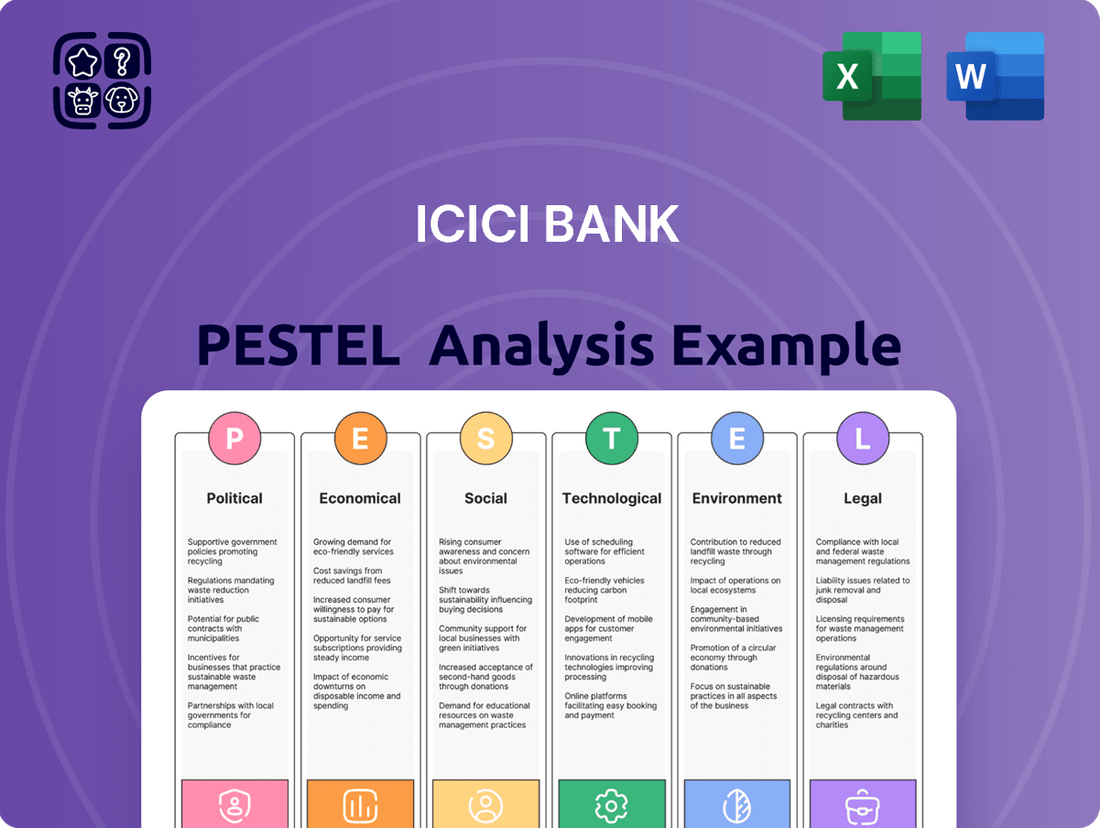

ICICI Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICICI Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ICICI Bank's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making. Download the full report to gain a competitive advantage.

Political factors

ICICI Bank's strategic direction is deeply intertwined with the stability and policy framework of the Indian government. A predictable political landscape fosters a conducive environment for regulatory continuity and enhances investor sentiment, which is crucial for the banking sector's expansion plans.

The Indian government's emphasis on digital transformation and expanding financial access, particularly evident in initiatives like the Pradhan Mantri Jan Dhan Yojana, directly informs ICICI Bank's strategic focus on digital offerings and customer outreach programs.

As of early 2024, India's political stability has been a key driver for economic growth, with the government continuing its push for ease of doing business, which positively impacts the operational efficiency and investment attractiveness of major financial institutions like ICICI Bank.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) are significantly expanding financial access. As of early 2024, PMJDY had over 50 crore (500 million) accounts opened, with a substantial portion in rural areas, directly benefiting banks like ICICI by bringing new customers into the formal financial system.

Programs such as Stand-Up India and MUDRA Yojana, which focus on entrepreneurship and small businesses, also create new avenues for ICICI Bank. These schemes encourage lending to previously unbanked segments, potentially increasing ICICI's loan portfolio and fee-based income streams as more individuals and businesses engage with banking services.

