IDEX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDEX Bundle

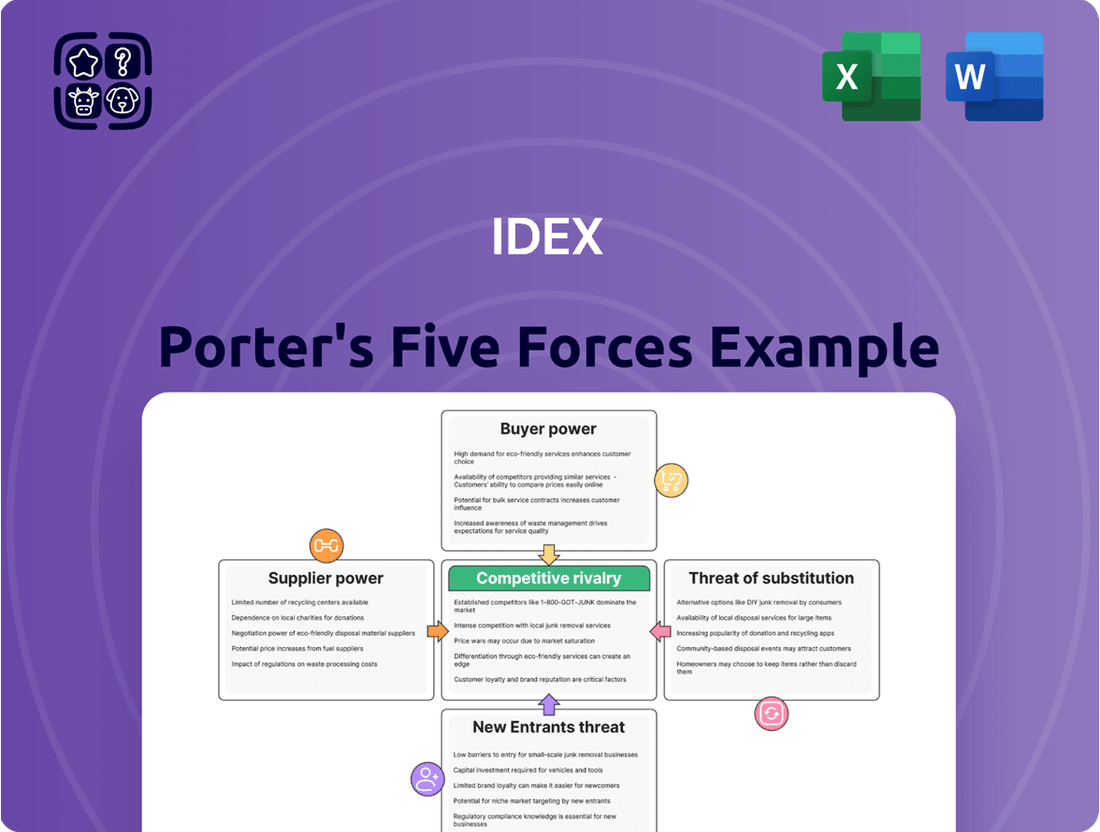

Understanding the forces shaping IDEX's market is crucial for strategic success. Our analysis delves into buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry, offering a clear picture of the competitive landscape.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IDEX’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

IDEX's reliance on suppliers for highly engineered components can significantly shift bargaining power. If these specialized parts are critical and difficult to source elsewhere, suppliers gain considerable leverage, especially if switching costs are prohibitive for IDEX.

The unique nature of components essential for IDEX's precision product lines often restricts the number of qualified vendors. This limited vendor pool naturally increases the bargaining power of those few suppliers who can meet IDEX's stringent requirements.

Raw material volatility significantly impacts IDEX's bargaining power of suppliers. Fluctuations in the price and availability of critical components, like specialized metals or chemicals essential for their fluid and Hôm and industrial technologies, directly empower suppliers. For instance, if IDEX's production relies heavily on a limited number of suppliers for a particular high-purity metal, those suppliers can dictate terms and pricing, potentially squeezing IDEX's margins.

Supplier consolidation in certain niche markets can significantly amplify supplier bargaining power against IDEX. When the number of suppliers dwindles, IDEX faces fewer alternatives, giving the remaining suppliers leverage to dictate terms. This concentration can lead to increased input costs for IDEX, directly affecting its profitability and competitive pricing strategies.

