Imerys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imerys Bundle

Unlock the strategic potential of Imerys with a comprehensive look at their BCG Matrix. Understand which of their diverse mineral solutions are market Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for actionable insights and a clear roadmap to optimize Imerys' portfolio and drive future growth.

Stars

Imerys's Solutions for Energy Transition (SET) business area, which includes Imerys Graphite & Carbon (IGC) and its stake in The Quartz Corporation (TQC), is strategically placed in rapidly expanding markets. These include mobile energy, specifically lithium-ion batteries and fuel cells, as well as solar and semiconductor industries. This focus aligns perfectly with global trends toward decarbonization and electrification.

IGC stands out as a world leader in conductive additives crucial for lithium-ion batteries, supplying all major battery manufacturers. The company's strong foothold in the booming electric vehicle market, coupled with its presence in other energy transition sectors, points to significant growth prospects and opportunities for increased market share.

High-purity quartz solutions, crucial for crucibles in the booming solar and semiconductor sectors, are a shining star for Imerys within the BCG matrix. These industries are experiencing robust growth, driving a significant increase in demand for specialized materials like high-purity quartz. Imerys's strategic 50% stake in The Quartz Corporation (TQC) underscores its strong presence and competitive edge in this high-growth, high-market-share segment.

The Graphite & Carbon segment within Imerys is a star performer, fueled by robust demand in conductive polymers. This market's growth is directly tied to the expansion of electric vehicles, where the need for high-performance, conductive materials is paramount. Imerys is well-placed to capture significant market share in this expanding sector.

Sustainable Construction Materials Innovation

Imerys is channeling significant investment into pioneering sustainable construction materials, such as cement alternatives and cutting-edge insulation. This positions them to capitalize on the construction sector's growing demand for eco-friendly solutions, a market segment experiencing robust expansion.

The global construction market is projected to reach $14.8 trillion by 2030, with a substantial portion driven by sustainable building practices. Imerys's commitment to innovation in this space, focusing on enhanced performance and reduced environmental impact, is strategically aligned with these market trends.

- Investment in Green Alternatives: Imerys is actively developing and promoting materials that offer lower embodied carbon compared to traditional options.

- Market Demand for Sustainability: The construction industry's push towards net-zero emissions creates a significant opportunity for Imerys's sustainable product portfolio.

- Performance and Durability Focus: Innovations aim not only for environmental benefits but also for improved material performance and longevity in building applications.

Diatomite and Perlite for Food, Beverage, Filtration, and Pharma

Imerys's strategic acquisition of Chemviron's European diatomite and perlite business in late 2023 marks a significant push into high-value sectors. This move is designed to capitalize on the robust demand within the food, beverage, filtration, and pharmaceutical industries, areas known for their consistent growth and specialized mineral needs. By integrating these operations, Imerys is bolstering its capabilities and market presence in these critical, expanding segments.

These specialized mineral solutions are classified as Stars within the Imerys BCG Matrix due to their strong market growth and Imerys's leading position. The filtration market, in particular, is projected to see substantial expansion. For instance, the global industrial filtration market was valued at approximately $28.5 billion in 2023 and is anticipated to grow at a CAGR of around 5.8% through 2030, driven by stringent environmental regulations and increasing demand for high-purity products in food and pharma.

- High Growth Potential: The food, beverage, filtration, and pharmaceutical sectors are experiencing sustained demand, making diatomite and perlite products key growth drivers.

- Market Expansion: The acquisition of Chemviron's European business significantly enhances Imerys's industrial footprint and market share in these specialized mineral applications.

- Filtration Dominance: The global filtration market's projected growth, fueled by regulatory and quality demands, underscores the Star status of Imerys's filtration-grade diatomite and perlite.

- Strategic Positioning: Imerys is strategically aligning its portfolio with high-margin, resilient end-markets, reinforcing its competitive advantage.

