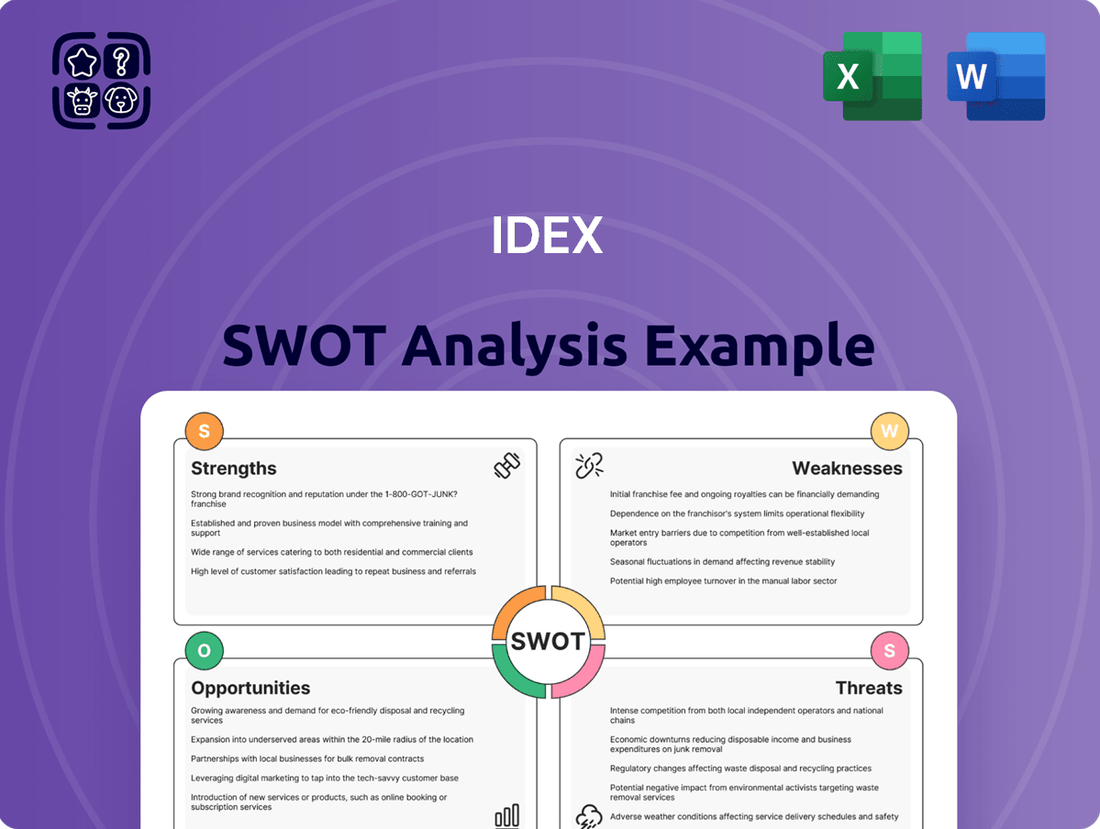

IDEX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

IDEX's strengths lie in its diversified product portfolio and established market presence, while its opportunities stem from emerging technologies and global expansion. However, potential threats like intense competition and regulatory changes require careful navigation.

Want the full story behind IDEX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IDEX Corporation boasts a highly diversified product portfolio, strategically positioned across critical industries like chemical processing, food and beverage, pharmaceuticals, and water management. This broad market reach, spanning its Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products segments, significantly mitigates risks associated with any single industry's performance. For example, in 2023, the Fluid & Metering Technologies segment generated approximately $940 million in revenue, showcasing its substantial contribution and stability.

The company's strength lies in its leadership within specialized, often overlooked, niche markets. These segments, while smaller, tend to offer higher margins and less intense competition, allowing IDEX to command significant market share and maintain strong profitability. This strategic focus on niches, where larger competitors may not see sufficient scale, underpins IDEX's consistent financial performance and competitive advantage.

IDEX has a strong history of successfully acquiring and integrating businesses, as seen with the September 2024 acquisition of Mott Corporation and the December 2023 addition of STC Material Solutions. These moves significantly broaden IDEX's technological expertise and extend its presence in various markets.

