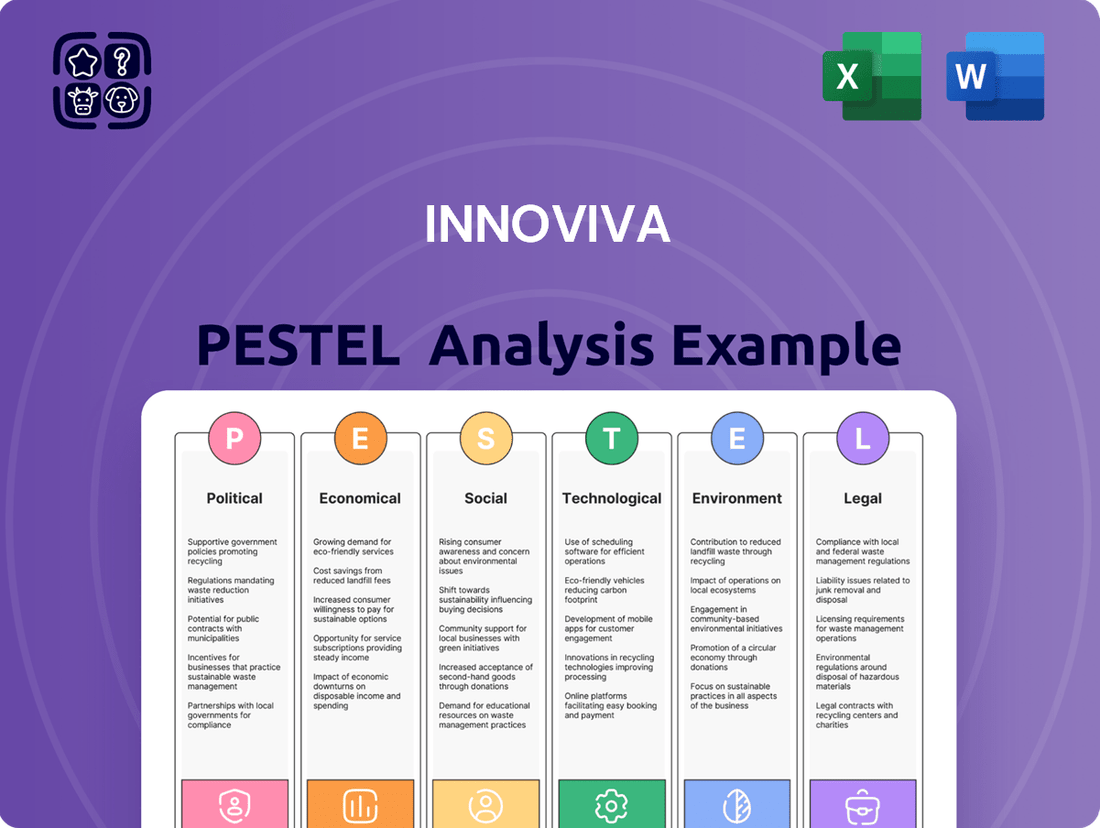

Innoviva PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

Unlock the critical external factors shaping Innoviva's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and anticipate market dynamics. Download the full PESTLE analysis now for a deeper understanding.

Political factors

Innoviva's revenue stream, primarily from royalties on respiratory drugs, is sensitive to government healthcare spending. Policies influencing drug pricing and reimbursement directly affect the profitability of these partnered medicines.

The Inflation Reduction Act (IRA) in the US, enacted in 2022, grants Medicare the power to negotiate prices for certain high-cost prescription drugs. For 2024, the IRA's first round of drug price negotiations is expected to impact an initial group of 10 Part D drugs, with potential implications for future negotiations affecting a broader range of pharmaceuticals.

These government interventions, such as the IRA's price negotiation provisions, could lead to reduced revenue for Innoviva's partners, consequently impacting the royalty income Innoviva receives, especially as more drugs become eligible for negotiation in subsequent years.

Innoviva operates within a highly regulated biopharmaceutical sector, where agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) dictate the pace and cost of product development. For instance, in 2024, the FDA continued to emphasize rigorous data requirements for respiratory drug approvals, potentially extending review timelines for new therapies. These evolving regulatory landscapes directly impact Innoviva's partners' capacity to launch and monetize their respiratory treatments, influencing revenue generation and market access.

