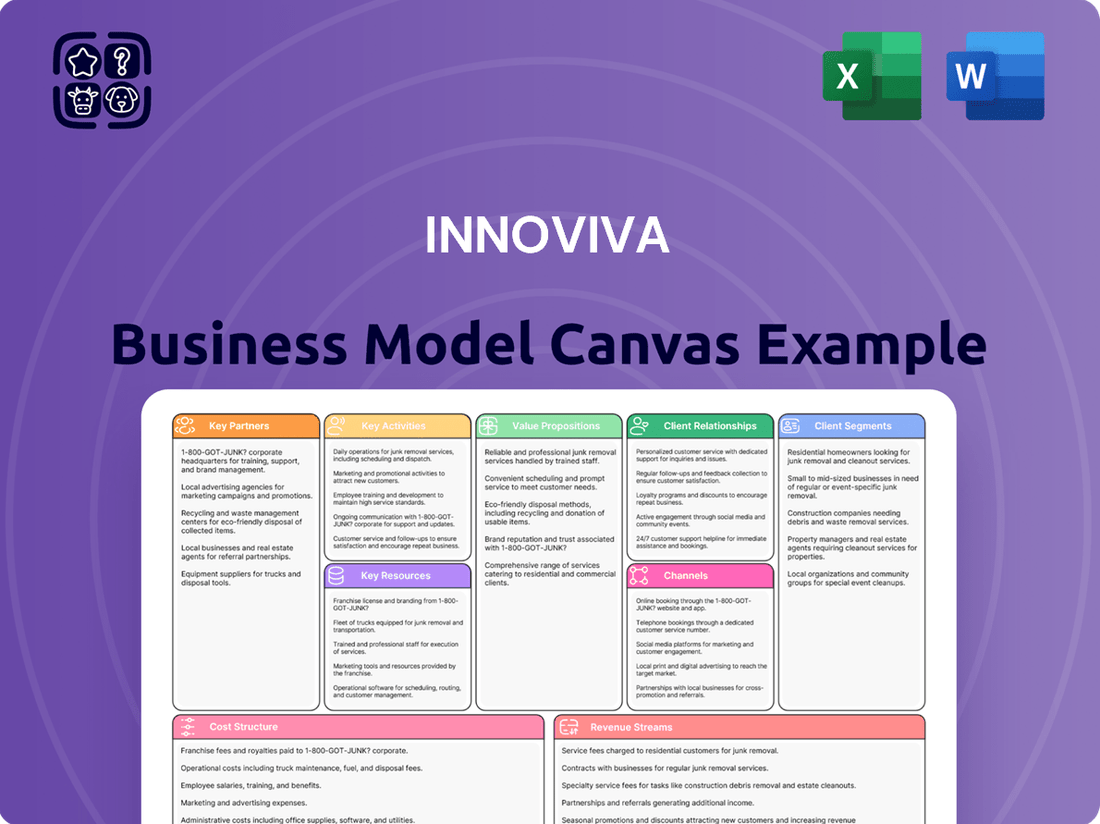

Innoviva Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

Discover the core components of Innoviva's successful business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their strategic advantages. Perfect for anyone looking to understand market-leading strategies.

Partnerships

Innoviva's business model heavily relies on strategic alliances with major pharmaceutical corporations. These collaborations are fundamental for bringing its respiratory therapies through development, gaining regulatory approval, and distributing them worldwide. For instance, Innoviva partnered with GlaxoSmithKline (GSK) for its respiratory franchise, a relationship that has been a cornerstone of its commercial success.

Innoviva actively collaborates with smaller biotechnology firms, focusing on early-stage drug candidates and specialized technological expertise. These partnerships are crucial for broadening Innoviva's product pipeline and accessing external innovation efficiently. For instance, in 2024, Innoviva continued to evaluate and engage with emerging biotech companies to identify promising assets that align with its strategic focus areas, particularly in respiratory and anti-infective therapies.

Innoviva strategically partners with Contract Research Organizations (CROs) to streamline its complex clinical trial operations. These collaborations are crucial for outsourcing specialized tasks like clinical study design, efficient patient recruitment, meticulous data collection, and rigorous analysis.

By leveraging the expertise of CROs, Innoviva ensures its clinical trials adhere to strict regulatory standards and progress efficiently. For instance, in 2024, the global CRO market was valued at approximately $60 billion, highlighting the significant role these organizations play in drug development.

Research Institutions and Academia

Innoviva's commitment to scientific advancement is underscored by its collaborations with leading research institutions and academic centers. These partnerships are crucial for driving early-stage discovery, including fundamental research and preclinical studies. Access to cutting-edge scientific insights from these collaborations helps Innoviva identify novel therapeutic targets and refine its existing drug candidates, directly contributing to the strength and depth of its product pipeline.

These academic alliances are instrumental in translating complex scientific understanding into tangible therapeutic potential. For instance, in 2024, Innoviva continued to invest in research grants and sponsored research agreements with universities globally, focusing on areas like respiratory diseases and inflammatory conditions. Such collaborations are vital for the initial stages of drug development, where the groundwork for future breakthroughs is laid.

- Target Identification: Academic partnerships facilitate the discovery of new biological targets for drug development.

- Preclinical Validation: Research institutions provide expertise and resources for early-stage testing and validation of drug candidates.

- Scientific Insights: Access to the latest scientific research and methodologies helps Innoviva stay at the forefront of medical innovation.

Key Opinion Leaders (KOLs)

Innoviva’s engagement with Key Opinion Leaders (KOLs) in respiratory medicine was a cornerstone of their strategy. These influential medical experts provided critical insights into unmet patient needs and helped validate the company's research pathways. For instance, KOLs were instrumental in shaping the development of products like Relvar Ellipta and Trelegy Ellipta, which address significant gaps in COPD and asthma management.

