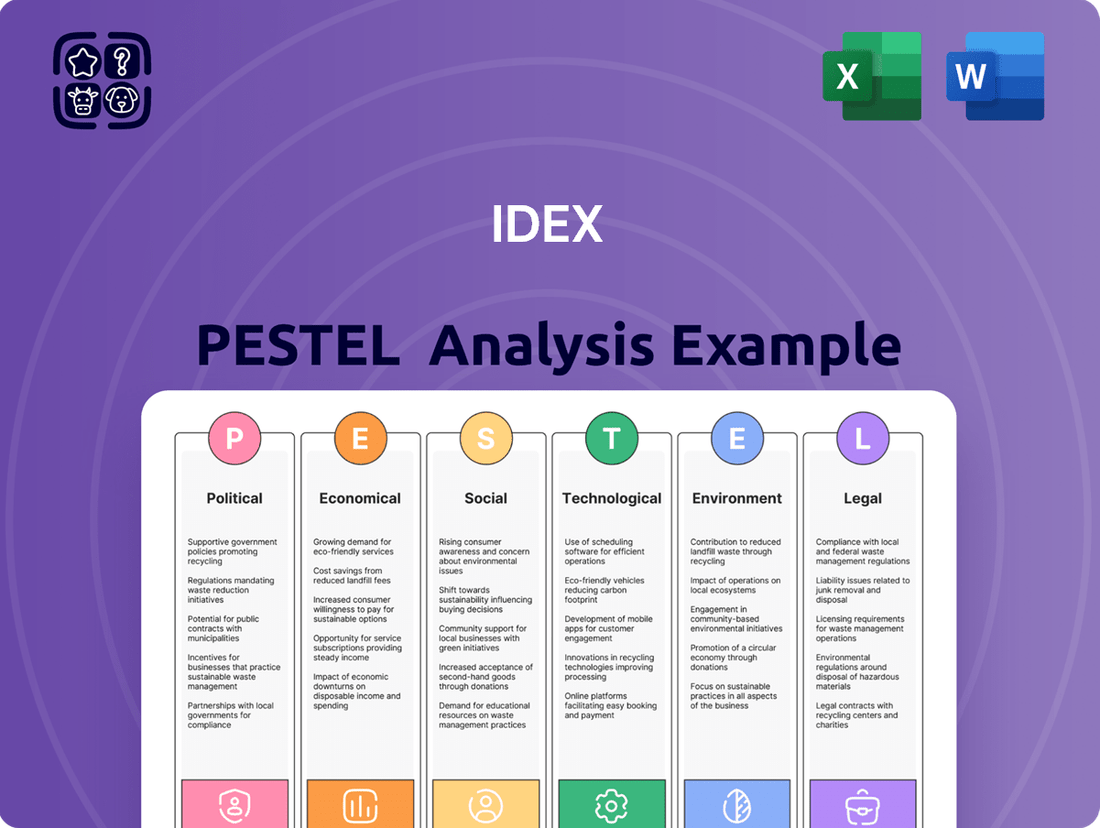

IDEX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping IDEX's trajectory. This meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the complete version now to gain a decisive competitive advantage.

Political factors

Changes in global trade policies, such as new tariffs or revised trade agreements, directly influence IDEX Corporation's operational costs and its ability to reach international markets. These shifts can create significant headwinds or tailwinds for the company's diverse business segments.

IDEX has specifically navigated challenges stemming from tariff-related inflation, which has put upward pressure on its cost of goods sold. For instance, in its 2023 fiscal year, the company noted that tariffs contributed to increased expenses, impacting its overall profitability and requiring strategic adjustments to pricing and sourcing.

Furthermore, geopolitical tensions have led to a slowdown in semiconductor orders, prompting IDEX to lower its financial projections. This demonstrates how broader international political dynamics can directly translate into reduced demand for key components and systems supplied by IDEX, affecting its revenue streams.

Government spending plays a crucial role in driving demand for IDEX's specialized products, particularly in sectors like water and wastewater treatment, fire and safety, and defense. Increased public investment in infrastructure projects or enhanced public safety measures directly translates to higher demand for IDEX's engineered solutions. For instance, the U.S. government's commitment to modernizing water infrastructure, with significant funding allocated in recent years, directly benefits IDEX's water segment. Furthermore, the company has observed robust growth in its space and defense applications, reflecting heightened government expenditure in these critical areas.

