IndusInd Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

Curious about IndusInd Bank's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in the full analysis. Discover which segments are driving growth and which require a closer look.

Unlock the complete IndusInd Bank BCG Matrix to gain a comprehensive understanding of their product portfolio's performance and potential. Purchase the full report for actionable insights and strategic recommendations to optimize your investment decisions.

Stars

IndusInd Bank's digital banking platforms, INDIE app and INDIE for Business, represent a significant push into digital transformation. These initiatives are designed to offer a smooth and feature-rich banking experience for both individual consumers and micro, small, and medium enterprises (MSMEs).

The bank is targeting substantial growth in customer acquisition and revenue through these digital channels, recognizing their critical role in future expansion. By focusing on user-friendliness and comprehensive digital services, IndusInd Bank aims to capture a larger share of the rapidly growing digital financial market.

IndusInd Bank's wealth management, especially its Pioneer Private Program for High-Net-Worth Individuals (HNIs) and Ultra-HNIs, is a significant growth engine. This segment is crucial for expanding Assets under Management (AuM).

The bank has ambitious plans to triple its AuM from $10 billion to $30 billion within the next three years, highlighting the strategic importance of wealth management. This aggressive expansion is fueled by India's burgeoning HNI population, making wealth management a high-potential area for the bank.

IndusInd Bank is strategically bolstering its presence in secured retail lending, specifically targeting housing loans, loans against property (LAP), and MSME lending. This pivot aims to capitalize on future growth opportunities and mitigate the impact of slower performance in unsecured loan categories. For instance, in the fiscal year 2023-24, the bank's retail loan book demonstrated resilience, with housing loans and LAP showing steady expansion, contributing positively to overall asset quality.

The bank's dedicated 'INDIE for Business' platform underscores its commitment to the substantial MSME segment. This initiative is designed to unlock significant revenue streams by providing tailored financial solutions to small and medium-sized enterprises. In 2024, the MSME loan portfolio of IndusInd Bank saw a notable uptick, reflecting the success of these targeted strategies and the increasing demand for credit within this vital economic sector.

Expansion of Branch Network and Client Base

IndusInd Bank is actively broadening its reach, evidenced by a consistent increase in its branch network and ATM footprint. This physical expansion is crucial for deepening market penetration and enhancing customer accessibility across various demographics.

The bank’s strategy focuses on strengthening its presence in areas with high potential for affluent banking clients and expanding its retail customer base. This dual approach aims to capture a wider market share and solidify its position in key economic hubs.

- Branch Network Growth: IndusInd Bank reported an increase in its total number of branches, reaching 2,600+ by the end of FY24, a testament to its commitment to physical expansion.

- ATM Deployment: The bank also expanded its ATM network, exceeding 3,000 ATMs, to provide greater convenience and accessibility for its growing customer base.

- Client Acquisition: This physical and digital outreach has contributed to a significant rise in its customer base, which crossed the 3.9 crore mark as of March 2024.

- Digital Integration: The physical network expansion is strategically aligned with its digital banking initiatives, ensuring a seamless omnichannel experience for all customers.

ESG-linked Financial Products

IndusInd Bank is actively expanding its ESG-linked financial product offerings, reflecting a strategic shift towards sustainable finance. This move aligns with a global surge in demand for responsible investment options. For instance, the sustainable finance market saw significant growth in 2023, with global sustainable debt issuance reaching over $1 trillion, indicating a strong investor appetite for ESG-focused instruments.

The bank's commitment to ESG integration is evident in its business and risk management frameworks. This focus positions IndusInd Bank to capture market share in a rapidly expanding sector. By offering innovative ESG-linked products, the bank aims to differentiate itself and meet the evolving needs of environmentally and socially conscious investors.

- Growing Market: The global sustainable finance market is projected to reach $50 trillion by 2025, presenting a substantial growth opportunity for institutions like IndusInd Bank.

- Investor Demand: A significant majority of investors, over 70% according to recent surveys, now consider ESG factors in their investment decisions.

- Product Diversification: IndusInd Bank's ESG-linked products may include green bonds, sustainability-linked loans, and ESG-focused mutual funds, catering to a diverse investor base.

- Brand Differentiation: A strong ESG proposition can enhance brand reputation and attract a loyal customer base, particularly among younger demographics.

