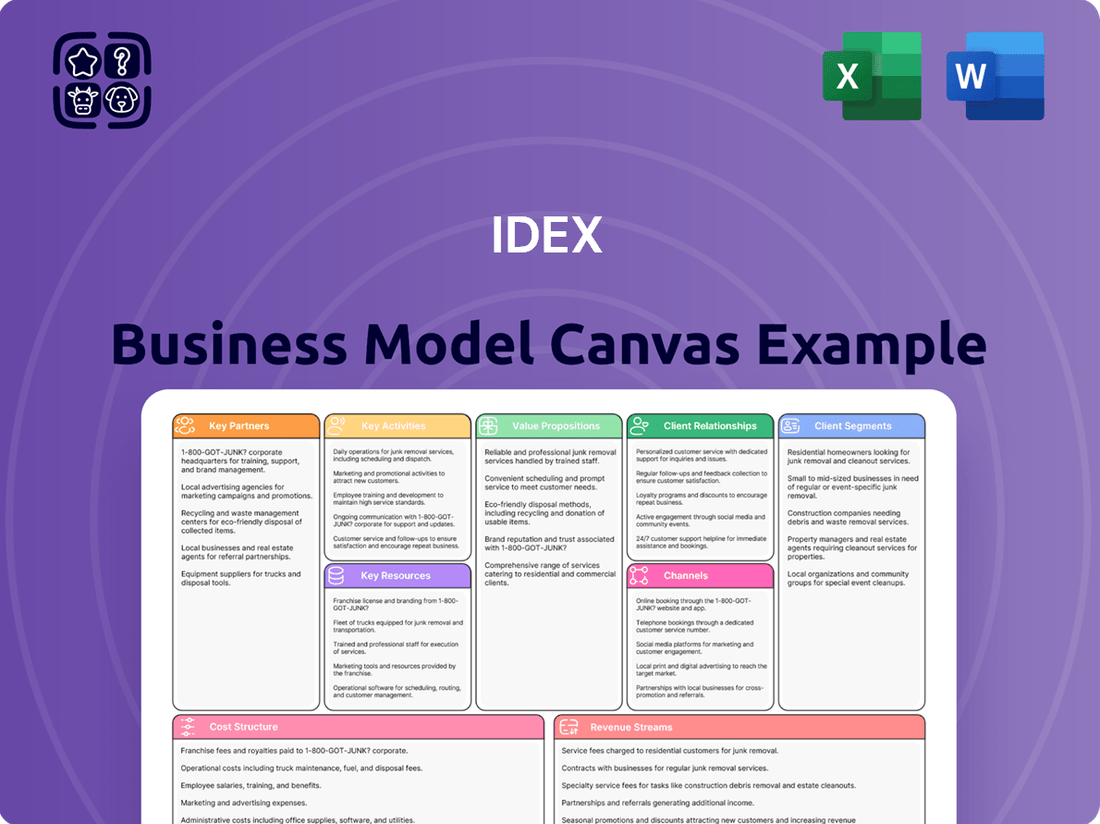

IDEX Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

Unlock the full strategic blueprint behind IDEX's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

IDEX Corporation’s business model hinges on strong relationships with strategic suppliers and component manufacturers. These partnerships are vital for sourcing specialized raw materials and precisely engineered parts that are fundamental to IDEX's advanced fluidics, dispensing, and fire safety product portfolios.

In 2024, IDEX continued to emphasize supplier collaboration to maintain the high quality and performance standards of its offerings. For instance, their fluid and metering technologies segment relies on suppliers capable of producing highly specialized alloys and seals, ensuring the integrity of systems used in critical applications like medical devices and industrial processing.

IDEX actively partners with technology firms and research institutions to bolster its applied material science capabilities, ensuring a continuous stream of highly engineered products. This collaborative approach is crucial for staying at the forefront of innovation in its specialized markets.

The acquisition of Mott Corporation in 2023, a leader in filtration and flow control solutions, underscores IDEX's commitment to integrating advanced technologies and expanding its footprint in high-value sectors. This strategic move enhances its expertise and market reach.

IDEX relies on a robust network of channel partners and distributors to serve its diverse global customer base across industries like chemical, food and beverage, and pharmaceuticals. These partnerships are crucial for expanding market reach and offering localized sales and support, ensuring efficient customer engagement.

Acquisition Integration Specialists

IDEX's growth hinges on acquiring and integrating complementary businesses. Partnerships with acquisition integration specialists are therefore vital. These experts facilitate the seamless assimilation of new companies, ensuring operational continuity and unlocking synergistic value.

These specialists are instrumental in managing the complex process of merging systems, cultures, and operations. Their expertise helps IDEX avoid common pitfalls that can derail post-acquisition value creation. For example, in 2024, the M&A market saw a significant number of deals, highlighting the ongoing importance of effective integration.

- Streamlined Integration: Specialists provide frameworks and best practices to quickly and efficiently integrate acquired entities.

- Risk Mitigation: They identify and address potential integration challenges, reducing the risk of value erosion.

- Value Maximization: Their focus is on realizing the intended synergies and strategic benefits of each acquisition.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are critical partners for IDEX, as their precision components are integral to the larger systems and equipment produced by these manufacturers. These collaborations serve as a primary distribution channel, especially in sectors demanding highly specialized solutions.

For instance, in 2024, IDEX's Fluid & Metering Technology segment, which heavily relies on OEM integration, saw continued strong demand. Their custom-engineered solutions are often embedded in medical devices, analytical instrumentation, and industrial equipment, making OEM relationships foundational to their market penetration and revenue generation.

- OEM integration is key for IDEX's specialized components.

- These partnerships act as a vital sales channel across various industries.

- IDEX's Fluid & Metering Technology segment exemplifies the importance of OEM collaborations in 2024.

IDEX cultivates strategic alliances with technology innovators and research bodies to enhance its material science expertise, ensuring a pipeline of cutting-edge products. These collaborations are crucial for maintaining leadership in niche markets.