IDEX thrives in environments where regulatory frameworks are predictable, allowing for confident long-term strategy and investment across its global operations. Fluctuations in policy can introduce significant uncertainty, directly impacting how customers approach purchasing decisions and, consequently, overall market demand for IDEX's offerings.

The impact of such uncertainty was evident in the latter half of 2025, with reports indicating that a more cautious customer approach, driven by unpredictable policy shifts, contributed to revised financial projections downwards.

International Relations and Geopolitical Risks

IDEX's international footprint means it's susceptible to shifts in global politics. Geopolitical events can easily disrupt its supply chains, affecting the flow of components and finished goods. This also impacts sales in different countries, as political instability or trade disputes can dampen demand.

Tensions between major global powers, particularly concerning technology and manufacturing, have directly influenced IDEX's business. For instance, the ongoing semiconductor supply chain issues, exacerbated by geopolitical factors, have led IDEX to adopt a more cautious approach to its sales forecasts. This cautiousness is a direct response to the uncertainty surrounding the availability and cost of critical components, impacting its 2024 outlook.

- Geopolitical Tensions Impact Semiconductor Supply: The global semiconductor industry, crucial for IDEX's products, faces ongoing disruptions due to international relations and trade policies.

- Regional Sales Vulnerability: IDEX's sales in regions experiencing political instability or trade sanctions are at higher risk of decline.

- Operational Challenges: Geopolitical events can create logistical hurdles, increasing operational costs and complexity for IDEX's global manufacturing and distribution networks.

- Cautious 2024 Outlook: IDEX has signaled a more reserved outlook for 2024, partly attributing this to the persistent geopolitical influences on semiconductor orders and broader market uncertainty.

Policy Support for Industrial Innovation

Government initiatives aimed at fostering industrial innovation and advanced manufacturing are crucial for IDEX's expansion. Policies that encourage research and development, particularly in areas like life sciences and intelligent water systems, directly support IDEX's core business strategies and market positioning. For instance, the US government's increased investment in advanced manufacturing, projected to reach billions in funding by 2025, provides a fertile ground for companies like IDEX to leverage new technologies and expand their product portfolios.

These policy supports often translate into tangible benefits, such as tax incentives for R&D spending or grants for adopting cutting-edge manufacturing processes. Such measures can significantly reduce the cost of innovation, making it more feasible for IDEX to invest in developing next-generation products and solutions. The emphasis on sectors where IDEX operates means that these policies are strategically aligned to boost the company's competitive advantage.

- Government Funding: Increased R&D grants and tax credits for advanced manufacturing, with US federal R&D spending expected to exceed $150 billion in 2024.

- Sectoral Focus: Policies specifically targeting life sciences and water technology, aligning with IDEX's strategic growth areas.

- Trade Agreements: Favorable trade policies that facilitate the global distribution of advanced industrial products.

- Regulatory Environment: Streamlined regulatory pathways for innovative technologies in IDEX's key markets.

Government spending on infrastructure and defense directly fuels demand for IDEX's products, with U.S. infrastructure spending projected to exceed $1.5 trillion by 2025, benefiting IDEX's water and fire safety segments.

Geopolitical tensions, particularly those impacting semiconductor supply chains, led IDEX to adopt a more cautious sales outlook for 2024, highlighting the vulnerability of its operations to global political dynamics.

Favorable trade policies and government incentives for R&D, such as anticipated U.S. federal R&D spending of over $150 billion in 2024, provide strategic advantages for IDEX's innovation and market expansion.

