ICICI Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICICI Bank Bundle

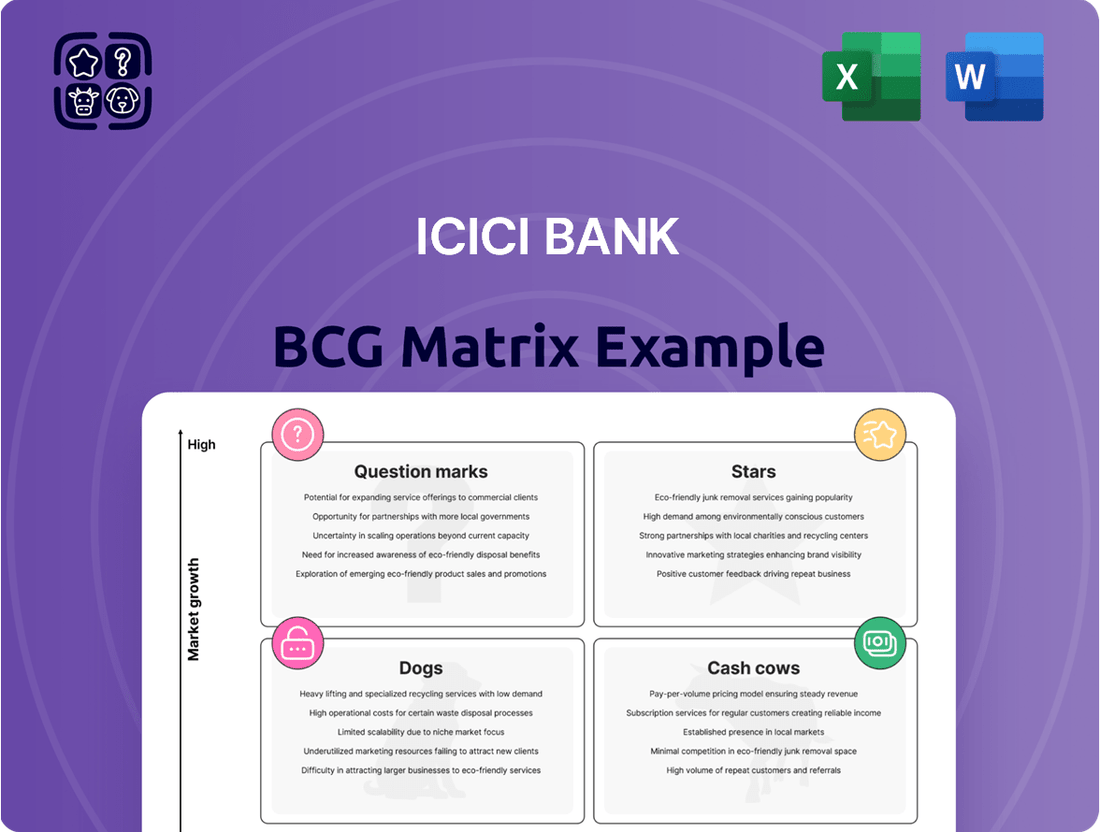

Curious about ICICI Bank's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a vital snapshot of their market performance.

Don't miss out on the complete picture! Purchase the full ICICI Bank BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investment and product strategies within the dynamic banking sector.

Stars

ICICI Bank's digital banking and payment solutions, including iMobile Pay and UPI merchant acquiring, are demonstrating robust growth. The bank reports that 95% of its transactions are now conducted digitally, highlighting a significant shift in customer behavior.

Specifically, UPI merchant acquiring has seen an impressive surge of over 50% year-on-year in the first quarter of 2025. This rapid expansion in a dynamic digital payments landscape underscores the strategic importance and high adoption rates of these offerings for ICICI Bank.

The retail loan portfolio stands as a significant growth driver for ICICI Bank, demonstrating a substantial 19.4% year-on-year expansion as of March 2024. This impressive growth underscores the bank's strong market presence and the enduring demand for its diverse retail lending products.

This segment, which includes crucial areas like housing loans, auto loans, and personal loans, represents a considerable and vital component of ICICI Bank's entire loan book. The consistent, high-paced growth observed here is a clear indicator of the bank's successful strategy in capturing market share and meeting customer needs effectively.

