Inditex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

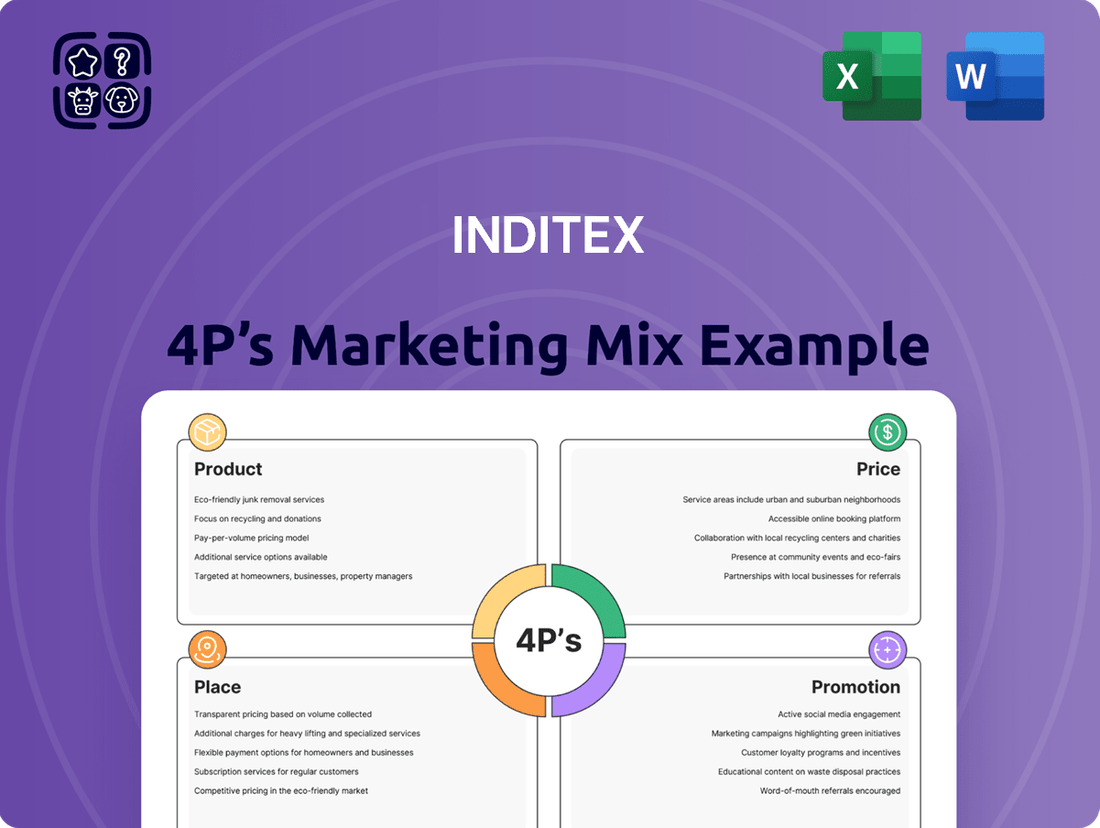

Inditex masterfully leverages its 4Ps to dominate fast fashion, offering trendy products at accessible prices through a vast, responsive retail network and dynamic promotional campaigns. This intricate dance between Product, Price, Place, and Promotion fuels their unparalleled market agility and customer engagement.

Ready to uncover the secrets behind Inditex's global retail empire? Dive deeper into their product innovation, pricing strategies, expansive distribution, and impactful promotions with our comprehensive 4Ps Marketing Mix Analysis.

Save hours of research and gain actionable insights into how Inditex executes its winning marketing formula. Our ready-made, editable analysis provides the strategic depth you need for business planning, academic study, or client presentations.

Product

Inditex's diverse brand portfolio, featuring names like Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, and Zara Home, caters to a wide spectrum of fashion preferences and consumer groups. This strategy allows Inditex to capture market share across various price points and styles, from fast fashion to more tailored offerings.

