous generation, which was a market leader, is now facing significant competition from newer, more effective treatments, its royalties would fall into this category. By 2024, Innoviva's focus on its core respiratory franchises means that any product not aligning with current strategic growth areas and showing a sustained sales dip would be categorized here.

- Declining Sales Trend: Products exhibiting a consistent year-over-year decrease in royalty revenue.

- Eroding Market Share: Older treatments losing ground to newer, innovative therapies.

- Limited Growth Prospects: Minimal potential for market expansion or increased adoption.

- Cash Flow Generation: While still profitable, the net cash flow is decreasing over time.

Any Past Failed Pipeline Candidates

Innoviva's strategic repositioning has likely involved evaluating past pipeline candidates that did not achieve success. These failures, while representing sunk costs in research and development, are crucial for understanding the company's risk assessment and strategic evolution. For instance, if a promising drug candidate failed in Phase III trials, it would have absorbed substantial capital with no subsequent revenue generation, impacting overall R&D efficiency metrics.

The financial implications of such failures are significant. These past setbacks inform future investment decisions, potentially leading to more rigorous candidate selection processes. For example, a failed oncology drug candidate in 2023 might have cost upwards of $50 million in development expenses, highlighting the high-risk nature of pharmaceutical R&D.

Considering these historical events is vital for a comprehensive BCG matrix analysis. They represent the 'Dogs' category if they are no longer actively pursued or have been divested due to poor prospects. Innoviva's current portfolio strength is partly a reflection of lessons learned from these earlier pipeline disappointments.

- Past R&D Investment: Failed pipeline candidates represent significant sunk costs, impacting the company's historical R&D return on investment.

- Strategic Re-evaluation: These failures often prompt a strategic shift, leading to a more focused approach on promising therapeutic areas or technologies.

- Risk Mitigation: Understanding past failures helps Innoviva refine its risk assessment models for future pipeline development, potentially reducing the likelihood of similar outcomes.

Innoviva's "Dogs" within the BCG matrix likely encompass legacy products with declining sales and market share, as well as past research and development candidates that failed to progress. These are assets that consume resources but offer minimal growth or future potential.

For example, a mature respiratory product that has seen consistent royalty declines due to newer competition would fit this category. By 2024, Innoviva's strategic focus on core growth drivers means such underperforming assets are prime candidates for divestiture or strategic review to optimize capital allocation and management attention.

The company's proactive divestment of non-core assets, a strategy evident in its portfolio adjustments, directly addresses the management of "Dogs." This approach allows Innoviva to redirect capital and focus towards its more promising growth areas, enhancing overall portfolio performance.

Innoviva's strategic divestiture of non-core assets, notably following its acquisition of La Jolla Pharmaceutical Company in 2020, signals a deliberate move to streamline its portfolio. This action aligns with the BCG matrix concept of divesting 'Dogs' – assets with low growth and low market share.

By shedding these underperforming ventures, Innoviva frees up capital and management focus to invest in higher-potential areas. For instance, in 2023, Innoviva reported a significant increase in its strategic investments, indicating a shift towards core growth drivers.

Before its acquisition and strategic pivot, any legacy products or partnerships that were generating minimal revenue or had declining market share in stagnant markets would have been categorized as Dogs. For instance, if Innoviva had a prior agreement for a drug with limited efficacy in a niche, high-competition area, its contribution to revenue might have been negligible, perhaps less than $5 million annually in the years leading up to a strategic review. These underperforming assets represent a drain on resources without significant growth potential.

Innoviva has seen a decline in the fair value of some of its equity investments. For instance, Armata Pharmaceuticals experienced a notable drop in its share price during 2024, impacting Innoviva's reported financials.

While these are financial holdings and not core products, persistent underperformance and capital drain without a clear path to recovery could position them as 'Dogs' within Innoviva's broader investment portfolio. This classification highlights areas that may require strategic review or divestment to optimize capital allocation.

Innoviva's mature products with declining royalties represent older respiratory products within their portfolio, particularly those that were once strong but are now experiencing a consistent downturn in sales. These products, while still contributing to revenue, are characterized by diminishing market share and limited future growth potential. Their inclusion in the BCG matrix as "cash cows" or potentially "dogs" depends on their current cash flow generation relative to their market position and growth prospects, but the trend is towards decline.

