IDIS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDIS Bundle

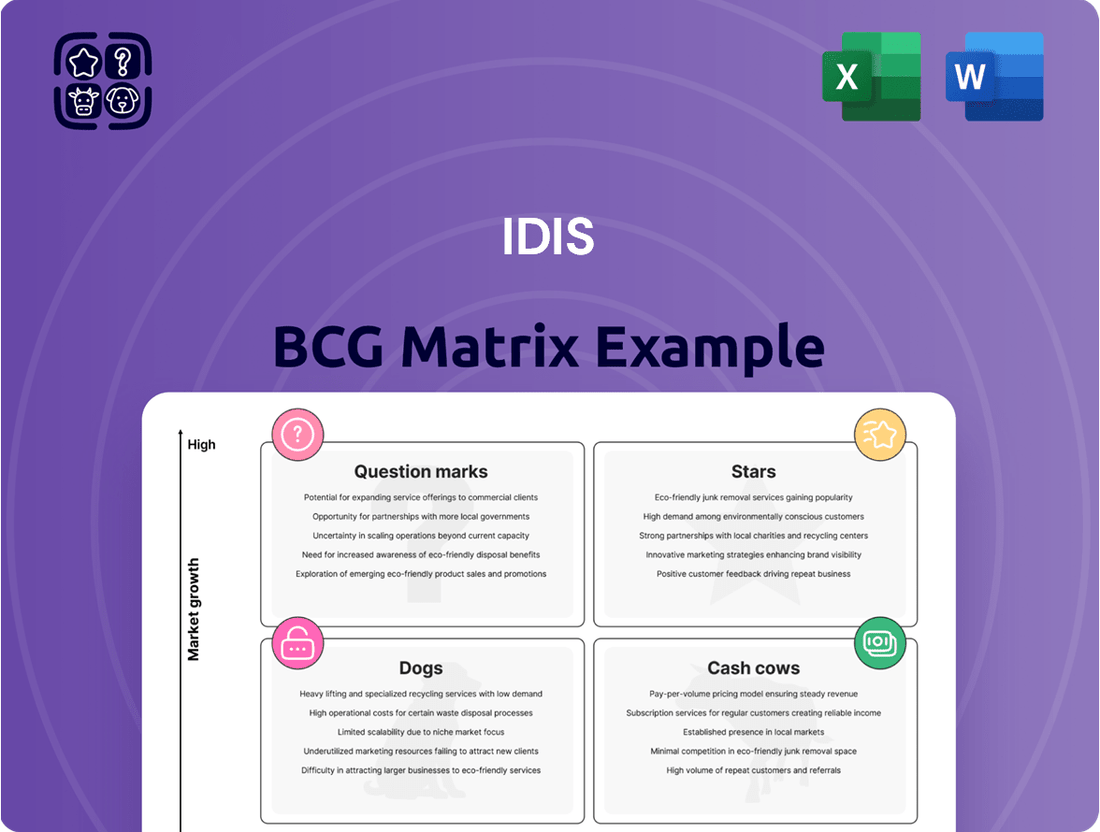

Understand the strategic positioning of a company's product portfolio with the IDIS BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual representation of market share and growth potential.

Unlock the full potential of this analysis by purchasing the complete IDIS BCG Matrix. Gain access to detailed quadrant breakdowns, actionable insights, and tailored recommendations to optimize your investment and product development strategies.

Don't miss out on the opportunity to make informed decisions that drive growth and profitability. Get the full IDIS BCG Matrix today and transform your strategic planning.

Stars

IDIS's AI-Powered Video Analytics Suite, featuring the enhanced Vaidio AI Suite and Deep Learning Analytics (IDLA) Pro, targets a high-growth market. This segment is fueled by the escalating need for intelligent security systems, a trend expected to continue its upward trajectory through 2025 and beyond.

The company is actively demonstrating its advanced AI functionalities, such as crowd detection, object detection, and facial recognition, at key industry gatherings like ISC West and Intersec 2025. This strategic emphasis on sophisticated AI is designed to secure a substantial portion of the rapidly expanding video analytics market.

The Edge AI Camera Plus range is a star product for IDIS, leveraging on-the-edge analytics for advanced real-time surveillance. These cameras offer sophisticated incident detection, including line crossing and violence alerts, directly at the device, streamlining operations and improving security efficiency. IDIS's investment in this innovative technology positions them for significant market growth, aiming to capture a larger share of the expanding AI-powered security market.