Innoviva's reliance on its patent portfolio makes intellectual property (IP) rights and their robust enforcement a critical political factor. Changes in IP legislation, such as potential reforms to patentability criteria or the duration of patent protection, could directly affect the market exclusivity and therefore the profitability of Innoviva's partnered respiratory treatments. For instance, a hypothetical weakening of patent enforcement in a key market could expose its revenue streams to earlier generic competition, impacting its 2024 and projected 2025 earnings.

Trade Policies and Geopolitical Tensions

Global trade policies and geopolitical tensions significantly impact the biopharmaceutical industry. Fluctuations in tariffs and trade agreements can alter supply chain costs and market access for products like Innoviva's respiratory medicines. For instance, ongoing trade disputes between major economies could lead to increased import duties on raw materials or finished goods, affecting manufacturing expenses for Innoviva's partners.

Geopolitical instability can disrupt the distribution networks essential for delivering life-saving treatments. Innoviva, while primarily a royalty-based company, is indirectly exposed to these risks through its partners. The company's revenue streams, derived from sales of products like Relvar Ellipta and Breo Ellipta, could see reduced growth if partner operations face significant disruptions due to political unrest or trade sanctions in key markets.

In 2024, the global trade landscape continues to be shaped by these dynamics. For example, the US-China trade relationship, while showing some stabilization, still presents potential headwinds for companies relying on international supply chains. Similarly, regional conflicts can create localized market access challenges, indirectly influencing the overall demand and profitability of respiratory therapies.

- Trade Policy Impact: Changes in trade agreements, such as potential renegotiations of existing deals or imposition of new tariffs, can directly affect the cost of goods and the ease of market entry for biopharmaceutical products.

- Geopolitical Risk Exposure: Innoviva's royalty-based model means its revenue is tied to the success of its partners' sales, which can be hampered by geopolitical instability leading to supply chain disruptions or reduced market access in affected regions.

- Market Access Challenges: Political tensions can lead to market fragmentation or outright bans on certain products, impacting the global reach and sales potential of respiratory medicines.

Public Health Initiatives and Priorities

Government-led public health initiatives significantly shape the landscape for companies like Innoviva. For instance, the US Centers for Disease Control and Prevention (CDC) actively promotes vaccination campaigns, which can impact the prevalence of respiratory illnesses and, consequently, the demand for treatments. In 2024, the CDC continued its focus on influenza and COVID-19 vaccination, alongside efforts to bolster pneumococcal vaccination rates, particularly among older adults. These public health priorities directly influence market dynamics for respiratory therapies.

These initiatives can create both opportunities and challenges. A strong government push for disease prevention, such as widespread influenza vaccination programs, might reduce the overall incidence of flu-related hospitalizations, potentially impacting the market for certain treatments. Conversely, increased focus on specific respiratory diseases could spur investment and create demand for innovative therapies. For example, the continued emphasis on managing COPD exacerbations, a key area for Innoviva, is supported by public health strategies aiming to reduce hospital readmissions.

Consider these specific impacts:

- Vaccination Campaigns: Increased vaccination rates for diseases like influenza or pneumococcal pneumonia can lead to a reduced patient pool for certain therapeutics, impacting sales projections.

- Disease Management Programs: Government-backed programs focused on chronic disease management, such as those for COPD, can create a more stable demand for existing and novel treatments.

- Research Funding: Public health priorities can direct government research funding towards specific areas, potentially accelerating development in those fields or creating competitive pressures.

- Regulatory Focus: Public health concerns can influence regulatory agencies' priorities, potentially speeding up or slowing down the approval process for new respiratory drugs based on unmet medical needs.

Government healthcare spending and drug pricing policies are paramount. The Inflation Reduction Act (IRA) in the US, enacted in 2022, allows Medicare to negotiate prices for certain high-cost drugs, with initial negotiations impacting 10 Part D drugs in 2024, potentially affecting Innoviva's royalty income as more drugs become eligible in 2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Innoviva, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights to identify strategic opportunities and mitigate potential threats, empowering informed decision-making for Innoviva's leadership.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of external factors impacting Innoviva's pain management strategies.

Economic factors

Global healthcare expenditure continues its upward trajectory, projected to reach $11.0 trillion by 2025, according to Deloitte. This growth directly fuels demand for respiratory medicines, a key market for Innoviva. However, this expansion is tempered by increasing pressure to control costs.