IndusInd Bank's digital banking initiatives, particularly the INDIE app and INDIE for Business, position it strongly in the rapidly growing digital financial services market. These platforms are designed for user-friendliness and comprehensive features, aiming to attract a broad customer base, from individuals to MSMEs.

The bank's wealth management services, especially its Pioneer Private Program, are a key growth driver, targeting High-Net-Worth Individuals (HNIs). IndusInd Bank has set an ambitious goal to triple its Assets under Management (AuM) from $10 billion to $30 billion in the next three years, capitalizing on India's expanding HNI segment.

IndusInd Bank is also strategically expanding its secured retail lending, focusing on housing loans and loans against property (LAP). This move aims to enhance its loan portfolio resilience and capitalize on the steady demand in these segments, as evidenced by positive growth in its retail loan book during FY23-24.

The bank's commitment to the MSME sector is reinforced by its 'INDIE for Business' platform, which offers tailored financial solutions. This focus has contributed to a notable increase in its MSME loan portfolio in 2024, reflecting the success of its targeted strategies and the increasing credit demand from this vital economic sector.

IndusInd Bank's expansion of its physical network, including branches and ATMs, complements its digital strategy. By the end of FY24, the bank operated over 2,600 branches and more than 3,000 ATMs, supporting a customer base that surpassed 3.9 crore by March 2024.

The bank is also actively developing its ESG-linked financial products, aligning with the global trend towards sustainable finance. With the sustainable finance market projected for significant growth, IndusInd Bank's focus on ESG aims to attract environmentally conscious investors and enhance its brand reputation.

| Business Segment | BCG Category | Strategic Rationale |

| Digital Banking (INDIE App, INDIE for Business) | Star | High market growth potential, strong competitive positioning with innovative digital offerings. Focus on customer acquisition and revenue growth in a rapidly expanding digital financial services landscape. |

| Wealth Management (Pioneer Private Program) | Star | High growth in HNI/UHNIs, significant potential for AuM expansion. Ambitious target to triple AuM to $30 billion by FY27. |

| Secured Retail Lending (Housing Loans, LAP) | Cash Cow / Question Mark | Steady growth and resilience in the retail loan book. Focus on capitalizing on future growth opportunities and mitigating risks in other loan categories. |

| MSME Lending | Star / Question Mark | Significant revenue potential through tailored solutions. Notable uptick in MSME loan portfolio in 2024, indicating growing market traction. |

| Branch & ATM Network Expansion | Star | Enhances market penetration and customer accessibility, supporting both digital and physical banking strategies. Contributes to overall customer base growth. |

| ESG-Linked Financial Products | Question Mark / Star | Capitalizes on growing investor demand for sustainable finance. Positions the bank for market share gains in an expanding sector with strong market growth projections. |