The company's adeptness at integrating these new entities is evident, with Mott Corporation already contributing positively to revenue and strengthening IDEX's position in critical sectors such as microfiltration and advanced materials science. This strategic integration enhances IDEX's overall product portfolio and market competitiveness.

IDEX demonstrates impressive financial resilience, boasting a healthy balance sheet and a consistent ability to generate substantial free cash flow. In 2024, the company achieved sales of $3.3 billion and a significant $603 million in free cash flow, which underpins its reliable dividend payments.

Operational Excellence and Cost Management

IDEX's operational excellence is a significant strength, driven by its proprietary '80/20' operating model. This framework streamlines processes and sharpens focus on high-impact markets and products, fostering efficiency across the organization.

This disciplined approach to cost management and operational productivity has been instrumental in preserving margins, even when facing market challenges. For instance, IDEX has identified substantial cost containment initiatives targeted for 2025, demonstrating a forward-looking strategy to bolster financial resilience.

Key aspects of this operational strength include:

- Enhanced Efficiency: The '80/20' model simplifies operations, allowing for better resource allocation.

- Margin Preservation: Disciplined cost management helps maintain healthy profit margins.

- Proactive Cost Containment: Specific cost reduction actions are planned for 2025 to counter potential headwinds.

Innovation and Focus on Critical Solutions

IDEX is deeply committed to innovation, consistently developing highly engineered products where peak performance, unwavering reliability, and exacting precision are absolutely paramount. This dedication to creating advanced solutions for critical sectors like life sciences, intelligent water management, and fire and safety strategically positions the company for robust growth within dynamic and evolving end markets.

The company's product portfolio often comprises essential, mission-critical components integrated into larger customer systems. For instance, IDEX's fluid and dispensing solutions are vital for diagnostic equipment in the life sciences sector, ensuring accurate sample handling and analysis. In the fire and safety segment, their specialized pumps and valves are crucial for the reliable operation of firefighting systems, directly impacting public safety.

This focus on critical applications means IDEX's offerings are not easily substituted, fostering strong customer loyalty and recurring revenue streams. The company reported that its Fire & Safety segment generated approximately $748 million in revenue for the fiscal year 2023, highlighting the significant market demand for its essential safety solutions.

- Innovation in Critical Applications: IDEX excels at creating highly engineered products where performance, reliability, and precision are non-negotiable.

- Strategic Market Focus: The company targets dynamic end markets such as life sciences, intelligent water, and fire and safety, ensuring relevance and growth potential.

- Mission-Critical Components: IDEX products often serve as indispensable parts of larger systems, making them vital to customer operations.

- Financial Performance Indicator: The Fire & Safety segment's 2023 revenue of $748 million underscores the market's reliance on IDEX's critical solutions.

IDEX's diversified product portfolio across essential industries like chemical processing, food and beverage, and life sciences significantly reduces reliance on any single market. This broad reach, exemplified by the Fluid & Metering Technologies segment's 2023 revenue of approximately $940 million, provides a stable foundation for growth. The company's strategic focus on niche markets, often characterized by higher margins and less competition, allows it to maintain strong profitability and a competitive edge.

IDEX demonstrates robust financial health, evidenced by its 2024 sales of $3.3 billion and $603 million in free cash flow, which supports consistent dividend payouts. Its operational excellence, driven by the proprietary '80/20' model, enhances efficiency and fosters margin preservation, with planned cost containment initiatives for 2025 further bolstering financial resilience.

The company's commitment to innovation is clear in its development of highly engineered, mission-critical products for sectors like life sciences and fire safety, where reliability is paramount. These essential components, such as those in the Fire & Safety segment which generated $748 million in 2023 revenue, foster strong customer loyalty and recurring revenue.

| Segment | 2023 Revenue (Approx.) | Key Strength |

| Fluid & Metering Technologies | $940 million | Diversified market reach, niche leadership |

| Fire & Safety/Diversified Products | $748 million | Mission-critical products, strong demand |

| Health & Science Technologies | N/A (Integrated into overall performance) | Innovation in critical applications |

What is included in the product

Analyzes IDEX’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT breakdown to identify and address critical business challenges.

Weaknesses

IDEX Corporation's reliance on sectors like semiconductors, automotive, and agriculture exposes it to significant cyclicality. For instance, the automotive industry saw production challenges in early 2024 due to supply chain issues, directly impacting demand for IDEX's fluidic solutions. This inherent sensitivity means that downturns in these key markets can directly translate to softer demand and slower revenue growth for IDEX.