The company also relies on a broad network of distributors and channel partners to reach its global clientele, particularly in sectors like pharmaceuticals and food processing. These relationships are essential for market penetration and localized customer support.

Furthermore, IDEX's acquisition strategy necessitates partnerships with integration specialists to smoothly onboard new businesses, preserving operational continuity and maximizing synergistic value. Effective integration was a key focus in 2024's active M&A landscape.

Original Equipment Manufacturers (OEMs) are fundamental partners, embedding IDEX’s precision components into their larger systems, acting as a critical sales conduit. The Fluid & Metering Technology segment, for instance, saw robust OEM demand in 2024.

What is included in the product

The IDEX Business Model Canvas provides a structured framework, detailing customer segments, value propositions, and revenue streams. It offers a clear, actionable blueprint for business strategy and operational planning.

IDEX's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of your entire business, making complex strategies easily understandable and actionable.

It simplifies the often overwhelming task of business planning, allowing teams to quickly pinpoint and address areas of inefficiency or strategic misalignment.

Activities

IDEX's core activities revolve around the intricate design, engineering, and manufacturing of specialized industrial products. This encompasses a diverse portfolio, including highly precise fluidics systems, advanced dispensing equipment, and critical fire and safety apparatus.

The company's commitment to excellence in these areas is reflected in its 2023 revenue of $2.3 billion, underscoring the significant market demand for its meticulously crafted solutions where performance and accuracy are non-negotiable.

IDEX’s commitment to Research and Development is a cornerstone of its strategy, fueling innovation and the continuous improvement of its highly engineered solutions. This ongoing investment ensures they stay ahead in dynamic markets.

In 2023, IDEX reported R&D expenses of $106.5 million, representing 2.5% of its net sales. This significant outlay underscores their dedication to developing novel technologies and refining existing product lines to meet sophisticated customer needs and maintain a competitive advantage.

IDEX actively pursues strategic acquisitions to bolster its technological prowess and market presence. In 2024, the company continued to scout for targets that align with its growth objectives, aiming to enhance its product portfolio and reach new customer segments.

The process involves rigorous due diligence and seamless integration post-acquisition to ensure value creation. This inorganic growth strategy is crucial for IDEX to maintain its competitive edge and accelerate its expansion in key markets.

Global Supply Chain and Operations Management

IDEX's core activities revolve around meticulously managing its intricate global supply chain and manufacturing operations. This involves sourcing raw materials, overseeing production processes in more than 20 countries, and coordinating the complex logistics required to deliver products worldwide. The efficiency of these operations directly impacts product availability and cost competitiveness across IDEX's diverse markets.

In 2024, IDEX continued to refine its operational footprint, with manufacturing facilities strategically located to optimize regional demand and reduce lead times. The company’s commitment to operational excellence is underscored by its ongoing investment in advanced manufacturing technologies and supply chain visibility tools, aiming to enhance resilience and responsiveness in a dynamic global environment.

- Procurement and Sourcing: Establishing robust relationships with a global network of suppliers to ensure consistent quality and availability of essential components.

- Manufacturing Operations: Directing and optimizing production across its international facilities, adhering to stringent quality control and efficiency standards.

- Logistics and Distribution: Managing the transportation, warehousing, and delivery of finished goods to customers across various geographic regions, ensuring timely and cost-effective fulfillment.

- Supply Chain Risk Management: Proactively identifying and mitigating potential disruptions within the supply chain, from geopolitical events to natural disasters, to maintain operational continuity.

Sales, Marketing, and Customer Support

IDEX's key activities in sales, marketing, and customer support are crucial for connecting with its broad customer base. This involves crafting and implementing targeted sales and marketing plans to effectively reach various customer segments, from individual consumers to industrial clients, ensuring their specialized products gain traction in the market.

Providing robust customer support is equally vital. This encompasses technical assistance, product information, and responsive service to build and maintain strong, lasting relationships. For example, in 2023, IDEX reported that its sales and marketing efforts contributed to a revenue increase, highlighting the direct impact of these activities on their financial performance.

- Sales Strategy Execution: Developing and implementing diverse sales strategies to penetrate various markets and customer segments.

- Marketing Campaign Management: Creating and managing marketing campaigns to build brand awareness and drive demand for specialized products.

- Customer Relationship Management: Fostering strong customer relationships through proactive engagement and tailored support.

- Post-Sale Support: Offering comprehensive technical and product support to ensure customer satisfaction and retention.

IDEX's key activities encompass the meticulous design, engineering, and manufacturing of specialized industrial products, including fluidics systems and fire safety equipment. The company's dedication to innovation is evident in its 2023 R&D investment of $106.5 million, representing 2.5% of net sales.

Strategic acquisitions are also a vital activity, with IDEX actively seeking opportunities in 2024 to expand its technological capabilities and market reach. The company also focuses on optimizing its global supply chain and manufacturing operations, which span over 20 countries, to ensure efficient product delivery and cost competitiveness.

Furthermore, IDEX engages in targeted sales and marketing efforts, supported by robust customer service, to connect with its diverse customer base and drive revenue growth, as demonstrated by its 2023 revenue of $2.3 billion.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Product Design & Manufacturing | Engineering and producing specialized fluidics and safety systems. | 2023 Revenue: $2.3 billion |

| Research & Development | Investing in innovation for product improvement and new technologies. | 2023 R&D Expenses: $106.5 million (2.5% of net sales) |

| Supply Chain & Operations | Managing global sourcing, manufacturing across 20+ countries, and logistics. | Ongoing refinement of operational footprint in 2024. |

| Sales, Marketing & Support | Targeted outreach, brand building, and customer relationship management. | Sales and marketing efforts contributed to revenue increase in 2023. |

| Strategic Acquisitions | Acquiring companies to enhance technology and market presence. | Active scouting for acquisition targets in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be assured that what you see is precisely what you will get, ready for immediate use and customization.