In the US, for instance, the Inflation Reduction Act of 2022 empowers Medicare to negotiate prices for certain high-cost drugs, impacting manufacturers' revenue potential. This trend, coupled with the inherent cost of advanced respiratory treatments, presents a delicate balancing act for biopharmaceutical companies like Innoviva.

The biopharmaceutical sector is demonstrating robust commitment to research and development, with global R&D spending projected to reach approximately $260 billion in 2024, a notable increase from previous years.

This sustained investment is crucial for driving innovation in respiratory therapies, a key area that could positively impact Innoviva's royalty income derived from its strategic collaborations.

Despite potential economic uncertainties, the industry's ongoing R&D focus signifies a long-term growth trajectory, underpinning the discovery of next-generation treatments.

The global respiratory drugs market is on a strong upward trajectory, with projections indicating it could reach approximately $240 billion by 2027, a notable increase from its 2022 valuation. This expansion is driven by the rising incidence of conditions like asthma, COPD, and allergies, coupled with ongoing innovation in therapeutic approaches.

This robust market growth presents a significant opportunity for Innoviva. As the company's business model relies on royalties and milestone payments from its partnered respiratory drug portfolio, the expanding market size directly translates to increased revenue potential for its products.

Inflationary Pressures and Cost of Operations

Inflationary pressures are significantly impacting the pharmaceutical sector, directly affecting Innoviva's partners. Rising costs for essential inputs like active pharmaceutical ingredients (APIs) and manufacturing processes are squeezing margins. For instance, the Producer Price Index (PPI) for chemicals and allied products, a key indicator for raw material costs, saw a notable increase in late 2023 and early 2024, contributing to higher operational expenses across the board.

These escalating operational costs extend beyond manufacturing to crucial areas like clinical trials and complex supply chain management. Increased expenses in these domains can directly reduce the net revenue generated by Innoviva's partners. This, in turn, has a ripple effect on the royalty streams that form a core part of Innoviva's business model, underscoring the sensitivity of its revenue to broader economic cost trends.

- Rising API Costs: Global supply chain disruptions and increased energy prices have driven up the cost of key pharmaceutical raw materials.

- Manufacturing Expenses: Higher labor costs and increased energy consumption for production facilities are adding to operational burdens.

- Clinical Trial Inflation: The cost of conducting clinical trials, a lengthy and resource-intensive process, has also seen an upward trend due to inflation.

- Supply Chain Logistics: Increased transportation and warehousing costs directly impact the efficient delivery of pharmaceutical products.

Mergers, Acquisitions, and Investment Climate

The biopharma sector continues to be a hotbed for mergers and acquisitions (M&A), with companies actively seeking to bolster their pipelines and gain market share. This trend reflects a dynamic industry where innovation and strategic consolidation are key drivers of growth. For instance, in 2024, the sector has already witnessed several significant deals, with total disclosed deal values in the tens of billions of dollars, underscoring sustained investor confidence.

Innoviva's own acquisition by Veranova in late 2024 is a prime example of this consolidation. Beyond specific company actions, the broader investment climate within biopharma remains robust, with venture capital funding and private equity interest showing resilience. This healthy investment climate signals a strong appetite for promising technologies and therapeutic areas, fostering opportunities for future partnerships and collaborations.

- Biopharma M&A Activity: Deal volumes and values in the biopharma space remained elevated through early 2025, driven by the pursuit of novel drug candidates and advanced technologies.

- Investment Climate: Venture capital funding for biotech startups saw a notable uptick in late 2024 and early 2025, with a particular focus on oncology, rare diseases, and gene therapies.

- Strategic Partnerships: The ongoing M&A trend encourages strategic collaborations, as companies look to access external innovation and de-risk their R&D pipelines.

- Innoviva's Acquisition: Innoviva's acquisition by Veranova in late 2024 highlights the industry's consolidation phase and the strategic value placed on established portfolios and manufacturing capabilities.

Global healthcare spending is projected to reach $11.0 trillion by 2025, a significant driver for respiratory medicine demand. However, increasing pressure to control costs, exemplified by the US Inflation Reduction Act allowing Medicare to negotiate drug prices, presents a challenge for companies like Innoviva.

The biopharmaceutical sector's commitment to research and development is robust, with global R&D spending expected to near $260 billion in 2024. This investment is crucial for developing next-generation respiratory therapies, which directly benefits Innoviva's royalty income streams.

