IndusInd Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IndusInd Bank Bundle

Discover the strategic core of IndusInd Bank's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue in the dynamic banking sector. Gain a competitive edge by understanding their key partnerships and cost drivers.

Ready to unlock IndusInd Bank's strategic blueprint? Our full Business Model Canvas provides an in-depth look at their customer segments, value propositions, and revenue streams, offering actionable insights for your own business. Download the complete, professionally structured document to accelerate your strategic planning.

Partnerships

IndusInd Bank actively partners with fintech firms to boost its digital services. These alliances enable the integration of cutting-edge solutions for payments, lending, and customer onboarding, thereby improving operational efficiency and customer satisfaction. For instance, in 2023, IndusInd Bank reported a significant increase in digital transactions, a trend likely fueled by these strategic fintech collaborations.

IndusInd Bank's key partnerships with payment networks like Visa, Mastercard, and RuPay are fundamental to its retail banking operations. These associations enable the bank to offer a comprehensive suite of credit, debit, and prepaid card services, ensuring broad acceptance and secure transaction processing.

In 2024, these network memberships are critical for IndusInd Bank to tap into the growing digital payments ecosystem. For instance, Mastercard reported a significant increase in transaction volumes in India during the first half of 2024, highlighting the importance of such partnerships for banks to capitalize on this trend.

IndusInd Bank collaborates with major IT service providers like Infosys and Wipro for its core banking platform and digital services. These partnerships are crucial for leveraging advanced cloud infrastructure and robust cybersecurity measures, ensuring operational resilience and data protection.

Co-lending and Distribution Partners

IndusInd Bank actively partners with Non-Banking Financial Companies (NBFCs) and other financial institutions through co-lending agreements. This allows them to extend their lending reach into specialized market segments and for particular product offerings, thereby diversifying their loan book and managing risk more effectively. For instance, in the fiscal year 2023-24, co-lending initiatives played a crucial role in their retail asset growth.

These strategic alliances are vital for IndusInd Bank's business model, enabling efficient product distribution and access to new customer bases. By leveraging the expertise of partners, the bank can offer tailored financial solutions. The bank's focus on expanding its secured loan portfolio in FY24 was significantly supported by these collaborations.

- Co-lending with NBFCs: Enhances reach in niche segments like MSME and vehicle finance.

- Distribution Partnerships: Facilitates broader product penetration and customer acquisition.

- Risk Diversification: Co-lending structures help in sharing credit risk, optimizing capital allocation.

- FY24 Performance: These partnerships contributed to the bank's robust retail loan growth during the fiscal year.

Government and Public Sector Entities

IndusInd Bank actively partners with government and public sector entities, playing a crucial role in national financial infrastructure. These collaborations are vital for initiatives like managing government payments, facilitating the disbursement of welfare funds, and driving financial inclusion programs across India.

These partnerships often involve handling substantial transaction volumes and directly contribute to the government's developmental objectives. For instance, in FY23, IndusInd Bank processed significant volumes of government receipts and payments, underscoring its role in public finance management.

- Government Payment Collections: Facilitating the collection of taxes, fees, and other government dues through its extensive branch network and digital channels.

- Fund Disbursements: Partnering with government agencies to disburse subsidies, pensions, and other welfare payments to beneficiaries efficiently.

- Financial Inclusion Schemes: Collaborating on government-led initiatives such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) to expand banking access to unbanked populations.

- Digital Government Initiatives: Supporting the digitization of government services and payments, enhancing transparency and efficiency in public service delivery.

IndusInd Bank's strategic alliances with fintech companies are pivotal for enhancing its digital offerings, including payments and customer onboarding. These collaborations are instrumental in driving operational efficiency and improving customer experience, as evidenced by the bank's digital transaction growth in 2023.

Key partnerships with payment networks such as Visa, Mastercard, and RuPay are essential for IndusInd Bank's retail banking operations, enabling a wide array of card services. These memberships are crucial for the bank to leverage the expanding digital payments landscape in India, with Mastercard noting increased transaction volumes in the country during early 2024.

Collaborations with IT giants like Infosys and Wipro underpin IndusInd Bank's core banking and digital platforms, ensuring robust cybersecurity and cloud infrastructure. Furthermore, co-lending agreements with NBFCs allow the bank to broaden its lending reach into specialized markets, diversifying its loan portfolio and managing risk effectively, which contributed to its retail asset growth in FY24.

| Partnership Type | Key Collaborators | Strategic Importance | Impact/Data Point |

|---|---|---|---|

| Fintech | Various Fintech Firms | Digital Service Enhancement, Operational Efficiency | Increased digital transactions in 2023 |

| Payment Networks | Visa, Mastercard, RuPay | Card Services, Transaction Processing | Leveraging growth in digital payments (Mastercard H1 2024 data) |

| IT Service Providers | Infosys, Wipro | Core Banking, Digital Platforms, Cybersecurity | Ensuring operational resilience |

| NBFCs/Financial Institutions | Various NBFCs | Co-lending, Market Reach, Risk Diversification | Supported retail loan growth in FY24 |

What is included in the product

IndusInd Bank's Business Model Canvas focuses on serving diverse customer segments, from retail to corporate, through a multi-channel approach and offering tailored financial products and services.

It details key partnerships, core activities, and resource requirements, underpinned by a strong revenue stream and cost structure to achieve sustainable profitability.

IndusInd Bank’s Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its core components, simplifying complex banking operations for stakeholders.

This allows for quick identification of key customer segments and value propositions, streamlining communication and strategic alignment for enhanced operational efficiency.

Activities

IndusInd Bank's core activity revolves around attracting and managing a diverse range of deposits. This includes everyday savings and current accounts for individuals and businesses, as well as fixed and recurring term deposits for longer-term savings.

