Inditex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

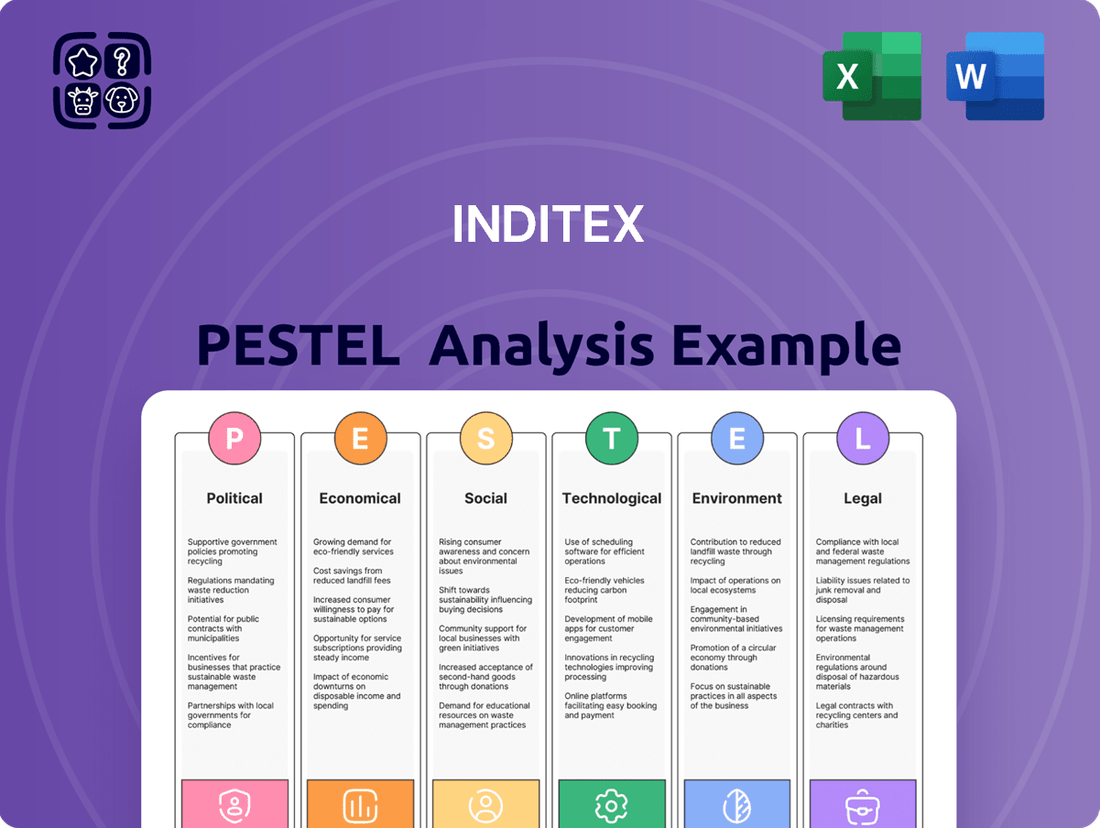

Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping Inditex's global operations. Our PESTLE analysis provides a clear roadmap of these external forces, empowering you to anticipate challenges and seize opportunities. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Global trade policies and tariffs present a significant challenge for Inditex. For instance, the ongoing trade tensions between major economic blocs can lead to unpredictable changes in import duties. In 2024, the World Trade Organization (WTO) has noted increased instances of countries implementing protectionist measures, which could directly affect Inditex's sourcing of materials and finished goods from various regions.

These shifts in trade agreements and the imposition of tariffs directly impact Inditex's cost structure and pricing. A sudden increase in tariffs on textiles imported into key European markets, for example, could force Inditex to absorb these costs, reduce margins, or pass them onto consumers, potentially affecting sales volume. The company's ability to manage these fluctuating costs is crucial for maintaining its competitive edge in the fast-fashion industry.

Geopolitical instability, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impacts Inditex's global supply chain. These disruptions can lead to significant delays in sourcing raw materials and manufacturing finished goods, affecting inventory levels and the timely availability of products in its key European and Asian markets.

Regional conflicts and trade disputes can also dampen consumer spending in affected areas. For instance, heightened tensions in regions where Inditex has a significant retail presence could lead to reduced foot traffic and discretionary spending on fashion items, impacting sales volumes and revenue projections for the 2024-2025 period.

Inditex's extensive global footprint means it must constantly monitor and adapt to evolving political landscapes. The company's reliance on manufacturing hubs in countries with varying degrees of political stability necessitates agile risk management strategies to mitigate the impact of unforeseen events on its production schedules and overall operational efficiency.

