Imerys SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imerys Bundle

Imerys, a global leader in specialty minerals, leverages its diverse product portfolio and extensive global reach as key strengths. However, the company faces challenges from fluctuating raw material costs and increasing environmental regulations, which could impact its profitability and operational efficiency.

Want the full story behind Imerys' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Imerys stands as a global frontrunner in mineral-based specialty solutions, a position secured by its comprehensive mineral portfolio and sophisticated processing techniques. This allows the company to deliver high-value products that significantly boost the performance of its customers' offerings across numerous sectors.

The company's robust global presence, operating in over 40 countries with approximately 12,400 employees as of 2024, is a testament to its established market leadership. This extensive network enables Imerys to effectively serve a diverse international clientele.

Imerys' diverse end-market exposure is a significant strength, as the company supplies essential minerals to a wide array of industries including construction, automotive, electronics, agriculture, and consumer goods. This broad reach acts as a powerful buffer against sector-specific downturns, ensuring more stable revenue streams. For instance, during early 2025, while the automotive and construction sectors experienced some headwinds, Imerys demonstrated resilience, partly due to continued strong demand in areas like consumer goods.

Imerys is strongly committed to sustainability, evidenced by its clear roadmap targeting carbon neutrality by 2030 and substantial reductions in greenhouse gas emissions. This commitment translates into tangible progress, with the company achieving a 28% decrease in Scope 1 & 2 GHG emissions by the close of 2024, measured against its 2021 baseline.

The company's dedication to innovation is intrinsically linked to its sustainability goals. Imerys consistently allocates resources to research and development, fostering the creation of novel, eco-friendly solutions. These innovations are crucial for supporting key growth areas like automotive lightweighting and the broader global transition towards a low-carbon economy.

Resilient Financial Performance and Strategic Investments

Imerys has demonstrated remarkable financial resilience, navigating a challenging economic landscape. The company achieved organic growth for four consecutive quarters through Q1 2025, a testament to its robust operational strategies.

This performance is underpinned by a strong emphasis on price discipline and rigorous cost management. These factors, combined with strategic acquisitions like Chemviron's European diatomite and perlite business in January 2025, position Imerys for sustained financial health and expansion into key growth markets.

- Consistent Organic Growth: Four consecutive quarters of organic growth up to Q1 2025.

- Price Discipline and Cost Control: Key drivers of financial stability.

- Strategic Acquisitions: Integration of Chemviron's business enhances market position.

- Focus on Growth Markets: Investments directed towards high-potential areas.

Strategic Positioning in High-Growth Markets

Imerys is making significant moves into markets poised for substantial expansion, directly aligning with major global shifts like the move towards greener transportation, the broader energy transition, and the increasing demand for sustainable building practices. This strategic focus is key to its future growth trajectory.

The company's investments are notably directed towards lithium projects, crucial for the booming electric vehicle battery sector. Additionally, Imerys is scaling up its production of black carbon and developing innovative materials that contribute to lighter vehicle designs. These efforts are designed to capture greater market share and drive revenue in the coming years.

For instance, Imerys announced in early 2024 its commitment to significant investments in lithium extraction and processing, aiming to become a key European supplier. This move is supported by projected market growth for lithium, which analysts forecast to more than double by 2030 due to EV adoption. Imerys's strategy also includes expanding its specialty graphite offerings, essential for battery anode materials, with production capacity increases planned through 2025. The company's focus on lightweighting solutions for the automotive sector is also a response to stringent emission regulations, a trend expected to accelerate across major markets.

- Strategic Focus on Megatrends: Imerys is capitalizing on the growth driven by green mobility, energy transition, and sustainable construction.

- Lithium Investment: Significant capital is being allocated to lithium projects to supply the rapidly expanding electric vehicle battery market.

- Automotive Solutions: Development of black carbon and lightweighting materials for vehicles addresses environmental regulations and consumer demand.

- Market Share Expansion: These initiatives are positioned to enhance Imerys's competitive standing and market presence in high-demand sectors through 2025 and beyond.