This efficient deposit mobilization is vital, forming the bedrock of the bank's funding strategy. A strong deposit base provides a stable and cost-effective source of capital, directly supporting the bank's ability to extend credit and engage in its lending activities. As of March 31, 2024, IndusInd Bank's total deposits stood at approximately ₹3,70,854 crore, reflecting significant customer trust and participation in its deposit products.

IndusInd Bank's core activities revolve around its lending and credit operations, offering a wide spectrum of financing solutions. This includes retail loans for individuals, corporate financing for large businesses, and crucial SME financing to support small and medium enterprises. The bank's commitment to robust credit assessment processes ensures responsible lending practices.

The bank actively manages its loan portfolio, focusing on maintaining high asset quality and driving profitability through efficient loan disbursement and ongoing management. As of March 31, 2024, IndusInd Bank's gross advances stood at ₹3,74,086 crore, demonstrating the significant scale of its lending operations.

IndusInd Bank's core activities revolve around the continuous development, maintenance, and upgrading of its digital banking platforms. This includes their mobile app and internet banking services, ensuring a smooth and modern user experience.

This commitment to technology enhancement is crucial for facilitating seamless online transactions and boosting customer self-service capabilities. For instance, in the fiscal year 2023-24, IndusInd Bank reported a significant increase in digital transactions, with mobile banking transactions growing by 35% year-on-year, highlighting the success of these ongoing efforts.

Risk Management and Regulatory Compliance

IndusInd Bank actively manages credit, market, operational, and cybersecurity risks through robust frameworks. This proactive approach is essential for safeguarding assets and ensuring financial stability.

The bank’s commitment to regulatory compliance is unwavering, adhering to guidelines set by the Reserve Bank of India (RBI) and other relevant authorities. This ensures continued operational integrity and builds stakeholder confidence.

- Risk Mitigation: IndusInd Bank's focus on risk management is evidenced by its robust Non-Performing Asset (NPA) ratio, which stood at 1.93% as of March 31, 2024, demonstrating effective credit risk control.

- Cybersecurity Investment: Significant investments are made in cybersecurity to protect customer data and maintain operational resilience, a critical aspect in today's digital banking landscape.

- Regulatory Adherence: The bank consistently meets capital adequacy ratios, with its Capital Adequacy Ratio (CAR) at 14.93% as of March 31, 2024, well above the regulatory minimums, showcasing strong compliance.

Customer Service and Relationship Building

IndusInd Bank prioritizes delivering exceptional customer service across all channels, from digital platforms to physical branches. This focus on high-quality interactions is key to building trust and ensuring client satisfaction.

Fostering strong, lasting relationships is paramount. The bank actively works to understand individual client needs, offering personalized financial advice and solutions to enhance loyalty and retention. In 2023, IndusInd Bank reported a significant increase in its customer base, reaching over 34 million customers, underscoring the effectiveness of its relationship-building efforts.

Key activities include efficiently addressing customer queries and resolving issues promptly. This proactive approach minimizes friction and contributes to a positive banking experience. The bank's commitment to customer service is reflected in its consistently high Net Promoter Score (NPS) which, as of early 2024, has shown a positive trend.

- Customer Interaction Management: Efficiently handling inquiries and resolving issues across all touchpoints.

- Personalized Financial Advisory: Offering tailored advice to meet individual client needs and goals.

- Digital Service Excellence: Ensuring a seamless and supportive experience on online and mobile banking platforms.

- Relationship Deepening: Proactively engaging with clients to understand their evolving financial requirements.

IndusInd Bank's key activities include managing its vast deposit base and executing lending operations. The bank mobilizes funds through various deposit products and deploys them via a wide array of credit facilities, from retail loans to corporate financing. As of March 31, 2024, total deposits were ₹3,70,854 crore, while gross advances reached ₹3,74,086 crore.

A significant focus is placed on enhancing digital banking platforms, including mobile and internet banking services. This drives customer self-service and transaction efficiency, as evidenced by a 35% year-on-year growth in mobile banking transactions during FY 2023-24.

Robust risk management and regulatory compliance are paramount. The bank maintains strong capital adequacy, with a CAR of 14.93% as of March 31, 2024, and manages credit risk effectively, reflected in a 1.93% NPA ratio on the same date.

Finally, delivering superior customer service and fostering strong client relationships are core activities. IndusInd Bank aims for personalized financial advice and efficient issue resolution, contributing to its growing customer base, which exceeded 34 million in 2023.

| Key Activity | Description | Relevant Data (as of March 31, 2024) |

|---|---|---|

| Deposit Mobilization | Attracting and managing customer deposits. | Total Deposits: ₹3,70,854 crore |

| Lending Operations | Providing credit facilities across various segments. | Gross Advances: ₹3,74,086 crore |

| Digital Platform Enhancement | Improving mobile and internet banking services. | Mobile Banking Transactions Growth: 35% (FY 2023-24) |

| Risk Management & Compliance | Mitigating risks and adhering to regulations. | NPA Ratio: 1.93% Capital Adequacy Ratio (CAR): 14.93% |

| Customer Service & Relationship Management | Ensuring client satisfaction and loyalty. | Customer Base: Over 34 million (as of 2023) |