ICICI Bank's commitment to the Business Banking and SME segments has driven significant expansion, with recent quarterly year-on-year growth surpassing 30%. This strategic focus capitalizes on the robust expansion of businesses within a growing economy, positioning the bank as a leader in a vibrant market.

Rural Banking Initiatives

ICICI Bank's rural banking initiatives are a key component of its growth strategy, reflecting a significant push into underserved markets. The bank's rural portfolio experienced robust growth, expanding by 17.2% year-on-year by March 2024. This impressive figure underscores the increasing relevance and success of its outreach programs in these areas.

The strategic integration of its retail and rural business groups allows ICICI Bank to tap into the burgeoning potential of India's rural economies more effectively. This synergy enables the bank to offer a comprehensive suite of financial products and services tailored to the specific needs of rural customers, fostering deeper engagement and driving future expansion.

Key aspects of ICICI Bank's rural focus include:

- Strong Rural Portfolio Growth: Achieved a 17.2% year-on-year growth in its rural business as of March 2024.

- Strategic Integration: Merged retail and rural business groups to enhance market penetration and service delivery.

- Leveraging Rural Opportunities: Capitalizing on the expanding economic activities and financial needs within India's rural landscape.

- Customer-Centric Approach: Developing tailored financial solutions to meet the unique requirements of rural populations.

Sustainable Financing

Sustainable Financing represents a significant growth opportunity for ICICI Bank, aligning with global ESG priorities. The bank's commitment is evident in its expanding green financing portfolio.

- Green Financing Growth: ICICI Bank's green financing portfolio saw substantial growth in fiscal 2024.

- Key Sectors: Major contributions come from sectors like renewable energy and electric vehicles.

- Market Position: This strategic focus positions ICICI Bank as a leader in a high-growth, impactful market segment.

ICICI Bank's digital offerings, including iMobile Pay and UPI, are strong performers, with 95% of transactions now digital. UPI merchant acquiring alone grew over 50% year-on-year in Q1 2025, showcasing rapid adoption in a key growth area.

The retail loan portfolio, a significant contributor, expanded by 19.4% year-on-year as of March 2024, demonstrating consistent demand for products like housing and auto loans. This segment is a vital part of the bank's overall loan book, reflecting successful market capture.

ICICI Bank's Business Banking and SME segments are experiencing over 30% year-on-year growth, capitalizing on economic expansion and positioning the bank as a leader in serving businesses. This focus highlights the bank's strategic engagement with a dynamic market.

The bank's rural initiatives are also yielding results, with the rural portfolio growing 17.2% year-on-year by March 2024, indicating success in reaching underserved markets. This growth is supported by the strategic integration of retail and rural business groups.

Sustainable financing, particularly green financing, is a growing area for ICICI Bank, with significant contributions from renewable energy and electric vehicles in fiscal 2024. This strategic focus aligns with global ESG trends and positions the bank in a high-growth segment.

| Business Segment | Growth (YoY) | Key Drivers | Data Point |

|---|---|---|---|

| Digital Banking & Payments | 95% Digital Transactions | iMobile Pay, UPI Merchant Acquiring | UPI Acquiring +50% (Q1 2025) |

| Retail Loans | 19.4% | Housing, Auto, Personal Loans | March 2024 |

| Business Banking & SME | >30% | Economic Expansion | Recent Quarterly Growth |

| Rural Banking | 17.2% | Market Penetration, Tailored Solutions | March 2024 |

| Sustainable Financing | Significant Growth | Renewable Energy, EVs | Fiscal 2024 |

What is included in the product

Highlights which ICICI Bank business units to invest in, hold, or divest based on market share and growth.

The ICICI Bank BCG Matrix offers a clear, one-page overview of each business unit's market position, relieving the pain of complex, scattered financial data.

Cash Cows

ICICI Bank boasts a robust Current Account and Savings Account (CASA) deposit base, a key strength in its financial structure. As of June 2025, this base represented a significant 38.7% of the bank's total deposits. This large pool of low-cost funding is crucial, providing a stable and consistent revenue stream through net interest income without requiring substantial new investments for growth.

