Imerys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imerys Bundle

Unlock the strategic advantages Imerys holds by understanding the intricate web of external forces at play. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping its operational landscape. Equip yourself with this essential intelligence to anticipate market shifts and refine your own strategic approach. Download the full PESTLE analysis now for actionable insights that drive informed decisions.

Political factors

Imerys, a significant player in mineral solutions, faces substantial risks from geopolitical shifts and changing trade agreements. The increasing global demand for essential minerals elevates the importance of securing reliable and ethical sourcing, making it a key concern for both nations and corporations.

The landscape of export restrictions and supply chain vulnerabilities is growing, particularly given China's substantial role in refining many critical minerals and its imposition of export controls on specific elements. This situation demands that Imerys maintain a vigilant watch on international affairs and proactively adjust its supply chain strategies to navigate potential disruptions effectively.

Governments globally are increasing their involvement in the mining and metals sector, often through strategic joint ventures with private companies. This trend, evident in many resource-rich nations, directly influences companies like Imerys by shaping regulatory landscapes, licensing requirements, and resource extraction policies. For instance, in 2024, several African nations announced plans to increase state ownership in critical mineral projects, impacting foreign investment and operational frameworks.

Governments globally are prioritizing critical mineral supply chains, with the US, for example, investing significantly in domestic production and processing. The Inflation Reduction Act (IRA) of 2022 allocated billions to secure these resources, aiming to reduce dependence on countries like China. This creates a dual dynamic for Imerys: potential for government incentives and subsidies for domestic operations, but also heightened regulatory oversight and competition.

Regulatory Stability and Policy Changes

The mining sector is subject to a constantly shifting regulatory environment, with frequent legislative and policy updates occurring globally. For Imerys, this necessitates ongoing adaptation to evolving environmental standards, permitting procedures, and enhanced reporting obligations. These changes can directly influence project schedules and escalate compliance expenses, impacting operational efficiency and profitability.

Navigating these regulatory shifts is crucial for Imerys's long-term strategy. For instance, in 2024, the European Union continued to refine its critical raw materials act, aiming to bolster domestic supply chains and environmental safeguards. This could introduce new permitting hurdles or necessitate investments in cleaner extraction technologies for Imerys operations within the EU.

- Environmental Regulations: Increased scrutiny on emissions, waste management, and water usage, potentially requiring significant capital expenditure for compliance upgrades.

- Permitting Processes: Extended timelines for new mine development or expansion due to more rigorous environmental impact assessments and stakeholder consultations.

- Resource Nationalism: Some governments may implement policies favoring local ownership or increased taxation on mineral extraction, affecting Imerys's international operations.

- Safety Standards: Continuous updates to health and safety regulations for mining operations, demanding ongoing training and investment in protective equipment and procedures.

International Climate Agreements and National Commitments

Global climate change commitments, like the Paris Agreement, and national net-zero targets significantly shape the mining industry. These policies mandate shifts towards lower-emission operations and sustainable resource management, directly impacting companies like Imerys.

Imerys' Climate Transition Plan, targeting substantial greenhouse gas reductions, is a direct response to these international and national policy drivers. This alignment necessitates significant investments in decarbonization technologies and the adoption of more sustainable operational practices across its mining and processing activities.

- Paris Agreement Goal: Limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- Imerys' 2030 GHG Reduction Target: A 37% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline.

- Estimated Investment in Decarbonization: Imerys has allocated €1 billion for its climate transition plan, with a significant portion directed towards decarbonization efforts.

- National Net-Zero Targets: Many of Imerys' operating countries have set net-zero emissions targets, influencing regulatory frameworks and operational expectations for mining companies.

Political stability and government policies significantly influence Imerys' operations, particularly concerning access to mineral resources and trade. Resource nationalism is a growing trend, with governments increasingly seeking greater control over their mineral wealth, potentially leading to higher taxes or local ownership requirements. For example, in 2024, several African nations revised mining codes to boost state participation in critical mineral projects.

Government incentives and subsidies, such as those provided under the US Inflation Reduction Act of 2022, can offer opportunities for companies like Imerys to invest in domestic processing and supply chains. However, these initiatives often come with stringent regulatory oversight and can increase competition. The EU's Critical Raw Materials Act, further refined in 2024, aims to secure regional supply chains, which could impact Imerys' operational strategies within Europe.