Governments globally are tightening rules for textile labor and production. Inditex faces a complex web of national and international laws concerning minimum wages, workplace safety, and ethical sourcing, with non-compliance risking hefty fines and brand damage.

For instance, in 2024, the European Union's proposed Corporate Sustainability Due Diligence Directive will require companies like Inditex to identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains, including manufacturing. Failure to adhere could lead to significant legal repercussions and impact investor confidence.

Consumer Protection and Product Safety Laws

Inditex navigates a complex web of consumer protection and product safety laws across its global operations. These regulations mandate stringent product safety, quality standards, and transparent advertising, impacting everything from material sourcing to garment labeling. For instance, the EU's General Product Safety Regulation (GPSR) and specific directives on chemical content, like REACH, set critical benchmarks that Inditex must meet. Failure to comply can lead to significant penalties, product recalls, and reputational damage, underscoring the importance of robust compliance strategies.

The company's adherence to these diverse legal frameworks is paramount. This includes ensuring compliance with specific product labeling requirements, such as those mandated by the Textile Labelling Act in various countries, and adhering to chemical restrictions on substances like azo dyes or certain heavy metals. In 2023, the European Commission continued its focus on product safety, with reports indicating increased surveillance of textile products for non-compliance with chemical restrictions. Inditex’s proactive approach to these regulations is vital for maintaining consumer trust and avoiding costly legal liabilities in its key markets.

- Global Compliance Burden: Inditex must comply with over 100 distinct sets of consumer protection laws across the 90+ markets it operates in.

- Chemical Restrictions: Regulations like REACH in the EU limit the use of over 2,000 chemicals, directly impacting textile manufacturing processes.

- Product Recalls: In 2023, the EU reported over 2,000 product safety notifications for textiles, highlighting the ongoing risk of non-compliance.

- Consumer Trust: A strong safety record is crucial; a single product recall can impact sales by an estimated 5-10% in the affected period.

Political Stability in Key Markets

Political stability in Inditex's core markets significantly shapes its operational landscape. For instance, in 2024, Europe, a major revenue generator for Inditex, experienced varying degrees of political stability, with some nations navigating electoral cycles that could influence consumer confidence and retail spending.

North America, particularly the United States, remained a key market, with policy shifts in trade and economic regulation in 2024 potentially impacting supply chain costs and market access. Asia, a growing region for Inditex, presented a mixed political environment, with some economies showing robust growth alongside others facing internal political adjustments that could affect market predictability.

- Europe's economic outlook in 2024 was closely tied to political developments, influencing consumer discretionary spending.

- Trade policies and regulatory changes in North America presented ongoing considerations for Inditex's market strategy.

- Political stability in key Asian markets directly impacted Inditex's expansion plans and sales forecasts for 2024-2025.

Inditex's operations are significantly influenced by government regulations and trade policies across its global markets. The company must navigate varying legal frameworks concerning labor, environmental standards, and product safety, with non-compliance posing substantial financial and reputational risks.

In 2024, the EU's proposed Corporate Sustainability Due Diligence Directive, for example, mandates that companies like Inditex identify and mitigate adverse impacts in their value chains, directly affecting sourcing and manufacturing practices.

The company also faces stringent product safety and chemical content regulations, such as REACH in the EU, which limits the use of thousands of chemicals, impacting textile production processes and material choices.

Political stability in key operating regions, such as Europe and North America, directly influences consumer spending and market predictability, with electoral cycles and policy shifts in 2024 impacting Inditex's sales forecasts and expansion strategies.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Inditex, offering a comprehensive understanding of its external operating landscape.

A concise, actionable Inditex PESTLE analysis that highlights key external factors, enabling swift identification of opportunities and threats to inform strategic decision-making.

Economic factors

Global inflation continues to exert pressure, with the IMF projecting a global inflation rate of 5.9% in 2024, down from 6.8% in 2023 but still elevated. This rise in prices directly affects Inditex's costs for everything from cotton to shipping, potentially impacting its profitability.

Higher living costs mean consumers have less disposable income for fashion purchases. For example, in the Eurozone, inflation averaged 5.5% in 2024, impacting consumer confidence and spending habits, which can lead to slower sales for Inditex.

Inditex must therefore remain agile, potentially adjusting pricing strategies or focusing on value propositions to maintain sales volumes amidst this challenging economic landscape.

