IDIS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDIS Bundle

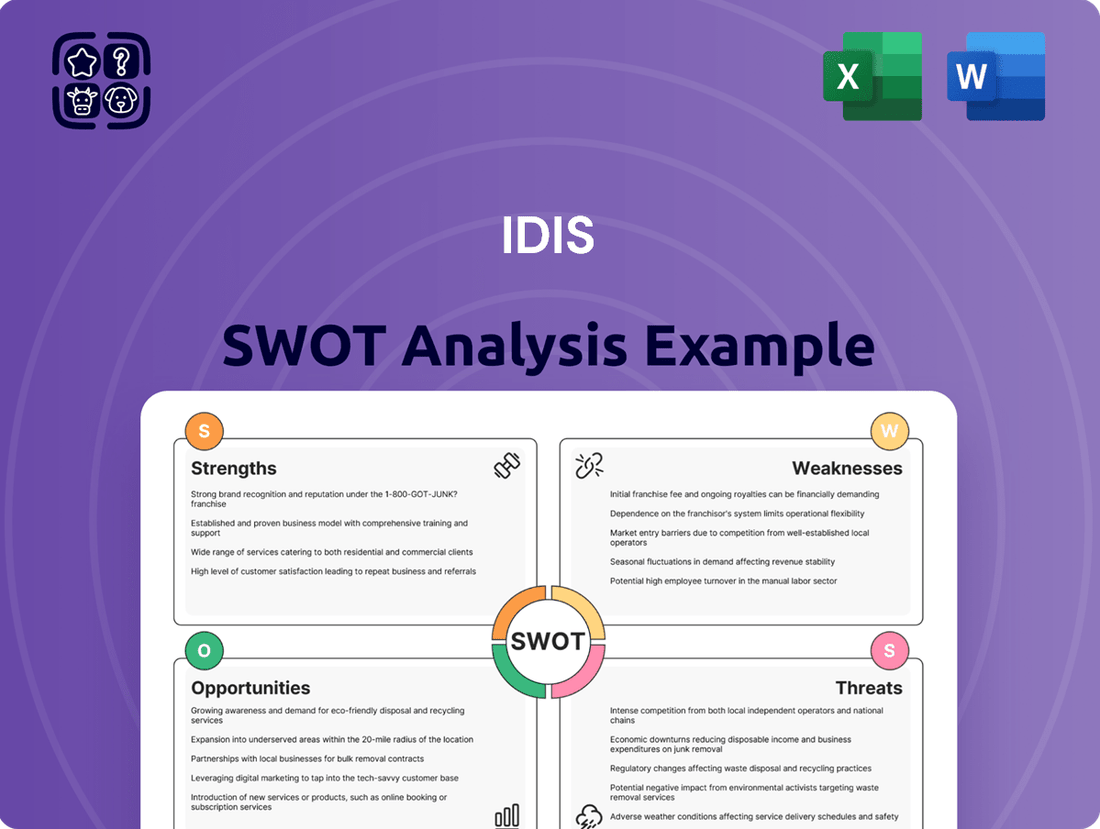

Curious about IDIS's competitive edge and potential hurdles? Our comprehensive SWOT analysis dives deep into their market position, revealing critical strengths, potential weaknesses, exciting opportunities, and looming threats. This isn't just a summary; it's your roadmap to understanding IDIS's strategic landscape.

Want to truly grasp IDIS's strategic advantage and future potential? Unlock the full SWOT analysis to gain access to a professionally crafted, editable report packed with actionable insights and expert commentary. Perfect for investors, strategists, and anyone looking to make informed decisions about IDIS.

Strengths

IDIS stands out as an end-to-end solution provider, offering a complete suite of video surveillance products. This includes everything from cameras and network video recorders (NVRs) to video management software (VMS), allowing customers to source all their needs from a single vendor. This integrated approach is a significant strength, simplifying installation and ensuring seamless compatibility between components, which ultimately reduces complexity for both end-users and system integrators.

IDIS's proprietary DirectIP and FEN (For Every Network) technologies are a significant strength, simplifying complex video surveillance setups. These solutions offer true plug-and-play capabilities, allowing for straightforward installation and remote access, which is a major advantage for users.

This emphasis on user-friendliness directly translates into a lower total cost of ownership (TCO) for customers. By minimizing the need for specialized IT expertise, IDIS makes advanced surveillance accessible and cost-effective, a key differentiator in the market.

IDIS is making significant strides in AI and advanced analytics, a key strength that sets it apart. The company is actively embedding AI-powered video analytics across its product portfolio. This includes innovations like the new Edge AI Camera Plus series and the upgraded IDIS Vaidio AI Suite.

