ICICI Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICICI Bank Bundle

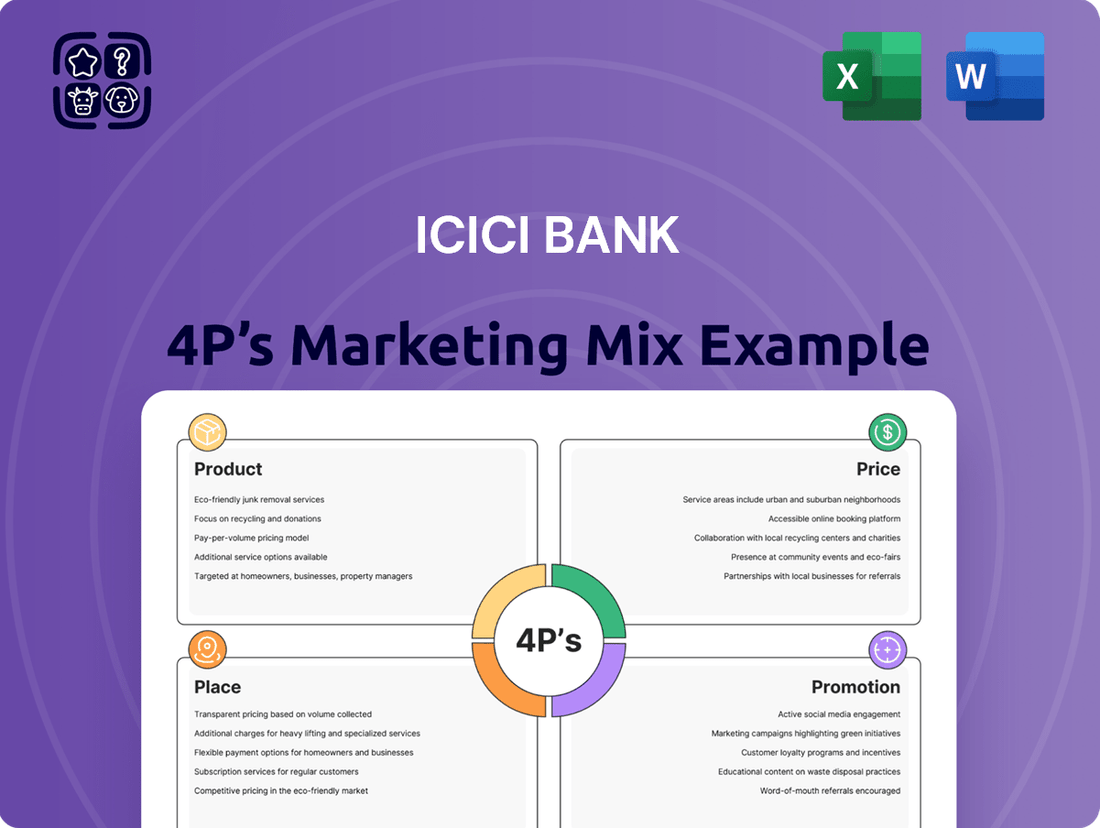

ICICI Bank strategically leverages its diverse product portfolio, competitive pricing, extensive branch and digital network, and multi-channel promotional efforts to capture a significant market share. Understanding these core 4Ps is crucial for anyone looking to grasp their success.

Go beyond this overview and unlock the full, in-depth 4Ps Marketing Mix Analysis for ICICI Bank. This comprehensive report is ideal for business professionals, students, and consultants seeking actionable insights into their product, price, place, and promotion strategies.

Product

ICICI Bank's product strategy is built around offering a comprehensive suite of banking and financial solutions. This caters to a broad customer base, encompassing both individual retail clients and large corporate entities. The bank provides a diverse range of offerings, including various deposit accounts, personal and business loans, credit and debit cards, and a wide spectrum of investment and insurance products.

This product depth is a key differentiator. For instance, as of early 2025, ICICI Bank reported a significant increase in its retail loan book, driven by demand for home and auto loans, showcasing the success of its diverse product portfolio in meeting everyday financial needs.