Imerys's strengths are deeply rooted in its diverse mineral portfolio and advanced processing capabilities, enabling it to deliver high-performance, value-added products across many industries. This broad market exposure, serving sectors from construction to electronics, provides significant resilience against sector-specific downturns, ensuring stable revenue streams even amidst economic fluctuations. The company's strategic focus on megatrends like green mobility and the energy transition, particularly through investments in lithium and lightweighting materials for automotive applications, positions it for substantial future growth and market share expansion.

| Strength | Description | Supporting Data/Context |

| Diverse Mineral Portfolio & Processing Expertise | Offers high-value mineral-based solutions across numerous sectors. | Leverages advanced techniques to enhance customer product performance. |

| Broad End-Market Exposure | Supplies essential minerals to construction, automotive, electronics, agriculture, and consumer goods. | Provides resilience against sector-specific downturns, ensuring stable revenues; demonstrated in early 2025 performance. |

| Strategic Focus on Growth Markets | Capitalizes on megatrends like green mobility and energy transition. | Investments in lithium projects and automotive lightweighting materials target high-demand sectors. |

| Commitment to Sustainability & Innovation | Clear roadmap for carbon neutrality by 2030 and R&D for eco-friendly solutions. | Achieved a 28% reduction in Scope 1 & 2 GHG emissions by end of 2024 (vs. 2021 baseline). |

| Financial Resilience & Growth | Achieved four consecutive quarters of organic growth up to Q1 2025. | Driven by price discipline, cost control, and strategic acquisitions like Chemviron's European business (Jan 2025). |

What is included in the product

Analyzes Imerys’s competitive position through key internal and external factors, detailing its strengths in specialized minerals, weaknesses in operational costs, opportunities in sustainable solutions, and threats from market volatility.

Offers a clear, actionable framework to identify and leverage Imerys' competitive advantages and mitigate potential risks.

Weaknesses

Imerys faces a significant vulnerability to downturns in key industrial markets, a risk amplified by its European exposure. For instance, early 2025 saw a noticeable slowdown in European industrial activity, directly impacting Imerys's revenue streams.

The construction and automotive sectors in Europe, both critical end-markets for Imerys's specialized mineral solutions, exhibited pronounced weakness during this period. This decline in demand for vehicles and building materials translated into reduced orders for Imerys's products.

This sensitivity underscores Imerys's exposure to the cyclical nature of industrial production and regional economic health. A contraction in these sectors, as observed in early 2025, directly translates to diminished sales volumes and profitability for the company.

Imerys' adjusted EBITDA can be significantly influenced by the performance of its joint ventures, which are inherently prone to volatility. This dependence creates a risk, as shifts in these partnerships can directly impact the company's reported financial results.

For example, the first quarter of 2025 saw a notable decline in adjusted EBITDA directly attributable to a deterioration in contributions from joint ventures. This contrasts sharply with the exceptional performance observed from these same ventures in the first quarter of 2024, highlighting the unpredictable nature of these revenue streams.

The divestment of non-core assets, exemplified by the paper market business sale in July 2024, can create temporary negative impacts on revenue due to perimeter effects. This strategic move, while beneficial long-term, contributed to a reported decrease in Imerys' overall revenue in the first quarter of 2025 when compared to the same period in 2024.

Dependence on Raw Material Availability and Pricing

Imerys's reliance on raw material availability and pricing presents a notable weakness. As a company extracting and processing minerals, its operational costs are directly tied to the supply and market value of these essential inputs. For instance, in 2023, the company's cost of sales was €3.7 billion, highlighting the significant impact of raw material procurement on its financial performance.

This dependence creates vulnerability. Unexpected disruptions in supply chains or sharp increases in mineral prices can squeeze profit margins. Imerys needs to maintain sophisticated supply chain management to mitigate these risks, ensuring access to necessary materials at predictable costs.

- Volatile Mineral Markets: Imerys is exposed to price fluctuations in key minerals like kaolin and graphite, which can impact its cost of goods sold.

- Supply Chain Disruptions: Geopolitical events or operational issues at mining sites can affect the consistent availability of essential raw materials.

- Cost Pass-Through Challenges: The ability to pass on increased raw material costs to customers may be limited by market competition and contract terms.