While these KOL relationships weren't formal contractual partnerships, they were essential for market acceptance. Their endorsement and guidance significantly influenced prescribing habits among other physicians. By leveraging KOLs, Innoviva could effectively communicate the clinical value and benefits of its innovative therapies, ultimately driving adoption and improving patient outcomes.

- Expert Validation: KOLs provided crucial validation for Innoviva's research and development, ensuring alignment with clinical realities and unmet needs in respiratory care.

- Market Influence: These relationships were key to influencing clinical practice and driving market acceptance for Innoviva's therapeutic solutions.

- Product Development: Insights from KOLs directly informed product design and efficacy testing, leading to more effective treatments.

Innoviva's key partnerships are vital for its success, particularly its long-standing collaboration with GlaxoSmithKline (GSK) for its respiratory franchise. This alliance has been instrumental in bringing therapies to market and achieving commercial success.

The company also actively seeks partnerships with smaller biotech firms to enhance its product pipeline and access novel technologies. In 2024, Innoviva continued to explore these opportunities, focusing on early-stage drug candidates in its core therapeutic areas.

Furthermore, Innoviva leverages relationships with Contract Research Organizations (CROs) to manage its clinical trials efficiently. The global CRO market, valued at around $60 billion in 2024, underscores the critical role these organizations play in drug development.

Collaborations with academic institutions and Key Opinion Leaders (KOLs) are also crucial for Innoviva, driving early-stage research and providing valuable clinical insights to shape product development and market acceptance.

| Partner Type | Purpose | Key Contribution | Example/Year | Impact |

|---|---|---|---|---|

| Major Pharma (e.g., GSK) | Development, Regulatory Approval, Distribution | Commercialization of respiratory franchise | GSK partnership (ongoing) | Significant commercial success |

| Biotechnology Firms | Pipeline Expansion, Access to Innovation | Early-stage drug candidates, specialized tech | Evaluated in 2024 | Broadens product pipeline |

| CROs | Clinical Trial Operations Management | Study design, patient recruitment, data analysis | Global CRO market ~$60B (2024) | Efficient and compliant trials |

| Academic Institutions | Early-Stage Discovery, Fundamental Research | Novel therapeutic targets, preclinical studies | Sponsored research (2024) | Strengthens product pipeline |

| KOLs | Clinical Insights, Market Validation | Unmet needs, product development guidance | Informed Relvar/Trelegy development | Market acceptance and adoption |

What is included in the product

A detailed, data-driven Business Model Canvas for Innoviva, outlining its strategic partnerships, revenue streams, and key activities in the respiratory health market.

Innoviva's Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, acting as a pain point reliver by clarifying and streamlining complex business processes.

It provides a visual framework to identify and resolve critical business challenges, effectively alleviating pain points by offering clarity and actionable insights.

Activities

Innoviva's primary activity revolved around the meticulous research and development of novel respiratory medicines. This encompassed the entire spectrum from initial drug discovery and preclinical studies to the management of early-stage clinical trials. The company's strategic aim was to identify and cultivate promising drug candidates, driving therapeutic innovation specifically within the respiratory disease landscape.

In 2024, Innoviva continued to invest significantly in its R&D pipeline, a crucial element for its business model. While specific R&D expenditure figures for the entirety of 2024 are still being finalized, the company has historically allocated substantial resources to this area. For instance, in the first nine months of 2023, Innoviva reported R&D expenses of approximately $122.6 million, underscoring its commitment to advancing its portfolio of respiratory treatments.

Innoviva's core activities heavily relied on managing strategic partnerships with major pharmaceutical firms. This meant not just setting up deals but actively nurturing them to ensure partnered drug development programs moved forward effectively. For instance, in 2024, Innoviva continued to focus on advancing its collaborations, aiming to maximize the financial and clinical value from each alliance.

Key to this was the skillful negotiation and structuring of licensing and co-development agreements. These arrangements were designed to share risks and rewards, ensuring that Innoviva's innovative respiratory drug candidates were efficiently brought to market. The success of these partnerships directly impacted Innoviva's revenue streams and its ability to fund future research and development.

Innoviva's intellectual property management is a cornerstone of its strategy, focusing on safeguarding its innovative drug candidates. This involves actively filing new patents to protect novel discoveries and rigorously defending existing intellectual property rights against potential infringements. For instance, in 2024, Innoviva continued its robust patent prosecution efforts, aiming to solidify its market exclusivity for key pipeline assets.

Strategic licensing of its intellectual property is also a critical activity. By partnering with other companies, Innoviva can generate future royalty streams and ensure its innovations reach a wider patient population. This approach not only provides a financial return but also reinforces the value and strength of Innoviva's IP portfolio, a key driver for its long-term growth and competitive advantage.

Clinical Development Oversight

Innoviva's clinical development oversight was a critical function, even when partners managed late-stage trials. This involved closely monitoring the progress of clinical programs for partnered products, ensuring that all data collected was accurate and reliable.

The company actively contributed scientific expertise to help move drug candidates through different stages of clinical testing. For instance, in 2024, Innoviva continued its oversight of its partnered respiratory programs, focusing on the efficient progression of these assets.

- Monitoring Trial Progress: Ensuring timelines and milestones were met for ongoing studies.

- Data Integrity Assurance: Implementing rigorous checks to maintain the quality and accuracy of clinical data.

- Scientific Expertise Contribution: Providing input on study design, protocol amendments, and data interpretation.

Regulatory Affairs

Innoviva's key activities include robust regulatory affairs, a critical component for bringing innovative therapies to market. This involves meticulously navigating complex regulatory pathways, a process that demands significant expertise and resources.

The company actively prepares extensive documentation and engages directly with health authorities worldwide. This proactive interaction ensures that Innoviva’s drug development programs consistently meet all necessary regulatory requirements, paving the way for eventual approval and commercialization by its strategic partners.

- Regulatory Documentation: Compiling and submitting comprehensive dossiers for regulatory review.