ICICI Bank's traditional corporate banking segment functions as a Cash Cow. This is evident in its substantial domestic corporate loan portfolio, which experienced a healthy 13.2% year-on-year growth as of December 2024. This mature segment serves established corporations, generating consistent and reliable income with minimal need for heavy investment in marketing or product development.

ICICI Bank's extensive branch and ATM network, boasting 6,983 branches and 16,285 ATMs and cash recycling machines as of March 2025, represents a significant cash cow. This mature physical infrastructure provides widespread customer access and reliably generates steady fee income from core banking services.

This well-established network acts as a stable revenue generator, supporting the bank's deposit base without requiring substantial new investment. The sheer scale ensures consistent transaction volumes and fee-based earnings, contributing significantly to ICICI Bank's overall profitability.

Investment Banking & Asset Management Subsidiaries

ICICI Bank's investment banking and asset management arms are prime examples of its cash cows. These specialized subsidiaries thrive in well-established financial sectors where ICICI Bank has cultivated a dominant presence.

These operations consistently deliver robust fee-based income and profits, acting as significant contributors to the bank's overall financial health. For instance, as of the fiscal year ending March 31, 2024, ICICI Bank reported a consolidated profit after tax of ₹44,795 crore, with its non-banking subsidiaries playing a crucial role in this achievement.

Unlike newer ventures, these mature businesses require more moderate investment for growth, allowing them to generate substantial returns with less capital expenditure. This strategic positioning allows them to efficiently convert their market strength into consistent profitability.

- Strong Market Position: ICICI Bank's subsidiaries in investment banking and asset management operate in mature markets where the bank has a significant competitive advantage.

- Consistent Fee Income: These businesses are reliable generators of fee-based income and profits, bolstering the bank's overall financial performance.

- Lower Growth Investment Needs: Compared to emerging business lines, these cash cows demand less aggressive investment for expansion, enhancing their profitability.

- Contribution to Profitability: In FY24, ICICI Bank's diversified operations, including these subsidiaries, contributed to a consolidated profit after tax of ₹44,795 crore.

Fee-Based Income from Core Banking Services

ICICI Bank’s fee-based income from core banking services is a significant contributor to its overall revenue, acting as a stable Cash Cow. This income stream is primarily generated from transaction charges, account maintenance fees, and various processing fees levied on its extensive customer base. In the fiscal year 2023-24, ICICI Bank reported a notable increase in its net interest margin, underscoring the consistent performance of its core lending activities, which in turn support the fee-based income generation.

These fees represent a high-margin revenue source because they are tied to a mature market segment where the bank has a well-established presence and loyal customer relationships. The sheer volume of transactions processed daily for millions of customers ensures a predictable and substantial inflow of non-interest income. For instance, the bank's digital banking platforms facilitate millions of transactions monthly, each potentially carrying a small fee that accumulates into a significant revenue stream.

- Stable Revenue: Fee-based income from core banking services provides a consistent and predictable revenue stream, less susceptible to market volatility.

- High Margins: These services typically have high profit margins due to minimal incremental costs once the infrastructure is in place.

- Customer Base Leverage: ICICI Bank leverages its large and active customer base to generate substantial fee income from everyday banking activities.

- Digital Transaction Growth: The increasing adoption of digital banking channels fuels higher transaction volumes, directly boosting fee-based earnings.

ICICI Bank's robust CASA deposit base, representing 38.7% of total deposits as of June 2025, is a prime Cash Cow. This low-cost funding fuels a stable net interest income without requiring significant new investments for expansion.

The traditional corporate banking segment, evidenced by a 13.2% year-on-year growth in its domestic corporate loan portfolio by December 2024, also acts as a Cash Cow. It serves established clients, generating reliable income with minimal new capital outlay.