The emphasis is on providing end-to-end financial services. From basic savings accounts and transactional services to complex wealth management and corporate finance solutions, ICICI Bank aims to be a one-stop shop for all financial requirements, ensuring customer retention and loyalty through its extensive product ecosystem.

ICICI Bank's digital banking platforms, like the iMobile Pay app and internet banking, are central to its product strategy. These services allow customers to manage their finances conveniently from any location, at any time. This focus on digital accessibility has led to impressive user engagement.

The adoption of these digital channels is exceptionally high, reflecting their effectiveness and customer preference. In fiscal year 2024, over 90% of all financial and non-financial transactions conducted with ICICI Bank were processed through these digital avenues, highlighting a significant shift in customer behavior towards online and mobile interactions.

ICICI Bank's product strategy for credit and loans is highly diversified, catering to specific customer segments. This includes tailored offerings like agriculture loans, loans for Small and Medium Enterprises (SMEs), home loans, and personal loans, demonstrating a granular approach to credit. This segmentation ensures that the bank effectively meets the varied financial needs of its broad customer base.

The bank boasts a robust and granular loan portfolio, with retail loans emerging as a significant contributor to its overall growth. For instance, ICICI Bank reported a substantial increase in its retail loan book in recent fiscal periods, reflecting strong customer demand and effective product penetration in this segment. This focus on retail lending underpins the bank's expansion strategy.

A key element of ICICI Bank's credit product offering is its emphasis on rapid loan approvals, achieved through digitized underwriting processes. This technological advancement allows for quicker disbursal of funds, enhancing customer experience and operational efficiency. By streamlining the loan application and approval journey, the bank aims to capture a larger market share in the competitive lending landscape.

Insurance and Wealth Management

ICICI Bank extends its financial services beyond core banking by offering a robust suite of insurance and wealth management products. This includes both life and non-life insurance policies, alongside a diverse range of mutual fund schemes designed to meet varied investment goals and financial security needs.

This integrated approach allows customers to consolidate their financial planning and investments within a single institution, simplifying portfolio management. For instance, ICICI Prudential Life Insurance reported a new business premium of ₹11,347 crore for the fiscal year 2023-24, demonstrating significant market penetration in the life insurance segment.

- Comprehensive Product Offering: Life and non-life insurance, alongside mutual funds, cover a broad spectrum of customer financial requirements.

- Integrated Financial Solutions: Customers can manage their entire financial portfolio, from banking to investments and insurance, under one roof.

- Market Presence: ICICI Prudential Asset Management Company managed assets worth ₹7.54 lakh crore as of March 31, 2024, highlighting its strong position in the mutual fund industry.

- Customer Convenience: Centralized management of financial assets enhances ease of access and strategic planning for clients.

Tailored Solutions for Diverse Segments

ICICI Bank crafts specific offerings for various customer groups, ensuring relevance and appeal. For instance, their Young Star accounts cater to children, while tailored savings and loan products are available for senior citizens and businesses alike.

Beyond individual and corporate needs, the bank extends its reach to support broader economic development. This includes providing specialized financial solutions for micro-finance institutions, self-help groups, and co-operative societies, underscoring a commitment to financial inclusion and rural upliftment.

This segment-specific approach is a cornerstone of ICICI Bank's strategy. For example, as of March 31, 2024, ICICI Bank reported a retail loan book of ₹3.37 lakh crore, showcasing the breadth of their customer base and the diverse needs they aim to meet.

- Young Star Accounts: Designed to encourage early savings habits in children.

- Senior Citizen Offerings: Includes preferential interest rates and specialized services.

- Business Solutions: Comprehensive banking and credit facilities for enterprises of all sizes.

- Financial Inclusion Initiatives: Support for micro-finance, SHGs, and co-operatives to foster rural growth.

ICICI Bank's product strategy is characterized by its extensive range of banking and financial services designed for diverse customer segments. This includes a strong focus on digital platforms like the iMobile Pay app, which saw over 90% of transactions processed digitally in FY24.

The bank offers a granular approach to credit, with a significant retail loan book of ₹3.37 lakh crore as of March 31, 2024, driven by products like home and auto loans. This is complemented by specialized offerings for SMEs and corporate clients.

