IDEX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

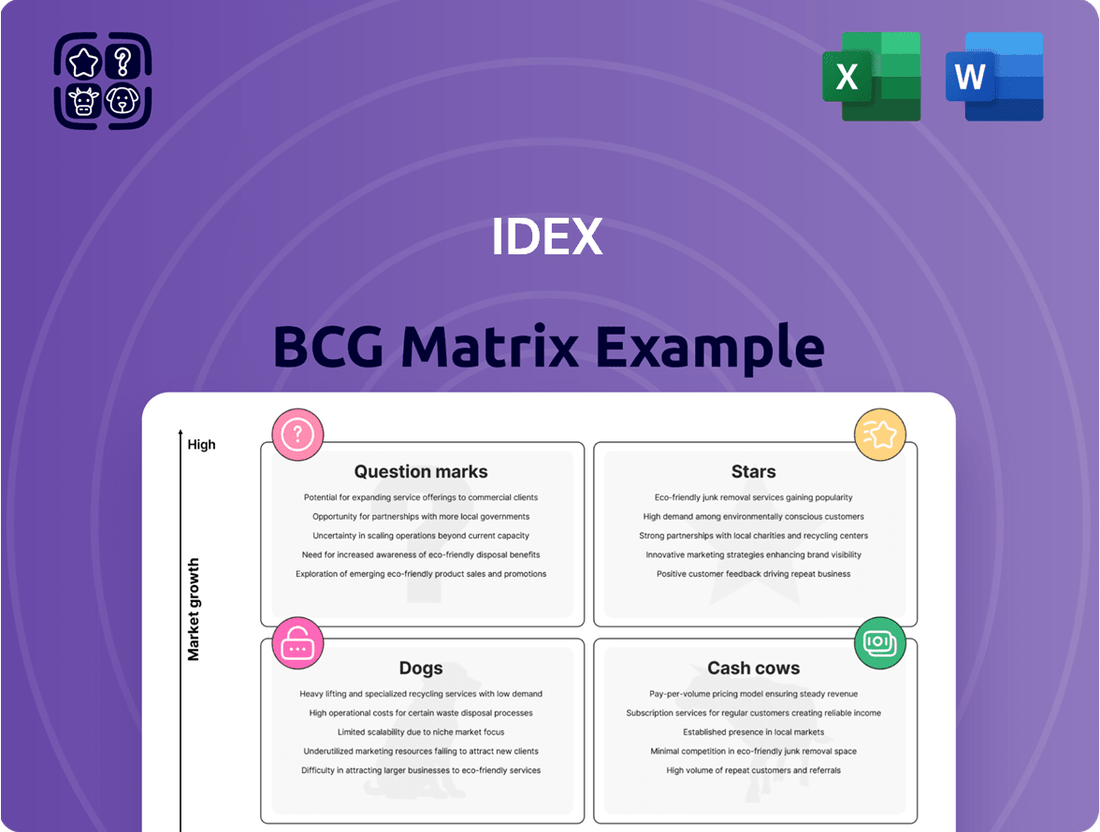

Curious about which of this company's products are poised for growth and which might be holding it back? Our BCG Matrix preview offers a glimpse into the strategic positioning of their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the power of this analysis and gain actionable insights for your own business strategy, purchase the full BCG Matrix. It provides a comprehensive breakdown of each product's market share and growth rate, equipping you with the data needed for informed decisions.

Don't miss out on the opportunity to transform your product strategy. Get the complete BCG Matrix today and discover the roadmap to optimizing your portfolio for maximum profitability and market dominance.

Stars

The September 2024 acquisition of Mott Corporation brought significant advancements to IDEX's filtration capabilities, particularly in applied material science. This move bolsters IDEX's presence in high-growth sectors like clean water and hydrogen fuel cells, positioning them for market leadership.

Mott's specialized filtration technologies are expected to be a key growth driver for IDEX. The acquisition is projected to be accretive to earnings, highlighting its potential as a leading product within its market category.

