Inditex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

Discover the core components of Inditex's agile business model, from its fast-fashion value proposition to its efficient supply chain and diverse customer segments. This Business Model Canvas provides a clear, actionable overview of how Inditex consistently delivers trend-driven apparel at scale.

Unlock the full strategic blueprint behind Inditex's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Inditex cultivates strong ties with its suppliers, a cornerstone of its rapid response model. A significant portion of its production is concentrated in countries like Spain, Portugal, Morocco, and Turkey, facilitating swift inventory turnover and trend adaptation. For instance, in 2023, Inditex continued to emphasize nearshoring, with a substantial percentage of its production originating from these proximate regions, directly supporting its ability to bring new fashion items to market within weeks.

Inditex actively partners with technology firms and innovative startups to accelerate its digital journey. These collaborations focus on improving retail efficiency, advancing sustainability efforts, and integrating cutting-edge solutions. For example, Inditex has engaged with companies developing advanced recycling technologies for textiles.

These strategic alliances are crucial for Inditex's commitment to innovation. Partnerships in areas like AI for trend forecasting and circular economy solutions underscore their forward-thinking approach. In 2024, Inditex continued to explore collaborations in areas like advanced materials and supply chain digitization.

Inditex partners with a vast array of logistics and transport providers to manage its extensive global supply chain. These partnerships are crucial for efficiently moving goods from production facilities to its numerous retail outlets and direct-to-consumer online channels.

In 2023, Inditex continued to invest heavily in its logistics infrastructure, with a focus on enhancing speed and sustainability. This includes the ongoing development of new, highly automated distribution centers designed to streamline operations and reduce delivery times, reflecting a commitment to optimizing its global reach.

Sustainability Initiatives and Organizations

Inditex actively collaborates with key partners to advance its sustainability agenda. These partnerships are crucial for developing innovative solutions and implementing responsible practices across its value chain.

Notable collaborations include those with Infinited Fiber for advanced textile recycling and Galy for supply chain transparency. Epoch Biodesign is another partner, focusing on biodegradable materials. Inditex also works with ZDHC (Zero Discharge of Hazardous Chemicals) to ensure responsible chemical management. Furthermore, the Moda Re- initiative, in partnership with Cáritas, supports the circular economy by promoting clothing reuse and recycling.

- Infinited Fiber: Partnership focused on next-generation textile recycling technologies.

- Galy: Collaboration aimed at enhancing supply chain traceability and transparency.

- Epoch Biodesign: Joint effort to develop and integrate biodegradable materials into fashion.

- ZDHC: Commitment to reducing hazardous chemicals in textile production.

- Moda Re- (with Cáritas): Initiative promoting the circular economy through clothing collection and resale.

Retail Space and Property Owners

Inditex's success hinges on its strategic relationships with retail space and property owners worldwide. This partnership is fundamental to securing prime locations for its extensive physical store network.

The selection of these locations is critical, focusing on high-traffic areas and prime shopping districts. This strategy directly enhances brand visibility and customer accessibility, a cornerstone of Inditex's retail approach.

- Global Store Network: Inditex operates thousands of stores across numerous countries, requiring constant collaboration with diverse property owners and real estate developers to secure and maintain these physical presences.

- Prime Location Strategy: The company prioritizes securing flagship locations in high-footfall areas, such as major city centers and premium shopping malls, to maximize brand exposure and customer reach. For instance, in 2023, Inditex continued its expansion and renovation efforts, with a significant portion of its capital expenditure allocated to store openings and refurbishments in key global markets.

- Lease Agreements and Negotiations: Inditex engages in complex lease agreements and negotiations with property owners, often securing long-term leases that provide stability and control over its retail footprint.

Inditex's key partnerships extend to its extensive supplier network, with a significant portion of production concentrated in countries like Spain, Portugal, Morocco, and Turkey. This nearshoring strategy, emphasized in 2023, allows for rapid inventory turnover and trend adaptation, with new fashion items reaching stores within weeks.

Collaborations with technology firms are vital for Inditex's digital transformation, focusing on retail efficiency and sustainability. Partnerships with companies developing advanced textile recycling, like Infinited Fiber, and those enhancing supply chain transparency, such as Galy, are crucial. In 2024, Inditex continued exploring collaborations in advanced materials and supply chain digitization.

Strategic alliances with logistics providers ensure efficient global product movement. Inditex's investment in automated distribution centers in 2023 aims to streamline operations and reduce delivery times, bolstering its global reach.

Inditex actively partners with property owners and real estate developers worldwide to secure prime locations for its vast store network. This strategy prioritizes high-traffic areas to maximize brand visibility and customer access, with significant capital expenditure in 2023 allocated to store openings and refurbishments in key global markets.

What is included in the product

A dynamic business model focused on rapid trend adoption and efficient supply chain management, Inditex's canvas details its fast-fashion value proposition, broad customer segments, and integrated online/offline channels.

This model emphasizes strong customer relationships through personalized experiences and efficient cost structures, supported by key partnerships in manufacturing and logistics.

Inditex's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their fast-fashion strategy, enabling rapid identification of key value propositions and customer segments to address market demands efficiently.

Activities

Inditex's design and product development is a core engine, focused on swiftly translating current fashion trends into tangible collections. This rapid cycle is crucial to their fast-fashion model, often seeing new items hit stores within weeks of initial concept. For example, in the first quarter of 2024, Inditex continued to emphasize agile product development, a strategy that has consistently allowed them to respond to evolving consumer preferences.

Inditex's manufacturing and production is a cornerstone of its fast-fashion strategy, involving a blend of in-house operations and outsourced partnerships. The company strategically places production facilities close to its headquarters in Spain, as well as in other key global markets, to ensure agility and responsiveness to changing fashion trends.