Furthermore, broader macroeconomic challenges pose a threat. Persistent inflation and rising interest rates throughout 2024 have increased operating costs and potentially reduced capital expenditure by IDEX's customers. Global trade tensions and tariffs also create uncertainty, potentially disrupting supply chains and impacting the cost-competitiveness of IDEX's products in international markets, as seen with ongoing discussions around tariffs impacting semiconductor components.

Acquisitions, while a key growth strategy for IDEX, introduce significant integration risks. These can manifest as challenges in merging operations, cultures, and systems, potentially hindering the expected synergies. For instance, the integration of acquired businesses requires careful management to avoid disruptions.

Furthermore, acquisitions often lead to increased amortization expenses from intangible assets and higher interest costs from financing. These expenses directly impact IDEX's net income and earnings per share (EPS), potentially creating a drag on profitability in the short to medium term.

The pace at which acquired businesses, like Mott, achieve their projected growth can also be a challenge. Slower-than-expected acceleration can temporarily dilute profit margins and overall earnings, making it harder to achieve the full financial benefits of the acquisition.

IDEX has faced challenges with declining organic sales growth in specific areas, notably its Fluid & Metering Technologies segment. This segment saw a dip in net sales, primarily driven by reduced volumes in key end markets such as chemical, agriculture, and semiconductors.

While IDEX anticipates overall organic growth in 2025, the slowdown in these particular segments compared to past performance indicates a hurdle in achieving uniform growth across all its business units. This disparity in performance can create headwinds for the company's overall revenue trajectory.

Impact of Higher Operating Expenses

IDEX Corporation has grappled with escalating operating expenses, particularly concerning employee-related costs and discretionary spending. These increased expenditures have somewhat diminished the positive impact of strong pricing strategies and improved operational efficiency.

While IDEX is actively pursuing cost containment measures, the persistent rise in operating expenses poses a challenge to maintaining healthy adjusted EBITDA margins and overall profitability. This ongoing cost management is crucial in navigating a fluctuating economic landscape.

- Employee Costs: Rising wages and benefits contribute significantly to higher operating expenses.

- Discretionary Spending: Increased investment in areas like marketing or R&D, while potentially beneficial long-term, adds to near-term cost pressures.

- Margin Pressure: Higher operating costs can directly impact the company's ability to translate revenue growth into profit.

- Economic Sensitivity: The dynamic economic environment necessitates continuous vigilance in controlling costs to protect profitability.

Potential for Slower Decision-Making and Order Patterns

IDEX management has observed a trend of increased customer caution, especially within industrial sectors. This heightened prudence translates into slower decision-making processes, which can result in less predictable order patterns and fluctuating demand. For instance, in the first quarter of 2024, the company noted a slowdown in order intake for certain industrial equipment compared to the previous year, a direct consequence of this cautious customer behavior.

This uncertainty in how customers are making purchasing decisions poses a significant challenge for accurate forecasting. The resulting 'choppy' order flow can make it difficult to project future revenue streams reliably and can impede consistent backlog growth, even when underlying market demand remains robust in other segments. This variability directly impacts operational planning and resource allocation.

- Slower Industrial Market Decisions: Customers in industrial markets are exhibiting increased caution, leading to longer sales cycles.

- Choppy Order Patterns: This caution results in less consistent order flow, making demand prediction more challenging.

- Forecasting Difficulties: The unpredictable nature of customer behavior complicates revenue and backlog growth projections.

- Impact on Revenue Streams: Inconsistent demand can negatively affect the predictability and stability of future revenue.

IDEX's reliance on cyclical industries like automotive and semiconductors means its performance can fluctuate significantly with market downturns. For example, the semiconductor industry experienced a slowdown in mid-2024, impacting demand for IDEX's specialized components. This sensitivity to economic cycles can lead to unpredictable revenue streams and pressure on profitability during unfavorable periods.

The company also faces challenges with integration risks associated with its acquisition strategy. Merging acquired businesses can lead to operational disruptions and higher amortization expenses, potentially diluting earnings per share. Successfully realizing synergies from these acquisitions remains a key hurdle for sustained growth and profitability.

