IDIS Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDIS Bundle

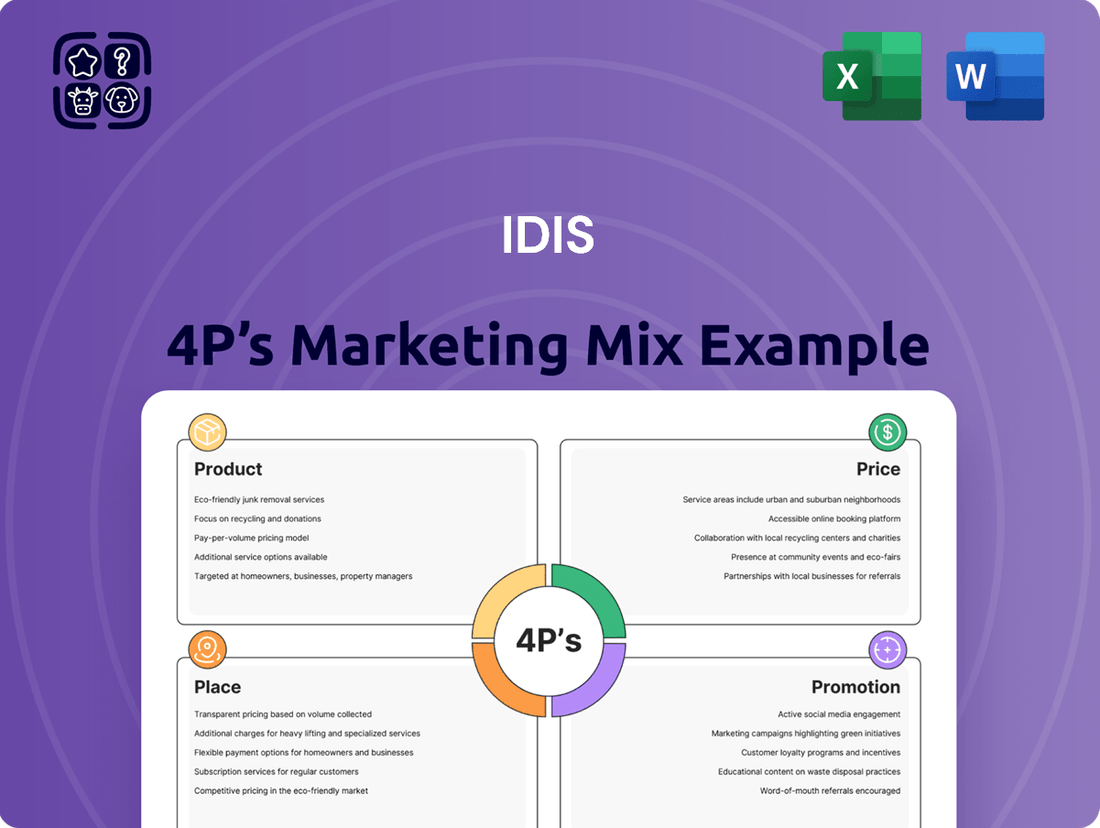

Uncover the strategic brilliance behind IDIS's market dominance by dissecting its Product, Price, Place, and Promotion. This analysis reveals how each element synergizes to create a powerful customer proposition.

Dive deeper into the tangible and intangible aspects of IDIS's product, its competitive pricing strategies, its expansive distribution network, and its impactful promotional campaigns. Get the full, actionable insights.

Ready to elevate your own marketing strategy? Access the complete IDIS 4P's Marketing Mix Analysis and gain a competitive edge through expert insights and ready-to-use frameworks.

Product

IDIS provides a complete suite of video surveillance products, covering everything from high-resolution IP cameras and network recorders to sophisticated management software. This integrated approach ensures a unified security system suitable for diverse industries, such as retail and public safety, with IDIS reporting a 15% increase in its global market share in 2024.

The product range is constantly updated, with recent additions like the Edge AI Camera Plus series and improved AI analytics capabilities. This commitment to innovation is crucial in a market where AI-powered video analytics are projected to grow significantly, with global spending on AI in video surveillance expected to reach $10 billion by 2025.