- Geographic Concentration of Resources: Dependence on specific regions for certain minerals can create concentration risk.

Potential for Litigation and Regulatory Risks

Imerys faces significant litigation and regulatory risks stemming from the inherent nature of mineral extraction and processing. The company is currently involved in ongoing asbestos litigation, which presents substantial financial liabilities and reputational challenges. While Imerys is actively working to address these historical issues, the potential for future claims and evolving environmental regulations remains a considerable weakness.

These risks can manifest in several ways:

- Ongoing Asbestos Litigation: Imerys has been involved in numerous lawsuits related to asbestos exposure from its past mining operations. For example, as of its 2023 annual report, the company continued to manage a significant number of ongoing claims, though specific financial provisions are subject to change.

- Environmental Regulations: The extraction and processing of minerals are subject to stringent environmental laws and regulations globally. Non-compliance can lead to fines, operational disruptions, and costly remediation efforts, impacting profitability and investor confidence.

- Reputational Damage: Litigation and regulatory scrutiny can negatively affect Imerys' public image and brand perception. This can make it harder to attract and retain talent, secure new permits, and maintain positive relationships with stakeholders and local communities.

Imerys's financial performance is sensitive to economic cycles, particularly in its key European markets like construction and automotive. The slowdown in European industrial activity observed in early 2025 directly impacted Imerys's revenue, as demand for building materials and vehicles decreased, leading to fewer orders.

The company's reliance on joint ventures introduces volatility into its financial results, as seen in the first quarter of 2025 when contributions from these partnerships declined significantly compared to the previous year. Furthermore, strategic divestments, such as the paper market business sale in July 2024, can temporarily depress revenue figures due to perimeter effects, as evidenced by a reported decrease in Q1 2025 revenue versus Q1 2024.

Imerys faces significant operational risks due to its dependence on raw material availability and pricing. The company's cost of sales, which stood at €3.7 billion in 2023, is directly influenced by fluctuations in mineral prices and potential supply chain disruptions, impacting its profit margins.

The company is also exposed to substantial litigation and regulatory risks, notably ongoing asbestos litigation, which presents significant financial and reputational challenges. As of its 2023 annual report, Imerys continued to manage a considerable number of these claims, underscoring the persistent nature of this liability.

