Ichor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ichor Bundle

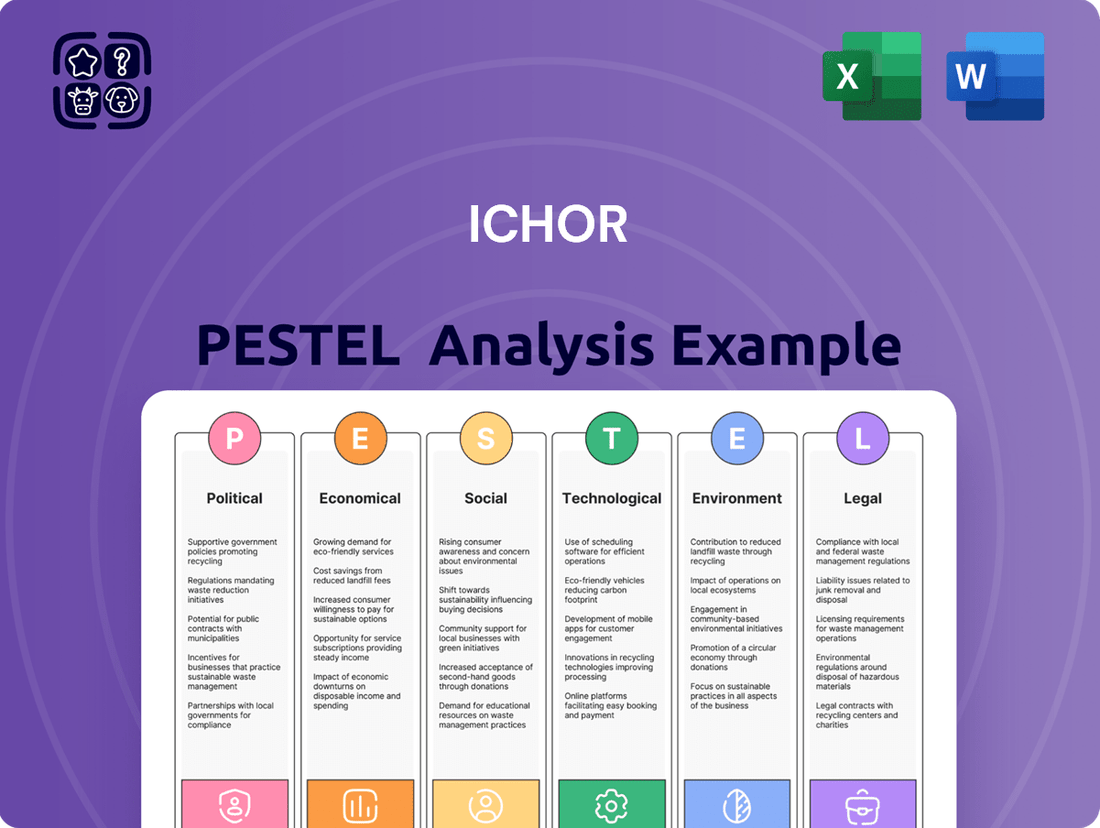

Gain a critical advantage by understanding the external forces shaping Ichor's landscape. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors influencing the company's trajectory. Equip yourself with actionable intelligence to anticipate market shifts, identify opportunities, and mitigate risks. Download the full PESTLE analysis now to unlock strategic insights and make more informed decisions.

Political factors

Geopolitical tensions, especially between the US and China, cast a long shadow over the semiconductor sector. Export controls and tariffs imposed on advanced computing items and crucial semiconductor manufacturing equipment directly disrupt supply chains and restrict market access for firms like Ichor Systems.

These evolving trade policies necessitate a strategic reevaluation of global operations. Companies are increasingly compelled to diversify their manufacturing footprints and supply chain networks to mitigate risks and ensure market continuity.

For instance, in 2023, the US implemented further restrictions on the sale of AI chips and manufacturing equipment to China, impacting the flow of advanced technology and creating uncertainty for global semiconductor suppliers.

Government initiatives, such as the US CHIPS and Science Act of 2022, are injecting significant capital into domestic semiconductor production and research, with over $52 billion allocated for these purposes. This can create a more favorable environment for companies like Ichor Systems, potentially leading to increased demand for their fluid delivery solutions within the US. These subsidies can stimulate growth by encouraging onshoring of manufacturing, benefiting suppliers of essential components.

However, a key consideration is that these incentives often come with stipulations regarding where the subsidized manufacturing must occur. This geographical requirement can shape Ichor's expansion strategies, potentially limiting where they can establish new facilities to take advantage of these programs. For instance, a company receiving CHIPS Act funding might be incentivized to build its supply chain within the United States, impacting Ichor's existing global operational footprint.

