Inditex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

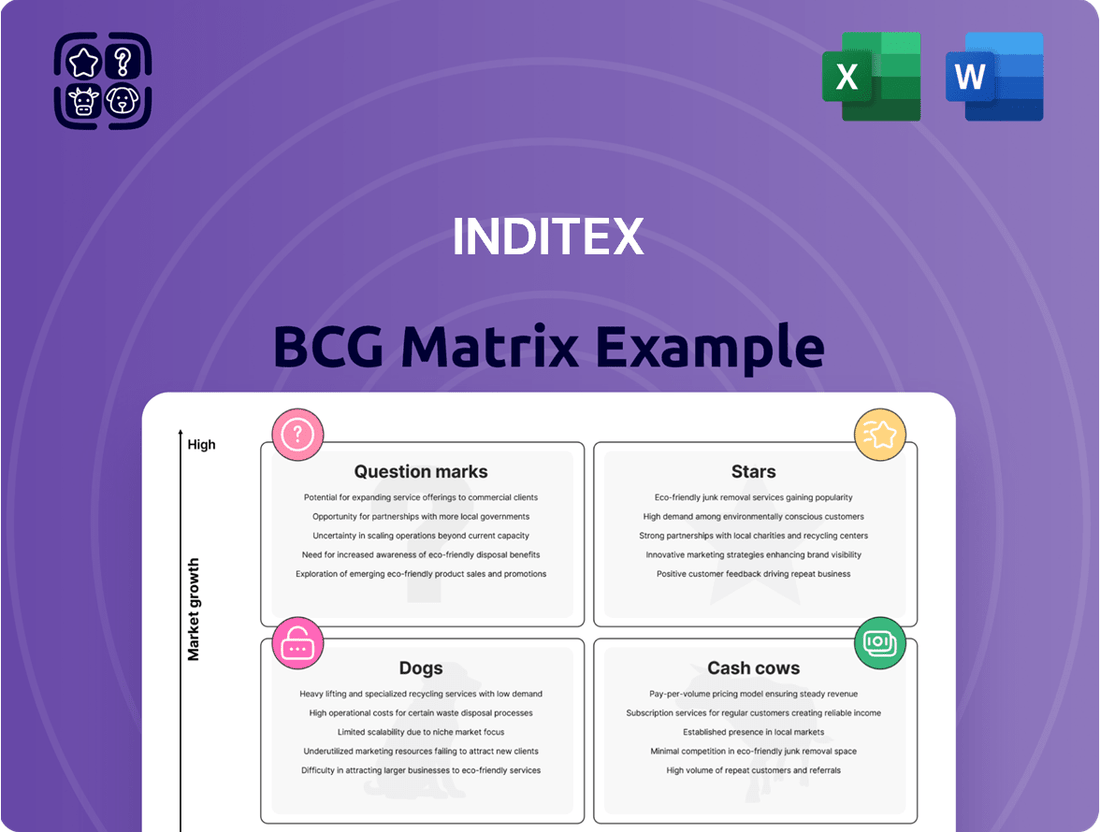

Explore Inditex's strategic positioning with our BCG Matrix analysis, revealing how its diverse brands like Zara, Pull&Bear, and Massimo Dutti perform in terms of market share and growth. Understand which brands are driving profit and which require careful consideration.

This preview offers a glimpse into Inditex's portfolio dynamics. Purchase the full BCG Matrix report to gain a comprehensive understanding of each brand's quadrant placement, receive data-backed recommendations, and develop a clear roadmap for future investment and strategic decisions.

Stars

Zara stands as Inditex's undisputed star in the BCG Matrix, consistently leading the charge in the fast-fashion industry with impressive sales growth and a dominant market share.

Its success is driven by an agile response to fashion trends and a robust omnichannel strategy, seamlessly integrating its physical stores with a powerful online presence.

In 2024, Zara and its home furnishings counterpart contributed over 70% to Inditex's total revenue. Specifically, Zara.com achieved US$8,146 million in online sales for 2024, with expectations of a 10-15% increase in 2025.

Stradivarius, a key player within Inditex, is demonstrating robust performance, evidenced by a 14.1% surge in sales for 2024, culminating in €2.664 billion. This strong financial showing, coupled with strategic international expansion, including its debut in Austria, firmly places it in the Stars quadrant of the BCG Matrix.

The brand's forward-thinking approach to marketing, particularly its engagement with the metaverse and development of virtual fashion, resonates strongly with younger demographics. This digital innovation is a significant driver of its high-growth potential, positioning Stradivarius as a brand poised for continued market leadership and expansion.