Imerys's Graphite & Carbon and high-purity quartz businesses are classified as Stars. These segments benefit from robust market growth, particularly in the electric vehicle battery and solar/semiconductor industries. Imerys holds a strong market position in both, driven by essential product offerings like conductive additives and high-purity quartz crucibles.

The company's investment in sustainable construction materials also aligns with Star characteristics, tapping into a growing demand for eco-friendly building solutions. This area shows strong market expansion potential, supported by global trends towards net-zero emissions in construction.

Furthermore, Imerys's recent acquisition of Chemviron's European diatomite and perlite business positions these specialized mineral solutions as Stars. These products cater to high-growth sectors like food, beverage, filtration, and pharmaceuticals, where demand for purity and performance is consistently increasing.

The filtration market, a key application for these minerals, is experiencing significant growth. For example, the global industrial filtration market was valued at approximately $28.5 billion in 2023 and is projected to grow at a compound annual growth rate of around 5.8% through 2030. This expansion is fueled by stricter environmental regulations and a rising need for high-purity products across various industries.

| Business Segment | Market Growth | Imerys Market Position | Key Drivers |

| Graphite & Carbon | High | Leading | Electric Vehicles, Conductive Polymers |

| High-Purity Quartz | High | Strong | Solar, Semiconductors |

| Sustainable Construction Materials | Growing | Emerging/Strong | Decarbonization, Eco-friendly Building |

| Diatomite & Perlite (Filtration) | High | Strengthening | Food & Beverage, Pharma, Environmental Regulations |

What is included in the product

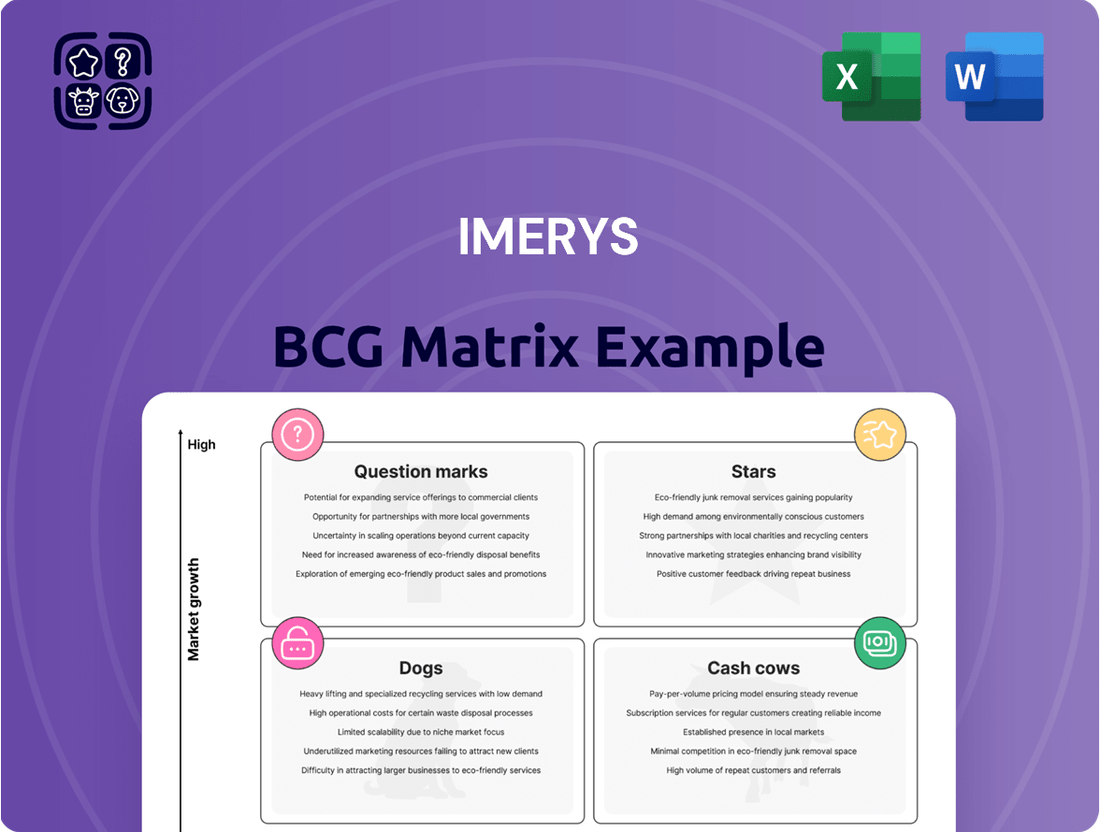

The Imerys BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth to guide investment decisions.

