Imerys Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Imerys Bundle

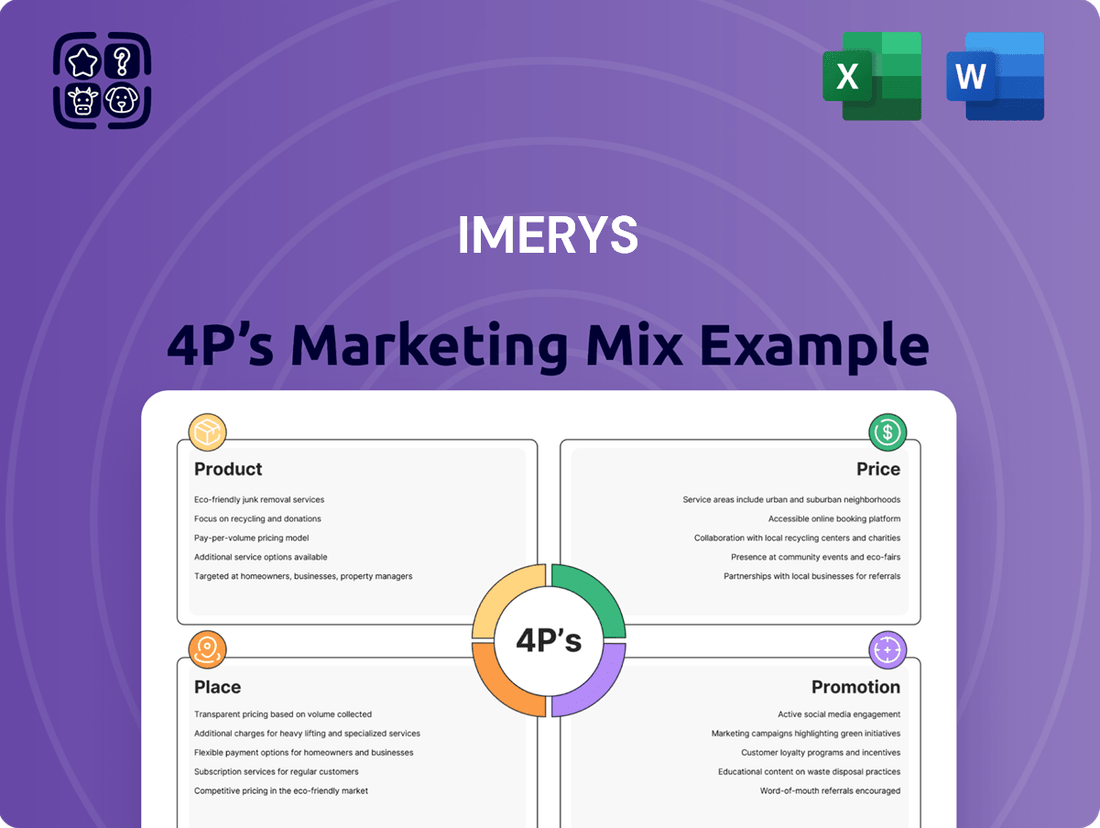

Discover how Imerys leverages its diverse product portfolio, strategic pricing, extensive global distribution, and targeted promotional efforts to maintain its leadership in specialty minerals. This analysis dives deep into each of the 4Ps, revealing the interconnected strategies that drive their market success.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Imerys's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights into a global industry leader.

Product

Imerys' product strategy centers on its mineral-based specialty solutions, transforming raw minerals into high-value functional additives. These solutions are engineered to improve customer product performance and manufacturing efficiency across a vast array of industries.

The company's extensive portfolio features key minerals such as talc, bentonite, and kaolin, which are critical components in sectors ranging from automotive and construction to paper, ceramics, and consumer goods. This diverse application base underscores the breadth of their product offering.

For instance, Imerys' mineral solutions contributed to its 2023 revenue of €4.4 billion, with a significant portion driven by these specialty products that offer tangible performance benefits, such as enhanced durability in construction materials or improved texture in cosmetics.