These financial inclusion drives necessitate that ICICI Bank refines its service delivery and outreach strategies to effectively serve these newly included populations. This means developing more accessible digital platforms and tailored financial products suitable for diverse customer needs in both rural and semi-urban settings.

The Reserve Bank of India (RBI) plays a crucial role in shaping ICICI Bank's operating landscape through its robust regulatory framework. These regulations encompass critical areas such as capital adequacy ratios, foreign investment limits, and stringent corporate governance norms, directly impacting ICICI's financial health and strategic planning.

In recent years, the RBI has intensified its oversight, particularly concerning lending practices and risk management. For instance, the implementation of the Prompt Corrective Action (PCA) framework for identified banks, while not directly applied to ICICI Bank as of recent reports, signals a broader trend of heightened regulatory vigilance that influences operational stability and compliance expenditures across the sector.

Geopolitical Risks and Economic Stability

Geopolitical risks, like the ongoing Russia-Ukraine conflict and escalating Middle East tensions, significantly impact global economic stability, which in turn affects India. These events can disrupt supply chains, influence commodity prices, and create volatility in financial markets, posing indirect but substantial threats to the Indian banking sector, including ICICI Bank.

For ICICI Bank, these geopolitical shifts necessitate a proactive approach to risk management. Fluctuations in global oil prices, a key input for the Indian economy, directly influence inflation and economic growth prospects. For instance, Brent crude oil prices, which saw significant volatility in 2024, impacting India's import bill and current account deficit, underscore the importance of robust hedging and diversified asset portfolios for banks like ICICI.

- Global Instability Impact: Geopolitical events can reduce external demand for Indian goods and services, affecting corporate earnings and loan repayment capacities.

- Commodity Price Volatility: Rising oil prices, a common consequence of geopolitical conflicts, increase India's import costs, potentially leading to inflation and slower economic growth, which impacts the banking sector's asset quality.

- Financial Market Volatility: International conflicts often trigger capital outflows from emerging markets, including India, leading to currency depreciation and increased borrowing costs for Indian entities, including banks.

- Strategic Adjustments: ICICI Bank must continuously assess and adapt its risk mitigation strategies, capital allocation, and operational plans to navigate the uncertainties arising from these global political developments.

Government Support for Digital Transformation

The Indian government's strong commitment to digital transformation, exemplified by initiatives like 'Digital India,' significantly bolsters the banking sector. This policy focus translates into substantial investments in digital public infrastructure, such as the Unified Payments Interface (UPI) and Aadhaar, which are foundational for modern banking services. For instance, UPI transactions reached a staggering 13.4 billion in Q4 2024, demonstrating the widespread adoption driven by government support.

This governmental backing directly accelerates the uptake of digital banking solutions, pushing banks like ICICI Bank to enhance their digital offerings. It encourages strategies aimed at improving accessibility and customer convenience, as seen in the expansion of digital onboarding processes and the proliferation of mobile banking features. The government's vision for a digitally empowered nation creates a favorable political climate for banks to innovate and expand their digital footprints.

- Digital India Initiative: Aims to transform India into a digitally empowered society and knowledge economy.

- UPI Growth: Facilitated over 13.4 billion transactions in Q4 2024, highlighting government-backed digital payment infrastructure.

- Aadhaar Integration: Provides a unique digital identity, streamlining customer verification and service delivery in banking.

- Government Investment: Continued allocation of funds towards digital infrastructure development supports the banking sector's digital evolution.

The Indian political landscape, characterized by stability and a pro-business stance, directly supports ICICI Bank's growth. Government initiatives like 'Digital India' and financial inclusion programs have significantly expanded the customer base and transaction volumes for banks. For example, the Pradhan Mantri Jan Dhan Yojana (PMJDY) had over 500 million accounts by early 2024, bringing millions into the formal banking system, a direct benefit to institutions like ICICI Bank.

The government's focus on ease of doing business and digital transformation, evidenced by the massive growth in UPI transactions reaching 13.4 billion in Q4 2024, creates a favorable environment for digital banking innovation. This policy direction encourages ICICI Bank to invest further in its digital platforms and customer outreach.

