IDIS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDIS Bundle

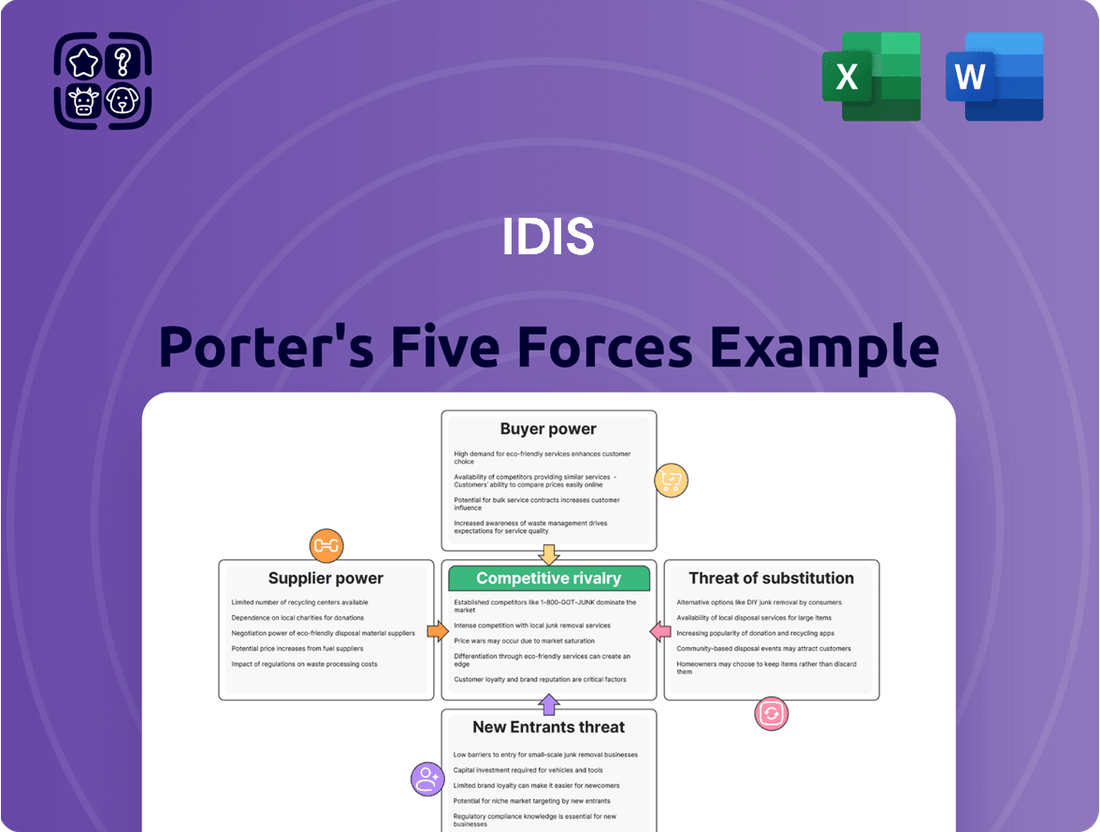

IDIS's competitive landscape is shaped by the interplay of five powerful forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any business operating within or considering entry into the IDIS market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IDIS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of specialized components, such as high-resolution sensors and advanced chipsets, significantly impacts supplier bargaining power for companies like IDIS. If IDIS depends on a few suppliers for unique parts crucial to their high-performance cameras and NVRs, those suppliers gain considerable leverage. For instance, in 2024, the global market for advanced semiconductor components saw continued consolidation, with a few key players dominating the supply of cutting-edge image sensors, potentially increasing their pricing power over electronics manufacturers.

The concentration of suppliers for critical video surveillance components significantly influences IDIS's leverage. When a market has few dominant suppliers, like those providing advanced image sensors or specialized chipsets, these suppliers can dictate terms more effectively. For instance, in 2024, the global semiconductor shortage highlighted how concentrated supplier bases can create substantial power imbalances, impacting lead times and pricing for manufacturers like IDIS.