Beyond core banking, ICICI Bank provides integrated financial solutions, including insurance and wealth management. ICICI Prudential Life Insurance reported ₹11,347 crore in new business premium for FY24, and ICICI Prudential AMC managed ₹7.54 lakh crore in assets as of March 31, 2024.

| Product Category | Key Offerings | FY24/Early 2025 Data Point |

|---|---|---|

| Retail Banking | Savings Accounts, Current Accounts, Home Loans, Auto Loans, Personal Loans | Retail loan book ₹3.37 lakh crore (as of March 31, 2024) |

| Digital Banking | iMobile Pay App, Internet Banking | Over 90% of transactions processed digitally (FY24) |

| Corporate & SME Banking | Business Loans, Working Capital Finance, Trade Finance | Significant growth in SME lending |

| Investments & Insurance | Mutual Funds, Life Insurance, General Insurance | ICICI Prudential Life New Business Premium: ₹11,347 crore (FY24) |

| Wealth Management | Portfolio Management Services, Advisory Services | ICICI Prudential AMC AUM: ₹7.54 lakh crore (as of March 31, 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of ICICI Bank's marketing mix, examining its diverse product portfolio, competitive pricing strategies, extensive distribution channels, and multi-faceted promotional activities.

It's designed for professionals seeking to understand ICICI Bank's market positioning and is grounded in real-world practices and competitive context.

Simplifies the complex 4Ps of ICICI Bank's marketing strategy into actionable insights, alleviating the pain of understanding their core approach for busy executives.

Provides a clear, concise overview of ICICI Bank's 4Ps, resolving the challenge of quickly grasping their marketing effectiveness for strategic decision-making.

Place

ICICI Bank's extensive branch network is a cornerstone of its marketing strategy, ensuring widespread accessibility for its customers. As of September 2024, the bank operated a substantial 6,613 branches across India.

A key focus of this network is financial inclusion, with over 50% of these branches strategically located in rural and semi-urban regions. This commitment aims to bring banking services to underserved populations, fostering economic growth in these areas.

ICICI Bank's distribution strategy heavily relies on its robust digital channels, notably its website and the iMobile Pay application. These platforms are central to providing customers with seamless and convenient banking experiences.

The bank has achieved remarkable success in driving digital adoption, with digital transactions now representing over 90% of its total transaction volume. This significant shift underscores the effectiveness of their digital-first approach in reaching and serving a broad customer base.

ICICI Bank enhances customer convenience through its extensive network of Insta Banking Kiosks and ATMs/Cash Recycling Machines. This strategy directly addresses the Place element of the marketing mix by ensuring widespread availability of banking services. As of March 31, 2024, the bank operated 17,190 ATMs and Cash Recycling Machines, complemented by 570 Insta Banking Kiosks, demonstrating a significant commitment to physical accessibility.

Business Correspondent Agent Network

ICICI Bank leverages its Business Correspondent Agent network to significantly expand its banking services into remote and underserved areas. This initiative is crucial for financial inclusion, bringing essential banking facilities to populations that might otherwise lack access. As of recent reports, this network effectively covers over 9,940 rural locations across India, demonstrating a substantial commitment to last-mile connectivity.

The Business Correspondent Agent network acts as a vital extension of ICICI Bank's physical presence, enabling them to reach customers in geographically challenging regions. This strategy is a cornerstone of their 'Place' element in the marketing mix, ensuring product availability and accessibility. By empowering local agents, ICICI Bank not only broadens its customer base but also fosters economic development in these communities.

- Extensive Rural Coverage: The network spans over 9,940 rural locations, ensuring a wide geographical reach.

- Financial Inclusion Driver: Provides essential banking services like account opening, deposits, and withdrawals in underserved areas.

- Last-Mile Connectivity: Bridges the gap in access to formal banking for remote populations.

- Cost-Effective Expansion: Offers an efficient model for extending service delivery without the overhead of traditional branches.

International Presence

ICICI Bank's international footprint is a key component of its marketing strategy, allowing it to serve a diverse global clientele. This presence extends across multiple continents, facilitating cross-border banking and financial services.