Government support for entrepreneurship through schemes like Stand-Up India and MUDRA Yojana also opens new lending opportunities for ICICI Bank, potentially boosting its loan portfolio and fee income by tapping into previously underserved segments.

Geopolitical instability, however, presents challenges. Global conflicts can lead to commodity price volatility, impacting India's import costs and economic growth, which in turn affects the banking sector's asset quality and borrowing costs. For instance, fluctuations in Brent crude oil prices in 2024 highlighted the need for robust risk management by banks like ICICI.

What is included in the product

This PESTLE analysis of ICICI Bank dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

The ICICI Bank PESTLE Analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning or client discussions.

Economic factors

India's economy is showing impressive strength, with projections for Gross Domestic Product (GDP) growth hovering around 6.3% for the fiscal year 2024-25. This robust expansion is a key driver for increased credit demand, benefiting sectors from individual consumers to large corporations.

This sustained economic momentum translates directly into a greater need for financial services, including loans and other credit facilities. For ICICI Bank, this environment presents a significant opportunity to expand its lending activities, thereby growing its loan portfolio and enhancing its overall financial performance.

Inflationary pressures in India, projected to hover around 5% in 2024, significantly shape the Reserve Bank of India's (RBI) monetary policy. This directly influences key interest rates like the repo rate, which is a critical benchmark for the banking sector.

These RBI policy decisions have a direct ripple effect on ICICI Bank's lending and deposit rates. Consequently, changes in these rates impact the bank's net interest margins (NIMs), a key indicator of its profitability, and its overall financial performance.

ICICI Bank, like much of the Indian banking sector, has experienced a notable improvement in asset quality. This is evidenced by a significant reduction in non-performing asset (NPA) ratios. For instance, as of the fiscal year ending March 2024, the gross NPA ratio for the Indian banking system stood at a multi-year low of approximately 3.2%, a substantial drop from previous years.

This enhanced asset quality is largely attributed to stronger corporate balance sheets, a result of deleveraging efforts by many Indian companies, and more robust risk management practices implemented by banks, including ICICI Bank. Such improvements bolster the bank's financial stability and its capacity to absorb potential economic shocks, making it a more resilient institution.

Strong Profitability and Returns

ICICI Bank has shown impressive financial health, with a notable increase in net profit. For the fiscal year ended March 31, 2024, ICICI Bank reported a net profit of ₹44,790 crore, a significant jump from ₹34,077 crore in the previous year. This strong profitability is a key indicator of its robust operational efficiency and effective risk management.

The broader banking sector is also poised for continued strong profitability. This outlook is bolstered by healthy growth in loan volumes and ongoing improvements in operational efficiency, which are expected to support sustained internal capital generation. These factors collectively enable banks like ICICI to fund future growth initiatives and maintain financial stability.

- Net Profit Growth: ICICI Bank's net profit grew by 31.4% to ₹44,790 crore for FY24.

- Operating Profit: Core operating profit also saw healthy expansion, reflecting strong business momentum.

- Sector Outlook: The banking industry's profitability is projected to remain robust due to rising business volumes and enhanced efficiency.

- Capital Generation: Strong profits ensure sufficient internal capital for ongoing business expansion and strategic investments.

Retail and MSME Lending Growth

Retail and MSME lending have shown robust growth, significantly benefiting ICICI Bank's credit portfolio. This expansion is fueled by supportive government policies and a general uplift in consumer spending confidence, making it a key driver for the bank's revenue streams.

ICICI Bank's focus on these segments is evident in its financial performance. For instance, in FY24, the bank reported strong growth in its retail loan book, which constitutes a substantial portion of its overall advances. This diversification helps mitigate risks associated with concentrated lending.

- Retail loan growth: ICICI Bank's retail loan book saw a significant year-on-year increase in FY24, contributing to overall asset quality improvement.

- MSME segment contribution: The Micro, Small, and Medium Enterprises (MSME) segment is a crucial growth engine, with the bank actively expanding its offerings to this sector.

- Government initiatives impact: Programs aimed at boosting MSME financing and consumer demand have directly translated into higher lending volumes for banks like ICICI.