International trade agreements and geopolitical tensions, including export restrictions on critical minerals, pose considerable risks. China's dominance in refining and its export controls on certain elements highlight the need for Imerys to diversify its supply sources and adapt to evolving global trade dynamics. Political instability in mining regions can also disrupt operations and affect project timelines.

| Political Factor | Impact on Imerys | Example/Data (2024-2025) |

|---|---|---|

| Resource Nationalism | Increased operational costs, potential for reduced foreign investment | African nations revising mining codes for greater state ownership in critical minerals. |

| Government Incentives (e.g., IRA) | Opportunities for domestic investment, but also increased regulatory scrutiny | US IRA allocated billions to secure critical mineral supply chains, impacting processing investments. |

| Trade Policies & Export Controls | Supply chain disruptions, need for diversification | China's export controls on gallium and germanium in 2023 continue to influence global supply strategies. |

| Regulatory Environment | Compliance costs, project delays, need for adaptation | EU's Critical Raw Materials Act refinement in 2024 impacts regional supply chain strategies and environmental standards. |

What is included in the product

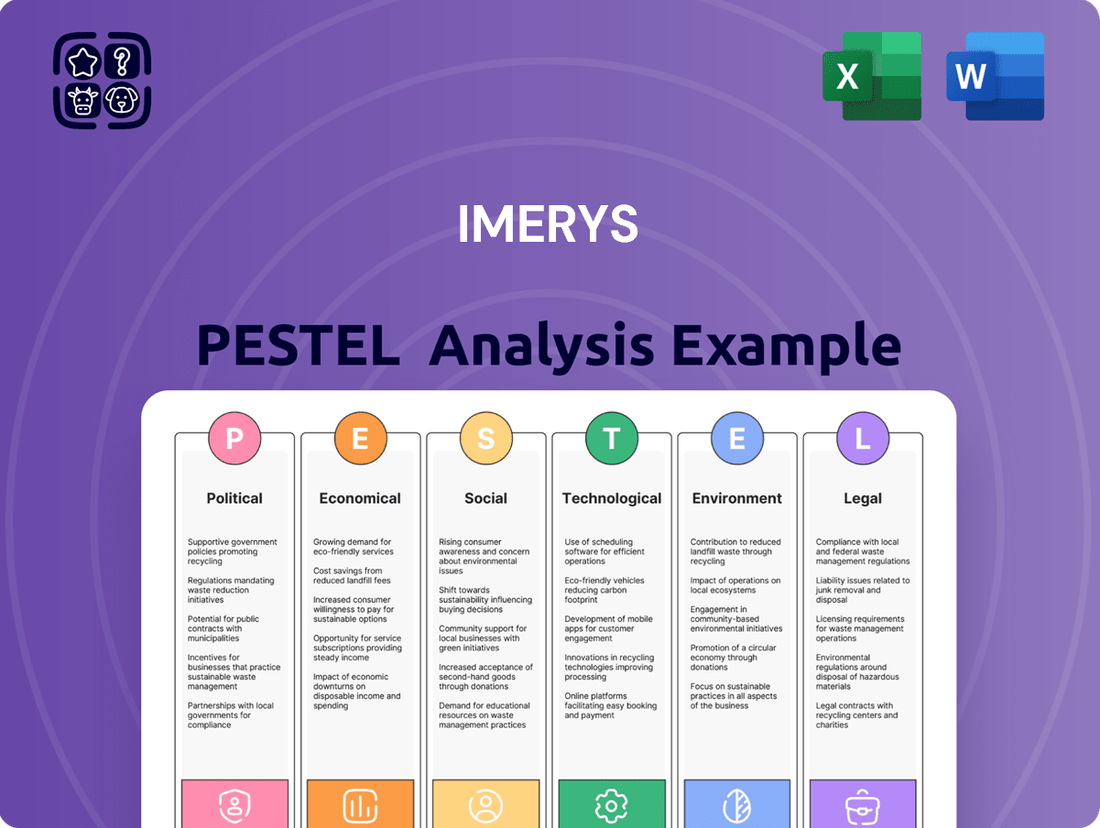

This Imerys PESTLE analysis provides a comprehensive review of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Imerys' PESTLE factors that directly informs strategic decision-making and mitigates potential external disruptions.

Economic factors

Imerys' revenue is intrinsically linked to the health of the global economy and the specific demand within its key sectors like construction, automotive, and electronics. The company saw robust performance in 2024, reflecting strong industrial activity.

