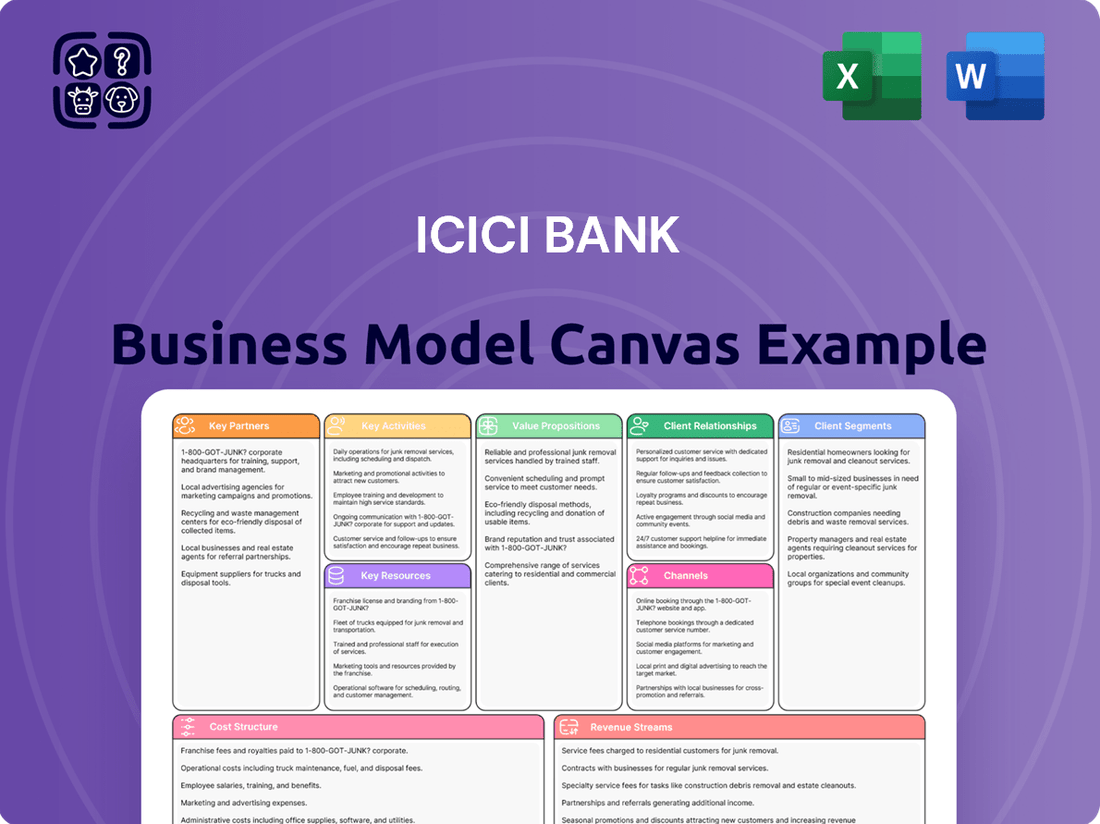

ICICI Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICICI Bank Bundle

Unlock the strategic blueprint of ICICI Bank’s success with our comprehensive Business Model Canvas. This detailed analysis breaks down how they attract and retain customers, manage key resources, and generate revenue in the dynamic banking sector. Get the full picture to inform your own strategic planning.

Partnerships

ICICI Bank actively collaborates with technology providers and fintech companies to bolster its digital capabilities. These partnerships are instrumental in integrating cutting-edge technologies such as artificial intelligence and blockchain, thereby enriching customer experiences and driving innovation in banking services.

For instance, in 2024, ICICI Bank continued to deepen its engagement with various tech firms to enhance its mobile banking app, iMobile Pay, which saw a significant increase in user adoption and transaction volume throughout the year. These collaborations are vital for the bank's ongoing digital transformation journey.

ICICI Bank leverages robust partnerships with its subsidiaries, ICICI Prudential Life Insurance and ICICI Lombard General Insurance, alongside ICICI Prudential Asset Management Company. These collaborations are crucial, enabling the bank to present a holistic range of financial solutions, encompassing life and non-life insurance products and sophisticated asset management services to its diverse customer base.

ICICI Bank's key partnerships with major payment networks like Mastercard and Visa are crucial for its digital payment strategy. These collaborations enable the bank to offer a wide array of debit and credit card products, driving higher debit card activation rates and facilitating secure, seamless transactions for customers across diverse online and offline channels.

These alliances are instrumental in capturing growth opportunities within India's rapidly expanding merchant ecosystem. By integrating with these networks, ICICI Bank can provide efficient payment processing solutions to businesses, thereby strengthening its position in the digital payments landscape and fostering increased transaction volumes.

Government and Public Sector Entities

ICICI Bank actively partners with government and public sector entities to drive financial inclusion and support national development agendas. These collaborations are crucial for extending banking services to underserved populations and facilitating the implementation of government welfare programs.

These partnerships allow ICICI Bank to play a significant role in various government-led initiatives. For instance, the bank's involvement in financial inclusion programs directly contributes to the broader economic upliftment of the country. In 2023-24, ICICI Bank continued its focus on expanding its reach to rural and semi-urban areas, aligning with the government's objectives.

- Financial Inclusion Initiatives: Partnerships enable ICICI Bank to offer tailored banking products and services to individuals in remote areas, boosting financial literacy and access to credit.

- Government Scheme Implementation: The bank acts as a conduit for various government schemes, ensuring efficient disbursement of funds and seamless service delivery to beneficiaries.

- Economic Development Projects: Collaborations extend to supporting large-scale infrastructure and development projects, often involving public sector undertakings, thereby contributing to economic growth.

- Healthcare System Fortification: The ICICI Foundation's collaboration with IIT Kanpur on projects like improving public healthcare systems exemplifies a commitment to societal well-being through strategic partnerships.

Educational and Research Institutions

ICICI Bank, via its ICICI Foundation, actively collaborates with leading educational and research bodies. A prime example is their partnership with IIT Kanpur, focusing on developing groundbreaking solutions like the Digital Health Stack. This initiative underscores a commitment to leveraging technology for societal benefit, aiming to create deployable technologies across diverse industries.