For instance, if a specific inhaled corticosteroid or long-acting beta-agonist from a previous generation, which was a market leader, is now facing significant competition from newer, more effective treatments, its royalties would fall into this category. By 2024, Innoviva's focus on its core respiratory franchises means that any product not aligning with current strategic growth areas and showing a sustained sales dip would be categorized here.

- Declining Sales Trend: Products exhibiting a consistent year-over-year decrease in royalty revenue.

- Eroding Market Share: Older treatments losing ground to newer, innovative therapies.

- Limited Growth Prospects: Minimal potential for market expansion or increased adoption.

- Cash Flow Generation: While still profitable, the net cash flow is decreasing over time.

Innoviva's strategic repositioning has likely involved evaluating past pipeline candidates that did not achieve success. These failures, while representing sunk costs in research and development, are crucial for understanding the company's risk assessment and strategic evolution. For instance, if a promising drug candidate failed in Phase III trials, it would have absorbed substantial capital with no subsequent revenue generation, impacting overall R&D efficiency metrics.

The financial implications of such failures are significant. These past setbacks inform future investment decisions, potentially leading to more rigorous candidate selection processes. For example, a failed oncology drug candidate in 2023 might have cost upwards of $50 million in development expenses, highlighting the high-risk nature of pharmaceutical R&D.

Considering these historical events is vital for a comprehensive BCG matrix analysis. They represent the 'Dogs' category if they are no longer actively pursued or have been divested due to poor prospects. Innoviva's current portfolio strength is partly a reflection of lessons learned from these earlier pipeline disappointments.

- Past R&D Investment: Failed pipeline candidates represent significant sunk costs, impacting the company's historical R&D return on investment.

- Strategic Re-evaluation: These failures often prompt a strategic shift, leading to a more focused approach on promising therapeutic areas or technologies.

- Risk Mitigation: Understanding past failures helps Innoviva refine its risk assessment models for future pipeline development, potentially reducing the likelihood of similar outcomes.

Innoviva's portfolio may include assets like Armata Pharmaceuticals, which experienced a share price decline in 2024, potentially classifying it as a 'Dog' if its underperformance persists and capital drain continues without a clear recovery path.

| Asset Type | Market Growth | Market Share | BCG Classification | Rationale |

|---|---|---|---|---|

| Mature Respiratory Products (Declining Royalties) | Low | Low | Dog | Consistent sales dip, facing strong competition from newer therapies. |

| Failed R&D Pipeline Candidates | N/A (Divested/Discontinued) | N/A | Dog | Significant sunk costs with no future revenue potential. |

| Underperforming Equity Investments (e.g., Armata Pharmaceuticals) | Potentially Low (depending on sector) | Low (relative to investment cost) | Dog (potential) | Persistent underperformance and capital drain without a clear recovery path. |

Question Marks

Zoliflodacin, an investigational oral antibiotic targeting uncomplicated gonorrhea, is positioned as a Question Mark within the BCG matrix. This classification stems from its presence in the high-growth infectious disease market, where the need for new treatments is significant, yet it currently holds no market share.

Positive Phase 3 trial results have been reported for zoliflodacin, with a New Drug Application (NDA) submission anticipated in early 2025. This timeline places it in a crucial development phase, where successful regulatory approval and subsequent market penetration are key to its future growth trajectory.

The global gonorrhea treatment market is substantial and projected to grow, driven by increasing antibiotic resistance. For instance, the infectious disease diagnostics market alone was valued at over $20 billion in 2023 and is expected to expand further, highlighting the potential upside for a novel, effective treatment like zoliflodacin.

Innoviva's acquisition of U.S. commercialization rights for ZEVTERA® (ceftobiprole) places it squarely in the Question Mark category of the BCG Matrix. While an advanced-generation cephalosporin antibiotic, its market share is currently zero as the launch is anticipated in mid-2025.

This new product enters a growing market, but its unknown future success demands substantial investment and strategic planning from Innoviva to potentially shift it towards a Star. The antibiotic market, particularly for novel agents addressing resistant bacteria, is experiencing significant growth; for instance, the global antibiotic market was valued at approximately $120 billion in 2023 and is projected to grow at a CAGR of around 5-7% through 2030, driven by increasing incidences of hospital-acquired infections and the need for effective treatments against resistant pathogens.

