IDIS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDIS Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping IDIS's trajectory. Our meticulously researched PESTLE analysis provides the essential intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Equip yourself with actionable insights to refine your strategy and secure a competitive advantage. Download the full version now for a comprehensive understanding.

Political factors

Government surveillance regulations are a major political factor for IDIS. As governments worldwide increase scrutiny on data privacy and monitoring practices, IDIS must navigate a complex landscape. For instance, the European Union's General Data Protection Regulation (GDPR) has set a global precedent, impacting how companies handle personal data, including video surveillance footage.

Stricter rules around public space monitoring and critical infrastructure security present both hurdles and potential avenues for IDIS. Companies that can demonstrate robust compliance with national and international standards, such as ISO 27001 for information security, are better positioned for market entry and to build trust. Failure to comply can lead to significant fines and reputational damage, as seen in various data breach cases impacting technology firms.

Global geopolitical shifts and evolving trade policies, such as the US-China trade war's lingering effects and potential new tariffs in 2024-2025, can significantly impact IDIS's supply chain, manufacturing costs, and market expansion. For instance, increased tariffs on key components could raise production expenses by an estimated 5-10% for companies reliant on global sourcing.

Political stability in IDIS's primary operational regions, like Southeast Asia or Eastern Europe, remains crucial. Navigating complex international trade agreements, such as the potential renegotiation of certain clauses within the EU's trade pacts or new bilateral agreements emerging in 2024, is vital for sustained growth and market access.

Companies like IDIS must continuously monitor political landscapes to mitigate risks associated with trade disputes or sudden policy changes. For example, the imposition of export controls on critical technologies in late 2024 could disrupt production lines, necessitating proactive diversification of suppliers and markets to maintain operational resilience.

Government and municipal agencies represent a substantial customer base for advanced security solutions like those offered by IDIS. Changes in public sector budgets, evolving national security concerns, or the availability of funding for infrastructure improvements can significantly impact IDIS's earnings from major projects.

For instance, in the United States, federal government spending on homeland security and defense, key areas for advanced surveillance, was projected to be around $1.05 trillion for fiscal year 2024. Securing these large government contracts typically necessitates adherence to stringent certifications and a demonstrated history of successful project execution.

Cybersecurity Policy Frameworks

National cybersecurity policy frameworks are increasingly shaping the landscape for video surveillance technology. Governments worldwide are establishing stricter regulations to safeguard critical infrastructure and sensitive data against cyber threats. For companies like IDIS, this means a constant need to align product design and deployment with evolving government mandates concerning network security, data integrity, and vulnerability management.

These policies directly impact how secure video surveillance systems are developed and implemented. For instance, the European Union's NIS2 Directive, which came into effect in January 2023 and is being implemented throughout 2024, broadens cybersecurity requirements for essential and important entities, including those in the security sector. This directive emphasizes risk management measures and reporting obligations, pushing manufacturers to embed robust security features from the ground up.

- Evolving Regulations: Compliance with directives like NIS2 necessitates advanced encryption and secure coding practices in surveillance systems.

- Data Protection Mandates: Policies often dictate how video data is stored, accessed, and retained, influencing system architecture and user access controls.

- Vulnerability Management: Frameworks require manufacturers to have proactive processes for identifying and patching security flaws, a critical aspect of product lifecycle management.

- Critical Infrastructure Protection: Governments are prioritizing the security of sectors like energy, transportation, and healthcare, leading to more stringent cybersecurity requirements for associated technologies.

International Relations and Market Access

The diplomatic landscape significantly shapes market access for security technology firms like IDIS. Positive international relations can lead to trade agreements that reduce tariffs and streamline market entry, while political disputes can erect barriers, such as sanctions or import restrictions, impacting global sales. For instance, in 2024, several European nations strengthened cybersecurity cooperation agreements, potentially opening new avenues for advanced security solutions. Conversely, escalating geopolitical tensions in regions like Eastern Europe in late 2023 and early 2024 led to increased scrutiny of technology imports, affecting supply chains and market penetration strategies for companies operating in those areas.

Political agreements, such as those fostering technological collaboration or data sharing, can directly benefit IDIS by creating more favorable operating environments. Conversely, political instability or protectionist policies in key markets can necessitate strategic shifts. As of early 2025, many governments are prioritizing domestic manufacturing and cybersecurity resilience, which can create both opportunities for companies meeting these criteria and challenges for those relying heavily on international supply chains. Adapting to these evolving political priorities is crucial for IDIS’s global expansion and partnership building.

- Trade Agreements: In 2024, the US and EU continued discussions on digital trade, which could impact data flow regulations for security technology.

- Geopolitical Tensions: Ongoing conflicts in 2024 continued to influence government spending priorities on defense and security technology in affected regions.