These collaborations are crucial for fostering technology-led innovation, particularly in areas that can address public welfare challenges. By working with academic institutions, ICICI Bank gains access to cutting-edge research and development capabilities, accelerating the creation of impactful solutions. For instance, in 2023, the ICICI Foundation supported various educational initiatives, reaching over 1.5 million beneficiaries, highlighting the scale of their commitment to this sector.

- Collaboration with IIT Kanpur: Development of the Digital Health Stack, showcasing a commitment to tech-driven public welfare solutions.

- CSR Focus: ICICI Foundation actively partners with educational institutions to drive innovation and societal impact.

- Technology Deployment: These partnerships aim to create practical, deployable technologies applicable across multiple sectors.

- Reach and Impact: In 2023, ICICI Foundation's educational programs benefited over 1.5 million individuals, demonstrating the broad scope of their engagement.

ICICI Bank's strategic alliances with fintech firms and technology providers are central to its digital advancement. These partnerships have been key in integrating advanced technologies like AI and blockchain, enhancing customer service and driving innovation in banking services. For example, in 2024, the bank continued to strengthen ties with tech companies to improve its iMobile Pay app, which saw substantial growth in users and transactions.

Collaborations with subsidiaries like ICICI Prudential Life Insurance, ICICI Lombard General Insurance, and ICICI Prudential Asset Management Company allow ICICI Bank to offer a comprehensive suite of financial products. These partnerships are vital for providing integrated solutions, from insurance to asset management, to a broad customer base.

ICICI Bank's partnerships with payment networks like Mastercard and Visa are fundamental to its digital payment strategy, enabling a wide range of card products and secure transactions. These alliances are crucial for capturing market share within India's expanding digital payment ecosystem, facilitating efficient payment processing for businesses and increasing overall transaction volumes.

The bank also partners with government and public sector entities to promote financial inclusion and support national development goals, extending banking services to underserved populations. These collaborations are vital for implementing government welfare programs and achieving broader economic upliftment, as seen in their continued focus on rural and semi-urban expansion in 2023-24.

What is included in the product

A detailed framework outlining ICICI Bank's strategy, covering its diverse customer segments, multi-channel approach, and tailored value propositions for retail, corporate, and SME clients.

This model reflects ICICI Bank's operational reality, detailing key partners, activities, resources, cost structure, and revenue streams for robust financial services delivery.

The ICICI Bank Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to identify and address inefficiencies in their banking operations.

It simplifies complex strategies into a digestible format, allowing for quick identification of areas needing improvement and fostering collaborative problem-solving.

Activities

ICICI Bank's core operations revolve around providing a full spectrum of banking services to both individual consumers and businesses. This encompasses everything from facilitating everyday transactions and savings for retail clients to offering sophisticated financial solutions for large corporations.

For its retail segment, key activities include managing a vast network of branches and digital channels to offer savings accounts, current accounts, personal loans, home loans, and credit cards. In 2024, ICICI Bank continued to expand its digital offerings, with a significant portion of retail transactions occurring through its mobile banking app, which saw a substantial increase in user engagement and transaction volume.

On the corporate side, the bank's primary activities involve providing working capital finance, term loans, trade finance, and treasury services to businesses of all sizes. As of the fiscal year ending March 31, 2024, ICICI Bank reported robust growth in its corporate loan book, reflecting its strong position in supporting India's economic development.

ICICI Bank's key activities revolve around its robust digital transformation and innovation initiatives. A significant focus is placed on continuous investment in cutting-edge technologies such as artificial intelligence, big data analytics, blockchain, and cloud computing. These investments are crucial for accelerating the bank's digital strategy and enhancing its competitive edge in the financial sector.

This commitment to technology translates into the enhancement of its digital platforms, including the popular iMobile Pay and iLens applications. By prioritizing the integration of technology, ICICI Bank aims to deliver seamless, secure, and highly convenient experiences for its customers, meeting their evolving digital banking needs.

In 2023, ICICI Bank reported a substantial increase in its digital transactions, with mobile banking transactions growing by 39% year-on-year. This highlights the success of their digital-first approach and the increasing adoption of their digital platforms by a growing customer base.

ICICI Bank's core activities revolve around originating, underwriting, and managing a wide array of loans. This includes everything from individual retail loans and small business credit to large corporate financing and specialized rural lending. The bank emphasizes a strategy of growth that is carefully calibrated to risk levels.

A significant focus is placed on operational efficiency, particularly in loan processing. ICICI Bank actively utilizes digital platforms to streamline the approval process, aiming for quicker turnaround times. For instance, in the fiscal year ending March 31, 2024, the bank reported a substantial increase in its retail loan book, showcasing its capability in managing a high volume of originations.

Wealth Management and Investment Services

ICICI Bank actively engages in providing a broad spectrum of wealth management and investment services. This includes offering a diverse range of investment products such as mutual funds, equities, bonds, and other tailored investment avenues to meet varied client objectives.

These services are crucial for catering to the financial aspirations of a wide customer base, from retail investors to high-net-worth individuals. For instance, in the fiscal year ending March 31, 2024, ICICI Bank reported a significant growth in its retail loan book, which often aligns with increased demand for wealth management services as customers' financial capacity grows.

- Offering diverse investment products: Mutual funds, equities, bonds, and structured products.

- Personalized wealth management: Tailored advice and portfolio management.

- Catering to varied customer needs: Serving retail, affluent, and high-net-worth clients.

Customer Service and Grievance Redressal

ICICI Bank prioritizes customer satisfaction, aiming for best-in-class service delivery. This customer-centric approach is crucial for retaining clients and fostering loyalty.

The bank actively manages customer grievances through a multi-channel strategy. This includes physical business centers, robust voice support, and increasingly, digital platforms for efficient issue resolution.

In 2024, ICICI Bank reported a significant increase in digital customer service interactions, reflecting a growing preference for online channels. This focus on accessibility and responsiveness is key to their operational model.

- Customer-Centricity: Maintaining a steadfast focus on customer needs to deliver superior banking experiences.

- Multi-Channel Support: Offering support through business centers, voice channels, and digital platforms for comprehensive grievance redressal.

- Transparency and Timeliness: Ensuring clear communication and prompt resolution of all customer issues.

- Digital Engagement: Leveraging digital channels to enhance service efficiency and customer accessibility.