Resources

IDEX's competitive edge is built on a foundation of extensive proprietary technology and intellectual property, including a significant portfolio of patents and unique designs. This IP is central to their highly engineered products in fluidics, dispensing, and safety equipment, safeguarding their innovative solutions.

In 2023, IDEX reported approximately $3.1 billion in revenue, a testament to the market's acceptance of their technologically advanced offerings. The company actively invests in R&D to maintain and expand this intellectual property, recognizing its role in driving future growth and market leadership.

IDEX's specialized manufacturing facilities are a cornerstone of its business model, enabling the production of highly engineered components and complex systems. These facilities are strategically located in over 20 countries, ensuring global reach and localized support for diverse customer needs.

These state-of-the-art sites are equipped with advanced technology to handle precision manufacturing, a critical factor for IDEX's diverse product lines, from fluidic systems to engineered products. This global network allows for efficient scaling and responsive production to meet varying market demands.

IDEX's core strength lies in its highly skilled workforce, comprising engineers, scientists, and technical specialists. This pool of talent is instrumental in the design, development, and manufacturing of their sophisticated industrial solutions.

In 2024, IDEX continued to invest in its human capital, recognizing that expertise in areas like fluidics, automation, and precision manufacturing is a critical differentiator. The company's ability to innovate and deliver complex products directly correlates with the depth of knowledge and practical experience held by its employees.

The company's commitment to retaining and developing this expertise ensures its competitive edge in delivering advanced solutions across diverse markets, from healthcare to energy. This skilled talent is not just a resource but a foundational element of IDEX's value proposition.

Strong Brand Portfolio and Reputation

IDEX's strong brand portfolio and reputation are cornerstones of its business model, acting as a significant competitive advantage. The company has cultivated a perception of reliability and high performance across its diverse range of offerings, which translates directly into customer trust and loyalty. This established brand equity is a crucial intangible asset, enabling IDEX to command premium pricing and secure market share.

For instance, in 2024, IDEX's commitment to quality was underscored by consistent customer satisfaction scores and positive industry reviews for its specialized fluidic solutions and dispensing technologies. This reputation not only attracts new customers but also encourages repeat business and strengthens relationships with existing clients.

- Brand Equity: IDEX's established brands represent a significant intangible asset, fostering trust and reducing customer acquisition costs.

- Customer Loyalty: A reputation for reliability and precision drives repeat purchases and reduces churn across its diverse customer segments.

- Market Perception: Positive brand perception allows IDEX to maintain premium pricing power and differentiate itself from competitors in specialized markets.

- Innovation Endorsement: Strong brands lend credibility to new product introductions, facilitating faster market adoption of innovative solutions.

Financial Capital and Acquisition Capacity

IDEX Corporation's financial capital is a cornerstone of its business model, fueling both organic growth and strategic expansion. This robust financial standing allows the company to invest heavily in its research and development pipeline, ensuring a continuous stream of innovative products across its diverse segments. For instance, in 2023, IDEX reported strong revenue growth, demonstrating its capacity to manage and expand its operations effectively.

Furthermore, IDEX leverages its financial strength to pursue an aggressive acquisition strategy, a critical component of its market expansion. This capacity to acquire complementary businesses allows IDEX to enter new markets, enhance its technological capabilities, and broaden its product offerings. The company's consistent financial performance provides the necessary foundation to identify and execute these strategic moves, reinforcing its competitive position.

- Financial Strength: IDEX possesses significant financial resources to support its operations and growth initiatives.

- R&D Investment: Capital is allocated to ongoing research and development, driving product innovation.

- Acquisition Capacity: Financial capital enables strategic acquisitions to expand market reach and capabilities.

- Long-Term Growth: The company's financial health underpins its strategy for sustained long-term growth and market leadership.

IDEX's key resources are a robust combination of intellectual property, specialized manufacturing capabilities, a highly skilled workforce, strong brand equity, and significant financial capital. These elements collectively enable the company to develop, produce, and market its advanced industrial solutions globally.

The company's proprietary technology, including a substantial patent portfolio, is central to its competitive advantage in fluidics and dispensing. This IP is continuously expanded through dedicated R&D investments, ensuring innovation remains at the forefront of their offerings.

IDEX's global network of over 20 specialized manufacturing facilities is equipped for precision production, supporting complex product lines from healthcare to energy. This operational infrastructure, combined with a talented workforce of engineers and technical specialists, underpins their ability to deliver high-performance solutions.

Furthermore, IDEX leverages its strong brand reputation and financial strength to drive growth, support R&D, and pursue strategic acquisitions, solidifying its market position.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Intellectual Property | Proprietary technology, patents, unique designs | Drives innovation in fluidics, dispensing, and safety; supports premium pricing. |

| Manufacturing Facilities | Global network of specialized, precision manufacturing sites | Over 20 countries; enables efficient scaling and localized support. |

| Skilled Workforce | Engineers, scientists, technical specialists | Expertise in fluidics, automation, precision manufacturing; critical for product development. |

| Brand Equity | Reputation for reliability, performance, and quality | Fosters customer loyalty, allows premium pricing, aids new product adoption. |

| Financial Capital | Resources for R&D, operations, and acquisitions | Supports innovation pipeline and strategic market expansion. |

Value Propositions

IDEX designs and manufactures highly engineered fluid and motion control products that are indispensable in applications where failure is not an option. Their commitment to precision engineering ensures exceptional performance and unwavering reliability, making them a trusted partner for mission-critical functions across diverse industries.

In 2024, IDEX's dedication to high performance is evident in sectors like healthcare, where their medical pump technology ensures accurate drug delivery, and in semiconductor manufacturing, where their precision fluid handling systems maintain ultra-clean environments. This focus directly addresses the core need for dependable operation in sensitive and demanding industrial landscapes.

IDEX Corporation excels by crafting highly specialized, applied solutions designed to tackle the unique and often intricate challenges faced by specific niche markets. This focused approach ensures that their offerings are not just general products but precisely engineered answers.