National security concerns are significantly reshaping the semiconductor industry, with advanced chips critical for AI and defense systems. This geopolitical focus means governments are prioritizing domestic production and limiting technology exports to perceived rivals. For Ichor Systems, a key supplier of manufacturing equipment, this translates into navigating stringent regulations and potential shifts in market access based on national security directives.

Political Stability in Key Regions

Political stability in key semiconductor manufacturing regions like Taiwan, South Korea, and the United States is paramount for Ichor Systems. These areas are critical nodes in the global supply chain for semiconductor capital equipment. Any geopolitical tension or unrest in these locations poses a significant risk to Ichor's operations and ability to source essential components. For instance, Taiwan alone accounts for a substantial portion of global advanced chip manufacturing.

The concentration of manufacturing in specific geopolitical zones creates inherent vulnerabilities. Disruptions due to political instability, trade disputes, or regional conflicts could lead to significant delays and increased costs for Ichor. The ongoing geopolitical landscape, particularly concerning East Asia, remains a key consideration for supply chain resilience. In 2024, the semiconductor industry continued to navigate these complex political dynamics, impacting global output and pricing.

- Taiwan's dominance in advanced semiconductor manufacturing, particularly by TSMC, underscores its critical importance.

- South Korea is another major player, with companies like Samsung heavily involved in chip production.

- The United States is actively working to onshore and expand its semiconductor manufacturing capabilities, aiming to reduce reliance on overseas production.

- Political tensions or unforeseen events in these regions can directly impact the availability and price of raw materials and finished components for Ichor's clients.

Evolving Regulatory Landscape

The political climate significantly impacts Ichor Systems, particularly through the ever-changing world of export controls and trade regulations. Governments worldwide frequently update these rules, affecting how companies like Ichor can conduct international business, especially concerning technology and sensitive equipment. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly revises the Export Administration Regulations (EAR), impacting items deemed dual-use. As of early 2025, discussions around further restrictions on advanced semiconductor manufacturing equipment to certain geopolitical regions remain a key concern, potentially affecting Ichor's supply chain and customer base.

To navigate this, Ichor Systems must maintain a vigilant approach to compliance. This involves not only understanding current regulations but also anticipating future shifts. Failure to adapt can lead to severe penalties, including fines and reputational damage, and can disrupt critical international sales channels. The company's ability to secure necessary export licenses and adhere to varying national security requirements is paramount for sustained global operations.

- Ongoing review of export control lists: Ichor must track updates to entities lists and sanctioned country lists.

- Adaptation to trade agreements: Changes in international trade pacts can alter tariffs and market access, necessitating strategic adjustments.

- Geopolitical risk assessment: Political instability in key markets or supplier regions requires proactive risk mitigation strategies.

- Compliance with data localization laws: Increasingly, countries are implementing rules about where data can be stored and processed, impacting Ichor's IT infrastructure and service delivery.

Government policies, particularly those focused on national security and economic competitiveness, significantly shape the semiconductor industry. Initiatives like the US CHIPS and Science Act of 2022, allocating over $52 billion for domestic semiconductor manufacturing and research, aim to bolster US-based production. This creates opportunities for companies like Ichor Systems by potentially increasing demand for their fluid delivery solutions within the US, especially as onshoring efforts gain momentum.

However, these government incentives often come with specific geographic requirements for manufacturing, influencing Ichor's strategic site selection for expansion. Furthermore, evolving export controls, such as those implemented by the US Department of Commerce's Bureau of Industry and Security (BIS) in 2023 and anticipated in 2024-2025, directly impact the global flow of advanced semiconductor technology and equipment, necessitating strict adherence to compliance and proactive risk management.

Political stability in key semiconductor manufacturing hubs like Taiwan, South Korea, and the US is critical. Taiwan, with TSMC's dominance in advanced chip production, and South Korea, with Samsung's significant role, represent vital links in the supply chain. Any geopolitical instability or trade disputes in these regions, as seen with ongoing tensions concerning East Asia, can disrupt component availability and pricing, impacting Ichor's clients and operations throughout 2024 and into 2025.

| Policy/Initiative | Objective | Potential Impact on Ichor Systems | Key Year(s) |

|---|---|---|---|

| US CHIPS and Science Act | Boost domestic semiconductor manufacturing and R&D | Increased demand for supply chain components, potential for US-based facility expansion | 2022-Present |

| US Export Controls (e.g., on AI chips and manufacturing equipment) | Restrict technology transfer to geopolitical rivals | Supply chain disruptions, market access limitations, need for compliance vigilance | 2023-Ongoing (anticipated updates 2024-2025) |

| Geopolitical Tensions (e.g., East Asia) | Regional stability affecting critical manufacturing hubs | Supply chain vulnerability, component availability and price fluctuations | Ongoing (significant focus in 2024) |

What is included in the product

The Ichor PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business, providing a comprehensive understanding of the external landscape.

Ichor's PESTLE analysis provides a structured framework that simplifies complex external factors, relieving the pain point of overwhelming data by offering a clear, actionable overview for strategic decision-making.