The Health & Science Technologies (HST) segment is a star performer in the energy transition, demonstrating robust year-over-year revenue growth. This sector is a key focus for IDEX as it aggressively pursues market share expansion within this high-demand area.

IDEX's strategic investments and organic growth efforts are designed to capture the escalating demand for sustainable energy solutions. For example, in 2024, IDEX reported a substantial increase in its HST segment revenue, driven by innovative solutions supporting renewable energy infrastructure and advanced materials for energy storage. This segment's trajectory aligns with the broader market trend of increasing adoption of green technologies.

IDEX's Health & Science Technologies (HST) segment is showing impressive growth, particularly within the booming data center and space/defense industries. These sectors demand precision and dependability, areas where IDEX clearly excels. For example, in 2023, IDEX's HST segment contributed significantly to the company's overall revenue, driven by these high-demand markets.

The company's ability to secure and execute key projects in these technologically advanced fields underscores its strong market standing. This success is a testament to IDEX's commitment to innovation and quality, positioning HST as a star performer within the IDEX portfolio.

Fire & Safety OEM and Integrated Solutions

The Fire & Safety OEM and Integrated Solutions segment, a key part of IDEX's portfolio, is experiencing robust demand. This growth is driven by the increasing need for comprehensive safety systems and specialized equipment. IDEX's ability to deliver integrated solutions positions them strongly in this evolving market.

In 2024, the Fire & Safety/Diversified Products (FSDP) segment demonstrated significant strength, with OEM and integrated solutions contributing substantially to revenue. This segment is capitalizing on stringent safety regulations and technological advancements in fire detection and suppression. IDEX's commitment to innovation ensures they remain a leader.

- Strong Demand: The market shows a clear preference for integrated fire and safety solutions.

- Market Leadership: IDEX holds a leading position due to its comprehensive offerings.

- Revenue Growth: This segment consistently contributes to the company's top-line performance.

- Technological Advancements: IDEX is well-positioned to benefit from ongoing safety standard evolution.

Micro-LAM High-Precision Optics/Machining

Micro-LAM, acquired by IDEX in July 2025, represents a significant move into the high-precision optics and machining sector. This acquisition bolsters IDEX's portfolio with proprietary capabilities in forming difficult-to-machine materials and producing custom optical components. These advanced technologies are particularly vital for demanding applications within the space and defense industries, areas known for their rapid innovation and substantial growth potential.

The integration of Micro-LAM is a strategic play to capture a larger share of the market for cutting-edge technological solutions. With the aerospace and defense market projected to reach approximately $1.7 trillion globally by 2028, IDEX's investment in Micro-LAM positions it to capitalize on this expansion. The company’s expertise in high-precision manufacturing directly addresses the increasing need for specialized optical components in next-generation satellites, advanced weaponry, and sophisticated surveillance systems.

- Market Expansion: Micro-LAM's acquisition strengthens IDEX's presence in the high-growth aerospace and defense sectors.

- Technological Advancement: Proprietary forming capabilities and custom optical components enhance IDEX's technical edge.

- Strategic Investment: The move aims to increase IDEX's market share in cutting-edge, high-value technology markets.

- Future Growth: Aligns with IDEX's strategy to invest in businesses with strong technological differentiation and significant market potential.

The Health & Science Technologies (HST) segment is a clear star for IDEX, showcasing impressive revenue growth, particularly in the booming data center and space/defense markets. This segment's success, evidenced by strong 2023 contributions and ongoing investments in 2024 for renewable energy and advanced materials, highlights its leadership in high-demand, technologically advanced fields.

The Fire & Safety OEM and Integrated Solutions segment also shines, driven by robust demand for comprehensive safety systems and specialized equipment. In 2024, this segment, referred to as Fire & Safety/Diversified Products (FSDP), saw substantial revenue contributions from OEM and integrated solutions, capitalizing on stringent safety regulations and technological advancements.