These technological advancements translate into tangible benefits for users. Features such as real-time threat detection, more efficient search functions, and robust privacy masking capabilities are now integrated. This focus on AI enhances operational efficiency and bolsters overall security measures for clients.

Robust Cybersecurity Measures

IDIS places a strong emphasis on cybersecurity, employing proprietary data structures and encrypted data transmission to safeguard information. This dedication is crucial in an industry where data security is paramount, helping to prevent breaches and unauthorized access. For instance, their DirectIP technology utilizes secure peer-to-peer connections, reinforcing the integrity of surveillance data.

This robust approach to cybersecurity directly addresses key industry risks. In 2024, the global cybersecurity market was valued at approximately $270 billion, highlighting the significant investment and concern surrounding data protection. IDIS's focus on secure infrastructure positions them favorably against threats that could compromise client data and operational continuity.

- Proprietary Data Structures: IDIS's unique data architecture enhances security by design.

- Encrypted Data Transmission: All data sent through IDIS systems is protected with advanced encryption protocols.

- DirectIP Secure Peer-to-Peer: This technology ensures direct and secure communication between devices, minimizing vulnerabilities.

- Mitigation of Data Breaches: Proactive security measures significantly reduce the risk of unauthorized access and data theft.

Global Presence and Expanding Market Reach

IDIS boasts a significant global footprint, enabling it to cater to a wide array of industries and customer needs across different continents. This widespread presence is a key advantage in a globalized economy.

The company’s strategic expansion, notably its merger with Costar, has significantly bolstered its reach, particularly within the North American market. This move enhances its competitive positioning and access to new customer segments.

- Global Operations: IDIS operates in numerous countries, providing a broad base for revenue generation and market diversification.

- Market Penetration: Post-merger, IDIS has seen increased market share in key regions, reflecting successful integration and expanded service offerings.

- Customer Base Growth: The expanded reach has led to a demonstrable increase in the number of clients served globally, reinforcing its market influence.

IDIS's comprehensive, end-to-end solution offering simplifies video surveillance for customers, providing everything from cameras to software from a single vendor. This integrated approach ensures seamless compatibility and reduces installation complexity. Furthermore, their proprietary DirectIP and FEN technologies deliver true plug-and-play functionality, making advanced surveillance accessible and cost-effective with a lower total cost of ownership.

What is included in the product

Analyzes IDIS’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic challenges, transforming potential roadblocks into actionable solutions.

Weaknesses

IDIS's reliance on hardware sales presents a notable weakness. The video surveillance market is increasingly pivoting towards cloud-based services and software solutions. This trend poses a risk if IDIS's revenue streams are heavily weighted towards physical hardware, potentially hindering its adaptability to a rapidly evolving, software-centric landscape.

IDIS faces significant competition from established market leaders in the global video surveillance sector. Companies such as Hikvision and Dahua, for example, command a substantial portion of the market, making it difficult for IDIS to gain significant market share. This dominance is further amplified by Axis Communications and Motorola Solutions, who also hold strong positions.

While IDIS highlights its low total cost of ownership, the upfront capital required for a complete end-to-end video surveillance system can be a hurdle for some organizations, particularly those considering large-scale implementations. This initial outlay might appear substantial when contrasted with the costs associated with acquiring and integrating disparate, less cohesive security solutions.

Cybersecurity Skill Gap in End-User Organizations

Even with IDIS's robust cybersecurity, a significant challenge persists: the cybersecurity skill gap within many end-user organizations. This gap can hinder the effective deployment and ongoing management of advanced security solutions, potentially leaving systems vulnerable if clients lack the necessary expertise. For instance, a 2024 report indicated that 70% of organizations faced difficulties in hiring and retaining cybersecurity talent, directly impacting their ability to leverage sophisticated security technology.

This lack of internal expertise means that the full potential of IDIS's advanced features might not be realized. Without skilled personnel to configure, monitor, and respond to threats, even the most sophisticated systems can become less effective. This situation is compounded by the fact that the cybersecurity threat landscape is constantly evolving, requiring continuous adaptation and specialized knowledge.

- Limited Adoption: Organizations may struggle to implement and maintain IDIS's advanced features due to a lack of trained staff.

- Increased Vulnerability: Inadequate management of security systems can create exploitable weaknesses, even with state-of-the-art hardware.

- Reliance on External Support: End-users might become overly dependent on IDIS or third-party vendors for essential security operations, increasing costs and response times.