ICICI Bank's key activities are centered on providing a comprehensive suite of banking and financial services. This includes managing customer deposits, originating and servicing loans across retail and corporate segments, and offering investment and wealth management solutions. The bank also focuses on leveraging technology to enhance customer experience and operational efficiency.

In the fiscal year ending March 31, 2024, ICICI Bank reported a 19.4% year-on-year growth in total assets, reaching ₹25,83,174 crore. This expansion underscores its active role in credit intermediation and financial service provision.

The bank's digital initiatives are a significant part of its key activities, with a strong emphasis on innovation. For instance, its mobile banking app, iMobile Pay, has seen substantial growth, facilitating a large volume of transactions and enhancing customer accessibility. This digital push is crucial for maintaining competitiveness and meeting evolving customer expectations.

| Key Activity Area | Description | 2024 Data/Trend |

|---|---|---|

| Deposit & Liability Management | Mobilizing customer deposits and managing the bank's funding structure. | Continued growth in customer deposits, supporting asset growth. |

| Loan Origination & Servicing | Underwriting, disbursing, and managing loans for retail, SME, and corporate clients. | Robust growth in retail and corporate loan books; focus on digital loan processing. |

| Investment & Wealth Management | Offering mutual funds, equities, bonds, and advisory services. | Significant growth in assets under management (AUM) for wealth management clients. |

| Digital Transformation & Innovation | Investing in and deploying new technologies for enhanced customer experience and operational efficiency. | Increased digital transaction volumes; expansion of iMobile Pay and other digital platforms. |

Preview Before You Purchase

Business Model Canvas

The ICICI Bank Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive snapshot details all key components of ICICI Bank's strategic framework, from customer segments and value propositions to revenue streams and cost structures. You'll gain full access to this complete, ready-to-use document, enabling you to analyze and understand ICICI Bank's operational blueprint without any alterations or missing sections.

Resources

ICICI Bank's extensive physical footprint, boasting over 6,500 branches and more than 16,000 ATMs and cash recycling machines across India as of early 2024, is a cornerstone of its business model. This vast network ensures widespread accessibility, allowing customers to conduct transactions and access services conveniently, reinforcing the bank's tangible presence and customer engagement capabilities.

ICICI Bank's robust digital infrastructure is a cornerstone of its business model, with significant investments poured into platforms like iMobile Pay, internet banking, and UPI payment solutions. These digital channels are not just about convenience; they are essential for reaching a wider customer base and facilitating seamless transactions.

The bank's commitment to advanced technologies like AI, big data analytics, and cloud computing directly supports efficient operations and innovative customer experiences. For instance, their focus on AI in fraud detection and personalized service delivery enhances security and customer satisfaction, a critical competitive advantage in today's market.

By leveraging secure APIs and a strong technological backbone, ICICI Bank ensures frictionless customer onboarding and streamlined internal processes. This technological prowess allows them to adapt quickly to market changes and offer cutting-edge digital banking services, as evidenced by their continued growth in digital transaction volumes, which have seen substantial year-on-year increases.

ICICI Bank's skilled human capital is a cornerstone of its business model, enabling the delivery of a wide array of financial services and the management of intricate operations. As of March 31, 2024, the bank employed approximately 100,000 people, a testament to its substantial workforce dedicated to serving a diverse customer base.

This extensive and capable team is crucial for driving the bank's digital transformation initiatives and maintaining its competitive advantage. Employees are actively fostered to be innovative and adaptable, directly contributing to ICICI Bank's customer-centric approach and its ability to navigate the evolving financial landscape.

Strong Brand Reputation and Trust

ICICI Bank's strong brand reputation is a cornerstone of its business model, built on a foundation of reliability and forward-thinking solutions within India's financial landscape. This trust isn't accidental; it's the result of a persistent focus on customer needs, clear and honest product offerings, and an unwavering dedication to safeguarding customer assets. This commitment fosters deep brand loyalty and solidifies its market position.

The bank's reputation for innovation is evident in its early adoption of digital banking technologies, which has significantly broadened its customer reach and service capabilities. For instance, by the end of fiscal year 2024, ICICI Bank reported a substantial increase in its digital transactions, highlighting customer confidence in its technology-driven services.

- Customer-Centric Approach: Consistently prioritizing customer satisfaction through personalized services and efficient issue resolution.

- Transparency and Security: Maintaining clear communication regarding financial products and robust security measures to protect customer data and funds.

- Digital Innovation: Leading the way in adopting and developing digital banking platforms, enhancing accessibility and user experience.

- Market Trust: Recognized for its stability and integrity, making it a preferred financial partner for individuals and businesses alike.

Capital and Financial Reserves

ICICI Bank's capital and financial reserves are built upon robust capital adequacy ratios, which are crucial for absorbing potential losses and maintaining financial stability. For instance, as of the fiscal year ending March 31, 2024, ICICI Bank reported a Common Equity Tier 1 (CET1) ratio of 13.74%, significantly above the regulatory minimums.

Healthy deposit growth is another cornerstone, providing a stable and cost-effective source of funding. In the fiscal year 2023-2024, ICICI Bank's total deposits grew by 19.5% year-on-year, reaching ₹13,047.88 billion (approximately $156.6 billion USD based on an approximate exchange rate). This strong deposit base underpins the bank's lending capacity and operational resilience.

The bank's strong financial performance, reflected in its core operating profit and consistently healthy asset quality, further bolsters its financial reserves. For the fiscal year ended March 31, 2024, ICICI Bank's net profit surged by 33.7% to ₹44,792 crore (approximately $5.38 billion USD). This profitability directly contributes to strengthening its capital base, enabling further lending and strategic investments.

- Capital Adequacy: CET1 ratio of 13.74% (FY24), well above regulatory requirements.

- Deposit Growth: Total deposits increased by 19.5% YoY to ₹13,047.88 billion (FY24).

- Profitability: Net profit grew 33.7% to ₹44,792 crore (FY24), enhancing reserves.

- Asset Quality: Maintained strong asset quality, supporting financial stability and lending capacity.

ICICI Bank's physical and digital infrastructure forms the bedrock of its customer reach and service delivery. With over 6,500 branches and 16,000 ATMs as of early 2024, it ensures broad accessibility, complemented by robust digital platforms like iMobile Pay and internet banking. These technological investments, including AI and big data analytics, enhance operational efficiency and customer experience, as seen in their substantial digital transaction volume growth.