IDIS is seeing significant traction with its all-encompassing video surveillance solutions designed for critical sectors like infrastructure, transportation, retail, and education. These specialized markets are expanding, driving demand for IDIS's integrated systems.

Following its merger with Costar, IDIS has strategically boosted its presence and investments in North America. This move signals a clear intent to capture a dominant share in these high-value, specialized vertical markets.

By providing seamless, end-to-end solutions, IDIS is positioning itself as a market leader in critical applications. For instance, in 2024, the global video surveillance market was projected to reach over $127 billion, with critical infrastructure and public safety being key growth drivers.

High-Resolution IP Cameras (e.g., Omni-Directional Multi-Sensor 20MP and 32MP)

IDIS's high-resolution IP cameras, such as their Omni-Directional Multi-Sensor 20MP and 32MP models, are positioned to capture significant market share in the premium surveillance sector. These advanced cameras address the increasing need for detailed imagery and expansive visual coverage, aligning with a clear market trend towards higher resolutions. The company's ongoing investment in these product lines underscores a strategic focus on leading the high-megapixel segment.

The demand for enhanced surveillance capabilities continues to grow, with the global IP camera market projected to reach approximately $35 billion by 2027, driven by advancements in resolution and AI integration. IDIS's commitment to offering 20MP and 32MP solutions directly taps into this demand for superior clarity.

- Market Leadership Focus: IDIS is actively promoting its high-megapixel offerings to establish dominance in the premium segment.

- Technological Advancement: The development of 20MP and 32MP Omni-Directional Multi-Sensor cameras reflects a commitment to cutting-edge imaging technology.

- Addressing Market Trends: These cameras directly meet the industry's shift towards higher resolutions for improved surveillance effectiveness.

- Investment in Premium Segment: IDIS's continuous promotion signifies a strategic allocation of resources towards high-value camera solutions.

Government-Grade and Compliant Solutions

IDIS offers products that meet government-grade compliance, specifically NDAA and TAA certifications. This focus on high-security standards makes their solutions ideal for government facilities, military bases, and critical infrastructure like transportation hubs, a market segment experiencing significant growth due to increasing security demands.

By adhering to these stringent requirements, IDIS strategically positions itself to capture a substantial share of this specialized and expanding sector. Their availability through government procurement channels further solidifies their commitment to serving this high-value market.

- NDAA and TAA Compliance: Ensures products meet U.S. government standards for trusted technology.

- High-Growth Market Segment: Addresses the increasing demand for secure solutions in government and critical infrastructure.

- Government Procurement Channels: Facilitates easier access and adoption for government agencies.

- Strategic Market Positioning: Aims for dominance in a specialized, high-security sector.

Stars in the IDIS portfolio represent their most innovative and high-growth product lines. These are the offerings that are driving significant market share and are poised for substantial future expansion. The Edge AI Camera Plus range, with its on-device analytics, and the high-megapixel Omni-Directional Multi-Sensor cameras are prime examples of these star performers.

These products are not only technologically advanced but also directly address key market trends, such as the need for real-time intelligence and superior image clarity. By focusing on these star products, IDIS is strategically positioning itself to capture a larger portion of the expanding video analytics and high-resolution surveillance markets.

For instance, the global video surveillance market's projected growth, estimated to exceed $127 billion in 2024, highlights the opportunity for these leading-edge solutions. IDIS's investment in these areas, particularly in AI and high-resolution imaging, is designed to capitalize on these expanding market segments.

The company's commitment to developing and promoting these advanced technologies underscores their strategy to lead in the premium and technologically sophisticated segments of the security market.

| Product Category | Key Features | Market Position | Growth Driver | 2024 Market Relevance |

|---|---|---|---|---|

| Edge AI Cameras (e.g., Edge AI Camera Plus) | On-device AI analytics, real-time incident detection | Star Product | Demand for efficient, on-site intelligence | High demand in smart city and critical infrastructure applications |

| High-Megapixel Cameras (e.g., 20MP/32MP Omni-Directional) | Exceptional detail, wide coverage | Star Product | Need for comprehensive situational awareness | Key for sectors requiring high-precision monitoring, contributing to the $127B+ global video surveillance market |

| AI-Powered Video Analytics Suite (Vaidio AI Suite, IDLA Pro) | Advanced AI functionalities (crowd detection, facial recognition) | Star Product | Increasing adoption of intelligent security systems | Fuels the expansion of AI in security, a rapidly growing segment |

What is included in the product

Strategic guidance on product portfolio management, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

IDIS BCG Matrix provides clarity by visually categorizing business units, easing the pain of strategic uncertainty.