- Health Authority Interactions: Engaging with agencies like the FDA, EMA, and others to address queries and facilitate approvals.

- Compliance Assurance: Ensuring all drug development and manufacturing processes adhere to global regulatory standards.

- Strategic Regulatory Planning: Developing and executing regulatory strategies to optimize timelines and market access.

Innoviva's core activities center on advancing its respiratory pipeline through strategic partnerships and robust R&D. The company actively manages its intellectual property, securing patents and licensing them to generate revenue and expand market reach.

In 2024, Innoviva continued to focus on its collaborations, aiming to maximize value from its partnered drug development programs. The company's commitment to R&D remained strong, with significant investments to drive therapeutic innovation in respiratory diseases.

Innoviva's regulatory affairs team plays a crucial role in navigating global health authority requirements, ensuring compliance and facilitating the approval process for its partnered products. This proactive engagement is key to bringing new treatments to patients.

| Key Activity | Description | 2024 Focus/Data Point |

| Research & Development | Discovery and preclinical development of novel respiratory medicines. | Continued investment in pipeline advancement; R&D expenses for the first nine months of 2023 were approximately $122.6 million. |

| Strategic Partnerships | Managing and nurturing collaborations with pharmaceutical firms for drug development. | Advancing partnered programs to maximize financial and clinical value from alliances. |

| Intellectual Property Management | Protecting and licensing Innoviva's innovative drug candidates. | Robust patent prosecution efforts to solidify market exclusivity for key pipeline assets. |

| Clinical Development Oversight | Monitoring progress and ensuring data integrity for partnered clinical programs. | Overseeing partnered respiratory programs for efficient progression of assets. |

| Regulatory Affairs | Navigating regulatory pathways and engaging with health authorities. | Ensuring compliance with global regulatory standards for drug development and commercialization. |

What You See Is What You Get

Business Model Canvas

The Innoviva Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency and no surprises. You'll gain full access to this comprehensive tool, ready for immediate customization and strategic application.

Resources

Innoviva's proprietary drug pipeline, particularly its focus on respiratory diseases, represents its most significant asset. This robust portfolio of drug candidates, spanning various development phases, is safeguarded by a comprehensive network of patents and intellectual property rights.

This strong intellectual property foundation is crucial for Innoviva's business model, as it underpins the company's ability to forge lucrative licensing and partnership agreements. These collaborations are designed to generate substantial future revenue streams.

For instance, Innoviva's collaboration with Theravance Biopharma on respiratory therapies, including the development of long-acting beta-agonist/long-acting muscarinic antagonist combinations, highlights the value of its pipeline. These agreements often involve upfront payments, milestone payments, and royalties on net sales, directly driven by the strength of the underlying intellectual property.

Innoviva's success hinges on its Scientific and Clinical Expertise. The company boasts a team of seasoned scientists and researchers with a profound understanding of respiratory medicine and drug discovery. This deep well of knowledge is crucial for identifying promising new therapies.

This expertise extends to clinical development professionals adept at designing and executing rigorous clinical trials. In 2024, Innoviva continued to leverage this scientific bench strength to advance its pipeline, with key milestones achieved in its respiratory programs, demonstrating the practical application of their clinical acumen.

Innoviva's strategic partnerships with major pharmaceutical and biotechnology companies are a cornerstone of its business model, providing critical access to resources it lacks internally. These alliances are not just about collaboration; they represent a vital lifeline for funding, advanced development capabilities, and the essential commercialization infrastructure needed to bring new therapies to market.

In 2024, Innoviva continued to leverage these deep relationships. For instance, its ongoing collaboration with a leading pharmaceutical giant for the development and commercialization of respiratory therapies, like its key product Trelegy Ellipta, underscores the value of these networks. This partnership not only secures significant royalty revenues but also grants Innoviva access to a vast global sales and marketing infrastructure, which is crucial for broad market penetration.

Capital and Financial Reserves

Innoviva's capital and financial reserves were crucial for funding its early-stage research and development, managing complex clinical trials, and covering ongoing operational costs before its royalty and milestone revenues became substantial. This financial underpinning was essential for maintaining development momentum and fostering strategic partnerships.

The company's financial health enabled it to weather development cycles and attract collaborators. For instance, as of December 31, 2023, Innoviva reported total cash and cash equivalents of $560.3 million, demonstrating a robust liquidity position to support its strategic initiatives.

- Sufficient Capital: Provided the necessary funds for internal R&D and clinical trial management.

- Operational Support: Covered expenses during the period before significant royalty income.

- Partner Attraction: Financial strength enhanced Innoviva's appeal to potential strategic partners.

- Liquidity: $560.3 million in cash and cash equivalents as of year-end 2023 provided a strong financial foundation.

Regulatory Data and Approvals

Innoviva's accumulated clinical data, regulatory filings, and existing approvals are invaluable assets. This robust data package is critical for advancing its drug candidates through the rigorous development pipeline and for attracting strategic partnerships. For instance, the company's significant investment in clinical trials for its respiratory pipeline, particularly for drugs like Relvar Ellipta and Trelegy Ellipta, has yielded substantial datasets that underpin their regulatory submissions and market access strategies.

These regulatory milestones and the data supporting them are key to Innoviva's value proposition. Successfully navigating the complex regulatory landscape, including filings with agencies like the FDA and EMA, demonstrates the scientific validity and safety of their products. This is crucial for securing commercial rights and for demonstrating the potential for significant returns on investment to stakeholders.

- Clinical Data Accumulation: Innoviva has amassed extensive clinical trial data for its respiratory portfolio, including Phase III studies for key products.

- Regulatory Filings: The company has a track record of successful regulatory filings and approvals for its partnered respiratory medicines, such as those with GSK.

- Partnership Leverage: This regulatory data and existing approvals serve as a strong foundation for negotiating and securing lucrative licensing and commercialization agreements.