In 2023, Inditex continued to invest in optimizing its production processes, aiming for greater efficiency and reduced lead times. This focus is crucial for its ability to quickly bring new designs from concept to store shelves. For instance, the company's integrated supply chain allows for rapid adjustments in production based on real-time sales data.

There's a growing emphasis on incorporating more sustainable materials and manufacturing practices. By 2025, Inditex aims for a significant portion of its materials to be more sustainable, reflecting a commitment to environmental responsibility within its production activities.

Inditex's logistics and distribution network is a cornerstone of its fast-fashion model, ensuring rapid product turnover. This involves a sophisticated, vertically integrated system that allows for swift movement of garments from production to over 6,000 stores and online channels globally.

The company makes substantial investments in cutting-edge logistics infrastructure, including automated distribution centers. For instance, in 2023, Inditex continued to enhance its logistics capabilities, with a focus on optimizing inventory management and delivery times for its expanding online presence.

This efficiency is further driven by the optimization of transport routes and a commitment to reducing lead times. Inditex's ability to get new styles into stores within weeks, rather than months, is a direct result of its meticulously planned and executed distribution strategy.

Retail Operations (Physical and Online)

Inditex's core activity revolves around expertly managing its diverse brand portfolio through a dual strategy of physical stores and robust online channels. This encompasses optimizing the layout and functionality of its extensive retail footprint, which included approximately 5,800 stores as of early 2024, while simultaneously enhancing its e-commerce capabilities. The company focuses on integrating technology to create a fluid and engaging customer journey across all touchpoints, ensuring a consistent brand experience whether shopping in-store or online.

This integrated approach allows Inditex to effectively manage sales across multiple channels, a critical component of its business model. By harmonizing inventory and customer data, they aim to provide a seamless experience, a strategy that has contributed to their strong performance. For instance, online sales represented a significant portion of their revenue, demonstrating the success of their digital investments.

- Store Network Optimization: Inditex continuously evaluates and optimizes its physical store locations, focusing on prime commercial areas to maximize visibility and foot traffic.

- E-commerce Integration: The company invests heavily in its online platforms, ensuring a user-friendly interface, efficient logistics, and personalized shopping experiences.

- Omnichannel Strategy: Seamlessly blending online and offline operations, allowing customers to buy online and pick up in-store, or return online purchases to physical stores.

- Inventory Management: Sophisticated systems are in place to manage inventory across all channels, minimizing stockouts and optimizing stock levels to meet demand efficiently.

Marketing and Brand Management

Inditex excels at strategic brand management across its portfolio, notably with Zara, Pull&Bear, and Massimo Dutti. This approach ensures each brand resonates with its target demographic.

Instead of heavy traditional advertising, Inditex prioritizes brand visibility through strategically chosen prime store locations. This physical presence is complemented by a robust and engaging online footprint.

Customer engagement is a cornerstone, with digital platforms playing a crucial role. In 2024, Inditex continued to leverage its integrated online and offline strategy to drive brand loyalty and sales.

- Brand Portfolio: Manages distinct brands like Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, and Zara Home.

- Advertising Strategy: Minimal traditional advertising spend, focusing on prime retail locations and digital presence.

- Digital Engagement: Strong emphasis on e-commerce and social media to connect with customers.

- Store Network: Over 6,400 stores globally as of early 2024, serving as key brand touchpoints.

Inditex's key activities center on a highly integrated model that links design, production, logistics, and sales across a vast global network. This allows for rapid response to fashion trends, ensuring fresh inventory is consistently available to customers.

The company's operational efficiency is driven by its vertically integrated supply chain and strategically located distribution centers, enabling swift product movement from factories to over 6,400 stores and online platforms as of early 2024. This agility is fundamental to its fast-fashion success.

Inditex's approach to sales and customer engagement is omnichannel, seamlessly blending its extensive physical store presence with a growing e-commerce operation. This integration facilitates a consistent brand experience and allows for flexible customer interactions, such as buy online, pick up in-store.

The brand management strategy relies on prime physical locations and a strong digital presence, minimizing traditional advertising. This focus on direct customer interaction and brand visibility across multiple touchpoints, including social media, fosters engagement and loyalty.

| Key Activity | Description | 2024 Data/Focus |

| Design & Product Development | Rapid translation of trends into collections. | Agile development responding to evolving preferences. |

| Manufacturing & Production | Blend of in-house and outsourced, with proximity focus. | Optimizing efficiency and reducing lead times; increasing sustainable materials. |

| Logistics & Distribution | Vertically integrated, swift movement to global stores and online. | Enhancing logistics infrastructure for optimized inventory and delivery. |

| Sales & Customer Engagement | Omnichannel strategy (physical stores + e-commerce). | Integrating technology for a fluid customer journey; strong online sales growth. |

| Brand Management | Managing diverse brands with minimal traditional advertising. | Focus on prime store locations and digital presence for brand visibility. |