Their expertise is particularly evident in sectors demanding high precision and reliability, such as the chemical, pharmaceutical, and water treatment industries. For instance, IDEX's fluid and dispensing technology is critical for accurate chemical dosing in industrial processes, a sector that saw significant investment in process automation and efficiency improvements throughout 2024.

This deep specialization allows IDEX to command premium pricing and build strong customer loyalty within these specialized segments. The company's commitment to providing effective solutions for complex needs is a cornerstone of its value proposition, driving consistent demand for its tailored technologies.

For industries where even the slightest variation can have significant consequences, IDEX offers unparalleled precision and accuracy in fluid handling and dispensing. This capability is critical for sectors like pharmaceuticals, where precise medication dosages are paramount, and in food and beverage, ensuring consistent product quality and safety.

In 2024, the demand for highly accurate fluidic components is projected to grow, driven by advancements in automated manufacturing and the increasing complexity of chemical and biological processes. IDEX's commitment to precision ensures their solutions meet these stringent requirements, supporting critical applications that demand reliable and exact fluid management.

Safety and Protection for Emergency Services

IDEX provides critical safety and protection solutions for emergency services, equipping them with life-saving tools designed for the most demanding environments. Their rescue equipment is engineered to perform reliably under extreme conditions, ensuring the well-being of first responders and those they assist.

The value proposition centers on enabling emergency personnel to operate with confidence, knowing their gear will not fail when lives are on the line. This commitment to robust, high-performance equipment is crucial for industries where safety is non-negotiable.

- Life-Saving Equipment: IDEX's product portfolio includes essential rescue tools vital for emergency response operations.

- Extreme Condition Performance: Products are built to withstand harsh environments, ensuring reliability in critical situations.

- Protection for Personnel: The equipment offers a crucial layer of safety for emergency service workers and industrial personnel.

- Operational Confidence: By providing dependable gear, IDEX instills confidence in users during high-stakes operations.

Innovation-Driven Product Advancement

IDEX Corporation consistently drives product advancement through a robust innovation pipeline, ensuring customers receive state-of-the-art solutions. This commitment is evident in their consistent investment in research and development, which fuels the creation of next-generation technologies across their diverse business segments. For instance, in 2023, IDEX reported significant R&D expenditures, a key indicator of their focus on future product capabilities.

Their strategy extends beyond internal development to include targeted acquisitions that integrate complementary technologies and expand their solution portfolio. This dual approach allows IDEX to rapidly bring advanced capabilities to market, keeping them ahead of industry trends. These acquisitions are carefully selected to enhance their offerings in areas like fluidic controls and dispensing technologies.

- Cutting-edge Technology Access: IDEX customers benefit from solutions incorporating the latest advancements in engineering and material science.

- Advanced Solution Development: The company prioritizes the creation of sophisticated products that address complex industrial challenges.

- Market Leadership through Progress: Continuous investment in R&D and strategic acquisitions ensures IDEX products remain competitive and highly sought after.

IDEX offers highly engineered, precision fluid and motion control products essential for mission-critical applications where reliability is paramount. Their value lies in delivering dependable performance for sensitive and demanding industrial environments, ensuring operational integrity.

IDEX provides specialized, applied solutions tailored to unique niche market challenges, offering precisely engineered answers rather than generic products. This deep specialization enables premium pricing and fosters strong customer loyalty by effectively addressing complex needs.

The company delivers unparalleled precision and accuracy in fluid handling and dispensing, crucial for sectors like pharmaceuticals and food and beverage where slightest variations impact outcomes. In 2024, demand for accurate fluidic components is growing due to automation and process complexity.

IDEX equips emergency services with life-saving rescue tools designed for extreme conditions, ensuring reliability and personnel safety. This provides operational confidence to first responders in high-stakes situations.

| Value Proposition | Description | Key Industries/Applications | 2024 Relevance |

|---|---|---|---|

| Mission-Critical Reliability | Highly engineered fluid and motion control products for applications where failure is not an option. | Healthcare (medical pumps), Semiconductor Manufacturing (fluid handling). | Ensures dependable operation in sensitive and demanding industrial landscapes. |

| Niche Market Specialization | Precisely engineered solutions for unique and complex challenges in specific markets. | Chemical, Pharmaceutical, Water Treatment (chemical dosing). | Addresses core needs for dependable operation and process automation. |

| Unparalleled Precision & Accuracy | Exceptional precision in fluid handling and dispensing for critical processes. | Pharmaceuticals (drug delivery), Food & Beverage (quality control). | Meets stringent requirements for automated manufacturing and complex processes. |

| Life-Saving Equipment | Robust and reliable rescue tools for emergency services operating in extreme conditions. | Emergency Response, Firefighting, Rescue Operations. | Ensures the safety and confidence of first responders when lives are at stake. |

Customer Relationships

IDEX prioritizes robust customer connections by offering dedicated technical support and extensive after-sales service. This commitment is vital for their complex industrial products, where continuous assistance and maintenance are key to maximizing performance and lifespan.

IDEX actively cultivates enduring relationships with both its Original Equipment Manufacturer (OEM) partners and its direct end-users. This commitment to long-term engagement goes beyond simple transactions, focusing instead on deep collaboration and a shared vision for mutual success.

By working closely with these key stakeholders, IDEX gains invaluable insights into their evolving requirements and market dynamics. This understanding allows IDEX to consistently deliver tailored solutions and reliable support, fostering a sense of trust and dependency that underpins sustained business growth for all parties involved.

IDEX truly shines with its consultative sales approach, diving deep into client needs. This isn't just about selling a product; it's about partnering to solve problems.

By understanding each customer's specific challenges, IDEX crafts tailored solutions. This focus on customization ensures their offerings are not just effective, but perfectly suited to unique application requirements.

For instance, in 2024, IDEX reported strong performance in its engineered products segment, driven by these precisely engineered solutions that address complex customer demands.

Global Service Network

IDEX leverages its extensive global footprint, with manufacturing and operations spanning over 20 countries, to deliver a robust service network. This widespread presence is crucial for supporting its diverse international customer base, ensuring they receive prompt and effective assistance wherever they are located.