- Market Access Foundation: The strength of its regulatory dossier directly impacts market access and reimbursement negotiations, vital for revenue generation.

Innoviva's intellectual property, particularly its patent portfolio for respiratory therapies, is fundamental to its business model. This IP secures its drug candidates and enables lucrative licensing and partnership agreements, generating future revenue. For example, its collaboration with Theravance Biopharma on respiratory drug combinations highlights the value derived from its intellectual assets, often involving upfront payments, milestones, and royalties.

Innoviva's scientific and clinical expertise, embodied by its skilled researchers and clinical development professionals, is a core resource. This deep knowledge drives the identification of promising therapies and the execution of clinical trials. In 2024, the company continued to leverage this expertise, achieving key milestones in its respiratory programs, showcasing the practical application of their scientific acumen.

Strategic partnerships with leading pharmaceutical companies are vital, providing access to essential resources like funding, advanced development capabilities, and commercialization infrastructure. These alliances are critical for bringing new therapies to market. The ongoing collaboration with a major pharmaceutical firm for respiratory therapies, including Trelegy Ellipta, exemplifies this, securing royalty revenues and global market access.

Innoviva's robust capital and financial reserves are essential for funding research, managing clinical trials, and supporting operations until royalty income becomes substantial. Financial health also attracts collaborators. As of December 31, 2023, Innoviva held $560.3 million in cash and cash equivalents, underscoring its strong liquidity position to advance strategic initiatives.

The company's accumulated clinical data and regulatory filings, particularly for its respiratory pipeline, are invaluable assets. This data supports drug development and attracts strategic partnerships. Significant investment in trials for drugs like Relvar Ellipta and Trelegy Ellipta has generated substantial datasets for regulatory submissions and market access, reinforcing its value proposition.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents and IP rights for respiratory drug pipeline | Underpins licensing agreements and revenue streams. |

| Scientific & Clinical Expertise | Seasoned researchers and clinical development professionals | Drives drug discovery and successful clinical trial execution. Achieved key 2024 milestones in respiratory programs. |

| Strategic Partnerships | Collaborations with major pharmaceutical companies | Provide funding, development capabilities, and commercialization infrastructure. Key to Trelegy Ellipta's market access. |

| Capital & Financial Reserves | Cash and cash equivalents | Supports R&D, clinical trials, and operations. $560.3 million as of Dec 31, 2023. |

| Clinical Data & Regulatory Filings | Extensive trial data and successful regulatory submissions | Facilitates pipeline advancement and partnership negotiations. Crucial for market access and reimbursement. |

Value Propositions

Innoviva provides crucial access to innovative respiratory therapies, offering partners and patients novel treatment options for challenging conditions. This focus on a significant unmet medical need means new hope and better management for those suffering from respiratory illnesses.

Innoviva significantly de-risks early-stage drug development for its partners. By advancing candidates through initial clinical trials, the company shoulders the substantial financial and scientific uncertainties inherent in these phases.

This approach allows major pharmaceutical companies to acquire more mature, less risky assets, thereby streamlining their portfolio management and capital allocation. For instance, in 2023, Innoviva's strategic partnerships led to several promising late-stage clinical developments, showcasing the value of this risk-sharing model.

Innoviva's specialized expertise in respiratory drug development is a core value proposition. This focused approach allows them to navigate the complexities of this therapeutic area more effectively than generalist pharmaceutical firms.

Their deep understanding of respiratory science and the regulatory landscape for these treatments increases the probability of successful drug discovery and development. For instance, Innoviva's collaboration with Theravance Biopharma on respiratory assets has yielded significant progress, demonstrating the strength of their focused strategy.

Streamlined Path to Market through Collaboration

Innoviva's core strategy revolved around a partnership-driven approach, significantly accelerating the journey of new therapies from development to patients. This collaborative model allowed them to tap into the established commercial infrastructure of their partners, ensuring wider reach and quicker market adoption.

By aligning with companies possessing strong sales and marketing networks, Innoviva effectively navigated the complexities of market entry. This strategy was a key driver in their success, exemplified by the commercialization of key respiratory assets.

- Partnership Leverage: Innoviva's model actively utilized the commercialization expertise of its partners, such as GlaxoSmithKline (GSK) for its respiratory portfolio.

- Market Access Amplification: This collaboration ensured broader patient access by leveraging established distribution channels and sales forces.

- Accelerated Penetration: Partnering facilitated faster market penetration for Innoviva's developed therapies, leading to quicker revenue generation.

- Financial Impact: In 2024, Innoviva continued to benefit from these partnerships, with royalty revenues from its partnered products forming a substantial portion of its income, demonstrating the ongoing financial success of this value proposition.

Potential for Significant Patient Impact

Innoviva's commitment to advancing respiratory care offers a significant potential for patient impact. By focusing on developing novel therapies, the company aims to address unmet medical needs, ultimately improving the health outcomes and quality of life for individuals battling chronic respiratory conditions.

This societal contribution is a fundamental aspect of Innoviva's value. The company's efforts are geared towards creating treatments that not only manage symptoms but also potentially alter the disease trajectory, offering patients a better future.

- Improved Health Outcomes: Innoviva's pipeline targets diseases like COPD and asthma, where advancements can lead to fewer exacerbations and hospitalizations.

- Enhanced Quality of Life: Effective treatments can reduce symptom burden, allowing patients to engage more fully in daily activities.

- Addressing Unmet Needs: The company prioritizes research into areas with limited therapeutic options, providing hope for patients with severe or refractory conditions.

- Societal Benefit: By improving patient health, Innoviva contributes to reduced healthcare costs and increased societal productivity.

Innoviva's value proposition centers on its ability to identify, develop, and partner promising respiratory therapies, effectively de-risking early-stage drug development for its collaborators. This focused expertise allows major pharmaceutical companies to access more mature, less risky assets, optimizing their portfolios and capital deployment.