What You See Is What You Get

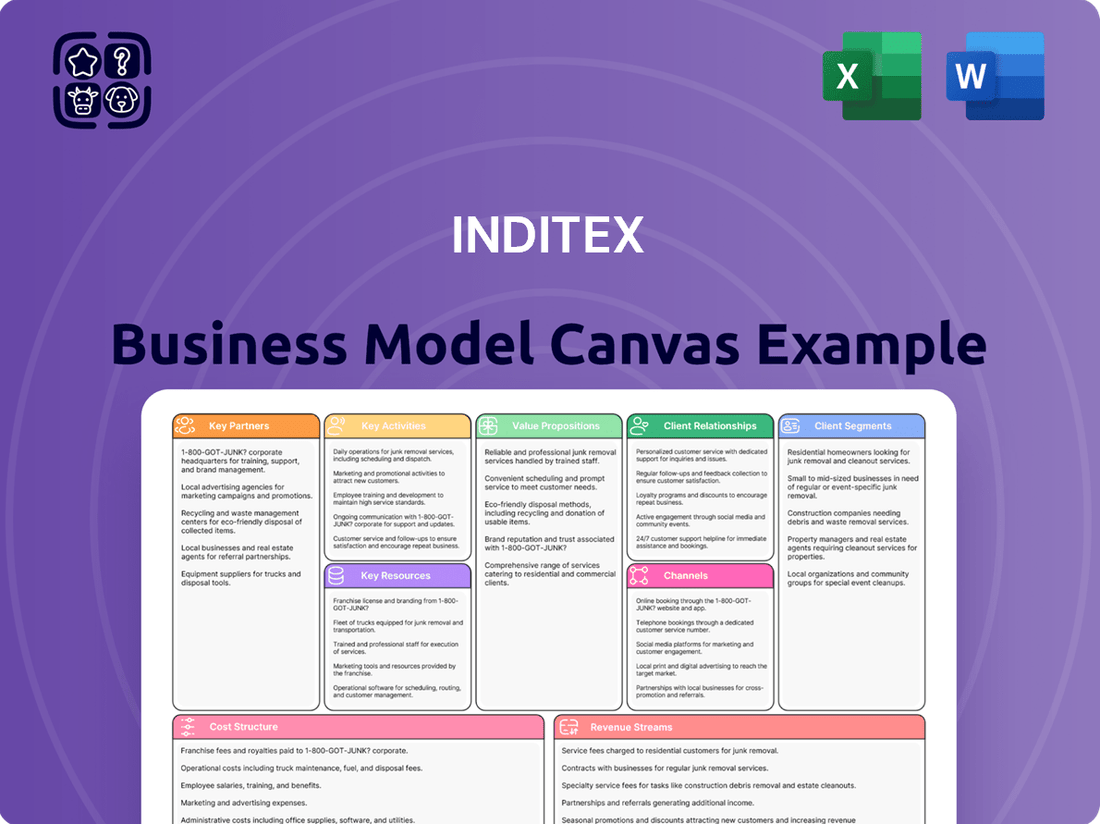

Business Model Canvas

The Inditex Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use analysis. Once your order is processed, you will gain full access to this same comprehensive document, allowing you to leverage its insights immediately.

Resources

Inditex's strength lies in its diverse portfolio of highly recognized brands like Zara, Pull&Bear, and Massimo Dutti. These brands are crucial intangible assets, attracting a broad customer base and enabling effective market segmentation. In 2023, Inditex's brand equity contributed significantly to its total revenue of €35.9 billion, demonstrating the commercial power of its intellectual property.

Inditex's extensive global store network, comprising over 5,800 stores as of early 2024, acts as a crucial physical resource. These locations are strategically chosen in prime retail areas, ensuring maximum customer visibility and accessibility.

Complementing the store footprint is a highly efficient logistics infrastructure. This includes a network of distribution centers and advanced transportation systems that facilitate rapid product movement from factories to stores and online customers.

The company consistently invests in enhancing this infrastructure. For instance, in 2023, Inditex continued its focus on optimizing store formats and expanding its logistics capabilities to support its integrated online and physical retail strategy.

Inditex heavily relies on its integrated technology platforms and data analytics as a core resource. These advanced digital systems, including robust e-commerce capabilities, are fundamental to delivering a seamless omnichannel experience for customers. For instance, in 2023, Inditex reported that online sales represented 18% of its total revenue, a testament to the effectiveness of these platforms.

These technological assets are instrumental in driving data-driven decision-making across the organization. By leveraging sophisticated data analytics tools, Inditex can optimize its supply chain, predict fashion trends, and tailor personalized customer interactions. This focus on data allows for agile responses to market demands, a key factor in their sustained success.

Human Capital (Designers, Retail Staff, Logistics Teams)

Inditex's design teams are the wellspring of its fast-fashion innovation, consistently translating trends into commercially viable collections. This creative engine is supported by a vast network of retail staff, whose customer interaction and operational efficiency are crucial for immediate sales feedback and inventory management. In 2023, Inditex employed approximately 164,855 people globally, a testament to the scale of its human capital investment.

The expertise of logistics teams is paramount to Inditex's agile supply chain, ensuring rapid product distribution from factories to stores worldwide. This operational backbone allows for swift replenishment and efficient movement of goods, a key differentiator in the retail landscape. For instance, Inditex's ability to get new designs into stores within weeks relies heavily on this logistical prowess.

- Design Innovation: Inditex's creative teams are central to its ability to quickly adapt to and set fashion trends, a core component of its business model.

- Retail Execution: The efficiency and customer-facing skills of its retail staff are critical for driving sales and gathering real-time market intelligence.

- Logistical Agility: Expert logistics personnel ensure the swift and cost-effective movement of merchandise, enabling Inditex's responsive supply chain.

- Talent Development: Inditex's commitment to fostering talent across all these areas is a strategic imperative for sustained growth and market leadership.

Flexible and Responsive Supply Chain

Inditex's supply chain is a critical asset, enabling rapid response to fashion trends. This agility allows them to design, produce, and deliver new collections to stores worldwide in a matter of weeks, a stark contrast to the months it takes many competitors.

This flexibility is powered by a highly integrated operational model. For example, in 2023, Inditex reported a net sales increase of 10% to €35.9 billion, demonstrating the effectiveness of their model in driving growth through responsiveness.

- Fast Fashion Cycle: Inditex can introduce new designs from concept to store shelf in as little as two to three weeks.

- Inventory Management: Tight control over inventory minimizes markdowns and waste, contributing to higher profit margins.

- Geographic Proximity: A significant portion of manufacturing is located in Spain, Portugal, and Morocco, facilitating quicker turnaround times.

- Data-Driven Decisions: Sales data from stores is fed back to design teams daily, informing production and merchandising choices.

Inditex's key resources are its powerful brands, extensive global store network, efficient logistics, integrated technology platforms, and skilled human capital. These elements work in synergy to support its fast-fashion model and deliver value to customers.