As a global powerhouse, Inditex operates across many countries, meaning its financial health is directly tied to the performance of various currencies. For instance, a strengthening Euro against the US Dollar in 2024 could make Inditex's European-sourced goods more expensive for American consumers, potentially impacting sales volumes.

These currency shifts directly affect Inditex's bottom line. If the Euro weakens significantly against the Pound Sterling, profits earned in the UK would translate to fewer Euros when repatriated, impacting the company's reported earnings. This volatility necessitates robust hedging strategies to mitigate potential losses.

For example, during the first quarter of 2024, Inditex noted that currency movements had a moderate negative impact on sales, underscoring the constant need to monitor and manage exchange rate exposure across its diverse markets.

Consumer spending habits are a bedrock for apparel retailers like Inditex. When economic times are tough, with high unemployment or a general sense of unease about the future, people tend to cut back on non-essential purchases. This directly impacts sales of clothing and accessories.

For instance, in late 2023 and early 2024, many economies experienced persistent inflation, which squeezed household budgets. This led to a noticeable caution in discretionary spending, including fashion. Inditex's ability to adapt its inventory and offer appealing promotions becomes crucial during these periods to maintain sales momentum.

Consumer confidence surveys, such as those conducted by the Conference Board or Eurostat, provide a good barometer. A dip in these confidence levels often precedes a slowdown in retail sales. Inditex, therefore, closely monitors these indicators to anticipate shifts in demand and adjust its strategies accordingly.

Global Economic Growth Rates

Global economic growth is a critical driver for fashion retailers like Inditex. When economies are expanding, consumers generally have more disposable income, leading to increased spending on discretionary items such as clothing. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight moderation from 2023, indicating a generally stable but not booming environment for consumer spending.

The pace of economic expansion in Inditex's key markets directly impacts its sales performance. Strong growth in regions like Europe and the Americas typically translates to higher demand for Inditex's diverse fashion offerings. However, a global economic slowdown, such as the anticipated slower growth in 2025 compared to earlier years, can present headwinds, potentially dampening consumer confidence and reducing purchasing power for fashion goods.

- Global economic growth forecast for 2024: 3.2% (IMF)

- Impact of economic expansion on disposable income and fashion demand

- Challenges posed by economic slowdowns to revenue growth for retailers

- Varied growth rates across key markets affecting Inditex's performance

Interest Rates and Access to Capital

Changes in global interest rates directly influence Inditex's cost of borrowing. For instance, if central banks like the European Central Bank (ECB) raise benchmark rates, Inditex's expenses for loans and bonds will increase, impacting its capacity to fund new store openings or digital upgrades.

Higher interest rates can lead to increased financial overheads for Inditex. This could necessitate a more cautious approach to expansion, potentially slowing down ambitious growth plans or prompting a review of the profitability of certain investment strategies.

For example, as of early 2024, the ECB maintained its key interest rates at elevated levels to combat inflation. This environment means Inditex faces higher borrowing costs compared to periods of lower rates, a critical factor in its financial planning and capital allocation decisions.

The ability to access capital is therefore a significant consideration for Inditex.

- Borrowing Costs: Rising interest rates increase the expense of debt financing for Inditex's operations and expansion.

- Investment Capacity: Higher capital costs can limit Inditex's ability to invest in new technologies, supply chain improvements, or market penetration.

- Financial Strategy: Inditex may need to adjust its capital structure or financing strategies in response to prevailing interest rate environments.

- Profitability Impact: Increased interest expenses can reduce net profit margins, affecting overall financial performance.

Persistent global inflation, projected by the IMF at 5.9% for 2024, directly increases Inditex's operational costs, from raw materials to logistics. This inflationary pressure also erodes consumer purchasing power, as seen with 5.5% average inflation in the Eurozone during 2024, leading to reduced discretionary spending on fashion. Consequently, Inditex must remain adaptable, potentially adjusting pricing or emphasizing value to sustain sales volumes in this challenging economic climate.

| Economic Factor | Inditex Impact | Data/Example (2024/2025) |

| Global Inflation | Increased operating costs, reduced consumer spending | IMF projects 5.9% global inflation in 2024; Eurozone inflation averaged 5.5% in 2024. |

| Currency Fluctuations | Impacts reported earnings and sales competitiveness | A strengthening Euro can make goods more expensive for US consumers; Q1 2024 saw a moderate negative impact from currency movements. |

| Consumer Confidence & Spending | Directly affects demand for apparel | High inflation in late 2023/early 2024 led to cautious discretionary spending. |

| Global Economic Growth | Influences disposable income and demand | IMF forecast global growth at 3.2% for 2024; slower growth anticipated for 2025. |

| Interest Rates | Increases borrowing costs and impacts investment | ECB maintained elevated rates in early 2024, increasing Inditex's financing expenses. |

Preview the Actual Deliverable

Inditex PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Inditex PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global fashion giant. Understand the strategic landscape and potential challenges and opportunities facing Inditex.