Escalating operating expenses, particularly employee-related costs, are also a concern. Despite cost-containment efforts, rising wages and discretionary spending can erode profit margins, making it difficult to maintain healthy EBITDA. This requires continuous vigilance in expense management to offset inflationary pressures.

Customer caution in industrial sectors has led to slower decision-making and less predictable order patterns throughout 2024. This 'choppy' order flow complicates forecasting and can hinder consistent backlog growth, impacting the stability of future revenue streams.

| Weakness | Description | Impact | Example/Data Point (2024/2025) |

|---|---|---|---|

| Cyclical Industry Reliance | Exposure to volatile sectors like automotive and semiconductors. | Revenue and profit fluctuations; reduced demand during downturns. | Semiconductor market slowdown in mid-2024 affected demand for IDEX components. |

| Acquisition Integration Risks | Challenges in merging operations, cultures, and systems of acquired companies. | Operational disruptions, higher amortization, potential earnings dilution. | Integration of acquired businesses requires careful management to avoid synergy loss. |

| Rising Operating Expenses | Increased employee costs and discretionary spending. | Pressure on profit margins and EBITDA; reduced profitability. | Persistent rise in wages and benefits impacting overall cost structure. |

| Customer Caution & Choppy Orders | Slower decision-making and unpredictable order patterns in industrial markets. | Forecasting difficulties, inconsistent backlog growth, revenue instability. | Q1 2024 saw a slowdown in order intake for certain industrial equipment due to customer prudence. |

Same Document Delivered

IDEX SWOT Analysis

This is the actual IDEX SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of IDEX's strategic position.

You’re viewing a live preview of the actual IDEX SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for your business planning.

Opportunities

IDEX's established global footprint presents a prime opportunity for expansion, especially within emerging markets experiencing robust industrial growth. This global reach allows IDEX to tap into diverse customer bases and leverage varying economic cycles.

The company is well-positioned to benefit from secular growth trends, particularly in its Health & Science Technologies segment, driven by increasing demand for innovative disease therapies. Furthermore, IDEX can capitalize on the growing need for intelligent water solutions, advancements in space technologies, and the global shift towards energy transition.

For instance, the global water and wastewater treatment market was projected to reach approximately $700 billion by 2024, showcasing the significant potential within the intelligent water sector. Strategic capital allocation towards these high-growth areas is anticipated to fuel substantial long-term revenue expansion and market share gains for IDEX.

IDEX has a prime opportunity to capitalize on its robust research and development strengths by innovating and launching new products tailored to changing customer preferences and market trends. For instance, in 2024, the company is investing heavily in next-generation fluidic solutions, aiming to capture a larger share of the growing medical diagnostics market, which is projected to reach $100 billion by 2028.

New product introductions in critical sectors such as semiconductor manufacturing equipment, advanced medical testing devices, and essential energy infrastructure components present a clear path to generating fresh revenue streams and solidifying IDEX's competitive edge. The company's strategic focus on advanced materials and digital integration is expected to boost its product portfolio's value proposition significantly.

IDEX's strategic acquisition strategy, focused on niche businesses that align with its current offerings, provides a significant avenue for inorganic growth. This disciplined approach allows for the integration of complementary capabilities and market access. For instance, the acquisition of **Capstan** in late 2023 expanded IDEX's precision fluidics capabilities, particularly in the life science and medical sectors, demonstrating the company's commitment to targeted expansion.

Further strategic acquisitions can broaden IDEX's geographical footprint and introduce cutting-edge technologies. By consolidating its presence in key market segments, such as the semiconductor industry where IDEX already holds a strong position, the company can solidify its competitive advantage and enhance its overall product portfolio. This inorganic growth complements its organic development efforts, creating a more robust and diversified business.

Leveraging Cross-Selling Synergies Across Segments

IDEX's diverse business structure, spanning fluid and advanced technologies, offers a significant opportunity to create powerful cross-selling synergies. By integrating solutions from its various segments, the company can develop more robust and complete customer offerings, driving revenue growth. For instance, combining its expertise in precision fluid handling with the capabilities of its recently acquired filtration businesses can lead to enhanced product bundles, appealing to a broader customer base and unlocking new market potential through tailored solutions.

This internal collaboration is key to realizing incremental revenue. In 2023, IDEX reported that its acquired businesses contributed significantly to its growth, and further integration can amplify these results.