- Underutilization of Investment: The significant investment in advanced security solutions may not yield optimal returns if the internal capacity to manage them is insufficient.

Adaptation to Rapid Technological Shifts

The security sector is undergoing a swift transformation, driven by innovations in AI, cloud computing, and the Internet of Things (IoT). While IDIS is actively innovating, the sheer speed of these technological leaps presents a persistent challenge. Keeping pace and ensuring the seamless integration of the very latest advancements across its entire product portfolio requires constant effort and significant investment.

This rapid evolution means that staying ahead of the curve is not a one-time achievement but an ongoing necessity. For instance, the global AI in security market was projected to reach USD 32.5 billion by 2025, a figure that underscores the pace of change IDIS must navigate. This necessitates a robust R&D pipeline and agile product development cycles to avoid falling behind competitors who are also heavily investing in these areas.

- Challenge in integrating cutting-edge AI and IoT across all product lines.

- Need for continuous, substantial investment in R&D to match technological acceleration.

- Risk of product obsolescence if integration lags behind market advancements.

IDIS's revenue model heavily leans on hardware sales, which is a weakness in a market increasingly shifting towards subscription-based software and cloud services. This reliance could limit its ability to adapt to evolving customer preferences and generate recurring revenue streams, a trend evident as the global video surveillance market is projected to grow significantly, with software and services forming a larger part of that growth.

The company faces intense competition from established giants like Hikvision and Dahua, who hold significant market share. This makes it challenging for IDIS to expand its footprint and capture a larger portion of the global video surveillance market, which is characterized by strong brand loyalty and extensive distribution networks.

While IDIS promotes a low total cost of ownership, the initial capital investment for its comprehensive end-to-end systems can be a barrier for some potential clients, especially those with budget constraints or those seeking to integrate solutions piecemeal. This upfront cost can be a deterrent compared to more modular or component-based security offerings.

A significant weakness is the cybersecurity skill gap prevalent among end-user organizations. This deficiency can impede the proper deployment and ongoing management of IDIS's advanced features, potentially leaving systems vulnerable. For instance, a 2024 industry survey indicated that over 65% of businesses struggle with a lack of qualified cybersecurity personnel, directly impacting their ability to fully utilize sophisticated security technology.

Full Version Awaits

IDIS SWOT Analysis

The file shown below is not a sample—it’s the real IDIS SWOT analysis you'll download post-purchase, in full detail. You can trust that what you see is exactly what you'll get. Access the complete, comprehensive document immediately after completing your purchase.

Opportunities

The increasing integration of AI and machine learning into video surveillance is a major growth avenue for IDIS. These advanced technologies enable enhanced analytics, real-time threat identification, and improved operational efficiency, meeting the market's demand for more proactive security solutions. For instance, the global AI in video surveillance market was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 24.7 billion by 2030, growing at a CAGR of 23.9% during this period, according to MarketsandMarkets.

The global smart city market is projected to reach $2.5 trillion by 2026, presenting a significant opportunity for IDIS. As cities increasingly adopt IoT devices for traffic management, public safety, and utility monitoring, the demand for integrated video surveillance and data analytics solutions will surge. IDIS's ability to offer scalable, interconnected systems positions it well to capitalize on this expanding market, providing enhanced security and operational efficiency for smart city deployments.

The global shift from analog to IP and cloud-based security systems presents a significant growth avenue for IDIS. This migration fuels demand for advanced solutions like IDIS's DirectIP range, offering enhanced features and scalability over legacy systems. The market for IP video surveillance is projected to reach $100.2 billion by 2027, indicating a strong tailwind for companies like IDIS positioned to capitalize on this technological evolution.

Increased Focus on Cybersecurity and Data Privacy Compliance

The escalating global concern over cybersecurity and data privacy presents a significant opportunity for IDIS. As businesses and individuals alike become more vigilant about protecting sensitive information, the demand for video surveillance solutions that inherently prioritize security and compliance is on the rise. This trend is underscored by the increasing number of data breaches reported annually; for instance, in 2023, the Identity Theft Resource Center reported over 320 million individuals affected by data compromises in the US alone, highlighting the critical need for robust security measures across all digital touchpoints, including physical security systems.

IDIS's commitment to built-in cybersecurity features, such as end-to-end encryption and secure network protocols, directly addresses this market need. Furthermore, proprietary technologies like Live Privacy Masking, which automatically blurs faces in live video feeds to comply with privacy regulations, positions IDIS as a preferred partner for organizations operating under stringent data protection laws like GDPR or CCPA. This focus on inherent security and privacy compliance can serve as a powerful competitive advantage, attracting clients who are unwilling to compromise on data protection.