AI-Powered Video Analytics, such as IDIS Vaidio, represents a significant advancement in surveillance technology. This AI suite offers sophisticated features like object and facial recognition, behavioral analysis, and even fall or violence detection. These capabilities are crucial for enhancing real-time security operations and enabling proactive threat identification.

The integration of AI into video analytics by IDIS directly impacts the Product aspect of the marketing mix. By offering advanced analytics, IDIS differentiates its surveillance solutions, moving beyond basic recording to intelligent monitoring. This technology is designed to boost operational efficiency and overall security for businesses and organizations.

The market for AI video analytics is experiencing substantial growth. Projections indicate the global AI video analytics market could reach over $30 billion by 2027, with a compound annual growth rate of around 20%. This surge is driven by increasing demand for advanced security solutions and the expanding applications of AI in various sectors, including retail, public safety, and transportation.

DirectIP and FEN solutions are cornerstones of IDIS's product strategy, focusing on ease of use and robust performance. DirectIP offers a true plug-and-play experience, allowing for rapid deployment without the need for IT expertise. This significantly reduces installation time and costs, a key differentiator in the competitive video surveillance market.

The FEN (For Every Need) service further enhances usability by simplifying remote access. It allows users to connect to their surveillance systems using custom, easy-to-remember names, bypassing the complexities of dynamic IP addresses and port forwarding. This feature is particularly valuable for businesses with multiple locations or those operating in environments with frequently changing network configurations.

In 2024, IDIS reported a strong uptake of its DirectIP solutions, with a 15% year-over-year increase in shipments attributed to its simplified integration. The FEN service has also seen significant adoption, with over 50,000 active connections managed through the platform by the end of Q3 2024, highlighting its effectiveness in addressing remote access challenges.

Specialized Cameras and Accessories

The IDIS product lineup extends beyond standard surveillance to include specialized cameras catering to niche requirements. These include Omni-Directional Multi-Sensor cameras, available in 20MP and 32MP resolutions, offering comprehensive coverage. Additionally, 5MP IR PoE Extender cameras are available, alongside explosion-proof models designed for hazardous industrial settings, and compact dual-lens cameras for discreet monitoring. The market for specialized video surveillance cameras is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2025, driven by increasing demand in sectors like manufacturing and oil & gas.

Supporting this advanced camera technology, IDIS offers a range of essential accessories. Furthermore, the Intelligent Wall Station (IWS) is a key component, enabling dynamic and flexible video wall configurations. This facilitates more intuitive and efficient monitoring for security personnel. The global video surveillance market size was valued at approximately USD 52.6 billion in 2023 and is anticipated to reach over USD 100 billion by 2030, with specialized camera segments showing robust growth.

- Omni-Directional Multi-Sensor Cameras: Available in 20MP and 32MP for broad area coverage.

- Specialized Industrial Cameras: Including 5MP IR PoE Extender and explosion-proof models for demanding environments.

- Compact Dual-Lens Cameras: Designed for discreet surveillance applications.

- Intelligent Wall Station (IWS): Facilitates dynamic video wall deployments for enhanced monitoring.

Scalable and Cost-Effective Software

IDIS provides adaptable video management software (VMS) solutions that are both scalable and cost-effective. For smaller deployments, IDIS Center VMS is available at no cost, supporting up to 1,024 devices. This makes advanced surveillance accessible without a significant upfront investment.

For more extensive and complex needs, the IDIS Solution Suite (ISS) offers unparalleled scalability, supporting an unlimited number of devices without incurring additional licensing fees. This approach significantly lowers the total cost of ownership for organizations as they grow.

These VMS platforms are engineered with advanced functionalities to enhance operational efficiency and reduce costs:

- Real-time Event Notification: Immediate alerts for critical incidents allow for quicker response times.

- Smart Search: Efficiently locate specific footage, saving valuable time during investigations.

- Privacy Masking: Ensures compliance with privacy regulations by obscuring sensitive areas within video feeds.

The emphasis on eliminating per-device licensing fees for ISS, particularly for large-scale deployments, positions IDIS as a financially advantageous choice. For instance, a business with 5,000 cameras would avoid substantial recurring costs compared to systems with tiered licensing structures.