Looking ahead to 2025, the global economic landscape presents a mixed picture. While some projections anticipate a recovery, actual economic conditions are proving to be quite volatile, which could impact industrial demand for Imerys' mineral solutions.

The global market for critical and specialty minerals, including lithium, cobalt, nickel, and rare earth elements, is experiencing a significant upswing, directly fueled by the accelerating energy transition and the widespread adoption of electric vehicles (EVs). This surge in demand creates a substantial economic tailwind for companies like Imerys, which are positioned to supply these essential materials. Projections indicate continued robust growth in this sector, with the specialty metals and minerals market anticipated to expand considerably through 2031.

The price volatility of raw materials significantly impacts Imerys' financial performance. Fluctuations in the cost of essential minerals and metals directly affect production expenses and, consequently, profit margins. For instance, while gold prices showed an upward trend in 2024, other commodities experienced declines, underscoring the dynamic nature of these markets.

Inflation and Interest Rates

Inflationary pressures, particularly in energy and raw material costs, have been a significant concern for industrial companies like Imerys. For instance, the Eurozone experienced inflation rates peaking around 10.6% in October 2022, impacting input costs. Rising interest rates, as implemented by central banks like the European Central Bank (ECB) to combat inflation, can increase the cost of borrowing for capital expenditures and affect overall demand for industrial products.

These economic factors directly influence Imerys' financial performance. Higher operating costs due to inflation can squeeze profit margins if not passed on to customers. Furthermore, increased interest expenses on debt can reduce net income. Imerys' ability to maintain its margins hinges on its success in implementing effective cost management strategies and driving operational efficiencies across its diverse mineral portfolio.

- Inflationary Impact: Persistent inflation in energy and key raw materials directly increases Imerys' cost of goods sold.

- Interest Rate Sensitivity: Rising interest rates increase the cost of servicing debt and can dampen capital investment and customer spending.

- Margin Management: The company must focus on operational efficiencies and strategic pricing to protect its profit margins against these economic headwinds.

- 2024/2025 Outlook: Continued vigilance on cost control and adaptability to evolving interest rate environments will be critical for Imerys' financial stability in 2024 and 2025.

Investment in Sustainable Solutions and Decarbonization

Imerys is channeling significant capital into decarbonization efforts and the creation of sustainable products. These investments, while crucial for environmental stewardship, represent substantial upfront costs for the company. For instance, Imerys has set ambitious targets, aiming for a 37% reduction in its Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2021 baseline.

These strategic investments are designed to foster long-term value by aligning Imerys with the growing global shift towards a low-carbon economy. The company's focus on sustainable solutions is not just an environmental imperative but also a business opportunity, tapping into increasing market demand for eco-friendly materials and processes. By 2025, Imerys plans to have 80% of its sales linked to sustainable solutions, demonstrating a clear commitment to this trend.

- Capital Expenditure: Imerys' commitment to sustainability involves significant capital outlays, impacting short-term financial flexibility.

- Market Alignment: Investments in decarbonization position Imerys favorably within a market increasingly prioritizing environmental, social, and governance (ESG) factors.

- Long-Term Value: The company anticipates these expenditures will translate into enhanced competitiveness and value creation as the global economy transitions to lower carbon intensity.

- Emission Targets: Imerys aims to reduce Scope 1 and 2 GHG emissions by 37% by 2030 (from a 2021 baseline), requiring substantial investment in cleaner technologies and processes.

The global economic outlook for 2024 and 2025 suggests continued volatility, with potential impacts on industrial demand for Imerys' products. While the energy transition is driving growth in critical minerals, inflationary pressures and rising interest rates remain key concerns, affecting operating costs and borrowing expenses.

Imerys' financial performance is directly influenced by commodity price fluctuations. For instance, while gold prices saw an increase in 2024, other mineral prices exhibited downward trends, highlighting the need for robust margin management strategies.

The company's significant investments in decarbonization and sustainable products, such as aiming for 80% of sales linked to sustainable solutions by 2025, represent substantial upfront costs but are crucial for long-term market positioning.

| Economic Factor | 2024/2025 Trend | Impact on Imerys |

|---|---|---|

| Global Economic Growth | Mixed, volatile | Potential impact on industrial demand |

| Inflation (Energy & Raw Materials) | Persistent | Increased operating costs, potential margin squeeze |

| Interest Rates | Rising | Higher borrowing costs, potential dampening of investment |

| Commodity Prices | Volatile (e.g., gold up, others down) | Affects production costs and profit margins |

| Energy Transition Demand | Strong growth | Tailwind for critical mineral supply |

What You See Is What You Get

Imerys PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—a comprehensive PESTLE analysis of Imerys, fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, detailing Imerys' Political, Economic, Social, Technological, Legal, and Environmental landscape, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external factors influencing Imerys' operations.