High Value-Added Functional Additives are key to Imerys' offering, acting as crucial components that imbue customer products with essential performance characteristics. These additives, ranging from enhancing heat resistance and conductivity to improving lightness and water repellency, are foundational to achieving desired end-product qualities.

While these additives represent a small fraction of a finished product's overall cost, their impact on performance is disproportionately large. For instance, Imerys' talc-based additives can significantly boost the rigidity of polymers used in the automotive sector, a critical factor for structural integrity and safety. Similarly, their calcium carbonate products enable plastic films to be breathable, a vital feature for applications like baby diapers, demonstrating the high value derived from these specialized materials.

Imerys provides essential mineral components that form the backbone of many customer products. For instance, their fused alumina is a crucial ingredient in industrial abrasives, enhancing performance and durability. In 2024, the global abrasives market was valued at approximately $45 billion, with industrial applications being a significant driver.

Beyond direct ingredients, Imerys also supplies vital process enablers. Their diatomaceous earth, for example, is indispensable for liquid filtration in various manufacturing sectors, ensuring product purity and quality. This filtration market is projected to grow substantially, reaching over $10 billion by 2027, underscoring the importance of such enablers.

Solutions for Megatrends

Imerys' "Solutions for Megatrends" directly addresses key societal shifts, ensuring their offerings remain relevant and competitive. By focusing on areas like green mobility and energy, sustainable construction, and natural solutions for consumer goods, Imerys positions itself to capture growth in high-demand sectors. This strategic alignment is crucial for sustained market presence and innovation.

This product strategy is supported by significant investment. For instance, Imerys' capital expenditure in 2024 was €719 million, with a substantial portion allocated to growth projects, many of which are tied to these megatrends. Their commitment to sustainable solutions is further evidenced by the fact that their products contribute to reducing CO2 emissions in various applications, a key aspect of green mobility and construction.

- Green Mobility & Energy: Imerys provides high-performance minerals for electric vehicle batteries, lightweight automotive components, and renewable energy infrastructure, aligning with the global push for decarbonization.

- Sustainable Construction: Their solutions enhance the performance and environmental footprint of building materials, offering lightweight aggregates, insulation minerals, and additives for lower-carbon concrete.

- Natural Solutions for Consumer Goods: Imerys develops mineral-based ingredients for personal care, home care, and food products, catering to the growing consumer demand for natural and sustainable alternatives.

Sustainable and Innovative Offerings

Imerys' product strategy heavily emphasizes sustainability and innovation. Their Pioneer label recognizes solutions with significant environmental and social benefits, showcasing a commitment to responsible development. This focus is evident in new offerings like SU-NERGY™, a sustainable graphite designed for enhanced environmental performance.

Further demonstrating this commitment, Imerys has introduced water-based graphite coatings. These innovative solutions significantly reduce volatile organic compound (VOC) emissions, aligning with global trends towards healthier and more environmentally friendly industrial processes. This proactive approach to eco-conscious product development is a key differentiator.

- Pioneer Label: Certifies products with outstanding environmental and social contributions.

- SU-NERGY™: A new sustainable graphite offering focused on environmental performance.

- Water-Based Graphite Coatings: Reduce VOC emissions, promoting healthier applications.

Imerys' product portfolio is built around high-value mineral-based specialty solutions that enhance customer product performance and manufacturing efficiency. These solutions are critical functional additives, often representing a small cost but delivering significant performance benefits. For example, their talc additives improve polymer rigidity in automotive applications, a key factor for safety and structural integrity.

The company's offerings are strategically aligned with global megatrends such as green mobility and sustainable construction, ensuring relevance and growth. Their 2023 revenue of €4.4 billion was significantly driven by these specialty products. Imerys' commitment to innovation is highlighted by initiatives like the Pioneer label for sustainable solutions and new products such as SU-NERGY™ graphite.