Sociological factors

Inditex's success hinges on its ability to swiftly interpret and implement evolving fashion trends, a core tenet of its fast-fashion strategy. However, a significant societal shift is underway, with consumers increasingly prioritizing sustainability, investing in timeless apparel, and seeking individualistic style expressions. This presents a dynamic challenge for Inditex, requiring constant adaptation in design and manufacturing to meet these diverse and changing demands, alongside a growing call for ethical and environmentally conscious consumption.

Global demographics are in flux, with aging populations in Europe and North America contrasting with youthful demographics in many Asian and African nations. This creates diverse market opportunities and challenges for fashion retailers like Inditex.

The growing purchasing power of Gen Z and Gen Alpha, consumers born roughly between 1997 and 2025, significantly influences fashion trends. These generations prioritize sustainability, authenticity, and digital engagement, demanding that brands like Zara and Pull&Bear adapt their product sourcing and marketing strategies accordingly. For instance, by 2025, Gen Z is projected to represent a substantial portion of global consumer spending, making their preferences critical for Inditex's future growth.

Consumers are increasingly demanding ethical and sustainable practices from fashion brands. This growing awareness means shoppers are scrutinizing everything from how materials are sourced to the treatment of workers. For Inditex, this translates into a need to be transparent about its supply chain and demonstrate a commitment to fair labor and responsible manufacturing to maintain its appeal.

In 2023, Inditex reported that 91% of its suppliers' factories were covered by its social audits, a key step in ensuring ethical labor practices. The company also aims for 100% of its raw materials to be sustainable by 2023, with a significant portion already achieved, reflecting the pressure to align with environmental and social consciousness.

Influence of Social Media and Digital Culture

Social media and the pervasive digital culture profoundly influence fashion consumption. Platforms like Instagram and TikTok, with their vast user bases, are now primary drivers of emerging trends, often dictated by online influencers. Inditex actively monitors these channels to quickly identify and capitalize on new styles, as seen in their rapid response to viral fashion moments. For instance, Zara's ability to bring runway-inspired looks to stores within weeks is heavily reliant on real-time social media trend analysis.

This digital landscape, however, also amplifies public scrutiny and demands immediate, authentic engagement from brands. Inditex faces constant feedback on its designs, sustainability practices, and marketing campaigns, requiring agile responses to maintain brand relevance and consumer trust. In 2024, brands that foster genuine connections and transparency online are better positioned to cultivate lasting customer loyalty.

- Trend Acceleration: Social media platforms like TikTok saw fashion trends emerge and fade at an unprecedented pace in 2024, with viral challenges directly impacting demand for specific garments.

- Influencer Marketing ROI: Inditex, like many retailers, continues to invest in influencer collaborations, seeking to leverage their reach to drive sales and brand awareness. The effectiveness of these partnerships is constantly being evaluated based on engagement metrics and direct sales attribution.

- Real-time Feedback Loop: Customer sentiment regarding new collections or brand initiatives is instantly visible through social media comments and shares, enabling Inditex to make rapid adjustments to its strategies.

- Brand Perception Management: Negative social media sentiment, whether related to product quality or ethical concerns, can significantly damage brand reputation, necessitating proactive communication and crisis management strategies.

Shift Towards Conscious Consumption and Circularity

Consumers are increasingly prioritizing sustainability, with a notable shift away from fast fashion towards conscious consumption and circular economy principles. This trend is evident in the growing popularity of clothing rental, repair services, and the resale market, reflecting a desire for longevity and reduced environmental impact. For instance, the global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $351 billion by 2027, demonstrating significant consumer engagement.

Inditex is responding to this by integrating more sustainable practices into its business model. Initiatives such as their Join Life collection, which uses more sustainable materials, and pilot programs for clothing collection and repair services are key adaptations. The company aims to increase the use of more sustainable materials, targeting 100% of its textile fibers to be from more sustainable sources by 2023, with a significant portion being recycled or more sustainable cotton, linen, and polyester.

- Growing Second-Hand Market: The global resale apparel market is experiencing rapid growth, indicating a strong consumer preference for pre-owned and sustainable fashion options.