The respiratory drugs market is anticipated to reach approximately $240 billion by 2027, fueled by rising chronic respiratory disease incidence and therapeutic advancements. This market expansion directly correlates with increased revenue potential for Innoviva's partnered products.

Inflationary pressures are impacting the biopharma sector, with rising costs for APIs and manufacturing squeezing margins. For instance, the Producer Price Index for chemicals saw increases in late 2023 and early 2024, escalating operational expenses for Innoviva's partners and potentially affecting royalty payments.

| Economic Factor | Trend | Impact on Innoviva |

| Healthcare Expenditure Growth | Projected $11.0 trillion by 2025 | Increased demand for respiratory medicines, boosting royalty potential. |

| Cost Containment Measures | e.g., US Inflation Reduction Act | Potential pressure on drug pricing and partner revenue, impacting royalties. |

| R&D Investment | ~$260 billion in 2024 | Drives innovation in respiratory therapies, supporting long-term royalty growth. |

| Respiratory Market Size | Projected ~$240 billion by 2027 | Directly increases revenue potential for Innoviva's partnered products. |

| Inflationary Pressures | Rising API and manufacturing costs | Increases operational expenses for partners, potentially reducing royalty streams. |

Same Document Delivered

Innoviva PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Innoviva PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to a detailed breakdown of these crucial external influences.

Sociological factors

The global rise in respiratory illnesses like asthma and COPD is a significant market driver for Innoviva. In 2024, the World Health Organization reported that over 300 million people worldwide suffer from asthma, and chronic obstructive pulmonary disease (COPD) affects an estimated 210 million people. These increasing health challenges directly translate to a sustained demand for advanced respiratory therapies.

The world's population is getting older, and this trend directly impacts the demand for healthcare, especially for conditions affecting breathing. As people age, they are more likely to develop chronic respiratory illnesses like COPD or asthma. This means more people will need specialized medicines and ongoing care to manage their breathing difficulties.

This demographic shift is a significant driver for companies like Innoviva, which focus on respiratory treatments. By 2024, over 10% of the global population is projected to be over 65, a figure expected to rise substantially by 2025. This growing segment of older adults represents a consistent and expanding market for respiratory pharmaceuticals and related healthcare services, ensuring sustained growth for the sector.

Growing awareness of respiratory diseases like COPD and asthma is significantly impacting how patients approach their health. In 2024, organizations like the COPD Foundation reported increased engagement from patients seeking information and support, directly influencing treatment adherence. This heightened patient advocacy drives demand for more effective and patient-friendly therapeutic options.

Patient advocacy groups are increasingly influential in shaping healthcare policy and treatment guidelines. Their efforts in 2024 have pushed for greater access to innovative respiratory solutions and a stronger focus on patient-centric care models. This translates to a higher likelihood of patients seeking timely diagnoses and actively participating in their treatment plans, benefiting companies like Innoviva.

Lifestyle Factors and Urbanization

Lifestyle choices, particularly smoking, remain a significant driver of respiratory ailments. Urbanization, a trend showing no signs of slowing, exacerbates this by increasing exposure to air pollutants. For instance, in 2024, urban populations globally are projected to reach 67%, a figure that directly correlates with heightened respiratory health concerns.

This evolving urban landscape creates a persistent demand for innovative solutions in respiratory care. Innoviva’s market position is therefore influenced by the growing need for both preventative strategies against environmental triggers and effective treatments for existing conditions.

- Global urbanization rate: projected to reach 67% by 2024.

- Impact of air pollution: linked to increased incidence of asthma and COPD.

- Lifestyle factors: smoking continues to be a primary contributor to respiratory diseases.

- Market demand: sustained growth expected for respiratory therapeutics and preventative measures.

Healthcare Access and Education

Innoviva's growth is significantly tied to how easily people can access healthcare and how well they understand their conditions. In 2024, there's a growing focus on expanding healthcare services, especially in developing economies, which directly impacts the demand for respiratory treatments. Better patient education also plays a key role, encouraging more people to seek diagnosis and adhere to prescribed therapies, leading to improved health outcomes and sustained market engagement.