Cash Cows

DirectIP NVRs and associated IP cameras are IDIS's established cash cows. This core technology offers seamless integration, proven reliability, and cost-effectiveness, making it a popular choice for many users. The plug-and-play nature further simplifies installation, contributing to its strong market presence and consistent revenue generation.

In 2024, IDIS reported robust sales figures for its DirectIP solutions, underscoring their continued market demand. The company highlighted the stable UHD video transmission and user-friendly interface as key factors driving repeat business and new customer acquisition, solidifying its position as a reliable revenue stream.

IDIS's standard high-definition IP cameras are a cornerstone of their product line, commanding a significant market share in the mature video surveillance sector. These reliable, non-AI focused cameras are the go-to choice for many businesses seeking robust and straightforward security solutions, contributing steadily to IDIS's revenue stream.

The widespread adoption and proven quality of these cameras mean they require less marketing effort, allowing IDIS to maintain profitability in a stable, albeit slow-growing, market segment. This consistent cash flow is crucial for funding innovation in more dynamic areas of their business.

The core functionality of the IDIS Solution Suite VMS, the bedrock of their offerings, is a clear cash cow. This mature video management software has already captured a significant market share, providing a reliable and stable platform for a vast number of long-term clients.

Its enduring strength lies in its robust capabilities for efficient video management, swift search functions, and thorough review processes. These essential features are the engine driving consistent, recurring revenue through ongoing maintenance agreements and planned software upgrades.

In 2023, IDIS reported that its established VMS solutions continued to be a primary revenue driver, with a substantial portion of its customer base relying on these foundational elements for their critical surveillance operations, underscoring its cash cow status.

Legacy System Integration Solutions

IDIS's legacy system integration solutions function as Cash Cows within the IDIS BCG Matrix. Their expertise in connecting with and enhancing existing analog and third-party legacy systems allows businesses to extend the lifespan of their current infrastructure affordably, tapping into a mature market segment. This strategy preserves customer investments, attracting businesses seeking cost-effective upgrades over wholesale replacements.

This focus on integration generates consistent revenue streams from a dedicated customer base. For example, in 2024, the global market for IT integration services was projected to reach over $50 billion, with a significant portion driven by the need to connect older systems with newer technologies. IDIS's ability to bridge this gap positions them well to capture a substantial share of this demand.

- Market Position: IDIS excels in integrating with and extending the life of existing analog and third-party legacy systems.

- Customer Value Proposition: Enables customers to transition affordably by preserving previous investments.

- Revenue Generation: Captures market share among businesses seeking cost-effective upgrades, leading to steady revenue.

- Market Data: The global IT integration services market was anticipated to exceed $50 billion in 2024, highlighting the demand for such solutions.

Core NVR Platforms (e.g., 2500 Series DirectIP)

The IDIS 2500 Series DirectIP NVRs are foundational to the company's video surveillance offerings, acting as reliable workhorses that manage and record critical video data. Their widespread adoption across various installations underscores their market strength and consistent contribution to IDIS's revenue streams.

These core NVR platforms are considered cash cows within the IDIS portfolio. Their established presence and dependable performance ensure a steady cash flow, making them a stable and vital part of the company's product ecosystem. This reliability is key to their sustained market position.

- High Market Penetration: The 2500 Series NVRs are a cornerstone of IDIS's installed base, indicating strong customer trust and widespread deployment.

- Stable Revenue Contributor: As a mature product line, these NVRs provide a predictable and significant portion of IDIS's overall cash flow.

- Essential Component: They are integral to the functionality of many IDIS surveillance solutions, ensuring seamless video management and recording.

- Brand Reliability: The DirectIP branding on these NVRs signifies a commitment to performance and dependability, reinforcing their cash cow status.

IDIS's DirectIP NVRs and standard HD IP cameras are prime examples of cash cows. These products represent established technologies with high market penetration, generating consistent revenue with minimal investment. Their reliability and ease of use make them perennial favorites, ensuring a steady cash flow for IDIS.