What is included in the product

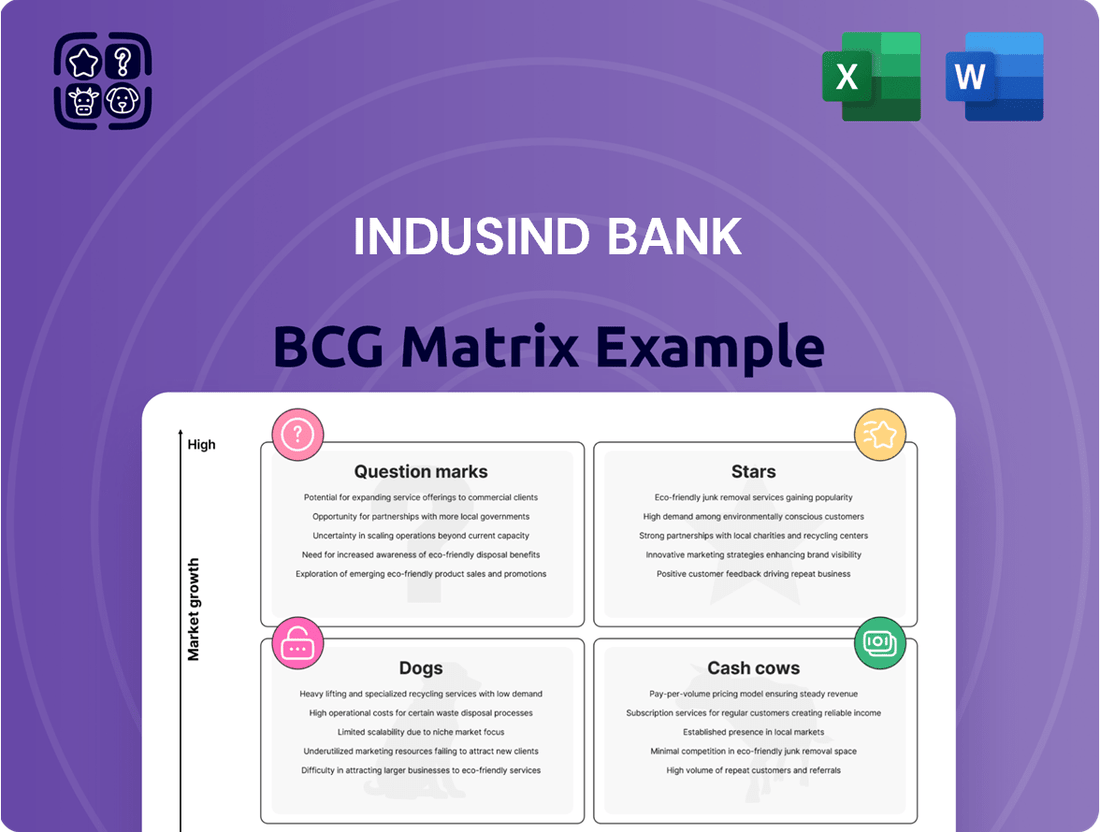

The IndusInd Bank BCG Matrix offers strategic insights into its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The IndusInd Bank BCG Matrix offers a clear, one-page overview, relieving the pain of uncertainty by strategically positioning each business unit.

Its export-ready design for PowerPoint eliminates the hassle of manual creation for quick, impactful stakeholder presentations.

Cash Cows

IndusInd Bank boasts a strong and expanding retail deposit base, a vital component for its operational funding and liquidity management. This mature segment consistently provides a significant portion of the bank's low-cost funds, underpinning its financial stability.

While the CASA ratio has seen some recent shifts, the bank's overall deposit growth remains robust year-on-year, demonstrating a resilient liability franchise. For instance, as of March 31, 2024, IndusInd Bank's total deposits stood at ₹4,04,468 crore, reflecting a healthy year-on-year growth.

IndusInd Bank's corporate and wholesale banking division is a cornerstone of its operations, acting as a significant cash cow. This segment consistently contributes a substantial portion to the bank's overall lending portfolio, ensuring a steady and reliable revenue stream.

As of the fiscal year ending March 31, 2024, corporate and wholesale banking advances constituted a major share of IndusInd Bank's gross advances, reflecting its established presence in serving large enterprises and government bodies. This mature market segment, while experiencing moderate growth, continues to be a primary source of consistent income for the bank.

IndusInd Bank's vehicle finance portfolio has historically been a robust contributor to its retail lending, consistently holding a significant position. Despite facing headwinds that led to some contraction, the bank has demonstrated resilience by maintaining or even enhancing its market share across diverse vehicle segments, signaling a strong recovery outlook.

This segment, operating within a largely mature market, has traditionally been a reliable source of healthy profits and substantial cash flows for IndusInd Bank. For instance, in FY2024, vehicle finance loans constituted a notable portion of the bank's overall retail advances, reflecting its sustained strength in this area.

Treasury Operations

IndusInd Bank's Treasury Operations, a significant component of its financial activities, functions as a cash cow within its business portfolio. This segment, which includes managing investment portfolios, foreign exchange, equities, and money market activities, is a steady generator of non-interest income for the bank. In the fiscal year 2024, the bank's treasury operations played a crucial role in its overall financial performance, contributing to its robust earnings.

This mature and vital banking function ensures the bank's liquidity and optimizes its investment positions, leading to predictable and stable returns. The treasury segment is foundational for any large financial institution, and IndusInd Bank leverages its expertise to maximize earnings from these core activities.

- Treasury's Contribution to Non-Interest Income: Treasury operations are a consistent source of non-interest income for IndusInd Bank.

- Stability and Maturity: As a mature segment, treasury provides stable earnings by managing the bank's liquidity and investments.

- Key Activities: Encompasses investment portfolios, foreign exchange, equities, and money market operations.