Imerys provides essential mineral components and process enablers. For instance, their fused alumina is vital for the approximately $45 billion global abrasives market, while diatomaceous earth is crucial for liquid filtration, a market projected to exceed $10 billion by 2027. Their capital expenditure in 2024, totaling €719 million, supports these growth-oriented product developments.

| Product Category | Key Minerals/Solutions | End-Market Applications | 2023 Revenue Contribution (Illustrative) | Strategic Alignment |

|---|---|---|---|---|

| Functional Additives | Talc, Calcium Carbonate, Graphite | Automotive (polymers), Consumer Goods (plastics), Personal Care | Significant portion of €4.4bn total revenue | Megatrends: Green Mobility, Natural Solutions |

| Essential Mineral Components | Fused Alumina, Kaolin | Industrial Abrasives, Ceramics, Paper | Integral to various industrial sectors | Industrial Efficiency, Performance Enhancement |

| Process Enablers | Diatomaceous Earth | Liquid Filtration (Food & Beverage, Pharma) | Key to purity and quality in manufacturing | Sustainability, Quality Assurance |

What is included in the product

This analysis provides a comprehensive breakdown of Imerys's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and operational approach.

It's designed for professionals seeking a deep understanding of Imerys's marketing mix, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering intricate plans for busy executives.

Provides a clear, concise overview of Imerys' 4Ps, removing the pain of information overload and enabling faster decision-making.

Place

Imerys boasts a robust global industrial network, with operations spanning 40 to 46 countries and a workforce of 12,400 employees as of early 2024. This extensive presence allows for localized production, a key advantage in navigating global trade complexities. For instance, their European operations, a significant contributor to revenue, benefit from this localized approach, mitigating the direct impact of tariffs on cross-border product movements.

Direct sales and B2B contracts are a cornerstone of Imerys' commercial strategy, accounting for a substantial 50% of its revenue in 2023. This approach allows Imerys to cultivate deep, lasting relationships with its industrial clientele.

This direct distribution model is crucial for Imerys' scalability, enabling them to effectively serve a wide range of industrial customers. It facilitates the creation of customized solutions, ensuring that specialized mineral products are delivered precisely to meet client needs.

Imerys strategically targets acquisitions to bolster its market share and operational reach within rapidly expanding sectors. This approach is a key component of their product strategy, ensuring they can offer a wider range of solutions to meet evolving customer needs.

A prime example is their January 2025 acquisition of Chemviron's European diatomite and perlite operations. This move significantly enhanced Imerys' standing in critical sectors like food and beverage processing, advanced filtration, and pharmaceuticals, demonstrating a clear focus on high-value markets.

Specialized Distribution Channels for Industries

Imerys tailors its distribution strategies to meet the unique demands of different industries, utilizing specialized channels to ensure its products effectively reach their intended markets. This targeted approach is crucial for industries with specific technical requirements or established purchasing behaviors.

The company actively participates in key industry events to showcase its specialized portfolios. For instance, Imerys will be present at ECS 2025, a premier event for the paints and coatings sector, and FEICA 2024, focusing on the adhesives industry. These platforms are vital for engaging directly with target audiences and demonstrating the value of their mineral-based solutions.

- Targeted Industry Events: Participation in events like ECS 2025 (paints & coatings) and FEICA 2024 (adhesives) ensures direct engagement with relevant industry professionals.

- Specialized Channel Utilization: Distribution networks are designed to cater to the specific needs of sectors such as construction, automotive, and consumer goods, optimizing product delivery and support.

- Portfolio Showcasing: These events allow Imerys to highlight its advanced mineral solutions, demonstrating how they enhance performance and sustainability in end-user applications.

Optimized Supply Chain and Logistics

Imerys prioritizes an optimized supply chain and logistics, ensuring their mineral-based solutions reach customers precisely when and where they are needed. This focus is critical for maintaining customer satisfaction, especially during unpredictable market conditions. Their operational efficiency in this area directly impacts product availability and delivery reliability.