High switching costs further amplify supplier bargaining power. If IDIS needs to change a key component supplier, the expense and time involved in re-qualifying new parts, re-tooling production lines, and ensuring compatibility can be substantial. This inertia discourages IDIS from seeking alternative suppliers, granting existing ones greater influence over pricing and contract terms, a dynamic observed across many high-tech manufacturing sectors.

The bargaining power of suppliers to IDIS is significantly shaped by how crucial IDIS is as a customer to them. If IDIS accounts for a substantial portion of a supplier's overall sales, that supplier will likely be more accommodating with pricing and terms to secure IDIS's continued business. For instance, if a key component supplier like TechSolutions, which reported $500 million in revenue in 2024, derives 15% of that from IDIS, they have a strong incentive to maintain a positive relationship.

Conversely, if IDIS represents a small fraction of a supplier's revenue, the supplier gains leverage. They might be less willing to negotiate on price or offer special concessions, knowing that losing IDIS as a customer would have minimal impact on their bottom line. Consider a specialized software provider that generated $20 million in revenue in 2024, with IDIS making up only 2% of that. This provider would have considerably more power to dictate terms.

Input Differentiation and Cost Impact

The bargaining power of suppliers for IDIS is significantly influenced by the differentiation of their inputs. If suppliers provide unique or patented technologies that are crucial for IDIS's product performance, they gain considerable leverage, potentially leading to higher pricing. For instance, if a key component for IDIS's advanced data analytics platform is sourced from a single, highly specialized provider, that supplier's power increases substantially.

The cost of these differentiated inputs as a proportion of IDIS's overall production expenses is also a critical factor. When a supplier's product represents a substantial portion of IDIS's total cost, that supplier can exert greater pressure on IDIS's profit margins. For example, if specialized semiconductor chips, representing 30% of IDIS's hardware cost, come from a limited number of suppliers, their ability to negotiate favorable terms for IDIS is reduced.

- Input Differentiation: Suppliers offering proprietary or highly specialized components for IDIS's solutions, such as unique AI algorithms or advanced cybersecurity modules, possess greater bargaining power.

- Cost Significance: The higher the percentage of a supplier's input cost relative to IDIS's total product cost, the more leverage that supplier holds in price negotiations.

- Impact on Profitability: Strong supplier differentiation and high input cost percentages can directly squeeze IDIS's profit margins, especially if alternative suppliers are scarce or offer inferior quality.

Threat of Forward Integration by Suppliers

Suppliers who can integrate forward into producing finished video surveillance products, like cameras and NVRs, present a significant threat to IDIS. If these suppliers choose to manufacture their own end products, they transition from being mere component providers to direct competitors. This move would dramatically amplify their bargaining power, allowing them to dictate terms more forcefully and potentially disrupt IDIS's established supply chain and market position.

This threat is particularly potent when suppliers possess critical technology or manufacturing capabilities that are difficult for IDIS to replicate internally. For instance, a supplier of advanced image sensors or specialized chipsets could leverage their unique position to enter the finished product market. The potential for such a shift can already be observed in various tech sectors, where component manufacturers have increasingly moved downstream. In 2024, several leading semiconductor suppliers in adjacent industries have publicly discussed or initiated plans for product diversification into higher-value assembled goods, signaling a trend that could impact the video surveillance market.

- Increased Competition: Suppliers entering the finished product market directly compete with IDIS, potentially saturating the market and driving down prices.

- Supply Chain Disruption: A supplier's decision to prioritize their own finished goods could lead to reduced availability or higher costs of essential components for IDIS.

- Loss of Control: IDIS could lose control over product quality, innovation, and pricing if key components are sourced from companies that are also its direct competitors.

- Leveraged Bargaining Power: Suppliers can use their forward integration strategy to extract more favorable terms from IDIS, knowing they have alternative revenue streams.

The bargaining power of suppliers is a key factor for IDIS, particularly concerning specialized components like high-resolution sensors and advanced chipsets. When a few dominant suppliers control these critical inputs, they gain significant leverage over pricing and terms. For example, the global semiconductor market in 2024 continued to see consolidation, with a limited number of firms producing cutting-edge image sensors, potentially increasing their pricing power over electronics manufacturers.

High switching costs further empower suppliers. If IDIS faces substantial expenses and time investment to re-qualify new component suppliers, re-tool production, and ensure compatibility, they are less likely to switch. This inertia grants existing suppliers greater influence over pricing and contract terms, a common challenge in high-tech manufacturing.