- Enhanced Customer Value: Bundling filtration solutions with existing fluidic systems provides customers with a more comprehensive and integrated offering, simplifying procurement and improving operational efficiency.

- Market Penetration: Leveraging existing customer relationships in one segment to introduce products from another can open up new avenues for market penetration and increased share of wallet.

- Revenue Diversification: Successful cross-selling reduces reliance on any single product line or market, contributing to more stable and diversified revenue streams.

- Innovation Synergy: The combined knowledge and technology from different IDEX segments can foster innovation, leading to the development of entirely new, integrated product categories.

Increased Demand for Sustainable and Low-Carbon Solutions

The intensifying global emphasis on sustainability and reduced carbon emissions presents a significant avenue for IDEX. The company’s existing footprint in municipal water and wastewater treatment, coupled with its capacity for developing energy-efficient fluidics systems, directly aligns with the escalating market appetite for eco-friendly solutions. This strategic positioning allows IDEX to tap into a growing demand for environmentally responsible technologies.

Furthermore, this trend is often bolstered by governmental incentives and substantial infrastructure investments aimed at promoting green initiatives. For instance, the US Bipartisan Infrastructure Law, enacted in 2021, allocated over $50 billion for water infrastructure improvements, including projects focused on resilience and sustainability. IDEX’s fluid handling technologies are well-suited to support such projects, potentially leading to increased sales and market share in the environmentally conscious sector.

- Growing Green Investment: Global sustainable finance is projected to reach $50 trillion by 2025, indicating a strong financial backing for companies prioritizing environmental impact.

- Water Infrastructure Needs: The World Bank estimates that global investment in water infrastructure needs to double to $1 trillion annually to meet future demands, a key area for IDEX.

- Government Support: Numerous governments worldwide are implementing policies and offering grants to encourage the adoption of low-carbon technologies, directly benefiting companies like IDEX.

IDEX's robust research and development capabilities present a significant opportunity to innovate and launch new products that cater to evolving customer needs and market dynamics. The company's focus on next-generation fluidic solutions in 2024, targeting the medical diagnostics market projected to reach $100 billion by 2028, exemplifies this strategic advantage.

Strategic acquisitions of niche businesses that complement existing offerings provide a clear path for inorganic growth, expanding market access and integrating new technologies. The acquisition of Capstan in late 2023, for instance, bolstered IDEX's precision fluidics expertise in life sciences.

Leveraging cross-selling synergies across its diverse business segments allows IDEX to offer more comprehensive solutions to customers, driving revenue growth and market penetration. Integrating filtration solutions with existing fluidic systems enhances customer value and diversifies revenue streams.

The global push for sustainability and reduced carbon emissions aligns perfectly with IDEX's expertise in water treatment and energy-efficient fluidics. This trend, supported by substantial government investments like the over $50 billion allocated for water infrastructure improvements in the US Bipartisan Infrastructure Law, offers significant growth potential.

Threats

The industrial products sector is inherently competitive, and IDEX is not immune to the threat of intensifying rivalry. This can translate directly into significant pricing pressures, potentially eroding IDEX's market share and impacting its overall profitability.

Competitors are continually striving to gain an advantage, often by introducing comparable products or employing more aggressive pricing strategies. For IDEX, this necessitates a constant focus on innovation and maintaining its competitive edge to counter these market dynamics.

For instance, in the first quarter of 2024, IDEX reported a 2% organic revenue decline, partly attributed to a challenging pricing environment in certain segments, underscoring the real-world impact of these competitive pressures.

Global economic downturns and financial market volatility present a significant threat to IDEX. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2024, down from 3.2% in 2023, indicating a potentially weaker demand environment for industrial products. This slowdown can directly impact IDEX's order volumes and revenue streams.

Geopolitical tensions, particularly those affecting key manufacturing regions or supply chains, also pose a substantial risk. Disruptions in the semiconductor industry, a critical component for many of IDEX's products, could lead to production delays and increased costs. For example, ongoing trade disputes and regional conflicts in Asia, a major hub for electronics manufacturing, create an unpredictable operating landscape.