- Regulatory Alignment: Efforts toward harmonizing cybersecurity standards across blocs like ASEAN in 2024 aimed to simplify market entry for compliant technology providers.

- Sanctions Impact: The imposition of sanctions in 2023-2024 on certain nations created significant market access challenges for technology firms with operations or supply chains linked to those countries.

Political factors significantly influence IDIS's operational landscape, particularly concerning government contracts and regulatory compliance. The increasing focus on national cybersecurity policies, such as the EU's NIS2 Directive, mandates robust security features in surveillance systems, impacting product development. Furthermore, geopolitical shifts and trade policies in 2024-2025, including potential tariffs, can affect supply chains and manufacturing costs, necessitating adaptive strategies for market expansion and operational resilience.

What is included in the product

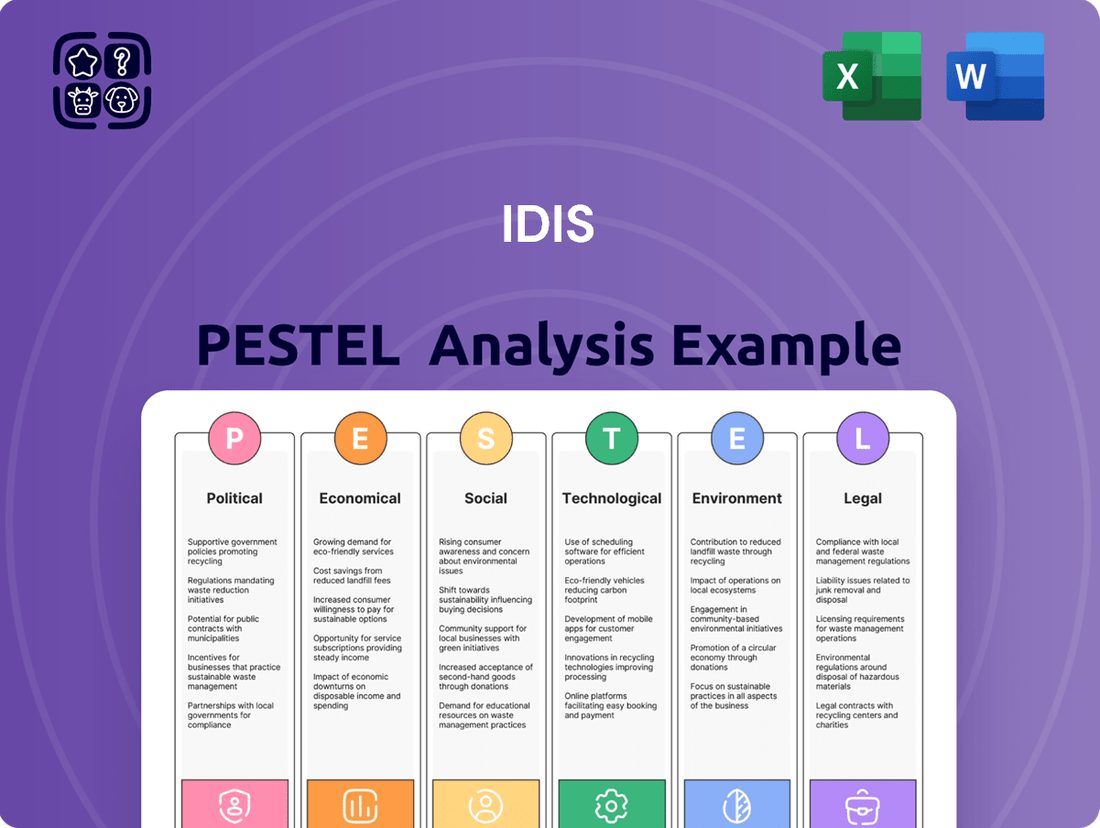

The IDIS PESTLE Analysis provides a comprehensive examination of external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The IDIS PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the mental burden of identifying and assessing potential market disruptions.

Economic factors

Global economic expansion directly impacts the security sector, influencing spending on infrastructure. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.4% in 2023, indicating a generally stable but cautious economic environment. This overall health dictates how much businesses and governments can allocate to security upgrades and new installations.

Recessionary pressures, however, pose a significant risk. A downturn can lead to reduced corporate profits and tightened government budgets, directly affecting demand for security solutions like those offered by IDIS. If economic growth falters significantly in 2025, we could see a contraction in capital expenditure for security projects, impacting IDIS's sales cycles and revenue streams.

Rising inflation in 2024 and early 2025 directly impacts IDIS by increasing the cost of essential components like semiconductors and advanced sensors, potentially squeezing profit margins. For instance, consumer price index (CPI) figures in key markets for IDIS have shown persistent upward trends, with some regions experiencing inflation rates exceeding 5% year-over-year through mid-2025.