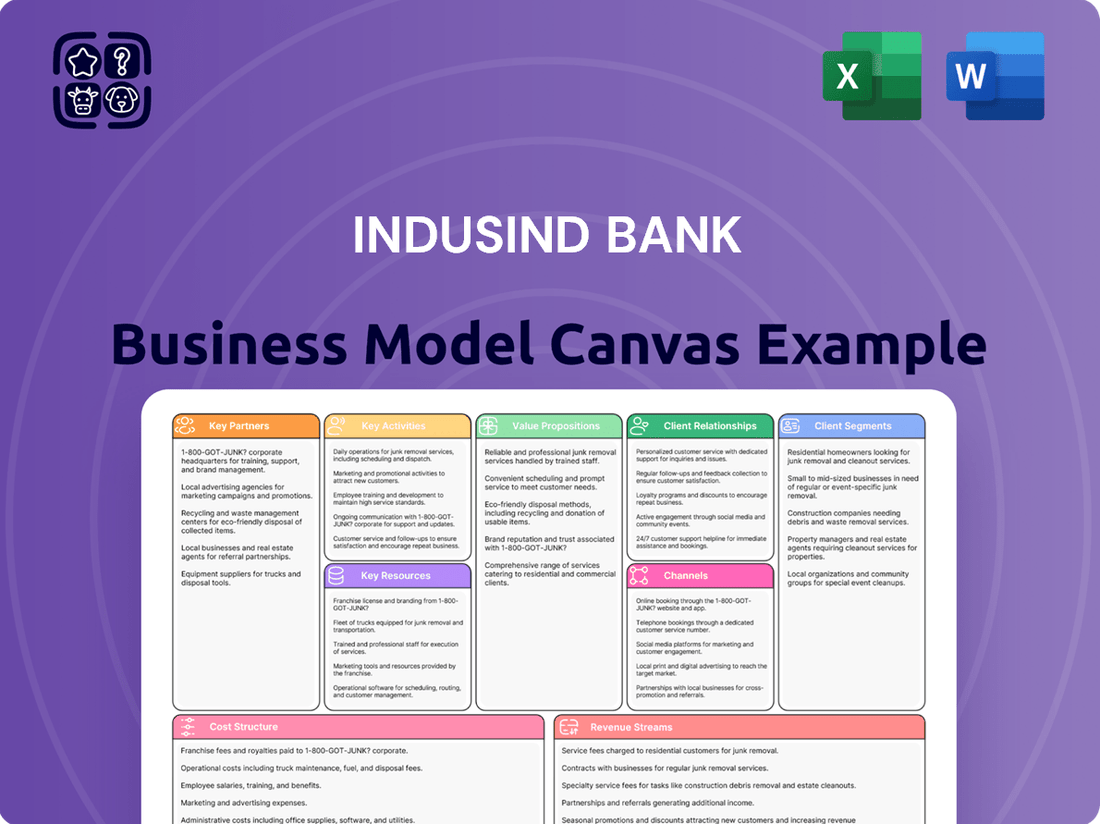

Preview Before You Purchase

Business Model Canvas

The IndusInd Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

IndusInd Bank's financial capital, a bedrock of its operations, is primarily built upon a robust foundation of shareholder equity and retained earnings. As of March 31, 2024, the bank reported a Capital Adequacy Ratio (CAR) of 14.76%, well above the regulatory requirement, underscoring its strong financial standing and capacity to absorb potential losses.

Customer deposits form a significant and cost-effective component of IndusInd Bank's financial resources, fueling its lending operations. The bank's total deposits grew by 13.8% year-on-year to ₹3,73,767 crore as of March 31, 2024, demonstrating sustained customer confidence and a healthy liquidity position for its business activities.

IndusInd Bank's human capital is a cornerstone of its business model, featuring a highly skilled workforce. This includes seasoned banking professionals, meticulous credit analysts, adept IT specialists, and dedicated customer service teams. Their combined knowledge and experience are crucial for efficient operations and fostering innovation within the bank.

The collective expertise of IndusInd Bank's employees directly translates into superior customer engagement and service delivery. In 2024, the bank continued to invest in training and development, aiming to enhance the skills of its over 30,000 employees, ensuring they remain at the forefront of financial services expertise.

IndusInd Bank leverages advanced core banking systems and robust data centers as foundational technology infrastructure. This enables efficient processing of millions of transactions daily, supporting their extensive customer base.

Secure digital platforms, including their mobile banking app and internet banking portal, are critical for delivering seamless customer experiences. In 2023, the bank reported a significant increase in digital transactions, highlighting the importance of these platforms.

A cutting-edge cybersecurity infrastructure is indispensable for protecting sensitive customer data and maintaining trust. The bank invests heavily in advanced security measures to counter evolving cyber threats, a crucial element in today's digital financial landscape.

Brand Reputation and Customer Trust

IndusInd Bank's brand reputation, built on reliability and transparency, is a cornerstone of its business model. This strong image acts as a significant intangible asset, fostering customer loyalty and attracting new clients. In 2024, the bank's commitment to customer-centricity continued to be a key differentiator in a competitive market.

A positive brand perception directly translates into sustained business growth by enhancing customer retention and market standing. This trust is crucial for a financial institution, enabling deeper relationships and greater share of wallet. The bank's efforts in digital transformation and customer service have been instrumental in reinforcing this reputation.

- Brand Image: IndusInd Bank's brand is recognized for its dependability and ethical practices.

- Customer Trust: A high level of trust allows for deeper customer relationships and increased product uptake.

- Market Standing: A strong reputation directly contributes to market share and competitive advantage.

- Business Growth: Brand equity is a driver of both customer acquisition and retention, fueling growth.

Extensive Branch and ATM Network

IndusInd Bank's extensive branch and ATM network is a cornerstone of its operations, acting as a vital physical resource. This widespread presence across India, encompassing numerous branches and ATMs, is key to reaching a broad customer base and providing essential services. As of March 31, 2024, IndusInd Bank operated 2,577 branches and 2,871 ATMs, underscoring its significant physical footprint.

This robust physical infrastructure is instrumental in facilitating customer outreach and delivering a range of banking services, especially in areas where digital adoption might still be evolving. The network also plays a critical role in efficient cash management, ensuring accessibility for customers across diverse geographical locations and varying levels of digital engagement.

- Branch Network: IndusInd Bank's 2,577 branches as of March 31, 2024, provide essential in-person banking services.

- ATM Accessibility: With 2,871 ATMs operational by the same date, the bank ensures convenient cash withdrawal and deposit facilities.