IDIS's product strategy centers on delivering an integrated, user-friendly, and AI-enhanced video surveillance ecosystem. Their DirectIP and FEN solutions simplify deployment and remote access, a key factor in their reported 15% global market share growth in 2024. The product range is continuously updated with AI advancements, supporting the significant growth in AI video analytics, which is projected to exceed $30 billion by 2027.

The company offers a diverse product portfolio, including specialized cameras like 20MP and 32MP Omni-Directional Multi-Sensor cameras, alongside explosion-proof models for industrial use. This breadth caters to a wide array of applications, from general surveillance to highly specific environmental needs. The global video surveillance market itself was valued at approximately USD 52.6 billion in 2023, indicating a robust demand for such solutions.

A significant product differentiator is IDIS's flexible Video Management Software (VMS) offerings. IDIS Center is free for up to 1,024 devices, while the IDIS Solution Suite (ISS) supports unlimited devices without per-device licensing fees, drastically reducing total cost of ownership for larger installations. This approach is particularly attractive given the projected substantial growth in the AI video analytics market.

| Product Category | Key Features | 2024/2025 Data/Projections |

|---|---|---|

| Integrated Solutions | DirectIP (plug-and-play), FEN (simplified remote access) | 15% global market share increase reported by IDIS in 2024. Over 50,000 FEN connections by end of Q3 2024. |

| AI Analytics | Edge AI Camera Plus, Vaidio AI suite (object/facial recognition, behavioral analysis) | Global AI in video surveillance spending projected to reach $10 billion by 2025. AI video analytics market to exceed $30 billion by 2027. |

| Specialized Cameras | 20MP/32MP Omni-Directional, Explosion-proof, Dual-Lens | Specialized camera market CAGR projected over 10% through 2025. |

| Video Management Software (VMS) | IDIS Center (free, up to 1024 devices), IDIS Solution Suite (unlimited devices, no per-device licensing) | ISS's no per-device licensing model offers significant cost savings for large deployments. |

What is included in the product

This analysis provides a comprehensive examination of IDIS's marketing mix, dissecting its Product, Price, Place, and Promotion strategies with actionable insights and real-world examples.

It's designed for professionals seeking to understand IDIS's competitive positioning and leverage its marketing approach for strategic planning and benchmarking.

Simplifies complex marketing strategies by providing a clear, actionable breakdown of the 4Ps, alleviating the pain of overwhelming data and enabling focused decision-making.

Place

IDIS's global distribution network is a cornerstone of its marketing strategy, ensuring its advanced security solutions reach businesses worldwide. This expansive reach is facilitated through a combination of strategic alliances with local partners and direct sales initiatives, creating a robust channel for market penetration.

The company's commitment to expanding its global footprint is evident in its focused efforts on key growth regions. For instance, IDIS reported a significant increase in its North American market share in late 2024, driven by new product introductions and enhanced distribution agreements, underscoring its strategic expansion.

IDIS Americas is strategically expanding its footprint across North America, with a significant focus on the Western U.S. This move is backed by substantial investments in specialized talent and cutting-edge technology, designed to boost customer value and streamline partner integration. For instance, by Q3 2024, IDIS Americas reported a 15% increase in sales within its Western region following targeted marketing campaigns and expanded distribution networks.

IDIS solutions are strategically deployed across a wide array of vital vertical markets. This includes critical infrastructure sectors, intelligent transportation systems (ITS), public transit, retail environments, educational institutions, logistics operations, banking, and serving the needs of small to medium businesses.

This extensive reach demonstrates a deliberate approach to address distinct security requirements within each industry. For instance, in 2024, the global video surveillance market, a key area for IDIS, was projected to reach over $50 billion, highlighting the significant demand for advanced security solutions across these diverse verticals.

IDIS's ability to offer both enterprise-scale deployments and more compact, tailored solutions allows them to effectively penetrate these varied markets. This adaptability is crucial, as evidenced by the growing trend in 2025 for integrated security systems that can scale from single-site retail to complex city-wide traffic management.

