IndusInd Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

Unlock the strategic advantages of IndusInd Bank by understanding the intricate web of Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Our comprehensive PESTLE analysis provides a critical roadmap to navigate these external forces effectively. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now to gain actionable intelligence and secure your competitive edge.

Political factors

The Reserve Bank of India (RBI) is the primary architect of India's banking sector, wielding significant influence through its monetary policies and regulatory directives. For instance, the RBI's decision to reduce the repo rate by 25 basis points in March 2025 and again by 15 basis points in May 2025 directly impacts lending costs and profitability for banks like IndusInd. Furthermore, amendments to the Liquidity Coverage Ratio (LCR) framework in April 2025, requiring banks to maintain a higher proportion of unencumbered liquid assets, necessitate strategic adjustments in asset-liability management.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) are significantly expanding financial access, particularly in rural India. As of early 2024, PMJDY has facilitated the opening of over 500 million bank accounts, a substantial portion of which are in previously unbanked regions.

These programs present a clear opportunity for IndusInd Bank to grow its customer base by offering specialized products and services to these newly included segments. The bank’s existing robust network and commitment to serving a wide array of customers position it well to capitalize on this expansion.

IndusInd Bank can leverage these government-backed financial inclusion drives to enhance its market penetration, tapping into the vast potential of underserved populations and solidifying its presence across diverse economic strata in India.

Political stability in India, a key factor for IndusInd Bank, underpins consistent policy frameworks vital for long-term financial planning and investor confidence. This stability has been a bedrock for the banking sector's growth.

Inconsistent government policies or political upheaval can disrupt investment flows and dampen credit demand, directly affecting the banking landscape. The Indian banking sector's inherent strength, fueled by robust domestic savings, benefits significantly from this predictable environment.

Anti-Money Laundering (AML) and KYC Norms

The Indian government and the Reserve Bank of India (RBI) are consistently enhancing Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This focus aims to curb financial crime and boost transparency within the banking sector. For instance, in 2023, the Financial Intelligence Unit-India (FIU-IND) flagged numerous suspicious transactions, underscoring the need for stringent AML measures.

Adherence to these evolving norms necessitates substantial investment by banks like IndusInd in sophisticated compliance systems and processes. These investments directly influence operational expenditures and the efficiency of customer onboarding. The cost of compliance for Indian banks in FY2023 averaged around 2-3% of their operating expenses, a figure expected to rise with stricter requirements.

Non-compliance with these critical regulations carries significant risks, including hefty financial penalties and severe reputational damage. In 2024, several smaller financial institutions faced penalties for AML/KYC lapses, highlighting the enforcement rigor.

- Stricter AML/KYC: Ongoing government and RBI efforts to combat financial crime.

- Investment in Compliance: Banks must allocate resources to robust systems and processes.

- Operational Impact: Affects operational costs and customer onboarding procedures.

- Risk of Non-Compliance: Potential for severe penalties and reputational damage.

Government Support for Digital India

The Indian government's unwavering commitment to digital transformation, exemplified by programs like Digital India, profoundly shapes the banking landscape. Initiatives such as the Unified Payments Interface (UPI) have dramatically accelerated the adoption of digital payments, fostering a less cash-dependent economy.

This strategic push necessitates that banks, including IndusInd Bank, continually enhance their digital capabilities and infrastructure to remain competitive and cater to evolving consumer preferences. IndusInd Bank's substantial digital transaction volume, reaching 96.7% of its total retail transaction mix in FY23, directly reflects its successful alignment with this national digital agenda.

- Digital India Initiative: Government's focus on digitizing services and promoting digital literacy.

- UPI Growth: Rapid expansion of UPI transactions, reaching over 12 billion in Q4 FY24.

- IndusInd Bank's Digital Adoption: High digital transaction mix underscores strategic alignment with national digital goals.

- Impact on Banking: Encourages investment in digital infrastructure and innovation within the sector.

Government policies significantly influence the banking sector, with the Reserve Bank of India (RBI) playing a crucial role through monetary policy adjustments. For instance, the RBI's repo rate changes in early 2025 directly affect lending costs for banks like IndusInd. Furthermore, initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) are expanding financial inclusion, with over 500 million accounts opened by early 2024, presenting growth opportunities for IndusInd Bank.