The bank's human capital, numbering around 100,000 employees by March 31, 2024, is vital for managing complex operations and driving digital transformation. This skilled workforce underpins ICICI Bank's customer-centric approach and its ability to innovate in the dynamic financial sector.

ICICI Bank's strong brand reputation, built on trust, transparency, and digital innovation, is a key resource. Its early adoption of digital banking and consistent customer focus have fostered significant market trust and loyalty, evidenced by the continued increase in digital transaction volumes throughout fiscal year 2024.

The bank's financial strength is anchored by strong capital adequacy, with a CET1 ratio of 13.74% as of FY24, and healthy deposit growth, which rose 19.5% YoY to ₹13,047.88 billion in FY24. This financial stability is further reinforced by a net profit surge of 33.7% to ₹44,792 crore in FY24, bolstering its reserves and lending capacity.

| Key Resource | Description | Supporting Data (FY24) |

|---|---|---|

| Physical Network | Extensive branch and ATM presence | 6,500+ branches, 16,000+ ATMs |

| Digital Infrastructure | Advanced online and mobile banking platforms | Significant growth in digital transaction volumes |

| Human Capital | Skilled and adaptable workforce | ~100,000 employees |

| Brand Reputation | Trust, transparency, and innovation | High customer trust in digital services |

| Financial Strength | Capital adequacy and deposit base | CET1: 13.74%, Deposits: ₹13,047.88 billion (+19.5% YoY) |

Value Propositions

ICICI Bank provides a broad spectrum of financial solutions, encompassing everything from everyday savings and personal loans to sophisticated corporate banking, investment advisory, and insurance services. This extensive range positions the bank as a singular destination for diverse financial needs.

For instance, as of March 31, 2024, ICICI Bank's total advances grew by 18.5% year-on-year, demonstrating its capacity to serve a wide customer base with various credit needs, from individuals to large corporations.

ICICI Bank's seamless digital banking experience is a cornerstone of its value proposition, offering customers convenient, secure, and user-friendly platforms like its mobile banking app and internet banking portal. This digital focus allows users to manage accounts, make payments, and access a broad spectrum of banking services with remarkable ease and efficiency, 24/7.

In 2024, ICICI Bank reported a significant surge in digital transactions, with over 80% of customer interactions occurring through its digital channels. This highlights the widespread adoption and reliance on their digital solutions, demonstrating a clear preference for the anytime, anywhere accessibility they provide.

ICICI Bank's business model is deeply rooted in a customer-centric philosophy, striving to understand and fulfill the distinct financial requirements of its wide-ranging customer base. This is achieved through a comprehensive 'Customer 360º' view, enabling the delivery of personalized financial solutions. For instance, in FY2024, ICICI Bank reported a significant increase in its retail loan portfolio, reflecting a growing trust and demand for its tailored offerings.

Accessibility and Wide Reach

ICICI Bank's value proposition of accessibility and wide reach is built on a robust multi-channel strategy. This includes an extensive network of over 5,000 branches and 14,000 ATMs across India as of early 2024, ensuring physical proximity for customers. The bank also boasts a significant digital footprint, with millions of active mobile banking users, making services available anytime, anywhere.

This commitment to widespread availability extends globally, with operations in key international markets. The bank's digital platforms, including its mobile app and internet banking, are designed for ease of use, catering to a diverse customer base. In 2023, ICICI Bank reported a 24% year-on-year growth in its retail loan portfolio, reflecting the success of its accessible offerings.

- Extensive Physical Network: Over 5,000 branches and 14,000 ATMs across India in early 2024.

- Strong Digital Presence: Millions of active mobile banking users providing 24/7 access.

- Global Footprint: Operations in key international financial centers.

- Customer Convenience: Multi-channel delivery enhances ease of banking for all segments.

Innovation and Future-Ready Banking

ICICI Bank demonstrates a strong commitment to innovation, consistently investing in new products and technologies to stay ahead. This forward-thinking approach is evident in their development of advanced solutions designed for the modern financial landscape.

The bank's focus on emerging technologies translates into tangible benefits for customers, offering cutting-edge services. For instance, their AI-powered lending platform, iLens, streamlines the credit process, making it more efficient and accessible.

ICICI Bank is actively exploring future banking concepts, including Metaverse Banking and GenAI Assistants. This proactive engagement with next-generation technologies positions them as a leader in financial technology, ready to meet evolving customer needs.

- Instant Credit Cards: Offering immediate access to credit facilities.

- AI-powered Lending (iLens): Enhancing efficiency and accessibility in loan processing.

- Metaverse Banking & GenAI Assistants: Exploring future customer engagement and service models.

ICICI Bank offers a comprehensive suite of financial products and services, acting as a one-stop shop for diverse customer needs, from basic savings to complex corporate finance. This broad offering is supported by a strong digital infrastructure and a commitment to innovation.

The bank's value proposition centers on providing accessible, convenient, and personalized banking experiences. This is achieved through a robust multi-channel strategy, blending an extensive physical network with advanced digital platforms, ensuring customers can bank anytime, anywhere.

Innovation is a key differentiator, with ICICI Bank actively investing in and adopting new technologies like AI and exploring future concepts such as Metaverse Banking to enhance customer service and operational efficiency.

ICICI Bank's customer-centric approach, exemplified by its 'Customer 360º' view, allows for tailored financial solutions that meet individual and corporate requirements, fostering strong customer relationships and loyalty.

| Value Proposition | Description | Supporting Data (as of early 2024 or latest available) |

|---|---|---|

| Comprehensive Financial Solutions | Offers a wide range of banking, investment, insurance, and lending products for individuals and businesses. | Total advances grew by 18.5% year-on-year as of March 31, 2024. |

| Seamless Digital Experience | Provides user-friendly mobile and internet banking platforms for 24/7 access to services. | Over 80% of customer interactions occurred through digital channels in 2024. |

| Customer-Centricity & Personalization | Focuses on understanding and fulfilling distinct customer needs through personalized solutions. | Significant increase in retail loan portfolio in FY2024, reflecting tailored offerings. |

| Accessibility and Wide Reach | Combines an extensive physical network with a strong digital presence for broad customer access. | Over 5,000 branches and 14,000 ATMs across India in early 2024. |

| Innovation and Future Technologies | Invests in new products and technologies, including AI and exploring Metaverse Banking. | AI-powered lending platform (iLens) streamlines credit processes. |

Customer Relationships

ICICI Bank champions a 360-degree customer relationship model, striving to grasp and address the complete financial spectrum of its clientele. This strategy transcends individual products or customer segments, aiming to build enduring trust and cultivate lasting loyalty.