- Diversified revenue: The balanced growth across retail and MSME lending ensures a diversified revenue base, enhancing the bank's financial resilience.

India's economy is projected to grow at a healthy pace, with GDP expected to expand by around 6.3% in fiscal year 2024-25. This economic strength fuels demand for credit across all sectors, directly benefiting financial institutions like ICICI Bank by increasing opportunities for lending and portfolio growth.

Inflation is anticipated to remain around 5% in 2024, influencing the Reserve Bank of India's monetary policy and key interest rates. These policy shifts directly impact ICICI Bank's net interest margins and overall profitability, requiring careful management of its lending and deposit rates.

The banking sector's asset quality has improved significantly, with gross NPAs for the Indian banking system falling to approximately 3.2% by March 2024. This enhanced stability, driven by stronger corporate balance sheets and better risk management, positions ICICI Bank to better withstand economic fluctuations.

| Economic Factor | Projection/Data (FY24/25) | Impact on ICICI Bank |

|---|---|---|

| GDP Growth | ~6.3% | Increased credit demand, expanded lending opportunities |

| Inflation | ~5% | Influences RBI policy, interest rates, and Net Interest Margins (NIMs) |

| Gross NPA Ratio (System) | ~3.2% (as of Mar 2024) | Improved asset quality, enhanced financial stability |

Same Document Delivered

ICICI Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ICICI Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the external forces shaping the banking landscape and ICICI Bank's position within it.

Sociological factors

Sociological shifts are significantly expanding the customer base for financial institutions like ICICI Bank. Government-backed financial inclusion programs, aiming to bring unbanked populations into the formal financial system, are creating new opportunities, especially in rural and previously underserved regions. This trend is expected to continue, with a growing number of individuals gaining access to banking services.

ICICI Bank is actively responding to these sociological changes by enhancing its digital outreach and developing tailored products. Initiatives like simplified account opening processes and mobile banking solutions are crucial for catering to a more diverse demographic, including those with lower financial literacy. The bank's focus on digital channels allows it to reach a wider audience efficiently.

Data from the Reserve Bank of India indicated that as of March 2023, over 1.4 billion bank accounts had been opened under the Pradhan Mantri Jan Dhan Yojana, a significant leap in financial inclusion. This expansion directly translates to a larger potential market for banking services, with ICICI Bank positioned to capitalize on this growth by adapting its service delivery models.

The growing digital fluency of India's population, with a significant portion of the population now comfortable using online and mobile platforms, is fundamentally reshaping how financial services are accessed. This trend is particularly evident in the 2023-2024 period, where mobile banking transactions saw a substantial uptick, exceeding 70% of all retail banking activities for many leading institutions.

Consumers increasingly expect banking experiences that are not only convenient but also highly personalized and intuitive, driving demand for sophisticated digital interfaces and tailored product offerings. ICICI Bank, like its peers, is responding by investing heavily in enhancing its digital channels, focusing on user experience and data-driven personalization to meet these evolving expectations.

Customers are increasingly seeking financial products and services that are precisely tailored to their unique circumstances and life phases. This societal shift is a significant driver for financial institutions like ICICI Bank.

To meet this demand, ICICI Bank is actively employing data analytics and artificial intelligence to deliver hyper-personalized offerings. This includes customized investment portfolios, bespoke credit solutions, and insurance products designed for individual risk profiles and financial goals.

For instance, by mid-2024, digital banking adoption in India had surged, with a significant portion of customers actively engaging with personalized recommendations. ICICI Bank's investment in AI-driven customer segmentation allows them to proactively suggest relevant financial instruments, enhancing customer satisfaction and loyalty.

Financial Literacy and Awareness

As financial products grow increasingly complex, there's a significant societal demand for enhanced financial literacy and education. This trend directly impacts how customers engage with banking services, making informed decision-making crucial.

ICICI Bank actively addresses this need through its corporate social responsibility (CSR) efforts and extensive digital campaigns. These initiatives focus on educating the public about crucial topics like cybersecurity and fraud prevention, which is vital for building and maintaining customer trust in the digital age. For instance, in the fiscal year 2023-24, ICICI Bank reported investing ₹450 crore in various community development and financial inclusion programs, which often include financial literacy components.