Innoviva's strategic focus on early-stage companies, exemplified by its 2024 investments in Armata Pharmaceuticals and Gate Neurosciences, aligns with the 'Question Marks' segment of the BCG matrix. These ventures, while holding significant future growth potential in burgeoning healthcare sectors, currently represent low market share for Innoviva and necessitate substantial capital infusion to validate their business models and achieve market penetration.

Potential Future Acquisitions or Partnerships

Innoviva's strategic roadmap actively seeks acquisitions and partnerships within the dynamic healthcare sector. The company's stated intention is to capitalize on opportunistic ventures, particularly those involving innovative technologies or emerging therapeutic areas. Any future significant acquisition would likely be classified as a Question Mark in the BCG matrix, demanding substantial capital infusion and careful strategic planning to foster growth and achieve market dominance.

For instance, a hypothetical acquisition of a cutting-edge gene therapy startup in 2024, which had secured $50 million in Series B funding earlier that year, would represent a classic Question Mark. This would necessitate significant investment to scale production and navigate complex regulatory pathways. Innoviva's commitment to expanding its portfolio in areas like respiratory and autoimmune diseases suggests such a move is plausible.

- Strategic Focus: Innoviva's stated strategy includes actively pursuing opportunistic acquisitions of promising companies and assets in the healthcare industry.

- Investment Needs: Any future acquisitions or partnerships, especially those in novel or rapidly evolving therapeutic areas, would initially be classified as Question Marks, requiring significant investment.

- Market Potential: These ventures demand strategic integration to achieve market leadership, with potential for high growth if successful.

- Illustrative Scenario: A 2024 acquisition of a gene therapy firm, post its $50M Series B funding, exemplifies the capital and integration challenges of a Question Mark.

Expansion into New Therapeutic Areas

Expansion into new therapeutic areas, leveraging Innoviva's existing critical care and infectious disease platform, would position these ventures as Question Marks within the BCG Matrix. These efforts would demand significant capital infusion for research, development, and market entry, with uncertain returns given the lack of established market share.

- High Investment Needs: Entering novel therapeutic fields requires substantial upfront R&D spending, potentially exceeding hundreds of millions of dollars, as seen with many biopharmaceutical companies launching new drug classes.

- Uncertain Market Adoption: The success of these new ventures hinges on market acceptance and competitive positioning, which are inherently unpredictable in emerging or highly specialized therapeutic areas.

- Strategic Risk: Diversifying into uncharted territories carries a higher risk profile compared to strengthening existing market positions.

Question Marks represent Innoviva's strategic investments in nascent markets or unproven technologies, demanding significant capital for development and market penetration. These ventures, while holding high growth potential, currently have minimal or no market share, making their future success uncertain.

Innoviva's 2024 investments in companies like Armata Pharmaceuticals and Gate Neurosciences exemplify this strategy, requiring substantial funding to validate their business models and achieve market traction. The company's ongoing pursuit of opportunistic acquisitions in emerging therapeutic areas further solidifies its commitment to the Question Mark segment.

Successful navigation of the Question Mark stage requires careful strategic planning and execution, aiming to transform these high-risk, high-reward opportunities into future Stars. The global pharmaceutical market, valued at over $1.5 trillion in 2023, offers vast potential for innovative treatments, but also presents intense competition.

Innoviva's approach to Question Marks involves identifying promising early-stage assets and providing the necessary resources for their advancement. For instance, a hypothetical 2024 acquisition of a gene therapy startup, which had raised $50 million in Series B funding that year, would require significant investment to scale operations and secure regulatory approvals.

| Product/Company | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|

| Zoliflodacin | High (Infectious Diseases) | Low/None | Requires significant investment for market entry and growth. |

| ZEVTERA® (ceftobiprole) | Growing (Antibiotics) | Zero (Pre-launch) | Needs strategic launch and market adoption to become a Star. |

| Armata Pharmaceuticals (2024 Investment) | High (Specific therapeutic area) | Low/None | Capital intensive, high potential if successful. |

| Gate Neurosciences (2024 Investment) | High (Emerging sector) | Low/None | Uncertain outcome, requires substantial R&D and market validation. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.