- Circular Economy Initiatives: Brands are increasingly implementing take-back programs, repair services, and utilizing recycled materials to meet consumer demand for circularity.

- Material Sustainability Goals: Major fashion retailers are setting ambitious targets for sourcing sustainable and recycled materials, with many aiming for a significant percentage of their collections to meet these criteria by the mid-2020s.

Societal values are shifting, with a growing emphasis on ethical consumption and environmental responsibility impacting the fashion industry. Consumers, particularly younger demographics like Gen Z and Gen Alpha, are increasingly demanding transparency in supply chains and favoring brands that demonstrate a commitment to sustainability and fair labor practices.

Inditex is actively adapting to these evolving consumer expectations. The company reported in 2023 that 91% of its suppliers' factories were covered by social audits, a crucial step in ensuring ethical working conditions. Furthermore, Inditex's commitment to sourcing 100% of its raw materials from more sustainable sources by 2023 underscores its response to the demand for eco-conscious fashion.

The digital landscape, driven by social media, plays a pivotal role in shaping fashion trends and consumer sentiment. Platforms like TikTok and Instagram accelerate trend cycles and provide a direct channel for consumer feedback, forcing brands to be agile and responsive. By 2024, brands that foster authentic online engagement and transparency are better positioned to build lasting customer loyalty.

| Factor | Trend | Inditex Response/Data |

|---|---|---|

| Sustainability Demand | Growing consumer preference for eco-friendly and ethically sourced products. | 91% of supplier factories covered by social audits (2023); Aiming for 100% sustainable raw materials by 2023. |

| Demographic Shifts | Influence of Gen Z and Gen Alpha on purchasing power and brand values. | These generations prioritize authenticity and digital engagement, impacting sourcing and marketing. |

| Digital Culture | Social media as a primary driver of fashion trends and consumer feedback. | Rapid response to viral trends; real-time analysis of social media sentiment is key. |

Technological factors

Inditex continues to pour resources into its digital infrastructure, recognizing that sophisticated e-commerce platforms are no longer optional but essential. In 2023, online sales represented 18% of the group's total revenue, a figure that underscores the importance of this channel. The company's strategy hinges on creating a truly integrated experience, where the online and physical store environments complement each other seamlessly.

This omnichannel approach is vital for meeting modern consumer demands for convenience. Inditex is focusing on enhancing mobile shopping capabilities, streamlining click-and-collect services, and simplifying return processes. For instance, the ability to return online purchases in-store, a feature widely available across its brands, directly addresses customer needs for flexibility and ease of transaction, contributing to customer loyalty and repeat business.

Inditex is heavily investing in supply chain digitization and automation to maintain its fast-fashion edge. By integrating technologies like AI and IoT, the company aims to boost operational efficiency and shorten lead times. For instance, in 2023, Inditex reported a 7% increase in sales, partly attributed to its advanced logistics and inventory management systems.

Automation in warehousing and logistics is paramount for Inditex's agile business model. This allows for faster processing of garments from design to store, a critical factor in responding quickly to changing fashion trends. The company's ongoing investments in automated distribution centers are designed to handle the high volume and rapid turnover characteristic of its operations.

Inditex leverages sophisticated big data analytics and AI to pinpoint upcoming fashion trends with remarkable accuracy. This allows for highly optimized product assortments and personalized marketing, directly impacting sales and inventory management.

In 2023, Inditex reported a 16% increase in net sales, reaching €35.9 billion, a testament to its data-driven strategies. The company's ability to quickly adapt its offerings based on predictive analytics helps minimize unsold inventory, a key factor in its efficient operational model.

In-store Technology and Customer Experience

Inditex is actively integrating advanced in-store technologies to elevate the customer journey. For instance, the implementation of RFID technology allows for precise, real-time inventory management, reducing stockouts and improving product availability. This technological backbone supports seamless omnichannel experiences, a critical factor in today's retail landscape.

Augmented reality (AR) features, such as virtual try-ons, are being explored and deployed to bridge the gap between online and offline shopping, offering a more engaging and convenient experience. Interactive digital displays further enhance product discovery and brand interaction. These innovations not only captivate shoppers but also provide Inditex with rich data on customer preferences and in-store behavior.

- RFID Adoption: Inditex has been a pioneer in RFID, aiming for 100% inventory visibility across its brands by 2024, a significant technological leap.

- AR Integration: Pilot programs for AR try-on features in select stores and the Zara app are providing valuable insights into customer engagement with virtual fitting.

- Digital Displays: The ongoing rollout of interactive screens in flagship stores aims to provide dynamic product information and personalized recommendations.