ICICI Bank’s extensive branch and ATM network, comprising 6,983 branches and 16,285 ATMs/cash recycling machines by March 2025, functions as a significant Cash Cow. This mature infrastructure ensures consistent fee income from core banking services.

| Segment | Description | Key Metric (as of relevant period) | Cash Cow Characteristic |

| CASA Deposits | Low-cost funding source | 38.7% of total deposits (June 2025) | Stable net interest income, low investment need |

| Corporate Banking | Established client base | 13.2% YoY growth in domestic corporate loans (Dec 2024) | Consistent, reliable income with minimal new investment |

| Branch & ATM Network | Mature physical infrastructure | 6,983 branches, 16,285 ATMs/CRMs (Mar 2025) | Steady fee income from core services, broad customer access |

Preview = Final Product

ICICI Bank BCG Matrix

The ICICI Bank BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means you get the complete strategic analysis, ready for immediate application without any watermarks or demo content. The report has been meticulously prepared to offer deep insights into ICICI Bank's business units, allowing for informed decision-making and effective strategic planning.

Dogs

ICICI Bank’s niche international operations, while part of its global strategy, might be facing challenges. Some smaller segments or branches in less competitive international markets could be showing low growth and market share. These operations may be consuming valuable resources without delivering substantial returns in the face of global competition.

For instance, while specific figures for underperforming niche operations are not publicly detailed, ICICI Bank’s overall international revenue contribution was around 15-20% in recent years. If these niche areas are not meeting performance benchmarks, they could represent a drag on overall profitability, potentially requiring a strategic review for divestment or significant restructuring to improve efficiency.

Certain legacy banking products at ICICI Bank, like older fixed deposit schemes or specific types of personal loans that haven't seen significant digital upgrades, could be considered Dogs. These offerings may have minimal new customer acquisition and stagnant or declining transaction volumes. For instance, if a particular savings account product saw only a 0.5% increase in customer base in 2024 while requiring significant backend IT support, it would fit this profile.

These products often have low growth prospects and a small market share within ICICI Bank's broader portfolio. The cost to maintain these aging systems can outweigh the revenue they generate, making them inefficient. Such offerings might represent a small fraction of the bank's overall digital transaction volume, perhaps less than 0.1% in early 2025, highlighting their limited impact.

ICICI Bank, like many traditional financial institutions, still grapples with certain highly manual back-office operations. These processes, often related to legacy systems or specific customer service functions, have proven resistant to full digitization. For instance, manual document verification for certain loan types or physical branch-based account opening procedures still require significant human intervention.

These manual processes are a clear indicator of operational inefficiencies. They consume valuable human and capital resources that could be better allocated to more strategic, digitally-driven initiatives. In 2024, the cost of manual processing in the banking sector globally continued to be a significant concern, with estimates suggesting that automating just a few key back-office tasks could save banks billions annually.

The limited scalability of manual operations means they cannot easily adapt to fluctuating customer demand or business growth. This lack of agility, coupled with the inherent higher operational costs compared to automated systems, positions these manual processes as a drag on ICICI Bank's overall efficiency and profitability. In a banking landscape that is rapidly embracing digital transformation, these manual remnants represent a competitive disadvantage.

Specific High-Risk Unsecured Loan Sub-segments

Within ICICI Bank's unsecured loan portfolio, specific high-risk sub-segments demand vigilant management. These areas, characterized by persistently elevated default rates or inefficient, resource-draining collection processes with low recovery yields, pose a potential drag on capital and operational efficiency. For instance, while ICICI Bank reported a Gross Non-Performing Asset (GNPA) ratio of 3.08% as of March 31, 2024, a granular analysis of certain unsecured loan categories might reveal significantly higher stress points. These segments, if not proactively addressed through aggressive write-offs, could become problematic.

These pockets of risk within unsecured lending, if left unmanaged, can indeed become a significant concern. They tie up valuable capital and operational resources that could otherwise be deployed more productively. For example, a particular segment of personal loans with a 90-day plus overdue rate exceeding 10% would warrant immediate attention. Such situations can lead to substantial write-offs, impacting profitability and requiring significant provisioning. The bank's focus on robust risk management frameworks is crucial to identify and mitigate these isolated sub-segments effectively.

- Focus on granular portfolio analysis to identify sub-segments with elevated default rates.

- Implement proactive write-off strategies for high-risk unsecured loan pockets.