ICICI Bank's digital self-service and engagement strategy is anchored by its iMobile Pay app and internet banking portal. These platforms allow customers to handle numerous financial and non-financial tasks independently, offering unparalleled convenience and control. For instance, in the fiscal year 2023-24, ICICI Bank reported a significant surge in digital transactions, with over 80% of all banking transactions conducted through digital channels, underscoring the success of this customer relationship approach.

ICICI Bank prioritizes exceptional customer service, ensuring transparency in all interactions. They offer a variety of support channels to assist customers effectively.

The bank actively monitors key customer service metrics, aiming for timely resolution of issues. This commitment to efficient grievance redressal is a cornerstone of their customer relationship strategy.

Community Building and Education

ICICI Bank actively fosters community through educational initiatives, aiming to empower customers with knowledge about their banking products and services. This goes beyond simple transactions, focusing on enabling informed financial decisions. For instance, in 2024, the bank continued its focus on digital literacy programs reaching thousands of individuals across various demographics.

The bank's commitment extends to broader community welfare through strategic partnerships, notably with the ICICI Foundation. These collaborations often target skill development and livelihood enhancement, reflecting a dedication to social progress. In 2024, the ICICI Foundation reported supporting over 100,000 beneficiaries in its various skill-building and rural development projects.

- Digital Literacy Programs: In 2024, ICICI Bank's digital literacy campaigns reached an estimated 50,000 new users, enhancing their understanding of online banking security and features.

- Financial Education Workshops: Over 20,000 customers participated in financial education workshops conducted by the bank in 2024, covering topics from savings to investment basics.

- ICICI Foundation Impact: The ICICI Foundation's initiatives in 2024 provided vocational training to over 25,000 individuals, contributing to improved employment opportunities in rural and semi-urban areas.

- Community Outreach: The bank's corporate social responsibility activities in 2024 involved over 5,000 employee volunteer hours dedicated to various community development projects.

Proactive Communication and Updates

ICICI Bank prioritizes keeping its business clients informed. They regularly share updates on new offerings, service improvements, and digital advancements across multiple platforms. This consistent outreach aims to foster stronger connections and cultivate lasting brand loyalty.

- Digital Channels: ICICI Bank actively uses its mobile app and internet banking portal to push notifications and personalized messages regarding account activity, new features, and relevant market insights.

- Personalized Outreach: Relationship managers proactively engage with business clients, offering tailored advice and updates relevant to their specific industry and financial needs.

- Product Launches: In 2023, ICICI Bank introduced several new digital banking solutions for businesses, including enhanced payment gateways and supply chain finance platforms, with ongoing communication about their benefits and usage.

- Customer Feedback Integration: The bank actively solicits and incorporates customer feedback on its communication strategies, ensuring updates are timely, relevant, and delivered through preferred channels.

ICICI Bank cultivates deep customer relationships through a multi-faceted approach, blending digital convenience with personalized engagement. Their commitment to transparency and effective grievance redressal builds significant trust.

The bank actively invests in customer empowerment through digital literacy and financial education programs. These initiatives, along with broader community development efforts via the ICICI Foundation, foster strong, lasting connections beyond transactional banking.

For business clients, ICICI Bank ensures consistent communication regarding new offerings and digital advancements, leveraging personalized outreach and feedback integration to strengthen partnerships.

| Customer Relationship Aspect | 2023-24 Data/Initiative | Impact/Focus |

| Digital Transactions | Over 80% of banking transactions via digital channels | Enhanced customer convenience and control |

| Digital Literacy Programs | Reached an estimated 50,000 new users in 2024 | Improved understanding of online banking security |

| Financial Education Workshops | Over 20,000 customers participated in 2024 | Empowered informed financial decision-making |

| ICICI Foundation Training | Provided vocational training to over 25,000 individuals in 2024 | Contributed to improved employment opportunities |

Channels

ICICI Bank's extensive branch network, numbering 6,983 as of March 31, 2025, is a cornerstone of its customer outreach. This physical presence facilitates direct engagement for essential banking services like account opening and loan processing.

ICICI Bank leverages its extensive network of 16,285 ATMs and cash recycling machines as of March 31, 2025, to provide unparalleled customer accessibility. This widespread infrastructure ensures round-the-clock availability for crucial banking services like cash withdrawals and deposits, significantly boosting customer convenience.

These self-service terminals are a cornerstone of ICICI Bank's customer relationship strategy, offering a reliable and efficient channel for everyday banking needs. Beyond basic transactions, they facilitate balance inquiries and other essential functions, reinforcing the bank's commitment to accessible financial services.

ICICI Bank's digital platforms, including its website and the iMobile Pay app, are the backbone of its operations, handling over 90% of all customer transactions. This digital-first approach allows customers to manage accounts, make payments, and even invest, all from their devices.

In 2024, ICICI Bank reported a significant increase in digital engagement, with mobile banking transactions alone growing by a substantial margin year-on-year. This reflects a broader trend of consumers preferring convenient, on-demand banking services accessible through their smartphones.

Call Centers and Customer Service Lines

ICICI Bank leverages dedicated call centers as a crucial customer service channel, offering telephonic support for a wide array of inquiries, service requests, and grievance redressal. This direct line of communication ensures customers can conveniently access assistance and information, fostering a sense of accessibility and trust. In 2024, the bank continued to invest in its call center infrastructure, aiming to enhance response times and customer satisfaction.

These centers are equipped to handle millions of customer interactions annually, providing a vital touchpoint for resolving issues and facilitating transactions. The efficiency of these lines directly impacts customer loyalty and operational costs. For instance, a significant portion of customer queries, often exceeding 70% for basic banking needs, are resolved through these channels, reducing the burden on physical branches.

- Dedicated Telephonic Support: Call centers provide direct access for customer queries, service requests, and grievance resolution.

- Customer Convenience: This channel offers an accessible and convenient way for customers to reach the bank for assistance.