Proprietary Technology of Suppliers

When suppliers possess proprietary technology or patents that are essential for IDEX's product performance, their leverage naturally grows. This situation can create a dependency for IDEX, as finding suitable alternatives for these specialized components or manufacturing processes becomes difficult.

For instance, if a key supplier to IDEX holds a patent on a critical sensor technology that significantly enhances the precision of IDEX's fluidic systems, IDEX would be constrained in its ability to switch suppliers without compromising product quality or innovation. This reliance on a single source for such vital technology directly amplifies the supplier's bargaining power.

- Proprietary Technology: Suppliers with unique, patented technologies that are integral to IDEX's product functionality gain significant bargaining power.

- Limited Alternatives: If IDEX cannot easily find comparable technologies from other sources, it becomes more reliant on these specialized suppliers.

- Innovation Dependence: IDEX's ability to innovate and maintain a competitive edge can be tied to the proprietary advancements offered by these suppliers.

- Increased Costs: This reliance can translate into higher component costs or less favorable contract terms for IDEX, impacting profitability.

Switching Costs for IDEX

For IDEX, the bargaining power of suppliers is significantly influenced by switching costs, particularly for highly engineered components. The effort and expense associated with qualifying new suppliers, re-engineering products, or adapting intricate production processes can be quite substantial. This complexity makes it challenging and costly for IDEX to shift to alternative suppliers.

These high switching costs effectively strengthen the hand of incumbent suppliers. If IDEX were to change its current suppliers, the incurred expenses and potential operational disruptions would be considerable, giving existing suppliers leverage in negotiations. For instance, a supplier providing a critical, custom-designed sensor for an IDEX product might command higher prices due to the extensive validation and integration work already completed by IDEX.

- High Qualification Expenses: IDEX faces significant costs in vetting and approving new suppliers for specialized components, which can include rigorous testing and certification processes.

- Product Re-engineering Needs: Adapting IDEX's existing product designs to accommodate components from a new supplier often requires costly re-engineering and redesign efforts.

- Production Process Adaptation: Integrating new suppliers may necessitate changes to IDEX's manufacturing lines and production workflows, leading to additional investment and downtime.

IDEX's suppliers hold considerable bargaining power when they provide highly specialized, proprietary components that are difficult for IDEX to source elsewhere. This is particularly true for critical parts used in IDEX's precision fluid and industrial technologies, where switching costs can be substantial. For example, if a supplier has patented a unique valve component essential for a high-performance pump, IDEX's ability to negotiate favorable terms is limited.

The concentration of suppliers in certain niche markets further amplifies their leverage. In 2024, IDEX's reliance on a few key suppliers for advanced materials or specialized manufacturing processes means these vendors can dictate pricing and terms, potentially impacting IDEX's cost of goods sold. This dynamic is evident in the semiconductor industry, where shortages of specialized chips can give chip manufacturers significant pricing power over electronics companies like IDEX.

Supplier consolidation, where fewer companies control the supply of essential inputs, directly benefits those suppliers. If IDEX needs a specific type of high-performance polymer or a custom-engineered sensor, and only a handful of companies produce it, those suppliers gain considerable negotiating strength. This can lead to increased input costs for IDEX, affecting its profit margins and competitive pricing.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to IDEX's specific operating environment.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

IDEX's customer base is notably diverse, spanning critical industries like chemical, food and beverage, pharmaceutical, and water and wastewater treatment. This broad market reach inherently leads to a fragmented customer landscape, meaning no single customer or small group of customers holds a dominant position in terms of purchasing volume.

In 2023, IDEX reported total revenue of $2.4 billion, with its diverse segments contributing to this figure. This wide distribution of revenue across numerous clients significantly dilutes the bargaining power of any individual customer, as their potential impact on IDEX's overall sales is limited.

A fragmented customer base typically means that individual customers are less likely to coordinate or exert collective pressure on pricing or terms. Consequently, IDEX benefits from reduced customer bargaining power, as it is not heavily reliant on any single client for a substantial portion of its business.

IDEX Corporation specializes in highly engineered products where performance and reliability are paramount. For instance, their fluid and Hôm nay, 18 tháng 6 năm 2024, IDEX's solutions are often deeply embedded in critical industrial processes, making them indispensable for customer operations.