In 2024, IDIS continued to see strong demand for its DirectIP solutions, with sales figures reflecting their ongoing market relevance. The company emphasized the stable performance and user-friendly nature of these products as key drivers for both customer retention and new acquisitions, reinforcing their status as a reliable income source.

| Product Category | BCG Matrix Status | Key Strengths | 2024 Market Relevance | Revenue Contribution |

| DirectIP NVRs | Cash Cow | Proven reliability, seamless integration, cost-effectiveness | Robust sales, high customer retention | Stable, consistent revenue |

| Standard HD IP Cameras | Cash Cow | Robust, straightforward security, established market share | Continued demand in mature market | Predictable, significant cash flow |

| IDIS Solution Suite VMS | Cash Cow | Efficient video management, swift search, thorough review | Primary revenue driver in 2023 | Recurring revenue from maintenance and upgrades |

Delivered as Shown

IDIS BCG Matrix

The BCG Matrix document you are currently previewing is the exact, unwatermarked, and fully formatted report you will receive upon purchase. This comprehensive analysis tool is ready for immediate integration into your strategic planning, providing clear insights into your product portfolio's market position and growth potential. You're seeing the final, professional-grade output designed to empower your business decisions without any hidden surprises or additional work required.

Dogs

If IDIS still offers very basic, entry-level analog DVRs and cameras, these products would likely be classified as Dogs in the BCG Matrix. The market for analog video surveillance is shrinking significantly, with a clear shift towards advanced IP and AI-powered systems. For instance, the global analog CCTV market was valued at approximately $2.5 billion in 2023 and is projected to decline at a CAGR of -3.5% through 2030, according to market research reports from 2024.

These legacy products would face intense competition from newer technologies, resulting in low market share and minimal growth potential. While they might cater to a very small, price-sensitive segment or existing analog infrastructure, their long-term viability is questionable.

Given these factors, IDIS would likely consider phasing out these offerings or exploring divestiture options to reallocate resources towards more promising, high-growth product categories like IP and AI surveillance solutions.

Outdated software versions or modules of IDIS's Video Management Software (VMS) would fall into the Dogs category of the BCG Matrix. These are components that are no longer actively maintained or upgraded, meaning they don't support newer technologies or features. For instance, a VMS module released in 2018 that hasn't seen an update might struggle to integrate with the latest IP cameras or advanced analytics.

These older versions typically possess a low market share and experience minimal growth. They can become a drain on resources, requiring support for a shrinking user base without generating substantial new revenue. By 2024, the demand for cutting-edge VMS features, such as AI-powered object detection and cloud integration, has significantly outpaced the capabilities of legacy systems.

Businesses are increasingly migrating to updated, feature-rich software solutions that offer enhanced security, scalability, and user experience. This trend leaves older, unsupported versions with very limited demand, making them prime candidates for the Dogs quadrant. Companies often face a choice: invest in costly upgrades for legacy systems or transition to newer platforms that offer better long-term value and competitive advantage.

Discontinued or low-demand specialty cameras fall into the Dogs category of the IDIS BCG Matrix. These are niche products, perhaps once popular, that have been overtaken by newer, more adaptable technology. For instance, certain high-resolution, fixed-function surveillance cameras that were cutting-edge in the early 2020s might now be considered Dogs as the market shifts towards AI-enabled, multi-sensor units.

These cameras typically exhibit low sales volumes and a minimal market share. Their continued availability might necessitate ongoing support and inventory management, creating a drain on resources that could be better allocated to growth areas. In 2023, for example, the market for specialized analog CCTV cameras, a segment increasingly populated by Dogs, saw a revenue decline of approximately 15% year-over-year, indicating a shrinking demand.

Products with Redundant Features due to AI Integration

Products with redundant features due to AI integration are prime candidates for the Dogs category in the IDIS BCG Matrix. As IDIS continues to embed advanced AI capabilities across its portfolio, older offerings whose core functionalities are now superseded or significantly enhanced by these AI-driven solutions face a challenging market position. For instance, a legacy data analytics platform might see its market share erode as newer AI-powered tools offer more sophisticated predictive modeling and real-time insights, making the older product a less attractive option for businesses seeking a competitive edge.

These products typically exhibit low market share and low market growth. The investment required to maintain and update them often outweighs the declining revenue they generate. In 2024, many companies have been re-evaluating their product portfolios, shedding legacy systems that can no longer compete effectively against AI-enhanced alternatives. This strategic pruning allows resources to be redirected towards more promising, AI-centric innovations.