The government's focus on digital transformation, exemplified by the Digital India initiative and the rapid growth of UPI, necessitates continuous investment in digital capabilities by banks. UPI transactions surpassed 12 billion in Q4 FY24, highlighting the shift towards a less cash-dependent economy and the need for banks to adapt.

Stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, bolstered by bodies like the Financial Intelligence Unit-India, require banks to invest in compliance systems. Non-compliance risks significant penalties, as seen with several institutions facing fines in 2024 for lapses.

| Government Policy/Initiative | Impact on Banking Sector | Relevant Data/Example |

|---|---|---|

| RBI Monetary Policy (Repo Rate) | Influences lending costs and bank profitability. | Repo rate reduced by 25 bps in March 2025 and 15 bps in May 2025. |

| Pradhan Mantri Jan Dhan Yojana (PMJDY) | Expands financial inclusion and customer base. | Over 500 million accounts opened by early 2024. |

| Digital India & UPI | Drives digital adoption and requires investment in digital infrastructure. | UPI transactions exceeded 12 billion in Q4 FY24. |

| AML/KYC Regulations | Increases compliance costs and necessitates robust systems. | Financial Intelligence Unit-India (FIU-IND) flagged suspicious transactions in 2023. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IndusInd Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers strategic insights into how these forces create both challenges and advantages, enabling informed decision-making for stakeholders.

This IndusInd Bank PESTLE analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into external factors impacting the bank.

Economic factors

India's economic expansion is a critical driver for IndusInd Bank, directly impacting credit demand and the growth of deposits. Projections indicate a robust GDP growth of approximately 6.5% for the fiscal year 2025 and a slightly moderated 6.2% for FY26, signaling a generally positive economic trajectory.

This anticipated stable economic environment is crucial for the overall health and operational capacity of banks like IndusInd. A resilient Indian economy, even when facing global headwinds, offers a solid bedrock for sustained banking activities and profitability.

The Reserve Bank of India's (RBI) monetary policy, especially its stance on interest rates, significantly influences banks like IndusInd Bank. When the RBI cuts rates, it generally compresses net interest margins (NIMs) as lending rates fall. For instance, following a period of rate hikes, the RBI's decision to hold the repo rate steady at 6.50% in early 2024 continued to shape the operating environment.

While lower rates can pressure NIMs, they are also intended to boost overall credit demand. This dual effect means IndusInd Bank needs to be agile, managing its loan book and deposit base effectively to navigate these shifts. The bank's ability to attract deposits at competitive rates while deploying assets profitably is crucial in this environment.

IndusInd Bank, like other financial institutions, closely monitors credit and deposit growth. In the fiscal year ending March 2024, India's banking sector saw robust credit growth, averaging around 15-16%, with retail and MSME segments showing particular strength. This expansion is a positive sign for economic activity.

However, deposit growth has lagged behind credit expansion, with deposit rates hovering around 7-7.5% for the period. This disparity has led to an increase in Loan-to-Deposit Ratios (LDRs) across the industry, prompting the Reserve Bank of India (RBI) to consider tightening liquidity measures. For IndusInd Bank, this necessitates a strategic focus on attracting and retaining a stable base of granular deposits to manage its funding costs and liquidity effectively.

Inflationary Pressures and Liquidity Conditions

While inflation has shown signs of easing from its earlier highs, the Reserve Bank of India (RBI) remains vigilant, maintaining a cautious monetary stance. This ongoing caution directly influences liquidity within the Indian banking system, impacting the cost of funds for institutions like IndusInd Bank. For instance, the RBI's repo rate, a key indicator of monetary policy, remained at 6.50% through early 2025, reflecting this sustained caution.

However, system liquidity has seen notable improvement, particularly from December 2024 onwards. This enhanced liquidity environment is generally beneficial for banks, as it tends to lower their borrowing costs and can improve net interest margins. Data from the RBI indicated a shift from net absorption of liquidity by the central bank to periods of surplus liquidity in the banking system during this timeframe.

- Inflationary Trends: Consumer Price Index (CPI) inflation, while moderating, stayed above the RBI's target band for extended periods, necessitating continued monetary vigilance.

- Liquidity Improvement: A noticeable increase in banking system liquidity was observed from late 2024, reducing reliance on RBI's liquidity facilities.