The company leverages an extensive global network combined with strategic local production sites. This dual approach provides resilience against external disruptions, such as geopolitical events or transportation challenges. For instance, Imerys's ability to adapt its logistics in response to global supply chain pressures in 2023-2024 highlights this commitment.

- Global Network: Imerys operates across numerous countries, facilitating localized supply and reducing lead times.

- Local Production: Their investment in regional manufacturing capabilities, such as new facilities announced in 2024, enhances responsiveness.

- Resilience: The supply chain is designed to mitigate risks from transportation bottlenecks and raw material sourcing volatility.

- Customer Focus: Reliable delivery ensures customers can maintain their own production schedules without interruption.

Imerys's place strategy is defined by its extensive global footprint, reaching 40 to 46 countries with a workforce of 12,400 as of early 2024. This vast network allows for localized production, a critical advantage in managing global trade dynamics and ensuring product availability. Their presence in Europe, for example, helps mitigate tariff impacts on cross-border movements, reinforcing supply chain stability.

What You See Is What You Get

Imerys 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Imerys 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to actionable insights to understand Imerys' strategic approach.

Promotion

Imerys leverages industry-specific exhibitions and conferences as a crucial promotional tool. By actively participating in events like ECS 2025 for the paints and coatings sector and FEICA 2024 for adhesives, Imerys directly engages with its target audiences.

These platforms are vital for showcasing their diverse product portfolio and highlighting recent innovations. For instance, at ECS 2025, Imerys can demonstrate how its mineral solutions enhance performance and sustainability in coatings, a key market where specialty minerals are increasingly valued for their environmental benefits and functional properties.

Participation in FEICA 2024 allows Imerys to connect with adhesive manufacturers, presenting their advanced mineral additives that improve bond strength, durability, and processing efficiency. This direct interaction is essential for building relationships and understanding evolving customer needs within these specialized markets.

Imerys actively manages its digital presence, using its official website and other online channels to share vital information. This includes company news, press releases, detailed financial reports, and comprehensive product details, ensuring transparency and accessibility for all stakeholders.

The company leverages digital platforms for investor relations, such as webcasts of financial results, and maintains online publications to keep investors, customers, and other interested parties informed about Imerys' progress and its diverse product portfolio.

In 2023, Imerys reported revenues of €4.5 billion, with a significant portion of its communication efforts directed through its digital ecosystem to reach a global audience and disseminate this financial data.

Imerys actively manages its public image through robust public relations, issuing press releases to communicate key developments like financial results and strategic acquisitions. For instance, in their 2024 reporting, Imerys highlighted their progress in sustainability initiatives, a crucial aspect of their brand narrative.

Leveraging established media relationships, the company ensures timely dissemination of important updates, reinforcing its position as a global leader in specialty mineral solutions. This strategic media engagement helps to shape public perception and build trust among stakeholders, particularly in the evolving landscape of industrial materials.

Sustainability Reporting and Initiatives

Imerys actively promotes its dedication to sustainability as a core element of its marketing strategy. This includes transparent reporting on their climate transition plan and ambitious greenhouse gas emission reduction targets, aiming for a 37% reduction in Scope 1 and 2 emissions by 2030 compared to a 2021 baseline.

Their commitment is further validated by external recognition, such as achieving an 'A' rating from CDP for climate leadership in 2023, underscoring their proactive approach to environmental stewardship. This strong performance in sustainability reporting significantly enhances their brand reputation among environmentally conscious stakeholders.

The introduction of 'Pioneer' labeled products showcases Imerys' focus on developing solutions that contribute to a more sustainable future, aligning with market demands for responsible innovation. This initiative directly supports their promotional efforts by highlighting tangible progress in responsible product development.

- Climate Transition Plan: Imerys is committed to reducing its environmental impact through a defined climate transition plan.

- Emission Reduction Targets: The company aims for a 37% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 (vs. 2021).

- CDP Rating: Achieved an 'A' rating from CDP for climate leadership in 2023, signifying strong environmental performance.