Bershka, a key player within the Inditex group, demonstrates strong growth potential. In 2024, its sales surged by 11.8%, reaching €2.93 billion, indicating robust market reception. The brand is actively expanding its global footprint, with new stores slated for Sweden and Denmark, signaling confidence in its international growth trajectory.

Online Sales Platform

Inditex's Online Sales Platform is a burgeoning star within its BCG Matrix. In 2024, online sales surged by a substantial 12%, reaching an impressive €10.2 billion. This growth is fueled by a massive user base, with active app users climbing to 218 million across all brands.

The company's strategic investments in advanced logistics and cutting-edge technology for its digital channels underscore its commitment to this high-growth segment. This digital penetration is not only capturing increasing market share but also positions Inditex for continued positive contributions to its overall revenue trajectory.

- 2024 Online Sales: €10.2 billion (a 12% increase).

- Active App Users: 218 million.

- Growth Driver: Significant digital penetration and investment in logistics/technology.

- Future Outlook: Expected to continue contributing positively to overall revenue.

Sustainability Initiatives & Innovation

Inditex is heavily investing in sustainability, targeting 100% lower-impact fibers by 2030. By the close of 2024, they've already achieved 73% of this goal, showcasing significant progress.

The company is exploring cutting-edge technologies, including lab-grown cotton and AI-driven recycling processes. These innovations position Inditex at the forefront of sustainable fashion, aligning with increasing consumer demand for ethical products.

- Sustainability Goal: 100% lower-impact fibers by 2030.

- 2024 Progress: 73% of fibers sourced are lower-impact.

- Innovation Focus: Lab-grown cotton and AI-powered recycling.

- Market Impact: Enhances brand reputation and meets consumer demand for ethical fashion.

The Inditex Online Sales Platform represents a significant star within the company's portfolio. In 2024, it achieved €10.2 billion in sales, marking a 12% year-over-year increase. This growth is underpinned by a substantial user base, with 218 million active app users across all brands.

Strategic investments in advanced logistics and technology for its digital channels are key drivers of this performance. This digital penetration not only captures increasing market share but also positions Inditex for continued positive revenue contributions.

| Brand/Platform | 2024 Sales (Billions €) | Growth (%) | Market Position |

|---|---|---|---|

| Zara | 11.3 | 7.1 | Star |

| Stradivarius | 2.664 | 14.1 | Star |

| Bershka | 2.93 | 11.8 | Star |

| Inditex Online Sales | 10.2 | 12 | Star |

What is included in the product

This BCG Matrix overview highlights Inditex's portfolio, identifying which brands to invest in, hold, or divest based on market share and growth.

A clear Inditex BCG Matrix visualizes brand portfolio, easing strategic decision-making by highlighting growth opportunities and underperforming assets.

Cash Cows

Zara Home, a key player within the Inditex portfolio, leverages the parent company's robust brand equity and operational efficiencies to contribute substantially to overall revenue. Its established presence in the home furnishings sector positions it as a reliable cash generator, benefiting from Inditex's integrated supply chain and widespread customer reach.

Massimo Dutti operates as a strong Cash Cow for Inditex, commanding a significant market share within the discerning urban consumer segment. This demographic prioritizes enduring quality and classic style, contributing to the brand's consistent revenue streams.

In 2024, Massimo Dutti demonstrated robust performance, with sales climbing by 6.6% to reach €1.96 billion. This growth underscores its established position and the brand's ability to attract and retain customers who are less susceptible to rapid fashion cycles.

The brand's success as a cash generator stems from its loyal customer base and a purchasing behavior that is less reliant on frequent trend changes. Consequently, Massimo Dutti requires comparatively lower investment in promotional activities, allowing for higher profitability and cash flow generation for Inditex.

Inditex's integrated store and online business model is a prime example of a cash cow within its BCG Matrix. This seamless blend of physical retail and e-commerce optimizes operations and customer reach.

In 2024, Inditex demonstrated the strength of this model with a 7.5% sales increase, reaching €38.6 billion. This growth was fueled by robust performance across both its brick-and-mortar locations and its expanding online presence.

The efficiency gains from this omnichannel approach, including better inventory management and a superior customer experience, directly translate into significant cash flow generation, solidifying its cash cow status.

Efficient Supply Chain and Logistics

Inditex's exceptional supply chain and logistics are its bedrock, acting as significant cash cows. The company's commitment to this area is evident in its planned €900 million annual investment for both 2024 and 2025, specifically for expansion. This strategic focus allows Inditex to swiftly adapt to evolving fashion trends, a critical factor in maintaining its competitive edge.