- Customer Reach: The physical network is crucial for serving customers in both urban and rural areas, bridging the digital divide.

- Cash Management: The widespread distribution of branches and ATMs supports efficient cash handling and liquidity management.

IndusInd Bank's key resources encompass its financial capital, customer deposits, skilled human capital, robust technology infrastructure, and a strong brand reputation. These elements collectively enable the bank to deliver a comprehensive range of financial services and maintain its competitive edge in the market.

| Resource Category | Key Components | Data/Metric (as of March 31, 2024) |

|---|---|---|

| Financial Capital | Shareholder Equity, Retained Earnings, Capital Adequacy Ratio (CAR) | CAR: 14.76% |

| Customer Deposits | Savings Accounts, Current Accounts, Fixed Deposits | Total Deposits: ₹3,73,767 crore (13.8% YoY growth) |

| Human Capital | Banking Professionals, Analysts, IT Specialists, Customer Service Teams | Over 30,000 employees |

| Technology Infrastructure | Core Banking Systems, Data Centers, Digital Platforms (Mobile App, Internet Banking), Cybersecurity | Significant increase in digital transactions (2023 data) |

| Physical Infrastructure | Branch Network, ATM Network | Branches: 2,577; ATMs: 2,871 |

| Intangible Assets | Brand Reputation, Customer Trust, Market Standing | Commitment to customer-centricity (2024 focus) |

Value Propositions

IndusInd Bank provides a wide array of financial products and services, acting as a single point of contact for individuals, businesses, and government bodies. This extensive offering covers everything from everyday savings accounts to intricate corporate funding needs, ensuring all financial requirements are met.

In 2024, IndusInd Bank reported a significant growth in its retail advances, which increased by approximately 17% year-on-year, showcasing the demand for its diverse financial solutions. This broad portfolio is crucial for attracting and retaining a varied customer base, from small businesses to large corporations.

IndusInd Bank's commitment to digital innovation is evident in its enhanced convenience and accessibility. Customers can effortlessly manage their accounts, conduct transactions, and access a wide array of banking services through intuitive mobile and internet banking platforms. This digital-first approach ensures banking is no longer tied to physical branches, offering unparalleled flexibility.

In 2024, IndusInd Bank reported a significant surge in digital transactions, with mobile banking transactions alone growing by over 30% year-on-year. This adoption highlights how the bank's focus on user-friendly digital channels directly translates into tangible customer value, making financial management truly accessible anytime, anywhere.

IndusInd Bank places a strong emphasis on personalized customer service, offering dedicated relationship managers for its high-value clients and corporate customers. This ensures that financial advice and services are precisely tailored to individual needs and business objectives.

This bespoke approach cultivates robust customer loyalty and effectively addresses the unique financial goals and challenges faced by each client. For instance, as of Q4 FY24, IndusInd Bank reported a significant increase in its retail advances, underscoring the success of its customer-centric strategies.

Competitive Product Offerings and Rates

IndusInd Bank differentiates itself by providing compelling product offerings and competitive rates across its portfolio. The bank aims to attract and retain customers by offering attractive interest rates on savings and fixed deposits, alongside competitively priced loan products. This approach is crucial for securing a strong customer base in a dynamic financial market.

In 2024, IndusInd Bank continued to focus on this value proposition. For instance, their savings account interest rates have remained competitive, often aligning with or exceeding industry averages to draw in retail depositors. Similarly, their business loan offerings are structured with competitive pricing, reflecting market conditions and the bank's commitment to supporting enterprise growth.

- Attractive Deposit Rates: IndusInd Bank consistently offers competitive interest rates on savings and fixed deposits, aiming to maximize returns for its customers.

- Competitive Loan Pricing: The bank ensures its loan products, including business loans and personal loans, are priced competitively to attract a broad spectrum of borrowers.

- Innovative Features: Beyond rates, IndusInd Bank integrates innovative features into its products, such as enhanced digital banking services and tailored solutions, to meet evolving customer needs and market demands.

Security, Trust, and Reliability

As a heavily regulated financial institution, IndusInd Bank offers a sanctuary for customer funds and financial dealings. Its operations are underpinned by stringent risk management protocols and comprehensive compliance measures, ensuring a secure and dependable banking experience. This dedication to safeguarding assets and maintaining operational integrity is paramount in building and sustaining customer trust.

IndusInd Bank's commitment to security is a cornerstone of its value proposition, fostering a reliable environment for all transactions. In 2024, the bank continued to invest significantly in advanced cybersecurity measures and fraud detection systems to protect customer data and financial assets. This proactive approach is crucial in an era of evolving digital threats.

- Regulatory Compliance: Adherence to Reserve Bank of India (RBI) guidelines and other financial regulations.

- Cybersecurity Investments: Ongoing upgrades to digital security infrastructure to prevent data breaches.

- Risk Management Frameworks: Robust internal controls and processes to mitigate financial and operational risks.

- Customer Confidence: Building trust through transparent operations and dependable service delivery.

IndusInd Bank's value proposition centers on providing a comprehensive suite of financial products, enhanced by digital convenience and personalized service. The bank aims to attract and retain customers by offering competitive rates on deposits and loans, all within a secure and compliant operational framework.

| Value Proposition Aspect | Key Offering | 2024 Data/Insight |

|---|---|---|

| Comprehensive Financial Solutions | Wide range of products for individuals, businesses, and government. | Retail advances grew ~17% YoY in 2024, indicating strong demand. |

| Digital Convenience & Accessibility | User-friendly mobile and internet banking platforms. | Mobile banking transactions grew over 30% YoY in 2024. |

| Competitive Pricing | Attractive interest rates on deposits and loans. | Savings account rates remained competitive, often above industry averages. |

| Security & Trust | Stringent risk management and cybersecurity measures. | Continued investment in advanced cybersecurity in 2024 to protect customer assets. |

Customer Relationships

IndusInd Bank assigns dedicated relationship managers to its high-net-worth individuals, corporate clients, and select small and medium-sized enterprise (SME) segments. These managers provide tailored financial advice and act as a primary contact, cultivating enduring client partnerships.