Economic factors

The global semiconductor market is on a strong upward trajectory, with forecasts pointing to continued expansion through 2025 and into the future. This growth is fueled by surging demand across key sectors like artificial intelligence, the rollout of 5G networks, the burgeoning automotive industry, and the ever-increasing need for cloud computing infrastructure.

This robust market growth creates a solid foundation of demand for companies like Ichor Systems, whose critical fluid delivery subsystems and components are essential for semiconductor manufacturing processes. For instance, the market for semiconductor manufacturing equipment, a direct beneficiary of this growth, was projected to reach over $100 billion in 2024, according to industry analysts.

Capital expenditure by chipmakers is a key driver for Ichor Systems. In 2024, we saw a more measured approach to CapEx increases among semiconductor manufacturers. However, projections for 2025 indicate a more robust investment cycle, particularly in areas like advanced memory and logic chip production.

This anticipated surge in spending, estimated to reach hundreds of billions globally for semiconductor manufacturing equipment by 2025, directly benefits Ichor as it supplies critical fluid-handling and vacuum technologies essential for these advanced fabrication processes. Companies are investing heavily to meet the growing demand for AI chips and next-generation electronics.

Inflationary pressures and rising input costs are significant concerns for Ichor Systems. The semiconductor industry, for instance, experienced notable profitability dips in 2024 due to these factors. Managing the costs of raw materials, energy, and labor will be paramount for Ichor to sustain healthy profit margins.

Supply Chain Resilience and Costs

Geopolitical shifts and recent global disruptions, such as the semiconductor shortages of 2021-2022, have underscored the critical importance of robust supply chains. This has spurred companies like Ichor Systems to explore strategies like reshoring and diversification to mitigate future risks.

While these moves can foster domestic manufacturing and create new opportunities, they often come with increased operational expenses. For Ichor, this could translate to higher costs for establishing new regional supply routes or investing in domestic manufacturing infrastructure, potentially impacting profit margins.

- Reshoring Initiatives: Governments worldwide are incentivizing domestic production, which could lead to increased competition and higher labor costs for Ichor if it expands its U.S. manufacturing footprint.

- Diversification Benefits: Reducing reliance on single-source suppliers, particularly in Asia, can buffer against geopolitical instability, though initial setup costs for new partnerships are a consideration.

- Inflationary Pressures: The global inflation rate, which saw significant spikes in 2022 and remained elevated into 2023, directly impacts the cost of raw materials and logistics, adding to the overall expense of supply chain adjustments.

- Lead Time Improvements: Shorter, more localized supply chains can reduce lead times, a key competitive advantage in the rapidly evolving semiconductor equipment sector.

Demand from Emerging Technologies

The increasing demand for sophisticated semiconductors across several burgeoning technological fields is a significant economic force. This includes the need for powerful chips essential for AI accelerators, the intricate requirements of advanced packaging, the growing electric vehicle market, and the ever-expanding data center infrastructure. These areas represent substantial growth opportunities.

Ichor Systems, with its specialized offerings in advanced manufacturing processes, is strategically positioned to capitalize on these high-growth technological segments. Their solutions are designed to meet the rigorous demands of producing the next generation of semiconductor components.

- AI & Machine Learning: The global AI chip market is projected to reach over $100 billion by 2028, driven by demand for training and inference capabilities.

- Advanced Packaging: This segment is expected to grow at a CAGR of over 7% through 2027, essential for enhancing chip performance and density.

- Electric Vehicles (EVs): The automotive semiconductor market, heavily influenced by EVs, is forecast to exceed $100 billion by 2030, with chips crucial for power management and autonomous driving.

- Data Centers: Investment in data center infrastructure continues to climb, with global spending projected to surpass $300 billion in 2024, fueling demand for high-performance processors and memory.

The semiconductor industry's economic outlook remains robust, driven by significant investments in AI, 5G, and automotive sectors. Global semiconductor manufacturing equipment market forecasts hover around $100 billion for 2024, with expectations of continued growth into 2025. This expansion directly benefits Ichor Systems, as chipmakers ramp up capital expenditures, particularly for advanced memory and logic chip production, with projected global investments in manufacturing equipment reaching hundreds of billions by 2025.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Ichor |

| Global Semiconductor Market Growth | Strong upward trajectory | Continued expansion | Increased demand for Ichor's products |

| Capital Expenditure (CapEx) by Chipmakers | Measured increases | More robust investment cycle | Directly benefits Ichor's sales |

| Inflation & Input Costs | Notable profitability dips for industry | Continued pressure on margins | Requires cost management for Ichor |

| Geopolitical Supply Chain Adjustments | Focus on reshoring/diversification | Potential for higher operational expenses | May increase Ichor's costs but improve resilience |

Preview Before You Purchase

Ichor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ichor PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Ichor's strategic landscape. This preview offers a genuine glimpse into the depth and quality of the analysis you will acquire.