IDEXX Laboratories (IDEX) faces significant threats from ongoing global supply chain disruptions and unpredictable swings in material costs. These vulnerabilities directly impact their ability to maintain consistent production schedules and manage manufacturing expenses, potentially squeezing profitability. For instance, the semiconductor shortage, a persistent issue throughout 2023 and into early 2024, has affected the availability of critical components for diagnostic instruments and laboratory equipment, leading to extended lead times for customers.

Such disruptions can cause production delays, inflate manufacturing costs due to expedited shipping or alternative sourcing, and ultimately hinder IDEX's capacity to fulfill customer orders promptly. This inability to meet demand not only affects revenue streams but also erodes customer satisfaction and loyalty. Furthermore, the company must navigate the challenges posed by tariff-related inflation, which can further escalate the cost of raw materials and finished goods, adding another layer of complexity to their operational planning and pricing strategies.

Currency Fluctuations and Trade Policy Changes

Currency fluctuations pose a significant risk to IDEX, particularly given its substantial international sales. A strengthening U.S. dollar, for instance, can make its products more expensive for overseas buyers, potentially dampening demand and impacting revenue generated from foreign markets. This dynamic directly affects pricing strategies and cost competitiveness on a global scale.

Changes in trade policy, including tariffs, present another considerable threat. For example, tariffs imposed on goods imported from China could directly increase IDEX's cost of goods sold for components sourced from that region, thereby squeezing profit margins. Such policy shifts can create immediate and unpredictable impacts on the company's financial performance and operational planning.

- Currency Risk: A stronger USD can negatively impact IDEX's international sales revenue and price competitiveness.

- Tariff Impact: Tariffs on imported components, especially from China, can directly increase IDEX's cost of goods sold and reduce profitability.

- Trade Policy Uncertainty: Evolving trade agreements and potential new tariffs create an unpredictable operating environment for IDEX.

Cybersecurity Incidents and Data Privacy Risks

As a global entity heavily reliant on digital infrastructure, IDEX is continually exposed to the persistent threat of cybersecurity incidents. A significant data breach or a critical system failure could result in substantial financial repercussions, severe damage to its brand image, and considerable legal liabilities. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure IDEX must actively mitigate.

These risks necessitate ongoing, robust investment in advanced cybersecurity protocols and comprehensive data privacy strategies. Failure to adequately protect sensitive information not only jeopardizes customer trust but also invites regulatory scrutiny and potential penalties, impacting operational continuity and market standing.

- Data Breach Costs: The average cost of a data breach globally was $4.45 million in 2023, highlighting the financial exposure.

- Reputational Impact: Cybersecurity failures can erode customer confidence, leading to lost business and long-term brand damage.

- Regulatory Fines: Non-compliance with data privacy regulations like GDPR can result in substantial financial penalties.

Intensifying competition remains a significant threat, with rivals frequently introducing comparable products or employing aggressive pricing. This dynamic pressures IDEX's market share and profitability. For example, IDEX experienced a 2% organic revenue decline in Q1 2024, partly due to this challenging pricing environment.

Global economic slowdowns and geopolitical instability also pose risks, impacting demand and supply chains. The IMF projected slower global growth for 2024, potentially reducing orders for industrial products. Disruptions in critical sectors like semiconductors, due to trade disputes, further complicate operations.

Supply chain vulnerabilities and material cost volatility directly affect IDEX's production schedules and expenses. Persistent semiconductor shortages into early 2024 have already led to extended lead times for customers. Currency fluctuations, particularly a strong USD, can also dampen international sales.

Cybersecurity threats represent a constant danger, with the average cost of a data breach reaching $4.45 million in 2023. A breach could lead to significant financial losses, reputational damage, and legal liabilities, necessitating ongoing investment in robust security measures.

| Threat Category | Specific Risk Example | Financial Impact/Data Point |

| Competition | Pricing Pressure | 2% organic revenue decline (Q1 2024) |

| Economic/Geopolitical | Slower Global Growth | IMF projects 2.8% global growth in 2024 (down from 3.2% in 2023) |

| Supply Chain | Semiconductor Shortage | Extended lead times for customers |

| Currency | Strong USD | Reduced international sales competitiveness |

| Cybersecurity | Data Breach | Average cost of $4.45 million (2023) |

SWOT Analysis Data Sources

This analysis leverages a robust blend of primary and secondary data, including IDEX's official financial filings, comprehensive market research reports, and insights from industry analysts to provide a well-rounded perspective.