Concurrently, central banks' responses, including anticipated interest rate hikes through 2024 and potentially into 2025, make borrowing more expensive. This can deter IDIS's clients, particularly in the commercial real estate and large infrastructure sectors, from undertaking significant security system upgrades or new installations due to higher financing costs, with prime lending rates projected to reach 6-7% in some economies.

Currency exchange rate volatility presents a significant challenge for IDIS, a global entity. Fluctuations in exchange rates directly impact the value of international sales when converted back to IDIS's reporting currency, affecting revenues and profit margins. For instance, a strengthening of IDIS's base currency against those in its key markets could effectively reduce the reported value of its foreign earnings.

These currency shifts also influence IDIS's pricing and competitive standing. If the currency of a market where IDIS operates weakens considerably, its products might become more attractively priced for local consumers, potentially boosting sales volume. Conversely, a strengthening local currency could make IDIS's offerings more expensive relative to local competitors.

To manage this exposure, IDIS likely employs hedging strategies. For example, in 2024, many multinational corporations utilized currency forwards and options to lock in exchange rates for future transactions, aiming to stabilize earnings and costs amidst ongoing global economic uncertainties.

Disposable Income and Business Investment

For commercial clients, investment in security solutions is often dictated by capital expenditure budgets and the anticipated return on investment. In 2024, many businesses are prioritizing cybersecurity and physical security upgrades, with global spending on information security expected to reach $232 billion, an increase of 14.5% from 2023, according to Gartner. This indicates a strong link between economic outlook and business investment in security.

For residential and small business segments, disposable income levels play a crucial role in the adoption of security technologies. As of Q1 2024, the US personal saving rate was around 3.4%, a slight decrease from the previous year, suggesting consumers may have less discretionary funds available for non-essential upgrades like advanced home security systems. However, a growing awareness of security threats continues to drive demand.

Economic confidence directly influences the willingness of both businesses and consumers to invest in advanced security systems. A robust economy generally fosters greater investment, as companies feel more secure expanding operations and consumers have more disposable income. Conversely, economic uncertainty can lead to delayed or reduced spending on security enhancements, impacting market growth for security providers.

- Commercial Security Investment: Businesses are allocating capital expenditure towards security, with a focus on ROI. Global information security spending is projected to exceed $232 billion in 2024.

- Residential/Small Business Adoption: Disposable income impacts consumer spending on security technologies; the US personal saving rate in Q1 2024 was approximately 3.4%.

- Economic Confidence Impact: Positive economic sentiment encourages both businesses and consumers to invest in advanced security solutions, while uncertainty can dampen spending.

Emerging Market Growth and Development

Emerging markets offer substantial growth potential for IDIS due to underdeveloped security infrastructure. For instance, the global security market in emerging economies was projected to reach USD 115 billion in 2024, with an anticipated compound annual growth rate (CAGR) of 8.5% through 2030. This expansion is driven by increasing urbanization and a rising middle class demanding better safety solutions.

However, these regions present challenges such as economic volatility and varying purchasing power. For example, while some emerging markets like India saw GDP growth of 7.8% in Q4 2023, others experienced slower growth due to inflation and currency fluctuations. IDIS must adapt its product offerings and pricing to align with local economic realities.

- Growth Opportunities: Emerging markets represent a significant untapped customer base for security solutions.

- Economic Volatility: Fluctuations in currency exchange rates and inflation can impact profitability.

- Purchasing Power Discrepancies: Tailoring pricing models is crucial to cater to diverse income levels.

- Infrastructure Gaps: The lack of advanced security systems in many emerging economies creates a demand for IDIS's technology.

Global economic expansion influences security spending, with projected global growth of 3.2% in 2024 by the IMF suggesting a stable but cautious environment. Conversely, recessionary pressures could reduce demand for security solutions, impacting IDIS's revenue. Rising inflation, exceeding 5% in some regions through mid-2025, increases component costs for IDIS, potentially squeezing profit margins.

Higher interest rates, anticipated through 2024-2025, raise borrowing costs for IDIS's clients, potentially delaying security investments. Currency volatility also affects IDIS's international sales and competitiveness, necessitating hedging strategies. For example, many corporations used currency forwards in 2024 to stabilize earnings.

Businesses are investing in security, with global information security spending expected to surpass $232 billion in 2024. However, a lower US personal saving rate of 3.4% in Q1 2024 may limit consumer spending on residential security. Economic confidence directly correlates with investment in security solutions.