- Pioneer Products: Introduction of 'Pioneer' labeled products demonstrates a commitment to sustainable innovation.

Innovation Partnerships and Product Launches

Imerys actively drives its marketing efforts through strategic innovation partnerships and the introduction of new products. This approach is clearly demonstrated by the launch of SU-NERGY™ graphite, a key material for the growing electric vehicle battery market. This launch, alongside collaborations focused on transforming industrial waste into valuable mineral resources, highlights Imerys' dedication to material science advancement and meeting dynamic market demands.

These initiatives are not just about new offerings; they are about positioning Imerys at the forefront of sustainable solutions. For instance, their focus on circular economy principles through waste valorization aligns with the increasing global demand for environmentally responsible industrial practices. By investing in these areas, Imerys is building a robust pipeline of future revenue streams and reinforcing its brand as an innovator.

The company's commitment to innovation is further evidenced by its financial performance. In 2024, Imerys reported significant investments in research and development, with a particular emphasis on sustainable materials and energy transition solutions. This strategic allocation of capital is designed to fuel future growth and solidify their competitive advantage in key emerging markets.

- SU-NERGY™ graphite launch: Targeting the booming EV battery sector.

- Industrial waste valorization: Partnerships focused on circular economy principles.

- R&D Investment (2024): Significant capital allocated to sustainable materials and energy transition.

Imerys' promotional strategy heavily relies on showcasing innovation and sustainability. Their participation in key industry events like ECS 2025 and FEICA 2024 provides direct engagement opportunities to highlight new mineral solutions and their benefits, such as enhanced performance in coatings and improved properties in adhesives.

The company also prioritizes a strong digital presence, using its website and online channels to disseminate company news, financial reports, and product information, ensuring transparency and accessibility for a global audience. This digital outreach is crucial for communicating their progress and diverse offerings.

Furthermore, Imerys actively promotes its commitment to sustainability, evidenced by ambitious emission reduction targets and the introduction of 'Pioneer' labeled products. Their 'A' rating from CDP in 2023 reinforces this dedication, resonating with environmentally conscious stakeholders.

Strategic innovation partnerships, like the launch of SU-NERGY™ graphite for the EV battery market, and efforts in waste valorization underscore Imerys' focus on future growth and sustainable solutions. These initiatives are supported by significant R&D investments, as seen in their 2024 financial planning, aiming to solidify their competitive edge.

Price

Imerys likely employs a value-based pricing strategy, reflecting the significant performance enhancements and functional benefits its specialized mineral solutions bring to customer products. This approach allows pricing to align with the perceived value and competitive advantage Imerys' offerings provide, rather than just production costs.

For instance, in the automotive sector, Imerys' lightweight mineral solutions can contribute to fuel efficiency, a key value driver for car manufacturers. Similarly, in the construction industry, their products might enhance durability and energy performance, justifying premium pricing based on these tangible benefits.

While specific pricing details are proprietary, Imerys' market leadership in many of its segments suggests it can command prices reflecting the superior performance and innovation embedded in its offerings. This is supported by their consistent investment in R&D, aimed at developing advanced materials that solve complex customer challenges.

Imerys commands a strong leadership position in the global specialty minerals sector, enabling competitive pricing strategies and fostering enduring customer loyalty. This market dominance, coupled with a consistent track record of innovation, allows them to command premium pricing for their high-performance, customized mineral solutions. For instance, in 2024, Imerys reported revenue growth driven by strong demand in sectors like automotive and construction, where their specialized products are critical for performance enhancement.

Imerys' pricing strategies are deeply intertwined with macroeconomic conditions and their proactive approach to cost management. The company's ability to navigate fluctuating market demand and broader economic trends is crucial for setting competitive and profitable prices.

In 2023, Imerys reported a notable achievement in maintaining a positive price/cost balance, alongside significant cost savings initiatives. This strategic discipline contributed to a healthy improvement in profitability and operating margins, demonstrating their capacity to translate cost efficiencies into enhanced financial performance.