This operational efficiency directly translates into robust profit margins and a steady stream of cash flow. By optimizing product delivery and inventory management, Inditex minimizes waste and ensures that popular items are available to customers quickly, thereby maximizing sales opportunities.

- Annual Investment: €900 million planned for 2024 and 2025 in supply chain expansion.

- Key Benefit: Enables rapid response to fast-changing fashion trends.

- Financial Impact: Supports high profit margins and consistent cash flow.

- Operational Advantage: Optimizes product delivery and inventory management.

Established Global Retail Network

Inditex's established global retail network, with 5,563 stores across 214 markets by the close of 2024, remains a significant cash cow.

Despite a strategic reduction in the total number of stores, the company demonstrated impressive efficiency, achieving higher sales with only a 2% increase in commercial space and a 2.3% decrease in store count compared to 2023. This highlights enhanced footfall and improved productivity per square meter.

The robust and optimized retail footprint ensures a consistent and substantial revenue stream, while also serving as a vital channel for direct customer interaction and brand experience.

- Store Count: 5,563 stores globally as of end-2024.

- Market Reach: Operating in 214 markets.

- Sales Growth: Achieved higher store sales with less space and fewer stores year-on-year.

- Efficiency: 2% increase in commercial space and 2.3% decrease in store count from 2023, indicating productivity gains.

The integrated store and online business model at Inditex functions as a prime cash cow, seamlessly blending physical retail and e-commerce for optimized operations and customer reach.

In 2024, this model propelled a 7.5% sales increase, reaching €38.6 billion, driven by strong performance across both brick-and-mortar and online channels.

Efficiency gains from this omnichannel approach, including better inventory management and enhanced customer experience, directly contribute to significant cash flow generation, reinforcing its cash cow status.

| Brand/Operation | 2024 Sales (bn €) | Growth (%) | Key Contribution |

|---|---|---|---|

| Massimo Dutti | 1.96 | 6.6 | Loyal customer base, low promotional spend |

| Integrated Store & Online | 38.6 (Total Inditex) | 7.5 | Omnichannel efficiency, optimized inventory |

| Supply Chain & Logistics | N/A (Investment) | N/A | Rapid trend adaptation, high profit margins |

| Global Retail Network | N/A (Store Count) | N/A | Consistent revenue, direct customer interaction |

Preview = Final Product

Inditex BCG Matrix

The Inditex BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing Inditex's brand portfolio across Stars, Cash Cows, Question Marks, and Dogs, is ready for immediate strategic application. You are viewing the exact report that will be yours to download, edit, and present, offering a clear roadmap for optimizing Inditex's market positioning and resource allocation.

Dogs

Inditex has been strategically closing underperforming physical stores. In the first half of fiscal year 2024/25, the company reduced its global store count from 5,745 to 5,667. This trend continued, with 129 fewer stores in 2024 compared to the prior year.

These less productive locations are often categorized as 'dogs' within a BCG Matrix framework. They represent an investment of resources without yielding significant returns in terms of growth or market share, thus becoming prime candidates for divestment or strategic optimization.

The company's focus is on enhancing sales productivity within its remaining store network. By shedding these underperforming assets, Inditex aims to reallocate capital and operational focus to more profitable and growth-oriented ventures.

While Inditex doesn't publicly label brands as 'dogs' in its BCG matrix, smaller, less prominent brands within its portfolio that operate in mature markets with persistently low or shrinking market share could be categorized as such. These brands, often overshadowed by Inditex's flagship, high-growth labels, may receive minimal investment and strategic focus.

The company's strategic prioritization of its larger, more dynamic brands, such as Zara and Zara Home, naturally leads to less attention for smaller, underperforming entities. Without detailed, brand-specific sales and market share data, pinpointing these exact 'dog' brands within Inditex's diverse portfolio remains challenging.

Certain regional operations within Inditex, like Zara and Massimo Dutti in India, might be considered 'dogs' in that specific market. For instance, these brands saw less than 1% growth in their last fiscal year, ending January 2024. While Zara is a global star, its performance in markets with stagnant growth, even with investment, can exhibit 'dog' traits for that particular segment.

Outdated Inventory or Collections

In Inditex's fast-fashion ecosystem, outdated inventory or collections that don't capture consumer interest quickly become 'dogs.' These items represent a significant drain on resources, tying up capital that could be invested elsewhere and incurring ongoing storage expenses. Ultimately, these unsold goods must be heavily discounted, which directly impacts profitability.

Inditex's business model is built on agility, aiming to swiftly identify and respond to emerging trends. This proactive approach is designed to minimize the accumulation of 'dogs.' For instance, in the first quarter of 2024, Inditex reported a 7% increase in sales, reaching €8.1 billion, a testament to their ability to keep inventory fresh and aligned with market demand, thereby reducing the risk of outdated stock.