The company's intellectual property, particularly its brand portfolio, represents significant intangible value, driving customer loyalty and market penetration. This is complemented by a vast physical presence and a sophisticated digital infrastructure that ensures seamless customer experiences.

The agility of its supply chain, powered by data analytics and efficient logistics, is a critical operational resource that allows Inditex to rapidly respond to market trends and consumer demand.

Inditex's human capital, from design teams to retail staff and logistics experts, is fundamental to its ability to innovate, execute, and maintain operational excellence.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Portfolio | Highly recognized brands (Zara, Pull&Bear, etc.) | Contributed significantly to €35.9 billion in revenue. |

| Global Store Network | Over 5,800 strategically located stores. | Prime retail locations ensure customer visibility. |

| Logistics Infrastructure | Efficient distribution centers and transportation. | Facilitates rapid product movement globally. |

| Technology Platforms | Integrated e-commerce and data analytics. | Online sales represented 18% of total revenue. |

| Human Capital | Design, retail, and logistics expertise. | Approximately 164,855 employees globally. |

Value Propositions

Inditex's value proposition centers on offering trendy and fashionable apparel, ensuring customers can access the latest styles as soon as they emerge. This rapid response to fashion cycles is a core differentiator, allowing them to capture consumer interest quickly.

The company excels at translating runway trends into readily available clothing collections, a strategy that resonated strongly in 2024. Inditex's ability to swiftly update its offerings means shoppers consistently find current and desirable fashion items across its brands.

Inditex excels at offering fashion-forward items that feel high-quality and stylish, yet remain affordable. This strategy directly targets consumers who want to keep their wardrobes current without overspending. For instance, in the first quarter of 2024, Inditex reported a 7% increase in net sales, reaching €8.15 billion, demonstrating the strong consumer demand for their accessible fashion.

Inditex’s lightning-fast product refresh cycle, often seeing new items hitting stores within weeks of design, fuels customer engagement. This rapid turnover means shoppers are consistently presented with novelties, driving repeat visits and impulse buys.

The company’s ‘see now, buy now’ approach, exemplified by its ability to quickly translate runway trends into affordable fashion, cultivates an environment of urgency and desirability. For instance, in fiscal year 2023, Inditex reported a net profit of €5.4 billion, showcasing the financial success of this agile model.

Seamless Omnichannel Shopping Experience

Inditex’s commitment to a seamless omnichannel experience means customers enjoy a unified journey across both its physical stores and online channels. This integration is key to their customer-centric approach, making shopping convenient and efficient.

Features like real-time in-store stock checks via mobile applications exemplify this strategy. For instance, in 2024, Inditex continued to invest heavily in its digital infrastructure, aiming to further bridge the gap between online and offline retail. This allows shoppers to locate desired items in nearby stores instantly, reducing friction in the purchasing process.

- Unified Customer Journey: Customers can browse online, reserve items, and pick them up in-store, or vice versa, creating a fluid shopping path.

- Enhanced Convenience: Mobile app features for stock checking and store navigation empower customers with immediate information.

- Digital-Physical Synergy: This approach leverages the strengths of both online reach and the tangible experience of physical retail.

- Inventory Visibility: Real-time data ensures customers know product availability across all locations, minimizing disappointment.

Commitment to Sustainability

Inditex's commitment to sustainability is a core value proposition, resonating strongly with a growing segment of environmentally aware consumers. The company is actively expanding its range of products crafted from lower-impact and recycled materials, demonstrating a tangible effort to reduce its environmental footprint.

This focus on eco-friendly materials is complemented by practical initiatives, such as widespread garment collection programs. These programs encourage circularity by allowing customers to return old clothing for recycling or reuse, further solidifying Inditex's dedication to a more sustainable fashion model. In 2023, Inditex collected over 10,000 tons of used garments through its in-store collection programs, a significant increase from previous years.

This strategy directly addresses the increasing consumer demand for ethical and sustainable fashion choices. By offering products that align with these values, Inditex enhances its brand appeal and fosters customer loyalty among those who prioritize environmental responsibility in their purchasing decisions.

Key aspects of this commitment include:

- Expanded use of sustainable materials: Inditex aims for 100% of its cotton to be sustainably sourced by 2025, with 2023 figures showing 80% of cotton used was sustainably sourced.

- Garment collection and recycling programs: These initiatives promote a circular economy by giving textiles a second life.

- Reduced environmental impact: Efforts are focused on water conservation, energy efficiency, and waste reduction across the supply chain.

- Transparency and traceability: Inditex is working to improve the traceability of its supply chain to ensure ethical and sustainable practices.

Inditex's value proposition is built on delivering on-trend fashion rapidly and affordably, ensuring customers always have access to the latest styles. This agility allows them to translate runway looks into accessible collections quickly, driving consistent consumer engagement and purchases.

The company’s success in 2024, marked by a 7% increase in net sales to €8.15 billion in Q1, underscores the appeal of its fast-fashion model. Inditex effectively bridges the gap between high fashion and everyday consumers, a strategy that proved financially robust.

Inditex also champions a seamless omnichannel experience, integrating online and physical stores for ultimate customer convenience. Features like real-time stock checks via mobile apps enhance this, allowing shoppers to easily find products, a key driver of their continued sales growth.

Sustainability is another pillar, with Inditex expanding its use of recycled materials and garment collection programs. By 2023, 80% of its cotton was sustainably sourced, reflecting a commitment to environmental responsibility that resonates with a growing consumer base.

| Value Proposition Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Fast Fashion & Trend Responsiveness | Rapidly translating runway trends into affordable, available clothing. | Net sales increased 7% to €8.15 billion in Q1 2024. |

| Affordability & Style | Offering fashionable, quality items at accessible price points. | Net profit of €5.4 billion in fiscal year 2023. |

| Omnichannel Experience | Seamless integration of online and physical stores for customer convenience. | Continued investment in digital infrastructure in 2024 to enhance customer journey. |

| Sustainability Commitment | Increasing use of sustainable materials and garment recycling initiatives. | 80% of cotton used was sustainably sourced in 2023; over 10,000 tons of garments collected. |

Customer Relationships

Inditex cultivates deep customer connections through its robust digital ecosystem, boasting millions of active app users and social media followers. This digital footprint allows for highly personalized product recommendations, driven by a sophisticated analysis of consumer behavior and purchasing patterns.