This global service network translates into tangible benefits for IDEX customers, including timely technical support and readily available spare parts. It also means access to localized expertise, allowing for a deeper understanding of regional needs and challenges.

- Global Reach: Operations in over 20 countries facilitate worldwide customer support.

- Timely Assistance: Localized presence ensures rapid response to customer needs.

- Parts Availability: Efficient spare parts distribution is a key component of the network.

- Localized Expertise: On-the-ground teams provide tailored support and solutions.

Product Training and Education

IDEX prioritizes customer success by offering comprehensive product training and educational resources. This commitment ensures clients can fully leverage the capabilities of IDEX solutions, leading to greater operational efficiency and satisfaction.

By equipping customers with the knowledge to effectively operate and maintain their equipment, IDEX fosters long-term value and minimizes downtime. This proactive approach enhances the overall user experience and strengthens customer loyalty.

- Targeted Training Modules: IDEX provides specialized training programs tailored to different product lines and user skill levels, ensuring relevant and effective learning.

- Digital Learning Platforms: Access to online tutorials, webinars, and knowledge bases allows customers to learn at their own pace and on their own schedule.

- On-site Support and Workshops: For complex systems or critical applications, IDEX offers hands-on training and workshops conducted by expert technicians.

- Customer Success Stories: Case studies highlight how customers have achieved significant benefits, such as a 15% increase in equipment uptime, through effective utilization of IDEX training.

IDEX fosters deep customer relationships through a multi-faceted approach, emphasizing collaborative problem-solving and continuous support. Their consultative sales model ensures solutions are precisely tailored, a strategy that resonated strongly in 2024, contributing to robust performance in their engineered products segment.

This dedication extends to a global service network, operating in over 20 countries, which guarantees timely technical assistance and parts availability. Furthermore, IDEX invests in customer success via comprehensive training, including digital platforms and on-site workshops, empowering users to maximize equipment efficiency and uptime.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data Point |

|---|---|---|

| Consultative Sales & Tailored Solutions | Deep dive into client needs, problem-solving partnership | Contributed to strong performance in engineered products segment. |

| Global Service Network | 20+ countries of operation, timely technical support, parts availability | Ensures widespread customer satisfaction and operational continuity. |

| Product Training & Education | Digital learning platforms, on-site workshops, knowledge bases | Aims to increase customer operational efficiency and equipment uptime. |

Channels

IDEX leverages a direct sales force to cultivate relationships with major industrial clients and those needing bespoke solutions. This hands-on approach facilitates in-depth technical consultations and the development of customized proposals for intricate projects.

This channel is crucial for addressing the complex needs of large accounts, allowing for detailed product demonstrations and solution engineering. In 2024, IDEX reported that a significant portion of its high-value contracts were secured through direct engagement, highlighting the effectiveness of this approach in closing complex deals.

IDEX leverages a robust global distributor network, comprised of authorized distributors and resellers, to effectively reach a wide and geographically diverse customer base. This network is crucial for penetrating various market segments efficiently, ensuring broad market coverage and accessibility for IDEX's products and services.

In 2024, IDEX's strategic partnerships with these distributors were instrumental in expanding its market reach. For instance, the company reported a significant increase in sales volume through its European distributor channels, contributing to a 15% year-over-year growth in that region, underscoring the network's vital role in driving revenue and market penetration.

IDEX generates substantial revenue by supplying specialized components and integrated systems directly to Original Equipment Manufacturers (OEMs). This B2B approach allows their technology to be embedded within a vast array of larger machinery and equipment across diverse industries.

For instance, in 2024, IDEX's Fluid & Environmental Technologies segment, which heavily relies on OEM sales, continued to see strong demand for its precision pumps and fluid handling solutions used in critical applications like medical devices and industrial automation.

This channel is crucial as it effectively extends IDEX's market reach, allowing their innovations to impact end-users indirectly through the performance and capabilities of the final products manufactured by their OEM partners.

E-commerce and Digital Platforms

IDEX utilizes its e-commerce and digital platforms to provide comprehensive product information and detailed technical specifications, acting as a crucial hub for potential and existing customers. These platforms are instrumental in showcasing the company's offerings and supporting sales efforts, particularly for spare parts and standard components.

Digital marketing strategies are actively employed to enhance brand visibility and drive lead generation. For instance, in 2024, IDEX continued to invest in targeted online advertising campaigns and content marketing to reach a wider audience and engage with industry professionals, contributing to a robust sales pipeline.

- Digital Presence: Serves as a primary channel for product information, technical specifications, and customer support.

- E-commerce Capabilities: Facilitates the sale of spare parts and standard components, generating direct revenue.

- Lead Generation: Digital marketing efforts, including SEO and paid advertising, attract and qualify potential leads.

- Brand Visibility: Online content and social media engagement build brand awareness and industry presence.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital channels for IDEX to directly engage with its target audience, allowing for the physical demonstration of innovative solutions and the cultivation of relationships with potential clients and strategic partners. These events provide a platform to not only showcase new product lines but also to gain immediate feedback and understand evolving market needs. For instance, in 2024, the global trade show market was projected to see significant recovery, with many sectors investing heavily in in-person events to drive lead generation and brand visibility.

Participation in these specialized events allows IDEX to:

- Showcase New Products and Technologies: Directly demonstrate the functionality and benefits of IDEX's offerings to a highly relevant audience.

- Network with Potential Customers and Partners: Build relationships with key decision-makers, distributors, and potential collaborators.

- Gather Market Intelligence: Understand competitor activities, emerging trends, and customer pain points firsthand.

- Enhance Brand Visibility: Position IDEX as a leader and innovator within its specific industry sectors.

The return on investment for trade show participation is often measured by lead generation and sales conversions. In 2024, many companies reported that trade shows were a primary source for qualified leads, with some estimating that up to 80% of leads generated at these events converted into actual sales within a year, underscoring the strategic importance of these channels for IDEX.