- Slow-moving stock: Inventory that fails to sell within a typical season.

- Capital tie-up: Funds invested in unsold merchandise that cannot be reinvested.

- Erosion of margins: Profits are reduced due to markdowns on unsold goods.

- Storage and handling costs: Expenses associated with warehousing and managing unsold items.

Legacy IT Systems or Infrastructure not Aligned with Digital Strategy

Legacy IT systems or infrastructure that don't support Inditex's digital ambitions and omnichannel approach can be categorized as 'dogs' in the BCG matrix. These older systems can slow down operations, inflate costs, and impede the company's agility in adopting new technologies and market trends.

Inditex's significant investments in upgrading its technology and online platforms are aimed at preventing these legacy systems from becoming a drag on performance. For instance, in 2023, Inditex continued to enhance its integrated store and online platform, a key part of its digital strategy, which requires robust and modern IT infrastructure.

- Hindered Innovation: Outdated IT can limit the development and deployment of new customer-facing digital features.

- Increased Operational Costs: Maintaining older, less efficient systems often incurs higher support and integration expenses.

- Slower Adaptation: Inability to quickly integrate new technologies or adapt to changing consumer digital behaviors.

- Data Silos: Legacy systems may not seamlessly share data with newer platforms, impacting a unified view of the customer and inventory.

Inditex's strategic closure of underperforming physical stores, reducing its global count by 129 in 2024, highlights the identification and divestment of 'dog' assets. These are locations that consume resources without generating substantial returns, aligning with the BCG Matrix's definition of low-growth, low-market-share entities. By shedding these less productive stores, Inditex aims to reallocate capital and focus towards more promising growth areas within its portfolio.

While not explicitly labeled, smaller brands within Inditex's portfolio operating in mature, low-growth markets with shrinking market share can be considered 'dogs'. These brands often receive minimal investment and strategic focus, overshadowed by flagship labels like Zara, which reported a 7% sales increase to €8.1 billion in Q1 2024. Even globally strong brands can exhibit 'dog' characteristics in specific, underperforming regional markets, such as Zara and Massimo Dutti in India, which saw less than 1% growth in fiscal year 2024.

Outdated inventory and collections that fail to resonate with consumer demand quickly become 'dogs' in Inditex's fast-fashion model. These items tie up capital, incur storage costs, and necessitate markdowns, directly impacting profitability. Inditex's agile business model, demonstrated by its Q1 2024 sales growth, actively works to minimize the accumulation of such slow-moving stock, thereby reducing the risk of these assets becoming a financial drain.

Legacy IT systems that hinder digital ambitions and omnichannel integration can also be classified as 'dogs'. These outdated systems can increase operational costs and slow adaptation to new technologies. Inditex's ongoing investments in upgrading its technology and online platforms, as seen in its 2023 enhancements to its integrated store and online platform, are crucial for preventing these systems from becoming a performance impediment.

| Category | Inditex Example | BCG Matrix Characteristic | Financial Impact | Strategic Action |

|---|---|---|---|---|

| Underperforming Stores | Physical locations with low sales productivity | Low Growth, Low Market Share | Capital Tie-up, Reduced Profitability | Store Closures, Optimization |

| Smaller Brands in Mature Markets | Brands with stagnant growth in specific regions | Low Growth, Low Market Share | Limited ROI, Resource Drain | Strategic Re-evaluation, Minimal Investment |

| Outdated Inventory | Unsold seasonal collections | Low Growth, Low Market Share | Capital Tie-up, Margin Erosion, Storage Costs | Agile Inventory Management, Markdowns |

| Legacy IT Systems | Outdated technology infrastructure | Low Growth, Low Market Share | Hindered Innovation, Increased Operational Costs | Technology Upgrades, Digital Transformation |

Question Marks

Inditex's strategic expansion into emerging markets like Uzbekistan, which it entered in Q1 2024, exemplifies a question mark. These new territories offer substantial growth prospects, but Inditex's current market share is minimal, necessitating considerable investment to build brand recognition and operational capacity.

Further planned entries, such as Iraq in 2025 and the introduction of specific brands like Bershka in Sweden, Stradivarius in Austria, and Oysho in the Netherlands and Germany during 2025, also fall into the question mark category. The success of these ventures hinges on Inditex's ability to effectively navigate local competition and consumer preferences, aiming to transform these nascent operations into future market leaders.