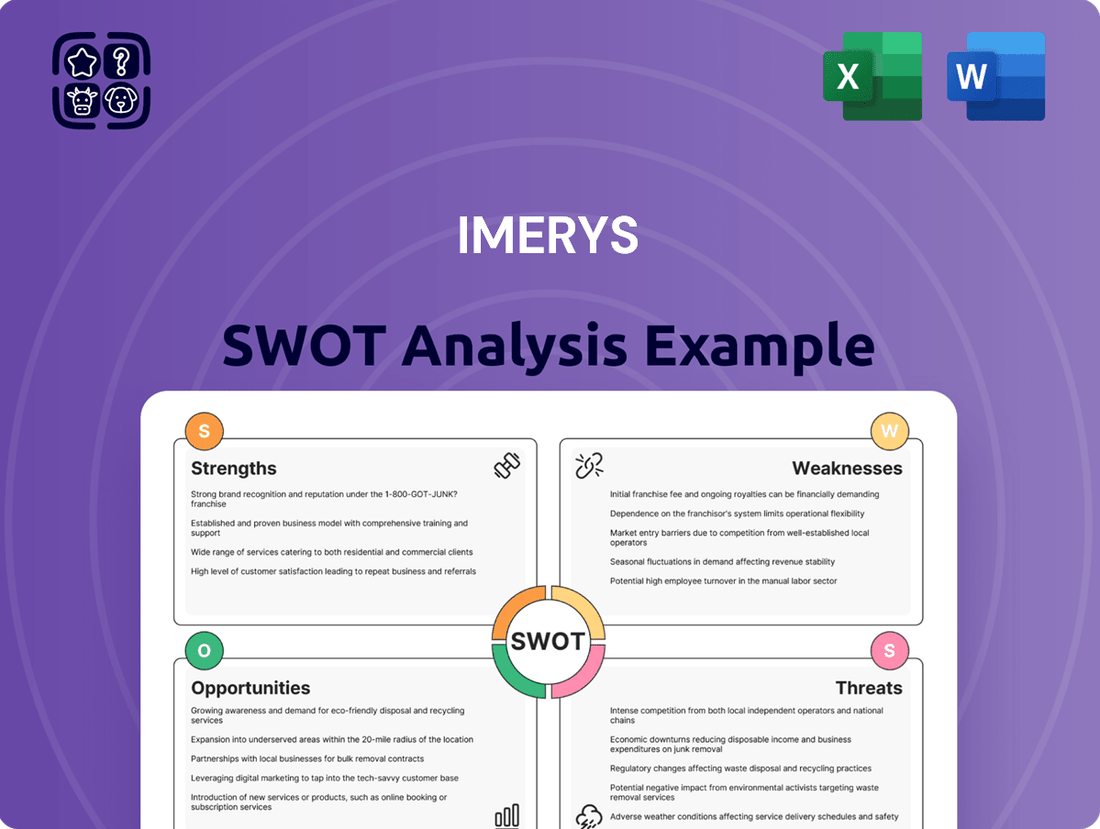

Preview the Actual Deliverable

Imerys SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, showcasing Imerys' Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, providing a clear overview of Imerys' strategic position. Once purchased, you’ll receive the full, editable version for your analysis.

You’re viewing a live preview of the actual SWOT analysis file for Imerys. The complete version, detailing key internal and external factors, becomes available after checkout.

Opportunities

The burgeoning electric vehicle (EV) market offers Imerys a significant growth avenue, driven by the increasing demand for specialized minerals essential for battery production. Imerys is well-positioned to capitalize on this trend, supplying critical materials like lithium and high-performance graphite, which are fundamental components in the advanced battery chemistries powering EVs.

Global EV sales are projected to reach over 15 million units in 2024, a substantial increase from previous years, underscoring the immense market potential. Imerys' strategic investments in expanding its mining and processing capabilities for these key minerals, including a significant expansion of its lithium operations in the US, are expected to bolster its market share and drive innovation in battery material solutions through 2025.

The global green building market is projected to reach $3.5 trillion by 2027, a significant increase from recent years, driven by stringent environmental regulations and growing consumer preference for eco-friendly structures. Imerys is well-positioned to benefit from this trend, with its mineral-based solutions offering lower embodied carbon and improved energy efficiency compared to traditional materials.

Imerys' investment in developing advanced mineral additives for concrete and insulation, such as its lightweight aggregates and high-performance clays, directly addresses the demand for sustainable construction. For instance, their solutions can reduce the weight of buildings, lowering transportation emissions and material usage, while also enhancing thermal performance, thereby decreasing operational energy consumption.

Imerys can bolster its market standing by acquiring companies that expand its product offerings, similar to its recent acquisition of Chemviron's European diatomite and perlite operations, which enhances its presence in filtration and life sciences markets.

Collaborating with industrial and financial entities for significant ventures, such as the ongoing lithium extraction project, provides a pathway for accelerated growth and shared financial responsibilities.

Leveraging Innovation for New Product Development

Imerys' commitment to continuous research and development fuels the creation of novel mineral-based solutions. These innovations are designed to meet the dynamic needs of customers and markets, particularly in sectors like automotive lightweighting and advanced material performance. This focus on innovation is a key driver for future revenue expansion and maintaining a strong competitive edge.

The company's investment in R&D is crucial for staying ahead. For instance, in 2023, Imerys reported R&D expenses of €220 million, highlighting its dedication to developing next-generation products. This strategic allocation of resources positions Imerys to capitalize on emerging trends and technological advancements.

- Innovation Pipeline: Imerys actively develops new products, such as advanced ceramic materials for electronics and high-performance additives for polymers, which are projected to contribute significantly to sales in the coming years.

- Market Responsiveness: The company's ability to quickly adapt its mineral solutions to evolving industry requirements, like the demand for sustainable materials in construction, provides a distinct market advantage.

- Competitive Differentiation: Through patented technologies and unique mineral formulations, Imerys creates differentiated offerings that command premium pricing and foster customer loyalty.