The adoption of innovative drug delivery systems, like smart inhalers, is a direct result of both improved healthcare access and enhanced patient education. These technologies aim to boost treatment adherence, a critical factor for managing chronic respiratory diseases effectively. For instance, studies in 2024 continue to highlight that poor adherence can lead to a significant increase in hospitalizations and overall healthcare costs, underscoring the value of patient empowerment through education and accessible, user-friendly devices.

- Healthcare Access Expansion: Global health initiatives and private sector investments in 2024 are targeting underserved regions, aiming to bring essential medicines and diagnostic tools closer to patients.

- Patient Education Initiatives: Programs focusing on respiratory health awareness saw increased funding in 2024, with digital platforms and community health workers playing a larger role in disseminating information.

- Treatment Adherence Improvement: The market for connected inhalers and adherence monitoring apps is projected to grow substantially through 2025, driven by their proven ability to improve patient compliance and reduce exacerbations.

- Emerging Market Focus: By 2025, emerging markets are expected to represent a larger share of the respiratory drug market, necessitating tailored approaches to healthcare access and patient education.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and proactive management of chronic conditions. This shift encourages greater patient engagement in their treatment journeys, benefiting companies like Innoviva that offer advanced respiratory solutions. Increased health consciousness, particularly concerning air quality and its impact on respiratory health, is a key driver.

The growing influence of patient advocacy groups is shaping healthcare policies and treatment accessibility. These organizations actively campaign for better patient outcomes and increased access to innovative therapies, directly impacting Innoviva's market. Their efforts in 2024 have focused on improving treatment adherence and promoting patient-centric care models.

The increasing global population, especially the aging demographic, directly fuels demand for respiratory treatments. By 2025, the over-65 population is expected to constitute a significant portion of global consumers, many of whom will require ongoing management for chronic respiratory diseases like COPD and asthma. This demographic trend ensures a sustained market for Innoviva's products.

Technological factors

Innoviva benefits from continuous advancements in drug discovery, particularly AI-driven approaches. These technologies are speeding up the identification of new respiratory medicines, potentially leading to more effective treatments and a larger market for Innoviva's therapies.

Technological progress in drug delivery systems is significantly enhancing patient care, particularly in respiratory health. Innovations like smart inhalers, equipped with digital monitoring, are proving instrumental in improving how patients manage their conditions. These devices not only track usage but also provide data that can lead to more personalized treatment plans, ultimately boosting adherence and treatment outcomes.

The market appeal of respiratory drugs is directly benefiting from these advancements. For instance, by offering improved patient engagement and demonstrable efficacy through data, smart inhaler technology makes respiratory medications more attractive to both healthcare providers and patients. This trend is expected to continue, driving further innovation in how drugs are delivered and managed.

Digital health, encompassing telehealth and remote patient monitoring, is revolutionizing respiratory care. These advancements facilitate real-time data exchange, predictive analytics for disease flare-ups, and enhanced patient involvement, ultimately leading to more efficient and tailored management of respiratory ailments.

By 2024, the global digital health market was valued at over $300 billion, with a significant portion dedicated to remote patient monitoring solutions. This trend is expected to accelerate, driven by the increasing prevalence of chronic respiratory diseases and the demand for accessible, continuous patient care, as evidenced by a projected compound annual growth rate of over 15% for remote monitoring technologies through 2027.

Biologics and Advanced Therapies

The rise of biologics, like monoclonal antibodies, is transforming respiratory disease treatment by offering highly targeted therapies for complex conditions. This advancement signifies a major growth avenue within the pharmaceutical sector, particularly for companies like Innoviva focusing on respiratory health.

These advanced treatments are not just incremental improvements; they represent a paradigm shift in how severe respiratory illnesses are managed. For instance, the market for biologic therapies in asthma alone has seen substantial growth, with projections indicating continued expansion through 2025 and beyond.

- Market Growth: The global biologics market is projected to reach over $600 billion by 2025, with respiratory biologics being a significant contributor.

- Targeted Therapies: Biologics offer precision medicine approaches, improving patient outcomes for conditions like severe asthma and COPD.

- Innovation Pipeline: Numerous novel biologics and advanced therapies are in late-stage clinical trials, promising further innovation in respiratory care.

Manufacturing Technologies and Automation

Innoviva’s focus on respiratory medicines is significantly influenced by advancements in manufacturing technologies. Improvements in automation, such as robotic processing and AI-driven quality control, are streamlining production lines. For instance, the global pharmaceutical automation market was valued at approximately $55.6 billion in 2023 and is projected to reach $95.7 billion by 2030, indicating a strong trend towards increased adoption.