By segmenting its brands, Inditex effectively reaches distinct customer demographics, ensuring broad market penetration. For instance, Zara is known for its trend-driven apparel, while Massimo Dutti appeals to a more classic and sophisticated clientele. This multi-brand approach strengthens Inditex's global retail presence and resilience.

In the first quarter of fiscal year 2024 (ending April 30, 2024), Inditex reported a 7% increase in net sales, reaching €8.19 billion, demonstrating the continued success of its diversified brand strategy in reaching a global customer base.

Inditex's product strategy is built on a fast-fashion model, enabling them to translate runway trends into store-ready garments in a remarkably short timeframe, often within two to three weeks. This agility is crucial for keeping pace with rapidly evolving consumer tastes and seasonal shifts.

This rapid cycle allows Inditex to offer a constant stream of newness, a key driver of customer loyalty and repeat purchases. For instance, in the first quarter of fiscal year 2024 (ending April 30, 2024), Inditex reported a 7% increase in sales, demonstrating the effectiveness of their responsive product strategy in a dynamic market.

Inditex is deeply embedding sustainability into its product strategy. By 2025, the company aims to source 100% of its cotton, linen, and polyester from organic, sustainable, or recycled origins. This commitment is a significant step towards reducing the environmental footprint of its vast product lines.

Further strengthening this dedication, Inditex targets 100% of its textile products to be made with lower-impact materials by 2030. This forward-looking goal demonstrates a proactive stance on environmental stewardship, directly appealing to a growing segment of eco-conscious consumers who prioritize ethical sourcing and production.

Limited Inventory and Exclusivity

Inditex, especially its flagship brand Zara, masterfully uses limited inventory and frequent, small production runs. This scarcity fuels a sense of urgency and exclusivity, encouraging customers to buy quickly before items disappear. It also significantly cuts down on the risk of having excess stock, thereby reducing the need for heavy end-of-season sales.

This approach, often referred to as "fast fashion's scarcity model," proved highly effective for Inditex in 2023, contributing to its robust financial performance. For instance, the company reported a net profit of €4.13 billion for the fiscal year ending January 31, 2024, a notable increase from the previous year, partly driven by this inventory management strategy.

The benefits of this "limited edition" feel extend beyond sales:

- Reduced Markdowns: By producing in smaller quantities, Inditex minimizes the amount of unsold merchandise, leading to fewer costly markdowns.

- Freshness and Novelty: Constant introduction of new styles keeps the offering exciting and encourages repeat visits.

- Agility: The model allows Inditex to quickly respond to emerging trends identified through their integrated store and online feedback systems.

- Lower Waste: Producing only what is likely to sell also contributes to a more sustainable operational model, aligning with growing consumer awareness.

Quality and Design Focus

Inditex places a strong emphasis on the creativity, quality, and design of its offerings, a cornerstone of its marketing strategy. The company's commitment to in-house design teams and rigorous prototyping ensures that each garment meets high standards for both quality and trend relevance. This focus allows Inditex to deliver fashion that resonates with consumers looking to express their personal style.

This dedication to design and quality is reflected in Inditex's financial performance. For the fiscal year ending January 31, 2024, Inditex reported net sales of €35.9 billion, a 10% increase compared to the previous year. This growth underscores the market's positive reception to their product development approach.

- Design Investment: Inditex consistently invests in its creative talent and product development processes.

- Quality Assurance: Meticulous prototyping and quality control are integral to maintaining brand standards.

- Trend Responsiveness: The company excels at translating current fashion trends into accessible, desirable products.

- Consumer Empowerment: Products are designed to enable individual expression and confidence.