Strengthening Global Presence in Emerging Markets

Imerys can significantly boost its global reach by focusing on expanding its industrial and commercial operations within emerging markets. These regions often show robust growth in industrial sectors, directly correlating with increased demand for the specialty minerals Imerys provides.

By establishing a stronger presence, Imerys can position itself closer to its customer base. This proximity facilitates easier access to essential minerals and allows for more responsive service, a key differentiator in competitive markets. For instance, in 2024, Imerys continued to invest in its South American operations, aiming to capitalize on the region's expanding mining and manufacturing sectors.

- Geographic Expansion: Targeting regions like Southeast Asia and parts of Africa where industrialization is accelerating.

- Customer Proximity: Establishing local production and distribution hubs to reduce lead times and improve supply chain efficiency.

- Market Penetration: Leveraging growing demand for high-performance minerals in sectors such as construction, automotive, and electronics in these developing economies.

Imerys is strategically positioned to benefit from the accelerating global transition to electric vehicles, a market expected to see substantial growth through 2025. The company's focus on supplying critical minerals like lithium and high-performance graphite for EV batteries is a key opportunity. This aligns with projections of over 15 million EV units sold globally in 2024, highlighting the immense demand for Imerys' specialized products.

The company's investment in expanding its lithium operations, particularly in the United States, demonstrates a proactive approach to meeting this rising demand. This expansion is crucial for capturing market share and driving innovation in advanced battery materials, ensuring Imerys remains a vital supplier in the evolving automotive sector.

Imerys is also capitalizing on the burgeoning green building market, projected to reach $3.5 trillion by 2027. Their mineral-based solutions offer lower embodied carbon and enhanced energy efficiency, directly addressing the demand for sustainable construction materials. This focus on eco-friendly alternatives provides a significant competitive advantage.

Furthermore, Imerys' commitment to research and development, with €220 million invested in 2023, fuels the creation of novel mineral solutions. These innovations, targeting areas like automotive lightweighting and advanced materials, are essential for future revenue growth and maintaining a strong competitive edge in dynamic markets.

| Opportunity Area | Market Projection/Growth Driver | Imerys' Strategic Response | Key Benefit |

|---|---|---|---|

| Electric Vehicles (EVs) | Global EV sales projected >15 million units in 2024 | Supplying lithium and high-performance graphite for batteries; expanding US lithium operations | Capitalizing on high-demand, high-growth sector; market leadership in battery materials |

| Green Building | Global market projected $3.5 trillion by 2027 | Developing mineral additives for concrete and insulation (e.g., lightweight aggregates, high-performance clays) | Meeting demand for sustainable construction; reducing environmental impact |

| Strategic Acquisitions & Partnerships | Enhancing product portfolio and market presence | Acquisition of Chemviron's European diatomite and perlite operations; collaborations on lithium extraction projects | Expanding into new markets (filtration, life sciences); shared financial responsibility and accelerated growth |

| Emerging Markets Expansion | Accelerating industrialization in regions like Southeast Asia and Africa | Increasing industrial and commercial operations in these regions; establishing local production and distribution hubs | Boosting global reach; improving customer proximity and supply chain efficiency |

Threats

A sustained global or regional economic slowdown, especially in crucial sectors such as construction and automotive, poses a significant risk to Imerys. This downturn could dampen demand for its specialized mineral solutions and impede revenue expansion. For instance, the current sluggishness observed in European industrial markets directly exemplifies this threat, impacting sectors that are key consumers of Imerys's offerings.

Imerys faces significant competition in the specialty minerals sector. Established rivals and emerging players are constantly vying for market share, potentially leading to downward pressure on prices. For instance, in 2023, the global industrial minerals market, which includes specialty minerals, was valued at approximately $320 billion, a highly contested arena.

This intense competition can directly impact Imerys' profitability and market position. If the company struggles to differentiate its offerings through innovation or superior product performance, it risks losing customers to competitors. Maintaining cost efficiencies is therefore crucial for Imerys to remain competitive and protect its margins against aggressive pricing strategies from rivals.