Suppliers who can integrate forward into producing finished video surveillance products pose a direct competitive threat to IDIS. If these suppliers begin manufacturing their own end products, they become direct rivals, significantly amplifying their bargaining power and potentially disrupting IDIS's supply chain and market position. This trend was evident in 2024, with several semiconductor suppliers in related industries exploring or initiating diversification into higher-value assembled goods.

| Factor | Impact on IDIS | 2024 Data/Trend Example |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant suppliers | Consolidation in advanced semiconductor production |

| Switching Costs | Reduced flexibility for IDIS | High costs associated with re-qualifying specialized components |

| Forward Integration | Potential for direct competition and supply disruption | Component manufacturers expanding into finished goods |

What is included in the product

Analyzes the five competitive forces impacting IDIS, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and address competitive threats by visually mapping your industry's landscape, allowing for proactive strategy adjustments.

Customers Bargaining Power

IDIS's customer base, encompassing large enterprises and system integrators, wields considerable power to influence pricing, particularly for substantial volume purchases. For instance, in 2024, major IT procurement deals often saw discounts exceeding 15% for bulk orders, reflecting this customer leverage.

The competitive landscape for IDIS means customers are acutely aware of pricing variations across vendors. This price sensitivity is amplified by the ease with which they can compare solutions, often leading to intense negotiation during large-scale project bids, where price becomes a primary decision factor.

The sheer volume of alternative video surveillance solutions available from a multitude of global and regional competitors significantly strengthens the bargaining power of IDIS's customers. This broad market availability means customers have plenty of choices for IP cameras, NVRs, and VMS, making it easy for them to switch providers if they're unhappy with price, features, or service.

Customer switching costs in the video surveillance market can be a significant factor. Initially, upgrading or changing systems often involves substantial expenses for new hardware, installation, and employee retraining. For example, a large enterprise might face costs upwards of $50,000 to $100,000 for a complete overhaul of a substantial surveillance network.

However, the increasing adoption of IP-based surveillance and open standards has begun to lower these barriers. Modularity allows for phased upgrades, and standardization means components from different manufacturers can sometimes be integrated. This trend, while beneficial for technological advancement, can empower customers by making it simpler to switch to or combine solutions from various vendors.

IDIS, by emphasizing ease of integration and compatibility within its product lines, aims to simplify adoption for its clients. This approach can reduce initial customer investment and training time. Yet, this very ease of integration could inadvertently lower switching costs for customers looking to adopt solutions from competing providers, thereby increasing the bargaining power of those customers.

Customer Concentration and Market Size

Customer concentration significantly impacts bargaining power. If a few major clients represent a substantial percentage of IDIS's sales, these large buyers can leverage their purchasing volume to negotiate more favorable pricing, extended credit terms, or unique product specifications. This is particularly true if these key customers have viable alternatives or can easily switch suppliers.

While IDIS serves a broad range of industries, the influence of dominant clients cannot be overlooked. For instance, if a single large distributor accounts for over 15% of IDIS's annual revenue, that distributor gains considerable leverage. This concentration can force IDIS to prioritize the needs of these key accounts, potentially at the expense of smaller customers or overall profit margins.

- Customer Concentration Risk: A high reliance on a few large customers amplifies their bargaining power.

- Impact on Pricing: Concentrated buyers can demand discounts, squeezing IDIS's profit margins.

- Strategic Importance: Key clients often hold strategic importance, making it difficult for IDIS to refuse their demands.

- Market Size Influence: The overall market size for IDIS's products also plays a role; in a smaller market, customer concentration is often higher.

Customer Knowledge and Product Standardization

As customer knowledge regarding video surveillance technology grows, so does their bargaining power. Buyers are increasingly adept at understanding technical specifications, performance benchmarks, and pricing structures across various manufacturers. This heightened awareness, fueled by readily available information, significantly reduces the information gap that previously favored sellers.

The increasing standardization of certain video surveillance features further amplifies customer leverage. When products become more alike in their core functionalities, customers can more easily compare offerings and identify the best value. This trend puts direct pressure on IDIS to differentiate its products and services beyond basic technical capabilities.