A clear Imerys BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Imerys's Performance Minerals business, especially its contribution to consumer goods, operates as a classic Cash Cow. This segment benefits from consistent, stable demand, reflecting a mature market where Imerys holds a significant share.

The predictable nature of consumer goods means this business generates reliable cash flow with minimal need for heavy promotional spending or aggressive market expansion. For instance, in 2023, Imerys reported that its Performance Minerals segment, which includes consumer goods applications, demonstrated robust performance, contributing significantly to the group's overall financial stability.

Imerys' traditional building materials, such as calcium carbonate and kaolin for paints, coatings, and plastics, represent a strong cash cow. These established mineral-based solutions benefit from high market share in mature construction sectors, consistently generating significant cash flow.

While growth in these segments is modest, Imerys focuses on operational efficiency and optimizing its existing production infrastructure to maximize profitability. For instance, in 2023, the construction materials segment contributed significantly to Imerys' overall revenue, underscoring the stable cash-generating power of these core products.

Imerys's minerals for paints and coatings are a prime example of a cash cow within their portfolio. This segment operates in a mature market, characterized by steady demand and established customer relationships, allowing Imerys to leverage its significant market share.

The company's focus here is on optimizing operations and defending its competitive position, rather than pursuing high-risk, high-reward growth initiatives. In 2024, the global paints and coatings market was valued at approximately $170 billion, with Imerys holding a notable share in key mineral inputs like calcium carbonate and kaolin, essential for product performance and cost-effectiveness.

Minerals for Ceramics (Traditional)

Imerys's traditional mineral solutions for ceramics, such as kaolin and feldspar, are likely categorized as cash cows in their BCG matrix. These materials serve well-established industries like sanitaryware, tableware, and tiles, where demand is steady but growth might be moderate.

The company's strong market position in these mature ceramic segments ensures consistent revenue generation. For instance, in 2024, the global ceramics market, while diverse, saw continued demand from construction and consumer goods, where Imerys's foundational products are essential.

- Established Market Presence: Imerys holds significant market share in traditional ceramic applications, leveraging decades of expertise and supply chain efficiency.

- Consistent Cash Flow Generation: These products reliably contribute to Imerys's overall profitability due to their stable demand and established pricing power.

- Mature but Stable Demand: While not high-growth areas, segments like sanitaryware and tiles represent a substantial and consistent market for Imerys's mineral solutions.

- Contribution to Financial Stability: The dependable cash flow from these operations helps fund investments in growth areas and supports overall financial health.

Calcite (Ground and Precipitated Calcium Carbonate)

Imerys' position in the ground and precipitated calcium carbonate (GCC and PCC) market firmly places calcite within the Cash Cows quadrant of the BCG matrix. The company is a significant global supplier, particularly noted for its high-quality products derived from sustainable mining practices.

This market is characterized by its maturity, yet it exhibits consistent, albeit moderate, growth. Imerys commands a substantial market share, estimated to be between 18% and 22%, which translates into reliable and substantial cash flow generation for the company.

- Market Maturity: The GCC and PCC markets are well-established, indicating stable demand but limited disruptive growth potential.

- Imerys' Market Share: Imerys holds a dominant 18-22% share, a key indicator of its Cash Cow status.

- Sustainable Operations: Emphasis on sustainable mining practices supports long-term operational viability and brand reputation.

- Cash Generation: The strong market position and mature demand allow for consistent and predictable cash inflows.