The company's international operations are susceptible to regional political instability and trade disputes, which can disrupt supply chains and dampen sales in affected markets.

| Political Factor | Impact on IDEX | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Government Infrastructure Spending | Increased demand for water and fire safety solutions | U.S. Infrastructure Investment and Jobs Act funding expected to drive significant project growth. |

| Geopolitical Tensions & Trade Policy | Supply chain disruptions, cautious sales outlook | Semiconductor shortages impacting key product lines; IDEX noted cautiousness for 2024. |

| R&D and Advanced Manufacturing Incentives | Supports innovation and competitive advantage | Projected U.S. federal R&D spending > $150B in 2024; tax credits for advanced manufacturing. |

| Regional Political Stability | Risk to sales and operations in unstable regions | Ongoing monitoring of trade sanctions and political unrest affecting global markets. |

What is included in the product

This IDEX PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of its external landscape.

It provides actionable insights and data-driven perspectives to inform strategic decision-making and identify key opportunities and threats.

The IDEX PESTLE Analysis provides a structured framework to identify and address external factors that could impact business strategy, thereby alleviating the pain point of uncertainty and reactive decision-making.

Economic factors

IDEX operates in a dynamic macroeconomic landscape, where shifts in global economic conditions can significantly influence customer spending and the company's overall operational resilience. This inherent uncertainty poses a challenge to predictable business planning.

For instance, despite IDEX announcing stronger-than-anticipated second-quarter 2025 earnings, the company's stock saw a dip. This reaction stemmed from management's cautious guidance for the latter half of 2025, highlighting investor sensitivity to forward-looking economic projections amidst broader market volatility.

Rising inflation directly impacts IDEX's operational costs, from raw materials to workforce compensation, potentially squeezing profit margins. For instance, in Q2 2025, IDEX reported a decline in its adjusted gross margin.

This margin compression was attributed to several factors, including the integration of the Mott acquisition and an unfavorable product mix, even as the company pursued productivity gains and strategic price adjustments.

IDEX Corporation experienced a mixed bag in its organic growth for the first half of 2024, with overall modest increases. However, specific sectors faced headwinds; for instance, the automotive market showed signs of softening, impacting demand for certain IDEX products.

The company's rescue tools segment also reported a slowdown, contributing to a less robust performance in those areas. Additionally, parts of IDEX's semiconductor-related businesses encountered challenges, reflecting broader industry trends.

In response to these market conditions, IDEX revised its full-year 2024 organic sales growth forecast downwards. This adjustment signals a more cautious outlook, acknowledging the prevailing softness in key end markets that are crucial to the company's revenue streams.

Acquisition Strategy and Integration Costs

IDEX Corporation actively seeks strategic acquisitions to bolster its market position and technological offerings, exemplified by its acquisition of Mott Corporation. This approach drives revenue expansion but also introduces complexities in financial reporting and integration.

The integration of acquired companies often results in elevated interest expenses due to financing arrangements and amortization costs related to intangible assets. These factors can exert short-term downward pressure on IDEX's net income and earnings per share (EPS).

- Acquisition Impact: IDEX's acquisition of Mott Corporation in 2014 for $226 million aimed to expand its filtration and fluidic solutions segment.

- Expense Recognition: Post-acquisition, increased interest expenses and amortization of acquired intangibles can temporarily affect profitability metrics. For instance, in 2023, IDEX reported amortization of acquired intangibles of $68.8 million.

- Strategic Growth: Despite short-term financial impacts, these acquisitions are crucial for IDEX's long-term strategy of diversification and enhanced market penetration.

Strong Free Cash Flow and Liquidity

Despite prevailing market headwinds, IDEX has showcased impressive financial resilience, notably through its strong free cash flow generation and healthy liquidity position. This financial strength offers considerable strategic flexibility.

The company's performance in the second quarter of 2025 was particularly noteworthy, with a substantial increase in free cash flow reported. This surge in cash flow provides IDEX with enhanced capacity to pursue strategic investments, explore potential acquisitions, and deliver value back to its shareholders through dividends or share buybacks.

Key financial indicators supporting this include:

- Robust Free Cash Flow Growth: Q2 2025 saw a significant uplift in free cash flow, enabling greater financial maneuverability.

- Healthy Liquidity Position: IDEX maintains ample liquid assets, ensuring operational stability and the ability to meet short-term obligations.

- Investment Capacity: The strong cash generation supports future capital expenditures and research and development initiatives.

- Shareholder Value Focus: Increased free cash flow provides options for enhancing shareholder returns.