- Funding Costs: Lower system liquidity costs directly translate to reduced funding expenses for banks, potentially boosting profitability.

- Operational Efficiency: Effective liquidity management is paramount for IndusInd Bank to ensure it can meet its short-term obligations and support its lending activities without disruption.

Non-Performing Assets (NPAs) and Asset Quality

The Indian banking sector has witnessed a remarkable improvement in asset quality, with Non-Performing Assets (NPAs) reaching historic lows. For instance, by March 2024, the gross NPA ratio for public sector banks stood at a commendable 4.1%, a significant drop from previous years. This overall improvement bolsters the financial health of banks, reducing their risk exposure and paving the way for enhanced profitability.

Despite the sector-wide positive trend, certain segments, such as microfinance, have experienced pockets of stress, necessitating continued caution in lending. Banks must remain vigilant, employing robust risk management frameworks to navigate these specific challenges effectively.

- Improved Sector-Wide Asset Quality: Gross NPAs for Indian banks have declined significantly, reaching multi-year lows by early 2024.

- Reduced Risk Burden: Lower NPAs translate to a healthier balance sheet for banks, diminishing the need for provisioning and boosting profitability.

- Segment-Specific Vigilance: While the overall picture is positive, areas like microfinance require ongoing monitoring due to localized stress.

- Profitability Enhancement: Better asset quality directly contributes to improved net interest margins and overall financial performance for banking institutions.

India's economic growth trajectory remains a primary economic factor for IndusInd Bank. Projections for FY25 estimate GDP growth around 6.5%, moderating slightly to 6.2% in FY26, indicating a generally supportive environment for banking operations and credit demand.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates, directly impacts IndusInd Bank's net interest margins (NIMs). The repo rate held steady at 6.50% through early 2025 reflects continued caution, influencing funding costs and lending rates.

System liquidity has improved significantly since late 2024, shifting from net absorption to surplus, which is beneficial for banks by potentially lowering borrowing costs.

Asset quality across the Indian banking sector has seen substantial improvement, with gross NPAs reaching multi-year lows by early 2024, benefiting banks like IndusInd by reducing provisioning needs and enhancing profitability.

| Economic Factor | 2024-2025 Data/Projection | Impact on IndusInd Bank |

|---|---|---|

| GDP Growth | FY25: ~6.5%, FY26: ~6.2% | Supports credit demand and deposit growth. |

| RBI Repo Rate | Held at 6.50% (early 2025) | Influences NIMs and funding costs. |

| System Liquidity | Improved, surplus from late 2024 | Potentially lowers borrowing costs. |

| Gross NPA Ratio (Industry) | Multi-year lows by early 2024 (e.g., Public Sector Banks at 4.1%) | Reduces provisioning, boosts profitability. |