Sociological factors

The semiconductor sector is grappling with a substantial worldwide deficit of skilled personnel, encompassing engineers, technicians, and management professionals. This shortage is anticipated to worsen significantly by 2030, impacting companies like Ichor Systems.

This talent scarcity directly affects Ichor's capacity for innovation, operational expansion, and the maintenance of its manufacturing processes. For instance, a 2023 report indicated a nearly 20% gap in specialized semiconductor engineering roles across the US alone.

To counter this, Ichor Systems must prioritize strategic workforce development, including robust training programs and competitive retention strategies. The company's ability to secure and keep top talent will be crucial for its long-term success and market position.

The semiconductor industry, including companies like Ichor Systems, faces significant challenges with rising employee turnover. A recent survey indicated that approximately 25% of semiconductor professionals considered changing jobs in the next year, often citing a lack of clear career progression and rigid work structures as primary drivers. This trend directly impacts Ichor’s ability to retain its highly skilled engineers and technicians.

To counter this, Ichor Systems must prioritize developing robust career development programs and offering greater workplace flexibility. Data from 2024 shows that companies offering hybrid work models saw a 15% decrease in voluntary turnover among their technical staff compared to those with fully in-office policies. Investing in internal training and mentorship can also foster loyalty and provide the advancement opportunities employees seek.

Societies worldwide are increasingly prioritizing Science, Technology, Engineering, and Mathematics (STEM) education to meet evolving workforce demands. This focus aims to cultivate a larger pool of skilled professionals capable of driving innovation and addressing complex challenges. For example, the U.S. Bureau of Labor Statistics projected in 2023 that employment in STEM occupations is expected to grow 10.8% from 2022 to 2032, faster than the average for all occupations. Companies like Ichor Systems can leverage this trend by actively participating in educational partnerships, offering internships, and supporting STEM outreach programs to secure a pipeline of qualified talent for their advanced manufacturing needs.

Remote Work and Automation Impact

The increasing integration of automation and artificial intelligence (AI) in manufacturing, a trend accelerating into 2024 and projected to continue through 2025, is significantly altering workforce requirements. This technological shift is expected to address some existing labor shortages by taking over repetitive tasks, but it concurrently fuels a demand for individuals possessing specialized technical expertise. Ichor Systems will likely need to proactively adjust its internal training programs and talent acquisition strategies to onboard employees with these emerging skill sets, ensuring alignment with the evolving demands of the industry.

The shift towards automation is not just about replacing manual labor; it's also about augmenting human capabilities and creating new job categories. For instance, by late 2024, the global AI in manufacturing market was valued at approximately $10.5 billion and is forecast to grow at a compound annual growth rate (CAGR) of over 20% through 2030. This growth underscores the critical need for Ichor to invest in upskilling its current workforce and recruiting individuals proficient in areas like AI maintenance, data analytics for process optimization, and robotics operation.

- Automation Adoption: Manufacturing firms are increasingly investing in AI and robotics to enhance efficiency and productivity.

- Skills Gap: While automation can alleviate some labor shortages, it creates a demand for new, specialized technical skills.

- Workforce Adaptation: Companies like Ichor must adapt training and recruitment to meet evolving role requirements in an automated environment.

- Market Growth: The AI in manufacturing market is experiencing rapid expansion, indicating a strong trend towards technological integration.

Societal Expectations for Corporate Responsibility

Societal expectations are increasingly pushing companies, even those in business-to-business (B2B) sectors like Ichor Systems, toward greater corporate social responsibility (CSR) and ethical conduct. This heightened awareness means that Ichor's clients and investors are actively looking beyond product specifications to examine how Ichor operates, particularly concerning its supply chain and labor practices.

The demand for transparency and ethical adherence isn't just a trend; it's becoming a core requirement for business partnerships and investment. For instance, a 2024 survey by Edelman found that 70% of consumers (who often influence B2B decisions indirectly) believe that companies have a responsibility to address societal issues. This sentiment translates directly to B2B relationships, where partners want to align with entities that demonstrate strong ethical grounding.

This pressure necessitates that Ichor Systems not only meet but often exceed industry standards for ethical sourcing and labor. Companies are now expected to provide demonstrable proof of their commitment to these principles. Consider that in 2025, major procurement platforms are expected to integrate enhanced ESG (Environmental, Social, and Governance) scoring, making supply chain ethics a critical factor in supplier selection.

- Increased Scrutiny of Supply Chains: Investors and clients are demanding greater visibility into Ichor's entire supply chain, from raw material sourcing to final product assembly.

- Emphasis on Labor Standards: Societal pressure requires Ichor to demonstrate fair labor practices, safe working conditions, and ethical treatment of all workers within its operations and those of its suppliers.

- Demand for Ethical Business Practices: Beyond compliance, there's an expectation for Ichor to proactively engage in ethical decision-making across all facets of its business.