Imerys' specialty minerals for the automotive sector, particularly those used in plastics and coatings, function as cash cows. These applications benefit from consistent demand in a mature industry where Imerys has a strong, established presence.

The predictable nature of automotive production cycles ensures a steady revenue stream with manageable investment needs. In 2023, Imerys' sales in the automotive sector remained a stable contributor to its overall performance, reflecting the mature yet reliable demand for its mineral solutions.

Imerys' kaolin and calcium carbonate products for the paper industry are also considered cash cows. These minerals are essential for improving paper brightness, opacity, and printability, serving a market with stable, albeit evolving, demand. Imerys' significant market share in this sector allows for consistent cash generation.

The company focuses on optimizing production and maintaining cost leadership to maximize profitability in this mature segment. For example, in 2024, the global paper and packaging market continued to rely on mineral fillers and coatings, with Imerys maintaining its position as a key supplier.

| Imerys Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Performance Minerals (Consumer Goods) | Cash Cow | Stable demand, mature market, significant market share | Robust performance in 2023, contributing to financial stability |

| Traditional Building Materials (Paints, Coatings, Plastics) | Cash Cow | High market share in mature sectors, consistent cash flow | Significant revenue contribution in 2023 |

| Specialty Minerals (Ceramics) | Cash Cow | Well-established industries, steady demand, strong market position | Continued demand in 2024 from construction and consumer goods |

| Calcium Carbonate (GCC & PCC) | Cash Cow | Mature market, consistent moderate growth, dominant market share (18-22%) | Reliable and substantial cash flow generation |

Delivered as Shown

Imerys BCG Matrix

The Imerys BCG Matrix preview you are currently viewing is the exact, unwatermarked final document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered directly to you, ready for immediate application in your business planning. You can be confident that this preview accurately represents the fully formatted and professionally designed report that will empower your decision-making processes.

Dogs

Imerys completed the sale of its paper market assets in July 2024, a move that followed exclusive negotiations initiated in March 2024. This divestment targeted activities that contributed around €370 million in sales during 2023.

These particular business lines were categorized as non-core and experiencing a decline, fitting the profile of a low-growth, low-market-share segment within Imerys' portfolio. The company's strategic decision was to exit this area.

Imerys's segments tied to traditional European automotive production have seen a noticeable drop in demand. This slowdown points to a market with limited growth potential, where some of Imerys's offerings might be struggling to maintain or gain market traction.

For instance, the European automotive sector, a key market for certain mineral-based solutions, faced significant headwinds in 2023. Production figures indicated a contraction in certain segments, impacting raw material suppliers like Imerys. While specific Imerys product line performance within this segment isn't publicly detailed, the overall market trend suggests a challenging environment.

Imerys has observed a slowdown in several industrial markets, particularly within Europe. Products that cater to these less robust sectors, especially where Imerys doesn't have a leading market share, are likely candidates for the 'dog' category in the BCG matrix.

These underperforming product lines typically represent a small fraction of the company's overall revenue and profit. For instance, Imerys’s refractory business, which serves heavy industries like steel and cement, experienced subdued demand in Europe throughout 2023, impacting volumes and margins in this segment.

Managing these 'dog' products requires a strategic approach. Options include optimizing costs to maintain minimal profitability, or in some cases, considering divestment to reallocate resources towards more promising growth areas within Imerys's portfolio.

Underperforming Joint Ventures

Some of Imerys's joint ventures are showing weaker performance, impacting the company's overall profitability. When these ventures operate in markets with limited growth and Imerys holds a small market share within them, they can be classified as dogs in the BCG matrix. This situation can lead to capital being tied up without generating significant returns.

For instance, if a joint venture focused on a mature, low-growth industrial mineral market saw its contribution to Imerys's revenue decline by 5% in 2024, while its market share remained stagnant at 2%, it would exemplify a dog. Such ventures require careful evaluation to determine if continued investment is warranted or if divestment is a more strategic option.