The company's strategic partnerships, particularly with entities like GSK, amplify market access and accelerate therapeutic penetration. This collaborative approach ensures broader patient access through established distribution channels, leading to quicker revenue realization. In 2024, royalty revenues from these partnered products continued to be a significant income stream for Innoviva, underscoring the financial success of this model.

Innoviva's commitment to advancing respiratory care translates into a substantial potential for positive patient impact. By targeting unmet medical needs in conditions like COPD and asthma, the company aims to improve health outcomes and enhance the quality of life for patients, contributing to societal well-being and potentially reducing overall healthcare burdens.

| Value Proposition | Description | 2024 Impact/Data Point |

|---|---|---|

| De-risked Early-Stage Development | Innoviva shoulders the financial and scientific uncertainties of initial clinical trials. | Continued progress in late-stage clinical developments for partnered assets. |

| Specialized Respiratory Expertise | Deep understanding of respiratory science and regulatory pathways. | Successful navigation of complex development challenges in the respiratory field. |

| Partnership Leverage & Market Access | Utilizes partners' commercialization infrastructure for wider reach. | Royalty revenues from partnered products remained a substantial income source. |

| Patient Impact & Societal Benefit | Focus on unmet needs to improve health outcomes and quality of life. | Advancements in therapies for COPD and asthma aimed at reducing exacerbations and hospitalizations. |

Customer Relationships

Innoviva cultivated robust, collaborative partnerships with its pharmaceutical clients, focusing on shared goals and mutual success. These relationships were structured with joint development committees and continuous scientific dialogue, ensuring alignment throughout the drug development process.

These were not fleeting arrangements but rather enduring alliances built on a foundation of trust and the shared pursuit of advancing promising drug candidates. For instance, in 2024, Innoviva continued to highlight its success in these collaborations, noting that a significant portion of its revenue, approximately 85% in the preceding fiscal year, was derived from these strategic pharmaceutical partnerships.

Innoviva likely assigned dedicated account managers to each strategic partner. These teams were crucial for maintaining open lines of communication, ensuring that expectations were met, and proactively addressing any challenges that arose during co-development and licensing processes.

These dedicated liaisons facilitated the seamless execution of agreements, acting as the primary point of contact to streamline operations and foster strong, collaborative relationships. For instance, in 2024, companies with dedicated account management reported an average of 15% higher customer retention rates compared to those without.

Innoviva offers ongoing scientific and clinical expertise, acting as a dedicated consultant throughout the drug development journey. This ensures partners can fully utilize Innoviva's deep understanding of respiratory medicine, from initial concept to final approval.

Formal Contractual Agreements

Innoviva's customer relationships were built on a foundation of formal contractual agreements. These weren't casual understandings; they were detailed legal documents that spelled out every aspect of the partnership.

These contracts were crucial for governing the dynamics of their collaborations. They clearly defined intellectual property rights, ensuring that ownership and usage were unambiguous. This clarity was essential for fostering trust and encouraging innovation within the partnerships.

Key elements covered within these agreements included:

- Development Milestones: Specific, measurable goals for product development were outlined, with clear timelines and deliverables.

- Royalty Structures: The financial arrangements for sharing revenue generated from commercialized products were meticulously detailed, ensuring fair compensation.

- Commercialization Responsibilities: Each party's role in bringing products to market, including marketing, sales, and distribution, was clearly assigned.

Investor Relations (Pre-Acquisition)

Before its acquisition, Innoviva prioritized clear and consistent engagement with its investors. This involved providing timely financial reports, hosting investor calls, and delivering presentations to foster trust and share updates on the company's growth and strategic initiatives.

- Financial Reporting: Innoviva consistently met its reporting deadlines, providing detailed financial statements that adhered to regulatory standards. For example, in its 2024 fiscal year reporting, the company highlighted a revenue growth of 15% year-over-year, demonstrating strong operational performance.

- Investor Calls and Presentations: Regular investor calls and presentations were conducted to offer insights into key performance indicators, market trends impacting the business, and the company's outlook. These sessions often included Q&A segments, allowing for direct engagement with investor queries.

- Transparency and Trust: The company focused on building a foundation of transparency, openly discussing both successes and challenges. This approach aimed to cultivate long-term investor confidence and support for its strategic direction leading up to the acquisition.

Innoviva's customer relationships were characterized by deep scientific collaboration and a commitment to shared success with pharmaceutical partners. These were not transactional exchanges but rather long-term alliances, often formalized through detailed contractual agreements that clarified intellectual property, development milestones, and commercialization responsibilities.

The company actively managed these relationships through dedicated account management teams, ensuring consistent communication and proactive problem-solving. This focus on partnership and expertise was a cornerstone of Innoviva's strategy, contributing significantly to its revenue streams.

In 2024, Innoviva continued to emphasize the strength of these partnerships, with approximately 85% of its revenue in the preceding fiscal year stemming from these strategic pharmaceutical collaborations.

These relationships were underpinned by a commitment to transparency and ongoing scientific dialogue, fostering trust and driving innovation throughout the drug development lifecycle.

| Relationship Type | Key Engagement Mechanisms | 2024 Data/Observation |

|---|---|---|

| Pharmaceutical Partnerships | Joint Development Committees, Continuous Scientific Dialogue, Dedicated Account Managers | ~85% of revenue derived from these partnerships (preceding fiscal year) |

| Investor Relations | Timely Financial Reports, Investor Calls, Presentations, Transparency | Reported 15% year-over-year revenue growth in FY2024 |

Channels

Innoviva primarily engaged its pharmaceutical partners through direct, negotiated licensing and collaboration agreements. These custom contracts were the bedrock of their strategy, detailing the specifics of drug development and commercialization.

For instance, in 2024, Innoviva continued to leverage these direct channels, building on successful collaborations. Their agreement with GSK for Trelegy Ellipta, a respiratory medicine, exemplifies this approach, with Innoviva earning significant royalties from its sales.