Preview the Actual Deliverable

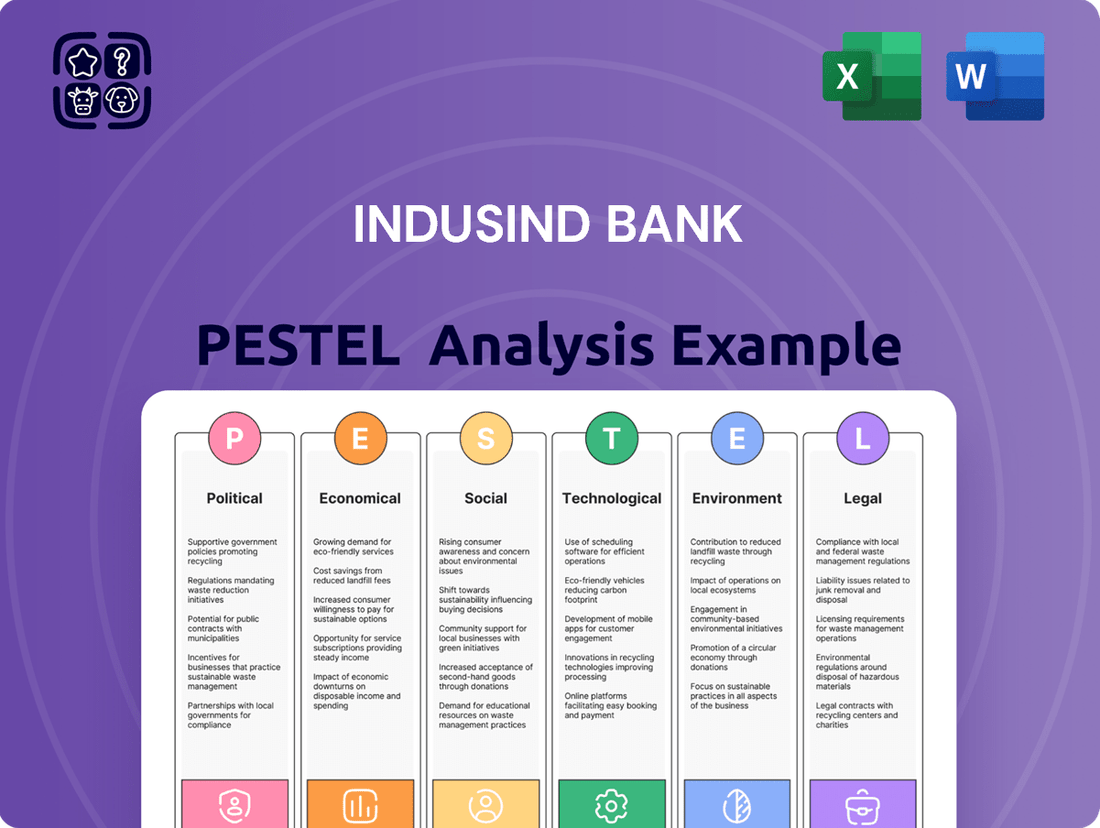

IndusInd Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing IndusInd Bank's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting IndusInd Bank.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the external forces shaping IndusInd Bank's strategic landscape.

Sociological factors

Indian consumers are increasingly turning to digital channels for their banking needs, prioritizing convenience and round-the-clock accessibility. This fundamental shift in behavior is compelling financial institutions to heavily invest in robust digital infrastructure, including user-friendly mobile apps and secure online platforms. For instance, by the end of fiscal year 2024, IndusInd Bank reported that over 95% of its retail transactions were conducted digitally, showcasing a strong response to these evolving customer expectations.

As financial inclusion efforts gain momentum, there's a significant and growing demand for enhanced financial literacy across India's diverse population, particularly in rural and underserved communities. This trend necessitates that financial institutions like IndusInd Bank develop user-friendly products and services that are easily comprehensible and accessible to a broad customer base.

To meet these evolving needs, banks are increasingly focusing on accessibility through vernacular language interfaces and voice-based banking solutions, catering to a wider segment of the population. For instance, by Q3 FY24, IndusInd Bank reported a 26% year-on-year growth in its retail advances, highlighting the expanding reach of financial services and the concurrent need for financial education to support this growth.

India's demographic landscape, characterized by a substantial and youthful population, presents a significant growth avenue for financial institutions like IndusInd Bank. As of 2024, India's median age hovers around 28.7 years, indicating a large segment of the population entering their prime earning and spending years. This burgeoning working-age demographic directly translates to increased demand for a wide array of banking services, from savings and investment accounts to credit facilities and insurance products.

The relentless pace of urbanization across India is another key sociological driver. By 2023, over 35% of India's population resided in urban areas, a figure projected to climb steadily. This trend necessitates that banks like IndusInd Bank strategically expand their physical branch networks and, crucially, enhance their digital banking capabilities to cater to these growing urban centers. Furthermore, rapid urbanization often correlates with evolving lifestyle needs, influencing demand for specific loan types such as home loans, vehicle loans, and personal loans for consumption.

Customer Expectations for Personalization

Customer expectations for personalization are rapidly evolving, with a significant portion of consumers now anticipating tailored financial experiences. This shift is fueled by widespread adoption of data analytics and artificial intelligence, enabling financial institutions to understand individual needs better. For instance, a 2024 survey indicated that over 60% of banking customers expect personalized product recommendations.

Banks like IndusInd are recognizing this trend and investing in technology to deliver hyper-personalized services. This includes everything from customized loan offers based on spending habits to bespoke investment portfolio suggestions. Such tailored approaches are crucial for not only retaining existing customers but also for attracting new ones in a competitive market.

- Data-Driven Personalization: Leveraging AI and machine learning to analyze customer data for tailored product offerings.