- Optimize collection efforts for cost-efficiency and improved recovery yields.

- Monitor the impact of these sub-segments on overall capital allocation and operational resource utilization.

Physical Branch Expansion in Saturated Urban Areas

ICICI Bank's continued aggressive physical branch expansion in already saturated urban markets could be classified as a 'Dog' in the BCG Matrix. These new branches might face significant challenges in capturing substantial market share, resulting in diminished profitability per location and elevated operational expenses. For instance, in 2024, while ICICI Bank maintained a strong presence, the cost of setting up and maintaining a new physical branch in a prime urban location can range from INR 50 lakhs to INR 2 crores, depending on size and amenities.

The low growth potential inherent in these highly competitive urban environments may not adequately justify the considerable capital outlay required for such expansion. In 2024, the average customer acquisition cost for new bank branches in major metropolitan areas has been reported to be upwards of INR 5,000, with a significant portion attributed to physical infrastructure and marketing.

This strategy could lead to:

- Low Return on Investment: High setup costs and intense competition limit the revenue potential of new urban branches.

- Increased Overhead: Maintaining a large physical footprint in saturated areas contributes to higher operating expenses.

- Stagnant Market Share: Difficulty in differentiating and attracting customers in established markets leads to slow growth.

- Resource Diversion: Capital and management focus might be better allocated to more promising growth areas or digital initiatives.

Certain legacy banking products at ICICI Bank, like older fixed deposit schemes or specific types of personal loans that haven't seen significant digital upgrades, could be considered Dogs. These offerings may have minimal new customer acquisition and stagnant or declining transaction volumes. For instance, if a particular savings account product saw only a 0.5% increase in customer base in 2024 while requiring significant backend IT support, it would fit this profile.

These products often have low growth prospects and a small market share within ICICI Bank's broader portfolio. The cost to maintain these aging systems can outweigh the revenue they generate, making them inefficient. Such offerings might represent a small fraction of the bank's overall digital transaction volume, perhaps less than 0.1% in early 2025, highlighting their limited impact.

The bank's niche international operations, while part of its global strategy, might be facing challenges. Some smaller segments or branches in less competitive international markets could be showing low growth and market share. These operations may be consuming valuable resources without delivering substantial returns in the face of global competition.

For instance, while specific figures for underperforming niche operations are not publicly detailed, ICICI Bank’s overall international revenue contribution was around 15-20% in recent years. If these niche areas are not meeting performance benchmarks, they could represent a drag on overall profitability, potentially requiring a strategic review for divestment or significant restructuring to improve efficiency.

| Category | Description | Market Growth | Market Share | ICICI Bank Example |

|---|---|---|---|---|

| Dogs | Low growth, low market share. Require significant investment to maintain but offer little return. | Low | Low | Legacy savings products, niche international operations |

Question Marks

ICICI Bank's metaverse banking initiatives, piloted in 2024, represent a bold entry into a nascent but potentially high-growth sector, akin to a question mark in the BCG matrix. This strategic exploration into virtual banking environments acknowledges the future of customer interaction, even as current market share for such services remains negligible.

These pioneering virtual branches demand significant capital expenditure for development and the establishment of robust infrastructure. The primary objective is to gauge customer acceptance and determine the long-term feasibility of these immersive banking experiences within the evolving digital economy.

ICICI Bank's strategic move into Generative AI assistants, slated for a 2025 launch, and its exploration of quantum encryption partnerships position it firmly in the "Question Marks" category of the BCG Matrix. These are high-growth potential, low-market share initiatives, demanding substantial investment in research and development to mature into viable, scalable offerings.

The bank's 2024 focus on these nascent technologies underscores a commitment to future-proofing its operations. While the exact R&D spend for these specific initiatives isn't publicly detailed, ICICI Bank's overall IT expenditure in FY24 was significant, reflecting a broader trend of digital transformation across the banking sector, with investments in AI and cybersecurity being paramount.

ICICI Bank's early-stage fintech collaborations, focusing on novel and experimental solutions, fit squarely into the Question Marks category of the BCG Matrix. These partnerships, while holding the promise of significant future growth and disruption, currently represent a small market share for the bank.