- FY24 Performance Indicator: Treasury operations were a key driver in the bank's financial results for the fiscal year 2024.

Fee-Based Income from Core Services

IndusInd Bank's fee-based income from core services, distinct from net interest income, forms a significant pillar of its financial strength. This income is generated through a broad spectrum of customer interactions and services.

These fees stem from various transaction processing, digital payment solutions, and a host of other customer-focused banking products. For instance, in the financial year 2024, IndusInd Bank reported a healthy growth in its non-interest income, which largely comprises these fee-based earnings.

This diversified revenue stream, derived from its established service offerings, provides a stable and predictable contribution to the bank's overall profitability, acting as a key cash cow.

- Fee-based income contributes significantly to profitability beyond net interest income.

- Sources include transaction fees, payment services, and other customer offerings.

- In FY2024, IndusInd Bank saw robust growth in its non-interest income.

- This diversified income stream provides stability and predictability.

IndusInd Bank's corporate and wholesale banking, along with its vehicle finance portfolio, represent strong cash cows. These mature segments, while experiencing moderate growth, consistently generate substantial revenue and cash flow, underpinning the bank's financial stability. The bank's treasury operations also act as a significant cash cow, providing stable non-interest income through prudent management of investments and liquidity.

| Segment | Contribution to Profitability | Growth Outlook | FY2024 Data Point |

|---|---|---|---|

| Corporate & Wholesale Banking | Steady revenue stream from lending | Moderate | Major share of gross advances |

| Vehicle Finance | Healthy profits and cash flows | Resilient, recovery outlook | Notable portion of retail advances |

| Treasury Operations | Stable non-interest income | Predictable returns | Key driver of FY24 financial performance |

Preview = Final Product

IndusInd Bank BCG Matrix

The IndusInd Bank BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This report, meticulously crafted with current market data, offers a clear strategic overview of IndusInd Bank's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You can confidently use this preview as an exact representation of the analysis-ready file you will obtain, ready for integration into your strategic planning or presentations without any further modifications.

Dogs

IndusInd Bank's Microfinance (MFI) Portfolio, primarily operated through Bharat Financial Inclusion Limited (BFIL), is currently positioned as a Question Mark in the BCG Matrix. Despite its scale, this segment has experienced a contraction in recent periods, with lower loan disbursements and a concerning rise in non-performing assets (NPAs). For instance, during the fiscal year ending March 31, 2024, the MFI segment's Gross NPA saw an uptick, impacting profitability.

The portfolio's challenges are further compounded by disclosed accounting errors and misclassification of loans, necessitating significant provisions. These issues have raised questions about the segment's long-term sustainability and its ability to generate consistent returns without substantial strategic adjustments or restructuring efforts.

IndusInd Bank has strategically scaled back its credit card operations, signaling a deliberate exit from specific market segments. This move strongly suggests that these particular credit card offerings were not meeting performance expectations, potentially draining resources without yielding sufficient returns or capturing meaningful market share.

These underperforming credit card segments are prime candidates for divestment or a thorough strategic reassessment. For instance, in the fiscal year ending March 31, 2024, IndusInd Bank's retail advances grew by 15.6% year-on-year, but the bank's commentary highlighted a focus on profitable growth, implying a pruning of less lucrative portfolios.

IndusInd Bank has been strategically trimming its personal loan portfolio, a move that aligns with a cautious approach to managing risk. This reduction is particularly noticeable in segments where specific products are demonstrating elevated slippage rates, meaning a higher proportion of these loans are becoming non-performing. For instance, if a particular personal loan product saw its slippage ratio climb to 7.5% in early 2024, compared to an industry average of 4.2%, it would signal a significant concern.

Products exhibiting such high slippages and failing to meet profitability targets would likely be classified as Cash Cows within the BCG framework, but in a negative light, indicating a drain on resources. The bank's proactive decision to scale back exposure to these areas reflects a clear strategy to cut losses and reallocate capital towards more robust and profitable ventures. This is a prudent step, especially considering that in the first quarter of 2024, the bank reported a 12% year-on-year increase in its gross non-performing assets, underscoring the importance of such portfolio adjustments.