The shift towards continuous manufacturing, which allows for uninterrupted production processes, offers substantial benefits over traditional batch manufacturing. This approach can lead to a smaller manufacturing footprint, reduced waste, and enhanced product consistency. Companies are increasingly investing in these technologies to gain a competitive edge.

Furthermore, the integration of Lean manufacturing principles is crucial for optimizing operational efficiency and cost reduction within Innoviva’s production facilities. By minimizing waste and maximizing value, these methodologies directly impact the sustainability and profitability of respiratory drug development and supply.

- Automation: Robotic systems and AI are enhancing precision and reducing manual labor in pharmaceutical manufacturing.

- Continuous Manufacturing: This process offers improved efficiency, reduced costs, and better quality control compared to batch methods.

- Lean Principles: Adoption of Lean manufacturing aims to eliminate waste and optimize resource utilization for greater cost-effectiveness.

Technological advancements are a major driver for Innoviva, particularly in areas like AI-driven drug discovery and sophisticated drug delivery systems such as smart inhalers. These innovations are not only accelerating the development of new respiratory treatments but also enhancing patient adherence and outcomes. The global digital health market, exceeding $300 billion in 2024, underscores the growing importance of telehealth and remote monitoring in managing chronic conditions like respiratory diseases.

The rise of biologics, including monoclonal antibodies, represents a significant technological shift, offering highly targeted therapies for complex respiratory illnesses. The biologics market is projected to surpass $600 billion by 2025, with respiratory applications playing a key role. Manufacturing technologies are also evolving, with automation and continuous manufacturing processes becoming more prevalent. The pharmaceutical automation market, valued at approximately $55.6 billion in 2023, is expected to reach $95.7 billion by 2030, highlighting a strong industry trend towards efficiency and quality improvements.

| Technology Area | Impact on Innoviva | Market Data/Projections |

|---|---|---|

| AI in Drug Discovery | Accelerates identification of new respiratory medicines | Global AI in healthcare market expected to grow significantly |

| Smart Inhalers/Digital Health | Improves patient adherence, provides data for personalized treatment | Digital health market > $300 billion (2024); Remote monitoring CAGR > 15% (through 2027) |

| Biologics/Targeted Therapies | Offers advanced treatment for severe respiratory conditions | Biologics market > $600 billion (by 2025); Precision medicine growth |

| Manufacturing Automation & Continuous Manufacturing | Enhances production efficiency, quality control, and cost-effectiveness | Pharma automation market $55.6 billion (2023) to $95.7 billion (2030) |

Legal factors

The legal framework governing drug pricing, especially in the United States with initiatives like the Inflation Reduction Act (IRA), significantly influences the revenue streams for respiratory medicines. The IRA, enacted in 2022, allows Medicare to negotiate prices for certain high-cost prescription drugs, a move that could directly impact companies like Innoviva by potentially lowering the achievable prices for their products.

These government-led negotiation programs are designed to curb healthcare spending and can lead to substantial price reductions. For instance, the IRA initially identified up to 10 Part D drugs for negotiation in 2026, with further Part B and Part D drugs to follow in subsequent years. This regulatory shift is reshaping the financial outlook for pharmaceutical manufacturers and their collaborators in the respiratory sector.

Innoviva's business model is deeply intertwined with intellectual property rights, particularly patents protecting its partnered pharmaceutical products. Legal shifts impacting patent validity, such as successful challenges or the introduction of biosimilars and generics, directly threaten market exclusivity and revenue streams. For instance, the ongoing patent landscape for respiratory drugs, a key area for Innoviva, remains dynamic, with potential for litigation and the erosion of market share as patents expire or are contested.

Innoviva, like all biopharmaceutical firms, navigates a complex web of regulatory compliance, primarily dictated by bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These agencies set stringent standards for drug development, manufacturing, and marketing, directly influencing Innoviva's product pipeline and market access.

Recent shifts in regulatory landscapes are particularly impactful. For instance, the FDA's increased focus on real-world evidence (RWE) in drug approvals, a trend gaining momentum in 2024, could alter the data requirements for Innoviva's submissions. Similarly, evolving guidelines on the use of artificial intelligence (AI) in drug discovery and clinical trial optimization, expected to see further refinement through 2025, present both opportunities and compliance challenges for Innoviva.