- Enhanced Customer Loyalty: Personalized services foster stronger customer relationships and increase retention rates.

- Competitive Advantage: Banks that excel in personalization can differentiate themselves and capture market share.

- Digital Engagement: Meeting customer demands for convenient, personalized interactions through digital channels.

Impact of Social Media and Reputation Management

Social media's influence on public perception is undeniable, impacting customer trust and brand loyalty for financial institutions like IndusInd Bank. In 2024, a significant portion of consumers, estimated to be over 60%, rely on online reviews and social media sentiment when choosing a bank. Proactive reputation management, including swift and transparent responses to customer feedback and any emerging issues, is therefore paramount.

IndusInd Bank, like other financial entities, must navigate the rapid dissemination of information online. Past events, such as past accounting discrepancies, can be amplified by social media, potentially eroding public trust if not addressed with clear communication and demonstrable corrective actions. This necessitates a robust strategy for monitoring online conversations and engaging constructively with stakeholders.

- Digital Scrutiny: Over 70% of banking customers in India engage with their bank through digital channels, making social media a primary touchpoint for brand perception.

- Reputation as Capital: A bank's online reputation directly correlates with its ability to attract and retain customers, a critical factor in market share growth.

- Crisis Amplification: Negative news or customer complaints, if unaddressed on social media, can spread rapidly, impacting investor confidence and stock performance.

The increasing digital savviness of Indian consumers, with over 95% of IndusInd Bank's retail transactions going digital by FY24, highlights a societal shift towards convenience and accessibility. This trend is further supported by a growing demand for financial literacy, especially in underserved areas, pushing banks to create simpler, more accessible products. The youthful demographic, with India's median age around 28.7 in 2024, represents a significant market for banking services, while urbanization, with over 35% of the population in cities by 2023, drives demand for tailored financial solutions like home and vehicle loans.

Technological factors

The Indian banking landscape is in the midst of a significant digital overhaul. Banks are channeling substantial investments into cutting-edge technologies aimed at streamlining operations and elevating customer interactions. This surge is evident in the broad embrace of digital channels for a spectrum of banking services, encompassing everything from new account openings to the processing of loan applications.

IndusInd Bank's robust digital transaction volume, which reached 97.3% of total retail loan disbursements in FY23, clearly demonstrates its proactive engagement with this transformative trend. This high percentage highlights the bank's strategic focus on leveraging digital platforms to enhance efficiency and customer accessibility, positioning it favorably within the evolving financial ecosystem.

India's FinTech sector is a powerhouse, ranking among the largest and fastest-growing worldwide, with a remarkable adoption rate. This dynamic landscape is fundamentally reshaping how financial services are delivered and consumed.

Banks like IndusInd are actively partnering with FinTech innovators to bring cutting-edge solutions to market. These collaborations are crucial for developing services such as embedded finance, which seamlessly integrates financial products into non-financial platforms, thereby broadening financial inclusion.

These strategic alliances not only streamline operational efficiencies for banks but also significantly enhance the customer experience. For instance, by leveraging FinTech's agility, banks can offer more personalized and accessible financial tools, meeting evolving consumer expectations.

IndusInd Bank is leveraging Artificial Intelligence (AI) and Machine Learning (ML) to bolster its operations. These technologies are crucial for advanced fraud detection and sophisticated risk management, areas where precision is paramount. For instance, AI-powered systems can analyze millions of transactions in real-time, identifying anomalies that might indicate fraudulent activity, a capability that has become indispensable in the digital banking age.

Furthermore, AI and ML are instrumental in developing dynamic credit models, allowing for more accurate risk assessments and personalized lending. This also extends to hyper-personalized customer services, where AI can anticipate customer needs and offer tailored solutions, improving engagement and satisfaction. By automating various workflows, these technologies significantly enhance operational efficiency and elevate the overall user experience for IndusInd Bank's clientele.

Cybersecurity and Data Protection

As IndusInd Bank, like all financial institutions, embraces greater digitalization, cybersecurity threats loom large. Protecting sensitive customer data and preventing breaches is paramount. This necessitates significant investment in advanced cybersecurity tools, including AI-driven systems, to stay ahead of evolving threats. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the scale of this challenge.