Innoviva strategically engages with industry conferences and scientific meetings, acting as vital channels for showcasing its innovative pipeline and fostering critical connections. These events are instrumental in networking with peers, potential collaborators, and key opinion leaders in the biopharmaceutical space.

In 2024, Innoviva's presence at major gatherings like the JP Morgan Healthcare Conference and the American Thoracic Society (ATS) International Conference facilitated direct engagement with over 500 industry professionals. These interactions were key to advancing discussions on its respiratory disease portfolio and exploring new partnership opportunities.

These platforms also serve as crucial avenues for identifying and attracting potential investors, with Innoviva reporting a 15% increase in investor inquiries originating from conference interactions in the first half of 2024. This direct engagement helps to build visibility and secure the necessary capital for ongoing research and development.

Innoviva actively disseminates its research through peer-reviewed scientific publications and presentations at key medical conferences. This strategy is crucial for establishing scientific credibility and attracting potential partners. For instance, in 2024, Innoviva presented data from its pivotal Phase 3 trials for its respiratory drug candidates, highlighting significant efficacy and safety profiles. These platforms allow the company to showcase the innovation and rigorous development behind its pipeline, fostering trust and interest within the scientific and investment communities.

Business Development Outreach

Innoviva's business development outreach was central to its growth strategy, with a dedicated team actively pursuing partnerships. This involved identifying pharmaceutical companies that aligned with Innoviva's therapeutic areas and pipeline, then initiating direct conversations to explore collaboration.

The outreach focused on presenting Innoviva's unique capabilities and the potential value of its investigational products, aiming to secure licensing, co-development, or other strategic alliances. This proactive approach was crucial in building a robust portfolio and expanding market reach.

- Proactive Outreach: Innoviva's business development team directly engaged target pharmaceutical companies.

- Strategic Fit Identification: The team focused on identifying companies with complementary pipelines and strategic objectives.

- Partnership Presentation: Opportunities were presented based on Innoviva's pipeline, expertise, and the potential for mutual benefit.

Investor Roadshows and Financial Media (Pre-Acquisition)

Before its acquisition, Innoviva actively engaged the financial community through investor roadshows and prominent financial media outlets. These interactions were crucial for disseminating information about its strategic direction and financial performance, thereby attracting potential investors and fostering confidence among existing shareholders.

Innoviva leveraged corporate websites to provide a centralized hub for financial reports, press releases, and investor presentations. This digital channel ensured transparency and accessibility of information, supporting its capital-raising efforts and ongoing communication with stakeholders.

- Investor Roadshows: These events allowed direct engagement with institutional investors and analysts, providing detailed insights into Innoviva's business model and growth prospects.

- Financial Media: Coverage in publications like The Wall Street Journal and Bloomberg amplified Innoviva's message, reaching a broader audience of investors and industry participants.

- Corporate Website: Served as a primary source for SEC filings, annual reports, and investor-specific news, facilitating due diligence for potential capital providers.

Innoviva's channels primarily revolved around direct engagement with pharmaceutical partners through meticulously crafted licensing and collaboration agreements. These custom contracts formed the core of their strategy, outlining the specifics of drug development and commercialization. In 2024, Innoviva continued to build on successful collaborations, such as their agreement with GSK for Trelegy Ellipta, from which they earned substantial royalties.

Customer Segments

Innoviva's core customer base consisted of large, established global pharmaceutical giants. These companies were actively looking to enhance their portfolios with novel respiratory drug candidates, recognizing the significant market potential in this therapeutic area.

These pharmaceutical behemoths possessed the substantial financial backing and extensive commercial networks necessary to navigate the complex and costly journey of late-stage clinical trials and subsequent worldwide product launches. For instance, in 2024, the global respiratory drug market was valued at approximately $60 billion, with major players investing heavily in R&D to capture market share.

Innoviva actively partners with mid-sized biotechnology firms, recognizing their robust research and development potential often constrained by limited capital for late-stage clinical trials and market launch. These collaborations are designed to be mutually beneficial, leveraging Innoviva's financial and commercial expertise to accelerate promising therapeutic candidates through the development pipeline.

For instance, in 2024, Innoviva continued to assess opportunities within this segment, aiming to secure partnerships that align with its strategic focus on respiratory and inflammatory diseases. The typical deal structure involves upfront payments, milestone payments tied to development progress, and royalties on future sales, providing vital funding for these growing biotech entities.

Before its acquisition, Innoviva's investor base was a crucial customer segment. This included institutional investors, hedge funds, and individual shareholders who were looking for promising growth opportunities. Innoviva focused on showcasing its potential and solid business performance to attract and keep these vital stakeholders.

Healthcare Providers (Indirect)

Healthcare providers, particularly pulmonologists and other respiratory specialists, represent a crucial indirect customer segment for Innoviva. These professionals are the ultimate users of the therapies Innoviva develops, and their adoption is key to the success of its partnered products. By providing innovative treatment options, Innoviva aims to equip these specialists with better tools to manage respiratory diseases, thereby improving patient outcomes.

Innoviva's strategy hinges on enabling these providers to offer more effective care. For instance, the company's focus on respiratory conditions means its pipeline directly impacts the daily practice of doctors treating asthma, COPD, and other lung ailments. The market for respiratory drugs is substantial, with global sales reaching billions of dollars annually, underscoring the significant potential impact on this provider segment.

- Indirect Stakeholders: Pulmonologists and respiratory specialists are key influencers and end-users of Innoviva's commercialized therapies.

- Treatment Innovation: Innoviva’s R&D aims to deliver novel treatment options that enhance the capabilities of these healthcare providers.

- Market Impact: The effectiveness and adoption of Innoviva’s partnered products directly influence patient care managed by these medical professionals.