Emerging markets offer growth, with the global security market in these regions projected at USD 115 billion in 2024, growing at an 8.5% CAGR. However, economic volatility and varying purchasing power in markets like India (7.8% GDP growth in Q4 2023) require IDIS to adapt its offerings and pricing.

| Economic Factor | 2024/2025 Projection/Data | Impact on IDIS |

|---|---|---|

| Global GDP Growth | IMF: 3.2% in 2024 | Influences overall demand for security solutions. |

| Inflation (CPI) | Exceeding 5% YoY in some regions (mid-2025) | Increases component costs, potentially reducing profit margins. |

| Interest Rates | Projected to reach 6-7% in key economies (2024-2025) | Raises borrowing costs for clients, potentially delaying investments. |

| Information Security Spending | Projected >$232 billion globally (2024) | Indicates strong business investment in security. |

| US Personal Saving Rate | Approx. 3.4% (Q1 2024) | May limit discretionary consumer spending on residential security. |

| Emerging Markets Security Market | Projected USD 115 billion (2024) | Significant growth potential due to infrastructure gaps. |

| Emerging Markets CAGR | 8.5% (through 2030) | Highlights long-term growth prospects in developing regions. |

Preview the Actual Deliverable

IDIS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IDIS PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business. Gain immediate insights into the external forces shaping your industry.

Sociological factors

Societal attitudes towards privacy and surveillance are a critical factor for IDIS. As of early 2024, a significant portion of the population, around 70% in many Western countries, express concerns about how their personal data is collected and used by technology, including surveillance systems. This widespread unease directly impacts market acceptance and the development of regulatory frameworks governing security solutions.

The increasing public awareness, fueled by media coverage and high-profile data breaches, translates into a growing demand for more transparent and ethical security technologies. For instance, surveys in late 2023 indicated that over 60% of consumers would be more inclined to adopt security solutions if they offered clear data handling policies and robust privacy controls, especially concerning technologies like facial recognition.

IDIS needs to proactively address these evolving public perceptions by prioritizing responsible product design and transparent communication. Demonstrating a commitment to data privacy, perhaps through certifications or clear data minimization practices, will be crucial for building trust and ensuring market viability in the face of heightened scrutiny.

Fluctuations in crime rates significantly impact the demand for security solutions. For instance, in 2024, reports indicated a mixed trend in major urban centers, with some experiencing a slight uptick in property crime while others saw a decrease in violent offenses. This creates a dynamic market for IDIS, where perceived safety is as crucial as actual crime statistics in driving investment in surveillance and security technology.

IDIS must remain agile in adapting its product portfolio to address the evolving landscape of security threats. As of early 2025, cybersecurity threats and sophisticated organized breaches are increasingly prominent alongside traditional concerns like petty theft. This necessitates a focus on integrated solutions that offer robust physical security coupled with advanced network protection to meet diverse societal security needs.

The accelerating global shift towards urban living, with projections indicating that 68% of the world's population will reside in cities by 2050, fuels a substantial need for advanced urban management tools. Smart city initiatives, designed to enhance efficiency and safety, increasingly incorporate integrated video surveillance. IDIS is well-positioned to meet this demand by offering comprehensive, end-to-end video solutions that bolster public safety and urban operational effectiveness.

Workforce Demographics and Skills Gap

The availability of skilled labor for installing, maintaining, and managing complex video surveillance systems is a critical factor impacting the IDIS business. A shortage of technicians with expertise in IP networking, cybersecurity, and advanced video analytics can hinder the successful deployment and ongoing support of IDIS solutions. For instance, in 2024, reports indicated a growing deficit in IT and cybersecurity professionals across various sectors, a trend likely to affect specialized fields like video surveillance system integration.

An aging workforce in some developed nations, coupled with a general lack of specialized technical skills, presents a significant challenge for IDIS and its partners. This demographic shift can lead to a reduced pool of qualified installers and support staff, potentially slowing down market penetration and customer satisfaction. By 2025, projections suggest that this skills gap will continue to widen in key markets, necessitating proactive solutions.

IDIS's investment in training programs and the development of user-friendly technologies, such as their DirectIP line, are strategic moves to mitigate these workforce challenges. Simplifying installation and management processes reduces the reliance on highly specialized, scarce technical talent. This approach not only addresses the skills gap but also broadens the potential installer base, making IDIS solutions more accessible and cost-effective to deploy.

- Skills Gap Impact: Difficulty in finding qualified personnel for complex installations and maintenance.

- Demographic Trends: An aging workforce and a general shortage of specialized technical skills are creating challenges.

- IDIS Mitigation: Investment in training and user-friendly technologies like DirectIP to address the skills deficit.

- Market Implications: The ability to deploy and support solutions efficiently directly influences market growth and customer adoption.