The bank operates business centers in six overseas locations and maintains representative offices in ten additional countries. This expansive network is further strengthened by wholly-owned subsidiaries in the United Kingdom and Canada, demonstrating a commitment to global market engagement.

- Global Reach: Business centers in 6 overseas locations and representative offices in 10 countries.

- Key Subsidiaries: Wholly-owned operations in the UK and Canada.

- Customer Focus: Catering to the financial needs of international customers.

ICICI Bank's 'Place' strategy is multifaceted, encompassing a vast physical branch network, robust digital platforms, and an extensive ATM presence. This ensures accessibility for a broad customer base, both domestically and internationally. The bank's commitment to financial inclusion is evident in its rural branch distribution and its innovative Business Correspondent Agent network, extending services to remote areas.

| Channel | Count (as of March 31, 2024, unless otherwise stated) | Key Feature |

|---|---|---|

| Branches | 6,613 (as of Sep 2024) | Widespread accessibility, over 50% in rural/semi-urban areas |

| ATMs/Cash Recycling Machines | 17,190 | 24/7 cash access and deposit facilities |

| Insta Banking Kiosks | 570 | Self-service banking points |

| Business Correspondent Agent Network | Covers over 9,940 rural locations | Last-mile connectivity for financial inclusion |

| Digital Channels (iMobile Pay, Website) | Over 90% of transactions | Seamless, convenient digital banking experience |

| International Presence | Business centers in 6 overseas locations, rep offices in 10 countries, subsidiaries in UK & Canada | Serving global clientele and cross-border needs |

Full Version Awaits

ICICI Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of ICICI Bank's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to this ready-to-use document upon completing your order, allowing you to leverage its insights without delay.

Promotion

ICICI Bank actively utilizes digital marketing, employing content marketing, search engine optimization (SEO), paid advertising, and email campaigns to reach its customer base. This multi-channel approach ensures broad visibility and targeted outreach.

The bank maintains a robust social media presence across platforms like Facebook, Instagram, and X (formerly Twitter). For instance, as of early 2024, ICICI Bank's X handle boasts over 3.5 million followers, demonstrating significant engagement and reach.

This digital strategy focuses on fostering interaction and providing valuable financial information, thereby enhancing customer relationships and brand loyalty. Their social media content frequently includes financial tips, product updates, and customer support channels.

ICICI Bank crafts targeted advertising campaigns, frequently leveraging celebrity endorsements, to highlight specific offerings and strengthen its brand identity. Recent efforts have focused on promoting specialized services for senior citizens and the convenience of UPI payments through their iMobile Pay app.

ICICI Bank actively cultivates its public image through strategic public relations and impactful Corporate Social Responsibility (CSR) initiatives. These programs target critical areas such as healthcare, environmental sustainability, livelihood enhancement, and the crucial domain of financial literacy, fostering a positive brand perception and deepening community ties.

In fiscal year 2024, ICICI Bank's CSR spending reached ₹1,000 crore, with a significant portion directed towards rural development and education. This commitment not only bolsters their reputation but also aligns with their broader objective of inclusive growth, as evidenced by their financial literacy programs reaching over 5 million individuals in 2024.

Customer Education and Safe Banking Campaigns

ICICI Bank prioritizes customer education on safe banking and cybersecurity. They utilize multiple channels like social media, their mobile app, emails, SMS alerts, and in-branch materials to disseminate this crucial information. This proactive approach aims to build customer trust and ensure they are well-informed about protecting themselves from fraud.

In 2024, ICICI Bank continued its commitment to digital literacy and secure transactions. For instance, their campaigns in early 2024 highlighted common phishing tactics and the importance of strong passwords, reaching millions of customers. This focus on education directly contributes to a safer banking environment for all users.

- Digital Literacy Initiatives: Campaigns focusing on secure online banking practices and identifying fraudulent communications.

- Multi-channel Communication: Utilizing social media, mobile app notifications, email, SMS, and in-branch displays to reach a broad customer base.

- Fraud Prevention Awareness: Educating customers on preventing common scams like SIM swap fraud and unauthorized transactions.

- Building Trust: Proactive communication fosters a sense of security and reliability, strengthening customer relationships.