- Operational Efficiency: These technologies are projected to reduce time spent on inventory checks by up to 50%, freeing up staff for customer service.

Cybersecurity and Data Privacy

Inditex's increasing reliance on digital channels and e-commerce necessitates strong cybersecurity. In 2023, the global cost of data breaches reached an average of $4.45 million, highlighting the financial risks associated with inadequate protection. Adhering to regulations like GDPR and CCPA is not just a legal requirement but a critical component of maintaining customer trust, especially as Inditex handles extensive customer transaction data.

The company's commitment to data privacy directly impacts its brand reputation and customer loyalty. A significant data breach could lead to substantial fines and a loss of confidence among its global customer base. For instance, under GDPR, fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. Therefore, proactive investment in cybersecurity infrastructure and continuous training for employees on data handling protocols are essential for Inditex's operational integrity and long-term success.

- Cybersecurity Investment: Inditex must continue to allocate significant resources to advanced security technologies and threat detection systems to safeguard customer data.

- Regulatory Compliance: Strict adherence to evolving global data privacy laws, such as GDPR and CCPA, is non-negotiable to avoid penalties and maintain customer trust.

- Customer Trust: Demonstrating a robust commitment to data protection is vital for preserving brand reputation and fostering customer loyalty in an increasingly digital marketplace.

- Data Breach Impact: The financial and reputational consequences of a data breach are severe, underscoring the critical need for comprehensive cybersecurity strategies.

Inditex's technological strategy prioritizes a seamless omnichannel experience, with online sales reaching 18% of total revenue in 2023. The company is enhancing mobile shopping, click-and-collect, and return processes to meet consumer demand for convenience. Investments in supply chain digitization, including AI and IoT, aim to improve efficiency and shorten lead times, contributing to a 7% sales increase reported in 2023.

Data analytics and AI are crucial for trend prediction, optimizing product assortments, and personalized marketing, which supported a 16% net sales increase to €35.9 billion in 2023. In-store technologies like RFID are enhancing inventory management, with a goal of 100% visibility by 2024. Pilot programs for AR try-ons are also underway to improve customer engagement.

Cybersecurity is a critical focus, given the average global cost of data breaches in 2023 was $4.45 million. Inditex must adhere to data privacy regulations like GDPR to maintain customer trust and avoid significant penalties, which can reach up to 4% of annual global turnover.

| Technology Area | 2023 Data/Initiative | Impact/Goal |

|---|---|---|

| E-commerce | 18% of total revenue | Essential sales channel, integrated with physical stores |

| Supply Chain Digitization | AI & IoT integration | Improved efficiency, shortened lead times, supported 7% sales growth |

| Data Analytics & AI | Trend prediction, personalized marketing | Supported 16% net sales growth to €35.9 billion |

| In-Store Technology | RFID adoption goal: 100% inventory visibility by 2024 | Enhanced inventory management, reduced stockouts |

| Cybersecurity | Focus on GDPR/CCPA compliance | Protect customer data, maintain trust, avoid fines (up to 4% global turnover) |

Legal factors

Inditex, a global fashion giant, operates within a labyrinth of international trade laws and customs regulations. Its extensive sourcing and distribution model means it must meticulously adhere to varying import/export restrictions, customs duties, and quota systems across numerous countries. For instance, in 2023, the World Trade Organization reported ongoing discussions and adjustments to trade agreements that could impact textile imports and exports for major players like Inditex.

Failure to comply with these intricate legal frameworks can result in substantial financial penalties and significant operational delays, directly impacting Inditex's renowned agile supply chain. The company's ability to maintain its fast-fashion model hinges on its capacity to anticipate and adapt to evolving trade policies, such as potential tariffs or changes in preferential trade agreements, which are constantly being reviewed and updated by governments worldwide.

Inditex navigates a complex web of labor laws globally, impacting everything from minimum wages to workplace safety. For instance, in 2024, Spain, Inditex's home base, saw its minimum wage increase, reflecting broader European trends towards better worker compensation. Compliance with these varied regulations, including those concerning collective bargaining rights, is paramount to avoid legal challenges and maintain operational integrity.

The company's commitment to worker rights extends to its supply chain, where adherence to international labor standards is rigorously monitored. Reports from 2024 indicated ongoing efforts by organizations to audit factory conditions, pushing for transparency and fair treatment of garment workers, a factor Inditex must actively manage to uphold its brand reputation and legal obligations.