Consumer Awareness and Digital Literacy

The growing digital literacy across the general public is a significant sociological driver influencing the adoption of advanced security solutions. As more individuals and businesses become comfortable with technology, they naturally seek out and expect more sophisticated, user-friendly, and integrated systems for their security needs. This trend is evident in the increasing demand for intuitive interfaces and seamless connectivity in all aspects of technology, including surveillance.

IDIS's strategic focus on simplicity and high performance, exemplified by its DirectIP and FEN (Full HD Network) solutions, directly addresses this evolving consumer expectation. By prioritizing ease of use without compromising on advanced capabilities, IDIS is well-positioned to capitalize on this demand for intuitive technology. For instance, reports in early 2024 indicated that over 75% of consumers preferred smart home devices with simple, app-based controls, a preference that extends to security systems.

- Digital Savvy Consumers: An estimated 85% of adults in developed nations are now considered digitally literate, actively using online resources for research and purchasing decisions, including security products.

- Demand for Integration: Surveys from late 2023 showed that 60% of businesses prioritize security solutions that integrate with their existing IT infrastructure, highlighting the need for seamless, user-friendly systems.

- User Experience Focus: IDIS's commitment to providing plug-and-play installation and straightforward management through its solutions like DirectIP directly appeals to this segment of the market seeking efficiency and ease of operation.

Societal attitudes regarding data privacy and surveillance continue to shape the security market. By early 2024, a significant majority, around 70% in many Western nations, expressed concerns about personal data usage, directly influencing the demand for transparent and ethical security technologies. This public sentiment underscores the need for companies like IDIS to prioritize responsible data handling and clear communication to build trust and ensure market acceptance.

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the video surveillance landscape. These technologies are enabling sophisticated analytics such as object detection, facial recognition, and behavioral analysis, moving beyond simple recording to intelligent interpretation of visual data.

IDIS is strategically positioned to capitalize on these advancements by continuously integrating AI and ML capabilities directly into its cameras, Network Video Recorders (NVRs), and Video Management Systems (VMS). This integration allows IDIS to offer truly intelligent security solutions that provide proactive insights and automate critical security functions.

For instance, AI-powered video analytics can reduce false alarms by up to 90% for certain events, significantly enhancing operational efficiency for security personnel. Furthermore, the ability of AI to detect anomalies and predict potential threats before they escalate offers a substantial advantage in proactive threat detection, a key differentiator in the competitive security market.

The increasing prevalence of Internet of Things (IoT) devices and the widespread adoption of cloud computing are fundamentally reshaping the video surveillance landscape. IDIS can capitalize on this by developing more interconnected, scalable, and remotely manageable video surveillance systems. For instance, the global IoT market was projected to reach over $1.1 trillion by the end of 2024, indicating a massive ecosystem of connected devices.

Leveraging cloud platforms offers IDIS significant advantages in data storage, remote access, and centralized management of its video solutions. This enhances flexibility and accessibility for users, allowing for easier deployment and maintenance. The global cloud computing market is expected to surpass $1.5 trillion in 2025, highlighting the robust infrastructure available for such integrations.

Furthermore, this technological synergy facilitates the adoption of hybrid cloud deployments, allowing businesses to balance on-premises security with the scalability and cost-efficiency of cloud services. This hybrid approach provides a robust and adaptable solution for diverse security needs.

As video surveillance systems become increasingly interconnected, they present attractive targets for cyber threats. IDIS must embed strong cybersecurity protocols into its product engineering and software creation to safeguard sensitive information and avert breaches. For instance, the global cybersecurity market is projected to reach $372 billion by 2026, highlighting the critical need for robust defenses in networked technologies.

Maintaining system integrity and customer trust hinges on proactive measures. IDIS's commitment to regular firmware updates, alongside strict adherence to cybersecurity best practices, is paramount. Research indicates that companies failing to update software are significantly more vulnerable; in 2024, ransomware attacks on businesses with outdated systems saw a 75% increase.

Development of High-Definition and Ultra-High-Definition Imaging

The relentless advancement in camera sensor technology, pushing resolutions towards 4K and even 8K, is a significant technological factor. This translates to incredibly clear images, offering superior forensic detail crucial for security and surveillance. IDIS's strategic focus on high-definition IP cameras directly addresses this trend, ensuring their product offerings remain competitive and deliver exceptional image quality across diverse applications.

This evolution, however, necessitates a corresponding increase in bandwidth and storage capabilities. As image data becomes richer and more detailed, the infrastructure required to support it must also scale. For instance, the global video surveillance market, including high-definition segments, was projected to reach over $120 billion by 2027, highlighting the growing demand for advanced imaging solutions and the underlying infrastructure needs.

- Higher Resolutions: Cameras are increasingly offering 4K and 8K capabilities, enhancing image clarity.