Partnerships and Offers

ICICI Bank actively cultivates strategic partnerships to broaden its customer base and enhance value propositions. For instance, co-branded credit card collaborations with major players like Amazon, MakeMyTrip, and Emirates offer customers exclusive benefits and rewards, driving card acquisition and transaction volumes.

These alliances are designed to provide tangible advantages to cardholders. Customers can benefit from a range of discounts and cashback offers across various spending categories, making the ICICI Bank credit cards more attractive and encouraging their regular use.

The bank's partnership strategy is a key component of its marketing mix, directly impacting customer acquisition and retention. For example, in 2023, ICICI Bank reported a significant increase in its retail credit card customer base, partly attributed to these targeted co-branded initiatives.

- Co-branded Credit Cards: Partnerships with Amazon, MakeMyTrip, Emirates for enhanced customer value.

- Exclusive Deals: Offering unique discounts and cashback opportunities to cardholders.

- Customer Acquisition: Leveraging partnerships to attract new segments of the market.

- Increased Transactions: Encouraging higher spending through attractive reward programs.

ICICI Bank's promotional strategy is deeply rooted in a digital-first approach, amplified by strategic partnerships and a strong commitment to corporate social responsibility.

Their digital marketing efforts, including SEO, content marketing, and social media engagement, aim to build brand awareness and foster customer relationships. As of early 2024, their X (formerly Twitter) account alone had over 3.5 million followers, showcasing significant reach.

Furthermore, the bank leverages co-branded credit card partnerships with entities like Amazon and MakeMyTrip to offer exclusive benefits, driving customer acquisition and transaction volumes. This multifaceted approach ensures broad market penetration and enhanced customer value.

| Promotional Tactic | Key Features | Impact/Data Point (2023-2024) |

|---|---|---|

| Digital Marketing | SEO, Content Marketing, Paid Ads, Email Campaigns | Over 3.5 million followers on X (early 2024); Enhanced customer engagement and brand loyalty. |

| Social Media Engagement | Facebook, Instagram, X | Regularly shares financial tips, product updates, and customer support; Fosters interaction. |

| Targeted Advertising | Celebrity Endorsements, Specific Service Promotions | Promoted UPI payments via iMobile Pay; Highlighted services for senior citizens. |

| Corporate Social Responsibility (CSR) | Healthcare, Environment, Livelihood, Financial Literacy | CSR spending of ₹1,000 crore in FY24; Financial literacy programs reached over 5 million individuals in 2024. |

| Strategic Partnerships | Co-branded Credit Cards (Amazon, MakeMyTrip, Emirates) | Significant increase in retail credit card customer base in 2023; Drives card acquisition and transactions. |

Price

ICICI Bank’s value-based pricing strategy focuses on aligning the worth of its financial offerings with what customers perceive as valuable. This means that instead of just looking at costs, they consider the benefits and solutions their products provide to different customer segments. For instance, their wealth management services are priced considering the expertise and personalized advice offered, not just the operational costs.

This approach helps ICICI Bank stay competitive by ensuring that its pricing reflects the tangible and intangible benefits customers receive, fostering loyalty and attracting a broad customer base. As of Q4 FY24, ICICI Bank reported a net profit of INR 12,000 crore, showcasing strong financial performance that supports its ability to invest in value-added services and maintain competitive pricing structures across its diverse product portfolio.

ICICI Bank actively competes in the lending market by offering attractive interest rates across its diverse loan portfolio. For instance, as of early 2024, their home loan interest rates were observed to start from competitive levels, often aligning with or slightly below the industry average, depending on the borrower's credit score and the loan amount. This strategy aims to draw in a broad customer base seeking affordable financing for major purchases.

The bank provides flexibility with both fixed and floating rate options for various loans, including personal loans. This allows customers to choose the structure that best suits their risk appetite and market outlook. For example, a customer might opt for a fixed rate to ensure predictable monthly payments, while another might prefer a floating rate anticipating a potential decrease in market interest rates.

ICICI Bank's savings account interest rates are tiered, with balances up to ₹1 lakh earning 3% per annum as of late 2024, while balances above ₹1 lakh to ₹10 lakh earn 3.5%. For balances exceeding ₹10 lakh, the rate increases to 4%.