Data privacy regulations, such as India's Digital Personal Data Protection Act (DPDPA) of 2023, further underscore the importance of robust data protection measures. These laws impose strict requirements on how banks handle and secure personal information, with potential penalties for non-compliance.

- Increased Digitalization: Banks are processing more sensitive data online, expanding the attack surface for cybercriminals.

- AI-Driven Security: Investing in AI and machine learning for threat detection and response is becoming a necessity, not an option.

- Regulatory Compliance: Adhering to data privacy laws like the DPDPA 2023 is critical to avoid legal repercussions and maintain customer trust.

- Customer Trust: A strong cybersecurity posture is directly linked to maintaining customer confidence and loyalty in the digital age.

Blockchain and Digital Currencies

Blockchain technology is being actively explored by banks like IndusInd to streamline operations, especially for international payments and secure record-keeping. This innovation promises greater transparency and efficiency in financial processes. For instance, in 2023, the global blockchain in banking market was valued at approximately $1.8 billion, with projections indicating substantial growth.

The Reserve Bank of India's (RBI) push for a Digital Rupee, or e-INR, represents a significant technological shift. This central bank digital currency (CBDC) has the potential to fundamentally alter how payments are made and how financial transactions are conducted within India. Pilot programs for the wholesale version of the e-INR commenced in November 2022, involving nine banks, and the retail pilot began in December 2022, expanding to more participants.

- Blockchain Adoption: Banks are investing in blockchain to improve the speed and security of cross-border payments, aiming to reduce settlement times and costs.

- Digital Rupee Impact: The e-INR could lead to more efficient payment systems, potentially lowering transaction fees and increasing financial inclusion.

- RBI's Role: The RBI's proactive stance on digital currencies positions India to leverage these technologies for economic advancement.

Technological advancements are rapidly reshaping the banking sector, with institutions like IndusInd Bank heavily investing in digital infrastructure. This focus is evident in the bank's high digital transaction volume, reaching 97.3% of total retail loan disbursements in FY23, showcasing a commitment to digital channels for services ranging from account opening to loan processing.

IndusInd Bank is strategically leveraging AI and ML for enhanced fraud detection, risk management, and personalized customer services, significantly improving operational efficiency. Furthermore, the bank's exploration of blockchain technology for international payments and record-keeping, alongside the Reserve Bank of India's (RBI) initiatives with the Digital Rupee, signals a future of more efficient and secure financial transactions.

The burgeoning Indian FinTech sector, a global leader in growth, is a key partner for banks like IndusInd, fostering innovation in areas like embedded finance. This collaborative approach not only streamlines operations but also elevates customer experience through personalized and accessible financial tools, meeting evolving consumer expectations.

The increasing reliance on digital platforms necessitates robust cybersecurity measures, with the global cybersecurity market projected to exceed $300 billion in 2024. Compliance with data privacy regulations, such as India's Digital Personal Data Protection Act of 2023, is paramount to maintaining customer trust and avoiding penalties.

| Key Technology Trend | IndusInd Bank's Engagement | Market Data/Impact |

| Digitalization | 97.3% of retail loan disbursements in FY23 were digital. | Drives operational efficiency and customer accessibility. |

| AI & ML | Used for fraud detection, risk management, and personalized services. | Enhances security and customer engagement. |

| FinTech Partnerships | Collaborations for embedded finance and innovative solutions. | India's FinTech sector is among the largest and fastest-growing globally. |

| Blockchain | Explored for international payments and secure record-keeping. | Global blockchain in banking market valued at ~$1.8 billion in 2023. |

| Digital Rupee (e-INR) | Participating in RBI's pilot programs. | Potential to revolutionize payment systems and financial inclusion. |

| Cybersecurity | Investment in advanced tools, including AI-driven systems. | Global market projected over $300 billion in 2024; crucial for data protection. |

Legal factors

IndusInd Bank operates within India's robust banking regulatory landscape, overseen by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Compliance with numerous master directions and circulars issued by these bodies is crucial for maintaining operational legitimacy and financial health.

The bank's commitment to regulatory adherence is tested by evolving compliance requirements. For instance, in FY23, the RBI levied penalties on various banks for non-compliance, underscoring the need for diligent oversight. IndusInd Bank's own reported instances of accounting issues, such as those concerning the recognition of certain loan assets in previous periods, emphasize the critical importance of strong internal controls and unwavering adherence to regulatory pronouncements to avoid financial penalties and reputational damage.