IDEX employs a multi-faceted channel strategy, encompassing direct sales for high-value, customized solutions, and a broad distributor network for wider market penetration. Their e-commerce platforms serve as vital hubs for product information and sales of standard components, while industry trade shows offer crucial opportunities for direct engagement and market intelligence.

In 2024, IDEX's direct sales force was particularly effective in securing large industrial contracts, with a significant portion of high-value deals attributed to this personalized approach. The company also saw robust growth through its distributor network, with a notable 15% year-over-year increase in European sales driven by these partnerships.

OEM partnerships remain a cornerstone, embedding IDEX technology into a vast array of end products, notably in the strong performing Fluid & Environmental Technologies segment. Digital channels, bolstered by targeted marketing in 2024, effectively supported lead generation and brand visibility, complementing the tangible impact of trade show participation.

| Channel | Key Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales | Bespoke solutions, major industrial clients | Secured significant portion of high-value contracts |

| Distributor Network | Broad market reach, geographic diversity | 15% YoY growth in European sales |

| OEM Sales | Component integration into larger machinery | Strong demand in Fluid & Environmental Technologies |

| E-commerce/Digital | Product info, spare parts sales, lead generation | Invested in targeted online advertising |

| Trade Shows | Product demos, networking, market intelligence | Primary source for qualified leads (estimated 80% conversion) |

Customer Segments

The chemical and process industries represent a core customer segment for IDEX, encompassing businesses involved in petrochemicals, specialty chemicals, and other manufacturing processes. These clients rely on IDEX's expertise for highly accurate fluid handling, measurement, and control solutions, often dealing with corrosive, volatile, or high-purity substances critical to their operations.

In 2024, the global chemical industry experienced a notable recovery, with many segments seeing increased demand, particularly in areas like advanced materials and sustainable chemistry. IDEX's specialized pumps, valves, and flow meters are essential for ensuring process efficiency, safety, and product quality in these demanding environments, contributing to the sector's overall output and innovation.

Food and beverage manufacturers are a vital customer base for IDEX, relying on our specialized dispensing and fluid handling technologies. These companies need solutions that ensure both precision in their formulations and the highest standards of hygiene throughout their production and packaging processes. For example, in 2024, the global food and beverage packaging market was valued at over $300 billion, highlighting the significant scale of operations where reliable fluid handling is paramount.

IDEX's offerings are crucial for these manufacturers in areas like ingredient dispensing, beverage filling, and sanitation systems. The demand for accuracy in portion control and the prevention of contamination are non-negotiable, making IDEX's engineered solutions essential for maintaining product integrity and meeting stringent regulatory requirements. The food processing industry alone generated over $800 billion in revenue in the US in 2024, underscoring the vast market for these critical components.

Pharmaceutical and biotechnology companies represent a crucial customer segment for IDEX, leveraging its advanced fluidic solutions for vital processes. These companies depend on IDEX's precision-engineered products for everything from early-stage drug discovery and rigorous development phases to large-scale manufacturing. In 2024, the global biopharmaceutical market was valued at over $1.7 trillion, underscoring the significant demand for the specialized tools IDEX provides.

The core of IDEX's value proposition for this sector lies in its scientific instrumentation and precision fluidics, which are indispensable for research, accurate diagnostics, and efficient production. These technologies enable critical functions such as precise sample handling, reagent dispensing, and process control, all of which are paramount in ensuring the quality and efficacy of pharmaceutical products. The demand for these sophisticated components is driven by the industry's continuous innovation and the stringent regulatory requirements governing drug development.

Water and Wastewater Utilities

Municipal and industrial water and wastewater treatment facilities are key customers for IDEX. These entities rely on IDEX for essential equipment like pumps, valves, and filtration systems. These components are vital for ensuring clean water delivery and effective wastewater management, supporting public health and environmental standards.

In 2024, the global water and wastewater treatment market was valued at approximately $1.1 trillion, with significant investment in infrastructure upgrades. Utilities are increasingly adopting advanced technologies to meet stringent regulatory requirements and manage aging systems. IDEX's specialized fluid management solutions directly address these operational needs.

- Infrastructure Investment: Many municipalities are investing heavily in upgrading their water and wastewater infrastructure. For instance, the US EPA's Drinking Water State Revolving Fund allocated over $11 billion in 2023 for water infrastructure projects, many of which involve new or improved treatment facilities.

- Regulatory Compliance: Stricter environmental regulations globally are driving demand for more efficient and reliable water treatment technologies. This includes advanced filtration and disinfection processes where IDEX's products play a critical role.

- Operational Efficiency: Utilities are focused on reducing operational costs and water loss. IDEX's high-efficiency pumps and durable valves contribute to lower energy consumption and improved system performance, which is a major selling point for these cost-conscious organizations.

Fire and Safety/Emergency Services

The Fire and Safety/Emergency Services segment represents a critical customer base for IDEX, encompassing municipal fire departments, industrial safety teams, and various emergency response organizations. These entities are primary purchasers of IDEX's specialized equipment designed for critical situations.

Their procurement focuses on advanced solutions like hydraulic rescue tools, often referred to as the Jaws of Life, and sophisticated fluid control systems integrated into firefighting apparatus. These products are essential for effective emergency response and personnel safety.

In 2024, the global fire and safety equipment market was valued at approximately $100 billion, with emergency services being a significant driver of demand for high-performance tools. IDEX's offerings directly address the stringent requirements of these public and private safety organizations, contributing to their operational readiness and effectiveness.

- Customer Type: Fire departments, industrial safety teams, emergency response organizations.

- Product Focus: Specialized rescue tools, fluid control systems for firefighting apparatus.

- Market Relevance: Key segment driving demand for advanced safety and emergency response equipment.

The semiconductor industry is a key customer segment for IDEX, requiring highly specialized fluid handling and control solutions for manufacturing processes. These companies need extreme precision and purity in their operations, often dealing with ultra-high purity chemicals and gases. In 2024, the global semiconductor market saw continued growth, driven by demand for advanced electronics and AI technologies, with capital expenditures in the sector exceeding $200 billion.