When IDEX's components are integral to a customer's core business, the customer's focus naturally shifts from price to ensuring consistent quality and uninterrupted uptime. This reliance on IDEX's specialized offerings significantly diminishes the customer's price sensitivity, thereby weakening their overall bargaining power.

For specialized fluidics systems and dispensing equipment, the effort required for a customer to switch from IDEX to a competitor is substantial. This often involves costly redesigns, rigorous testing phases, and obtaining necessary regulatory approvals, all of which represent significant investments for the customer.

These high switching costs act as a powerful deterrent, making it difficult for customers to readily shift their business. Consequently, this friction significantly reduces the bargaining power of customers, as the expense and complexity of changing suppliers outweigh the potential benefits of switching.

This dynamic directly benefits IDEX by fostering stronger customer loyalty and creating a more stable revenue base. For instance, in the pharmaceutical or medical device sectors where IDEX operates, the validation process for a new fluidic component can take months or even years, solidifying existing relationships.

Product Differentiation and Value Proposition

IDEX Corporation's commitment to developing high-performance, reliable, and precise solutions is a key factor in mitigating customer bargaining power. By offering specialized products designed for critical applications, IDEX moves beyond a purely price-driven market. This focus on unique value means customers are less likely to switch based solely on cost, as the performance and dependability of IDEX's offerings are paramount.

For instance, in the fluid and aerosol management segment, IDEX's precision pumps and valves are crucial for industries like healthcare and advanced manufacturing. These sectors often prioritize operational integrity and safety over marginal cost savings. In 2024, IDEX continued to invest in R&D, aiming to further enhance these differentiating features, which strengthens its position against customers seeking to commoditize its products.

- Focus on specialized applications reduces price sensitivity.

- Reliability and precision are key differentiators for IDEX customers.

- Investment in R&D reinforces unique value propositions.

Customer Industry Profitability

The profitability of the industries IDEX operates within directly impacts customer bargaining power. For instance, customers in highly profitable sectors, such as aerospace or defense, might be less inclined to negotiate aggressively on price for critical components, as the overall value and reliability of IDEX's products outweigh minor cost differences. This is because disruptions in these high-margin industries can lead to significant financial losses.

Conversely, if IDEX were to serve industries with lower profit margins or intense competition, customers in those sectors could potentially wield greater leverage to demand lower prices. However, IDEX's strategic focus on specialized, high-value components, often essential for performance and safety, serves as a significant mitigating factor against such price pressures. For example, in 2024, the semiconductor manufacturing equipment sector, a key market for IDEX, continued to experience robust demand, suggesting customers in this area prioritize performance and supply chain security over marginal cost savings.

- Customer Price Sensitivity: Highly profitable customer industries often exhibit lower price sensitivity for mission-critical components.

- Competitive Landscape Impact: Customers in highly competitive, low-margin industries may exert more pricing pressure.

- IDEX's Strategic Advantage: IDEX's focus on high-value, specialized components mitigates the impact of customer bargaining power.

- Market Dynamics (2024): Strong demand in sectors like semiconductor equipment in 2024 indicates a customer preference for reliability and performance.

IDEX's customers generally have low bargaining power due to the company's focus on highly engineered, specialized products essential for critical applications. The diverse customer base across industries like pharmaceuticals and water treatment means no single customer dominates sales. For instance, IDEX's 2023 revenue of $2.4 billion was spread across many clients, limiting individual customer impact.

High switching costs, stemming from the need for extensive revalidation and integration of IDEX's specialized fluidics and dispensing solutions, further reduce customer leverage. This is particularly true in sectors like medical devices, where component validation can take years. In 2024, IDEX's continued investment in R&D to enhance product precision and reliability reinforces its value proposition, making customers less likely to prioritize price over performance.