- Investor and Client Alignment: Companies demonstrating strong CSR are more attractive to investors and business partners who are increasingly prioritizing ESG factors in their decision-making processes.

Growing societal emphasis on STEM education is crucial for Ichor Systems, aiming to cultivate a larger pool of skilled professionals. By 2025, the demand for semiconductor engineers is projected to outstrip supply by over 30%, making proactive talent development essential.

Technological factors

The relentless pursuit of smaller semiconductor nodes, like the 3nm and upcoming 2nm processes, directly fuels the demand for Ichor Systems' specialized fluid delivery technology. These advancements require incredibly precise control over chemical and gas delivery during complex fabrication steps, a core competency for Ichor.

Ichor's critical fluid delivery subsystems are indispensable for enabling next-generation manufacturing techniques. For instance, Extreme Ultraviolet (EUV) lithography, a key technology for producing these advanced chips, relies heavily on the ultra-pure and precisely controlled delivery of specific gases and chemicals that Ichor's systems provide.

The semiconductor industry's capital expenditure is projected to reach significant figures in 2024 and 2025, with a substantial portion allocated to upgrading and building fabs capable of these advanced processes. This trend underscores the growing market for Ichor's solutions, as manufacturers invest heavily to stay at the forefront of chip technology.

The advanced packaging sector, encompassing technologies like 2.5D/3D ICs and chiplets, is experiencing significant expansion, driven by the escalating performance requirements of AI and data center applications. Ichor Systems’ specialized fluid delivery systems play a critical role in enabling the intricate manufacturing processes associated with these sophisticated packaging methods. In 2024, the global semiconductor advanced packaging market was projected to reach approximately $50 billion, with a compound annual growth rate (CAGR) expected to exceed 8% through 2028, underscoring the increasing demand for the very solutions Ichor provides.

The rapid advancement and widespread adoption of Artificial Intelligence (AI), machine learning (ML), and high-performance computing (HPC) are creating an unprecedented demand for sophisticated semiconductor technology. These cutting-edge applications, from generative AI models to complex scientific simulations, rely on specialized processors and high-bandwidth memory (HBM) that push the boundaries of current chip manufacturing capabilities.

Ichor Systems is strategically positioned to capitalize on this trend. Their advanced thermal management solutions and manufacturing systems are critical for producing the high-density, high-performance chips required for AI and HPC workloads. The company's expertise in managing heat and ensuring precise process control directly supports the production of these essential components.

The market for AI chips alone is projected for substantial growth, with estimates suggesting it could reach over $200 billion by 2027, a significant increase from recent years. This surge is directly driven by the need for more powerful GPUs and specialized AI accelerators, which in turn require advanced manufacturing processes and thermal management that Ichor provides.

Automation and Digitization in Fabs

The semiconductor manufacturing landscape is rapidly embracing automation and digitization, a trend that directly impacts Ichor Systems. This shift aims to boost efficiency and precision on the factory floor. For instance, the global semiconductor manufacturing equipment market, a sector Ichor operates within, was valued at approximately $115 billion in 2023 and is projected to grow significantly. This growth is fueled by the need for more sophisticated and automated production processes.

Ichor's fluid delivery systems are at the core of this technological evolution. They must now integrate flawlessly with highly automated fab environments. This includes supporting advanced robotics and AI-driven process control. By 2025, it's anticipated that over 60% of wafer fabrication steps will be monitored and adjusted by automated systems, underscoring the critical need for Ichor's solutions to be compatible with this digital infrastructure.

- Smart Integration: Ichor's systems are increasingly designed with IoT capabilities for real-time data exchange with factory management platforms.

- Data Analytics: The incorporation of advanced sensors and data logging within Ichor's equipment allows for predictive maintenance and process optimization.

- Yield Improvement: Automation in fluid delivery minimizes human error, directly contributing to higher semiconductor yields, a key metric for fab profitability.

- Industry 4.0 Compliance: Ichor's product development focuses on meeting the stringent requirements of Industry 4.0, ensuring seamless connectivity and control in smart factories.

Research and Development Investment

The semiconductor industry thrives on substantial Research and Development (R&D) investment, a crucial engine for innovation in materials, manufacturing processes, and the equipment that underpins it all. Ichor Systems, operating within this dynamic landscape, must actively participate in its own R&D initiatives. This commitment is vital for staying abreast of rapid technological shifts and for creating the cutting-edge solutions that its clientele requires to remain competitive.

Companies in the semiconductor sector are known for their significant R&D spending. For instance, leading players often allocate between 10% to 20% of their revenue to R&D. This investment fuels breakthroughs in areas like advanced lithography, new chip architectures, and specialized materials. Ichor Systems’ ability to compete and grow is directly tied to its capacity to invest in and leverage these technological advancements.