Inditex's product strategy is defined by its rapid response to fashion trends, offering a constant stream of newness through its fast-fashion model. This agility, coupled with a commitment to sustainability and in-house design, allows them to meet diverse consumer demands effectively. The company's approach to product also includes a scarcity model, utilizing limited inventory and frequent, small production runs to drive urgency and minimize excess stock.

| Brand | Target Audience | Key Product Characteristics |

|---|---|---|

| Zara | Trend-conscious, fashion-forward individuals | Fast fashion, runway-inspired, frequent new arrivals |

| Pull&Bear | Young, casual, urban youth | Streetwear, comfortable, youthful designs |

| Massimo Dutti | Sophisticated, classic, professional | Elegant, quality materials, timeless styles |

| Bershka | Young, energetic, trend-driven | Edgy, vibrant, music and youth culture influenced |

| Stradivarius | Feminine, contemporary, style-conscious women | Bohemian, casual chic, feminine details |

| Oysho | Women seeking comfort and style in loungewear and intimates | Comfortable, stylish, intimate apparel, activewear |

| Zara Home | Consumers looking for stylish home décor | Home furnishings, textiles, decorative items, modern aesthetics |

What is included in the product

This analysis provides a comprehensive breakdown of Inditex's marketing mix, detailing its agile product development, value-driven pricing, expansive global distribution, and integrated promotional strategies.

Simplifies Inditex's complex 4P strategy into actionable insights, relieving the pain of understanding their market dominance.

Provides a clear, concise overview of Inditex's Product, Price, Place, and Promotion, alleviating confusion for strategic decision-making.

Place

Inditex masterfully blends its physical stores with a robust online presence, creating a truly integrated shopping experience. This omnichannel strategy is a cornerstone of their success, allowing customers to browse online and pick up in-store, or return online purchases to a physical location. In 2024, Inditex reported that online sales represented 18% of total sales, a testament to the model's effectiveness.

Inditex boasts an expansive global retail footprint, operating over 5,600 stores as of early 2024 across more than 90 markets. This presence is strategically concentrated in prime high-street locations and major shopping centers in key international cities, underscoring its commitment to accessibility and brand visibility.

The company's expansion strategy remains robust, with plans to open approximately 100 new stores and refurbish others throughout fiscal year 2024. This includes targeted growth in emerging markets and strengthening its position in established regions, aiming to reach around 5,700 stores by early 2025.

Inditex is strategically refining its store footprint, prioritizing fewer but more impactful locations. This approach involves opening larger, digitally integrated flagship stores designed to be higher grossing. For instance, by the end of fiscal year 2023 (ending January 31, 2024), Inditex reported a total of 5,874 stores, a slight decrease from previous years, reflecting this optimization strategy.

These flagship stores are not just larger; they are technologically advanced, incorporating elements like augmented reality to create engaging, immersive shopping experiences. This focus on innovation aims to boost customer satisfaction and drive sales in a competitive retail landscape.

Efficient Logistics and Supply Chain

Inditex's commitment to efficient logistics and supply chain management is a cornerstone of its marketing mix. This vertical integration, controlling everything from design to store delivery, enables swift responses to fashion trends and customer demand. The company's strategic focus on optimizing these operations is evident in its planned investments.

For 2024 and 2025, Inditex is allocating significant capital to further enhance its logistics capabilities. This includes expanding warehouse capacity and investing in advanced technology to streamline operations. Such investments are crucial for maintaining rapid product replenishment and minimizing inventory holding costs, directly impacting the Product and Price elements of the marketing mix by ensuring availability and competitive pricing.

- Vertical Integration: Inditex manages design, manufacturing, logistics, and retail internally or through closely controlled partners.

- Rapid Replenishment: This model allows stores to be restocked with new merchandise within days of design completion.

- Inventory Management: Efficient logistics minimize excess stock and reduce markdowns, directly impacting profitability.

- Planned Investments: Significant capital expenditure is earmarked for logistics capacity expansion in 2024 and 2025.

Convenience and Accessibility

Inditex's distribution strategy heavily emphasizes customer convenience, making its fashion accessible across numerous touchpoints. This approach ensures shoppers can find desired items whether they prefer browsing in a physical store or shopping online, reflecting a commitment to meeting customers wherever they are.

The company's extensive global store network, combined with a sophisticated e-commerce operation, provides unparalleled accessibility. For instance, as of early 2024, Inditex operates over 5,800 stores worldwide, complemented by its robust online presence which covers a vast majority of countries.

This omnichannel approach not only boosts customer satisfaction by offering flexible purchasing options but also significantly broadens sales opportunities. The seamless integration of online and offline channels allows for efficient inventory management and faster delivery, further enhancing the convenience factor.