The Reserve Bank of India’s (RBI) comprehensive digital lending guidelines, effective May 2025, aim to enhance transparency and customer protection. These regulations mandate stricter operational standards, thorough due diligence for lenders, and robust data privacy measures, directly influencing how banks like IndusInd Bank conduct their digital lending operations.

These new directives, such as the requirement for explicit customer consent for data usage and clear disclosure of all charges, are designed to curb unfair practices and build trust. For IndusInd Bank, this means adapting its digital platforms to ensure full compliance, potentially impacting the speed and cost of digital loan origination while fostering a more secure lending environment.

Consumer protection laws are increasingly stringent, demanding that banks like IndusInd Bank uphold fair practices, provide clear disclosures, and establish robust grievance redressal systems. Regulations covering loan agreements, credit card operations, and investment products are critical for maintaining customer trust and minimizing legal liabilities. For instance, the Reserve Bank of India's (RBI) updated guidelines on fair practices code and grievance redressal, effective from 2023, emphasize greater transparency in all customer interactions.

Data Privacy and Security Laws

As digital banking grows, data privacy and security laws are getting stricter. IndusInd Bank, like all financial institutions, must adhere to regulations on how customer data is gathered, kept, and used to avoid breaches and keep trust. This is a significant legal consideration for the bank's operations.

Compliance with these evolving regulations, such as India's Digital Personal Data Protection Act, 2023, is paramount. Failure to comply can result in substantial penalties. For instance, the DPDP Act allows for penalties up to INR 250 crore for data breaches.

To meet these demands, IndusInd Bank needs to invest heavily in secure IT infrastructure and robust data protection protocols. This includes regular security audits and employee training to safeguard sensitive customer information and maintain regulatory compliance.

Corporate Governance and Accountability

Recent events, including accounting mismatches and leadership changes at IndusInd Bank, highlight the intense focus on corporate governance and accountability in the banking industry. These incidents have led to increased regulatory intervention, impacting board decisions and executive appointments.

Regulatory bodies are actively ensuring robust oversight and addressing governance failures. For instance, the Reserve Bank of India (RBI) has been proactive in strengthening governance norms following past issues in the sector. This heightened scrutiny means that IndusInd Bank, like its peers, must adhere to stricter compliance frameworks.

- Increased Regulatory Oversight: The RBI's continued focus on governance standards means banks face more stringent compliance requirements.

- Board Independence and Accountability: There is growing pressure for independent board members and clear lines of accountability for management decisions.

- Leadership Stability: Transitions in leadership are now subject to greater scrutiny to ensure continuity and adherence to governance principles.

- Transparency in Reporting: Accounting practices and financial disclosures are under a microscope, demanding greater accuracy and transparency.

IndusInd Bank navigates a dynamic legal environment shaped by the Reserve Bank of India (RBI) and SEBI, necessitating strict adherence to evolving master directions and circulars. Recent RBI directives, such as the comprehensive digital lending guidelines effective May 2025, mandate enhanced transparency, customer protection, and robust data privacy, directly impacting the bank's digital operations and requiring platform adaptations. Furthermore, stringent consumer protection laws and data privacy regulations like the Digital Personal Data Protection Act, 2023, which allows penalties up to INR 250 crore for breaches, demand significant investment in secure IT infrastructure and data protection protocols to maintain customer trust and avoid legal repercussions.

| Regulation | Effective Date | Key Impact on IndusInd Bank | Potential Penalty (DPDP Act) |

|---|---|---|---|

| Digital Lending Guidelines | May 2025 | Stricter operational standards, enhanced due diligence, data privacy measures for digital loans. | N/A |

| Fair Practices Code & Grievance Redressal | Updated 2023 | Increased transparency in customer interactions, robust grievance handling. | N/A |

| Digital Personal Data Protection Act | Gazetted 2023 | Mandatory adherence to data gathering, storage, and usage protocols. | Up to INR 250 crore for breaches. |

Environmental factors

Indian banks, including IndusInd Bank, are actively embedding Environmental, Social, and Governance (ESG) principles into their core operations. This involves a critical review of the environmental and social footprints of their loan portfolios and the implementation of greener internal policies. By 2024, a significant portion of Indian banks reported enhanced ESG disclosures, reflecting a commitment to sustainable finance.