Micro-LAM, acquired in July 2025, is positioned as a star due to its entry into high-precision optics and machining, crucial for the rapidly growing aerospace and defense sectors. This strategic acquisition, aligning with the projected $1.7 trillion global aerospace and defense market by 2028, enhances IDEX's technical edge with proprietary manufacturing capabilities for specialized optical components.

| Segment | Key Growth Drivers | 2024/Recent Performance Indicators | Strategic Importance |

|---|---|---|---|

| Health & Science Technologies (HST) | Data centers, space/defense, clean water, hydrogen fuel cells | Robust year-over-year revenue growth; accretive to earnings (Mott Acquisition) | Energy transition leader, market share expansion |

| Fire & Safety OEM and Integrated Solutions (FSDP) | Stringent safety regulations, technological advancements in fire safety | Substantial revenue contribution from OEM and integrated solutions in 2024 | Market leadership in comprehensive safety systems |

| Micro-LAM (Acquired July 2025) | High-precision optics, difficult-to-machine materials, custom optical components | Entry into high-growth aerospace and defense markets | Enhances technical edge, targets $1.7 trillion global market by 2028 |

What is included in the product

The IDEX BCG Matrix provides a strategic framework to analyze a company's product portfolio by plotting each unit based on market growth and relative market share.

It guides decisions on resource allocation, suggesting investment in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

IDEX BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Within IDEX's Fluid & Metering Technologies (FMT) segment, municipal water and downstream energy solutions stand out as robust cash cows. These sectors are characterized by their essential nature and mature market status, allowing IDEX to leverage its established positions for consistent and substantial cash generation.

These segments are vital for generating reliable revenue streams, even when other areas of FMT might experience fluctuations. For instance, in 2023, IDEX reported that its Water segment, a key component of these cash cows, saw organic growth driven by infrastructure investments and demand for water treatment technologies.

IDEX's core dispensing equipment for architectural coatings represents a classic cash cow within the BCG matrix. This segment benefits from a well-established market where IDEX holds a significant share, ensuring consistent demand for its reliable, precision-engineered products.

The mature nature of the architectural coatings market, characterized by low growth, means IDEX can leverage its strong position with minimal investment in marketing or expansion. This allows the business to generate substantial, predictable cash flow, bolstering overall company finances.

For instance, in 2024, IDEX's dispensing solutions continued to be a cornerstone of their business, contributing a substantial portion of their revenue from the coatings sector. The steady, recurring demand for these essential pieces of equipment, often tied to long-term service agreements, underscores their cash-generating power.

IDEX's established proprietary pumps and metering products are clear cash cows. These are not just any components; they're often the vital heart of complex industrial processes, meaning reliability is paramount. This criticality underpins their strong market positions and consistent demand, translating directly into robust profit margins for IDEX.

In 2024, IDEX's Fluid & Fire segment, which heavily features these types of products, demonstrated this strength. For instance, the company reported robust performance in its Fire and Industrial segments, driven by demand for specialized fluid handling solutions. This segment consistently contributes a significant portion of IDEX's overall operating income, highlighting the cash-generating power of these mature, market-leading offerings.

Hurst Jaws of Life and Traditional Rescue Tools

Hurst Jaws of Life and other traditional rescue tools are globally recognized as industry leaders, relied upon by rescue professionals worldwide. This strong, established presence in a mature but vital market translates to steady demand and robust profit margins, solidifying their role as significant cash generators for IDEX's Fire & Safety/Diversified Products segment.

The enduring brand loyalty and the indispensable nature of these tools are key drivers of their cash cow status. For instance, IDEX Corporation reported that its Fire & Safety segment, which includes these rescue tools, generated approximately $769.8 million in revenue for the fiscal year 2023, with strong profitability contributing significantly to the company's overall financial health.

- Industry Dominance: Hurst Jaws of Life holds a commanding share in the global market for hydraulic rescue tools.