Impact of Strategic Investments and Acquisitions

Imerys' strategic investments and acquisitions directly impact its pricing power. For instance, the acquisition of Chemviron's diatomite and perlite business in late 2023 expanded Imerys' specialty minerals portfolio. This move strengthens their market position, potentially enabling more competitive or optimized pricing strategies in the filtration and performance minerals sectors.

These strategic moves allow Imerys to offer a broader range of solutions, which can lead to enhanced value perception and thus influence pricing. By integrating new capacities and businesses, Imerys can achieve economies of scale and operational efficiencies that may translate into more favorable pricing for customers or improved margins for the company.

- Expanded Portfolio: Acquisitions like Chemviron's diatomite and perlite business broaden Imerys' product offerings, allowing for cross-selling opportunities and potentially influencing pricing through bundled solutions.

- Market Consolidation: Strategic investments can lead to market consolidation, giving Imerys greater leverage in price negotiations with both suppliers and customers.

- R&D Integration: Acquired technologies and capacities can be integrated with existing operations, driving innovation and potentially leading to premium pricing for differentiated products.

- Geographic Reach: Expanding into new markets through acquisitions can allow Imerys to adapt pricing strategies to local competitive landscapes and demand dynamics.

Response to Trade Policies and Regulations

Imerys' pricing strategy is significantly influenced by international trade policies and regulations. For instance, the company actively engages in advocating for and benefiting from measures like anti-dumping duties on imported materials, such as fused alumina. These duties are implemented to safeguard domestic industries from unfair pricing practices.

Such regulatory interventions directly impact Imerys' cost structure and competitive positioning. By leveling the playing field, these policies allow Imerys to maintain more stable and predictable pricing for its products in markets where such duties are in effect. This can lead to improved market share and profitability for the company's offerings.

The market dynamics are particularly sensitive to these trade policies, especially in cross-border transactions. For example, in 2024, the global trade landscape continued to see adjustments in tariffs and import restrictions, directly affecting the landed cost of raw materials and finished goods for companies like Imerys. These shifts require constant monitoring and strategic adaptation in pricing to remain competitive.

- Trade Policy Impact: Anti-dumping duties on fused alumina imports, pursued by Imerys, aim to protect domestic production.

- Pricing Competitiveness: These duties can alter the price competitiveness of Imerys' products in international markets.

- Market Dynamics: Regulations influence market dynamics, affecting supply, demand, and pricing equilibrium.

- 2024 Data Relevance: Global trade policy shifts in 2024 continue to shape the cost and pricing environment for industrial minerals.

Imerys employs a value-based pricing strategy, aligning prices with the performance benefits its mineral solutions offer. This is evident in sectors like automotive, where lightweighting improves fuel efficiency, and construction, where enhanced durability justifies premium pricing. Their market leadership and R&D investments support this premium positioning.

In 2023, Imerys achieved a positive price/cost balance, bolstered by cost-saving initiatives, which improved profitability. Strategic acquisitions, such as Chemviron's diatomite and perlite business in late 2023, expand their portfolio and market reach, potentially influencing pricing through bundled solutions and economies of scale.

Trade policies significantly impact Imerys' pricing. For instance, advocacy for anti-dumping duties on imported fused alumina helps level the playing field, allowing for more stable pricing. Global trade adjustments in 2024 continue to shape the cost and pricing environment for industrial minerals.

| Metric | 2023 (EUR million) | 2024 (Projected/Actual Data if available) |

|---|---|---|

| Revenue | 5,539 | Data not yet fully available, but growth expected driven by key sectors. |

| Operating Margin | 12.1% | Expected to remain robust due to pricing discipline and cost management. |

| Price/Cost Balance | Positive | Continued focus on maintaining this balance. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Imerys is grounded in a comprehensive review of their official corporate disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and competitive intelligence reports to capture their product strategies, pricing structures, distribution networks, and promotional activities.