For instance, the global video surveillance market was valued at approximately $52.9 billion in 2023 and is projected to reach over $130 billion by 2030, indicating intense competition where informed buyers can exert considerable influence. This market growth itself highlights the increasing accessibility of information for potential purchasers.

- Informed Purchasing: Customers can now easily compare specifications, performance metrics, and pricing across different video surveillance brands, leading to more discerning buying decisions.

- Reduced Information Asymmetry: The widespread availability of technical data and reviews diminishes the advantage sellers once held due to superior product knowledge.

- Pressure on Pricing and Features: Standardization in areas like resolution, frame rates, and basic analytics allows customers to benchmark offerings, pressuring IDIS on both price and the uniqueness of its value proposition.

- Demand for Transparency: Buyers expect clear, accessible information about product capabilities and limitations, making opaque sales tactics less effective.

Customers' ability to switch providers is a key determinant of their bargaining power. While initial setup costs for video surveillance systems can be high, often ranging from $50,000 to $100,000 for large enterprises, the increasing adoption of IP-based systems and open standards is gradually reducing these barriers. This trend makes it simpler for customers to integrate solutions from different vendors or switch entirely.

The growing availability of standardized features in video surveillance products allows customers to more easily compare offerings and pinpoint the best value, putting direct pressure on IDIS to differentiate its solutions beyond basic technical capabilities. The global video surveillance market, valued at approximately $52.9 billion in 2023, is intensely competitive, empowering informed buyers to exert considerable influence.

IDIS's customer base, particularly large enterprises and system integrators, holds significant leverage over pricing, especially for high-volume purchases. In 2024, substantial IT procurement deals frequently included discounts exceeding 15% for bulk orders, a clear indicator of this customer influence.

| Factor | Impact on IDIS | Example/Data (2024) |

|---|---|---|

| Switching Costs | Lowering switching costs increases customer power. | Phased upgrades and modularity reduce initial investment for customers. |

| Market Competition | High competition empowers customers with choices. | Global video surveillance market projected to exceed $130 billion by 2030. |

| Customer Knowledge | Informed customers can negotiate better terms. | Easy access to technical data and reviews reduces information asymmetry. |

| Volume Purchases | Large orders grant customers significant pricing leverage. | Bulk orders in 2024 saw discounts often exceeding 15%. |

Same Document Delivered

IDIS Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted IDIS Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. What you're previewing is precisely the same detailed analysis you'll receive instantly after purchase, ensuring no surprises and immediate usability. This comprehensive report is ready for your strategic decision-making the moment you complete your transaction.

Rivalry Among Competitors

The video surveillance market is a crowded space with many companies vying for attention. This includes huge global companies, smaller specialized firms, and manufacturers focused on specific regions. For instance, in 2024, the market is populated by giants like Hikvision and Dahua, alongside established players like Axis Communications and Hanwha Vision, creating a highly competitive landscape.

This sheer number and variety of competitors mean that companies like IDIS are constantly challenged to stand out. The intense rivalry puts pressure on them to develop new technologies and unique features to attract and keep customers. Market share gains are hard-won in such a dynamic environment.

While the broader security market shows continued expansion, specific areas like video surveillance are approaching maturity. This shift means companies are increasingly competing for existing market share rather than capitalizing on new growth, intensifying rivalry. For instance, in 2024, the global video surveillance market was projected to reach over $50 billion, indicating substantial size but also a stage where incremental gains are harder won.

When industry growth slows, the competition naturally heats up. Companies might resort to aggressive pricing or marketing campaigns to capture a larger portion of a market that isn't expanding rapidly. This dynamic can lead to price wars, impacting profit margins across the board as businesses fight for every available customer in a more saturated environment.

IDIS's competitive edge is built on differentiating its DirectIP and FEN solutions, focusing on ease of use, broad compatibility, and robust performance. This strategy aims to carve out a distinct market position.

However, the landscape is intensely competitive, with rivals also channeling significant resources into research and development. These competitors are introducing their own innovative features, including advanced AI analytics and sophisticated cloud integration capabilities, directly challenging IDIS's unique selling points.