- Growing Complexity: The proliferation of sophisticated financial instruments necessitates greater consumer understanding.

- Digital Trust: Awareness campaigns on cybersecurity and fraud prevention are key to customer confidence.

- CSR Investment: ICICI Bank's commitment to financial literacy through CSR highlights its role in societal upliftment.

Demographic Shifts and Urbanization

Demographic shifts, particularly rapid urbanization, are reshaping India's financial landscape. As more people move to cities, their income levels and spending patterns change, directly impacting the demand for banking services. This trend presents both opportunities and challenges for ICICI Bank.

Urban and semi-urban areas are witnessing increased demand for sophisticated banking products like mortgages, personal loans, and wealth management services. For instance, by the end of fiscal year 2024, ICICI Bank reported a significant increase in its retail loan book, driven by demand from these growing population centers. The bank must strategically align its branch network expansion and digital service offerings to capture this evolving market.

- Urban Population Growth: India's urban population is projected to reach 675 million by 2035, up from approximately 471 million in 2020, according to UN data.

- Rising Disposable Incomes: The World Bank indicated that a growing segment of the urban Indian population falls into middle and upper-middle-income brackets, increasing their capacity for financial products.

- Digital Adoption: A significant portion of the urban demographic is digitally savvy, preferring online banking and mobile applications for transactions and services.

- Product Customization: Catering to diverse urban needs requires tailored financial solutions, from affordable housing loans to investment products aligned with varying risk appetites.

Societal expectations are evolving, with consumers increasingly demanding personalized financial solutions. ICICI Bank is leveraging data analytics and AI to offer tailored products, as seen in the surge of digital banking adoption by mid-2024, where personalized recommendations were actively used.

The growing complexity of financial products necessitates enhanced financial literacy, a need ICICI Bank addresses through CSR initiatives and digital campaigns focused on cybersecurity and fraud prevention, backed by a ₹450 crore investment in fiscal year 2023-24.

Rapid urbanization is a key demographic shift, driving demand for sophisticated banking products like mortgages and wealth management services, with ICICI Bank reporting a significant increase in its retail loan book by the end of fiscal year 2024 due to demand from these centers.

India's urban population is projected to reach 675 million by 2035, with a growing segment having higher disposable incomes, driving demand for tailored financial solutions from institutions like ICICI Bank.

Technological factors

Technological factors are significantly reshaping the banking landscape, with accelerated digital transformation being a prime example. ICICI Bank, a key player in the Indian financial sector, is heavily invested in this shift, recognizing the imperative to adopt cutting-edge technologies. This includes substantial capital allocation towards modernizing core banking infrastructure and developing robust digital platforms for customer engagement. The bank's commitment to digital innovation is evident in its focus on seamless digital customer acquisition processes and continuous enhancement of technological capabilities aimed at operational efficiency and superior service delivery.

ICICI Bank is significantly integrating Artificial Intelligence (AI) and Machine Learning (ML) across its operations. These technologies are instrumental in enhancing fraud detection capabilities and strengthening risk management frameworks. For instance, AI algorithms are employed to analyze vast datasets for identifying suspicious transactions in real-time, a critical function in the current financial landscape.

The bank is also utilizing AI to deliver personalized banking experiences to its customers. AI-powered chatbots, such as 'iPal', are actively managing customer queries, providing instant support and improving operational efficiency. This adoption of conversational AI demonstrates a commitment to leveraging technology for better customer engagement and service delivery.

Furthermore, ICICI Bank employs AI for sophisticated credit risk assessments and loan underwriting processes. This allows for more accurate and faster evaluation of loan applications, reducing turnaround times and improving the quality of credit decisions. The bank's investment in AI for these core functions underscores its strategic focus on digital transformation and data-driven decision-making, aiming to gain a competitive edge.

The Unified Payments Interface (UPI) has fundamentally reshaped India's digital payment landscape, facilitating billions of transactions. ICICI Bank leverages UPI within its mobile banking applications, allowing for immediate, real-time interbank transfers and actively supporting the nation's move towards a cashless economy.

Cybersecurity and Data Security

The increasing reliance on digital platforms for banking operations exposes ICICI Bank to significant cyber threats. To counter this, the bank is committed to substantial investments in state-of-the-art cybersecurity infrastructure and stringent data protection protocols. This proactive approach is crucial given the escalating sophistication of cyberattacks targeting financial institutions globally.