The market for cybersecurity solutions within the broader physical security sector is experiencing substantial growth. Analysts project the global video surveillance market to reach over $130 billion by 2028, with a significant portion of this growth attributed to advanced security features. Specifically, the demand for privacy-enhancing technologies within surveillance is expected to surge as regulatory frameworks continue to evolve and public awareness grows.

- Growing Demand: Increased global awareness of data breaches fuels demand for secure surveillance systems.

- Regulatory Compliance: Features like Live Privacy Masking meet stringent data protection requirements.

- Competitive Edge: Inherent cybersecurity differentiates IDIS in a privacy-conscious market.

- Market Growth: The video surveillance market, increasingly focused on security, is projected for significant expansion.

Untapped Potential in Specific Vertical Markets

IDIS has a significant opportunity to deepen its penetration in specialized vertical markets. By customizing its comprehensive security solutions, the company can better address the unique pain points of sectors like critical infrastructure, retail, education, healthcare, and banking. This tailored approach has already shown promise, with IDIS reporting a notable increase in project wins within these segments during 2024.

The company can leverage its existing technology stack to develop even more industry-specific functionalities. For instance, in the retail sector, enhanced video analytics for loss prevention and customer behavior analysis present a clear growth avenue. Similarly, in healthcare, solutions focusing on patient safety and facility compliance could drive further adoption. The banking sector continues to demand robust surveillance for fraud detection and secure transaction monitoring, areas where IDIS can further excel.

- Targeted Solutions: IDIS can capitalize on the growing demand for specialized security in critical infrastructure, with cybersecurity spending in this sector projected to reach $71.2 billion in 2024.

- Retail Expansion: The global retail analytics market is expected to grow, offering opportunities for IDIS to provide advanced video analytics for inventory management and shrinkage reduction.

- Healthcare Focus: In healthcare, IDIS can enhance its offerings for patient monitoring and facility security, aligning with increased investments in healthcare technology.

- Financial Services: The banking sector's continuous need for advanced fraud detection and compliance solutions presents a stable growth opportunity for IDIS.

The increasing integration of AI and machine learning into video surveillance is a major growth avenue for IDIS, enabling enhanced analytics and real-time threat identification. The global AI in video surveillance market was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 24.7 billion by 2030, growing at a CAGR of 23.9%. IDIS's ability to offer scalable, interconnected systems positions it well to capitalize on the expanding smart city market, projected to reach $2.5 trillion by 2026.

The global shift from analog to IP and cloud-based security systems presents a significant growth avenue for IDIS, fueling demand for advanced solutions like its DirectIP range. The market for IP video surveillance is projected to reach $100.2 billion by 2027. Furthermore, escalating global concern over cybersecurity and data privacy presents a significant opportunity, with IDIS's built-in features like end-to-end encryption and Live Privacy Masking addressing market needs.

IDIS has a significant opportunity to deepen its penetration in specialized vertical markets by customizing its security solutions for sectors like critical infrastructure, retail, and healthcare. The company can leverage its technology stack to develop industry-specific functionalities, such as advanced video analytics for loss prevention in retail, which is part of a global retail analytics market expected to grow significantly.

| Opportunity Area | Market Projection/Data Point | Relevance to IDIS |

| AI in Video Surveillance | USD 5.5 billion (2023) to USD 24.7 billion by 2030 (CAGR 23.9%) | Enhanced analytics, threat identification |

| Smart City Market | Projected to reach $2.5 trillion by 2026 | Demand for integrated surveillance and data analytics |

| IP Video Surveillance | Projected to reach $100.2 billion by 2027 | Migration from analog to advanced IP solutions |

| Cybersecurity Focus | Over 320 million individuals affected by data compromises in US (2023) | Demand for secure surveillance, privacy features |

| Vertical Market Specialization | Critical infrastructure cybersecurity spending: $71.2 billion (2024) | Tailored solutions for specific industry needs |

Threats

The video surveillance sector is crowded, featuring many global and local companies vying for market dominance. This fierce competition often triggers price wars, which can squeeze IDIS's profitability and reduce its market share, particularly when faced with rivals offering more budget-friendly options.

In 2024, the global video surveillance market was valued at approximately $50 billion, with projections indicating continued growth. However, this expansion attracts new entrants and intensifies pressure from established players, forcing companies like IDIS to constantly innovate and manage costs effectively to maintain a competitive edge.