Inditex's physical stores are designed to be more than just points of sale; they are immersive brand environments. Here, customers can touch, feel, and try on clothing, fostering a deeper connection with the product. This tactile experience is crucial in fashion retail.

Associates play a key role, offering personalized service. They are increasingly equipped with mobile technology, allowing them to check stock, process transactions, and provide styling advice efficiently. This integration of technology enhances the human interaction, blending the convenience of digital with the warmth of personal service.

For example, in 2024, Inditex continued to invest in store renovations and technology upgrades. While specific figures for in-store tech adoption are proprietary, the company's consistent focus on omnichannel integration suggests a significant portion of their sales associates are empowered with these tools to improve customer engagement and operational efficiency across their vast store network.

Inditex places significant emphasis on customer feedback, actively weaving it into their design and production cycles. This direct integration allows the company to swiftly adjust to evolving consumer tastes, a crucial element in fast fashion. For example, Inditex's Zara brand is known for its ability to get new designs from concept to store shelves in as little as two weeks. This agility, fueled by customer insights gathered from sales data and in-store interactions, directly contributes to customer satisfaction and fosters strong brand loyalty by ensuring their offerings remain relevant and desirable.

Loyalty and Repeat Purchase Incentives

Inditex cultivates customer loyalty by consistently introducing new collections, a core element of its fast-fashion strategy. This constant product refresh, with new items hitting stores multiple times a week, encourages frequent visits and repeat purchases. For instance, in 2023, Inditex's Zara brand alone introduced thousands of new styles, keeping the offering dynamic and appealing.

Beyond the inherent draw of newness, Inditex also employs direct incentives. New customers are often greeted with introductory offers, such as discounts on their first purchase, making the initial entry into the Inditex ecosystem more attractive. This strategy aims to convert first-time shoppers into recurring patrons.

- Frequent Product Introductions: Inditex's model ensures a constant influx of new styles, driving repeat visits.

- New Customer Incentives: Offers for first-time buyers encourage initial engagement and future purchases.

- Fast Fashion Conditioning: The rapid trend cycle inherently prompts customers to return regularly to see the latest offerings.

Sustainability Communication and Initiatives

Inditex actively engages its customer base by transparently communicating its commitment to sustainability. This includes highlighting initiatives like the 'Join Life' collection, which features garments made with more sustainable materials, and its widespread garment collection programs.

By educating consumers about these efforts, Inditex fosters a deeper connection and builds trust, particularly with an increasingly environmentally conscious customer segment. For instance, in 2023, Inditex reported that 45% of its polyester was recycled polyester, a significant step in its garment recycling and sustainable material sourcing goals.

- Customer Engagement: Communicating sustainability efforts like the 'Join Life' line and garment recycling programs.

- Trust and Loyalty: Educating customers on commitments builds loyalty among eco-conscious consumers.

- Data Point: In 2023, 45% of Inditex's polyester was recycled polyester, showcasing tangible progress.

Inditex's customer relationships are built on a foundation of constant engagement and personalized experiences, both online and in-store. Their robust digital presence, with millions of app users, allows for tailored recommendations based on detailed consumer behavior analysis.

Physical stores act as immersive brand spaces, encouraging tactile interaction with products, which is vital in fashion. This is complemented by sales associates empowered with technology to offer efficient, personalized service, blending digital convenience with human touch.

The company actively incorporates customer feedback into its rapid design and production cycles, ensuring its offerings remain aligned with evolving tastes. This agility, exemplified by Zara's quick turnaround times, fosters strong brand loyalty by consistently delivering relevant fashion.

Inditex also drives loyalty through frequent new collection introductions, encouraging repeat visits and purchases. For instance, in 2023, Zara alone introduced thousands of new styles. They also utilize introductory offers for new customers to encourage initial engagement and build a recurring customer base.

Furthermore, Inditex transparently communicates its sustainability initiatives, such as the 'Join Life' collection and garment recycling programs. This builds trust and loyalty, particularly with environmentally conscious consumers. In 2023, 45% of their polyester was recycled, demonstrating tangible progress in this area.

Channels

Inditex boasts an extensive worldwide presence with over 5,800 physical stores across its brands, serving as crucial hubs for sales and brand immersion. These strategically positioned locations in prime shopping areas ensure high visibility and direct customer engagement.

Inditex leverages its extensive network of brand-specific websites and mobile applications as primary channels for global sales and distribution. These digital platforms are central to reaching a broad customer base and facilitating direct-to-consumer transactions worldwide.

The company's significant investment in digital infrastructure ensures a fluid and user-friendly online shopping experience, crucial for customer retention and driving e-commerce growth. This focus on seamless digital engagement is a cornerstone of their customer relationship strategy.

In 2023, Inditex reported that online sales represented 18% of its total revenue, reaching €5.8 billion. This highlights the critical role these e-commerce channels play in the company's overall business model and its ability to adapt to evolving consumer purchasing habits.

Inditex’s channels are a masterclass in integration, ensuring customers experience a smooth transition between browsing online and shopping in physical stores. This interconnectedness is key to their strategy. For instance, the ‘store mode’ feature within their apps allows shoppers to instantly check real-time inventory availability at their local Inditex branches.