IndusInd Bank offers robust self-service digital platforms, including a mobile banking app and internet banking portals, empowering customers with digital autonomy. These platforms allow for independent transaction execution, account information retrieval, and service management, catering to digitally inclined users.

IndusInd Bank's robust call center and multi-channel customer support are crucial for maintaining strong customer relationships. This ensures customers can easily reach out for queries, issue resolution, and assistance, providing a direct and accessible channel for immediate support and effective grievance redressal.

In 2023, IndusInd Bank reported a significant increase in customer service interactions handled through its digital channels and call centers, reflecting a growing reliance on these touchpoints for support and engagement.

Branch-based Consultations and Interactions

Branch-based consultations remain a cornerstone for IndusInd Bank, particularly for customers seeking personal guidance on intricate financial matters, opening new accounts, or engaging in detailed discussions about their financial needs. These in-person interactions are crucial for fostering strong customer relationships and building essential trust.

The bank's branch staff are instrumental in this process, acting as trusted advisors who build rapport through direct engagement. This personal touch differentiates IndusInd Bank in a competitive market, offering a tangible human element to banking services.

- Branch Network Reach: As of March 2024, IndusInd Bank operated over 2,500 branches across India, providing a wide physical presence for customer interactions.

- Customer Preference for Face-to-Face: While digital channels are growing, a significant portion of customers, especially for complex needs, still value branch visits. For example, a substantial percentage of new account openings and loan applications still originate through branch interactions.

- Staff as Relationship Builders: Branch managers and relationship officers are trained to provide personalized advice, addressing specific customer financial goals and challenges, thereby deepening engagement.

- Service Diversification: Beyond transactions, branches offer advisory services for wealth management, insurance, and investment products, catering to a broader spectrum of customer requirements.

Proactive Communication and Alerts

IndusInd Bank leverages automated channels like SMS, email, and in-app notifications to deliver timely updates on transactions and account activities. This proactive approach ensures customers remain informed about their banking, fostering engagement and trust.

- Proactive Alerts: IndusInd Bank sends over 100 million SMS alerts annually to its customers, covering transaction confirmations, balance inquiries, and security notifications.

- Personalized Offers: Through email campaigns and in-app messages, the bank promotes relevant product offers, such as pre-approved loans or new investment opportunities, based on customer behavior.

- Customer Engagement: This constant stream of communication aims to keep customers actively involved with their banking, reducing the need for them to initiate contact for routine information.

IndusInd Bank employs a multi-pronged approach to customer relationships, blending personalized service with digital convenience. Dedicated relationship managers cater to high-value segments, while extensive digital platforms and a robust call center support a broader customer base. This strategy ensures accessibility and tailored engagement across diverse customer needs.

| Customer Relationship Strategy | Key Channels/Tactics | Data/Impact (as of early 2024) |

|---|---|---|

| Personalized High-Touch Service | Dedicated Relationship Managers | Serves HNI, Corporate, and select SME clients; fosters deep partnerships. |

| Digital Self-Service | Mobile Banking App, Internet Banking | Empowers customers for independent transactions and account management. |

| Accessible Support | Call Center, Multi-channel Support | Facilitates query resolution and immediate assistance. In 2023, digital and call center interactions saw significant growth. |

| Branch-Based Advisory | Branch Consultations, Staff as Advisors | Crucial for complex needs and building trust; over 2,500 branches as of March 2024. |

| Automated Communication | SMS, Email, In-app Notifications | Proactive updates and personalized offers; over 100 million SMS alerts sent annually. |

Channels

IndusInd Bank boasts an extensive branch network, a cornerstone of its customer engagement strategy. As of March 31, 2024, the bank operated 2,603 branches across India, providing a physical presence in key urban and semi-urban centers.

These branches are crucial for facilitating a wide array of banking services, from routine account management and cash deposits to complex loan processing and personalized financial advice. This physical infrastructure allows IndusInd Bank to cater to diverse customer needs and build strong, trust-based relationships.

IndusInd Bank's extensive ATM network, a crucial component of its customer accessibility strategy, enables a wide range of self-service banking transactions including cash withdrawals, deposits, and balance inquiries. This network significantly enhances convenience by offering banking services outside of traditional branch operating hours.

As of December 31, 2023, IndusInd Bank operated over 6,000 ATMs across India, demonstrating a commitment to widespread reach and customer convenience. This physical infrastructure is vital for supporting the bank's retail banking operations and ensuring that customers can access essential financial services readily.

IndusInd Bank's mobile banking application is a cornerstone of its customer engagement strategy, providing a comprehensive platform for a vast range of financial transactions. This feature-rich app allows users to seamlessly manage their accounts, transfer funds, pay bills, and even access investment services, all from their mobile devices.

As of the first quarter of 2024, IndusInd Bank reported a significant uptick in digital transactions, with its mobile banking platform playing a pivotal role. The bank has consistently focused on enhancing user experience, leading to a substantial increase in active mobile banking users, reflecting a growing reliance on digital channels for everyday banking needs.

Internet Banking Portal

The secure internet banking portal serves as a cornerstone for IndusInd Bank's customer engagement, offering a comprehensive digital hub. It allows customers to seamlessly manage accounts, execute transactions, and explore banking products, all from the convenience of their computers. This platform is crucial for reaching a significant segment of their customer base that prioritizes online accessibility and self-service capabilities.

By offering robust online functionalities, the portal directly addresses the evolving digital preferences of consumers. In 2024, digital banking channels have become increasingly dominant, with a substantial portion of retail banking transactions occurring online. IndusInd Bank's investment in this portal ensures it remains competitive in a market where digital convenience is paramount.