- Deteriorating JV profitability impacting Imerys's bottom line.

- Low-growth market participation and small market share as key indicators.

- Potential for capital being locked in with minimal returns.

Legacy Products with Limited Innovation Potential

Imerys' legacy mineral solutions with limited innovation potential fall squarely into the dogs category of the BCG matrix. These are products that haven't kept pace with evolving market demands or technological advancements. Consequently, they often experience stagnant or declining sales volumes and hold a small, often shrinking, market share.

These 'dog' products typically operate at a break-even point or even consume cash without offering significant future growth prospects. For instance, certain traditional kaolin applications in paper manufacturing might be seeing reduced demand due to the shift towards digital media and the development of new paper coatings. In 2023, Imerys reported that while overall performance was robust, certain legacy segments did face pricing pressures and volume challenges, indicative of products in this category.

- Stagnant Demand: Products like basic industrial talcs for older manufacturing processes may face declining demand as industries modernize.

- Low Market Share: These offerings typically hold a minimal share in their respective markets, lacking competitive differentiation.

- Cash Consumption: Investments required to maintain production levels for these products can outweigh the revenue generated, leading to cash burn.

- Limited Growth Outlook: Without significant R&D investment or market repositioning, these products are unlikely to see future growth.

Products in Imerys's 'Dogs' category are those with low market share in low-growth markets. These are often legacy products or business units that require careful management to avoid becoming cash drains. The divestment of paper market assets in July 2024, which generated around €370 million in sales in 2023, exemplifies Imerys's strategy to exit such non-core, declining segments.

Segments tied to traditional European automotive production, which saw a noticeable drop in demand in 2023, also represent areas where Imerys might have 'dog' products. These are offerings operating in markets with limited growth potential, where maintaining or increasing market traction is challenging.

Imerys's refractory business, serving sectors like steel and cement, experienced subdued demand in Europe throughout 2023, impacting volumes and margins. Such segments, especially where Imerys doesn't hold a leading market share, are prime candidates for the 'dog' classification, necessitating cost optimization or divestment.

Joint ventures in mature, low-growth markets where Imerys has a small market share can also be classified as dogs. For example, a joint venture contributing 2% market share and seeing a 5% revenue decline in 2024 would highlight this issue, tying up capital with minimal returns.

| Category | Characteristics | Imerys Example/Consideration |

|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Divested Paper Market Assets (2024), Certain Refractory Segments (Europe, 2023), Legacy Kaolin Applications |

| Impact | Stagnant or declining sales, potential cash consumption, limited future prospects | Subdued demand in European automotive and heavy industries (2023), potential for capital tied up in underperforming JVs |

| Strategy | Cost optimization, divestment, or minimal investment | Exit non-core assets, reallocate resources to growth areas |

Question Marks

Imerys's Project Emili, located at its Beauvoir site, represents a substantial commitment to Europe's energy transition and industrial self-sufficiency by developing a significant lithium mining operation. This project is positioned as a question mark within the BCG matrix due to its high growth potential in the burgeoning lithium market, driven by exponential consumption increases, yet it currently holds a low market share as it remains in the development phase.

The project requires considerable capital investment before it can generate substantial returns, a characteristic hallmark of question mark entities. For instance, in 2024, Imerys continued to advance this project, with significant capital allocation planned for its development, underscoring the substantial upfront investment needed to tap into the growing demand for battery-grade lithium.

Imerys is actively exploring mineral-based carbon capture technologies as a key part of its sustainability roadmap, aiming for more circular production processes. This aligns with a growing global demand for decarbonization solutions.

The market for carbon capture is still in its early stages, presenting significant growth opportunities. However, Imerys's current market share in this emerging field is likely minimal, positioning it as a question mark within the BCG matrix that will necessitate substantial investment to establish a strong foothold.

The burgeoning field of bio-sourced and recycled materials presents a significant growth opportunity, directly addressing the global push for sustainable production. Imerys is actively investing in these innovative materials to bolster circular economy principles and minimize its ecological footprint.