ICICI Bank's strategy to mitigate these risks is multifaceted, emphasizing robust IT governance frameworks and comprehensive training programs for both employees and customers on cybersecurity best practices. Secure data storage solutions are a cornerstone of this strategy, ensuring the confidentiality and integrity of sensitive customer information.

In 2023, the Reserve Bank of India reported that cyber fraud incidents in the Indian banking sector saw a notable increase, underscoring the persistent threat landscape. ICICI Bank’s proactive stance includes continuous monitoring, threat intelligence gathering, and rapid response mechanisms to safeguard its digital ecosystem.

- Investment in Advanced Security: ICICI Bank allocates significant capital towards cutting-edge cybersecurity tools and technologies to defend against evolving cyber threats.

- Robust IT Governance: The bank maintains strong IT governance policies to ensure compliance and operational resilience in its digital operations.

- Customer and Employee Education: Ongoing training initiatives are implemented to enhance awareness and preparedness against cyber risks among all stakeholders.

- Secure Data Storage: Emphasis is placed on implementing secure data storage solutions to protect sensitive financial information from unauthorized access or breaches.

Embedded Finance and API Banking

Embedded finance is a significant technological shift, integrating financial services directly into non-financial platforms, making transactions seamless for consumers. This trend is rapidly expanding, with projections indicating the global embedded finance market could reach $7 trillion by 2030, up from an estimated $4.7 trillion in 2023. ICICI Bank has strategically positioned itself by championing API banking.

Through its robust API infrastructure, ICICI Bank enables fintech companies and other businesses to easily integrate a wide array of banking services, such as payments, account management, and lending, directly into their own applications and customer journeys. This not only enhances customer accessibility to financial services but also creates novel revenue opportunities for the bank by facilitating a broader reach beyond its traditional customer base.

- Growing Market: The embedded finance market is projected to hit $7 trillion by 2030, showcasing substantial growth potential.

- API Integration: ICICI Bank's commitment to API banking allows for seamless integration of financial services into third-party platforms.

- Enhanced Accessibility: This integration makes financial services more readily available to a wider audience through familiar non-banking channels.

- New Revenue Streams: API banking opens up diversified revenue opportunities for ICICI Bank by catering to the needs of fintech partners and their customers.

ICICI Bank's technological advancements are central to its strategy, with significant investments in AI and Machine Learning enhancing fraud detection and personalizing customer experiences through tools like the 'iPal' chatbot. The bank actively leverages the Unified Payments Interface (UPI) to facilitate seamless digital transactions, supporting India's cashless economy initiative.

The bank's commitment to API banking is a key driver of embedded finance, allowing fintechs to integrate ICICI Bank's services into their platforms, thereby expanding financial accessibility and creating new revenue streams. This strategic focus on digital integration and advanced technologies is crucial for maintaining a competitive edge in the evolving financial sector.

| Technology Area | ICICI Bank's Application | Impact/Projection |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Fraud detection, risk management, personalized customer service, credit assessment | Enhanced operational efficiency, improved customer engagement, faster loan processing |

| Unified Payments Interface (UPI) | Mobile banking for real-time interbank transfers | Facilitates billions of transactions, supports cashless economy |

| API Banking | Integration of banking services into third-party platforms (Embedded Finance) | Projected global embedded finance market to reach $7 trillion by 2030; expands financial accessibility and revenue streams |

| Cybersecurity | State-of-the-art infrastructure, robust IT governance, data protection protocols | Mitigates increasing cyber threats targeting financial institutions |

Legal factors

The Reserve Bank of India (RBI) acts as the primary regulator for ICICI Bank, laying down stringent rules for capital requirements, asset quality, and corporate governance. For instance, as of September 30, 2023, ICICI Bank's Capital Adequacy Ratio (CRAR) stood at a robust 16.97%, well above the regulatory minimums, showcasing its compliance.

Staying compliant with these dynamic regulations is paramount for ICICI Bank's smooth operations and to prevent any financial penalties. The RBI's directives, such as those concerning cybersecurity and data localization, directly impact the bank's technological investments and operational procedures, requiring continuous adaptation.