This seamlessness is crucial for customer satisfaction and driving sales across all touchpoints. In 2023, Inditex reported a significant portion of its sales originating from online channels, demonstrating the effectiveness of their digital integration. This omnichannel approach aims to capture every opportunity, whether a customer prefers to shop from their couch or visit a brick-and-mortar location.

Social Media Presence

Inditex masterfully uses social media to connect with its global customer base. Platforms like Instagram, TikTok, and Facebook are crucial for showcasing new fashion arrivals, running targeted campaigns, and fostering a sense of community around its brands.

The company’s brands boast an impressive social media footprint, driving significant engagement and brand loyalty. For instance, as of early 2024, Zara alone has over 85 million followers across its primary social media channels, demonstrating the immense reach of Inditex’s digital strategy.

- Brand Engagement: Social media facilitates direct interaction, enabling feedback and trend monitoring.

- Collection Showcasing: Visual platforms are key to presenting new products and seasonal lines effectively.

- Global Reach: A strong social media presence amplifies brand awareness across diverse international markets.

- Data-Driven Insights: Social media analytics inform marketing strategies and product development.

Logistics and Distribution Network

Inditex's logistics and distribution network is a powerhouse, acting as a vital channel that ensures products reach customers swiftly. This network efficiently moves fashion items from production hubs to over 5,800 stores worldwide and directly to online shoppers, a testament to its global reach.

The company's integrated approach, which includes a significant portion of production in proximity to its distribution centers, allows for remarkable agility. In 2023, Inditex reported a net sales increase of 10% to €35.9 billion, underscoring the effectiveness of its streamlined supply chain in meeting consumer demand.

- Global Reach: Inditex operates a vast distribution network that serves customers in over 200 markets.

- Speed and Efficiency: The company's logistics model is designed for rapid inventory turnover, enabling new collections to be in stores within weeks of design.

- Omnichannel Integration: The network seamlessly supports both brick-and-mortar stores and the booming e-commerce operations, with online sales growing significantly.

- Sustainability Focus: Inditex is increasingly investing in sustainable logistics, aiming to reduce the environmental impact of its distribution operations.

Inditex’s channels are a sophisticated blend of physical and digital touchpoints, designed for maximum customer reach and engagement. Their extensive store network, numbering over 5,800 globally, serves as prime locations for direct customer interaction and sales, complemented by robust e-commerce platforms. The company's strategic integration of these channels, exemplified by features allowing in-app store inventory checks, ensures a seamless omnichannel experience.

Social media plays a pivotal role, with brands like Zara commanding tens of millions of followers, fostering community and driving brand awareness. This digital presence is crucial for showcasing new collections and gathering market insights. The efficiency of Inditex's logistics network underpins this channel strategy, enabling rapid product delivery to both stores and online customers, a key factor in their reported 10% net sales increase to €35.9 billion in 2023.

| Channel Type | Key Features | 2023 Performance/Reach |

|---|---|---|

| Physical Stores | High-street locations, brand immersion | Over 5,800 stores worldwide |

| E-commerce | Brand websites, mobile apps | 18% of total revenue (€5.8 billion) |

| Social Media | Instagram, TikTok, Facebook engagement | Zara alone: 85M+ followers (early 2024) |

| Logistics & Distribution | Global network, rapid delivery | Supports 200+ markets, key to sales growth |

Customer Segments

Trend-Conscious Consumers are a core demographic for Inditex, driven by a desire to stay current with the latest fashion movements. They actively seek out new styles and appreciate the rapid turnover of collections that Inditex offers.

This segment is a key driver of Inditex's success, as their demand for novelty perfectly aligns with the company's fast-fashion operational model. In 2023, Inditex's net sales reached €35.9 billion, reflecting strong demand from consumers eager for updated wardrobes.

Value-Seeking Shoppers are a core demographic for Inditex, drawn to brands like Zara and Stradivarius for their ability to deliver on-trend fashion at accessible price points. They actively seek out clothing that reflects current styles without demanding a premium price tag, making Inditex's fast-fashion model highly appealing.

In 2024, Inditex continued to leverage this segment's demand, reporting a significant portion of its sales driven by these cost-conscious consumers. The company's strategy of rapid inventory turnover and efficient supply chains allows them to translate runway trends into affordable garments quickly, directly catering to this segment's desire for stylish, budget-friendly options.

Omnichannel shoppers value a fluid experience, blending online discovery with in-store interaction. They might browse a Zara collection on their phone, try items on at a physical store, and then complete the purchase via the app for home delivery or store pickup. This flexibility is key to their engagement.

Inditex's strategy directly addresses this by integrating its digital and physical channels. For instance, in 2024, the company continued to enhance its store inventory visibility online, allowing customers to check stock availability before visiting. This seamless integration is crucial for retaining these high-value customers.

Younger Demographics (Gen Z and Millennials)

Inditex's brands, especially Zara and Pull&Bear, resonate deeply with Gen Z and Millennials. These younger consumers are heavily influenced by social media trends and actively seek to replicate high-fashion looks at accessible price points. In 2024, Inditex continued to leverage this by offering rapidly updated collections that align with current viral styles.

This demographic's purchasing decisions are often driven by a desire for instant gratification and a constant refresh of their wardrobes. Inditex's fast-fashion model, with its quick turnaround from design to store, perfectly caters to this demand. For instance, Zara often introduces new items multiple times a week, ensuring a continuous stream of novelty that keeps younger shoppers engaged.

- Brand Appeal: Zara and Pull&Bear are key for attracting Gen Z and Millennials.

- Social Media Influence: These groups are highly responsive to fashion trends disseminated through platforms like TikTok and Instagram.

- Affordable Fashion: The desire to emulate high-end styles without the high cost is a primary motivator for this segment.

- Rapid Trend Adoption: Inditex's ability to quickly translate runway and social media trends into wearable, affordable clothing is crucial.