- Operational Efficiency: A high volume of customer interactions are handled, contributing to overall operational efficiency.

- Customer Satisfaction Driver: Effective call center operations are key to maintaining and improving customer satisfaction levels.

Specialized Subsidiaries and Global Presence

ICICI Bank effectively leverages specialized subsidiaries to broaden its service offerings, notably in insurance and asset management, thereby capturing a wider customer base. This strategic diversification allows the bank to provide integrated financial solutions beyond traditional banking.

The bank's global presence is a cornerstone of its business model, extending its reach through banking subsidiaries, branches, and representative offices across key international markets. This expansive network facilitates cross-border transactions and caters to the diverse needs of a global clientele.

- Global Reach: ICICI Bank operates in 15 countries, including the US, UK, Canada, Germany, and Singapore, as of early 2024.

- Subsidiary Strength: Key subsidiaries include ICICI Prudential Life Insurance and ICICI Prudential Asset Management Company, which are significant players in their respective Indian markets.

- Customer Segmentation: The international presence allows ICICI Bank to serve non-resident Indians (NRIs) and also tap into local customer segments in each operating country.

- Diversified Revenue Streams: Subsidiaries contribute significantly to the bank's overall revenue, reducing reliance on standalone banking operations.

ICICI Bank's channels are a multi-faceted approach to customer engagement, blending physical accessibility with robust digital solutions. This strategy ensures a broad reach, catering to diverse customer preferences and banking needs. The bank strategically utilizes its extensive branch and ATM network alongside advanced digital platforms and dedicated call centers to provide a seamless banking experience.

The bank's digital channels are particularly dominant, with over 90% of transactions occurring online or via mobile. This digital-first approach is supported by a significant year-on-year increase in mobile banking transactions observed in 2024, highlighting customer preference for convenience and instant access.

Complementing its digital prowess, ICICI Bank maintains a substantial physical presence with nearly 7,000 branches and over 16,000 ATMs as of March 2025, facilitating essential in-person services and cash management. These physical touchpoints remain vital for specific customer needs, reinforcing the bank's commitment to accessibility.

Furthermore, dedicated call centers act as a crucial support mechanism, handling millions of inquiries annually and resolving a high percentage of basic banking needs, thereby enhancing customer satisfaction and operational efficiency.

Customer Segments

ICICI Bank serves a vast array of retail customers, offering a comprehensive suite of personal banking solutions. This includes essential services like savings and current accounts, alongside a wide range of credit facilities such as personal loans, home loans, and vehicle loans. As of the fiscal year ending March 31, 2024, ICICI Bank reported a retail loan book of INR 3.49 trillion, highlighting its significant penetration in this segment.

The bank's strategy in the retail sector is built on a diversified and granular loan portfolio, aiming to minimize risk and maximize reach. This approach allows them to cater to the varied financial needs of individual customers, from everyday banking to major life purchases. Their credit card business also plays a crucial role, with the bank issuing over 15 million credit cards by the end of FY24, demonstrating strong customer adoption.

ICICI Bank's corporate clients segment is broad, encompassing large corporations and mid-market companies. These businesses rely on a comprehensive suite of corporate banking services. This includes essential working capital solutions to manage day-to-day operations, term loans for significant capital expenditures, and trade finance to facilitate international business transactions.

The bank also offers sophisticated investment banking services, catering to the complex financial needs of these larger entities. ICICI Bank's strategy is to support these clients across their entire value chain, from initial funding to strategic financial advisory and capital market access.

As of March 31, 2024, ICICI Bank reported total advances of ₹11,02,396 crore, with a significant portion attributed to its corporate and business banking segment, demonstrating its substantial engagement with these clients.

Small and Medium Enterprises (SMEs) are a crucial segment for ICICI Bank, encompassing businesses with diverse turnover levels. These enterprises require a comprehensive suite of financial products, from business loans and specialized current accounts to advanced digital banking tools designed for operational efficiency.

ICICI Bank has demonstrated robust growth within its SME portfolio, actively addressing the multifaceted financial needs of these businesses. This strategic focus underscores the bank's commitment to empowering the SME sector, a vital engine of economic growth.

In the fiscal year 2024, ICICI Bank reported a significant increase in its retail and business loans, with SMEs forming a substantial part of this expansion. The bank's digital offerings, including its business banking platform, have been instrumental in attracting and retaining these clients by providing seamless transaction management and credit access.

Rural and Agricultural Customers

ICICI Bank actively serves the rural and agricultural sectors, recognizing their importance for inclusive economic development. The bank provides a range of financial products and services tailored to the unique needs of this segment.

Key customer groups within this segment include farmers, self-help groups (SHGs), agricultural co-operatives, and agri-input dealers. ICICI Bank also supports micro-entrepreneurs operating in rural areas, offering them access to credit and other banking facilities to foster their growth.

This dedicated focus on rural markets is a strategic imperative for ICICI Bank, contributing significantly to its inclusive growth agenda. The bank's efforts in this area are supported by initiatives aimed at increasing financial literacy and accessibility in remote regions.

- Farmers: Access to crop loans, equipment financing, and savings accounts.

- Self-Help Groups (SHGs): Micro-credit facilities and support for group savings.

- Agri-input Dealers: Working capital loans and trade finance.

- Micro-entrepreneurs: Business loans and support for small-scale enterprises.

Non-Resident Indians (NRIs) and International Clients

ICICI Bank caters to Non-Resident Indians (NRIs) and international clients, leveraging its global footprint to offer specialized financial solutions. This segment demands services that bridge their overseas residency with their financial needs in India, including efficient remittance and tailored investment options.

The bank provides a suite of international banking services designed to meet the unique requirements of this demographic. These services often include multi-currency accounts, cross-border payment solutions, and wealth management products that align with global financial landscapes.

- Global Reach: ICICI Bank's international presence facilitates seamless banking for NRIs and global clients, with operations in key financial hubs.

- Specialized Services: Key offerings include remittance facilities, international money transfers, and foreign exchange services.

- Investment Opportunities: Clients have access to a range of investment products, including Indian equities, bonds, and mutual funds, often with specific NRI-focused schemes.

- Digital Platforms: Robust online and mobile banking platforms ensure convenient access to services, regardless of the client's location.