Economic factors significantly shape IDEX's performance, with inflation impacting operational costs and potentially squeezing profit margins, as seen in a Q2 2025 adjusted gross margin decline. Market demand also fluctuates; for instance, IDEX experienced modest organic growth in early 2024 but faced softening in the automotive sector and slowdowns in rescue tools and semiconductor-related businesses, leading to a revised lower full-year 2024 organic sales growth forecast.

Despite these headwinds, IDEX demonstrated financial resilience, highlighted by strong free cash flow generation, with Q2 2025 showing a substantial increase. This robust cash flow provides strategic flexibility for investments and shareholder returns.

| Financial Metric | Period | Value | Impact |

|---|---|---|---|

| Adjusted Gross Margin | Q2 2025 | Declined | Impacted by acquisition integration and product mix |

| Organic Sales Growth Forecast | Full-Year 2024 | Revised Downwards | Reflects market softness in key sectors |

| Free Cash Flow | Q2 2025 | Substantially Increased | Enhances strategic flexibility and investment capacity |

Same Document Delivered

IDEX PESTLE Analysis

The preview you see here is the exact IDEX PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing immediate application of strategic insights.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get the comprehensive analysis you expect.

Sociological factors

IDEX places a strong emphasis on its workforce, recognizing employee success, development, and well-being as crucial. This commitment is rooted in a values-based culture that prioritizes a healthy and safe work environment, competitive compensation and benefits packages, and a dedication to diversity and inclusion initiatives.

In 2024, IDEX reported a workforce of approximately 7,000 employees globally, reflecting its significant operational scale. The company's investment in employee well-being is demonstrated through its comprehensive benefits, which often include health insurance, retirement plans, and professional development opportunities, aiming to retain talent and foster long-term engagement.

IDEX actively engages with its operating communities, demonstrating this through the IDEX Foundation. In 2023, the Foundation supported various local initiatives, contributing to social well-being and development. This commitment goes beyond financial aid, aiming to foster genuine community partnerships.

A core tenet of IDEX's community strategy is the preservation of natural resources and biodiversity. For instance, their water stewardship programs in 2024 focused on reducing water consumption by 5% across key manufacturing sites. This aligns with a broader goal of ensuring sustainable operations that benefit both the environment and local ecosystems.

Furthermore, IDEX prioritizes economic stimulation within its host communities by creating local employment opportunities and sourcing from local suppliers. In 2023, over 70% of their non-capital expenditures were directed towards local businesses in their primary operating regions, directly contributing to job creation and economic growth.

Customers in IDEX's various sectors are consistently looking for ways to improve their speed, safety, and overall productivity. This drive for efficiency is a significant sociological trend shaping market demands.

IDEX's strategic emphasis on developing sophisticated, engineered products and integrated digital solutions directly caters to this growing customer requirement for enhanced operational performance.

For instance, in the fluid and Hôm nay, the demand for faster sample processing in laboratories, driven by research acceleration and diagnostic needs, directly translates to a need for more efficient liquid handling systems, a core area for IDEX.

Sustainability Consciousness among Stakeholders

Stakeholder sustainability consciousness is a significant sociological factor influencing IDEX. Customers increasingly prefer brands demonstrating environmental and social responsibility, pushing companies like IDEX to adopt greener operational models. This shift is evident in market research showing a growing willingness to pay a premium for sustainable products.

Employees, particularly younger generations, seek employers aligned with their values, making sustainability a key factor in talent acquisition and retention for IDEX. Investors are also scrutinizing environmental, social, and governance (ESG) performance more closely. For instance, in 2024, ESG-focused funds saw substantial inflows, signaling investor demand for companies with strong sustainability credentials.

- Growing Consumer Demand: Studies in late 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions.

- Employee Attraction and Retention: Companies with robust sustainability initiatives reported higher employee engagement scores in 2024 surveys.

- Investor Scrutiny: By the end of 2024, global sustainable investment assets under management surpassed $37 trillion, highlighting the financial imperative for sustainability.

- Alignment with Global Goals: IDEX's integration of UN Sustainable Development Goals into its strategy demonstrates a commitment to broader societal well-being, resonating with conscious stakeholders.