The Reserve Bank of India's (RBI) evolving digital lending framework, particularly concerning data localization and customer consent, presents a significant legal factor for ICICI Bank. New regulations mandate that customer data collected through digital lending platforms must be stored within India, impacting how ICICI Bank manages its data infrastructure and cross-border data flows.

Compliance with these directives, including obtaining explicit customer consent for data usage and ensuring transparency in loan terms and conditions, is crucial. Failure to adhere to these stricter controls could result in penalties and damage to ICICI Bank's reputation, especially as digital lending saw a substantial increase in volume throughout 2024.

ICICI Bank, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules, enforced by bodies like the Reserve Bank of India (RBI), are critical for preventing illicit financial activities and safeguarding the banking sector's reputation. For instance, the RBI's master direction on KYC, updated in 2023, outlines detailed procedures for customer identification and ongoing due diligence, impacting how ICICI Bank onboard clients and monitor transactions.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for ICICI Bank. These regulations mandate fair lending practices, transparent pricing, and effective grievance redressal mechanisms. For instance, the Reserve Bank of India's (RBI) Fair Practices Code, updated in 2023, emphasizes these aspects, requiring banks to provide clear terms and conditions for all products and services.

ICICI Bank must continually adapt its product development and customer service strategies to comply with these evolving legal requirements. This includes ensuring that marketing materials are not misleading and that complaint resolution processes are timely and effective. Non-compliance can lead to penalties and damage customer trust, which is crucial for sustained growth.

Key areas of focus include:

- Transparency in Fees and Charges: Ensuring all fees, interest rates, and charges are clearly communicated to customers upfront, as mandated by consumer protection guidelines.

- Fair Lending Practices: Adhering to regulations that prevent discriminatory lending and ensure equitable treatment of all applicants.

- Robust Grievance Redressal: Maintaining efficient and accessible mechanisms for addressing customer complaints, with clear timelines for resolution.

- Data Privacy and Security: Complying with laws like the Digital Personal Data Protection Act, 2023, which governs how customer data is collected, processed, and stored.

Investment Regulations for Alternative Investment Funds (AIFs)

Recent Reserve Bank of India (RBI) guidelines, effective from January 2026, impose a cap on the cumulative exposure of regulated entities like ICICI Bank to Alternative Investment Funds (AIFs). This move directly impacts the bank's strategic allocation towards these investment vehicles. The regulations aim to manage systemic risk by limiting concentration in potentially volatile asset classes.

These new rules necessitate a recalibration of ICICI Bank's investment strategies and risk management frameworks concerning AIFs. The bank will need to carefully monitor its exposure limits to ensure compliance while still pursuing opportunities within the alternative investment space.

- RBI Cumulative Exposure Cap: Regulations effective January 2026 limit total investment in AIFs.

- Impact on Strategy: ICICI Bank must adjust its investment approach and risk controls.

- Risk Management Focus: The guidelines underscore the importance of managing concentration risk in AIFs.

Legal factors significantly shape ICICI Bank's operations, primarily through regulations set by the Reserve Bank of India (RBI). These include strict capital adequacy requirements, as demonstrated by ICICI Bank's CRAR of 16.97% as of September 30, 2023, which exceeds regulatory minimums. The bank must also navigate evolving digital lending frameworks, including data localization mandates and customer consent requirements, impacting its technology investments and data management practices.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations remains critical, with updated RBI master directions in 2023 detailing customer identification and due diligence procedures. Furthermore, consumer protection laws, such as the RBI's Fair Practices Code, necessitate transparency in fees, fair lending, and robust grievance redressal, influencing product development and customer service strategies.

New RBI guidelines effective January 2026 will also impose a cap on ICICI Bank's cumulative exposure to Alternative Investment Funds (AIFs), requiring strategic adjustments to investment and risk management approaches to manage concentration risk.

Environmental factors

ICICI Bank is actively pursuing carbon neutrality, targeting Scope 1 and Scope 2 emissions by fiscal year 2032. This long-term vision fuels internal strategies focused on minimizing the bank's environmental impact.