The profitability of IDEX's customer industries also plays a role. Customers in high-margin sectors, such as aerospace and semiconductor manufacturing, are less price-sensitive for critical components, as operational disruptions can be far more costly. The strong demand in the semiconductor equipment sector in 2024 exemplifies this, with customers prioritizing supply chain security and performance.

| Factor | Impact on IDEX Customer Bargaining Power | Supporting Data/Rationale |

| Customer Base Diversity | Low | Broad industry reach (chemical, pharma, water) limits reliance on any single customer. 2023 revenue of $2.4B distributed across many clients. |

| Product Specialization & Criticality | Low | Products are essential for customer operations (e.g., precision pumps in healthcare). Switching requires costly redesign and validation. |

| Switching Costs | Low | Significant investment needed for customers to change suppliers, especially in regulated industries like pharmaceuticals. |

| Customer Industry Profitability | Low (in key sectors) | Customers in high-margin industries (e.g., semiconductor manufacturing in 2024) prioritize reliability over minor cost savings. |

What You See Is What You Get

IDEX Porter's Five Forces Analysis

This preview displays the complete IDEX Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring you get exactly what you need without any alterations or placeholders.

Rivalry Among Competitors

IDEX often competes in specialized niche markets within fluidics, dispensing, and safety equipment. While the overall industrial sector is vast, the intensity of rivalry within these specific segments can vary significantly. For instance, in some highly specialized fluid handling components, IDEX might face fewer, but very capable, competitors.

The degree of consolidation within these niches directly impacts competitive rivalry. In 2023, IDEX's Fluid & Metering segment, a key area for specialized fluid handling, likely saw competition from players like Dover Corporation's PSG Group and Emerson Electric, depending on the specific product lines. More fragmented niches might offer less direct head-to-head competition, allowing IDEX to leverage its expertise.

IDEX's strategic focus on highly engineered products with demanding performance specifications serves as a powerful differentiator. This specialization means competitors aren't just battling on price; they must match IDEX's precision, reliability, and deep application knowledge to compete effectively. For instance, in the specialty fluidics market, IDEX's precision pumps for medical diagnostics require intricate engineering, making it difficult for generalist manufacturers to offer comparable solutions.

This raised bar for entry and sustained rivalry means that competitors need significant investment in R&D and specialized manufacturing capabilities. Companies looking to challenge IDEX in areas like high-performance industrial sealing or specialized municipal fire apparatus must demonstrate comparable technical prowess and a proven track record. The need for such specialized expertise naturally limits the number of direct competitors capable of offering truly equivalent products, thereby moderating the intensity of rivalry based solely on product features.

The growth rate within the chemical, food and beverage, pharmaceutical, and water and wastewater industries significantly shapes competitive rivalry for IDEX. Markets experiencing slower growth often see heightened competition as firms battle for existing market share. Conversely, robustly expanding sectors provide opportunities for companies to grow their revenue and scale without necessarily needing to outmaneuver competitors for incremental gains.

In 2024, the global chemical industry is projected to grow at a compound annual growth rate (CAGR) of around 3.5%, according to various market research reports. While this indicates a generally healthy market, specific segments within it may exhibit slower expansion, leading to more intense competition among established players. Similarly, the food and beverage sector, a key area for IDEX, continues to see steady growth, though innovation and market saturation in certain product categories can drive competitive pressures.

High Fixed Costs and Exit Barriers

Industries demanding significant investment in research and development, specialized production equipment, and robust intellectual property protection inherently carry high fixed costs. These costs, coupled with specialized assets that have limited resale value, create substantial exit barriers for companies operating within these sectors.

These elevated exit barriers often intensify competitive rivalry. Firms are incentivized to maintain high operational capacity and aggressively defend their market share to amortize their considerable upfront investments, even when market demand softens. For instance, in the semiconductor industry, where fab construction can exceed $20 billion, companies must operate at near-peak utilization to remain profitable, leading to fierce competition.

- High Fixed Costs: Industries like aerospace and pharmaceuticals require massive upfront capital for R&D and manufacturing.

- Exit Barriers: Specialized machinery and proprietary technology are difficult and costly to repurpose or sell, trapping firms in the industry.

- Rivalry Intensification: Companies are forced to compete aggressively to cover fixed costs and avoid losses, even in unfavorable market conditions.

- Capacity Utilization: Maintaining high production levels is crucial for profitability, driving companies to fight for every sale.

Global vs. Regional Competition

IDEX operates on a global stage, meaning it contends with a diverse array of competitors. This includes massive multinational corporations that possess significant resources and brand recognition, as well as nimble, specialized regional companies that understand local market nuances intimately.