Globally Diverse Consumers

Inditex's globally diverse consumer segment is vast, reflecting its presence in over 200 markets. This broad reach allows the company to cater to a wide array of cultural backgrounds and demographic profiles, adapting its offerings to local tastes and fashion trends.

The company's strategy involves providing diverse collections that resonate with varied regional preferences. This approach is crucial for capturing market share across different continents and economic landscapes.

- Global Reach: Inditex operates in more than 200 markets, showcasing its commitment to a worldwide customer base.

- Cultural Adaptation: Collections are tailored to suit diverse regional tastes and preferences, ensuring relevance across cultures.

- Demographic Inclusivity: The target audience spans a wide spectrum of ages, incomes, and lifestyles globally.

Inditex's customer base is characterized by its diversity, encompassing trend-conscious individuals, value-seeking shoppers, and omnichannel consumers. Younger demographics, particularly Gen Z and Millennials, are a significant focus, drawn to the brand's ability to quickly translate social media trends into affordable fashion. This broad appeal is reflected in Inditex's expansive global presence, with operations in over 200 markets, allowing for adaptation to local tastes.

In 2023, Inditex reported net sales of €35.9 billion, underscoring the strong demand from these varied customer segments. The company's success hinges on its fast-fashion model, which caters to the desire for novelty and affordability. For instance, Zara's rapid inventory turnover ensures that styles seen on social media are available in stores and online quickly, appealing to the impulse purchasing behavior of younger consumers.

The company's strategic integration of online and physical channels further enhances its appeal to omnichannel shoppers. By providing features like real-time inventory visibility in 2024, Inditex ensures a seamless shopping experience, encouraging repeat business from customers who value flexibility. This multifaceted approach to customer segmentation allows Inditex to maintain its competitive edge in the global fashion market.

| Customer Segment | Key Characteristics | Inditex's Strategy Alignment | 2023 Data/2024 Insights |

|---|---|---|---|

| Trend-Conscious Consumers | Seek latest fashion, appreciate rapid collection turnover. | Fast-fashion model, frequent new arrivals. | Strong demand driving overall sales. |

| Value-Seeking Shoppers | Desire current styles at accessible prices. | Efficient supply chain, affordable pricing. | Significant portion of sales driven by this segment. |

| Omnichannel Shoppers | Blend online browsing with in-store interaction, value flexibility. | Integrated digital and physical channels, stock visibility. | Enhanced online inventory visibility in 2024. |

| Gen Z & Millennials | Influenced by social media, seek affordable trend replication. | Rapid trend adoption, fast delivery from design to store. | New items introduced multiple times weekly by Zara. |

| Global Diverse Consumers | Wide range of cultural backgrounds and preferences. | Adaptation of collections to local tastes across 200+ markets. | Commitment to worldwide customer base. |

Cost Structure

Inditex’s production and manufacturing costs represent a substantial part of its operational expenses. These costs encompass the sourcing of raw materials like cotton and polyester, wages for factory workers involved in sewing and assembly, and the overheads associated with running production facilities.

In 2023, Inditex reported a cost of sales of €16.6 billion, a significant portion of which is directly attributable to these production and manufacturing activities. This figure reflects the scale of their global operations and the complex supply chain involved in bringing fashion items to market.

Logistics and distribution expenses are a significant component of Inditex's cost structure, reflecting its vast global operations and commitment to rapid inventory turnover. These costs encompass warehousing, the movement of goods across its extensive network, and last-mile delivery to stores and online customers.

The company's integrated supply chain, while efficient, necessitates substantial investment in maintaining and optimizing its logistics infrastructure. This includes advanced warehousing facilities and sophisticated transportation management systems to ensure timely product availability across its numerous brands and markets.

In recent years, Inditex has notably increased its reliance on air freight to expedite delivery times, particularly for its fast-fashion model. This strategic choice, while enhancing responsiveness, contributes to higher transportation costs. For instance, in the first quarter of 2024, Inditex reported a 7% increase in sales, underscoring the operational scale that drives these logistical expenses.

Inditex's extensive retail operations are a significant cost driver, encompassing rent for prime locations, utilities, and the salaries of a large global workforce. In 2024, the company continued to invest in its store network, balancing physical presence with online integration.

Maintaining thousands of stores worldwide involves substantial outlays for upkeep, visual merchandising, and the integration of technology to enhance the customer experience. These operational costs are crucial for delivering Inditex's fast-fashion model to consumers.

Technology and Digital Transformation Investments

Inditex significantly invests in its technology and digital transformation, a key component of its cost structure. This includes substantial capital expenditure aimed at bolstering online platforms and the underlying digital infrastructure. For instance, in 2023, Inditex's capital expenditure reached €1.8 billion, with a notable portion dedicated to technology and store upgrades, reflecting a commitment to enhancing its digital capabilities and customer experience through innovation.

The company actively incorporates new technologies, such as artificial intelligence, to streamline operations and personalize customer interactions. These investments are crucial for maintaining efficiency across its vast supply chain and for offering a seamless shopping experience, both online and in-store. Inditex's focus on digital transformation is not just about e-commerce; it's about integrating technology across all facets of the business to drive growth and customer loyalty.

- Technology Investments: Inditex's 2023 capital expenditure of €1.8 billion highlights its commitment to digital infrastructure and online platforms.

- AI Integration: New technologies, including AI, are being adopted to boost operational efficiency and enhance customer engagement.

- Customer Experience Focus: These technological advancements are designed to create a more integrated and improved shopping experience for customers.

- Strategic Allocation: A significant portion of capital is allocated to technology, underscoring its importance in Inditex's business model for future growth.

Marketing and Brand Management Expenses

Inditex’s marketing and brand management expenses are notably lean compared to traditional retailers, focusing on organic growth and customer engagement rather than extensive advertising campaigns. While direct advertising spend is minimized, significant resources are allocated to maintaining brand equity through strategic initiatives.