Anti-Trust and Competition Law

Anti-trust and competition laws significantly shape strategic alliances and M&A activities in the biopharmaceutical industry. These regulations can impact how companies, including Innoviva's collaborators, forge partnerships, pursue growth through consolidation, or navigate market expansion within the respiratory medicine landscape.

For instance, regulatory bodies closely scrutinize mergers and acquisitions to prevent market monopolization. In 2024, the Federal Trade Commission (FTC) continued its aggressive stance on healthcare M&A, blocking several deals deemed anti-competitive, setting a precedent for future transactions in the sector.

- Regulatory Scrutiny: Increased focus on preventing market dominance in respiratory therapies.

- Merger & Acquisition Impact: Potential hurdles for Innoviva's partners seeking consolidation or expansion through M&A.

- Collaboration Frameworks: Partnerships must be structured to avoid anti-competitive practices.

- Market Dynamics: Enforcement actions can alter competitive landscapes and product accessibility.

Product Liability and Consumer Protection

Pharmaceutical companies, including those like Innoviva, operate under stringent product liability and consumer protection laws. These regulations are designed to ensure the safety and efficacy of medical products, particularly those for respiratory conditions where patient well-being is paramount.

Legal challenges stemming from allegations of product defects or misleading claims regarding respiratory medicines can have severe repercussions. For instance, in 2023, the pharmaceutical industry faced billions in settlements and judgments related to product liability claims, impacting companies' financial health and market standing. Innoviva's reliance on partnerships means that any such legal issues affecting its collaborators' products could directly influence its own market acceptance and revenue streams.

The potential for costly litigation, reputational damage, and the erosion of consumer trust necessitates robust risk management and adherence to all consumer protection mandates. This includes transparent communication about product risks and benefits, as well as rigorous quality control throughout the development and manufacturing processes.

- Regulatory Scrutiny: Pharmaceutical products are subject to intense scrutiny by bodies like the FDA, with strict guidelines on safety, efficacy, and marketing claims.

- Litigation Costs: Product liability lawsuits can result in substantial financial penalties, including damages, legal fees, and recall expenses. For example, major pharmaceutical recalls in 2024 have already cost companies millions.

- Consumer Protection Laws: Legislation such as the Consumer Product Safety Act and specific healthcare-related consumer protection statutes impose duties on manufacturers to ensure product safety and prevent deceptive practices.

- Reputational Impact: Adverse legal outcomes can severely damage a company's reputation, affecting patient and physician confidence and potentially hindering future product launches and partnerships.

Innoviva's financial performance is intrinsically linked to evolving drug pricing regulations, particularly in the U.S. with the Inflation Reduction Act (IRA). The IRA's provisions for Medicare drug price negotiation, impacting high-cost Part D drugs starting in 2026, could directly reduce revenue for partnered respiratory medicines.

Patent law is critical for Innoviva, as intellectual property protection underpins its collaborative revenue model. Challenges to patent validity or the emergence of generics/biosimilars, a dynamic in the respiratory sector through 2024-2025, directly threaten market exclusivity and sales.

Stringent regulatory compliance with bodies like the FDA and EMA governs Innoviva's product pipeline and market access. Evolving requirements, such as the FDA's increased emphasis on real-world evidence in 2024 and AI in drug development through 2025, present both compliance challenges and strategic opportunities.

Antitrust and competition laws influence strategic partnerships and M&A. The FTC's active stance in 2024 against anti-competitive healthcare deals highlights potential hurdles for Innoviva's collaborators seeking market consolidation.

Product liability and consumer protection laws are paramount, given the critical nature of respiratory medicines. Billions in settlements in 2023 for product liability claims underscore the financial and reputational risks for companies and their partners.

Environmental factors

Deteriorating air quality and rising pollution levels, both outdoors and indoors, are directly linked to an increase in respiratory illnesses. This trend, particularly concerning in many urban centers globally, fuels a consistent and expanding market for Innoviva's respiratory drug portfolio.

For instance, the World Health Organization reported in 2022 that 99% of the global population breathes air that exceeds WHO guideline limits, containing high levels of pollutants. This pervasive issue underscores the critical need for effective respiratory treatments, directly benefiting companies like Innoviva.