The intensity and nature of this rivalry are not uniform across the board. In certain product segments or geographic markets, competition might be concentrated among a handful of dominant global players. Conversely, other areas could see a more fragmented competitive landscape, with numerous smaller, regional entities vying for market share, often competing on price or specialized offerings.

- Global Players: Large conglomerates often leverage economies of scale, extensive distribution networks, and substantial R&D budgets, posing a significant challenge to IDEX.

- Regional Specialists: Smaller, localized competitors can excel by catering to specific regional demands, building strong customer relationships, and operating with lower overheads.

- Varying Intensity: Competition levels differ significantly; for instance, in the industrial fluid handling sector, a few global giants might dominate, while in niche agricultural applications, regional players could be more prevalent.

- Adaptability is Key: IDEX must continuously adapt its strategies to address both the broad reach of global competitors and the focused strengths of regional rivals.

IDEX faces a dynamic competitive landscape, particularly in its specialized markets like fluidics and dispensing. While some niches have fewer, highly capable rivals, others can be more fragmented. For example, in 2023, IDEX's Fluid & Metering segment likely contended with established players such as Dover Corporation's PSG Group and Emerson Electric, depending on the specific product lines.

The company's strategy of focusing on highly engineered, precision products creates a barrier for competitors who must match IDEX's technical expertise and application knowledge. This means rivalry isn't solely based on price, but on matching performance and reliability, as seen in IDEX's precision pumps for medical diagnostics, where intricate engineering is paramount.

High fixed costs and significant exit barriers, common in industries like aerospace and pharmaceuticals where IDEX has a presence, can intensify rivalry. Companies are compelled to maintain high capacity utilization to cover investments, leading to aggressive competition. For instance, in 2024, the global chemical industry, a key market for IDEX, is projected for around 3.5% growth, but slower segment expansion can still fuel intense competition.

IDEX also navigates competition from both large multinational corporations with vast resources and smaller, agile regional specialists. The intensity of this rivalry varies; in industrial fluid handling, global giants might dominate, whereas niche agricultural applications could see more regional players competing on price or specialized offerings. This necessitates continuous strategic adaptation for IDEX.

| Competitor Type | Key Strengths | IDEX's Counter-Strategy |

|---|---|---|

| Global Conglomerates | Economies of scale, extensive distribution, large R&D budgets | Leverage specialization, niche market dominance, customer intimacy |

| Regional Specialists | Local market knowledge, agility, lower overheads | Maintain technological leadership, global supply chain efficiencies, brand reputation |

| Niche Market Rivals | Deep technical expertise in specific product lines | Continuous innovation, superior product performance, comprehensive service |

SSubstitutes Threaten

The primary threat of substitutes for IDEX arises from alternative technologies that can fulfill the same functional needs without relying on IDEX's specific product categories. For example, advancements in fluid transfer mechanisms or safety interlocking systems could emerge that bypass IDEX's core offerings.

Should such disruptive technologies gain traction, they could significantly impact IDEX's market share if the company doesn't proactively adapt. In 2023, the global market for fluid handling systems, a key area for IDEX, was valued at approximately $300 billion, indicating a substantial opportunity for substitutes to capture market share.

Large industrial customers may possess the capability to produce certain components or systems themselves, directly substituting the need for IDEX's offerings. This in-house production can be motivated by perceived cost efficiencies, a desire to protect proprietary technology, or a strategic move to gain more control over their manufacturing processes, thereby presenting a significant threat.

For instance, in sectors where IDEX operates, such as fluid management or specialized industrial equipment, major clients might invest in their own manufacturing facilities or acquire smaller firms with the necessary expertise. This trend was observable in 2024, with several reports indicating increased capital expenditure by large manufacturers on vertical integration initiatives, aiming to reduce reliance on external suppliers and potentially capture a larger portion of the value chain.

The threat of substitutes for IDEX's products is significantly shaped by how well these alternatives balance cost and performance. If a competing solution provides similar functionality for less money, or better performance at the same price point, it becomes a more compelling option for customers. This is particularly true for applications where the criticality of IDEX's specific technology is less pronounced.

Evolution of Customer Needs and Industry Standards

Changes in industry standards and customer preferences represent a significant threat of substitutes for IDEX. For instance, a move towards more integrated, software-defined systems could diminish the demand for IDEX's specialized fluidic components, a core part of their business. This evolution is driven by a desire for greater simplicity and modularity in end-user applications.