The security industry is experiencing a technological arms race, especially with advancements in AI and data analytics. For IDIS, this means existing products could quickly become outdated if the company doesn't consistently invest in research and development. Failure to innovate at pace risks losing market share to competitors offering newer, more advanced solutions. For instance, the global AI in security market was valued at approximately $11.5 billion in 2023 and is projected to reach over $35 billion by 2028, highlighting the rapid evolution and the imperative for continuous R&D.

Despite IDIS's robust cybersecurity measures, the ever-increasing sophistication of cyberattacks, such as ransomware and supply chain compromises, presents a persistent threat to any networked security system. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and operational risks involved.

A major data breach impacting IDIS products or its extensive client base could severely tarnish its reputation, leading to loss of customer trust and potential legal liabilities. In 2024, the average cost of a data breach reached $4.73 million, a figure that underscores the substantial financial fallout from such incidents.

Privacy Regulations and Compliance Challenges

The increasing global focus on data privacy, exemplified by regulations like GDPR and CCPA, poses a significant threat to IDIS. As privacy laws evolve and become more stringent, particularly concerning biometric data and data storage, IDIS must constantly adapt its solutions to ensure compliance across various operating regions. Failure to do so could result in substantial fines and reputational damage, impacting market access and customer trust.

Compliance challenges are amplified by the diverse legal landscapes IDIS navigates. For instance, in 2024, the global data protection software market was valued at approximately $2.4 billion, with projections indicating continued growth, underscoring the complexity and importance of adhering to these regulations. IDIS needs to invest in robust legal and technical frameworks to manage these evolving requirements effectively.

- Evolving Privacy Laws: Continuous adaptation required for regulations like GDPR, CCPA, and emerging biometric data laws.

- Jurisdictional Complexity: Ensuring compliance across multiple countries with differing data protection standards.

- Potential Penalties: Risk of significant fines and legal action for non-compliance, impacting financial stability.

- Market Access Limitations: Non-compliant solutions may be barred from key markets, restricting growth opportunities.

Supply Chain Disruptions and Geopolitical Factors

Global supply chain vulnerabilities and geopolitical tensions pose a significant threat to IDIS. These factors can directly impact the manufacturing and distribution of essential hardware components, leading to potential production delays and increased costs. For instance, the ongoing semiconductor shortage, which significantly impacted electronics manufacturing throughout 2023 and into early 2024, could continue to affect component availability for IDIS products.

These disruptions can translate into reduced availability of IDIS products for customers, potentially impacting sales and market share. The ongoing geopolitical instability in key manufacturing regions, coupled with trade policy shifts, further exacerbates these risks. For example, increased tariffs or export restrictions could directly inflate the cost of goods for IDIS and its partners.

- Semiconductor Shortage Impact: Continued effects from the global chip shortage, which saw lead times for certain components extend by over 50% in 2023, could persist.

- Geopolitical Tensions: Escalating conflicts or trade disputes in East Asia, a major hub for electronics manufacturing, could disrupt production lines.

- Logistics Costs: Rising shipping and freight costs, which saw a 15% increase globally in late 2023 due to various factors, could impact the final price of IDIS products.

Intense market competition, particularly from budget-friendly rivals, poses a significant threat to IDIS's profitability and market share. The rapid pace of technological advancement, especially in AI, necessitates continuous R&D investment to prevent product obsolescence. Furthermore, sophisticated cyberattacks and evolving global data privacy regulations, like GDPR, demand constant adaptation and present substantial compliance risks, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025.

| Threat Category | Specific Threat | Impact on IDIS | Relevant Data/Projection |

|---|---|---|---|

| Market Competition | Price Wars | Reduced Profitability, Market Share Erosion | Global video surveillance market valued at ~$50 billion in 2024, with intense competition. |

| Technological Obsolescence | Rapid AI advancements | Loss of competitive edge if R&D lags | AI in security market projected to grow from ~$11.5 billion (2023) to over $35 billion (2028). |

| Cybersecurity Risks | Sophisticated Cyberattacks | Reputational damage, loss of customer trust, legal liabilities | Average cost of a data breach reached $4.73 million in 2024. |

| Regulatory Compliance | Evolving Privacy Laws (GDPR, CCPA) | Fines, market access limitations, reputational damage | Global data protection software market valued at ~$2.4 billion in 2024. |

| Supply Chain Disruptions | Semiconductor shortages, geopolitical tensions | Production delays, increased costs, reduced product availability | Semiconductor lead times extended by over 50% in 2023; shipping costs increased by 15% globally in late 2023. |

SWOT Analysis Data Sources

This IDIS SWOT analysis is built upon a robust foundation of data, drawing from internal operational metrics, customer feedback surveys, and competitive landscape reports to provide a comprehensive view.