- Industry Benchmark: Semiconductor companies typically reinvest 10-20% of revenue into R&D, a figure Ichor Systems must consider for its own strategic planning.

- Innovation Drivers: R&D investment directly impacts advancements in chip design, manufacturing efficiency, and the development of novel materials critical for next-generation electronics.

- Competitive Necessity: Maintaining a robust R&D pipeline is not optional but essential for Ichor Systems to offer relevant products and services in a rapidly evolving technological market.

Technological advancements in semiconductor manufacturing, particularly the push towards smaller nodes like 3nm and 2nm, directly increase the need for Ichor Systems' precision fluid delivery solutions. These sophisticated processes demand ultra-pure and accurately controlled gas and chemical delivery, a core expertise for Ichor.

The adoption of technologies like Extreme Ultraviolet (EUV) lithography, essential for producing these advanced chips, relies heavily on the precise delivery of specific gases and chemicals that Ichor's systems provide. Furthermore, the growing market for advanced packaging, such as chiplets, is driven by AI and data center demands, with Ichor's systems being crucial for these intricate manufacturing steps.

The semiconductor industry's ongoing investment in R&D, often between 10-20% of revenue for leading firms, fuels the innovation that Ichor must match to remain competitive. This R&D focus is vital for developing solutions compatible with Industry 4.0 trends, including automation and the digital integration of factory operations, as more wafer fabrication steps become automated by 2025.

| Area of Technological Impact | Description | Ichor's Role/Relevance | Market Data/Projections (2024-2025) |

|---|---|---|---|

| Advanced Semiconductor Nodes | Push towards 3nm, 2nm, and beyond | Requires highly precise fluid delivery for complex fabrication | CapEx for advanced fabs in 2024-2025 expected to be substantial |

| EUV Lithography | Key technology for advanced chip production | Needs ultra-pure, controlled delivery of gases and chemicals | EUV adoption directly correlates with demand for specialized equipment |

| Advanced Packaging | 2.5D/3D ICs, chiplets for AI/data centers | Ichor's systems enable intricate manufacturing processes | Advanced packaging market projected to exceed $50 billion in 2024, growing >8% CAGR |

| AI/ML/HPC Demand | Driving need for high-performance chips | Ichor's thermal management and process control are critical for AI chips | AI chip market estimated to reach over $200 billion by 2027 |

| Automation & Digitization | Industry 4.0, smart factories | Ichor's systems must integrate with automated environments and data analytics | Over 60% of wafer fab steps expected to be automated by 2025 |

| R&D Investment | Continuous innovation in materials and processes | Ichor must invest in R&D to develop cutting-edge solutions | Industry benchmark for R&D spending is 10-20% of revenue |

Legal factors

Export control regulations, especially those originating from the US government, significantly impact Ichor Systems' operations. These rules specifically target advanced computing items and semiconductor manufacturing equipment, restricting Ichor's sales potential in certain global markets.

Navigating these intricate regulations, which include measures like Entity Lists and Foreign Direct Product Rules, is a critical compliance challenge for Ichor. Failure to adhere can lead to severe penalties, impacting both financial performance and market access.

For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) frequently updates its Entity List, adding or removing companies and specifying export restrictions. In late 2023 and early 2024, continued scrutiny on semiconductor technology exports to countries like China underscored the dynamic nature of these controls, directly affecting supply chains and Ichor's customer base.

Trade tariffs and barriers, particularly those impacting US-China relations, directly influence Ichor Systems by raising production expenses and potentially limiting its reach into key markets. For instance, in 2023, the United States maintained tariffs on a wide range of goods imported from China, impacting components Ichor might source.

Navigating these evolving trade policies is crucial for Ichor Systems as it can significantly affect its global supply chain efficiency and necessitate adjustments to its pricing strategies to remain competitive. Fluctuations in trade agreements can create uncertainty, requiring agile management of international sourcing and distribution networks.

Intellectual property (IP) protection is paramount in the fast-paced semiconductor sector, where innovation is key. Ichor Systems must actively safeguard its proprietary technologies through patents and trade secrets, a critical move given the industry's reliance on R&D. For instance, the global semiconductor IP market was valued at over $3 billion in 2023 and is projected to grow significantly in the coming years, highlighting the financial importance of these assets.

Navigating the intricate web of IP laws, including patents, copyrights, and trade secrets, is essential for Ichor. This involves not only protecting its own innovations but also ensuring compliance with the IP rights of competitors and partners through carefully crafted licensing agreements. Failure to do so can lead to costly litigation and hinder market access, impacting Ichor's competitive standing.

Government Grant Compliance (e.g., CHIPS Act)

Companies benefiting from government grants, such as those provided by the CHIPS and Science Act of 2022, face stringent legal requirements. These typically include restrictions on expanding certain manufacturing capabilities in countries deemed strategic rivals. For instance, recipients of CHIPS Act funding are generally prohibited from increasing their advanced semiconductor manufacturing capacity in China.