These costs include investments in digital marketing, social media engagement, and the creation of compelling online content to foster a strong brand presence. Furthermore, the selection and design of flagship store locations serve as crucial brand showcases, contributing to marketing efforts without direct advertising costs.

For instance, in the fiscal year ending January 31, 2024, Inditex's advertising and marketing expenses amounted to €1,082 million, representing approximately 2.3% of its total revenue. This demonstrates a deliberate strategy to leverage its store network and digital platforms for brand building.

- Digital Presence: Significant investment in online platforms and social media to engage customers.

- Brand Showcases: Strategic placement and design of physical stores as key brand touchpoints.

- Lean Advertising: Minimal traditional advertising spend, prioritizing organic reach and word-of-mouth.

- Brand Management: Ongoing efforts to maintain and enhance brand perception and loyalty.

Key cost drivers for Inditex include production, logistics, retail operations, and technology investments. The company's efficient, integrated supply chain, while a strength, necessitates significant expenditure in warehousing and transportation, particularly with the increasing use of air freight to meet fast-fashion demand. Inditex also invests heavily in its global store network and digital transformation, with capital expenditure in 2023 reaching €1.8 billion, a portion of which was allocated to technology and store upgrades.

| Cost Category | 2023 Data | Key Components |

| Cost of Sales | €16.6 billion | Raw materials, manufacturing wages, factory overheads |

| Logistics & Distribution | Significant component | Warehousing, global transportation, last-mile delivery |

| Retail Operations | Substantial outlays | Store rent, utilities, staff salaries, store upkeep |

| Technology & Digital | €1.8 billion (Capital Expenditure in 2023) | Online platforms, digital infrastructure, AI integration |

| Marketing & Brand Management | €1,082 million (FY ending Jan 31, 2024) | Digital marketing, social media, store design |

Revenue Streams

Inditex's primary revenue engine is its vast physical store network, a cornerstone of its business model. These brick-and-mortar locations are crucial for customer engagement and impulse purchases, driving a substantial portion of its income.

In 2024, Inditex continued to leverage its global store presence, with sales from physical stores remaining a significant contributor to its overall financial performance. This enduring strength highlights the continued importance of a tangible retail experience for its customer base.

E-commerce sales are a critical and expanding revenue source for Inditex, driven by significant investment in digital platforms. The company's own brand websites and mobile apps are central to this growth, offering customers a seamless shopping experience. For the fiscal year 2023, Inditex reported that online sales represented 18% of total group sales, a notable increase that underscores the effectiveness of their digital strategy.

Inditex's main income comes from selling clothes and accessories for women, men, and kids. This includes everything from everyday wear to trendier pieces, plus items like bags, scarves, and jewelry.

In 2023, Inditex reported a net sales figure of €35.9 billion, showcasing the massive scale of its clothing and accessory sales operations.

Sales of Home Furnishings (Zara Home)

Inditex's Zara Home brand is a significant contributor to its revenue, offering a diverse range of home furnishings and decor. This segment allows Inditex to capture a broader market share by catering to consumers' lifestyle needs beyond apparel. The brand's success is built on providing stylish, trend-driven products that align with Zara's fashion-forward ethos.

In 2024, Zara Home continued to expand its global presence, with a focus on enhancing its online and physical store offerings. While specific revenue figures for Zara Home are not always broken out separately by Inditex in their public reports, it is a key component of the group's overall performance. The brand's strategy involves leveraging Inditex's robust supply chain and design capabilities to quickly bring new collections to market.

- Diversified Product Offering: Zara Home extends Inditex's reach into the home decor market, complementing its fashion retail.

- Global Expansion: The brand actively grows its footprint through both e-commerce and physical stores worldwide.

- Trend-Driven Approach: Zara Home mirrors the fast-fashion model, offering contemporary designs to consumers.

Franchise and Licensing Fees

While Inditex predominantly operates through company-owned stores, it does generate some revenue from franchise and licensing agreements. These arrangements are strategically employed in specific international markets where this model offers advantages for brand expansion and market penetration. This approach allows Inditex to leverage local expertise and capital while maintaining brand control.

For instance, in markets where direct investment might be challenging or less efficient, franchising can unlock growth opportunities. Licensing can also extend brand presence into product categories or regions not covered by its core retail operations.

- Franchise Revenue: While not a primary driver, franchise fees and royalties contribute to overall revenue, particularly in emerging markets.

- Licensing Agreements: Inditex may license its brands for specific product lines or territories, generating additional income streams.

- Strategic Market Entry: These models are utilized to facilitate global reach and brand visibility in select geographies.

Inditex's revenue streams are multifaceted, primarily driven by its extensive global store network and a rapidly growing e-commerce presence. The core business revolves around the sale of fashion apparel and accessories for all demographics, with Zara Home contributing significantly to lifestyle-related sales.

While direct sales through owned stores and online platforms form the bulk of revenue, franchise and licensing agreements also play a strategic role in expanding the brand's reach in select international markets. This diversified approach allows Inditex to capture revenue across various channels and geographies.

| Revenue Stream | Description | Key Driver |

|---|---|---|

| Physical Stores | Sales from Inditex's global network of brick-and-mortar retail locations. | Customer footfall, impulse purchases, brand experience. |

| E-commerce | Online sales generated through brand websites and mobile applications. | Digital investment, seamless user experience, expanding online reach. |

| Zara Home | Sales of home furnishings and decor items under the Zara Home brand. | Lifestyle market penetration, trend-driven product offerings. |

| Franchise & Licensing | Revenue from franchise fees, royalties, and licensing agreements in specific markets. | Market entry strategy, leveraging local expertise, brand extension. |

Business Model Canvas Data Sources

The Inditex Business Model Canvas is built using a blend of internal financial reports, extensive market research on consumer behavior, and competitive analysis of the fast-fashion industry. These diverse data sources ensure a comprehensive and accurate representation of Inditex's strategic operations and market positioning.