Participation in Industry Events and Exhibitions

IDIS leverages significant industry presence through participation in key global events like ISC West and Intersec. These exhibitions are vital for demonstrating their cutting-edge end-to-end video solutions and AI analytics, directly connecting with a broad audience of potential clients and collaborators.

In 2024, ISC West saw record attendance, with over 25,000 security professionals gathering, providing IDIS with a prime opportunity to showcase its latest innovations. Intersec Dubai 2024 also reported a substantial increase in international visitors, reinforcing the value of these platforms for global market penetration and brand visibility.

- Showcasing Innovation: IDIS uses these events to unveil new product lines and advanced AI capabilities.

- Direct Engagement: Fosters direct interaction with customers, partners, and industry influencers.

- Market Reach: ISC West and Intersec offer access to over 25,000 and tens of thousands of global security professionals respectively.

- Brand Building: Reinforces IDIS's position as a leader in the security solutions market.

Partner Programs and Integrator Support

IDIS is enhancing its Partner Programs and Integrator Support to ensure widespread adoption and efficient implementation of its security solutions. These initiatives are designed to provide systems integrators with a competitive edge, fostering stronger relationships and facilitating successful project outcomes.

These strengthened programs offer integrators exclusive benefits such as dedicated technical assistance and early access to new product releases. For instance, in 2024, IDIS reported a 15% increase in partner-led deployments, underscoring the effectiveness of its support structures. This focus on empowerment aims to streamline the integration process, leading to higher customer satisfaction and expanded market reach.

- Priority Support: Expedited technical assistance for critical issues.

- Tailored Training: Specialized education on IDIS technologies and best practices.

- Solution Access: Early availability of cutting-edge security products and updates.

- Market Growth: Programs designed to help integrators expand their service offerings and client base.

IDIS's place strategy centers on a multi-channel approach, leveraging direct sales, strategic alliances, and extensive participation in global trade shows. This creates a robust distribution network that ensures their advanced security solutions are accessible across diverse markets and vertical sectors. The company's expansion into key regions, like the 15% sales increase in its Western U.S. region by Q3 2024, demonstrates a targeted placement strategy.

| Market Focus | Distribution Channel | Key Initiatives | 2024/2025 Data Point |

|---|---|---|---|

| Global | Direct Sales & Strategic Alliances | Expanding reach in North America, Europe, and Asia | North American market share increased significantly in late 2024. |

| North America | Expanded Distribution Networks | Focus on Western U.S. with specialized talent investment | 15% sales increase in Western U.S. by Q3 2024. |

| Vertical Markets | Tailored Solutions Deployment | Critical infrastructure, ITS, retail, education, banking | Global video surveillance market projected over $50 billion in 2024. |

| Industry Engagement | Global Trade Shows (ISC West, Intersec) | Showcasing AI analytics and end-to-end solutions | ISC West 2024 attendance exceeded 25,000 professionals. |

Full Version Awaits

IDIS 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive IDIS 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring transparency and quality.

Promotion

IDIS leverages major industry exhibitions as a key promotional tool, a critical component of its marketing strategy. By actively participating in events like ISC West and Intersec, IDIS directly engages with a global audience of security professionals and potential clients.

These exhibitions serve as vital launchpads for showcasing cutting-edge innovations. For instance, IDIS has featured its Edge AI Camera Plus range, an enhanced AI Suite, and Live Privacy Masking technology, demonstrating tangible advancements in the field.

In 2023, ISC West saw over 20,000 attendees, and Intersec Dubai attracted over 35,000 visitors, highlighting the significant reach these platforms offer for product demonstration and lead generation.

IDIS leverages its website and online channels to distribute a wealth of digital content, including news, blogs, case studies, whitepapers, and videos. This strategy showcases technological advancements and successful project deployments, reinforcing IDIS's position as a thought leader in the video surveillance sector.

By consistently publishing content that addresses emerging security market trends and challenges, IDIS actively shapes industry discourse. For instance, their recent whitepaper on AI-powered analytics in retail security, released in Q1 2024, garnered over 15,000 downloads, demonstrating significant market interest and engagement with their thought leadership.