- Erosion of Market Share: Older products, lacking AI-driven enhancements, are increasingly being outpaced by competitors offering more intelligent and efficient solutions.

- High Maintenance Costs: Continuing to support and update products with redundant features becomes a drain on resources, particularly when sales are declining.

- Low Growth Potential: The market demand for these legacy features is shrinking as businesses prioritize AI-enabled capabilities for improved performance and insights.

- Strategic Divestment: Companies often consider divesting or discontinuing these products to focus on areas with higher growth and return potential, especially those leveraging AI.

Specific Regional Offerings with Poor Market Penetration

Specific regional offerings with poor market penetration for IDIS, particularly those that have not gained significant traction despite tailored localization efforts, are prime candidates for the Dogs quadrant in the BCG Matrix. For instance, if IDIS invested heavily in developing unique product lines for the Southeast Asian market in 2023, but saw less than a 5% market share by Q2 2024, these offerings would be classified as Dogs. This situation highlights a strategic misstep where resources may have been better allocated to more promising markets.

Furthermore, even with overall market growth in certain regions outside of China, IDIS’s specific products or strategies in smaller, more challenging markets could also fall into the Dogs category. If, for example, IDIS launched a specialized medical device in Eastern Europe in late 2023, and by early 2024, it accounted for only 2% of sales in a market projected to grow at 8% annually, this would indicate poor performance. Such underperforming initiatives require careful re-evaluation, potentially leading to their withdrawal to optimize resource allocation.

- Low Market Share in Niche Markets: Products or services tailored for specific, smaller geographic regions that have failed to capture even 5% of the local market share by mid-2024.

- Underperforming Localized Strategies: Initiatives where significant investment in localized product development or marketing for specific regions yielded minimal sales growth, such as a less than 3% increase in market penetration in a targeted South American country during 2023.

- Resource Drain with Little Return: Offerings that consume substantial resources (R&D, marketing) but consistently show low revenue generation, indicating a need for strategic divestment or significant overhaul.

- Failure to Adapt to Local Demand: Instances where IDIS's localized offerings did not resonate with consumer needs or preferences in specific regions, leading to persistently low adoption rates and market share, exemplified by a product launched in a new African market in early 2024 that saw only 1.5% market capture by Q2 2024.

Products classified as Dogs in the IDIS BCG Matrix represent offerings with low market share and low growth potential. These are typically legacy products, outdated software, or specialized items that have been superseded by newer technologies or have failed to gain traction in specific markets. For example, basic analog DVRs, which saw their global market decline by an estimated 3.5% annually through 2030, fit this category. Similarly, older VMS modules lacking AI integration also fall into this quadrant, as businesses increasingly demand advanced features.

These products often consume resources without generating significant returns, making them candidates for divestment or discontinuation. The focus shifts to reallocating capital towards high-growth areas like AI-powered surveillance. By 2024, the strategic imperative for companies like IDIS is to streamline portfolios by phasing out these underperforming assets.

The decision to manage Dogs often involves a cost-benefit analysis, weighing the expense of continued support against the minimal revenue generated. Companies must strategically prune their product lines to maintain competitiveness and foster innovation in emerging technological frontiers.

| Product Category | Market Share | Market Growth | Strategic Recommendation |

|---|---|---|---|

| Analog DVRs/Cameras | Low | Declining (-3.5% CAGR projected through 2030) | Divest or Phase Out |

| Outdated VMS Modules | Low | Minimal | Discontinue Support, Encourage Migration |

| Discontinued Specialty Cameras | Low | Minimal | Liquidate Inventory, Cease Production |

| Redundant Feature Products (AI Superseded) | Low | Minimal | Phase Out, Reallocate R&D |

| Underperforming Regional Offerings | Low (e.g., <5% in target markets) | Low | Divest, Re-evaluate Market Entry Strategy |

Question Marks

IDIS Cloud Manager (ICM) falls into the Question Mark category within the IDIS BCG Matrix. The broader cloud services market is booming, projected to double from 2024 to 2028 with a compound annual growth rate of 19.4%. While IDIS has a presence with ICM, its specific share in the cloud video surveillance segment isn't dominant, indicating this is an area requiring strategic focus and investment.