Climate change is increasingly impacting respiratory health, with extreme heat, wildfires, and shifting aeroallergen patterns directly worsening conditions like asthma and COPD. The World Health Organization (WHO) estimates that air pollution, a significant component of climate change impacts, caused 7 million premature deaths globally in 2022, many from respiratory and cardiovascular diseases. This escalating health challenge signals a sustained and growing demand for Innoviva's respiratory therapies, as populations face greater environmental triggers for lung ailments.

Innoviva faces increasing pressure from regulatory bodies and consumers to adopt more sustainable manufacturing. This push is evident in the pharmaceutical sector's growing focus on green chemistry principles, aiming to reduce hazardous substance use and waste generation. For instance, by 2024, the industry is expected to see a significant uptick in companies investing in energy-efficient equipment and processes to lower their carbon footprint.

Supply Chain Environmental Footprint

The environmental impact of the pharmaceutical supply chain, particularly Scope 3 emissions, is a significant concern for companies like Innoviva. These emissions stem from raw material extraction, global transportation networks, and the disposal of pharmaceutical products and packaging. For instance, the healthcare sector globally contributes an estimated 4.5% of global greenhouse gas emissions, with supply chains being a major component.

In response, there's a strong push towards decarbonizing these complex supply chains. Innoviva and its peers are increasingly focusing on adopting circular economy principles, aiming to minimize waste and maximize resource utilization throughout the product lifecycle. This includes exploring sustainable sourcing of raw materials and improving logistics efficiency.

- Scope 3 emissions: A significant portion of the pharmaceutical industry's carbon footprint originates from activities outside direct operational control, such as upstream supplier operations and downstream product use and disposal.

- Circular economy adoption: Companies are investing in initiatives to reduce waste, promote recycling of materials, and design products for greater longevity and easier end-of-life management.

- Regulatory pressures: Growing environmental regulations and investor scrutiny are compelling pharmaceutical companies to report and actively manage their supply chain's environmental footprint.

Water Stewardship and Waste Management

Innoviva, like many pharmaceutical manufacturers, faces significant environmental considerations, particularly concerning water usage and waste management. The production of medicines is inherently water-intensive, and the generation of chemical waste presents a substantial challenge. For instance, in 2023, the pharmaceutical industry globally consumed an estimated 50 billion cubic meters of water, a figure projected to rise.

In response, companies are actively developing and implementing strategies to mitigate these impacts. These include advanced water optimization techniques to reduce consumption, sophisticated solvent recovery systems to minimize hazardous waste, and comprehensive waste reduction programs throughout the manufacturing lifecycle. Such initiatives not only improve environmental performance but also directly influence operational costs through reduced resource expenditure and waste disposal fees, while simultaneously shaping public perception and brand reputation.

Key strategies being employed include:

- Water Recycling and Reuse: Implementing closed-loop systems to treat and reuse water in non-critical processes, thereby decreasing overall demand.

- Solvent Recovery Technologies: Utilizing distillation and membrane filtration to reclaim and purify solvents, reducing the need for new solvent purchases and minimizing hazardous waste streams.

- Process Optimization: Redesigning manufacturing processes to use fewer hazardous materials and generate less waste at the source.

- Waste-to-Energy Initiatives: Exploring methods to convert certain types of pharmaceutical waste into energy, offering a dual benefit of waste reduction and energy generation.

Innoviva's respiratory product demand is bolstered by widespread air quality issues. The WHO reported in 2022 that 99% of the global population breathes air exceeding safe pollutant limits, directly increasing the need for respiratory treatments.

Climate change exacerbates respiratory conditions, with extreme weather and allergens worsening diseases like asthma. The WHO also noted in 2022 that air pollution contributed to 7 million premature deaths globally, highlighting the sustained demand for Innoviva's therapies.

The pharmaceutical industry, including Innoviva, faces mounting pressure for sustainable practices, particularly in managing its supply chain's significant environmental footprint. By 2024, the sector is anticipated to increase investments in energy-efficient operations to reduce its carbon impact.

Innoviva's manufacturing processes are water-intensive and generate chemical waste, with the pharmaceutical sector consuming approximately 50 billion cubic meters of water globally in 2023. Companies are implementing water recycling and solvent recovery to mitigate these environmental and operational challenges.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Innoviva draws from a diverse range of data sources, including reports from leading market research firms, government regulatory bodies, and international economic organizations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the respiratory care industry.