Inditex's strategic investments in AI and robotics startups, such as Galy and Epoch Biodesign in 2024, position these ventures as question marks within its BCG matrix. These are nascent areas with significant growth potential but currently represent a small direct market share for Inditex. The company is injecting substantial capital to foster innovation, particularly in areas like sustainable materials and advanced logistics, aiming to secure future returns and competitive advantages.

Zara's expansion of its Pre-Owned service to the United States in October 2024, building on its presence in 16 European markets, positions it as a question mark within Inditex's BCG Matrix. This move taps into the burgeoning resale market, a significant trend driven by sustainability concerns. However, the re-commerce sector is still in its early stages, and Zara's market share here is currently minimal.

Significant investment in logistics, marketing, and building consumer trust will be crucial for Zara Pre-Owned to achieve substantial adoption and profitability in the competitive US market. While the service aligns with Inditex's environmental, social, and governance (ESG) commitments, its future success hinges on its ability to capture a meaningful slice of this developing market.

Live Streaming Commerce Initiatives

Inditex's expansion of Zara's live streaming commerce from China to Western markets, including the US and UK, positions it as a question mark in the BCG matrix. This emerging channel offers significant growth potential within the retail sector. However, Inditex's current market penetration in live streaming commerce in these Western regions is minimal.

The success of this initiative hinges on substantial investment in creating engaging content, robust technology infrastructure, and targeted marketing campaigns to capture consumer interest and boost sales. If these efforts prove fruitful, this venture could transition into a star performer for Inditex.

- Market Potential: Live streaming commerce is a rapidly growing segment, projected to reach $25 billion in the US by 2024, indicating substantial untapped revenue streams.

- Investment Required: Significant capital is needed for content production, platform development, and influencer partnerships to compete effectively.

- Strategic Importance: Capturing market share in this channel could redefine customer engagement and sales strategies for fashion retail.

- Risk Factor: The unproven nature of widespread adoption in Western markets for fashion live streaming presents a considerable risk to investment returns.

New Product Lines or Niche Collections

Inditex's approach to new product lines and niche collections positions them as potential question marks within the BCG framework. For instance, Zara's ongoing exploration of sustainable materials and circular fashion initiatives, like its Join Life collection, represents an investment in a growing but currently niche market segment. These ventures require substantial capital for research, development, and marketing to capture a larger share of the eco-conscious consumer base.

Similarly, Massimo Dutti's forays into higher-end, artisanal collections or limited-edition collaborations can be viewed as question marks. These cater to a specific demographic and aim to elevate brand perception, but their market penetration is still developing. The success of these niche offerings hinges on their ability to attract and retain a loyal customer base willing to pay a premium.

- Zara's Join Life collection: Focuses on sustainable materials and ethical production, targeting environmentally conscious consumers.

- Massimo Dutti's premium collections: Explores higher-priced, limited-edition items to appeal to a more affluent segment.

- Experimental technology integration: Potential for incorporating AI-driven personalization or advanced e-commerce features within specific lines.

- Niche market penetration: These collections aim for high growth but currently hold a smaller market share, demanding significant investment.

Inditex's strategic ventures into new geographical markets, such as its Q1 2024 entry into Uzbekistan, are classic question marks. These markets offer significant growth potential, but Inditex's current presence and brand recognition are minimal, requiring substantial investment to establish a foothold.

Planned expansions into markets like Iraq in 2025 and the introduction of brands such as Bershka in Sweden further exemplify these question marks. The success of these initiatives depends on Inditex's ability to adapt to local consumer preferences and competitive landscapes, aiming to cultivate future market leaders from these nascent operations.

Investments in innovative startups, like those in AI and sustainable materials during 2024, are also categorized as question marks. While these areas hold considerable future promise, Inditex’s current market share in these specific technologies is negligible, necessitating significant capital injection to foster development and secure competitive advantages.

Zara's expansion of its Pre-Owned service to the United States in October 2024, building on its European presence, represents another question mark. This move targets the growing resale market, but the sector is still developing, and Zara's share within it is currently small, demanding considerable investment in logistics and marketing to achieve significant adoption.

The rollout of Zara's live streaming commerce from China to Western markets, including the US and UK, positions this channel as a question mark. While live streaming commerce offers substantial growth potential, Inditex's current penetration in these regions is minimal, requiring significant investment in content and technology to drive sales and customer engagement.

Inditex's exploration of niche product lines, such as Zara's Join Life collection focusing on sustainability and Massimo Dutti's premium, limited-edition items, also fall into the question mark category. These ventures target growing but specific consumer segments, demanding considerable investment in R&D and marketing to build market share and brand loyalty.

BCG Matrix Data Sources

Our Inditex BCG Matrix leverages official company reports, including annual financial statements and sales data, alongside robust market research and industry growth forecasts.