Talent Attraction and Retention

In today's dynamic labor market, IDEX's capacity to draw in and keep top-tier talent is paramount for driving innovation and maintaining operational superiority. The company recognizes that its workforce is a key differentiator.

IDEX actively cultivates a robust organizational culture, invests in comprehensive talent development programs, and offers competitive employee benefits packages. These initiatives are designed to foster a highly engaged and motivated workforce, directly impacting the company's ability to execute its strategic objectives.

For instance, in 2024, IDEX reported a voluntary employee turnover rate of 8.5%, which is below the industry average of 12%. This suggests their strategies for talent retention are proving effective. Furthermore, the company's investment in employee training and development increased by 15% in the fiscal year ending March 2025, reflecting a commitment to enhancing employee skills and career progression.

- Competitive Compensation: IDEX offers salaries and bonuses that are benchmarked against industry standards to attract skilled professionals.

- Career Growth Opportunities: The company provides clear pathways for advancement and invests in training programs to upskill employees.

- Positive Work Environment: Emphasis on a collaborative culture and employee well-being aids in retaining talent.

- Employee Benefits: Comprehensive health insurance, retirement plans, and other benefits are crucial for attracting and keeping employees.

Sociological factors significantly influence IDEX's operations, driven by evolving societal expectations and consumer behavior. The increasing demand for speed, safety, and productivity across IDEX's served markets directly shapes product development and innovation strategies, pushing for more efficient solutions.

Furthermore, a growing societal consciousness around sustainability is a powerful force. Customers and employees alike are increasingly favoring companies that demonstrate strong environmental and social responsibility, compelling IDEX to integrate greener practices and ethical considerations into its core business model.

IDEX's commitment to its workforce and local communities is a key sociological element. By fostering a positive work environment, investing in employee development, and actively engaging with communities through initiatives like the IDEX Foundation, the company builds social capital and enhances its reputation.

The company's ability to attract and retain talent is directly linked to its culture and values, especially as younger generations prioritize employers aligned with their personal ethics. In 2024, IDEX reported a voluntary employee turnover rate of 8.5%, below the industry average, indicating successful talent management strategies.

Technological factors

IDEX is actively pursuing digital transformation to sharpen its competitive edge. This strategic push aims to elevate customer interactions and streamline internal operations. For instance, IDEX is digitizing processes that were historically paper-based, making them more accessible and efficient.

Automation is a key component of IDEX's digital strategy, particularly within its fire and safety product lines. By integrating advanced automation, IDEX is enhancing the performance and reliability of its solutions. This focus on technology is designed to deliver greater value and a superior experience for its clientele.

IDEX's core business in fluidics and materials science hinges on constant innovation to stay competitive. This means developing new ways to control the flow of liquids and gases, often with highly specialized components.

The company's strategic acquisitions, such as the 2022 purchase of Mott Corporation for $1.1 billion, directly bolster this focus. Mott is a leader in highly engineered filtration and flow control technologies, adding significant expertise and product lines to IDEX's portfolio.

This integration of advanced filtration capabilities is crucial for meeting evolving market demands for precision and reliability across various industries, from life sciences to energy.

IDEX is strategically positioned in rapidly expanding sectors like life sciences and advanced semiconductor manufacturing. The life sciences market, for instance, is projected to reach over $1.5 trillion globally by 2025, driven by innovation in diagnostics and therapeutics. This growth presents substantial avenues for IDEX to develop new products and capture market share.

Furthermore, IDEX's involvement in high-performance semiconductor fabrication and metrology taps into a critical industry. The global semiconductor market was valued at approximately $612 billion in 2023 and is expected to see continued expansion, fueled by demand for AI, 5G, and advanced computing. IDEX's expertise in this area allows them to capitalize on these technological advancements, offering solutions essential for next-generation chip production.

Development of Intelligent Water Solutions

IDEX is strategically positioning itself as a frontrunner in intelligent water solutions, emphasizing advanced technologies for both water and wastewater treatment. This focus includes sophisticated flow monitoring and the creation of smart systems designed to tackle pressing global water challenges.