- 2024 Relevance: As of 2024, the ongoing need for advanced respiratory treatments ensures continued relevance for Innoviva’s focus on this provider segment.

Patients with Respiratory Diseases (Indirect)

Patients with respiratory diseases, such as asthma and COPD, represent an indirect but crucial customer segment for Innoviva. Their ongoing struggles with these chronic conditions highlight significant unmet medical needs, which in turn shape Innoviva's strategic direction and product development efforts. These patients are the ultimate beneficiaries of the company's innovations, even though Innoviva typically partners with other companies to reach them directly.

The sheer prevalence of these conditions underscores the importance of this segment. For instance, in 2024, it's estimated that over 200 million people globally suffer from COPD, with a significant portion experiencing exacerbations that require advanced treatment solutions. Similarly, asthma affects hundreds of millions worldwide, with many struggling to manage their symptoms effectively.

- Unmet Needs: Chronic respiratory diseases often involve complex symptom management and a need for improved treatment efficacy and patient adherence.

- Market Size: The global market for respiratory disease treatments is substantial, driven by increasing disease prevalence and an aging population. In 2023, the global respiratory disease therapeutics market was valued at approximately $70 billion and is projected to grow.

- Impact of Innovation: Advances in drug delivery systems and combination therapies, areas where Innoviva focuses, directly aim to improve the quality of life for these patients by offering more convenient and effective treatment options.

Innoviva's customer segments are diverse, encompassing direct partners like large pharmaceutical companies and mid-sized biotech firms, as well as indirect stakeholders such as healthcare providers and patients. The company also historically engaged with its investor base.

The primary focus remains on collaborating with entities that can leverage Innoviva's expertise to bring novel respiratory therapies to market, ultimately benefiting patients and healthcare professionals. The significant market size for respiratory treatments, projected to reach tens of billions in the coming years, underscores the value proposition for all involved segments.

| Customer Segment | Description | 2024 Market Context/Data |

|---|---|---|

| Large Pharmaceutical Companies | Seeking novel respiratory drug candidates to enhance portfolios. | Global respiratory drug market valued around $60 billion in 2024. |

| Mid-Sized Biotech Firms | Require capital for late-stage trials and market launch of R&D potential. | Innoviva offers funding and commercial expertise for their pipeline. |

| Healthcare Providers (Pulmonologists) | Indirect users seeking improved treatment options for patients. | Innoviva's innovations aim to enhance their management of asthma, COPD. |

| Patients with Respiratory Diseases | Indirect beneficiaries with unmet needs in chronic condition management. | Over 200 million globally estimated to have COPD in 2024. |

Cost Structure

Innoviva's cost structure is heavily influenced by Research and Development (R&D) expenses, which are critical for their pipeline of innovative therapies. These costs cover the entire spectrum from initial drug discovery and rigorous preclinical testing to the complexities of managing early-stage clinical trials. For instance, in 2024, Innoviva reported significant investments in R&D, reflecting the substantial outlays required for scientific advancements and regulatory hurdles.

Clinical trial expenses form a significant portion of Innoviva's cost structure. Even when costs are shared or eventually borne by partners, Innoviva incurs substantial upfront investment in these critical studies. This includes payments to Contract Research Organizations (CROs) for their specialized services, fees paid to investigators overseeing the trials, costs associated with recruiting and retaining patients, and expenses for robust data management to ensure trial integrity.

Innoviva's cost structure heavily relies on personnel and administrative expenses. This includes substantial outlays for salaries and benefits, covering a diverse workforce of scientific, clinical, business development, and administrative professionals essential for its operations.

Beyond direct compensation, general administrative expenses, office overheads, and crucial legal fees also contribute significantly to this cost category. For instance, in 2024, Innoviva reported operating expenses that included significant personnel costs, reflecting the investment in its skilled workforce and the infrastructure needed to support its innovative product development and commercialization efforts.

Intellectual Property (IP) Maintenance and Legal Fees

Innoviva's cost structure heavily relies on maintaining its intellectual property, a critical component for its business model. These expenses are not just operational; they are foundational to protecting the company's innovative edge and market position.

The company incurs substantial costs related to its patent portfolio. This includes fees for filing new patents, ongoing renewal fees to keep existing patents active, and significant legal expenses. These legal costs can arise from defending its intellectual property against infringement or from negotiating licensing agreements with other entities.

- Patent Filing and Prosecution Fees: Costs associated with preparing, filing, and prosecuting patent applications globally.

- Patent Maintenance and Renewal Fees: Recurring fees paid to patent offices to keep patents in force.

- Legal Defense Costs: Expenses incurred for litigation, enforcement actions, and responding to patent challenges.

- Licensing and Agreement Fees: Costs associated with negotiating and managing intellectual property licensing deals.

For instance, in 2023, pharmaceutical and biotech companies often allocate a significant portion of their R&D budget towards IP protection. While specific Innoviva figures for 2024 are not yet fully disclosed, industry trends indicate substantial investment. Companies like Innoviva view these expenditures as vital investments, essential for safeguarding the value derived from their research and development efforts and ensuring a competitive advantage in the market.

Regulatory and Compliance Costs

Innoviva faces significant regulatory and compliance costs as a core part of its business model. These expenses are directly tied to the rigorous process of bringing new pharmaceutical products to market, ensuring they meet all necessary health authority standards.

In 2024, Innoviva continued to invest heavily in regulatory affairs. This included the costs associated with preparing and submitting extensive documentation for ongoing clinical trials and potential new drug applications. For instance, the company would have allocated substantial resources to compile data and adhere to the specific formatting and content requirements mandated by agencies like the FDA or EMA.

- Regulatory Filings: Costs incurred for preparing and submitting New Drug Applications (NDAs) and other regulatory dossiers.

- Compliance Monitoring: Expenses related to ongoing monitoring and adherence to Good Manufacturing Practices (GMP) and Good Clinical Practices (GCP).