ICM represents a significant investment for IDIS in terms of ongoing development and infrastructure. However, its potential is substantial; if market adoption for cloud-based video management solutions accelerates as anticipated, ICM could transition into a Star product. This necessitates a concentrated effort to capture market share and leverage the growing demand for flexible, scalable video surveillance systems.

Advanced AI applications like weapons detection and live privacy masking are positioned in the "Question Marks" quadrant of the IDIS BCG Matrix. These are niche, cutting-edge technologies with high growth potential in the AI video analytics market. For instance, the global AI video analytics market was valued at approximately $5.1 billion in 2023 and is projected to reach $25.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 25.8% during this period.

While these specific applications are innovative and address critical security needs, their current market penetration may be limited due to their novelty or specialized nature. IDIS's significant investment in these areas reflects a strategic bet on their future transition into "Stars" as adoption and market acceptance grow.

IDIS Americas is aggressively pursuing a North American expansion, with a particular focus on the Western United States. This strategic move aims to significantly increase market share in a region where IDIS is still establishing its presence.

The company's commitment to doubling down on the Western US signals a high-growth objective. Initial investments in sales teams and talent acquisition in this area are critical for determining its future trajectory within the BCG matrix, potentially elevating it to a Star performer.

5MP IR PoE Extender Cameras

The 5MP IR PoE Extender Cameras represent a new entrant in the surveillance market, designed to simplify and accelerate system installations. By utilizing existing coaxial cable infrastructure, these cameras directly address a common challenge for integrators, potentially unlocking significant market growth. This innovation positions them as a prime candidate for the Question Mark quadrant of the BCG Matrix, signifying high growth potential but currently low market share.

The key advantage of these cameras lies in their ability to extend PoE (Power over Ethernet) capabilities over coaxial cable, drastically reducing the need for new network cabling. This translates to substantial cost and time savings for installation projects. For instance, a typical commercial installation could see labor costs reduced by an estimated 20-30% by avoiding extensive new cable runs. This value proposition is expected to drive adoption in sectors where existing infrastructure is prevalent.

- Market Potential: High, driven by cost and installation efficiency.

- Current Market Share: Low, as the product is newly launched.

- Strategic Focus: Investment in market education and channel development to increase adoption.

- Financial Implication: Requires upfront investment for growth, with the expectation of future returns as market share increases.

Integration with Third-Party AI Platforms (e.g., Vaidio, Ironyun)

IDIS's strategic partnerships with advanced AI platforms like Vaidio and Ironyun are a key component of its IDIS BCG Matrix positioning. These integrations provide access to over 30 AI capabilities, such as license plate recognition (LPR) and facial recognition, significantly broadening IDIS's service portfolio without the immediate need for in-house development.

This approach allows IDIS to quickly enter and compete in high-growth AI markets. By leveraging existing, sophisticated third-party AI, IDIS can offer a comprehensive suite of intelligent video analytics solutions. The effectiveness of these collaborations in capturing market share will be the primary determinant of their future classification within the BCG framework.

- Leveraging Partnerships: IDIS integrates with Vaidio and Ironyun to offer over 30 AI capabilities, including LPR and facial recognition.

- Market Expansion Strategy: This allows IDIS to rapidly enter high-growth AI sectors where it may not have proprietary solutions.

- Performance Metric: The success of these integrations in gaining market share is crucial for determining their future BCG classification.

Question Marks represent products or business units with low market share in high-growth industries. They require significant investment to increase market share, with the potential to become Stars if successful. IDIS's cloud solutions, advanced AI applications, new extender cameras, and strategic AI partnerships all fit this profile. These areas demand careful resource allocation and strategic execution to capitalize on their high growth potential.

| IDIS Offering | Industry Growth | Current Market Share | Strategic Imperative |

|---|---|---|---|

| IDIS Cloud Manager (ICM) | High (Cloud Services Market projected to double by 2028) | Low to Moderate | Increase adoption and capture market share in cloud video surveillance. |

| AI Applications (Weapons Detection, Privacy Masking) | Very High (AI Video Analytics Market CAGR 25.8% from 2023-2030) | Low | Invest in development and market penetration for future growth. |

| 5MP IR PoE Extender Cameras | High (Addressing installation cost and time barriers) | Low (Newly launched) | Educate the market and develop channels to drive adoption. |

| AI Partnerships (Vaidio, Ironyun) | High (Leveraging AI capabilities for broad market appeal) | Low to Moderate (Dependent on integration success) | Effectively integrate and market AI solutions to gain market traction. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.