Sociological factors

The mining sector, including companies like Imerys, faces a significant workforce evolution. There's a growing demand for employees skilled in managing advanced technologies such as artificial intelligence and autonomous mining equipment. This shift necessitates a proactive approach to reskilling and upskilling the existing workforce to meet these new technological demands.

Imerys must prioritize investment in comprehensive training programs. These programs are crucial for equipping its employees with essential digital competencies and ensuring the company can attract and retain talent in a traditionally skilled labor market. Addressing potential talent shortages by fostering internal growth and development will be key to navigating this transformation successfully.

Mining companies like Imerys are under growing scrutiny to respect local community rights and ensure equitable benefit sharing from resource extraction. This pressure is particularly acute in areas with delicate social and environmental landscapes, where maintaining a positive relationship with residents is crucial for continued operations.

In 2024, for instance, the mining sector globally saw a rise in community-led initiatives demanding greater transparency in revenue sharing. Imerys' commitment to robust community dialogue and responsible resource management is therefore paramount for securing its social license to operate, a key factor in long-term business sustainability.

Consumers are increasingly prioritizing sustainable products, a shift impacting sectors like construction and consumer goods that Imerys serves. This growing demand for eco-friendly options, driven by heightened environmental awareness, is pushing companies to re-evaluate their offerings. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, directly influencing material choices.

Health and Safety Standards

Societal expectations for robust health and safety standards in mining operations are paramount, and Imerys is keenly aware of this critical responsibility. The company actively monitors its safety performance, recognizing that continuous improvement is essential to protect its employees and stakeholders.

Imerys reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.79 in 2023, a slight increase from 0.75 in 2022, underscoring the ongoing need for vigilance. While this rate remains low compared to industry averages, any incident highlights areas where safety protocols can be further reinforced.

- Focus on Incident Prevention: Imerys is committed to reducing the frequency and severity of workplace accidents through rigorous training and adherence to best practices.

- Workforce Protection: Ensuring the well-being of its global workforce is a core tenet, driving investment in advanced safety equipment and procedures.

- Regulatory Compliance: Adherence to evolving national and international health and safety regulations is fundamental to maintaining operational integrity and public trust.

- Continuous Improvement: The company regularly reviews its safety performance data to identify trends and implement targeted interventions that strengthen its safety culture.

Diversity, Equity, and Inclusion Initiatives

Societal expectations increasingly demand that companies actively foster diversity, equity, and inclusion (DEI) within their operations. This focus is not just about social responsibility; it's becoming a critical factor in attracting and retaining a skilled workforce and building a positive brand image. Imerys recognizes this trend, as evidenced by its stated commitment to improving its Diversity, Equity & Inclusion Index score, aiming to align with evolving societal values.

The drive for DEI impacts how businesses operate and are perceived. Companies that demonstrate genuine commitment to these principles often find themselves more competitive in the talent market and better positioned to understand and serve a diverse customer base. This can translate into tangible benefits, such as enhanced innovation and improved employee morale.

- Talent Attraction: A strong DEI record helps companies stand out to job seekers, particularly younger generations who prioritize inclusive workplaces.

- Employee Retention: Inclusive environments tend to have higher employee satisfaction, leading to lower turnover rates.

- Innovation: Diverse teams bring a wider range of perspectives, fostering creativity and problem-solving.

- Reputation: Publicly visible DEI efforts can enhance a company's brand reputation and customer loyalty.

Societal shifts are profoundly influencing the mining industry, pushing companies like Imerys to adapt their workforce strategies and community engagement. Growing consumer demand for sustainable products, with 73% of global consumers willing to alter habits for environmental impact in 2024, directly affects material choices. Furthermore, increased scrutiny on community rights and benefit sharing, highlighted by rising community-led transparency initiatives in 2024, necessitates robust dialogue and responsible resource management for Imerys to maintain its social license to operate.

Technological factors

The mining industry is undergoing a significant digital transformation, with Artificial Intelligence (AI) at the forefront of efforts to boost efficiency, safety, and overall productivity. Imerys is actively investigating new digital technologies and AI applications within its research and development operations, aiming to improve its operational efficiency and advance its sustainability objectives.