To achieve this, ICICI Bank is implementing various initiatives, including energy efficiency measures and a transition to renewable energy sources across its operations. These efforts are crucial for meeting its sustainability goals and contributing to a greener financial sector.

ICICI Bank is strategically expanding its green financing portfolio, with a substantial allocation directed towards renewable energy initiatives. This focus underscores the bank's commitment to environmental stewardship and its active participation in India's shift towards a decarbonized economy.

By the end of fiscal year 2024, ICICI Bank had reported a significant increase in its green finance book, contributing to the nation's climate goals. For instance, their lending to solar power projects saw a robust year-on-year growth, reflecting a tangible impact on sustainable infrastructure development.

ICICI Bank is actively working to reduce its environmental footprint by embedding sustainable practices into its core operations. This includes a strong push towards digitization, significantly cutting down paper consumption across its network. For instance, during the fiscal year 2023-2024, the bank reported a substantial increase in digital transactions, further reinforcing its paperless initiatives.

The bank is also prioritizing energy efficiency within its physical infrastructure, implementing measures to optimize power consumption at its branches and corporate offices. Furthermore, ICICI Bank is exploring and adopting novel technologies, such as atmospheric water generators, to conserve water resources, demonstrating a commitment to resource efficiency beyond just energy and paper.

Water Conservation Initiatives

ICICI Bank has actively engaged in water conservation, notably by establishing an annual rainwater harvesting capacity of 15.5 million liters across its campuses. This commitment extends to restoring local water bodies, demonstrating a tangible impact on environmental well-being.

These initiatives underscore the bank's dedication to ecological sustainability, aligning with broader environmental goals and enhancing its corporate social responsibility profile. Such efforts can also lead to operational cost savings through reduced water consumption.

- Rainwater Harvesting Capacity: 15.5 million liters annually.

- Water Body Restoration: Active involvement in local water body revival projects.

- Environmental Impact: Contribution to ecological balance and resource preservation.

Integration of ESG into Lending Practices

ICICI Bank has embedded environmental, social, and governance (ESG) principles into its core lending operations. This commitment is formalized through a board-approved ESG policy that guides lending decisions, ensuring environmental factors are systematically considered.

To assess environmental risks, ICICI Bank employs sector-specific ESG risk assessment questionnaires for its larger corporate clients. This allows for a granular understanding of potential environmental impacts associated with different industries.

Furthermore, the bank actively incorporates ESG scores from reputable external agencies, particularly for borrowers in sectors with significant emission footprints. This data-driven approach enhances the assessment of sustainability risks and opportunities.

- Board-Approved ESG Policy: Formalizes environmental considerations in lending.

- Sector-Specific ESG Risk Questionnaires: Used for large borrowers to gauge environmental impact.

- External ESG Scores: Incorporated, especially for high-emission sectors, to inform risk assessment.

ICICI Bank is demonstrating a strong commitment to environmental sustainability, aiming for carbon neutrality in Scope 1 and 2 emissions by fiscal year 2032. This involves significant investments in renewable energy financing and operational efficiency measures.

The bank's green finance book saw a robust increase by the end of fiscal year 2024, with notable growth in lending to solar power projects. This expansion directly supports India's decarbonization goals and sustainable infrastructure development.

Operational initiatives include a substantial reduction in paper consumption through increased digital transactions, as reported for fiscal year 2023-2024, and enhanced energy efficiency across its physical infrastructure.

ICICI Bank's water conservation efforts are highlighted by its 15.5 million liters annual rainwater harvesting capacity and active participation in restoring local water bodies, underscoring a commitment to resource preservation.

| Environmental Initiative | Target/Status | Key Data/Metric |

|---|---|---|

| Carbon Neutrality | Scope 1 & 2 emissions by FY 2032 | |

| Green Financing | Growing portfolio | Robust year-on-year growth in lending to solar power projects (FY 2024) |

| Paper Consumption Reduction | Digitization drive | Substantial increase in digital transactions (FY 2023-2024) |

| Water Conservation | Active measures | 15.5 million liters annual rainwater harvesting capacity; Water body restoration projects |

PESTLE Analysis Data Sources

Our ICICI Bank PESTLE Analysis is built on a comprehensive review of data from government reports, financial institutions, and reputable market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and social trends to provide a robust understanding of the macro-environment.