Legacy/Non-Core Assets

IndusInd Bank, like many large financial institutions, likely manages legacy or non-core assets. These are typically business units or portfolios that no longer align with the bank's primary strategic direction or are underperforming. For instance, a divested retail loan portfolio from a past acquisition or a non-performing asset (NPA) pool that is being managed down could fall into this category. Such assets often generate lower returns and may tie up capital that could be better deployed in growth areas.

While specific details on IndusInd Bank's legacy assets aren't publicly itemized within a BCG Matrix framework, banks of its scale often identify these as candidates for divestment or strategic wind-down. The goal is to streamline operations and improve capital efficiency. For example, if a particular segment of its past business, like a niche insurance product line, is no longer a strategic priority and consistently shows low profitability, it would be a prime candidate for consideration as a legacy asset.

- Potential Legacy Assets: Divested loan portfolios or non-performing asset (NPA) pools from prior strategic initiatives.

- Strategic Alignment: Units not aligning with current growth focus, such as niche financial products no longer prioritized.

- Capital Optimization: Assets requiring disproportionate capital with low return on equity (ROE) are candidates for divestment.

- Performance Metrics: Low profitability and declining market share are indicators of legacy asset status.

Outdated Technology Infrastructure/Services

In the fast-paced world of banking, outdated technology infrastructure and services can become a significant drag on a bank's performance. For IndusInd Bank, these legacy systems represent a potential 'Dog' in the BCG Matrix. They often come with high maintenance costs and fail to support the innovative services customers expect, hindering growth and competitive positioning. For instance, by the end of fiscal year 2023, banks globally were investing heavily in modernizing their core banking systems, with estimates suggesting that over 70% of IT spending in the sector was directed towards digital transformation and upgrading legacy platforms. This highlights the financial burden and strategic imperative to move beyond outdated infrastructure.

IndusInd Bank's strategic focus on 'Digital 2.0' explicitly signals a commitment to shedding these inefficient, older technologies. Such systems may offer limited functionality, poor user experience, and increased vulnerability to cyber threats, all of which detract from the bank's ability to compete effectively. The bank's ongoing efforts to streamline operations and enhance digital offerings are directly aimed at migrating away from these costly and underperforming assets.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and are prone to frequent breakdowns, diverting resources from growth initiatives.

- Limited Scalability and Innovation: Outdated infrastructure struggles to support new digital products and services, impacting the bank's ability to adapt to market demands.

- Reduced Customer Experience: Inefficient systems can lead to slower transaction times and a less intuitive digital interface, negatively affecting customer satisfaction and retention.

- Security Risks: Older platforms may have unpatched vulnerabilities, making them more susceptible to cyberattacks and data breaches.

IndusInd Bank's older, less efficient technology infrastructure and services can be considered 'Dogs' in the BCG Matrix. These legacy systems often incur high maintenance costs and fail to support modern digital offerings, hindering competitiveness. For instance, by the end of fiscal year 2023, global banks were heavily investing in core banking system modernization, with a significant portion of IT spending focused on upgrading legacy platforms.

These outdated systems typically offer limited functionality and a poor user experience, increasing vulnerability to cyber threats. The bank's 'Digital 2.0' strategy directly addresses the need to move away from these costly and underperforming assets to improve operational efficiency and digital capabilities.

The financial burden of maintaining these systems, coupled with their inability to support innovation, makes them prime candidates for divestment or strategic wind-down. This proactive approach is crucial for optimizing capital allocation and enhancing overall performance.

For example, a legacy payment processing system that is slow, expensive to maintain, and cannot integrate with newer fintech solutions would be a classic 'Dog'. Such systems might have seen their market share decline significantly as newer, more efficient alternatives emerged.

Question Marks

IndusInd Bank is actively forging new digital partnerships, aiming to become a central hub for a wide array of digital services by integrating with e-commerce giants and various digital service providers. This strategic move places the bank squarely within the rapidly expanding digital ecosystem market.

While these collaborations offer immense growth potential, their precise market share and profitability are still emerging, necessitating substantial investment and meticulous strategic implementation to achieve their full impact. For instance, the Indian digital payments market alone was projected to reach $3 trillion by 2026, highlighting the scale of opportunity these integrations tap into.

IndusInd Bank's exploration into niche digital product innovations, beyond its established INDIE platforms, signals a strategic move towards high-growth potential areas. These could include advancements like completely paperless, biometric-driven account opening, a significant step in streamlining customer onboarding. The bank is also likely focusing on hyper-personalization powered by artificial intelligence and machine learning to offer tailored banking experiences.