Automation and autonomous machinery are increasingly vital in mining, enhancing safety by reducing human exposure to dangerous conditions and boosting output. For instance, Caterpillar's Cat R1700 XE autonomous loader is designed to operate in underground mining, potentially increasing operational efficiency by up to 30% compared to manned equipment. Imerys can integrate these technologies to streamline its extraction processes and mitigate labor shortages.

Imerys' commitment to innovation in mineral processing is key to unlocking new market opportunities. For instance, advancements in lithium recovery technologies are vital as demand surges, with the global lithium market projected to reach over $100 billion by 2030.

The company is actively exploring methods like hydrothermal synthesis to engineer minerals with enhanced properties, catering to sectors requiring high-performance materials. This focus on custom mineral development supports the growing need for specialized inputs in advanced manufacturing and battery technologies.

Development of Low-Carbon and Renewable Energy Technologies

Imerys is heavily investing in technologies that drive the shift towards a low-carbon future. This includes innovating materials for renewable energy sectors and sustainable building solutions. For instance, the company is exploring electrification for its plant machinery and dedicating resources to research aimed at cutting down emissions generated during its manufacturing processes.

The company’s commitment to technological advancement in this area is underscored by its strategic focus on reducing its environmental footprint. In 2023, Imerys reported a 2.5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, a step towards its 2030 targets. This progress is directly linked to their technological development efforts.

Key areas of technological focus for Imerys include:

- Development of high-performance materials for batteries and solar panels.

- Innovations in mineral-based solutions for energy-efficient construction and insulation.

- Research into carbon capture and utilization technologies for industrial processes.

- Electrification of mining and processing equipment to reduce reliance on fossil fuels.

Supply Chain Traceability and Monitoring Technologies

Digital tracking and traceability systems are becoming essential, with regulations increasingly mandating their use to combat illegal mining and promote responsible sourcing. For instance, the European Union's Critical Raw Materials Act, proposed in 2023 and expected to be finalized in 2024, aims to bolster the EU's supply chain resilience, likely including enhanced traceability requirements for critical minerals. Imerys can harness these technologies to boost its supply chain transparency, a crucial step in meeting stringent environmental, social, and governance (ESG) standards demanded by investors and consumers alike.

Leveraging these advancements allows Imerys to demonstrate its commitment to ethical practices and supply chain integrity. This proactive approach can differentiate Imerys in a market where consumers and regulators are increasingly scrutinizing the origins of raw materials. The global market for supply chain traceability solutions is projected to grow significantly, with some estimates suggesting it could reach over $15 billion by 2027, indicating a strong trend towards greater visibility.

- Enhanced Transparency: Digital tools provide end-to-end visibility from mine to market.

- Regulatory Compliance: Meeting mandates like those anticipated in the EU's Critical Raw Materials Act.

- Responsible Sourcing: Verifying the ethical and sustainable extraction of minerals.

- Risk Mitigation: Identifying and addressing potential disruptions or unethical practices within the supply chain.

Technological advancements are reshaping Imerys' operational landscape, driving efficiency and sustainability. The company is actively exploring AI and automation to enhance safety and productivity, mirroring industry trends where autonomous mining equipment, like Caterpillar's Cat R1700 XE, promises up to 30% efficiency gains. Imerys' focus on innovative mineral processing, particularly in areas like lithium recovery, aligns with a global market projected to exceed $100 billion by 2030, unlocking new revenue streams and meeting surging demand for advanced materials.

Legal factors

Mining legislation is undergoing significant shifts globally, with governments increasingly prioritizing environmental protection. This means stricter rules for sustainable resource extraction, aiming to combat climate change and conserve natural assets. For Imerys, this translates to navigating more demanding environmental impact assessments and permitting procedures.

Compliance with waste disposal restrictions is also becoming more rigorous. For instance, in 2024, the European Union continued to refine its circular economy action plan, impacting how mining waste is managed and recycled, a key consideration for Imerys' operations across the continent.

Imerys has been embroiled in extensive litigation concerning asbestos contamination in its talc products, resulting in thousands of claims and forcing its North American talc operations into Chapter 11 bankruptcy. The company has set aside significant reserves to address these liabilities, with estimates for total settlements reaching billions of dollars.