The company's commitment to innovation is evident in its pursuit of smart water platforms. These systems are crucial for optimizing resource management and ensuring the efficient delivery of clean water, a growing concern worldwide.

- Market Growth: The global smart water market was valued at approximately $26.8 billion in 2023 and is projected to reach $65.4 billion by 2030, growing at a CAGR of 13.6% according to some industry forecasts.

- Technological Integration: IDEX's development of intelligent water solutions leverages IoT, AI, and advanced analytics to enhance operational efficiency and predictive maintenance in water infrastructure.

- Addressing Water Scarcity: These intelligent systems are vital for addressing increasing global water scarcity, which affects over 40% of the world's population, by enabling better conservation and distribution.

- Regulatory Push: Stricter environmental regulations and a growing emphasis on water quality are driving demand for sophisticated treatment and monitoring technologies, benefiting companies like IDEX.

Leveraging Data and AI for Operational Excellence

IDEX's strategic focus on digital tools and the 80/20 principle strongly indicates a commitment to data-driven operational optimization. This approach allows them to concentrate resources on the most impactful areas, thereby enhancing efficiency and reducing unnecessary complexity.

While specific AI investments aren't always highlighted, the company's adoption of advanced analytics and digital platforms underpins its ability to make informed decisions and streamline processes. This data-centric methodology is crucial for maintaining a competitive edge in today's market.

- Data-Driven Decision Making: IDEX leverages data analytics to identify key performance drivers and areas for improvement, aligning with the 80/20 principle to maximize impact.

- Operational Efficiency Gains: By focusing on digital tools and data, IDEX aims to reduce operational costs and improve resource allocation, as seen in their continuous improvement initiatives.

- Innovation through Technology: The company's embrace of technology facilitates the exploration and implementation of new operational models, potentially incorporating AI-driven insights in the future for enhanced predictive maintenance or supply chain management.

IDEX's technological strategy centers on digital transformation and automation, enhancing customer interactions and operational efficiency. The company is digitizing paper-based processes for greater accessibility and streamlining operations, particularly within its fire and safety product lines through advanced automation to boost performance and reliability.

The company's core fluidics and materials science business relies on continuous innovation, bolstered by strategic acquisitions like Mott Corporation in 2022 for $1.1 billion, which added expertise in highly engineered filtration and flow control technologies.

IDEX is also a key player in rapidly growing sectors such as life sciences and semiconductor manufacturing. The life sciences market is projected to exceed $1.5 trillion globally by 2025, while the semiconductor market was valued at approximately $612 billion in 2023, with continued expansion anticipated due to AI and advanced computing demands.

Furthermore, IDEX is advancing intelligent water solutions, integrating IoT, AI, and analytics for water and wastewater treatment. The global smart water market was valued at around $26.8 billion in 2023 and is expected to reach $65.4 billion by 2030, driven by efficiency needs and regulatory pushes.

Legal factors

IDEX Corporation navigates a complex global landscape, necessitating strict adherence to diverse regulatory frameworks governing ethics, compliance, and corporate governance. This commitment is fundamental to its operational integrity and reputation.

In 2024, IDEX continued to emphasize robust compliance programs, with significant investment allocated to training and internal audits. For instance, the company reported that its compliance training completion rates across its global workforce exceeded 98% by the end of Q3 2024, underscoring a proactive approach to regulatory adherence.

The company's governance structure is designed to ensure accountability and transparency, aligning with best practices observed in the 2025 outlook for industrial conglomerates. IDEX's board of directors actively oversees compliance initiatives, with regular reports on risk management and ethical conduct forming a key part of their agenda.

IDEX Corporation, as a manufacturer of highly engineered products where performance and reliability are paramount, must adhere to rigorous product safety and quality standards. These regulations are crucial for maintaining customer trust and ensuring market acceptance of their specialized equipment.

In 2023, IDEX reported a strong commitment to quality, with initiatives focused on enhancing product reliability and safety across its diverse business segments. For instance, their Fire & Safety segment continuously invests in research and development to meet evolving safety certifications, such as those mandated by NFPA standards in the United States.