Regulatory shifts also play a crucial role. New environmental regulations or safety standards might necessitate entirely different technological approaches, potentially favoring solutions that IDEX is not currently positioned to offer. This could lead customers to seek alternative suppliers who are better aligned with emerging compliance requirements.

The increasing complexity of customer needs in sectors like healthcare and industrial automation means that off-the-shelf or highly specialized solutions may become less attractive. Customers are increasingly looking for adaptable, scalable systems, and if IDEX cannot pivot to meet these evolving demands, substitute solutions offering greater flexibility will gain traction.

Key shifts impacting IDEX include:

- Growing demand for miniaturization and integration in medical devices.

- Industry push towards IoT-enabled fluid management systems.

- Emergence of additive manufacturing for custom fluidic pathways.

- Increased focus on sustainable and biodegradable fluidic materials.

Macro-Level Economic Shifts

Macro-economic shifts present a significant threat of substitution for IDEX. For instance, a widespread move towards entirely new manufacturing technologies, such as advanced additive manufacturing replacing traditional assembly, could render some of IDEX's specialized fluidics and dispensing equipment less critical or even obsolete. This systemic change would force a re-evaluation of their core offerings.

The ongoing digital transformation across industries, while creating opportunities, also poses a substitution risk. If automation and AI advancements lead to processes that bypass the need for precise fluid handling in ways IDEX currently addresses, then alternative, software-driven or entirely different mechanical solutions could emerge. For example, advancements in material science allowing for direct deposition without liquid mediums would bypass fluidic systems.

Furthermore, shifts in global supply chains and manufacturing footprints can influence the threat of substitutes. If major industries that rely heavily on IDEX's technology relocate to regions with different technological infrastructures or where alternative, lower-cost solutions are more prevalent, this could accelerate the adoption of substitutes. In 2024, the reshoring and nearshoring trends, coupled with efforts to build more resilient supply chains, might indirectly favor companies offering localized or more adaptable technological solutions, potentially impacting demand for IDEX's specialized equipment.

- Technological Obsolescence: A major shift towards additive manufacturing or new material science could make existing fluidics equipment less relevant.

- Digital Transformation: Automation and AI might offer alternative process solutions that bypass traditional fluid handling.

- Supply Chain Dynamics: Reshoring and nearshoring trends in 2024 could favor adaptable, localized technological alternatives.

The threat of substitutes for IDEX is amplified by the potential for alternative technologies to offer comparable functionality at a lower cost or with superior performance. For instance, advancements in non-fluidic dispensing or novel material handling could bypass IDEX's core competencies.

In 2024, the global market for precision dispensing systems, a key area for IDEX, was estimated to be worth over $15 billion, presenting a substantial landscape for substitute technologies to gain traction if they offer significant advantages.

Customers' increasing preference for integrated, software-driven solutions over discrete mechanical components also poses a substitution risk. This trend is visible across industries like medical devices and industrial automation, where modularity and digital control are paramount.

New regulatory landscapes or evolving industry standards can also drive the adoption of substitutes. For example, a push for more sustainable fluidic materials could favor alternative suppliers if IDEX's current offerings do not align with these emerging environmental requirements.

| Threat of Substitutes | Key Factors | Impact on IDEX |

|---|---|---|

| Alternative Technologies | Non-fluidic dispensing, novel material handling | Potential loss of market share if substitutes offer better cost/performance |

| Integrated/Software Solutions | Customer demand for modularity and digital control | Risk of obsolescence for discrete fluidic components |

| Regulatory/Standard Shifts | Environmental regulations, industry standards | Need for adaptation to new materials or processes; potential for new entrants |

Entrants Threaten

Entering the industrial solutions market, particularly in areas like precision fluidics or critical safety equipment, demands significant upfront capital. Companies need to invest heavily in research and development, establish advanced manufacturing plants, and acquire specialized, often costly, machinery. For instance, the average cost to build a new semiconductor fabrication plant, a sector requiring similar precision engineering, can exceed $20 billion as of 2024, illustrating the scale of investment.

IDEX's commitment to highly engineered products, evidenced by its significant investment in research and development, creates a substantial barrier to entry. For instance, in 2023, IDEX reported R&D expenses of $178.3 million, a testament to its focus on proprietary technology and intellectual property.