ICICI Bank's customer segments are diverse, reflecting its broad market reach. The bank strategically targets retail customers with a full spectrum of banking and credit products, evidenced by its retail loan book of INR 3.49 trillion as of March 31, 2024. Corporate and business clients form another significant segment, relying on the bank for working capital, term loans, and investment banking services, with total advances reaching ₹11,02,396 crore in FY24. The bank also actively engages with Small and Medium Enterprises (SMEs), providing essential business loans and digital tools to support their growth, contributing to overall loan expansion in FY24. Furthermore, ICICI Bank extends its services to the rural and agricultural sectors, supporting farmers, SHGs, and micro-entrepreneurs, aligning with its inclusive growth agenda.

| Customer Segment | Key Offerings | FY24 Data/Notes |

|---|---|---|

| Retail Customers | Savings/Current Accounts, Personal Loans, Home Loans, Vehicle Loans, Credit Cards | Retail loan book: INR 3.49 trillion; Over 15 million credit cards issued |

| Corporate & Business Clients | Working Capital, Term Loans, Trade Finance, Investment Banking | Total advances: ₹11,02,396 crore; Significant portion from this segment |

| Small & Medium Enterprises (SMEs) | Business Loans, Specialized Current Accounts, Digital Banking Tools | Substantial part of loan expansion in FY24; Digital platforms key for acquisition |

| Rural & Agricultural Sectors | Crop Loans, Equipment Financing, Micro-credit, Business Loans for Micro-entrepreneurs | Focus on inclusive growth; Supports farmers, SHGs, agri-dealers |

| Non-Resident Indians (NRIs) & International Clients | Remittance, Multi-currency Accounts, Cross-border Payments, Wealth Management | Leverages global footprint; Facilitates banking needs in India and abroad |

Cost Structure

ICICI Bank faces substantial costs in building and maintaining its digital backbone. This includes significant investment in developing and upgrading its online banking platforms, mobile applications, and core banking systems to ensure seamless customer experience and operational efficiency.

Cybersecurity is a paramount concern, demanding continuous expenditure on advanced security measures to protect sensitive customer data and prevent cyber threats. The bank also allocates resources to embrace emerging technologies such as artificial intelligence for personalized services and fraud detection, big data analytics for customer insights, and cloud computing for scalable infrastructure. In 2024, ICICI Bank's estimated annual ICT spending reached approximately $1.1 billion, highlighting the critical role and associated cost of technology in its business model.

Employee salaries and benefits represent a significant cost for ICICI Bank, reflecting its extensive workforce. In the fiscal year 2023-24, the bank’s total employee expenses, encompassing salaries, wages, and other benefits, were a substantial component of its operating costs, crucial for maintaining its service-oriented operations.

ICICI Bank's extensive physical footprint, comprising branches and ATMs, represents a substantial cost. This includes expenses for real estate, whether leased or owned, along with ongoing costs for utilities, security systems, and regular maintenance to ensure operational efficiency and customer accessibility.

In 2024, the operational costs for maintaining such a vast network are significant. For instance, while specific figures for ICICI Bank's network maintenance aren't publicly itemized in this context, industry averages suggest that a single ATM can cost anywhere from $3,000 to $10,000 annually to maintain, encompassing software, hardware, cash handling, and connectivity. Branches, naturally, incur higher costs due to staffing, larger utility consumption, and more complex security needs.

Marketing and Promotional Expenses

ICICI Bank invests significantly in advertising campaigns across various media, including digital, print, and television, to reach a broad customer base. These efforts are essential for highlighting new products, services, and competitive offerings in the dynamic banking sector.

Promotional activities, such as special offers on credit cards, loans, and digital banking services, are key to customer acquisition and retention. Brand building initiatives focus on reinforcing ICICI Bank's image as a reliable and innovative financial institution.

- Advertising Campaigns: ICICI Bank's marketing expenditure is a substantial part of its operational costs, driving customer acquisition and engagement.

- Promotional Offers: Targeted promotions on digital platforms and banking products are used to attract new customers and reward existing ones.

- Brand Visibility: Investments in brand building aim to enhance market presence and foster long-term customer loyalty in a highly competitive environment.

Regulatory Compliance and Risk Management Costs

ICICI Bank faces significant expenses to meet the rigorous regulatory landscape governing the banking sector. These costs are essential for maintaining operational integrity and client trust.

Robust risk management frameworks, encompassing credit, market, and operational risks, demand substantial investment in technology, skilled personnel, and ongoing monitoring systems. This proactive approach helps mitigate potential financial losses and ensures stability.

Ensuring strong corporate governance practices, including internal controls and external audits, adds to the bank's operational expenditure. These measures are critical for transparency and accountability.

- Compliance Costs: ICICI Bank's expenditure on adhering to Reserve Bank of India (RBI) guidelines and other financial regulations is a key component of its cost structure.

- Risk Management Investment: Significant outlays are directed towards sophisticated risk assessment tools, cybersecurity measures, and a dedicated risk management team to safeguard assets and operations.

- Audit and Governance Expenses: Costs associated with internal and external audits, as well as maintaining a strong governance framework, contribute to operational overheads.

- Asset Quality Management: Resources are allocated to managing and improving asset quality, including provisioning for non-performing assets, which directly impacts profitability.

ICICI Bank's cost structure is largely driven by its extensive operations and technology investments. Key expenses include maintaining its digital infrastructure, which in 2024 saw an estimated $1.1 billion in ICT spending, covering platform development and cybersecurity. The bank also incurs substantial costs related to its large workforce, with employee expenses being a significant operational outlay in FY 2023-24.

Furthermore, the physical network of branches and ATMs, alongside marketing and promotional activities to drive customer acquisition, contribute to ongoing operational expenditures. Compliance with stringent banking regulations and robust risk management practices are also critical cost centers, ensuring stability and client trust.

| Cost Category | Description | Estimated/Actual Data (as of latest available, e.g., 2023-24 or 2024) |

|---|---|---|

| Technology & Digital Infrastructure | Development, maintenance, and upgrades of online platforms, mobile apps, core banking systems, and cybersecurity measures. | Approx. $1.1 billion ICT spending in 2024. |

| Employee Expenses | Salaries, wages, and benefits for a large workforce. | Substantial component of operating costs in FY 2023-24. |

| Physical Network Operations | Maintenance of branches and ATMs, including real estate, utilities, and security. | Industry average ATM maintenance: $3,000-$10,000 annually per ATM. |

| Marketing & Advertising | Campaigns across various media to attract and retain customers. | Significant expenditure for brand building and product promotion. |

| Regulatory Compliance & Risk Management | Adherence to RBI guidelines, internal controls, audits, and risk mitigation systems. | Essential for operational integrity and financial stability. |

Revenue Streams

Net Interest Income (NII) stands as ICICI Bank's core revenue engine. This income is generated from the spread between the interest the bank earns on its lending activities and investments, and the interest it pays out on customer deposits and other borrowings. The bank's ability to effectively manage this interest rate differential is crucial for its profitability.