- Global Store Network: Over 5,800 stores as of early 2024, strategically located for maximum customer reach.

- Omnichannel Integration: Seamless blending of physical stores and online platforms for a unified shopping experience.

- E-commerce Reach: Online sales available in a significant majority of countries, expanding accessibility beyond physical locations.

Inditex's "Place" strategy is defined by its extensive, strategically located physical store network and a rapidly growing, integrated online presence. This dual approach ensures maximum customer accessibility and convenience, allowing shoppers to engage with the brand across multiple touchpoints.

The company is actively optimizing its store portfolio, favoring larger, high-impact flagships in prime locations. This focus on quality over sheer quantity, alongside significant investment in its e-commerce capabilities, underpins its commitment to a seamless omnichannel experience.

As of early 2024, Inditex operated over 5,800 stores globally, with plans for continued strategic openings and refurbishments throughout 2024. Online sales constituted 18% of total sales in 2024, highlighting the successful integration of digital channels.

This carefully curated physical presence, combined with a robust digital infrastructure, allows Inditex to respond swiftly to market trends and customer preferences, reinforcing its position as a global fashion leader.

| Metric | Value (Early 2024) | Change/Outlook |

|---|---|---|

| Total Stores | 5,874 (End FY23) | Targeting ~5,700 by early 2025 (optimization) |

| Online Sales Share | 18% (2024) | Growing |

| New Store Openings/Refurbishments | Approx. 100 new stores planned for FY24 | Focus on prime locations and flagship formats |

Same Document Delivered

Inditex 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Inditex's 4P's Marketing Mix (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This detailed breakdown explores how Inditex strategically leverages each element of the marketing mix to maintain its global fashion leadership.

This isn’t a teaser or a sample—it’s the actual content you’ll receive when you complete your order. Gain immediate insight into Inditex's successful strategies across product assortment, pricing tactics, distribution channels, and promotional campaigns.

Promotion

Inditex, especially Zara, strategically shuns heavy traditional advertising. This approach, often termed 'anti-marketing,' means minimal spending on TV commercials, print ads, or celebrity endorsements. In 2023, Inditex's advertising and marketing expenses represented a mere 0.6% of its total sales, a stark contrast to many competitors.

Inditex excels on social media, using platforms like Instagram, TikTok, and YouTube to present visually stunning content. This approach highlights new fashion lines and provides style inspiration, effectively capturing attention.

The brand's visual strategy is designed to boost recognition and foster interaction. By connecting with a worldwide audience, Inditex reinforces its status as a fashion leader, ultimately driving sales.

In 2023, Inditex's social media presence continued to grow, with significant engagement across its key platforms. For instance, its Instagram account alone boasted over 10 million followers, a testament to its visual content's appeal.

Inditex leverages its physical stores as a primary promotional tool, transforming them into immersive brand experiences. Innovative store designs and eye-catching window displays act as powerful marketing messages, drawing customers in and conveying a sense of exclusivity and desirability.

These carefully crafted retail environments are central to Inditex's strategy, making the store itself a key part of the product offering and a significant driver of sales. By creating appealing atmospheres, Inditex effectively communicates its brand image and encourages impulse purchases, contributing to their strong performance. For instance, in the first quarter of 2024, Inditex reported a 7% increase in net profit, reaching €1.29 billion, demonstrating the continued effectiveness of their in-store strategies.

Limited-Time s and Scarcity Marketing

Inditex masterfully employs limited-time sales and scarcity tactics to drive consumer behavior. By offering promotions for a restricted period, they cultivate an immediate need to buy, preventing customers from delaying purchases. This urgency is a cornerstone of their strategy.

The company's approach to small batch production is a key driver of perceived scarcity. This deliberate limitation of inventory makes items feel more exclusive and desirable, encouraging quicker decision-making. For instance, Inditex's Zara brand often sees popular items sell out rapidly, reinforcing this scarcity effect.

These promotions and scarcity techniques directly support Inditex's fast-fashion model. The rapid turnover of styles, coupled with limited availability, creates a constant cycle of newness and demand. This encourages repeat visits and impulse buys, crucial for maintaining sales momentum.