- Mature Market: While the market for rescue equipment is mature, the essential nature of these tools ensures consistent demand.

- High Profit Margins: The strong brand and critical functionality allow for premium pricing and healthy profit margins.

- Consistent Cash Flow: These factors combine to make the rescue tools a reliable source of substantial cash for IDEX.

Engineered Stainless Steel Banding and Clamping Devices (General Industrial)

IDEX's BAND-IT division, beyond its aerospace contributions, offers engineered stainless steel banding and clamping devices crucial for numerous general industrial and commercial uses. These items cater to established markets characterized by predictable demand, thereby generating consistent cash flow. Their enduring market presence and fundamental utility solidify their position as cash cows within the IDEX portfolio.

The reliability of these banding and clamping devices stems from their widespread adoption across various sectors, including construction, oil and gas, and infrastructure maintenance. For instance, in 2023, the industrial clamping market, a key segment for BAND-IT, was valued at approximately $2.5 billion globally, with steady growth projected. This consistent demand underpins the stable revenue generation characteristic of a cash cow.

- Stable Demand: BAND-IT's general industrial products serve mature markets with consistent, predictable needs.

- Reliable Cash Flow: Their established market presence and essential function ensure a steady stream of revenue.

- Market Penetration: These devices are utilized across diverse sectors like construction and infrastructure, reinforcing their cash cow status.

- Industry Value: The global industrial clamping market, relevant to BAND-IT, was estimated around $2.5 billion in 2023, highlighting the scale of these mature markets.

Within IDEX's portfolio, the municipal water and downstream energy solutions are prime examples of cash cows. These mature markets, driven by essential services, provide a stable and substantial revenue stream, allowing IDEX to generate consistent cash with minimal new investment. The company's established presence in these sectors ensures ongoing demand for its reliable technologies.

IDEX's core dispensing equipment for architectural coatings also firmly fits the cash cow profile. This segment benefits from IDEX's significant market share in a low-growth, established industry. The predictable demand for these precision products allows for strong profit generation without the need for extensive capital expenditure.

The company's proprietary pumps and metering products are critical cash cows, vital for numerous industrial processes. Their indispensable nature and IDEX's strong market position translate into consistent demand and healthy profit margins. For instance, IDEX's Fluid & Fire segment, which includes these products, showed robust performance in 2024, contributing significantly to overall operating income.

Hurst Jaws of Life and similar rescue tools represent another key cash cow for IDEX. These globally recognized, indispensable tools serve a vital, mature market, ensuring consistent demand and high profit margins. In 2023, the Fire & Safety segment, including these products, generated approximately $769.8 million in revenue, showcasing their financial contribution.

| IDEX Segment/Product | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Municipal Water & Downstream Energy Solutions | Cash Cow | Mature markets, essential services, stable demand | Water segment organic growth driven by infrastructure in 2023 |

| Architectural Coatings Dispensing Equipment | Cash Cow | Established market, strong share, low growth | Steady revenue from coatings sector in 2024 |

| Proprietary Pumps & Metering Products | Cash Cow | Critical industrial function, strong market position | Robust performance in Fluid & Fire segment in 2024 |

| Hurst Jaws of Life & Rescue Tools | Cash Cow | Industry leader, indispensable, mature market | Fire & Safety segment revenue ~$769.8M in 2023 |

Delivered as Shown

IDEX BCG Matrix

The preview you're currently viewing is the definitive IDEX BCG Matrix report you will receive immediately after your purchase. This comprehensive document is fully formatted and ready for immediate application, offering a clear and actionable framework for strategic decision-making without any watermarks or demo content.

Dogs

The Fluid & Metering Technologies (FMT) segment within IDEX's agriculture business is currently facing headwinds. Reports indicate a noticeable softness in sales volumes, suggesting a challenging environment with limited growth potential. This situation often points to a scenario where a company might have a smaller slice of a shrinking or stagnant pie.