While these emerging product lines are poised for expansion, they currently hold a modest market share. Consequently, substantial marketing efforts and capital investment will be crucial to foster widespread market penetration and acceptance.

Advanced Ceramics for High-Performance Applications

Advanced ceramics represent a burgeoning sector, driven by escalating demand across critical industries like aerospace, energy, healthcare, and electronics. These materials are essential for components requiring extreme heat resistance, wear resistance, and specific electrical properties.

While Imerys operates within the broader ceramics market, its specific penetration into these high-growth, advanced ceramics segments may be nascent. This positions these offerings as potential question marks within the BCG matrix, characterized by substantial growth prospects but potentially limited current market share.

The global advanced ceramics market was valued at approximately USD 17.5 billion in 2023 and is projected to reach over USD 32 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 9%. This robust expansion highlights the significant opportunity for players capable of meeting the stringent requirements of these demanding applications.

- Market Growth Drivers: Increased adoption in 5G infrastructure, electric vehicles, and renewable energy systems.

- Imerys' Position: Potential for strategic investment to capture share in a rapidly expanding, high-value market.

- Competitive Landscape: Dominated by specialized manufacturers with proprietary technologies, presenting both challenges and opportunities for new entrants.

- Key Applications: Components for gas turbines, medical implants, semiconductor manufacturing equipment, and advanced sensors.

New Capacity in Fast-Growing Markets

Imerys is strategically allocating a significant portion of its financial resources, with around 40% of its annual capital expenditures from 2023 to 2025 earmarked for expanding capacity in rapidly growing markets. This focus highlights a deliberate move into areas with strong future potential, aiming to capture emerging demand.

These investments are classified as question marks because they involve entering or strengthening positions in markets where Imerys's current market share may be nascent or requires substantial development. The success of these ventures hinges on their ability to demonstrate sustained growth and profitability, validating the initial investment.

- Strategic Allocation: Approximately 40% of Imerys's 2023-2025 capital expenditures are directed towards new capacity in fast-growing markets.

- Question Mark Classification: These investments target areas where Imerys aims to build or expand market share, requiring them to prove their long-term viability.

- Market Focus: The strategy emphasizes capturing growth in high-potential product segments and geographic regions.

Imerys's ventures into emerging markets, such as lithium extraction and bio-sourced materials, are classic examples of question marks. These initiatives possess high growth potential, driven by global trends like electrification and sustainability, but currently represent a small market share for Imerys as they are in development or early adoption phases.

Significant capital investment is required to nurture these question marks into strong market positions. For instance, Imerys's commitment to Project Emili for lithium production necessitates substantial upfront funding to scale operations and meet growing demand. Similarly, developing new bio-sourced materials demands investment in research, production, and market education.

The success of these question mark initiatives hinges on Imerys's ability to effectively manage the associated risks and capitalize on market opportunities. Strategic investments in technology, market development, and operational efficiency will be crucial for converting these potential growth areas into profitable business segments.

Imerys's focus on advanced ceramics also falls into the question mark category. While the global market for advanced ceramics is expanding rapidly, with projections indicating growth to over USD 32 billion by 2030, Imerys’s specific share in these niche, high-performance segments is still developing.

| Initiative | Market Potential | Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| Project Emili (Lithium) | High (Energy Transition) | Low (Development Phase) | High Capital Expenditure | Question Mark |

| Carbon Capture Technologies | High (Decarbonization Demand) | Minimal (Emerging Field) | Substantial Investment | Question Mark |

| Bio-sourced & Recycled Materials | High (Sustainability Push) | Modest (Nascent Lines) | Marketing & Capital Investment | Question Mark |

| Advanced Ceramics | High (Aerospace, Energy, Healthcare) | Nascent in High-Growth Segments | Strategic Investment | Question Mark |

BCG Matrix Data Sources

Our Imerys BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research reports, and expert industry analysis to provide a clear strategic overview.