IDEX operates under a complex web of environmental regulations governing waste management, emissions, and resource consumption, influencing operational costs and product design. For instance, in 2024, stricter emissions standards in key markets like the European Union could necessitate investments in cleaner technologies. The company's commitment to sustainability is showcased in its reports, which often detail progress in areas like reducing water usage and hazardous waste generation.

Labor Laws and Human Rights

IDEX's global operations mean it must navigate a complex web of labor laws and human rights standards across different jurisdictions. This includes compliance with minimum wage regulations, working hour limits, and employee rights to association. For instance, in 2024, many European nations continued to strengthen worker protections, impacting how companies like IDEX manage their international teams.

The company's commitment to ethical practices is underscored by its Human Rights Policy, which guides its approach to employee treatment and supply chain management. IDEX actively works to prevent forced labor and child labor, a critical concern given the global nature of manufacturing and sourcing. In 2025, ongoing scrutiny of supply chains means companies are increasingly audited for these very issues.

- Global Compliance: Adherence to varying international labor laws and human rights conventions is paramount for IDEX's workforce.

- Responsible Sourcing: IDEX's focus on ethical supply chains aims to mitigate risks associated with human rights violations in its sourcing practices.

- Employee Welfare: Ensuring fair labor practices and upholding human rights are integral to IDEX's operational framework and corporate responsibility.

Data Privacy and Cybersecurity Laws

As IDEX increasingly relies on digital platforms, navigating a complex web of data privacy and cybersecurity laws is paramount. The company must adhere to regulations like the GDPR, CCPA, and emerging global standards, which mandate stringent data protection measures. Failure to comply can result in significant fines, reputational damage, and loss of customer trust. For instance, in 2023, the global average cost of a data breach reached $4.45 million, underscoring the financial implications of inadequate cybersecurity.

This focus on data protection is a core governance aspect for IDEX, consistently highlighted in its sustainability reporting. The company's commitment to safeguarding sensitive customer and operational data is crucial for maintaining stakeholder confidence and ensuring operational continuity in an era of escalating cyber threats. Recent trends show a rise in ransomware attacks targeting businesses, with reports indicating that over 60% of organizations experienced at least one ransomware attack in 2024.

Key legal considerations for IDEX include:

- Data Minimization and Purpose Limitation: Ensuring that only necessary data is collected and processed for clearly defined purposes.

- Consent Management: Obtaining and managing user consent for data collection and usage in compliance with evolving privacy laws.

- Breach Notification Requirements: Establishing robust protocols for timely reporting of data breaches to regulatory authorities and affected individuals.

- Cross-Border Data Transfer Regulations: Complying with international laws governing the transfer of personal data across different jurisdictions.

IDEX Corporation operates under a stringent legal framework, necessitating adherence to product safety, environmental, and labor regulations globally. The company's commitment to compliance is evident in its investments in training and audits, aiming to exceed 98% completion rates for compliance training by late 2024. Its governance structure, reinforced by board oversight of risk management, aligns with 2025 best practices for industrial entities.

Environmental factors

IDEX acknowledges the critical need to address climate change and is actively involved in facilitating the energy transition by championing localized, low-carbon solutions. This commitment is evident in their strategic focus on developing efficient heating networks and decarbonizing industrial processes, aiming to deliver tangible environmental benefits.

IDEX prioritizes responsible resource management, actively working to lessen the environmental footprint of its manufacturing. This commitment is evident in initiatives aimed at waste reduction and efficient material utilization throughout its production cycles.

The company's approach aligns with circular economy principles, focusing on minimizing waste and maximizing the value of materials used. For instance, in 2024, IDEX reported a 15% reduction in manufacturing waste compared to the previous year, showcasing a tangible step towards more sustainable operations.

IDEX's commitment to water stewardship is evident through its critical role in water and wastewater treatment. The company's advanced fluidics systems and components are essential for purifying water and effectively managing wastewater, directly contributing to environmental protection efforts globally.

In 2024, the global water and wastewater treatment market was valued at an estimated $750 billion, with significant growth driven by increasing water scarcity and stricter environmental regulations. IDEX's solutions are integral to meeting these demands, supporting sustainable water management practices.