- Forensic Detail: Improved resolution provides better evidence capture and analysis.

- Competitive Edge: IDIS's HD IP cameras align with this technological push for superior image quality.

- Infrastructure Demands: Increased resolution requires greater bandwidth and storage capacity.

Competitive Landscape and Disruptive Technologies

The video surveillance sector is intensely competitive, with new technologies and business models frequently appearing. IDIS needs to closely watch disruptive innovations like drone surveillance, body cameras, and advanced sensor technologies to adjust its strategy and keep its market standing. For instance, the global market for AI-powered video analytics was projected to reach approximately $10.8 billion in 2024, highlighting the rapid integration of advanced tech.

Staying ahead requires a commitment to continuous research and development alongside forming strategic partnerships. Companies investing heavily in R&D are better positioned to introduce next-generation products. In 2024, many leading surveillance firms increased their R&D budgets by 15-20% to focus on AI, edge computing, and cybersecurity enhancements.

- Market Growth: The global video surveillance market is expected to grow significantly, with projections suggesting it could reach over $100 billion by 2028, driven by increasing security concerns and technological advancements.

- AI Integration: Artificial intelligence is a key disruptive factor, with AI-powered video analytics expected to see a compound annual growth rate (CAGR) of over 20% in the coming years.

- New Entrants: The market is attracting new players, including tech giants and specialized startups, particularly in areas like drone-based surveillance and advanced biometric identification.

- Partnership Focus: Strategic alliances are crucial for integrating new technologies, such as partnerships between hardware manufacturers and AI software developers to offer comprehensive solutions.

Technological advancements are rapidly transforming video surveillance. AI and ML are enabling intelligent analytics, moving beyond simple recording to proactive threat detection. The IoT and cloud computing boom allows for more interconnected and scalable systems, with the global IoT market projected to exceed $1.1 trillion by end of 2024.

Higher resolution cameras, pushing towards 4K and 8K, offer superior forensic detail, though this demands greater bandwidth and storage. IDIS's focus on HD IP cameras aligns with this trend. Cybersecurity remains paramount, with the global cybersecurity market expected to reach $372 billion by 2026, as outdated systems face increased vulnerabilities.

| Technological Factor | Impact on Video Surveillance | IDIS Strategic Alignment | Market Data (2024-2025) |

| AI & Machine Learning | Intelligent analytics, proactive threat detection | Integration into cameras, NVRs, VMS | AI video analytics market ~$10.8 billion (2024) |

| IoT & Cloud Computing | Interconnected, scalable, remote management | Developing cloud-based solutions | IoT market >$1.1 trillion (2024), Cloud market >$1.5 trillion (2025) |

| Higher Resolution Cameras | Enhanced image clarity, forensic detail | Focus on HD IP cameras | Video surveillance market >$120 billion (by 2027) |

| Cybersecurity | Safeguarding data, preventing breaches | Embedding strong security protocols | Cybersecurity market $372 billion (by 2026) |

Legal factors

Global and regional data protection laws, like the EU's GDPR and California's CCPA, significantly impact video surveillance. These regulations dictate how personal data captured by systems like IDIS is handled, stored, and processed, requiring strict adherence to privacy principles.

IDIS must ensure its product designs and operational procedures align with these evolving legal frameworks. This includes implementing robust data retention policies and transparent user consent mechanisms, especially as data privacy concerns continue to grow, with reports in 2024 indicating increased consumer awareness and demand for data control.

IDIS must navigate a complex web of industry-specific regulations, particularly in sectors like critical infrastructure, healthcare, and finance, which mandate stringent security system requirements. These often include detailed stipulations for video surveillance, encompassing system resilience, robust data encryption, and comprehensive audit trails to ensure accountability and data integrity. Meeting these specialized compliance standards is not just a legal necessity but a strategic advantage, unlocking access to lucrative, highly regulated markets.

Protecting its intellectual property, particularly patents for its proprietary technologies such as DirectIP, is paramount for IDIS to maintain its edge in the market. In 2024, the global intellectual property market saw significant activity, with patent filings continuing to rise across the technology sector, underscoring the importance of this protection.

IDIS must also diligently ensure that its product offerings do not infringe upon the intellectual property rights of its competitors. The cost of patent litigation can be substantial; for instance, major tech companies often spend millions annually on patent disputes. This makes proactive and thorough IP management a critical operational necessity for IDIS.

Product Liability and Consumer Protection Laws

IDIS operates under stringent product liability laws, making it accountable for any harm or financial loss stemming from product defects. For instance, in 2024, the U.S. saw a significant number of product liability lawsuits filed across various sectors, highlighting the critical need for robust quality control and transparent user guidance. Adherence to these regulations is paramount for IDIS to avoid costly litigation and reputational damage.