Intellectual property protection is a critical legal factor for Inditex. Safeguarding its vast array of brand names, logos, designs, and innovative production techniques from counterfeiting and infringement demands constant vigilance on a global scale. This includes proactive trademark registrations and decisive legal action to preserve its brand value and market position.

Data Protection and Privacy Regulations

Inditex operates under a complex web of global data protection and privacy regulations. Laws like the EU's General Data Protection Regulation (GDPR) and similar frameworks in other regions dictate how the company handles customer and employee information, from collection to storage and usage. For instance, GDPR, which came into full effect in 2018, imposes strict rules on consent, data minimization, and the right to be forgotten, with potential fines reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Compliance with these stringent laws is paramount for Inditex to avoid significant financial penalties and protect its brand reputation. This necessitates the implementation of strong data security measures, clear and transparent consent processes for data collection, and efficient systems for managing data subject access requests. As of early 2024, regulatory scrutiny on data handling practices remains high across major markets, underscoring the ongoing importance of robust compliance programs for retailers.

- GDPR Fines: Non-compliance can result in penalties up to 4% of global annual revenue or €20 million.

- Data Subject Rights: Inditex must facilitate access, rectification, and erasure requests from individuals regarding their data.

- Consent Management: Obtaining explicit and informed consent for data processing is a core requirement.

- Data Security: Implementing technical and organizational measures to protect personal data is mandatory.

Product Safety and Labeling Standards

Inditex navigates a complex web of product safety regulations across its global operations. This includes stringent requirements for chemical content, such as restrictions on azo dyes and phthalates, which are common in apparel and accessories. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continuously updates its list of substances of very high concern, impacting material sourcing and manufacturing processes.

Adherence to accurate and compliant labeling is a legal imperative. This covers detailed information on material composition, care instructions, and country of origin. In 2024, several regions, including the UK and the EU, have been enhancing their textile labeling requirements, focusing on durability and recyclability information to support sustainability goals. Failure to comply can lead to significant fines, product recalls, and damage to brand reputation, as seen in past instances where companies faced penalties for misleading labeling.

- Chemical Safety: Compliance with regulations like EU REACH and California's Proposition 65 regarding hazardous substances in textiles.

- Labeling Accuracy: Ensuring precise information on fiber content, care instructions, and country of origin as mandated by consumer protection laws.

- Flammability Standards: Meeting specific flammability requirements for children's sleepwear and other regulated product categories in various markets.

- Recall Prevention: Implementing robust quality control to avoid costly product recalls due to safety non-compliance, a persistent challenge for global apparel retailers.

Inditex must navigate evolving international trade laws, including customs duties and import/export restrictions across its global operations. For example, in 2024, the EU continued to review and adapt trade agreements, potentially influencing textile sourcing and market access for companies like Inditex.

Labor laws are a significant legal consideration, with minimum wage adjustments and workplace safety regulations varying by country. In 2024, Spain, Inditex's home market, saw an increase in its minimum wage, a trend mirrored in other European nations, necessitating ongoing compliance adjustments.

Intellectual property protection is crucial for Inditex to safeguard its brands and designs against counterfeiting. The company actively pursues trademark registrations and legal action to maintain its market position and brand value globally.

Data privacy regulations, such as the GDPR, impose strict requirements on how Inditex handles customer information. Non-compliance can lead to substantial fines, with penalties potentially reaching up to 4% of global annual revenue, as highlighted by regulatory actions in early 2024.

Environmental factors

Consumers, investors, and regulators are increasingly pushing Inditex to embrace sustainability, driving a shift towards a circular economy. This means incorporating recycled materials, designing for longevity, and minimizing textile waste. For instance, by 2023, Inditex had already committed to sourcing 100% of its polyester from recycled sources by 2023, a significant step in reducing reliance on virgin materials.

Global climate regulations are increasingly pushing companies like Inditex to drastically cut their carbon footprint. This means scrutinizing everything from how clothes are made and shipped to how stores use energy. For instance, by the end of 2023, Inditex reported that 80% of its energy came from renewable sources, a significant step towards its 2025 goal of 100% renewable electricity.

Inditex is investing heavily in strategies to achieve these environmental goals. This includes exploring more sustainable materials, optimizing logistics to reduce transport emissions, and upgrading its stores and warehouses with energy-saving technologies. Their commitment is underscored by targets such as reducing emissions in their own operations by 50% by 2030 compared to 2018 levels.

The textile sector, a core area for Inditex, is inherently water-intensive and a significant waste generator. The dyeing and finishing stages, in particular, demand substantial water resources, and the resulting wastewater requires careful management to prevent environmental harm.