ICICI Bank has demonstrated robust growth in its Net Interest Income, a testament to its expanding loan book and prudent asset-liability management. For the fiscal year ending March 31, 2024, ICICI Bank reported a Net Interest Income of ₹65,430 crore, reflecting a healthy increase driven by both volume growth and a favorable interest rate environment.

ICICI Bank generates substantial revenue from fee and commission income, reflecting the diverse banking services it offers. This includes processing fees for loans, transaction charges, wealth management services, and credit card fees, all contributing to its non-interest income streams.

For the fiscal year ending March 31, 2024, ICICI Bank reported consolidated net profit of ₹44,790 crore, with fee and commission income playing a vital role in this profitability. Fees from retail, rural, and business banking segments are particularly significant, underscoring the bank's broad customer base and service penetration.

ICICI Bank's consolidated revenue benefits significantly from the profits and dividend income generated by its diverse subsidiaries. These include key players like ICICI Prudential Life Insurance, ICICI Lombard General Insurance, and ICICI Prudential Asset Management Company, all contributing to the bank's overall financial strength.

These subsidiaries offer a broad spectrum of financial services, from life and general insurance to asset management, creating multiple avenues for income generation and diversification for the parent company. For instance, in the fiscal year ending March 31, 2024, ICICI Lombard General Insurance reported a Gross Direct Premium Income of ₹21,182 crore, showcasing the scale of operations within its subsidiaries.

Treasury Income and Investment Gains

ICICI Bank's treasury operations are a significant source of revenue, generating income from its investment portfolio. This includes earnings from government securities, corporate bonds, and various other financial instruments. The gains realized from these investments can vary considerably, directly influenced by prevailing market conditions and interest rate movements.

For the fiscal year ending March 31, 2024, ICICI Bank reported substantial income from its treasury and investment activities. This segment plays a crucial role in the bank's overall profitability, demonstrating its adeptness in managing financial assets amidst dynamic market environments.

- Treasury Income: This encompasses interest earned on the bank's holdings of government and other approved securities, as well as income from foreign exchange operations.

- Investment Gains: Profits realized from the sale of securities, including equities and debt instruments, that form part of the bank's investment portfolio.

- Market Volatility Impact: Performance in this area is sensitive to interest rate fluctuations and broader market sentiment, which can lead to both gains and potential mark-to-market losses.

- Contribution to Overall Revenue: Treasury and investment gains are a key component of ICICI Bank's diversified revenue streams, complementing its core lending business.

Forex and Derivative Income

ICICI Bank generates significant revenue from foreign exchange (forex) transactions and derivative activities. This income stream is crucial for supporting the international banking needs of both corporate clients engaged in cross-border trade and retail customers making remittances.

In the fiscal year 2023-24, ICICI Bank’s net interest income, which is closely linked to its lending and forex activities, saw robust growth. The bank reported a net profit of ₹44,786 crore for the fiscal year ended March 31, 2024, indicating strong operational performance across its various revenue segments, including forex and derivatives.

- Forex Transaction Fees: Revenue earned from facilitating currency exchange for customers involved in international trade, travel, and remittances.

- Derivative Income: Profits derived from offering and trading financial derivatives, such as futures, options, and swaps, to hedge against currency risks or for speculative purposes.

- Corporate Client Services: Providing specialized forex and derivative solutions to large corporations for managing their international financial exposures.

- Retail Customer Services: Offering forex services for individuals, including currency notes, remittances, and forex cards for travel.

ICICI Bank's revenue streams are diverse, encompassing core banking activities and income from its subsidiaries. Net Interest Income (NII) remains the primary driver, generated from the spread between interest earned on loans and interest paid on deposits. For the fiscal year ending March 31, 2024, ICICI Bank reported a Net Interest Income of ₹65,430 crore, showcasing its strong lending operations and effective asset-liability management.

Beyond NII, fee and commission income forms a significant portion of the bank's earnings. This includes charges for retail banking services, wealth management, credit cards, and loan processing. The bank's consolidated net profit for FY24 was ₹44,790 crore, with these non-interest income sources playing a crucial role in this robust performance.

ICICI Bank also derives substantial revenue from its subsidiaries, such as ICICI Prudential Life Insurance and ICICI Lombard General Insurance. These entities contribute through profits and dividends, diversifying the bank's income base. For example, ICICI Lombard reported Gross Direct Premium Income of ₹21,182 crore in FY24, highlighting the scale of these operations.

Treasury operations and foreign exchange activities further contribute to ICICI Bank's revenue. Income from investments in securities and gains from forex transactions and derivatives support the bank's overall financial health. These segments are vital for managing international banking needs and capitalizing on market opportunities.

| Revenue Stream | Description | FY24 (₹ Crore) |

| Net Interest Income (NII) | Interest earned on loans minus interest paid on deposits. | 65,430 |

| Fee and Commission Income | Charges from banking services, wealth management, credit cards, etc. | (Part of overall profitability, not separately reported for this segment in this context) |

| Subsidiary Contributions | Profits and dividends from insurance and asset management arms. | (Significant contributor to overall profit, e.g., ICICI Lombard's ₹21,182 Cr Gross Direct Premium Income) |

| Treasury and Investment Income | Earnings from securities and financial instruments. | (Contributes to overall profitability) |

| Forex and Derivative Income | Revenue from currency exchange and financial derivatives. | (Supports international banking needs) |

Business Model Canvas Data Sources

The ICICI Bank Business Model Canvas is constructed using a blend of internal financial data, extensive market research on customer needs, and competitive analysis of the banking sector. These sources provide a robust foundation for understanding the bank's strategic positioning and operational efficiency.