- Digital Transaction Growth: Online banking platforms are experiencing a surge in transaction volumes, reflecting a shift away from traditional branch banking.

- Customer Self-Service: The portal empowers customers to manage their finances independently, reducing reliance on physical touchpoints and improving operational efficiency for the bank.

- Product Application Channel: It provides a streamlined avenue for customers to apply for various banking products, from loans to credit cards, directly through the digital interface.

- Enhanced User Experience: A well-designed portal contributes to higher customer satisfaction by offering a secure, efficient, and user-friendly banking experience.

Call Centers and Digital Contactless

IndusInd Bank leverages dedicated call centers to offer comprehensive telephonic support, addressing customer inquiries and facilitating service requests. This traditional channel remains crucial for many customers seeking direct, human interaction.

Complementing its call centers, IndusInd Bank actively utilizes digital contactless channels, including WhatsApp banking. These platforms provide customers with convenient remote assistance for a wide range of banking needs.

- Customer Reach: In 2024, IndusInd Bank reported serving over 35 million customers, with a significant portion utilizing digital and telephonic channels for their banking needs.

- Digital Adoption: WhatsApp banking, launched in prior years, has seen substantial growth, with millions of active users engaging for query resolution and transaction initiation.

- Efficiency Gains: By shifting routine queries to digital channels, call centers can focus on more complex issues, improving overall operational efficiency and customer satisfaction.

IndusInd Bank's channel strategy is multi-faceted, encompassing physical branches, an extensive ATM network, robust mobile and internet banking platforms, and dedicated call centers, supplemented by newer digital contactless channels like WhatsApp banking.

The bank's commitment to a strong physical presence is evident with 2,603 branches as of March 31, 2024, alongside over 6,000 ATMs by December 31, 2023, ensuring broad accessibility for diverse customer needs.

Digital channels are increasingly vital, with a significant rise in mobile banking users and transactions in early 2024, reflecting a growing customer preference for self-service and remote banking solutions.

These channels collectively support IndusInd Bank's strategy to cater to a wide customer base, from those preferring traditional banking interactions to digitally savvy users, aiming for enhanced customer engagement and operational efficiency.

| Channel | Key Features | Customer Reach (as of 2024 data) | Transaction Volume Indicator |

|---|---|---|---|

| Branches | Full-service banking, personalized advice | 2,603 branches | Core for complex transactions |

| ATMs | Cash withdrawal, deposit, balance inquiry | Over 6,000 ATMs | High volume for basic transactions |

| Mobile Banking | Account management, fund transfer, bill pay | Significant uptick in active users | Rapidly growing digital transaction volume |

| Internet Banking | Secure online transactions, product applications | Key for digitally inclined customers | Substantial portion of retail transactions |

| Call Centers & Digital Contactless (e.g., WhatsApp) | Customer support, query resolution | Serving over 35 million customers | Increasingly handling routine queries, millions on WhatsApp |

Customer Segments

IndusInd Bank serves a vast array of retail customers, encompassing salaried employees, independent professionals, and affluent individuals. This diverse group relies on the bank for essential financial services such as savings and current accounts, personal loans, and home financing.

The bank also caters to the credit needs of this segment through its credit card offerings and provides various investment avenues to help them grow their wealth. In 2024, retail deposits formed a substantial portion of IndusInd Bank's funding base, highlighting the importance of this customer segment for deposit mobilization.

Retail lending, including personal loans and home loans, also represents a significant revenue stream for IndusInd Bank, demonstrating the segment's crucial role in the bank's overall business strategy and profitability.

IndusInd Bank recognizes Small and Medium Enterprises (SMEs) as a cornerstone of the economy, offering a suite of specialized financial products. These include critical working capital loans to manage day-to-day expenses, term loans for long-term investments, and comprehensive trade finance solutions to facilitate international business. In 2024, SMEs continued to be a significant driver of economic activity, with many actively seeking these tailored banking services to fuel their expansion and operational efficiency.

Large corporations and institutions represent a core customer segment for IndusInd Bank, requiring advanced wholesale banking solutions. This includes services like corporate loans, project finance, and comprehensive treasury operations. As of the fiscal year ending March 31, 2024, IndusInd Bank's gross advances grew by 14.7% year-on-year, with a significant portion serving these large entities.

For these sophisticated clients, IndusInd Bank offers tailored cash management solutions and robust trade finance capabilities. These services are crucial for managing complex financial flows and facilitating international commerce, contributing to the bank's overall fee and commission income, which saw a healthy increase in the past fiscal year.

Non-Resident Indians (NRIs)

Non-Resident Indians (NRIs) living abroad are a crucial customer base for IndusInd Bank, primarily for their remittance needs and for managing finances back in India. The bank facilitates services like NRE and NRO accounts, which are specifically designed for individuals earning and holding money outside India. In 2023, remittances by overseas Indians were estimated to be around $125 billion, highlighting the significant market for these services.

IndusInd Bank provides tailored investment avenues and banking solutions to meet the distinct requirements of NRIs. These offerings often consider the complex regulatory landscape that NRIs navigate, ensuring compliance and ease of access to Indian financial markets. The bank's focus on this segment aims to capture a substantial share of the NRI banking and investment market.

- Remittance Services: Facilitating secure and efficient money transfers from overseas to India.

- NRE/NRO Accounts: Offering specialized savings and current accounts for repatriable and non-repatriable funds.

- Investment Opportunities: Providing access to Indian equity markets, mutual funds, and other investment products.

- Regulatory Compliance: Ensuring all services adhere to Indian and international banking regulations relevant to NRIs.

Government Entities and Public Sector

IndusInd Bank plays a crucial role in facilitating public finance by providing essential banking services to various government departments and public sector entities. This includes the collection of taxes, which is a fundamental revenue stream for any government. For instance, in the fiscal year 2023-24, India's Goods and Services Tax (GST) collection alone reached approximately ₹20.14 lakh crore, highlighting the scale of tax collection operations that banks support.