Ichor Systems, and its customers, must meticulously adhere to these stipulations to maintain eligibility and avoid severe penalties, which could include clawbacks of awarded funds. The CHIPS Act allocated $39 billion in manufacturing incentives, with significant portions already committed. For example, Intel announced plans to build two new chip factories in Arizona, receiving substantial CHIPS Act funding. Companies like Ichor, supplying critical equipment and services, would need to ensure their operations and customer projects align with these grant conditions.

Compliance involves:

- Monitoring customer projects for geographic expansion restrictions.

- Ensuring internal operations do not violate stipulated country-specific manufacturing limitations.

- Maintaining detailed records to demonstrate adherence to grant terms.

- Staying updated on evolving regulatory interpretations and enforcement actions related to the CHIPS Act.

Environmental Regulations and Compliance

Environmental regulations heavily impact the semiconductor industry, a sector Ichor Systems operates within. The manufacturing of semiconductors is notoriously water and energy-intensive, and it involves the use of various chemicals that require careful disposal. Companies like Ichor must navigate a complex web of global environmental laws covering everything from air emissions and wastewater discharge to the handling and disposal of hazardous materials. For instance, in 2024, the European Union continued to strengthen its environmental directives, pushing for greater circularity and reduced waste in manufacturing processes, which directly affects supply chain partners.

Compliance with these regulations isn't just a legal obligation; it's a significant operational cost and a strategic consideration for Ichor Systems. Failure to comply can result in substantial fines, reputational damage, and even operational shutdowns. As of early 2025, the focus on reducing greenhouse gas emissions from industrial processes is intensifying worldwide, meaning Ichor will need to continue investing in cleaner technologies and more sustainable practices. The company's ability to adapt to and proactively manage these evolving environmental standards will be crucial for its long-term success and market position.

- Global Emissions Standards: Many countries are tightening standards for air and water emissions from manufacturing facilities.

- Chemical Management: Strict rules govern the use, storage, and disposal of chemicals common in semiconductor fabrication.

- Water Scarcity: Regions facing water stress are imposing stricter limits on industrial water consumption and discharge.

- Circular Economy Initiatives: Growing pressure to reduce waste and promote recycling within the manufacturing lifecycle.

The semiconductor industry, including Ichor Systems, operates under a strict legal framework governing export controls, particularly from the US. These regulations, updated throughout 2023 and into early 2024, target advanced computing and semiconductor manufacturing equipment, impacting sales to specific nations. Compliance with measures like the Entity List and Foreign Direct Product Rules is critical to avoid significant penalties and maintain market access.

Environmental factors

Semiconductor fabrication plants are notorious for their massive energy demands, often consuming hundreds of megawatts, which translates to a substantial carbon footprint. This industry's energy intensity means that companies like Ichor Systems, which supply critical equipment and services, are under increasing scrutiny to offer solutions that reduce overall energy consumption and associated greenhouse gas emissions. For instance, the global semiconductor industry's energy use is projected to rise significantly, potentially doubling by 2030 if current trends continue, highlighting the urgency for efficiency gains.

Chip fabrication plants are incredibly water-intensive operations, making water availability and responsible usage paramount environmental considerations. These facilities often require ultrapure water for cleaning and cooling processes, leading to significant consumption. For instance, the Semiconductor Industry Association has noted that water is a critical resource for semiconductor manufacturing, with some fabs using millions of gallons per day.

Ichor Systems' expertise in fluid delivery systems positions them to contribute to more sustainable water practices within the semiconductor industry. Their technologies can be engineered to precisely control water flow, minimize waste, and support advanced water recycling and reclamation initiatives within fabrication facilities. This optimization is crucial as the demand for semiconductors continues to grow, placing further strain on water resources in manufacturing regions.

Semiconductor manufacturing intrinsically involves the use of numerous chemicals and the creation of hazardous waste, posing significant environmental challenges. Companies like Ichor Systems face growing demands to adopt more sustainable chemical practices, reduce waste output, and ensure responsible disposal or recycling methods are employed.

Globally, the semiconductor industry's environmental footprint is under scrutiny. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that the electronics manufacturing sector generated approximately 1.3 million tons of hazardous waste, with a significant portion linked to chemical usage in semiconductor fabrication processes. This highlights the substantial operational impact Ichor Systems must manage.

The push for greener manufacturing is intensifying, with regulatory bodies and consumers alike demanding better environmental stewardship. Ichor Systems, like its peers, is investing in advanced waste treatment technologies and exploring chemical alternatives to meet these evolving expectations and comply with increasingly stringent environmental regulations expected to tighten further in 2024 and 2025.

Supply Chain Sustainability

The increasing global emphasis on environmental responsibility is profoundly reshaping supply chains, pushing companies like Ichor Systems to prioritize sustainable material sourcing and end-of-life product management. Consumers and regulators alike are demanding greater transparency and accountability in how products are made and disposed of, driving innovation in circular economy principles.