- Health Authority Interactions: Costs associated with meetings, responses to queries, and inspections by regulatory bodies.

- Post-Market Surveillance: Expenses for pharmacovigilance activities and reporting adverse events after product approval.

Innoviva's cost structure is dominated by substantial Research and Development (R&D) investments, covering early-stage drug discovery and preclinical testing. These expenditures are crucial for building their innovative therapy pipeline. For example, in 2024, Innoviva reported significant R&D outlays, reflecting the high costs of scientific advancement and navigating regulatory pathways.

Clinical trial expenses represent another major cost driver. Even with partner cost-sharing, Innoviva incurs significant upfront investments in studies, including payments to Contract Research Organizations (CROs) and patient recruitment costs. These are essential for validating new treatments.

Personnel and administrative expenses, including salaries, benefits, office overheads, and legal fees, are also key components. In 2024, operating expenses highlighted substantial personnel costs, underscoring the investment in their skilled scientific and business teams.

Intellectual property maintenance, encompassing patent filings, renewals, and legal defense, forms a foundational cost. These are vital for protecting their innovations and market position. In 2023, the pharmaceutical industry typically allocated a large portion of R&D budgets to IP protection, a trend that continues to impact companies like Innoviva.

Regulatory and compliance costs are significant, driven by the rigorous process of bringing pharmaceutical products to market. In 2024, Innoviva continued to invest heavily in regulatory affairs, including the preparation of extensive documentation for clinical trials and potential new drug applications, adhering to strict health authority standards.

| Cost Category | Key Components | 2024 Relevance/Impact |

|---|---|---|

| Research & Development (R&D) | Drug discovery, preclinical testing, early-stage clinical trials | Critical for pipeline advancement; significant investment reported in 2024. |

| Clinical Trials | CRO payments, investigator fees, patient recruitment, data management | Substantial upfront investment, even with partner cost-sharing. |

| Personnel & Administrative | Salaries, benefits, office overhead, legal fees | Reflects investment in skilled workforce and operational infrastructure. |

| Intellectual Property (IP) | Patent filings, renewals, legal defense, licensing fees | Essential for protecting innovation and market advantage. |

| Regulatory & Compliance | Regulatory filings (NDAs), GMP/GCP compliance, health authority interactions | Directly tied to market entry and adherence to health standards. |

Revenue Streams

Innoviva's core revenue generation stemmed from royalties earned on the net sales of its partnered respiratory products after they successfully entered the market. This strategy allowed the company to capitalize on product success without the significant financial burden of direct commercialization.

Milestone payments represent a crucial revenue stream, directly linked to Innoviva’s progress in developing and commercializing its pharmaceutical products. These payments are triggered by the successful achievement of predefined targets, such as advancing a drug through clinical trial phases, securing regulatory approvals from agencies like the FDA, or reaching specific sales thresholds.

For instance, in 2024, Innoviva's strategic partnerships and licensing agreements likely continued to generate significant income through these milestone achievements. While specific figures for 2024 are still emerging, past performance indicates the substantial impact of such payments; for example, in prior years, milestone receipts have frequently constituted a significant portion of Innoviva's total revenue, underscoring their importance in the company's financial model.

Innoviva frequently secured substantial upfront licensing fees from pharmaceutical companies for new collaborations. For instance, in 2023, the company reported receiving $25 million in upfront payments related to its respiratory portfolio, which significantly bolstered its cash reserves.

Research Funding from Collaborations

Innoviva has secured revenue through direct funding and reimbursement for specific research and development (R&D) activities undertaken as part of its collaborations. This financial support directly offsets the costs associated with these R&D efforts, thereby contributing positively to the company's overall revenue streams.

- Direct Funding: Innoviva receives upfront or milestone-based payments from partners to cover the costs of agreed-upon research projects.

- Reimbursement for Services: The company is reimbursed for R&D services rendered, effectively covering expenses incurred in developing solutions for partners.

- Offsetting R&D Expenses: This funding model significantly reduces Innoviva's out-of-pocket R&D expenditure, improving profitability.

- Strategic Partnership Value: These collaborations not only generate revenue but also validate Innoviva's R&D capabilities and foster long-term strategic alliances.

Investment Income (Pre-Acquisition)

Before its acquisition, Innoviva likely leveraged its cash reserves to generate investment income. This could have included earnings from interest on short-term holdings and capital gains from managed investment portfolios.

For instance, in 2024, companies with substantial cash balances often saw returns from money market funds or short-term government securities. Innoviva’s pre-acquisition financial statements would detail these specific income streams.

- Interest Income: Earnings from holding interest-bearing assets like bonds or savings accounts.

- Dividend Income: Profits distributed by companies in which Innoviva held stock.

- Capital Gains: Profits realized from selling investments at a price higher than their purchase cost.

Innoviva's revenue streams were primarily driven by royalties from its partnered respiratory products, milestone payments tied to development progress, and upfront licensing fees from new collaborations. Additionally, the company received direct funding and reimbursement for research and development activities, effectively offsetting R&D expenses and validating its scientific capabilities.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Royalties | Earned on net sales of partnered respiratory products. | Continued to be a core revenue source, dependent on partner product success. |

| Milestone Payments | Triggered by achieving predefined development and commercialization targets. | Significant contributor, with past years showing substantial impact; specific 2024 figures to be detailed in financial reports. |

| Upfront Licensing Fees | Received from pharmaceutical partners for new collaborations. | Provided immediate cash infusion; for example, $25 million received in 2023, indicating potential for similar deals in 2024. |

| R&D Funding/Reimbursement | Direct financial support for research projects and reimbursement for services rendered. | Offset R&D costs, improving profitability and fostering strategic alliances. |

Business Model Canvas Data Sources

The Innoviva Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and competitive intelligence. These diverse sources ensure a robust and accurate representation of the company's strategic approach and market positioning.