Geopolitical tensions and evolving trade policies create significant headwinds for Imerys. For instance, the ongoing trade disputes between major economic blocs could lead to new tariffs on raw materials or finished goods, directly increasing Imerys's operational costs and potentially impacting its pricing competitiveness. This uncertainty also makes long-term strategic planning more challenging, as it affects global market access and supply chain reliability.

The impact of these uncertainties is already being felt across various industries. In 2023, global trade growth slowed, partly due to these geopolitical factors, affecting companies with extensive international operations like Imerys. Any escalation or new trade barriers could further disrupt Imerys's ability to source key minerals efficiently and distribute its specialized mineral solutions worldwide, thereby posing a direct threat to its revenue streams and profitability.

Fluctuations in Raw Material and Energy Prices

Imerys faces a significant threat from the volatility in raw material and energy prices. These are fundamental inputs for their diverse range of mineral-based products. For instance, fluctuations in the cost of bauxite, kaolin, or graphite can directly affect their cost of goods sold. The energy component, vital for mining and processing operations, also presents a challenge.

The impact of these price swings on Imerys's financial performance is substantial. Increased raw material and energy costs can squeeze profit margins if not effectively passed on to customers or offset through operational efficiencies. For example, a sharp rise in natural gas prices, a key energy input for many industrial processes, could significantly increase Imerys's operating expenses.

- Raw Material Cost Volatility: Imerys's profitability is directly tied to the cost of essential minerals like kaolin and graphite, which can experience significant price swings based on global supply and demand dynamics.

- Energy Price Sensitivity: As an energy-intensive industry, Imerys is vulnerable to fluctuations in oil, natural gas, and electricity prices, impacting operational costs and potentially their competitive pricing.

- Impact on Margins: Unmanaged increases in raw material and energy expenses can compress Imerys's gross and operating margins, affecting overall financial health and investment capacity.

- 2024/2025 Outlook: Projections for 2024 and 2025 indicate continued global supply chain uncertainties and geopolitical factors that could exacerbate price volatility for key commodities and energy sources.

Environmental Regulations and Compliance Costs

Imerys faces increasing pressure from evolving environmental regulations concerning mineral extraction, processing, and emissions. These stricter rules can translate directly into higher compliance costs, potentially impacting profitability. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, which could affect Imerys' operations in the region through new emission standards and waste management requirements.

Adapting to these ever-changing regulatory landscapes presents a significant challenge. While Imerys has a stated commitment to sustainability, the operational adjustments and investments required to meet new standards, such as those related to water usage or carbon footprint reduction, can be substantial. Failure to comply could result in operational restrictions or even fines, as seen with other industrial players facing penalties for environmental non-compliance in recent years.

The financial implications of these environmental mandates are a key concern. Companies like Imerys must invest in cleaner technologies and more sustainable practices. For example, the cost of upgrading processing facilities to meet stricter air quality standards or implementing advanced water treatment systems can run into millions of euros. These investments, while necessary for long-term viability, can strain capital expenditure budgets in the short to medium term.

- Rising Compliance Costs: Increased investment needed for emissions control and waste management technologies.

- Operational Restrictions: Potential for new regulations to limit extraction or processing activities.

- Sustainability Investments: Ongoing need to adapt to evolving environmental standards, impacting capital allocation.

Imerys's reliance on global supply chains makes it susceptible to disruptions from geopolitical instability and trade policy shifts, potentially increasing costs and hindering market access. For instance, the ongoing trade tensions in 2023 and early 2024 have already impacted global trade flows, affecting companies with international operations.

Intense competition within the specialty minerals sector could lead to price erosion and pressure on Imerys's profit margins. The global industrial minerals market, valued at approximately $320 billion in 2023, is highly contested, requiring continuous innovation and cost management to maintain market share.

The company faces significant threats from the volatility of raw material and energy prices, which are critical inputs for its operations. Projections for 2024 and 2025 suggest continued supply chain uncertainties that could exacerbate these price fluctuations.

Evolving environmental regulations, particularly in regions like the European Union with its strengthened Green Deal, necessitate increased compliance costs and investments in sustainable practices, potentially impacting capital expenditure and operational flexibility.

SWOT Analysis Data Sources

This Imerys SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market intelligence reports, and expert industry analyses to provide a robust and informed strategic overview.