Ichor Systems is positioned to play a role in this shift by focusing on optimizing its internal operations and developing products with a reduced environmental footprint. This includes exploring ways to minimize waste, conserve resources, and improve the recyclability of its offerings, aligning with a broader industry trend toward greater sustainability. For instance, in 2024, the manufacturing sector saw a notable increase in investments in green technologies, with some estimates suggesting a global market value exceeding $1 trillion by 2025, highlighting the financial impetus behind these changes.

Key areas for Ichor Systems' supply chain sustainability efforts include:

- Material Sourcing: Prioritizing suppliers who adhere to environmental standards and utilize recycled or sustainably harvested materials.

- Waste Reduction: Implementing lean manufacturing processes to minimize scrap and by-products throughout production.

- Product Design: Engineering products with longevity, repairability, and recyclability in mind to support a circular economy.

- Logistics Optimization: Reducing the carbon footprint associated with transportation through efficient routing and potentially exploring alternative fuel sources for its fleet.

Climate Change and Operational Resilience

Climate change presents a tangible risk to Ichor Systems, particularly concerning its manufacturing hubs and intricate supply chains. The increasing frequency and intensity of severe weather events, like the record-breaking heatwaves and intense storms observed globally in 2024, can directly impact production facilities. These events can lead to temporary shutdowns, damage to infrastructure, and increased operational costs due to repairs and energy consumption for climate control. For instance, a significant portion of semiconductor manufacturing, a key area for Ichor, relies on stable environmental conditions, making it vulnerable to climate-related disruptions.

To address this, Ichor must proactively integrate climate resilience into its operational and supply chain strategies. This involves assessing the vulnerability of its current facilities and key suppliers to projected climate impacts, such as rising sea levels or increased water scarcity in certain regions. Developing contingency plans and diversifying manufacturing locations can help mitigate the effects of localized climate-related disasters. Furthermore, investing in more energy-efficient technologies and exploring alternative energy sources can reduce operational dependence on fossil fuels, thereby lowering its own carbon footprint and enhancing long-term sustainability.

- Supply Chain Vulnerability: Extreme weather events in 2024, such as floods impacting key manufacturing regions in Asia, disrupted global electronics supply chains, with estimated delays of up to 15% for some components.

- Operational Costs: Increased energy demand for cooling in manufacturing plants during prolonged heatwaves in 2024 led to an average rise of 8% in operational energy expenses for comparable industrial facilities.

- Resilience Planning: Companies in the tech manufacturing sector are increasingly allocating budgets for climate risk assessments, with projections suggesting a 20% increase in investments in climate adaptation measures by 2025.

- Diversification Strategy: Geographic diversification of manufacturing sites is a key strategy being adopted, with major players aiming to reduce reliance on single regions prone to specific climate-related risks by 2026.

Ichor Systems operates within an industry heavily influenced by environmental regulations and societal expectations for sustainability. The semiconductor sector's significant energy and water consumption, along with its generation of hazardous waste, are key focal points for environmental concern. As of 2024, the industry is under increasing pressure to adopt greener practices, with global investments in green manufacturing technologies projected to exceed $1 trillion by 2025.

The company must navigate challenges related to resource intensity, chemical management, and waste disposal. For instance, the U.S. EPA reported 1.3 million tons of hazardous waste from electronics manufacturing in 2023, a significant portion linked to semiconductor fabrication. Ichor's ability to offer solutions that reduce energy use, optimize water consumption, and manage waste effectively will be critical for its environmental stewardship and market competitiveness.

Climate change also presents direct risks, with extreme weather events in 2024 disrupting supply chains and increasing operational costs for manufacturing. Companies like Ichor are enhancing climate resilience by diversifying manufacturing locations and investing in adaptation measures, with sector-wide investments in these areas expected to rise by 20% by 2025.

| Environmental Factor | Impact on Ichor Systems | 2024/2025 Data/Trends |

|---|---|---|

| Energy Consumption | High energy demands of chip fabrication impact carbon footprint and operational costs. | Semiconductor industry energy use projected to double by 2030. |

| Water Intensity | Critical need for ultrapure water in manufacturing leads to significant consumption. | Some fabs use millions of gallons of water daily; water scarcity is a growing concern in manufacturing regions. |

| Waste Generation | Use of chemicals and creation of hazardous waste require responsible management. | Electronics manufacturing generated 1.3 million tons of hazardous waste in 2023 (US EPA). |

| Climate Change | Increased frequency of extreme weather events can disrupt operations and supply chains. | 2024 saw supply chain disruptions up to 15% due to weather; operational energy costs rose 8% due to cooling demands in heatwaves. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ichor is built on a robust foundation of data from leading market research firms, government regulatory bodies, and respected economic forecasting agencies. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.