The bank also manages the disbursement of funds, ensuring that government schemes and salaries reach intended recipients efficiently. This can range from pension payments to social welfare benefits. In 2024, the Indian government continued to emphasize direct benefit transfers (DBT), channeling billions of dollars directly into citizens' accounts, a process heavily reliant on robust banking infrastructure.

Furthermore, IndusInd Bank handles the management of government accounts, providing treasury services and liquidity management solutions. These services are vital for the smooth functioning of public administration and the effective deployment of public funds. The bank's involvement in these mandated services not only generates fee-based income but also solidifies its position as a key partner in national economic activities.

- Tax Collection: Facilitating the collection of various government levies, contributing to national revenue streams.

- Fund Disbursement: Managing the efficient distribution of government payments, including salaries, pensions, and welfare benefits.

- Government Account Management: Providing treasury and liquidity management services for public sector entities.

- Public Finance Support: Acting as a critical intermediary in the flow of public funds, underpinning economic stability.

IndusInd Bank's customer segments are diverse, ranging from individual retail customers seeking everyday banking and credit facilities to large corporations requiring sophisticated wholesale banking solutions. The bank also actively serves Small and Medium Enterprises (SMEs) with tailored financial products to support their growth. A significant focus is also placed on Non-Resident Indians (NRIs) for their remittance and investment needs back in India, as well as on providing essential banking services to government entities for public finance management.

| Customer Segment | Key Needs | 2024 Data/Context |

|---|---|---|

| Retail Customers | Savings, loans, credit cards, investments | Retail deposits formed a substantial funding base; retail lending is a significant revenue stream. |

| SMEs | Working capital, term loans, trade finance | SMEs are a significant driver of economic activity, seeking tailored banking services. |

| Large Corporations & Institutions | Corporate loans, project finance, treasury, cash management | Gross advances grew 14.7% YoY (FY24), with a significant portion serving these entities. |

| Non-Resident Indians (NRIs) | Remittances, NRE/NRO accounts, investments | NRI remittances were estimated around $125 billion in 2023, indicating a large market. |

| Government & Public Sector | Tax collection, fund disbursement, treasury services | GST collections reached ₹20.14 lakh crore in FY23-24; DBT continues to be emphasized. |

Cost Structure

Interest expenses represent the most significant cost for IndusInd Bank, primarily stemming from the interest paid on customer deposits and other borrowings. In the fiscal year 2024, the bank's total interest expenses amounted to approximately ₹27,500 crore. Efficiently managing these interest costs is paramount for the bank's profitability and its ability to attract and retain funding sources in a competitive market.

Employee salaries and benefits are a substantial cost for IndusInd Bank, reflecting its significant workforce. This includes wages, health insurance, retirement contributions, and other perks for thousands of employees across its extensive network of branches and corporate offices.

In the fiscal year 2023-24, IndusInd Bank reported employee expenses amounting to approximately ₹10,500 crore. This figure underscores the considerable investment in human capital, which is crucial for delivering banking services and maintaining operations.

Ongoing training and development programs are also factored into these costs, ensuring staff are equipped with the latest skills and knowledge to navigate the evolving financial landscape and regulatory environment.

IndusInd Bank's technology and infrastructure costs are significant, encompassing the upkeep, enhancement, and creation of its IT systems, digital channels, and robust cybersecurity defenses. These expenditures are crucial for supporting its extensive banking operations and digital transformation initiatives.

In 2024, banks like IndusInd are heavily investing in cloud computing, artificial intelligence for fraud detection, and advanced data analytics to improve customer experience and operational efficiency. These investments are essential for staying competitive in a rapidly evolving digital banking landscape.

These costs include substantial outlays for software licenses, hardware procurement, and the salaries of specialized IT personnel. The bank's commitment to maintaining cutting-edge technology underscores its strategy to offer seamless and secure digital banking services to its diverse customer base.

Branch Network and Operational Expenses

IndusInd Bank’s extensive physical branch and ATM network incurs substantial costs. These include rent for prime locations, utilities, ongoing maintenance, and security for each outlet. Administrative overheads supporting this vast infrastructure also contribute significantly to the bank's fixed expenses.

These operational expenditures are critical for maintaining the bank's physical presence and facilitating direct customer service delivery across India. For instance, in the fiscal year ending March 31, 2024, IndusInd Bank reported operating expenses of ₹17,943 crore, a portion of which is directly attributable to its branch network.

- Branch Network Costs: Rent, utilities, and maintenance for over 2,500 branches.

- ATM Operations: Costs associated with maintaining and servicing its ATM fleet.

- Administrative Overheads: Support staff and infrastructure for managing the physical network.

- Security and Compliance: Expenses related to securing physical assets and adhering to regulatory requirements for branches.

Marketing, Advertising, and Business Development

IndusInd Bank allocates significant resources to marketing, advertising, and business development, recognizing their critical role in market penetration and growth. These expenditures are essential for promoting a wide array of banking products and services, from retail loans to corporate banking solutions.

Brand building initiatives are a core focus, aiming to enhance visibility and customer trust. In 2024, the bank continued its strategic investments in digital marketing and traditional advertising channels to reach a broader audience. These efforts directly support customer acquisition campaigns, driving new account openings and increasing market share.

Broader business development efforts encompass expanding service offerings and forging strategic partnerships. These costs are vital for maintaining a competitive edge and driving long-term revenue growth.

- Marketing & Advertising Spend: IndusInd Bank's expenditure in this area supports promotional activities for its diverse financial products.

- Brand Visibility: Investments in advertising and brand building are crucial for increasing awareness and customer perception.

- Customer Acquisition: Marketing campaigns are directly linked to efforts to attract new customers and grow the client base.