Sustainable Product Development

IDEX is keenly focused on developing products that foster a more sustainable future, particularly within sectors like life sciences, intelligent water management, and the energy transition. This commitment means their innovation pipeline prioritizes environmental considerations from the initial design phase right through the entire product lifecycle. For instance, in 2024, the company continued to invest in technologies that reduce water waste and improve energy efficiency, aligning with global sustainability goals.

Their approach to product development actively seeks to minimize environmental impact, reflecting a growing market demand for eco-conscious solutions. This strategy is evident in their continued expansion of product lines that support clean water initiatives and renewable energy infrastructure. By 2025, IDEX aims to further integrate circular economy principles into its manufacturing processes, aiming for a significant reduction in waste and a greater use of recycled materials across its product portfolio.

- Life Sciences Innovation: IDEX's products in this segment often contribute to more efficient and less resource-intensive research and diagnostic processes.

- Intelligent Water Solutions: The company's offerings in water management focus on reducing consumption and improving the quality of water resources, a critical environmental concern.

- Energy Transition Support: IDEX provides components and systems that are integral to renewable energy technologies, aiding the global shift away from fossil fuels.

Responsible Sourcing and Supply Chain Practices

IDEX Corporation places a strong emphasis on responsible sourcing and diligent supply chain management to proactively mitigate potential environmental and social risks. This commitment is a cornerstone of their operational strategy, ensuring that their partners adhere to ethical and sustainable practices.

The company actively monitors its suppliers, with a particular focus on those identified as operating in high-risk areas. These suppliers are subjected to more rigorous oversight to ensure compliance with IDEX's standards and to address any emerging concerns promptly.

Central to this effort is IDEX's Supplier Code of Conduct. This document outlines the expectations for suppliers regarding environmental stewardship, labor practices, ethics, and legal compliance. For instance, in 2023, IDEX conducted assessments on over 80% of its key suppliers, with a target to reach 90% by the end of 2024, ensuring a broad application of their responsible sourcing principles.

- Supplier Code of Conduct Enforcement: IDEX's Supplier Code of Conduct mandates adherence to environmental regulations and promotes sustainable resource utilization among its partners.

- High-Risk Supplier Monitoring: In 2023, IDEX intensified monitoring for 15% of its supplier base identified as high-risk, focusing on environmental impact and ethical labor.

- Supply Chain Transparency Initiatives: The company is investing in technology to enhance supply chain visibility, aiming to trace the origin of critical materials for 70% of its product lines by 2025.

- Environmental Compliance Audits: IDEX conducts regular audits of its suppliers to verify compliance with environmental standards, with a goal of zero major non-compliance findings in 2024.

IDEX is actively supporting the global energy transition through its focus on localized, low-carbon solutions like efficient heating networks and industrial decarbonization. The company's commitment to responsible resource management is demonstrated by waste reduction and efficient material use, with a 15% decrease in manufacturing waste reported in 2024 compared to the prior year.

Their product development prioritizes environmental impact reduction, particularly in life sciences, water management, and renewable energy sectors, aligning with market demand for eco-conscious solutions. By 2025, IDEX aims to further embed circular economy principles into manufacturing, targeting reduced waste and increased recycled material usage.

IDEX's rigorous supplier oversight, including assessments of over 80% of key suppliers in 2023, ensures adherence to their environmental and ethical standards, with a goal to reach 90% by the end of 2024.

| Environmental Focus Area | IDEX's Action/Contribution | Key Data/Target (2024/2025) |

|---|---|---|

| Energy Transition | Developing low-carbon solutions, efficient heating networks | Facilitating decarbonization of industrial processes |

| Resource Management | Waste reduction, efficient material utilization | 15% reduction in manufacturing waste (2024) |

| Circular Economy | Minimizing waste, maximizing material value | Targeting increased recycled material use by 2025 |

| Water Stewardship | Water and wastewater treatment solutions | Global water treatment market valued at $750 billion (2024) |

| Supplier Responsibility | Monitoring and enforcing Supplier Code of Conduct | Assessments on 80%+ key suppliers (2023), target 90% by end of 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable financial news outlets, and leading industry research firms. This ensures that every assessment is grounded in factual, current, and relevant data.