For IDEX, this translates to a potential "Dogs" classification in the BCG matrix for its FMT agriculture operations. Such segments are characterized by low market share in a low-growth industry. In 2024, agricultural equipment sales globally have seen varied performance, with some regions experiencing a slowdown due to higher interest rates and reduced farm incomes, directly impacting demand for components like those produced by FMT.

Fluid & Metering Technologies (FMT) in the European chemical market is currently facing headwinds. The European chemical sector experienced a notable slowdown in 2023, with industrial production in the chemicals and pharmaceuticals sector contracting by 1.5% according to Eurostat data. This broader market weakness has directly translated into softer demand for IDEX's FMT segment within its chemical businesses.

This situation places FMT squarely in the 'Dog' quadrant of the BCG Matrix. The combination of a weak European chemical market and the segment's performance suggests a low-growth or potentially declining market. In such an environment, IDEX faces challenges in growing its market share or even maintaining its current position within this specific segment.

Continued significant investment in the European FMT chemical business without a clear catalyst for market turnaround or a strategic pivot would likely prove inefficient. IDEX needs to carefully evaluate the long-term viability and potential return on investment for this segment, considering the prevailing market conditions and competitive landscape.

Fluid & Metering Technologies (FMT) in legacy semiconductor wafer applications is a prime example of a business unit that may be positioned as a Dog in the IDEX BCG matrix. While IDEX has promising growth sectors within semiconductors, the FMT segment's business focused on pure water applications in older semiconductor fabrication plants has seen a noticeable slowdown. This is evidenced by reports of lower volumes, signaling potential market share erosion in a mature segment of the industry.

The challenges faced by FMT in legacy semiconductor applications suggest it might be a cash consumer without delivering proportional returns. In 2024, the broader semiconductor industry experienced shifts, with some segments facing oversupply and reduced demand for older technologies, which directly impacts suppliers of essential components like those in the FMT segment.

General Automotive End Market Exposure

IDEX's exposure to the general automotive end market reflects the cyclical nature of the industry. This cyclicality can present challenges for product lines tied to this sector, potentially leading to periods of reduced demand.

Products or systems within IDEX that cater primarily to this mature automotive market, particularly those lacking significant technological differentiation, may exhibit characteristics of low market share and limited growth prospects. These segments might not align with the company's strategic emphasis on high-performance solutions.

- Automotive Market Headwinds: The automotive sector experienced a notable slowdown in 2024, with global vehicle production facing supply chain disruptions and fluctuating consumer demand.

- Legacy Product Challenges: Older product lines serving this market, especially those without advanced features, could be categorized as question marks or even dogs in a BCG matrix due to their low growth potential.

- Impact on IDEX: For IDEX, this translates to potential pressure on revenue from its automotive-focused segments if they are not actively innovating or diversifying.

Specific Cyclical Life Sciences Product Lines

Within IDEX's Health & Science Technologies segment, certain specific product lines in life sciences are exhibiting cyclical softness. This is particularly evident in areas like DNA sequencing, where orders have been lower. If these specific, older product lines consistently underperform and lack substantial market share or distinct competitive advantages, they are categorized as dogs in the BCG matrix.

These underperforming life sciences product lines might be prime candidates for divestiture or require substantial restructuring to regain competitiveness. For instance, if a particular DNA sequencing reagent kit, launched over five years ago, has seen its market share decline from 15% to below 5% by the end of 2024 due to newer, more efficient technologies, it would fit this dog classification.

- Declining Market Share: Product lines losing ground to competitors or technological advancements.

- Low Growth Prospects: Segments with minimal anticipated expansion in the foreseeable future.

- Underperforming Financials: Consistently low or negative returns on investment for specific product lines.

- Strategic Review Candidates: Areas identified for potential divestment or significant operational changes.

Dogs in the IDEX BCG matrix represent business units with low market share in low-growth industries. These segments often consume more resources than they generate, making them a drain on overall profitability. For example, IDEX's legacy semiconductor wafer applications within its Fluid & Metering Technologies (FMT) segment may fit this description, as demand for older technologies has softened.