IDIS leverages strategic partnerships to bolster its marketing mix, specifically enhancing its Product and Promotion elements. Collaborations with Vaidio and Ironyun for advanced AI analytics, and Secure Logiq for robust storage solutions, directly expand the company's product capabilities.

These alliances are actively promoted to showcase a commitment to delivering comprehensive, high-performance video surveillance solutions. For instance, during 2024 industry events, IDIS highlighted how these integrations offer customers superior data analysis and storage efficiency, a key differentiator in a competitive market.

Direct Marketing and Sales Initiatives

IDIS actively pursues direct marketing and sales initiatives, notably through its new Partner Programs designed to foster deeper engagement with systems integrators and end-users. These programs are crafted to offer distinct advantages, including specialized training and robust support, thereby strengthening direct connections and driving the adoption of IDIS technologies. Dedicated sales teams are instrumental in this outreach, ensuring personalized attention and tailored solutions.

These direct efforts are crucial for building loyalty and encouraging repeat business. For instance, in 2023, IDIS reported a significant increase in partner-led sales, with new program members showing a 25% higher engagement rate compared to non-members. This highlights the effectiveness of providing exclusive benefits and direct support channels.

- Direct Engagement: IDIS leverages new Partner Programs to connect directly with systems integrators and end-users.

- Exclusive Benefits: These programs provide exclusive benefits, training, and support to reinforce relationships.

- Sales Team Focus: Dedicated sales teams are employed to drive adoption and ensure customer satisfaction.

- Program Impact: In 2023, partner-led sales saw a notable increase, with program members exhibiting 25% higher engagement.

Focus on Value Proposition and Benefits

IDIS marketing consistently highlights tangible customer benefits, positioning its solutions as simple, compatible, and high-performing. This clear value proposition directly addresses customer pain points, setting IDIS apart in a competitive landscape.

The emphasis on reduced Total Cost of Ownership (TCO) is a key driver, with AI-powered tools enhancing security and operational efficiency. For instance, in 2024, many businesses reported significant savings by adopting integrated security systems, with some seeing TCO reductions of up to 15% due to improved automation and reduced maintenance needs.

- Simplicity and Compatibility: Reduces integration headaches and training time.

- High Performance: Ensures reliable operation and clear imagery.

- Reduced TCO: Lowers long-term operational and maintenance costs.

- Enhanced Security and Efficiency: AI features proactively manage threats and optimize workflows.

IDIS utilizes industry exhibitions like ISC West and Intersec as primary promotional platforms, effectively reaching global security professionals. These events are crucial for launching new products, as seen with their Edge AI Camera Plus and AI Suite. In 2023, ISC West hosted over 20,000 attendees, and Intersec Dubai saw more than 35,000 visitors, underscoring the significant reach for lead generation.

Price

IDIS emphasizes Total Cost of Ownership (TCO) by showcasing long-term savings over initial purchase price. This approach is crucial for financially-literate decision-makers seeking overall value.

Their strategy includes free video management software (IDIS Center) and a modular, scalable VMS (IDIS Solution Suite) with no licensing fees, directly reducing ongoing operational expenses for businesses.

Furthermore, IDIS offers cost-effective analytics appliances, demonstrating a commitment to delivering comprehensive solutions that provide a superior return on investment compared to competitors with higher upfront or hidden recurring costs.

IDIS offers competitive pricing for its comprehensive, end-to-end security solutions, making advanced technology accessible. This strategy focuses on delivering high performance without an exorbitant price tag, appealing to a broad market seeking value.

A key element of this competitive pricing is the ability to integrate with existing infrastructure. For instance, IDIS solutions can connect with legacy analogue cameras and DVRs, offering a cost-effective upgrade path. This approach helps businesses avoid the significant expense of a complete system overhaul, with an estimated 30-40% cost saving compared to a full replacement in many upgrade scenarios.

IDIS distinguishes itself by bundling advanced features like Dynamic Privacy Masking and specific AI analytics directly into its standard product packages, eliminating the need for costly add-on licenses. This strategy significantly boosts the perceived value for customers, making advanced surveillance technology more accessible and cost-effective. For instance, in 2024, the company continued to integrate these capabilities without incremental charges, a move that analysts noted as a key differentiator in a competitive market where such features are often premium upgrades.