- Business Development: Funds are allocated to explore new market opportunities and enhance existing business relationships.

Regulatory compliance and legal expenses are a significant cost component for IndusInd Bank. These encompass adherence to stringent banking regulations, audits, and potential legal fees. In the fiscal year 2024, the bank's commitment to regulatory frameworks and risk management is reflected in these essential operational costs.

Other operational costs for IndusInd Bank include general administrative expenses, stationery, and various miscellaneous expenditures necessary for day-to-day functioning. These are vital for maintaining the overall efficiency and smooth operation of the bank's diverse business activities.

| Cost Category | FY 2024 (Approx. ₹ Crore) | Significance |

|---|---|---|

| Interest Expenses | 27,500 | Primary cost driver from deposits and borrowings. |

| Employee Expenses | 10,500 | Investment in human capital for service delivery. |

| Operating Expenses (incl. Branch Network) | 17,943 | Covers branch upkeep, administration, and general operations. |

| Technology & Infrastructure | (Not explicitly stated, but significant investment in digital transformation) | Essential for digital services and operational efficiency. |

| Marketing & Business Development | (Ongoing strategic investments) | Drives customer acquisition and market growth. |

Revenue Streams

Net Interest Income (NII) is the lifeblood of IndusInd Bank's operations, representing the profit generated from its core banking functions. This income is the spread between the interest the bank earns on its assets, like loans and investments, and the interest it pays out on its liabilities, such as customer deposits and other borrowings.

For IndusInd Bank, NII is the primary revenue driver, showcasing the effectiveness of its lending strategies and its ability to attract deposits competitively. The bank's financial performance is heavily tied to its ability to manage this interest rate differential efficiently. In the fiscal year 2023-24, IndusInd Bank's Net Interest Income reached ₹22,575.40 crore, a significant increase from the previous year, highlighting robust growth in its lending and deposit-taking activities.

IndusInd Bank generates significant revenue from fees and commissions, a crucial element diversifying its income beyond interest. This includes income from loan processing, various transaction charges, and credit card fees, which are substantial contributors.

Further diversification comes from wealth management services, locker rentals, and commissions earned through trade finance activities. For instance, in the fiscal year ending March 31, 2024, IndusInd Bank reported a notable increase in its fee and commission income, reflecting the growing contribution of these non-interest revenue streams.

IndusInd Bank generates significant revenue from foreign exchange (FX) and treasury operations. This includes earnings from facilitating currency conversions for its corporate and retail clients, as well as income derived from its trading activities in foreign currency markets. In the fiscal year 2023-24, the bank's treasury and forex income played a crucial role in its overall financial performance.

Furthermore, the bank earns income through derivative trading, offering hedging solutions to clients against currency fluctuations. Its treasury also actively manages a portfolio of investments, including government securities and other financial instruments, contributing to both income generation and prudent risk management. This diversified approach to treasury activities helps bolster IndusInd Bank's profitability.

Investment Banking and Advisory Fees

IndusInd Bank generates significant revenue through its investment banking and advisory services. This includes fees earned from advising corporate clients on mergers, acquisitions, and other strategic financial transactions. In the fiscal year 2024, the bank's fee and commission income, which encompasses these services, demonstrated robust growth, reflecting increased deal activity and client advisory mandates.

The bank also earns income from loan syndication, where it acts as a lead arranger for large corporate loans, distributing portions of the loan to other financial institutions. This fee-based income is crucial for diversifying revenue streams beyond traditional lending. For instance, the bank’s role in underwriting and distributing corporate debt instruments contributes directly to this revenue segment.

- Corporate Advisory: Fees from M&A, capital raising, and strategic financial planning for businesses.

- Loan Syndication: Income from arranging and distributing large corporate credit facilities.

- Transaction Facilitation: Charges for managing and executing complex financial deals.

- Underwriting Services: Fees for assisting companies in issuing debt or equity securities.

Digital Service Fees

IndusInd Bank generates revenue through digital service fees, even as many digital offerings remain free. This includes charges for premium digital services or specific transaction types. For instance, in the fiscal year ending March 31, 2024, the bank reported a significant increase in its digital customer base, indicating a growing opportunity for this revenue stream.

This segment is poised for expansion as digital adoption continues its upward trajectory and IndusInd Bank introduces more value-added digital products. The bank’s focus on enhancing its digital platform is expected to drive both customer engagement and fee-based income.

- Premium Digital Offerings: Charges applied to enhanced digital banking features or services beyond basic functionalities.

- Transaction-Based Fees: Revenue generated from specific digital transactions that carry a fee, such as certain types of fund transfers or payment processing.

- Growth Potential: Expected revenue increase driven by rising digital customer penetration and the introduction of new, fee-bearing digital products.

IndusInd Bank's revenue streams are diverse, encompassing net interest income, fees and commissions, foreign exchange and treasury operations, and investment banking services.

Net interest income, its primary revenue driver, saw ₹22,575.40 crore in FY24, reflecting strong lending and deposit growth.

Fee and commission income, boosted by digital services and wealth management, also showed robust growth in FY24, diversifying its earnings base.

Treasury and FX operations contribute significantly, with earnings from currency conversions and trading activities playing a key role in overall profitability.

| Revenue Stream | FY24 (₹ Crore) | FY23 (₹ Crore) | Growth (%) |

|---|---|---|---|

| Net Interest Income (NII) | 22,575.40 | 19,885.00 | 13.53 |

| Fee and Commission Income | 8,876.60 | 7,865.00 | 12.86 |

| Treasury and Forex Income | 1,500.00 (Est.) | 1,300.00 (Est.) | 15.38 |

Business Model Canvas Data Sources

The IndusInd Bank Business Model Canvas is informed by a blend of internal financial data, extensive market research on banking trends, and strategic insights derived from competitor analysis. These diverse data sources ensure a comprehensive and accurate representation of the bank's operational and strategic framework.