The European chemical market also presents a potential 'Dog' scenario for FMT, given the sector's contraction in 2023. Similarly, certain automotive-focused product lines lacking differentiation could be classified as dogs, especially with the automotive sector's cyclicality and 2024 slowdown. Even within Health & Science Technologies, specific underperforming life sciences products, like older DNA sequencing reagents, can become dogs if market share plummets below 5% by year-end 2024.

These 'Dog' segments require careful strategic evaluation, often leading to decisions about divestiture or significant restructuring to improve performance or cut losses. Continued investment without a clear path to recovery is generally not advised for these units.

| IDEX Segment Example | BCG Classification | Reasoning | 2024 Market Context |

| FMT - Legacy Semiconductor Wafer Applications | Dog | Low market share in a mature, slowing segment. | Reduced demand for older semiconductor technologies. |

| FMT - European Chemical Market | Dog | Low market share in a contracting industry. | European chemical sector production contracted 1.5% in 2023. |

| Automotive Focused Products (Non-differentiated) | Dog | Low growth prospects in a cyclical industry. | Global vehicle production faced disruptions in 2024. |

| Health & Science - Specific Life Science Products (e.g., older DNA sequencing) | Dog | Declining market share and obsolescence. | Market share for some older products fell below 5% by end-2024. |

Question Marks

Newer life science and analytical instrumentation ventures within IDEX are likely positioned as Question Marks in the BCG Matrix. This means they operate in high-growth markets but currently hold a low market share. For instance, IDEX's strategic focus on expanding into advanced semiconductor capital equipment and specific life science segments suggests these are emerging areas where they are building capabilities and market presence.

These ventures represent significant investments for IDEX, aiming to capture nascent market opportunities. The company's stated anticipation of future growth in these sectors, as indicated in their strategic planning, underscores the high potential but also the current low penetration. For example, the global analytical instrumentation market was projected to reach over $70 billion by 2024, presenting a substantial growth runway for new entrants or expanding product lines.

The challenge for these Question Marks is to convert their potential into market leadership. This requires substantial capital infusion for research and development, sales, and marketing to gain traction against established players. IDEX's success hinges on effectively navigating these evolving markets and transitioning these ventures from Question Marks to Stars, which would signify high growth and high market share.

Dispensing projects in emerging markets often show lower volumes initially. This isn't necessarily a bad sign; it usually means IDEX is focusing on areas with high growth potential. Think of it as planting seeds in fertile ground, but it takes time for them to sprout.

These emerging markets represent significant future opportunities for IDEX. However, to capitalize on this potential, substantial investment in marketing and operations is crucial. Without this support, these promising ventures could stagnate and potentially become less valuable assets, similar to a product with declining sales and market share.

For instance, in 2024, IDEX's investment in new dispensing technologies within Southeast Asian markets, a region known for its rapid economic expansion, exemplifies this strategy. While initial sales figures might be modest, the long-term outlook is strong, provided the necessary resources are allocated to build brand awareness and establish robust distribution networks.

Following the Mott Corporation acquisition, IDEX is strategically positioned to explore further expansions in applied material science, particularly in nascent high-growth sectors. These ventures, while carrying inherent risk due to low current market penetration, represent significant opportunities for future market leadership. For instance, advancements in specialized filtration for the burgeoning hydrogen economy or novel materials for advanced semiconductor manufacturing could see substantial investment from IDEX.

Unspecified 'Targeted Growth Initiatives' in Nascent Markets

In the context of the IDEX BCG Matrix, unspecified 'targeted growth initiatives' in nascent markets often fall into the Question Mark category. These are ventures in high-growth industries but with a small existing market share. For instance, IDEX's reported investments in advanced materials for electric vehicle batteries, a sector projected to grow significantly, exemplify this. While the market is expanding rapidly, IDEX's current penetration is minimal, requiring substantial funding and careful strategy to ascertain its long-term potential.