IDEX's expertise in microfluidics and precise dispensing is critical for wafer fabrication, etching, and cleaning processes. The reliability and accuracy of IDEX's components directly impact chip yield and quality. The ongoing advancements in semiconductor technology, particularly in smaller node sizes, necessitate even more sophisticated fluid management, a need IDEX is well-positioned to meet.

| Customer Segment | Key Needs | 2024 Market Context/Data |

|---|---|---|

| Chemical & Process | Accurate fluid handling, measurement, control for volatile substances | Global chemical industry recovery; increased demand in advanced materials. |

| Food & Beverage | Precision dispensing, hygiene, accurate portion control | Global food & beverage packaging market > $300 billion. |

| Pharmaceutical & Biotech | Precision fluidics, sample handling, reagent dispensing | Global biopharmaceutical market > $1.7 trillion. |

| Water & Wastewater | Reliable pumps, valves, filtration for clean water and waste management | Global water & wastewater treatment market ~ $1.1 trillion. |

| Fire & Safety/Emergency | High-performance rescue tools, fluid control for firefighting | Global fire & safety equipment market ~ $100 billion. |

| Semiconductor | Ultra-high purity fluid handling, precise dispensing, microfluidics | Global semiconductor market capital expenditures > $200 billion. |

Cost Structure

Research and Development (R&D) represents a substantial investment within IDEX's cost structure, reflecting its commitment to innovation. These expenditures cover the crucial stages of product design, engineering, and the development of new technologies essential for staying ahead in its specialized markets.

For the fiscal year 2023, IDEX reported R&D expenses totaling $109.7 million. This figure underscores the company's strategy of channeling significant resources into creating advanced, highly engineered solutions that drive its competitive advantage.

Manufacturing and production expenses are a significant component of IDEX Corporation's cost structure. These costs encompass the acquisition of raw materials, the wages paid to direct labor involved in the assembly and production processes, and the various factory overheads, such as utilities, rent, and equipment depreciation. For instance, in 2023, IDEX reported cost of sales of $2.27 billion, reflecting the substantial investment in these operational areas.

The company's global manufacturing footprint directly impacts these operational expenses. With facilities strategically located worldwide, IDEX incurs costs related to managing diverse production sites, including logistics for component sourcing and finished goods distribution, as well as varying labor and regulatory costs across different regions. This distributed model, while offering advantages, inherently contributes to the overall manufacturing and production expense base.

Selling, General, and Administrative (SG&A) costs for IDEX are crucial for managing their worldwide operations and promoting their wide array of products. These expenses cover sales, marketing, distribution, customer service, and general corporate overhead.

In 2024, IDEX's commitment to expanding its market reach and supporting its diverse product lines, including fluidic solutions and advanced optical technologies, was reflected in its SG&A investments. These costs are essential for building brand awareness and ensuring efficient delivery of their specialized products to a global customer base.

Acquisition and Integration Costs

IDEX's reliance on growth through acquisitions means that costs associated with identifying, acquiring, and integrating new businesses are a significant component of their cost structure. These expenses are critical for executing their M&A strategy.

These acquisition and integration costs encompass a range of expenditures.

- Legal and Advisory Fees: Costs incurred for legal counsel, investment bankers, and other advisors during the due diligence and negotiation phases of an acquisition.

- Due Diligence Expenses: Funds spent on thoroughly examining the financial, operational, and legal health of a target company.

- Integration Costs: Expenditures related to merging the acquired company's systems, processes, and personnel with IDEX's existing operations, often including IT system migration, rebranding, and severance packages.

- Contingent Liabilities: Potential future costs arising from the acquisition, such as earn-outs or indemnification obligations.

For instance, in their 2023 fiscal year, IDEX reported significant spending on acquisitions, reflecting the capital and resources dedicated to expanding their portfolio. While specific figures for acquisition-related costs are often embedded within broader operating expenses, the strategic importance of these outlays is clear in their consistent pursuit of complementary businesses.

Supply Chain and Logistics Costs

Managing IDEX's intricate global supply chain, which handles a wide array of products for different industries, naturally leads to significant expenses. These costs are essential for ensuring that goods reach their destinations efficiently.

Key components of these supply chain and logistics costs include:

- Transportation: Expenses related to moving raw materials and finished goods across various regions, whether by air, sea, or land.

- Warehousing: Costs associated with storing inventory in strategically located facilities to meet demand and manage lead times.

- Inventory Management: Expenditures for maintaining optimal stock levels, including costs of capital tied up in inventory and potential obsolescence.

- Customs and Duties: Fees and taxes incurred when importing or exporting goods across international borders, a common factor in global operations.

For instance, in 2024, companies in similar diversified manufacturing sectors often saw logistics costs represent anywhere from 5% to 15% of their total revenue, depending on product complexity and geographic reach. IDEX's commitment to timely delivery across its diverse end markets means these costs are a critical consideration in its operational budget.

IDEX Corporation's cost structure is multi-faceted, driven by innovation, manufacturing, global operations, and strategic growth initiatives. Significant investments in Research and Development, totaling $109.7 million in 2023, highlight the company's focus on technological advancement. Manufacturing and production expenses, including a cost of sales of $2.27 billion in 2023, are substantial due to raw materials, labor, and overheads across its global facilities.

Selling, General, and Administrative (SG&A) costs are essential for supporting IDEX's worldwide operations and product promotion. Acquisition and integration costs, while not always explicitly detailed, represent a significant investment in the company's growth strategy through mergers and acquisitions. Furthermore, supply chain and logistics expenses are critical for ensuring efficient global product delivery.