The ongoing resolution of these talc-related lawsuits, including the establishment and funding of trusts to compensate claimants, remains a paramount legal concern. These proceedings directly impact Imerys' financial stability and future operational capacity, with the company actively working towards a comprehensive settlement framework.

Legislation such as the EU Critical Raw Materials Act, enacted in 2023, emphasizes sustainable sourcing and requires enhanced supply chain transparency for crucial minerals. This act aims to secure Europe's access to these materials, which are vital for green and digital transitions.

In parallel, the United States is actively pursuing strategies to bolster its critical mineral supply chains, potentially introducing new regulations affecting domestic production and imposing restrictions on foreign entities deemed a risk. For instance, the Inflation Reduction Act of 2022 includes provisions aimed at incentivizing domestic sourcing and processing of critical minerals for electric vehicle batteries.

Imerys, a global leader in mineral-based specialty solutions, must diligently adapt to these evolving legal landscapes. Navigating these complex regulatory frameworks, which increasingly scrutinize sourcing practices and supply chain integrity, is paramount for continued operational success and market access.

Labor Laws and Workforce Rights

Legal revisions in the mining sector are increasingly focused on strengthening labor rights. Imerys, operating in 54 countries, faces the complex task of adhering to a wide array of labor laws. This includes ensuring safe working conditions, fair compensation, and respecting employee rights across its global workforce.

The company's commitment to these legal frameworks is crucial for maintaining its social license to operate and attracting talent. For instance, in 2024, many European Union member states continued to implement directives aimed at improving workplace safety and fair pay, impacting Imerys' operations in regions like France and Germany.

- Global Compliance: Imerys must navigate labor laws in 54 countries, covering everything from hiring practices to termination procedures.

- Workplace Safety: Adherence to evolving health and safety regulations, such as those updated in 2024 concerning dust exposure in mining, is paramount.

- Fair Wages and Benefits: Ensuring compensation meets or exceeds local minimum wage laws and provides adequate benefits is a constant legal requirement.

- Employee Representation: Respecting the right to collective bargaining and employee representation, as mandated by various national laws, is essential.

Corporate Governance and Reporting Standards

Imerys operates within a landscape of increasingly stringent corporate governance and reporting standards. These evolving regulations, particularly concerning environmental, social, and governance (ESG) factors, necessitate detailed disclosures. For instance, new climate disclosure rules mandate comprehensive reporting on greenhouse gas (GHG) emissions, impacting how companies like Imerys must track and communicate their environmental footprint.

The company's commitment to transparency and responsible business practices is underscored by its performance in adhering to these standards. Imerys achieved an A rating from CDP (formerly the Carbon Disclosure Project) for its climate leadership in 2023, reflecting its proactive approach to managing climate-related risks and opportunities. This recognition highlights its dedication to robust reporting and stakeholder engagement on critical sustainability issues.

- Regulatory Compliance: Imerys must navigate and comply with a growing body of international and national regulations governing corporate reporting, including those focused on climate change and sustainability.

- CDP Climate Leadership: The company's 2023 CDP A rating signifies a high level of environmental disclosure and performance, demonstrating adherence to leading reporting frameworks.

- Transparency and Accountability: Adherence to these standards enhances Imerys's transparency, fostering trust with investors, customers, and other stakeholders by providing clear and verifiable information on its operations and impacts.

Imerys faces significant legal challenges stemming from asbestos litigation, with thousands of claims leading to its North American talc operations filing for Chapter 11 bankruptcy in 2024. The company has allocated billions of dollars to cover these liabilities, with ongoing efforts focused on establishing trusts for claimant compensation. This legal quagmire directly impacts Imerys' financial health and operational capabilities, necessitating a comprehensive settlement strategy.

Environmental factors

Climate change presents a significant environmental factor for Imerys, driving its commitment to ambitious greenhouse gas (GHG) emission reduction targets. These targets have been validated by the Science Based Targets initiative (SBTi), underscoring their scientific credibility.

Imerys has set a clear goal to reduce its absolute scope 1 and 2 GHG emissions by 42% and its scope 3 emissions by 25% by the year 2030, using 2021 as the baseline. This strategic approach involves implementing key initiatives such as enhancing energy efficiency across operations, transitioning to lower-carbon fuels, and increasing the procurement of renewable electricity.

Water scarcity poses a significant environmental challenge for the mining sector, with projections indicating that a substantial portion of global copper supply, potentially over 50% by 2030, could be affected by water-related disruptions like floods or droughts. Imerys is actively addressing this by prioritizing improved water management across its operations, aiming for all its priority sites to meet new water reporting requirements by 2025.