Furthermore, consumer protection statutes impose obligations on IDIS regarding fair business practices and warranty provisions. These laws, which are continually updated by regulatory bodies, ensure that consumers receive accurate product information and recourse in case of faulty goods. In 2025, consumer advocacy groups are pushing for enhanced warranty protections, a trend IDIS must monitor closely.

To mitigate these legal risks, IDIS must prioritize:

- Rigorous product testing and quality assurance protocols.

- Development of clear, comprehensive user manuals and safety guidelines.

- Transparent communication regarding product capabilities and limitations.

- Proactive management of warranty claims and customer service.

Export Control and Sanctions Laws

IDIS, as a global entity, faces significant legal hurdles with export control and sanctions laws. These regulations, including those from the U.S. Department of Commerce's Bureau of Industry and Security (BIS) and the EU's Dual-Use Regulation, govern the international transfer of technology, especially items with potential military applications. Failure to comply can result in substantial fines; for instance, violations of U.S. export control laws can lead to civil penalties up to $300,000 per violation or twice the value of the transaction, whichever is greater, and criminal penalties including imprisonment.

Navigating these complex legal frameworks is crucial for IDIS's international operations. The company must adhere to restrictions on sales to specific countries, entities, or individuals, particularly those targeted by sanctions regimes like those imposed by the United Nations, the U.S. Office of Foreign Assets Control (OFAC), or the EU. In 2023, OFAC continued to enforce sanctions against numerous countries and individuals, highlighting the ongoing need for rigorous due diligence in all international transactions.

- Export Control Compliance: Adherence to regulations like the Export Administration Regulations (EAR) is mandatory for technology sales.

- Sanctions Regimes: Understanding and complying with global sanctions, such as those administered by OFAC, is vital to avoid penalties.

- Dual-Use Technology: Special attention is required for products that could have both commercial and military applications, often subject to stricter controls.

- Penalty Avoidance: Non-compliance can lead to severe financial penalties and reputational damage, impacting global trade relationships.

IDIS must navigate a complex landscape of data privacy laws, including GDPR and CCPA, impacting how it handles captured video data. Ensuring compliance with these regulations, which are increasingly consumer-focused as evidenced by growing demand for data control in 2024, is critical for user trust and legal operation.

The company also faces stringent industry-specific regulations, particularly in finance and healthcare, which mandate high levels of security, encryption, and auditability for surveillance systems. Adherence to these specialized requirements is key to accessing and succeeding in these lucrative, regulated markets.

Intellectual property protection, especially for technologies like DirectIP, is vital for IDIS's competitive advantage, with global IP filings rising in 2024. Simultaneously, avoiding infringement on competitor IP is crucial, as patent litigation can cost millions annually for major tech firms.

Product liability laws hold IDIS accountable for defects, with product liability lawsuits seeing a notable increase across sectors in the US in 2024. Consumer protection statutes also mandate fair practices and warranty provisions, with advocacy for enhanced warranties expected to grow in 2025.

Export control and sanctions laws, such as those from the U.S. BIS and EU Dual-Use Regulation, govern technology transfers. Violations can incur substantial fines, with U.S. export control violations potentially reaching $300,000 per instance or twice the transaction value, alongside criminal penalties.

| Legal Factor | Impact on IDIS | 2024/2025 Relevance |

| Data Privacy (GDPR, CCPA) | Dictates data handling, storage, and processing. | Increased consumer demand for data control; heightened regulatory scrutiny. |

| Industry-Specific Regulations | Mandates security, encryption, and audit trails for sectors like finance. | Unlocks access to highly regulated, high-value markets. |

| Intellectual Property | Protection of proprietary tech (DirectIP) and avoidance of infringement. | Rising global IP filings; high cost of patent litigation necessitates proactive management. |

| Product Liability & Consumer Protection | Accountability for product defects; fair business practices and warranty adherence. | Increased product liability lawsuits; growing advocacy for enhanced warranty protections. |

| Export Controls & Sanctions | Governs international tech transfer, especially dual-use items. | Significant fines for violations; ongoing enforcement of global sanctions regimes. |

Environmental factors

Clients are increasingly prioritizing sustainability, making the energy consumption of surveillance systems a key factor in purchasing decisions. This trend is driven by a global push towards greener operations, with many organizations setting ambitious net-zero targets by 2030 or 2050.

IDIS can leverage this by developing and highlighting its energy-efficient solutions. For instance, the company's IR illuminators in some of its cameras utilize advanced LED technology that consumes significantly less power compared to older models, potentially reducing energy usage by up to 30% for comparable illumination levels.

Beyond environmental benefits, lower power consumption directly translates to reduced operational expenses for end-users. This cost saving can be a significant differentiator, especially for large-scale deployments where energy bills can accumulate substantially over time.