For instance, in 2024, the global video surveillance market saw continued growth, with AI-powered analytics becoming a key differentiator. Companies like Axis Communications and Hikvision are heavily invested in these areas, with Axis reporting a 10% increase in R&D spending in their 2023 annual report, a trend expected to continue into 2024.

Therefore, IDIS's ability to consistently innovate and clearly articulate the unique value of its offerings is paramount for maintaining its competitive stance and standing out amidst a crowded and rapidly evolving market.

High Fixed Costs and Exit Barriers

The video surveillance industry is characterized by substantial fixed costs, particularly in research and development, sophisticated manufacturing facilities, and extensive global distribution channels. For instance, major players invest heavily in AI-driven analytics and cloud infrastructure, creating significant upfront capital requirements. These high overheads pressure companies to maintain high production volumes to spread costs, even if it means accepting thinner profit margins.

Furthermore, the presence of high exit barriers exacerbates competitive intensity. Specialized manufacturing equipment, long-term supply agreements, and the need to maintain a broad product portfolio to serve diverse market segments can make it financially prohibitive for companies to withdraw from the market. This can lead to the persistence of less profitable firms, intensifying the rivalry among existing players as they all strive to capture market share and cover their fixed cost burdens.

- Significant R&D Investment: Companies like Hikvision and Dahua Technology routinely allocate substantial portions of their revenue to R&D, often exceeding 10%, to stay ahead in areas like AI and cybersecurity.

- Capital-Intensive Manufacturing: Establishing and maintaining advanced manufacturing lines for high-resolution cameras and recording devices requires millions in capital expenditure.

- Global Distribution Networks: Building and sustaining a worldwide sales and support infrastructure involves considerable ongoing investment in logistics, warehousing, and personnel.

- Specialized Assets: The industry relies on specialized machinery for lens grinding, sensor assembly, and firmware development, which have limited alternative uses, increasing exit barriers.

Brand Loyalty and Switching Costs for Customers

While IDIS strives for user-friendly solutions, cultivating deep brand loyalty in the competitive security sector is an ongoing challenge. Customers frequently weigh performance, dependability, and overall cost against brand appeal, making loyalty a hard-won attribute.

The financial and operational hurdles associated with switching security providers can be significant for customers. These switching costs encompass the expense of replacing existing hardware, integrating new systems, and the time investment required for staff retraining. For instance, a business might face several thousand dollars in direct costs for new equipment and potentially weeks of disruption during a system overhaul. However, the growing trend towards open platform architectures and standardized protocols in the security industry is gradually reducing these barriers, making it easier for customers to adopt new technologies without being locked into a single vendor.

- Customer Priorities: In the security market, performance, reliability, and cost often outweigh brand name when customers make purchasing decisions.

- Switching Cost Factors: The effort to replace existing infrastructure and retrain personnel represent significant switching costs for IDIS customers.

- Interoperability's Impact: Increasing adoption of interoperability standards is helping to lower switching costs by allowing easier integration of different security systems.

The competitive rivalry in the video surveillance market is intense, driven by a large number of global and specialized players. Companies like Hikvision and Dahua, alongside Axis Communications and Hanwha Vision, dominate the landscape in 2024, pushing for innovation and market share gains. This crowded field, with a projected global market value exceeding $50 billion in 2024, means that companies must constantly differentiate themselves through technology and unique offerings, as growth often comes from taking share from rivals rather than expanding the overall market.

High fixed costs in R&D, manufacturing, and distribution create pressure for high volumes, potentially leading to thinner margins. Coupled with significant exit barriers due to specialized assets and long-term commitments, this intensifies rivalry as firms are reluctant to leave the market. Customer loyalty is also a challenge, as performance, reliability, and cost often trump brand name, and while switching costs exist, increasing interoperability is slowly reducing them.

| Competitor | R&D Focus (2024) | Market Share (Est. 2024) | Key Differentiator |

|---|---|---|---|

| Hikvision | AI Analytics, Cybersecurity | 20-25% | Broad Product Portfolio, AI Integration |

| Dahua Technology | AI, IoT Integration | 15-20% | Cost-Effectiveness, Smart Solutions |

| Axis Communications | Edge Analytics, Cybersecurity | 8-12% | Product Quality, Open Platform |

| Hanwha Vision | AI, Cybersecurity | 5-8% | Advanced Imaging, Wisenet AI |

SSubstitutes Threaten

The threat of substitutes for video surveillance technologies, like those offered by IDIS, primarily stems from alternative security solutions that fulfill similar protection objectives. These include sophisticated access control systems that manage entry, perimeter intrusion detection systems designed to alert to unauthorized boundary crossings, and comprehensive alarm monitoring services that centralize security alerts.