Inditex has been under observation for its water footprint, with a focus on responsible chemical application and minimizing wastewater discharge. For instance, in 2023, the company reported a reduction in water consumption per garment produced, aiming for further improvements in 2024 and 2025.

To address these environmental pressures, Inditex is actively investing in water-saving technologies and closed-loop systems for dyeing. Their 2025 sustainability goals include increasing the use of recycled water and reducing chemical discharge by a further percentage compared to 2023 levels.

Material Sourcing and Ethical Supply Chain

Inditex faces increasing pressure regarding the environmental footprint of its raw material sourcing, from cotton farming to the production of synthetic fibers. For example, in 2023, the fashion industry continued to grapple with water scarcity and pollution linked to cotton cultivation, a key material for many Inditex brands.

Ensuring ethical practices throughout its supply chain is paramount, with consumers and regulators demanding greater transparency and accountability. Inditex's commitment to sustainability means its suppliers must meet rigorous environmental benchmarks, including those related to biodiversity conservation and the adoption of eco-friendly materials. This focus is critical for maintaining brand reputation and compliance with evolving environmental regulations.

In 2024, Inditex reported that 70% of its strategic raw materials were sourced through its Sustainable Materials chapter, with a target of 100% by 2030. This includes materials like organic cotton, recycled polyester, and more sustainable viscose. The company's 2025 goals aim to further increase the proportion of these materials.

- Sustainable Materials: Inditex aims for 100% of its strategic raw materials to be sustainable by 2030.

- Water Stewardship: Efforts are in place to reduce water consumption in the manufacturing processes of its suppliers.

- Biodiversity: The company is working with suppliers to implement practices that protect and promote biodiversity in raw material cultivation.

- Circular Economy: Inditex is investing in initiatives to promote the circularity of its products, including recycling and reuse programs.

Consumer Demand for Eco-Friendly Products and Transparency

Consumer demand for sustainable fashion is a significant environmental factor influencing Inditex. A growing segment of shoppers actively seeks out brands demonstrating genuine commitment to eco-friendly practices and transparency. This trend directly impacts purchasing decisions, making it crucial for Inditex to effectively communicate its sustainability initiatives, certifications, and progress in reducing its environmental footprint. Failing to do so risks alienating a key demographic and impacting brand loyalty.

Inditex's sustainability reporting highlights this shift. For instance, in their 2023 Integrated Report, they detailed progress on their "Join Life" collection, which uses more sustainable materials. This collection saw continued growth, reflecting the market's appetite for environmentally conscious options. The company is increasingly focused on supply chain transparency, a key demand from consumers who want to understand the origins and environmental impact of their clothing.

- Growing Market Share: The global market for sustainable fashion is projected to reach significant growth, with estimates suggesting it will continue to expand rapidly through 2025 and beyond.

- Consumer Scrutiny: Consumers are increasingly scrutinizing brands' environmental claims, demanding verifiable proof of sustainability efforts, such as certifications like the Global Organic Textile Standard (GOTS) or Bluesign.

- Brand Reputation Impact: Brands that demonstrate robust sustainability practices and transparency are more likely to build trust and attract environmentally conscious consumers, positively impacting sales and brand perception.

Environmental factors are increasingly shaping Inditex's operations and strategy, driven by consumer demand for sustainability and growing global climate regulations. The company is actively working to reduce its environmental footprint by focusing on sustainable materials, water stewardship, and a circular economy model. For example, by the end of 2023, Inditex reported that 80% of its energy came from renewable sources, with a goal of 100% by 2025.

Inditex's commitment to sustainability is evident in its sourcing practices, with a target for 100% of its strategic raw materials to be sustainable by 2030. In 2024, 70% of these materials met this criterion, including organic cotton and recycled polyester. The company is also addressing water usage, aiming to reduce consumption per garment produced and increase the use of recycled water in its manufacturing processes.

| Environmental Focus Area | 2023 Status/Commitment | 2024/2025 Target/Progress |

|---|---|---|

| Renewable Energy | 80% of energy from renewable sources | 100% renewable electricity by 2025 |

| Sustainable Materials | 70% of strategic raw materials sourced sustainably | Increase proportion of sustainable materials; 100% by 2030 |

| Water Consumption | Reduction in water consumption per garment | Further improvements in water usage efficiency and recycled water use |

| Carbon Footprint | Ongoing reduction efforts | 50% reduction in own operations emissions by 2030 (vs. 2018) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Inditex is built on a foundation of robust data, drawing from official government publications, reputable financial news outlets, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the fashion retail giant.