Environmental regulations surrounding e-waste are becoming increasingly stringent globally. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive sets ambitious collection and recycling targets, with member states aiming for 85% of e-waste to be collected by 2024. IDIS must navigate these requirements, potentially investing in product take-back programs and designing products with recyclability in mind to comply with mandates like extended producer responsibility.

Adherence to these environmental mandates directly impacts product lifecycle management. Companies are expected to consider the entire lifespan of their products, from sourcing materials to end-of-life disposal. Sustainable manufacturing practices, such as reducing hazardous substances and improving energy efficiency in production, are no longer optional but are key drivers of stakeholder trust and brand reputation. For example, many electronics manufacturers are now publishing their Scope 1, 2, and 3 emissions data, with a growing focus on reducing these footprints throughout the value chain.

Businesses and governments are increasingly scrutinizing corporate social responsibility (CSR) and green initiatives. IDIS's proactive stance on environmental sustainability, going beyond mere regulatory adherence, can significantly bolster its brand image and attract environmentally aware clientele. This commitment is demonstrated through practices like sustainable sourcing, robust waste reduction programs, and diligent carbon footprint management.

Climate Change Impact on Operations and Infrastructure

Climate change presents a nuanced challenge for IDIS, primarily affecting supply chain resilience and product durability. Extreme weather events, such as floods or intense heatwaves, can disrupt manufacturing processes or logistics, impacting the timely delivery of surveillance equipment. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with global average temperature 1.45°C above pre-industrial levels, highlighting an increasing trend that could strain global supply chains.

This necessitates a strategic consideration for IDIS in designing products capable of withstanding more volatile environmental conditions. Think about outdoor surveillance cameras needing to endure higher temperatures or increased precipitation. The durability requirements for equipment exposed to the elements are likely to escalate, potentially influencing material choices and product lifecycle planning.

Furthermore, climate-related events can directly impact the infrastructure of IDIS clients. Power outages due to severe storms or damage to buildings from extreme weather could affect the operational capacity of surveillance systems. This means IDIS might need to offer solutions that are more robust against such disruptions or provide guidance on resilient deployment strategies for their customers.

- Supply Chain Disruption: Increased frequency of extreme weather events globally, as evidenced by record-breaking temperatures in 2023, poses a risk to manufacturing and logistics operations.

- Product Durability: Designing surveillance equipment to withstand harsher environmental conditions, such as extreme heat or heavy rainfall, becomes crucial for reliable outdoor performance.

- Client Infrastructure Vulnerability: Climate-induced events like power outages or physical damage to client sites can impact the functionality and uptime of installed IDIS systems.

Sustainable Sourcing and Supply Chain Ethics

Companies are facing increasing scrutiny regarding the environmental and ethical practices within their supply chains. IDIS must actively evaluate its suppliers to ensure they meet stringent environmental standards, focusing on responsible material sourcing and efforts to reduce ecological footprints throughout manufacturing. For instance, by 2025, a significant portion of global consumers, estimated at over 70%, are expected to consider sustainability as a key factor in purchasing decisions, directly impacting brand reputation.

Transparency in supply chain operations is no longer optional but a critical component for maintaining a positive corporate image and building consumer trust. IDIS should implement robust systems for tracking and verifying the ethical and environmental compliance of its suppliers. Reports from 2024 indicate that companies with transparent supply chains experienced an average of 10% higher customer loyalty compared to those with opaque practices.

- Supplier Audits: Implement regular audits to verify adherence to environmental regulations and ethical labor practices.

- Material Traceability: Enhance systems to trace the origin of raw materials, ensuring they are sourced responsibly.

- Carbon Footprint Reduction: Work with suppliers to set and achieve targets for reducing greenhouse gas emissions in their operations.

- Ethical Labor Standards: Ensure all suppliers uphold fair labor laws, including safe working conditions and fair wages.

Growing consumer and regulatory pressure emphasizes energy efficiency and reduced environmental impact in electronics. IDIS's focus on power-saving technologies, like advanced LED IR illuminators, directly addresses this, potentially cutting camera energy use by up to 30% and lowering operational costs for clients.

Stringent e-waste regulations, such as the EU's WEEE Directive targeting 85% collection by 2024, necessitate responsible product lifecycle management. IDIS must consider recyclability and potentially implement take-back programs to comply with mandates like extended producer responsibility.

Climate change impacts supply chain resilience and product durability. Record-breaking global temperatures in 2023, 1.45°C above pre-industrial levels, underscore the need for equipment designed to withstand extreme weather, ensuring reliable performance in challenging conditions.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data sourced from leading international organizations, government statistical agencies, and reputable industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.