- Limited-Time Promotions: Inditex frequently runs sales events, such as mid-season sales or flash discounts, creating a clear deadline for purchasing.

- Scarcity through Production: Small production runs mean popular items are often unavailable for long, fostering a sense of urgency.

- Impulse Purchase Driver: The combination of limited availability and time-bound offers significantly boosts impulse buying behavior.

- Brand Exclusivity: Scarcity marketing enhances the perceived value and exclusivity of Inditex's fashion items.

Word-of-Mouth and Brand Loyalty

Inditex masterfully leverages its fast-fashion model to cultivate powerful word-of-mouth marketing. By consistently introducing new, on-trend styles at accessible price points, the company encourages customers to share their discoveries and positive shopping experiences. This rapid turnover and emphasis on immediate gratification fuels organic buzz, a key driver of brand loyalty.

The brand's ability to quickly translate runway trends into affordable, readily available clothing fosters a deep sense of customer loyalty. This loyalty translates into repeat purchases and, crucially, acts as a potent, cost-effective promotional tool. For instance, Inditex's Zara brand, a key component of its success, saw its net sales reach €26.05 billion in the fiscal year ending January 31, 2024, reflecting strong customer engagement.

- Customer Advocacy: Inditex's rapid new arrivals and appealing price points encourage customers to become vocal advocates, sharing their finds and driving organic traffic.

- Loyalty as Promotion: The brand's consistent delivery of desirable fashion fosters repeat business, with loyal customers acting as a powerful, unprompted marketing force.

- In-Store Experience: A curated and dynamic in-store environment further enhances the customer journey, encouraging positive interactions and recommendations.

Inditex's promotional strategy heavily relies on creating buzz and urgency rather than traditional advertising. Their minimal ad spend, around 0.6% of sales in 2023, is a deliberate choice, focusing instead on organic growth and customer engagement.

This approach is amplified by a strong social media presence, with platforms like Instagram showcasing new collections and inspiring style. In early 2024, Inditex reported a net profit of €1.29 billion for the first quarter, indicating the effectiveness of their unconventional promotional tactics.

Furthermore, their physical stores act as powerful promotional hubs, with engaging designs and window displays drawing customers in. This strategy, combined with limited-time sales and the scarcity created by small production runs, drives impulse purchases and reinforces the brand's desirability.

The company's fast-fashion model, with its rapid turnover of styles, also fosters significant word-of-mouth marketing. By consistently offering on-trend items at accessible prices, Inditex encourages customers to become brand advocates, driving repeat business and loyalty. For the fiscal year ending January 31, 2024, Inditex's net sales reached €26.05 billion, underscoring the success of this customer-driven promotion.

Price

Inditex, especially through Zara, excels at market-oriented pricing, constantly adjusting based on real-time data. This dynamic approach allows them to react swiftly to shifts in demand and sales performance, ensuring their prices reflect what the market will bear.

In 2024, Inditex's agile pricing strategy, informed by extensive sales data and consumer trend analysis, has been a key driver of its continued market leadership. For instance, during peak seasons, prices for popular items might see slight adjustments based on inventory levels and competitor offerings, a testament to their responsive pricing model.

Zara masterfully positions itself as offering affordable luxury, bringing runway-inspired styles to a broader consumer base. This approach allows them to capture market share by providing trend-driven fashion at accessible price points, making high fashion feel attainable.

This strategic balance between aspirational design and approachable pricing is key to Zara's appeal, particularly for fashion-forward individuals. For instance, in the first half of fiscal year 2024, Inditex reported a 7% increase in revenue to €16.1 billion, demonstrating the continued success of its value-driven strategy.

Inditex's commitment to cost leadership is deeply embedded in its vertically integrated model, a cornerstone of its pricing strategy. This integration allows for significant control over production and distribution, directly impacting cost efficiency.

By managing a substantial portion of its supply chain, Inditex effectively minimizes intermediary costs and streamlines operations. This operational efficiency translates into competitive pricing for consumers while safeguarding robust profit margins, a testament to their strategic approach.