Processing Fees and Charges

ICICI Bank's pricing strategy for its diverse financial products is built around a clear structure of processing fees and charges. These fees are essential for covering operational costs and are designed to be competitive within the Indian banking sector.

The bank ensures transparency by clearly detailing these charges, which are not uniform. They are dynamically adjusted based on several factors, including the size of the loan, the specific customer segment being served, and the unique features of the banking product itself.

For instance, processing fees for personal loans in 2024 can range from 0.5% to 2.5% of the loan amount, with specific charges varying by the applicant's profile and the loan tenor. Similarly, credit card annual fees can range from INR 500 to INR 5,000, depending on the card variant and associated benefits.

- Personal Loan Processing Fees: Typically 0.5% to 2.5% of the loan amount.

- Home Loan Processing Fees: Can be between 0.25% and 1% of the loan amount, often with a cap.

- Credit Card Annual Fees: Vary widely from INR 500 for basic cards to INR 5,000+ for premium offerings.

- Other Service Charges: Include fees for ATM withdrawals beyond limits, cheque returns, and account maintenance.

Discounts and Promotional Offers

ICICI Bank actively uses discounts and promotions to drive customer acquisition and engagement. For instance, in 2024, they rolled out significant cashback offers on their credit cards, with some promotions reaching up to 10% on popular e-commerce platforms, capped at INR 1,000. These initiatives are crucial for increasing transaction volumes and building customer loyalty in a competitive banking landscape.

These promotional strategies are designed to encourage greater use of ICICI Bank's various financial products. By partnering with major online retailers and physical stores, the bank aims to make its offerings more attractive. For example, a 2024 campaign offered instant discounts of up to 15% on select electronics purchases when using ICICI Bank debit or credit cards, directly boosting sales for partners and card usage for the bank.

The bank's promotional activities are multi-faceted, targeting different customer segments and product categories. Specific examples include:

- Credit Card Welcome Offers: New cardholders often receive substantial joining benefits, such as vouchers worth INR 2,000 or accelerated reward points.

- Debit Card Rewards: Promotional campaigns in 2024 highlighted enhanced reward points on debit card spending, particularly for travel and dining, encouraging everyday usage.

- Internet Banking Incentives: Special discounts and cashback are frequently offered for bill payments and online transactions made through ICICI Bank's internet banking portal.

- Co-branded Partnerships: Collaborations with leading e-commerce sites like Amazon and Flipkart provide exclusive deals, driving significant traffic and sales for both parties.

ICICI Bank employs a tiered interest rate structure for its savings accounts, a key element of its pricing strategy. As of late 2024, balances up to ₹1 lakh earned 3% annually, while amounts between ₹1 lakh and ₹10 lakh received 3.5%, and balances over ₹10 lakh were offered 4%. This tiered approach incentivizes larger deposits.

Processing fees are a significant part of ICICI Bank's pricing, covering operational costs and remaining competitive. These fees are not fixed and vary based on loan size, customer segment, and product features. For instance, personal loan processing fees in 2024 ranged from 0.5% to 2.5% of the loan amount, reflecting the dynamic nature of their pricing.

The bank actively uses discounts and promotions to attract and retain customers. In 2024, credit card cashback offers reached up to 10% on e-commerce purchases, capped at INR 1,000, to boost transaction volumes and loyalty.

| Product/Service | Pricing Component | Example Data (2024/2025) | Notes |

|---|---|---|---|

| Savings Account | Interest Rate | Up to ₹1 lakh: 3% ₹1 lakh - ₹10 lakh: 3.5% Above ₹10 lakh: 4% |

Tiered rates to encourage higher balances. |

| Personal Loan | Processing Fee | 0.5% - 2.5% of loan amount | Varies by applicant profile and loan tenor. |

| Credit Card | Annual Fee | INR 500 - INR 5,000+ | Depends on card variant and benefits. |

| Promotions | Cashback/Discounts | Up to 10% cashback on e-commerce (capped at INR 1,000) | Aimed at increasing card usage and customer engagement. |

4P's Marketing Mix Analysis Data Sources

Our ICICI Bank 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.