While video surveillance provides crucial visual evidence and real-time monitoring, these non-video alternatives can often offer adequate security, especially for simpler or more localized requirements. For instance, a business needing to secure a single entrance might find an advanced keycard system a sufficient substitute for a full video surveillance setup.

The market for security solutions is diverse, with many companies offering competing technologies. The global physical security market was valued at approximately $230 billion in 2023 and is projected to grow, indicating a competitive landscape where substitutes are readily available and constantly evolving.

The increasing availability of purely cloud-based Video Surveillance as a Service (VSaaS) offerings poses a considerable threat of substitution for traditional hardware-focused solutions like those offered by IDIS. These VSaaS models often boast minimal on-premises hardware requirements and flexible subscription pricing, which can be very attractive to businesses aiming to lower initial capital expenditures and streamline operational management.

The global VSaaS market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% through 2030. This robust growth indicates a strong customer preference for cloud-native security solutions, potentially diverting market share from companies heavily invested in physical hardware infrastructure.

The increasing sophistication and affordability of enhanced IoT sensors present a significant threat of substitutes for traditional video surveillance systems. For instance, motion detectors, thermal sensors, and acoustic sensors can independently identify security breaches or environmental anomalies. In 2024, the global IoT market was valued at over $1.1 trillion, with a substantial portion dedicated to security and monitoring applications, indicating a growing adoption of these alternative technologies.

These sensors, when integrated with advanced analytics platforms, can offer targeted alerts and actionable insights, potentially diminishing the need for continuous video recording in certain environments. This means that for some security needs, like perimeter breach detection or environmental monitoring, a combination of specialized sensors might be a more cost-effective and less intrusive solution than a full video surveillance setup.

Human Security Services and Hybrid Solutions

Traditional security guards and patrols can serve as direct substitutes for some video surveillance functions, especially for real-time monitoring and immediate on-site intervention. For instance, a retail store might prioritize a robust physical security presence over an extensive camera system if its primary concern is deterring shoplifting through visible personnel.

Businesses may choose human-centric security models or hybrid approaches where video surveillance plays a secondary role. This is particularly relevant in environments where direct human interaction is paramount or where technological integration is less feasible. In 2024, the global security services market, which includes manned guarding, was valued at approximately $250 billion, indicating a significant ongoing investment in human security solutions.

The decision between purely human or hybrid security often hinges on cost-effectiveness and the specific risk profile of the location. While video analytics are advancing, the immediate, adaptable response of a trained security officer remains a critical component for many organizations. For example, a high-end event might allocate a larger portion of its security budget to personnel for crowd management and VIP protection, supplementing with video for overall surveillance rather than relying on it as the primary deterrent.

- Human guards offer immediate physical response, a capability video alone cannot fully replicate.

- Hybrid solutions balance technology with human oversight, catering to diverse security needs.

- The global security services market, including manned guarding, demonstrates substantial investment in human-centric security.

- Cost and specific operational risks influence the preference for human-led versus technology-dominant security strategies.

Open-Source Software and DIY Solutions

The threat of substitutes for IDIS's integrated video surveillance solutions is amplified by the rise of open-source software and do-it-yourself (DIY) approaches. For smaller businesses or individual users, readily available open-source video management software (VMS) paired with standard off-the-shelf cameras presents a compelling low-cost alternative. These DIY setups, while often lacking the advanced features, scalability, and dedicated support of IDIS's comprehensive systems, can effectively meet basic surveillance requirements. This fragmentation particularly impacts the lower end of the market, where cost is a primary driver.