For instance, in fiscal year 2023, Inditex reported a net profit of €5.4 billion, a 33% increase year-over-year, demonstrating the financial success of its cost-conscious strategy. This financial performance underscores how controlling costs through vertical integration directly supports their attractive price points.

Geographical and Psychological Pricing

Inditex tailors its pricing geographically, recognizing that a one-size-fits-all approach won't work. Prices are adjusted to reflect local economic realities, including average incomes and what competitors are charging in specific markets. For instance, a garment might be priced higher in a high-income European country than in a developing market, even if production costs are similar.

Beyond location, Inditex leverages psychological pricing. This often involves setting prices just below a whole number, like €19.99 instead of €20.00. This small difference can create a perception of greater value and affordability for the consumer. In 2024, this tactic remains a cornerstone of their strategy to drive sales volume across their brands.

- Geographic Price Variation: Inditex's pricing reflects local purchasing power and competitive landscapes, with prices adjusted for different countries.

- Psychological Pricing: Tactics like using prices ending in .99 are consistently applied to enhance perceived affordability.

- 2024 Impact: This dual strategy supports Inditex's ability to capture market share by appealing to diverse consumer sensitivities to price.

Minimal Discounts Policy

Zara's pricing strategy leans heavily on maintaining full price, with minimal discounts offered throughout the year. This deliberate approach aims to bolster the perceived value and exclusivity of its fashion items. Promotions are typically reserved for end-of-season stock clearance or specific campaigns designed to boost demand.

This strategy is evident in Inditex's financial reporting, where inventory turnover and gross margins are closely watched. For instance, in the first quarter of fiscal year 2024 (ending April 30, 2024), Inditex reported a gross profit margin of 57.7%, reflecting strong pricing power and efficient inventory management that minimizes the need for deep markdowns.

- Full-Price Sales Dominance: Zara prioritizes selling items at their initial price point.

- Perceived Value Enhancement: The scarcity of discounts contributes to an image of quality and desirability.

- Strategic Markdowns: Discounts are primarily used for seasonal clearance, not as a constant sales driver.

- Financial Impact: This policy supports healthy gross margins, as seen in Inditex's consistent profitability.

Inditex's pricing strategy is a sophisticated blend of market responsiveness, cost control, and perceived value. They dynamically adjust prices based on real-time sales data and consumer trends, ensuring competitiveness. This is supported by a vertically integrated supply chain that drives cost efficiency, allowing for attractive price points without sacrificing margins. For example, Inditex reported a net profit of €5.4 billion in fiscal year 2023, a 33% increase year-over-year, highlighting the success of this cost-conscious approach.

Geographic and psychological pricing tactics further refine their approach. Prices vary by region to match local purchasing power and competitive pressures, while strategies like using prices ending in .99 enhance perceived affordability. In 2024, this dual strategy continues to be a key factor in capturing market share by appealing to diverse consumer price sensitivities.

Zara, in particular, emphasizes selling at full price, minimizing discounts to enhance the perception of quality and exclusivity. Promotions are strategic, typically reserved for end-of-season clearance. This focus on full-price sales is reflected in their strong gross profit margins, with a Q1 FY2024 margin of 57.7%, indicating effective inventory management and pricing power.

| Pricing Tactic | Description | 2024/2025 Relevance |

| Market-Oriented Pricing | Dynamic price adjustments based on sales data and trends. | Ensures competitiveness and responsiveness to demand shifts. |

| Cost Leadership | Leveraging vertical integration to minimize production and distribution costs. | Enables competitive pricing and healthy profit margins. |

| Geographic Pricing | Adjusting prices based on local economic conditions and competition. | Maximizes market penetration in diverse global markets. |

| Psychological Pricing | Using prices like €19.99 to influence consumer perception of value. | Drives sales volume by enhancing perceived affordability. |

| Full-Price Strategy | Prioritizing sales at initial price points with minimal discounts. | Bolsters brand image and supports strong gross margins. |

4P's Marketing Mix Analysis Data Sources

Our Inditex 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.