While these innovations represent the future of digital banking, they are currently in nascent stages. The success of such ventures hinges on market adoption and the eventual return on investment, which remain uncertain. For instance, the global digital banking market was projected to reach over $20 trillion by 2024, indicating a strong underlying trend, but specific adoption rates for highly niche features are still developing.

Expanding into Tier 2 and Tier 3 cities presents a significant opportunity for IndusInd Bank, tapping into previously underserved markets with high growth potential. This strategic move aligns with the bank's aim to broaden its customer base and increase its financial inclusion footprint across India.

However, this expansion requires substantial investment in physical branches, digital infrastructure, and tailored marketing campaigns to resonate with local populations. For example, setting up a new branch in a Tier 3 city can cost upwards of ₹1 crore, including real estate, technology, and staffing, making the initial outlay considerable.

IndusInd Bank's focus on digital banking solutions can mitigate some of these costs, but localized customer acquisition strategies remain critical. The bank's reported customer base growth in FY24, which saw a 14% increase in retail customers, highlights the potential of such expansion efforts when executed effectively.

Advanced AI and Machine Learning Applications

IndusInd Bank is pushing AI and machine learning into advanced applications, moving beyond basic chatbots and fraud detection. The bank aims for deep integration into customer-facing tools to offer hyper-personalized experiences, a significant step into a high-growth technological area.

This strategic push into advanced AI applications places IndusInd Bank in a developing market position. While the potential for market share growth is substantial, it necessitates considerable research and development investment to refine these sophisticated customer interactions.

- Hyper-personalization: Leveraging AI to tailor product offerings and customer service based on individual behavior and preferences.

- R&D Investment: Significant capital allocation towards developing and implementing cutting-edge AI algorithms and infrastructure.

- Market Development: Focus on building a strong market presence in the nascent but rapidly expanding field of advanced AI-driven banking services.

- Competitive Landscape: Navigating a competitive environment where early adopters of advanced AI are likely to gain a significant advantage.

New Credit Offerings within Emerging Segments

IndusInd Bank is strategically looking to expand its credit offerings into emerging segments, aiming to diversify its loan portfolio. These new offerings would target high-growth areas where the bank currently holds a minimal market share. This expansion necessitates a focused approach to market penetration and substantial investment to achieve scale.

For instance, the bank could introduce specialized financing solutions for the burgeoning electric vehicle (EV) ecosystem, including loans for EV manufacturers, charging infrastructure developers, and fleet operators. Another avenue is offering tailored credit products for the rapidly growing renewable energy sector, supporting solar and wind power projects. These initiatives align with the bank's goal of capturing new market opportunities and building a robust presence in future-oriented industries.

- Targeting High-Growth Niches: Focus on sectors like fintech, green technology, and the digital economy, which are experiencing rapid expansion.

- Tailored Credit Products: Develop specific loan structures, collateral requirements, and repayment terms to suit the unique needs of these emerging businesses.

- Market Seeding Investment: Allocate capital for relationship building, product development, and marketing to establish a strong foothold in these new segments.

- Risk Mitigation Strategies: Implement robust due diligence and risk assessment frameworks to manage the inherent uncertainties associated with nascent markets.

IndusInd Bank's ventures into new digital services and niche product innovations, such as AI-driven personalization and paperless account opening, represent its "Question Marks" in the BCG matrix. These initiatives are in high-growth potential markets but currently have low market share and require significant investment to mature.

The bank's expansion into Tier 2 and Tier 3 cities also falls into this category. While these regions offer substantial untapped customer bases, the associated costs for infrastructure and localized strategies are considerable, making their profitability uncertain in the short term.

Similarly, the bank's strategic push into advanced AI applications, aiming for deep integration into customer-facing tools, is a clear Question Mark. The R&D investment is high, and the market development for these sophisticated services is still nascent, with a competitive landscape favoring early adopters.

Expanding credit offerings into emerging segments like EVs and renewable energy also positions these as Question Marks. These sectors offer high growth but require tailored products and significant market seeding investments, with inherent risks needing robust mitigation strategies.

BCG Matrix Data Sources

Our IndusInd Bank BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market analytics, and expert industry evaluations to provide a data-driven strategic overview.