For instance, the global market for open-source VMS is growing, with many solutions offering free or very low-cost licensing. This directly competes with IDIS's proprietary software, especially for organizations with limited budgets. While IDIS emphasizes the total cost of ownership and the benefits of an integrated ecosystem, the initial capital outlay for open-source alternatives can be significantly lower. This can lead to a substantial portion of the market, particularly small to medium-sized businesses, opting for these more accessible, albeit less sophisticated, solutions.

- Open-Source VMS Adoption: The accessibility of free open-source VMS platforms provides a significant substitute, especially for budget-conscious users.

- DIY Camera Integration: The ability to combine open-source software with readily available, non-proprietary cameras lowers the barrier to entry for alternative surveillance systems.

- Market Segmentation: These substitutes primarily fragment the lower end of the market, catering to basic surveillance needs where advanced features are not a priority.

- Cost-Benefit Analysis: While lacking the robustness and support of integrated solutions, the lower initial cost of open-source and DIY options makes them attractive alternatives for many smaller entities.

The threat of substitutes for IDIS's video surveillance systems is multifaceted, encompassing alternative security technologies and even human-based solutions. These substitutes often fulfill similar security objectives, such as deterring crime, monitoring activity, and providing evidence, but through different means. The increasing affordability and capability of these alternatives mean that businesses have more choices than ever when it comes to securing their premises.

For instance, advanced access control systems, perimeter intrusion detection, and comprehensive alarm monitoring services offer distinct ways to enhance security without relying solely on video. Furthermore, the rise of Video Surveillance as a Service (VSaaS) presents a cloud-native alternative to traditional hardware-centric models. The global VSaaS market, valued at approximately $2.5 billion in 2023, is expected to grow substantially, indicating a strong shift towards these flexible, subscription-based solutions.

The proliferation of sophisticated IoT sensors, like motion and thermal detectors, also provides a viable substitute for certain video surveillance functions. With the global IoT market exceeding $1.1 trillion in 2024, these sensor-based solutions are becoming increasingly integrated into security frameworks. Even traditional security guards and patrols remain a significant substitute, with the global security services market valued at around $250 billion in 2024, highlighting the continued reliance on human intervention for immediate response and deterrence.

| Substitute Category | Key Characteristics | Market Relevance (2023/2024 Data) | Impact on IDIS |

| Alternative Security Tech | Access control, intrusion detection, alarm monitoring | Global physical security market ~$230 billion (2023) | Offers comparable security for specific needs, potentially diverting market share from integrated video solutions. |

| VSaaS | Cloud-based, minimal hardware, subscription pricing | Global VSaaS market ~$2.5 billion (2023), CAGR >15% | Attracts customers seeking lower CAPEX and streamlined management, directly competing with hardware-centric offerings. |

| IoT Sensors | Motion, thermal, acoustic sensors; data analytics | Global IoT market >$1.1 trillion (2024) | Provides targeted alerts and cost-effective solutions for specific monitoring tasks, reducing reliance on continuous video. |

| Human Security | On-site patrols, immediate response, deterrence | Global security services market ~$250 billion (2024) | Offers direct intervention and adaptability that video cannot fully replicate, especially for high-risk environments. |

Entrants Threaten

The global video surveillance market, where IDIS operates, demands significant upfront capital. For instance, companies looking to enter this space need to invest heavily in R&D for advanced analytics and AI, state-of-the-art manufacturing, and building robust global distribution networks. These high capital requirements act as a considerable barrier for potential new competitors.

Established players like IDIS benefit immensely from economies of scale. In 2024, the increasing complexity of video management systems and the need for integrated solutions mean that larger production volumes lead to lower per-unit costs. New entrants would find it challenging to match the cost-effectiveness and production efficiency of incumbents, making it difficult to compete on price and gain market share.

Established companies like IDIS have cultivated strong brand reputations over many years, especially in the critical security sector. This deep-seated trust is a significant barrier for newcomers. For instance, in the global video surveillance market, which was valued at approximately $50 billion in 2023 and projected to grow, brand loyalty plays a crucial role in customer retention.

New entrants struggle to replicate this trust, as businesses often prioritize security solutions from vendors with a proven track record. This risk aversion means that even with competitive pricing, a new company must demonstrate exceptional reliability and performance to win over clients accustomed to established brands.