Mining operations inherently affect biodiversity and natural habitats. Imerys acknowledges this, and their sustainability reports, including those from 2024 and looking ahead to 2025, detail their commitment to biodiversity conservation.

Stricter environmental regulations are now in place, compelling mining firms to not only restore land after extraction but also actively conserve biodiversity. This shift reflects a growing global emphasis on ecological responsibility in resource extraction.

Imerys' approach includes specific initiatives to mitigate impacts and enhance biodiversity at their sites. For instance, their 2023 sustainability report highlighted projects focused on habitat restoration and species protection, aiming to offset operational footprints.

Waste Management and Circular Economy Principles

Environmental regulations are becoming stricter, particularly concerning how waste is handled and encouraging the embrace of circular economy ideas. This shift means companies must find more sustainable ways to operate, moving away from a linear take-make-dispose model.

Imerys is actively investigating methods to prolong the usability of minerals and discover novel avenues for extracting value from industrial byproducts. This strategic focus directly supports the principles of a circular economy, aiming to minimize waste and maximize resource efficiency.

- Circular Economy Initiatives: Imerys is developing solutions to reuse and recycle materials, contributing to a closed-loop system for mineral resources.

- Waste Valorization: The company is exploring innovative techniques to transform industrial waste streams into valuable secondary raw materials.

- Regulatory Compliance: Adherence to evolving environmental laws regarding waste management is a key driver for Imerys's sustainable practices.

- Resource Efficiency: By extending mineral lifecycles and utilizing waste, Imerys aims to reduce its environmental footprint and enhance resource productivity.

Pollution Control and Emissions Reduction

Governments worldwide are tightening regulations on emissions and waste management to curb the environmental impact of mining. Imerys is actively addressing these pressures by investing in advanced technologies to cut process emissions and increasing its procurement of renewable energy sources. For instance, in 2023, Imerys reported a 7% reduction in its Scope 1 and 2 greenhouse gas (GHG) emissions compared to 2022, reaching 1.1 million tonnes of CO2 equivalent.

These initiatives are crucial for maintaining operational compliance and enhancing corporate sustainability. By prioritizing low-carbon electricity sourcing, Imerys aims to significantly lower its carbon footprint. The company has set a target to source 75% of its electricity from renewable sources by 2025, up from 45% in 2022.

- Regulatory Compliance: Adherence to stricter pollution control standards is paramount for continued operations.

- Technological Innovation: Implementing new technologies to reduce process-related emissions is a key strategy.

- Renewable Energy Sourcing: Increasing the use of low-carbon and renewable electricity is a direct response to environmental mandates.

- GHG Emission Reduction: Imerys achieved a 7% year-on-year reduction in Scope 1 and 2 GHG emissions in 2023.

Imerys is actively responding to climate change by targeting a 42% reduction in absolute scope 1 and 2 GHG emissions and a 25% reduction in scope 3 emissions by 2030, using 2021 as a baseline. This includes boosting energy efficiency and increasing renewable electricity procurement, with a goal of sourcing 75% of electricity from renewables by 2025, up from 45% in 2022.

Water scarcity is a growing concern, with projections suggesting over 50% of global copper supply could face water-related disruptions by 2030. Imerys is prioritizing improved water management, aiming for all its priority sites to meet new water reporting requirements by 2025.

The company acknowledges its impact on biodiversity and is committed to conservation, with sustainability reports from 2024 detailing ongoing projects in habitat restoration and species protection.

Stricter environmental regulations are driving Imerys towards circular economy principles, focusing on waste valorization and extending mineral lifecycles to minimize environmental impact and enhance resource efficiency.

| Environmental Factor | Imerys's Target/Action | Key Metric/Progress | Year |

|---|---|---|---|

| GHG Emissions Reduction | Reduce Scope 1 & 2 by 42%, Scope 3 by 25% | Achieved 7% reduction in Scope 1 & 2 in 2023 | 2030 (Baseline 2021) |

| Renewable Electricity Sourcing | Source 75% of electricity from renewables | Sourced 45% of electricity from renewables | 2025 (Progress 2022) |

| Water Management | Meet new water reporting requirements at priority sites | N/A | 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Imerys is built on a robust foundation of data from official government publications, leading financial institutions like the IMF and World Bank, and respected industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.