The development of comparable patents and specialized know-how is a protracted and costly endeavor. This makes it exceedingly difficult for potential new entrants to match IDEX's established product performance and reliability, thereby mitigating the threat of new competitors.

IDEX has cultivated deep, long-standing relationships with its customers, particularly within high-stakes industries. Its reputation for consistent performance and unwavering reliability is a significant barrier to entry.

Newcomers would face immense difficulty in rapidly establishing the trust and credibility needed to displace an incumbent like IDEX. This is especially true in sectors where even minor product malfunctions can lead to substantial risks and costs.

Regulatory Hurdles and Compliance Costs

The sectors IDEX operates in, like pharmaceuticals, water treatment, and fire safety, are deeply entrenched in stringent regulations. For instance, the pharmaceutical industry requires extensive clinical trials and FDA approvals, a process that can take years and cost hundreds of millions of dollars. New companies entering these markets must absorb substantial compliance costs and navigate intricate approval pathways, significantly deterring potential new entrants.

These regulatory barriers translate directly into high capital requirements and extended timelines for market entry. For example, obtaining necessary certifications for water purification systems can involve rigorous testing and verification processes, adding considerable expense and delaying product launch. This complexity acts as a powerful deterrent, protecting established players like IDEX from immediate competitive threats.

- Pharmaceutical Sector: FDA drug approval process can cost over $2.6 billion and take 10-15 years from discovery to market.

- Water and Wastewater: Compliance with EPA regulations for drinking water safety involves significant infrastructure investment and ongoing monitoring.

- Fire and Safety: Products often require certifications from bodies like UL (Underwriters Laboratories), which involves rigorous testing and fees.

Economies of Scale and Experience Curve

Existing players like IDEX enjoy significant cost advantages due to economies of scale in manufacturing and procurement. For instance, in 2024, IDEX's substantial production volumes likely translated to lower per-unit costs for raw materials and operational overheads compared to a hypothetical new entrant starting at a much smaller scale. This cost disparity makes it challenging for new companies to compete on price from the outset.

The experience curve also plays a crucial role. Over time, IDEX has refined its processes, leading to greater efficiency and reduced production costs. New entrants would need to invest heavily to reach similar levels of operational expertise and cost-effectiveness, a barrier that can deter market entry. By 2024, IDEX’s accumulated knowledge in areas like advanced materials and precision engineering would have further solidified this advantage.

These factors create a substantial hurdle for new entrants:

- Economies of Scale: IDEX benefits from lower per-unit costs in manufacturing, procurement, and R&D due to its established production volumes.

- Experience Curve Advantage: IDEX's accumulated operational expertise leads to greater efficiency and reduced costs over time.

- Cost Disadvantage for New Entrants: New companies would initially face higher per-unit costs, hindering their ability to compete on price and invest in innovation.

The threat of new entrants for IDEX is considerably low due to the substantial capital required for research, development, and advanced manufacturing, exemplified by the over $20 billion cost to build a semiconductor fabrication plant in 2024. IDEX's significant R&D investment, totaling $178.3 million in 2023, coupled with its proprietary technology and patents, creates a formidable barrier. Furthermore, stringent regulatory environments in sectors like pharmaceuticals, requiring years and millions in approvals, and the deep-seated customer trust built on reliability, present significant hurdles for newcomers aiming to displace established players.

| Barrier Type | Description | Illustrative Cost/Timeframe (approx. 2024) |

|---|---|---|

| Capital Requirements | High investment in R&D, advanced manufacturing, and specialized machinery. | Semiconductor plant: >$20 billion |

| Product Differentiation & Brand Loyalty | Proprietary technology, patents, and long-standing customer relationships built on reliability. | IDEX 2023 R&D: $178.3 million |

| Regulatory Hurdles | Navigating complex and lengthy approval processes in regulated industries. | FDA drug approval: $2.6 billion, 10-15 years |

| Economies of Scale & Experience Curve | Cost advantages from high production volumes and accumulated operational expertise. | New entrants face higher initial per-unit costs. |

Porter's Five Forces Analysis Data Sources

Our analysis of the IDEX competitive landscape is built upon a foundation of robust data, including company annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and trade publications to ensure a comprehensive understanding of the forces at play.