IndusInd Bank is increasingly involved in green financing, offering green loans and supporting renewable energy projects to aid the shift towards a low-carbon economy. This aligns with the global push for sustainable development, with many financial institutions, including IndusInd, actively participating in this sector.

The bank is developing robust frameworks for responsible lending. These frameworks integrate environmental and social considerations directly into how they assess credit risk, ensuring that lending decisions reflect a commitment to sustainability and responsible business practices.

IndusInd Bank, like other financial institutions, is increasingly focused on managing the financial implications of climate change. This includes assessing physical risks, such as the potential impact of extreme weather events on its loan portfolio, particularly in sectors like agriculture. For instance, a severe drought in 2024 could directly affect the repayment capacity of farmers, leading to increased non-performing assets for the bank.

Furthermore, the bank is actively considering transition risks, which arise from the shift towards a lower-carbon economy. This means evaluating the exposure of its lending to carbon-intensive industries, such as fossil fuels. As regulations tighten and consumer preferences shift, loans to these sectors may face devaluation or increased default probabilities. By 2025, it's anticipated that climate-related disclosures will become more standardized, requiring banks to provide greater transparency on these exposures.

Regulatory Push for Sustainable Finance

India's Reserve Bank (RBI) and other regulatory bodies are actively championing sustainable finance, pushing banks like IndusInd Bank towards more responsible practices. This includes the issuance of specific guidelines for green deposits and a growing emphasis on transparent Environmental, Social, and Governance (ESG) performance disclosures. Banks are increasingly expected not only to comply with these evolving regulations but also to proactively contribute to their successful implementation.

The regulatory landscape is shifting significantly, with a clear mandate for banks to integrate sustainability into their core operations. For instance, the RBI's framework for green deposits, introduced in April 2023, aims to channel credit towards green activities. By June 2024, several banks had launched green deposit products, reflecting this regulatory push. IndusInd Bank, in line with these directives, is expected to enhance its reporting on climate-related financial risks and its contributions to India's net-zero targets.

- RBI's Green Deposit Framework: Issued in April 2023, encouraging banks to offer green deposit products.

- ESG Disclosure Emphasis: Growing regulatory requirement for transparent reporting on ESG metrics.

- Climate Risk Management: Banks are increasingly expected to manage and disclose climate-related financial risks.

- Sustainable Finance Growth: The market for sustainable finance in India is projected to see substantial growth, driven by regulatory impetus and investor demand.

Corporate Social Responsibility (CSR)

IndusInd Bank actively pursues Corporate Social Responsibility (CSR) initiatives that extend beyond mere compliance, focusing on community upliftment, financial education, and ecological stewardship. These efforts are designed to bolster the bank's public image and foster societal progress, directly reflecting the social component of Environmental, Social, and Governance (ESG) principles.

In FY23, IndusInd Bank reported a total CSR expenditure of approximately ₹200 crore, demonstrating a significant commitment to its social objectives. A notable portion of this was allocated to financial inclusion programs, aiming to bring unbanked populations into the formal financial system.

- Financial Literacy: Programs conducted by IndusInd Bank in FY23 reached over 500,000 individuals, enhancing their understanding of banking products and services.

- Community Development: Investments were made in rural infrastructure and healthcare, impacting more than 250,000 lives in underserved areas.

- Environmental Protection: Initiatives included tree plantation drives and water conservation projects, contributing to a greener footprint.

- Employee Volunteering: The bank encouraged employee participation in CSR activities, with over 10,000 employee volunteering hours logged in FY23.

IndusInd Bank, like other financial institutions, is increasingly focused on managing the financial implications of climate change, assessing both physical risks like extreme weather events impacting agricultural loans and transition risks from shifts away from carbon-intensive industries. By 2025, climate-related disclosures are expected to become more standardized, pushing banks towards greater transparency on these exposures.

PESTLE Analysis Data Sources

Our PESTLE analysis for IndusInd Bank is grounded in data from reputable sources including Reserve Bank of India (RBI) reports, economic surveys from the Indian government, and financial market analyses from leading institutions. We also incorporate global economic indicators and regulatory updates relevant to the banking sector.