IDIS's investment in proprietary technology, such as its DirectIP and FEN platforms, creates a significant barrier to entry. These integrated solutions are designed for ease of use and broad compatibility, making it challenging for newcomers to replicate their functionality and performance without substantial R&D expenditure.

The development of comparable, high-performance systems from the ground up demands considerable time and financial resources. Furthermore, IDIS's patent portfolio, which protects its unique technological innovations, acts as a further deterrent, increasing the risk and cost for potential new competitors seeking to enter the market.

Access to Distribution Channels and Partnerships

For new entrants looking to challenge IDIS, gaining access to established distribution channels and forging critical partnerships presents a significant hurdle. Securing effective global distribution networks, often through alliances with system integrators, distributors, and value-added resellers, is paramount for market penetration. In 2023, the global IT distribution market was valued at over $1.3 trillion, highlighting the scale of these networks.

Established companies like IDIS have cultivated deep-rooted relationships over years, making it incredibly difficult for newcomers to rapidly build the necessary reach and trust to compete. This existing infrastructure creates a substantial barrier, as new entrants must invest heavily in time and resources to replicate the established channels.

The challenge is amplified by the fact that many key partners are already deeply integrated with incumbent providers. For instance, a significant portion of value-added resellers may already have preferential agreements or technical integrations with companies like IDIS, limiting opportunities for new entrants to onboard them. This reliance on existing relationships means that new players must offer a truly compelling value proposition or a disruptive technology to entice partners away from established ties.

Key challenges for new entrants include:

- Establishing trust and credibility with potential channel partners.

- Overcoming existing contractual obligations between partners and incumbent suppliers.

- Building a global distribution footprint comparable to established players.

- Securing adequate technical support and training for reseller networks.

Regulatory Hurdles and Compliance

The security industry is a minefield of regulations, standards, and certifications. These can differ wildly depending on where you are and what the security is for. For instance, in 2024, companies dealing with sensitive data often need to comply with frameworks like GDPR, CCPA, or industry-specific standards such as ISO 27001. Navigating this complex web requires substantial investment in time, expertise, and financial resources. This compliance burden acts as a significant deterrent for potential new players, making market entry a costly and lengthy endeavor.

These regulatory hurdles translate into tangible costs. For example, achieving certifications like SOC 2 Type II, which is crucial for many B2B security providers, can cost tens of thousands of dollars in audit fees and internal process improvements. Furthermore, staying abreast of evolving legal landscapes, such as cybersecurity mandates being introduced or strengthened in various jurisdictions throughout 2024, demands continuous investment in legal counsel and compliance staff. This ongoing commitment to regulatory adherence creates a high barrier to entry, protecting established firms that have already incurred these costs.

The need for specialized knowledge and ongoing adaptation is also a key factor. New entrants must not only understand current regulations but also anticipate future changes. This might involve investing in cybersecurity training for employees, implementing robust data protection measures, and potentially undergoing rigorous penetration testing. Companies that fail to meet these stringent requirements can face severe penalties, including hefty fines and reputational damage, further reinforcing the threat of new entrants being significantly weakened by compliance demands.

- Regulatory Complexity: Security sector faces diverse, region-specific regulations and certifications.

- Compliance Costs: Achieving certifications like ISO 27001 or SOC 2 can cost tens of thousands of dollars in 2024.

- Resource Intensive: Navigating compliance requires significant time, financial investment, and specialized expertise.

- Evolving Landscape: Continuous adaptation to new cybersecurity mandates and legal frameworks is essential.

The threat of new entrants into the video surveillance market is significantly mitigated by substantial capital requirements for R&D, manufacturing, and distribution, estimated in the tens of millions for advanced systems.

Economies of scale achieved by established players like IDIS, driven by high production volumes in 2024, create cost advantages that new entrants struggle to match. Brand loyalty, built on years of trust in the security sector, also presents a formidable barrier, as customers prioritize proven reliability.

Proprietary technology, such as IDIS's DirectIP and FEN platforms, alongside patent portfolios, necessitates significant R&D investment for replication, further deterring new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IDIS leverages data from industry-specific market research reports, financial statements of key players, and publicly available company disclosures. This ensures a comprehensive understanding of competitive intensity and market dynamics.