In 2024, logistics costs for diversified manufacturers often ranged from 5% to 15% of revenue, underscoring the importance of managing these expenses for IDEX's global reach.

| Cost Category | Description | 2023 Data (USD) | 2024 Outlook/Consideration |

| Research & Development (R&D) | Product design, engineering, new technology development | $109.7 million | Continued investment in innovation for specialized markets. |

| Manufacturing & Production | Raw materials, direct labor, factory overheads | $2.27 billion (Cost of Sales) | Impacted by global footprint, logistics, and labor costs. |

| SG&A | Sales, marketing, distribution, customer service, corporate overhead | N/A (Embedded in operating expenses) | Essential for market expansion and brand building. |

| Acquisition & Integration | Legal, advisory, due diligence, integration activities | Significant spending reported in FY23 | Crucial for executing M&A-driven growth strategy. |

| Supply Chain & Logistics | Transportation, warehousing, inventory management, customs | N/A (Variable based on global operations) | Key consideration for timely delivery across diverse end markets. |

Revenue Streams

The core of IDEX's revenue comes from selling its specialized engineered products. This includes sophisticated fluidics systems, precise dispensing equipment, and critical fire and safety gear.

These products are sold directly to Original Equipment Manufacturers (OEMs) who integrate them into their own systems, as well as to end-use customers who utilize them in their operations.

For the first quarter of 2024, IDEX reported net sales of $757.7 million, with a significant portion derived from these engineered product sales.

IDEX Corporation benefits from a robust aftermarket parts and service revenue stream. This segment generates consistent income through the sale of replacement parts, components, and essential maintenance services for their existing equipment installations. This recurring revenue model is crucial for fostering long-term customer loyalty and predictable financial performance.

For instance, in 2024, IDEX's aftermarket and service segments are expected to continue contributing significantly to overall revenue, building on the strong performance seen in previous years. While specific figures for 2024 aftermarket revenue are still being finalized, the company has historically demonstrated a steady growth trend in this area, often outpacing the growth of new equipment sales. This highlights the strategic importance of their installed base and commitment to ongoing customer support.

Strategic acquisitions are a significant driver of revenue for IDEX, directly injecting sales from newly acquired businesses. For instance, the acquisition of Mott Corporation in 2023 immediately broadened IDEX's reach into filtration and fluidics markets, adding to its overall revenue base.

These acquisitions not only contribute existing revenue but also unlock new growth avenues and expand market presence. By integrating companies with established customer bases and product lines, IDEX effectively bolsters its financial performance and diversifies its income sources.

Custom Solution and Project-Based Revenue

IDEX leverages its engineering expertise to generate revenue through custom solutions and project-based sales, particularly for intricate industrial applications. This approach involves developing highly specialized product configurations and providing extensive engineering support to meet unique client needs.

These significant undertakings often translate into substantial revenue streams. For instance, IDEX's Fire & Safety segment, a key area for such solutions, reported strong performance. In 2024, the company's Fire & Safety business saw continued demand for its specialized systems, contributing to overall revenue growth.

- Customization for Complex Needs: IDEX designs and delivers tailored solutions for challenging industrial environments.

- Project-Based Revenue: Large-scale projects, often involving significant engineering input, form a core revenue driver.

- Engineering & Configuration Focus: Revenue is generated from the intellectual property and tailored product development.

- Segment Performance: The Fire & Safety segment, a prime example of this revenue stream, demonstrated robust demand throughout 2024.

Licensing and Royalty Income

IDEX's robust intellectual property portfolio, particularly in areas like fluidics and optics, opens avenues for licensing its proprietary technologies. This could translate into significant royalty income from other manufacturers adopting IDEX's innovations. For instance, in 2023, IDEX reported strong performance in its Health & Science segment, which heavily relies on its patented technologies, indicating the underlying value of its IP.

While not a primary focus in their public disclosures, the potential for licensing is a clear strategic asset. Imagine other companies in the medical device or analytical instrumentation sectors integrating IDEX's advanced microfluidic pumps or optical components. This would create a recurring revenue stream without the direct manufacturing overhead.

- Licensing Opportunities: IDEX's patented technologies in fluidics and optics can be licensed to other manufacturers.

- Royalty Income Potential: This licensing can generate a steady stream of royalty payments.

- Strategic IP Value: The company's intellectual property is a valuable asset for future revenue diversification.

IDEX Corporation generates revenue through several key streams, primarily centered on its specialized engineered products and the ongoing support for its installed base. The company’s diverse product portfolio, ranging from fluidic systems to fire safety equipment, is sold to both original equipment manufacturers and end-users. The first quarter of 2024 saw IDEX report net sales of $757.7 million, underscoring the substantial contribution of these product sales.

Beyond new equipment, a significant and reliable revenue source is the aftermarket parts and service segment. This recurring revenue stream, driven by the sale of replacement parts and maintenance services, is vital for customer retention and predictable financial performance. This segment continues to be a strong performer, building on historical growth trends.

Strategic acquisitions also play a crucial role, immediately adding revenue from newly integrated businesses and expanding market reach. Furthermore, IDEX capitalizes on its engineering prowess by offering custom solutions and engaging in project-based sales for complex industrial needs, particularly within its robust Fire & Safety segment. The company's intellectual property also presents potential for licensing revenue, offering a pathway for diversification.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Engineered Product Sales | Sale of specialized fluidics, dispensing, and fire/safety equipment. | Core revenue driver, contributing significantly to Q1 2024 net sales of $757.7 million. |

| Aftermarket Parts & Service | Recurring revenue from replacement parts and maintenance for existing equipment. | Consistent income, historically outperforming new equipment sales growth. |

| Custom Solutions & Projects | Tailored engineering solutions and project-based sales for complex industrial applications. | Significant revenue driver, especially in the Fire & Safety segment. |

| Acquisitions | Immediate revenue injection from newly acquired businesses. | Broadened market reach and diversified income sources, exemplified by past acquisitions. |

| Technology Licensing | Potential royalty income from licensing proprietary technologies. | Strategic asset for future revenue diversification, particularly in Health & Science segments. |

Business Model Canvas Data Sources

The IDEX Business Model Canvas is built upon a foundation of market intelligence, competitive analysis, and internal operational data. These sources ensure each component of the canvas accurately reflects our strategic positioning and market engagement.