These ventures, by their very nature, require substantial investment and strategic nurturing to mature. For instance, a collaboration with an AI-powered personalized financial advisory fintech, still in its pilot phase, exemplifies this. While its potential to revolutionize customer engagement is high, its current adoption rate and revenue contribution are minimal, demanding careful resource allocation.

Hyper-personalized Services using AI/Predictive Analytics

The Indian banking sector is rapidly embracing AI and predictive analytics to deliver highly personalized customer experiences. ICICI Bank is actively investing in these AI-driven tools, aiming to tailor services to individual customer needs.

However, in the context of a BCG Matrix, hyper-personalized services using AI/predictive analytics could be considered a nascent area for ICICI Bank. While the bank is making significant investments, its current market share in these highly customized offerings might still be relatively low as the technology and its application are still evolving.

- Market Trend: The Indian digital banking market is projected to grow significantly, with AI adoption being a key driver for customer engagement and retention.

- ICICI Bank's Position: ICICI Bank's focus on AI aligns with industry trends, but the hyper-personalization segment requires sophisticated data handling and continuous refinement to gain substantial market traction.

- Future Potential: Success in this area hinges on the bank's ability to effectively leverage vast customer data to anticipate needs and offer truly unique financial solutions.

New Cross-border Digital Payment Solutions for NRIs

ICICI Bank's move to allow NRIs to use international mobile numbers for UPI payments targets a significant remittance market, estimated to be worth billions annually. This innovation addresses a key friction point for many Non-Resident Indians seeking seamless digital transactions back home.

While the NRI customer base is substantial, ICICI Bank's current market share in these specific cross-border digital payment solutions is likely in its nascent stages. This positions the offering in a growth phase, requiring strategic investment to capitalize on the opportunity and build a dominant presence.

- Market Opportunity: The global NRI remittance market is projected to reach over $150 billion by 2025, presenting a vast potential customer base.

- Innovation Adoption: Early adoption rates for novel digital payment methods among NRIs are crucial for establishing market leadership.

- Competitive Landscape: Other financial institutions are also exploring similar digital solutions, intensifying the need for ICICI Bank to differentiate and scale quickly.

- Strategic Focus: Continued investment in user experience and expanding payment network partnerships will be key to capturing a larger share of this growing segment.

ICICI Bank's metaverse banking and Generative AI initiatives, alongside early-stage fintech collaborations, are prime examples of "Question Marks" in the BCG matrix. These ventures, while holding significant future growth potential, currently represent a low market share and demand substantial investment for development and customer adoption.

The bank's strategic exploration into these nascent technologies, including partnerships for quantum encryption, highlights a commitment to future-proofing its operations. While specific R&D figures for these initiatives are not detailed, ICICI Bank's overall IT expenditure in FY24, which was considerable, reflects a broader industry trend towards digital transformation, with AI and cybersecurity being key focus areas.

The NRI UPI payment solution is another "Question Mark," targeting a large remittance market. Despite the substantial NRI customer base, ICICI Bank's current market share in these specific cross-border digital payment solutions is likely nascent, necessitating strategic investment to build a dominant presence.

The global NRI remittance market is projected to exceed $150 billion by 2025, offering a vast opportunity. Early adoption rates for novel digital payment methods among NRIs are critical for ICICI Bank to establish market leadership in this segment.

| Initiative | BCG Category | Market Potential | Current Share | Investment Focus |

|---|---|---|---|---|

| Metaverse Banking | Question Mark | High (Emerging) | Negligible | R&D, Infrastructure, Customer Adoption |

| Generative AI Assistants | Question Mark | High (Rapidly Growing) | Low | R&D, Talent Acquisition, Integration |

| Fintech Collaborations (AI Advisory) | Question Mark | High (Disruptive) | Minimal | Pilot Programs, Scalability, Strategic Nurturing |

| NRI UPI Payments | Question Mark | High (Significant Remittance Market) | Nascent | User Experience, Network Expansion, Marketing |

BCG Matrix Data Sources

Our ICICI Bank BCG Matrix leverages comprehensive data from annual reports, financial statements, and market research reports to accurately position products and services.