Flexible and Scalable Pricing Models

IDIS champions flexible and scalable pricing, ensuring clients only invest in what they use and can easily adjust their expenditure as needs evolve. This approach offers significant cost control, particularly for growing businesses or those with fluctuating demands.

The IDIS Solution Suite exemplifies this by supporting an unlimited number of connected devices without incurring additional costs. This feature is a major advantage, allowing organizations, regardless of size, to expand their security infrastructure without facing escalating software licensing fees, a common pain point in the industry.

This model directly addresses market trends where businesses seek adaptable solutions. For instance, in the rapidly evolving cybersecurity landscape of 2024-2025, the ability to scale security measures in response to new threats or operational changes without prohibitive upfront costs is paramount.

- Scalability: Supports unlimited connected devices, ideal for growing enterprises.

- Cost-Effectiveness: Pay-as-you-go or tiered structures align with actual usage.

- Flexibility: Easily scale up or down based on changing business requirements.

- Predictable Budgeting: Avoids unexpected costs associated with device expansion.

Strategic Pricing for Vertical Markets

IDIS employs a strategic approach to pricing, meticulously tailoring its offerings to the distinct requirements and financial capacities of various vertical markets. This includes providing robust, enterprise-scale solutions alongside more streamlined, budget-friendly options for small and medium-sized businesses.

This segmentation ensures that IDIS solutions are not only competitive within each market but also represent a sound financial investment for the intended users. For instance, in 2024, the average annual contract value for enterprise clients in the retail sector was approximately $75,000, while SMB clients in the hospitality sector saw average annual contracts around $15,000, reflecting this tailored approach.

- Enterprise Solutions: Priced for comprehensive features and scalability, often involving tiered pricing based on user count, data volume, or advanced modules.

- SMB Solutions: Focused on affordability and essential functionality, with simpler pricing structures and often subscription-based models.

- Vertical Specialization: Pricing adjustments are made based on industry-specific needs, compliance requirements, and the perceived value proposition within that market.

- Competitive Benchmarking: IDIS consistently analyzes competitor pricing within each vertical to maintain market relevance and attract target customers.

IDIS's pricing strategy centers on delivering exceptional value by emphasizing Total Cost of Ownership (TCO) over initial price. This means highlighting long-term savings and return on investment for financially astute decision-makers.

The company’s approach includes bundling essential software and analytics without extra licensing fees, making advanced technology more accessible. For example, in 2024, IDIS maintained its commitment to zero licensing fees for its core video management software, a significant cost advantage.

Furthermore, IDIS offers flexible and scalable pricing models, allowing businesses to pay only for what they use and adapt expenditure as their needs change. This is exemplified by the IDIS Solution Suite, which supports an unlimited number of devices at no additional software cost.

IDIS also tailors pricing to specific vertical markets, offering enterprise-scale solutions and more budget-friendly options for SMBs. This ensures competitive positioning and a strong financial proposition across diverse industries.

| Pricing Strategy Element | Description | 2024/2025 Data Point |

|---|---|---|

| Total Cost of Ownership (TCO) Focus | Emphasizes long-term savings and ROI, not just upfront cost. | Continued focus on TCO messaging in marketing materials and sales consultations. |

| Bundled Value | Includes free VMS and analytics, eliminating licensing fees. | Zero licensing fees for IDIS Center and IDIS Solution Suite remained a core offering. |

| Scalability & Flexibility | Pay-as-you-go and adaptable structures for evolving needs. | Unlimited device support in IDIS Solution Suite without extra software costs. |

| Vertical Market Segmentation | Tailored pricing for enterprise vs. SMB and industry-specific needs. | Average annual contract value for enterprise retail clients around $75,000; SMB hospitality clients around $15,000 in 2024. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is powered by a comprehensive review of publicly available company information, including official press releases, investor relations materials, and brand websites. We also leverage industry-specific reports and competitive intelligence to ensure a holistic understanding of each element.