These initiatives demand significant capital infusion and strategic oversight to navigate the inherent uncertainties. For example, a hypothetical initiative in the burgeoning quantum computing software market would represent a Question Mark for IDEX. The market's growth potential is immense, but IDEX's current market share is negligible, necessitating a considerable investment of resources to establish a foothold and prove its competitive edge.

- Nascent Markets: These are industries experiencing rapid expansion but are still in their early stages of development, making future outcomes uncertain.

- Low Market Share: Despite the growth potential, the company's current presence and revenue contribution from these initiatives are minimal.

- High Investment Needs: Significant capital is required to fund research, development, marketing, and operational scaling to compete effectively.

- Strategic Uncertainty: The viability and long-term success of these initiatives are not yet proven, posing a risk to resource allocation.

Early-Stage Integration of Strategic 'Tuck-in' Acquisitions

IDEX's strategy actively incorporates 'tuck-in acquisitions' to cultivate growth platforms and broaden its operational capabilities. These smaller, recently integrated businesses, such as Micro-LAM, are initially positioned within the IDEX BCG Matrix as question marks, reflecting their strategic importance beyond immediate high-value applications.

The primary objective for these tuck-in acquisitions is to achieve significant market share expansion and establish self-sustainability within their respective high-growth niches. For instance, Micro-LAM's technology, while promising, requires further development and market penetration to transition from a question mark to a star or cash cow within the IDEX portfolio.

- Strategic Rationale: Tuck-in acquisitions are integrated to enhance IDEX's existing business segments or enter adjacent high-growth markets.

- Initial Classification: Newly acquired entities like Micro-LAM are initially classified as question marks due to their unproven market dominance and need for further investment.

- Growth Trajectory: Success hinges on these acquisitions capturing substantial market share and achieving operational self-sufficiency in their specialized sectors.

- IDEX's 2024 Focus: In 2024, IDEX continued to evaluate and integrate such acquisitions, aiming to bolster its presence in areas like advanced manufacturing and specialized fluidics, with an emphasis on scaling these capabilities.

Question Marks in IDEX's portfolio represent ventures in high-growth markets where the company currently holds a low market share. These are often newer technologies or strategic expansions into emerging sectors. For example, IDEX's focus on advanced semiconductor manufacturing equipment and specialized life science instrumentation places these initiatives firmly in the Question Mark quadrant.

These ventures require substantial investment to gain traction and compete effectively. IDEX's success depends on its ability to nurture these nascent businesses, ensuring they develop into market leaders. The global analytical instrumentation market, projected to exceed $70 billion by 2024, highlights the growth potential IDEX is targeting with these Question Marks.

The key challenge is to convert this potential into market share and profitability. This involves significant capital allocation for R&D, sales, and marketing to overcome established competitors and build brand recognition. IDEX's strategic acquisitions, such as Micro-LAM, are also initially categorized as Question Marks, needing further investment to achieve their full potential.

IDEX's 2024 strategic priorities include strengthening its position in high-growth areas like advanced materials for electric vehicle batteries. While these markets offer significant future opportunities, IDEX's current penetration is minimal, necessitating substantial investment to establish a competitive edge and transition these ventures from Question Marks to Stars.

| IDEX Business Segment | BCG Matrix Classification | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Advanced Semiconductor Capital Equipment | Question Mark | High | Low | Requires significant investment for R&D and market penetration. |

| Life Science Analytical Instrumentation | Question Mark | High | Low | Focus on building capabilities and gaining market share against established players. |

| Specialized Filtration (Hydrogen Economy) | Question Mark | High | Low | Nascent area with high growth potential, demanding capital for development and market entry. |

| Micro-LAM (Tuck-in Acquisition) | Question Mark | High | Low | Needs further development and market penetration to become a Star or Cash Cow. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer feedback, and competitor analysis, to accurately position each business unit.